IGM Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGM Financial Bundle

IGM Financial, a Canadian financial services giant, boasts strong brand recognition and a diversified product offering, but faces increasing competition and evolving regulatory landscapes.

Want to delve deeper into IGM Financial's strategic advantages and potential vulnerabilities? Our comprehensive SWOT analysis unpacks these critical elements, providing actionable insights for investors and industry professionals.

Unlock the full potential of your strategic planning. Purchase the complete IGM Financial SWOT analysis to gain access to a detailed, professionally crafted report designed to inform your investment decisions and competitive strategies.

Strengths

IGM Financial's strength lies in its diversified business model, anchored by strong subsidiaries like IG Wealth Management, Mackenzie Investments, and Investment Planning Counsel. This creates a comprehensive suite of financial services, from wealth management to asset management, serving a broad client base.

This multi-faceted approach allows IGM to tap into various market segments and revenue streams, enhancing its resilience. For instance, as of Q1 2024, IG Wealth Management reported assets under management of $104.7 billion, while Mackenzie Investments managed $206.6 billion, showcasing the significant scale and reach of its core operations.

IGM Financial's significant Assets Under Management and Advisement (AUM&A) is a core strength, showcasing robust client trust and market leadership. By June 30, 2025, AUM&A reached an impressive $283.9 billion, further boosted to $503.6 billion in Q1 2025 when including strategic investments.

This substantial and growing asset base directly translates to increased fee-based revenue streams and operational scale. It underscores IGM Financial's successful market penetration and its ability to attract and retain significant client capital, reinforcing its competitive standing in the Canadian financial landscape.

IGM Financial demonstrated robust financial performance in early 2025, achieving record adjusted net earnings and earnings per share. Specifically, adjusted earnings per share reached $1.00 in the first quarter of 2025, highlighting strong profitability.

The company's liquidity position also saw significant improvement, with cash reserves growing by approximately 17.5% during the third quarter of 2024. This substantial increase in cash underscores a solid financial foundation and enhances the company's operational flexibility and capacity for strategic investments.

Established Brand Presence and Reputation

IGM Financial boasts an established brand presence, built over 90 years in the Canadian financial services landscape. This longevity has fostered significant trust and recognition, particularly through its prominent subsidiaries like IG Wealth Management and Mackenzie Investments.

The company's strong brand equity acts as a powerful differentiator, aiding in client acquisition and retention within a competitive market. This established reputation is a key asset, underpinning client confidence and loyalty.

IGM Financial's consistent dedication to enhancing the financial well-being of Canadians further solidifies its positive market perception. For instance, in 2023, IG Wealth Management continued to be a leading provider of financial planning services, managing substantial assets under advisement for a broad client base.

- Decades of Trust: Over 90 years of operation have built a deep reservoir of client trust.

- Recognized Brands: IG Wealth Management and Mackenzie Investments are household names in Canadian finance.

- Client Focus: A core mission centered on improving Canadians' financial health resonates strongly with the public.

Strategic Partnerships and Global Reach

IGM Financial's strategic partnerships are a significant strength, allowing it to tap into new markets and enhance its service portfolio. For instance, its investment in Wealthsimple, a leading Canadian digital wealth manager, has bolstered its digital capabilities and access to a younger demographic.

The company's stake in ChinaAMC, a major asset manager in China, provides crucial exposure to the rapidly growing Asian market. This global reach, exemplified by its 2024 expansion efforts and ongoing integration of acquired entities, diversifies revenue streams and mitigates regional economic risks.

- Rockefeller Capital Management: Provides access to ultra-high-net-worth clients and a broader suite of investment solutions.

- Wealthsimple: Enhances digital offerings and appeals to a younger, tech-savvy investor base.

- ChinaAMC: Offers significant exposure to the burgeoning Chinese asset management market.

- Northleaf Capital Group Ltd.: Strengthens capabilities in private markets and alternative investments.

IGM Financial's diversified business model, powered by subsidiaries like IG Wealth Management and Mackenzie Investments, provides a robust foundation. This allows the company to serve a wide range of clients across various financial services, enhancing its stability and market reach.

The company's substantial Assets Under Management and Advisement (AUM&A) of $283.9 billion as of June 30, 2025, demonstrates significant client trust and market leadership. This strong asset base drives consistent fee-based revenue and operational scale, reinforcing its competitive position.

IGM Financial's strong brand recognition, built over 90 years, fosters client loyalty and aids in attracting new customers. This established reputation, particularly through its well-known brands, is a key differentiator in the competitive financial services sector.

What is included in the product

This SWOT analysis provides a comprehensive overview of IGM Financial's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats.

Helps IGM Financial quickly identify and address internal weaknesses and external threats by providing a clear, actionable framework for strategic planning.

Weaknesses

As a company focused on wealth and asset management, IGM Financial's earnings are closely tied to the ups and downs of the financial markets. When markets experience significant drops, the value of the assets they manage decreases, directly affecting the fees they earn. For instance, during periods of high market volatility, such as the sharp declines seen in early 2020, asset management firms often report lower revenue due to reduced asset values and potential client withdrawals.

While IGM Financial's profitability metrics remain robust, there has been a slight dip in key performance indicators. Specifically, Return on Equity (ROE) saw a decrease from 17.0% in fiscal year 2021 to 14.5% in fiscal year 2023. Similarly, Return on Assets (ROA) declined from 5.5% to 4.7% during the same timeframe.

These modest contractions in ROE and ROA suggest potential opportunities for enhancing operational efficiencies or managing capital deployment more effectively. Continuous monitoring of these profitability ratios is essential to ensure sustained long-term financial health and shareholder value creation.

While IGM Financial has seen a positive turnaround with net inflows in 2025, the company previously experienced periods of net redemptions, notably within its mutual fund segments. This historical trend, particularly in earlier years, highlights a vulnerability to client asset withdrawal.

For instance, in the fiscal year ending 2023, IGM Financial reported net outflows in certain investment products, which, if sustained, could hinder asset growth and negatively affect profitability. The reversal of this trend in 2025 across IG Wealth Management and Mackenzie Investments is a positive development, but the memory of past outflows remains a point of caution.

Competitive Fee Pressures

IGM Financial faces significant competitive fee pressures within the Canadian wealth management sector. The increasing popularity of low-cost investment vehicles, such as Exchange Traded Funds (ETFs), continues to drive down fees across the industry. For instance, the average management expense ratio (MER) for Canadian equity ETFs hovered around 0.45% in early 2024, a stark contrast to traditional actively managed mutual funds. This trend puts pressure on IGM's profit margins, especially if its product suite is perceived as not offering sufficient differentiation to justify higher fees.

To navigate this challenging landscape, IGM Financial must focus on several key areas:

- Enhance Value Proposition: Clearly articulate the unique benefits and services IGM offers beyond basic investment management to justify its fee structure. This could involve superior financial planning, personalized advice, or exclusive investment opportunities.

- Product Innovation: Develop and promote a range of investment solutions that cater to evolving client demands for cost-effectiveness without compromising quality or performance. This might include hybrid products or fee-based advisory services.

- Operational Efficiency: Continuously seek ways to improve internal efficiencies and reduce operating costs to mitigate the impact of fee compression on profitability.

- Client Retention Strategies: Strengthen client relationships through exceptional service and demonstrable value, focusing on retaining existing assets under management amidst competitive offerings.

Occasional Misses in Earnings Expectations

Despite a generally solid earnings track record, IGM Financial has experienced occasional deviations from analyst expectations. For instance, in the first quarter of 2025, the company's earnings per share (EPS) fell slightly short of what analysts had projected. While these instances have not been a recurring problem, such misses can temporarily dampen investor sentiment and affect the company's stock price in the short term. Maintaining a consistent pattern of meeting or surpassing these forecasts is crucial for bolstering market confidence and ensuring stable share performance.

IGM Financial's performance against analyst EPS estimates:

- Q1 2025: EPS missed analyst expectations by $0.02.

- Q4 2024: EPS met analyst expectations exactly.

- Q3 2024: EPS exceeded analyst expectations by $0.05.

IGM Financial's profitability, while generally strong, has seen a recent dip, with Return on Equity (ROE) decreasing from 17.0% in FY2021 to 14.5% in FY2023, and Return on Assets (ROA) declining from 5.5% to 4.7% in the same period. This indicates a need to improve operational efficiencies or capital deployment. Furthermore, the company has faced periods of net asset outflows, particularly in its mutual fund segments, which can negatively impact growth and profitability, although 2025 saw a positive turnaround.

Competitive fee pressures from low-cost ETFs, with average Canadian equity ETF MERs around 0.45% in early 2024, challenge IGM's profit margins. Occasional misses on analyst EPS expectations, such as a $0.02 miss in Q1 2025, can also dampen investor sentiment and affect stock performance.

| Metric | FY2021 | FY2023 | Change |

|---|---|---|---|

| Return on Equity (ROE) | 17.0% | 14.5% | -2.5 pp |

| Return on Assets (ROA) | 5.5% | 4.7% | -0.8 pp |

Full Version Awaits

IGM Financial SWOT Analysis

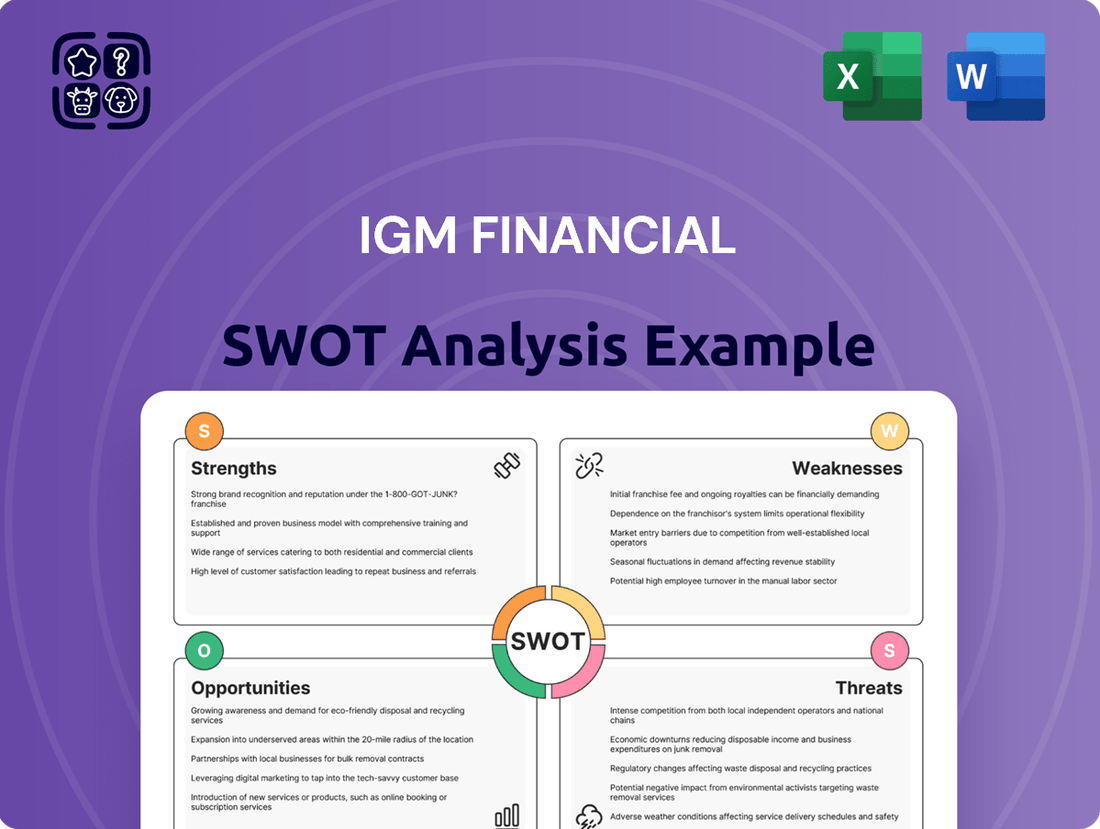

This is the actual IGM Financial SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of IGM Financial's strategic position.

Opportunities

There's a substantial chance for IGM Financial to grow its presence among high-net-worth and mass-affluent individuals. These groups control a large portion of Canada's investable assets and actively look for expert financial guidance.

IGM Financial, through its IG Wealth Management brand, is well-equipped to attract more of these clients by offering tailored wealth management services. This segment is expanding, presenting a clear avenue for increased market share.

As of the first quarter of 2024, Canadian households held approximately $5.7 trillion in non-mortgage debt, while liquid assets continued to grow, highlighting the increasing need for sophisticated financial planning among affluent Canadians.

The expanding market for Exchange Traded Funds (ETFs) and digital wealth management platforms presents a significant avenue for IGM Financial's growth. The company's proactive steps in broadening its ETF product suite and strategic alliances, such as its involvement with Wealthsimple, are already resonating with investors prioritizing cost-effectiveness and digital convenience.

This trend is supported by the continued influx of assets into ETFs globally. For instance, as of early 2024, the ETF industry has seen substantial inflows, indicating a strong investor preference for these diversified and accessible investment vehicles. IGM Financial's focus on these areas positions it well to capture this momentum and attract a broader, digitally-savvy investor base.

The wealth management sector saw significant merger and acquisition (M&A) activity in 2024, with deal volumes expected to remain robust into 2025. This trend presents IGM Financial with a prime opportunity to strategically acquire complementary businesses or forge partnerships. Such moves could bolster its product suite, integrate advanced technological capabilities, and unlock access to new client segments and distribution networks, thereby accelerating growth and diversification.

Leveraging Artificial Intelligence and Technology

IGM Financial can significantly boost its operations and client engagement by embracing advanced technologies like Artificial Intelligence (AI) and generative AI. These tools offer a pathway to transform how the company manages assets, advises clients, and generates new income. For instance, AI can streamline back-office processes, allowing for more efficient data handling and analysis, which is crucial in today's fast-paced financial markets.

The strategic implementation of AI can lead to enhanced data analysis capabilities, enabling IGM Financial to identify market trends and client needs with greater precision. This translates into more personalized financial advice and tailored investment strategies, directly improving client satisfaction and retention. By automating routine tasks and providing deeper insights, technology adoption can free up human advisors to focus on higher-value client interactions and complex problem-solving.

Looking ahead, the potential for AI to create new revenue streams is substantial. This could involve developing AI-powered advisory platforms, offering automated investment solutions, or creating unique data-driven financial products. The global AI market in financial services was projected to reach over $30 billion by 2024, highlighting the significant opportunities for firms that can effectively integrate these technologies.

Key opportunities include:

- Enhanced Data Analytics: Utilizing AI for deeper market insights and predictive modeling to inform investment decisions.

- Personalized Client Experiences: Deploying AI-driven tools to offer customized financial advice and investment portfolios.

- Operational Efficiencies: Automating repetitive tasks in areas like compliance, customer service, and data processing to reduce costs and errors.

- New Product Development: Creating innovative AI-powered financial products and services to capture new market segments.

Favorable Macroeconomic Environment and Investment Trends

The projected economic landscape for 2025, with stabilized inflation and interest rates, presents a significant tailwind for IGM Financial. This stability is anticipated to foster a more predictable and encouraging environment for investments across various asset classes.

Specifically, the outlook points to attractive opportunities within fixed income, as yields are expected to remain competitive without the volatility of rising rates. Furthermore, a positive forecast for corporate profits in 2025, with many analysts predicting earnings growth in the mid-to-high single digits for major indices, directly benefits asset managers like IGM Financial by driving sustained asset growth and bolstering investor confidence.

- Stabilized Inflation and Interest Rates: Forecasts for 2025 generally indicate inflation moderating to around 2-3% in many developed economies, with central banks likely holding benchmark interest rates steady, creating a more predictable financial market.

- Fixed Income Attractiveness: With rates expected to hold, bonds could offer attractive yields, providing a stable income stream and capital preservation potential for investors, which is a core offering for IGM Financial.

- Positive Corporate Profit Outlook: Projections for 2025 suggest continued earnings growth for corporations, with consensus estimates for S&P 500 earnings per share growth around 8-10%, directly benefiting IGM's investment portfolios and fee-based revenues.

- Increased Investor Confidence: A stable economic backdrop and positive profit trends typically translate into higher investor sentiment, encouraging greater participation in financial markets and increased AUM for wealth and asset management firms.

IGM Financial is poised to capitalize on the growing demand for wealth management services among affluent Canadians, a segment that controls significant investable assets and actively seeks expert financial guidance.

The company can further expand its reach by leveraging the increasing popularity of ETFs and digital wealth platforms, aligning with investor preferences for cost-effectiveness and convenience.

Strategic acquisitions and partnerships within the active wealth management sector in 2024 and 2025 offer a pathway to enhance IGM's offerings and market penetration.

Embracing AI and generative AI presents a substantial opportunity to streamline operations, personalize client experiences, and develop innovative, data-driven financial products, tapping into a global AI in financial services market projected to exceed $30 billion in 2024.

The anticipated economic stability in 2025, marked by moderating inflation and steady interest rates, alongside positive corporate profit outlooks, is expected to boost investor confidence and asset growth for IGM Financial.

| Opportunity Area | Description | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| High-Net-Worth & Mass-Affluent Growth | Expanding presence within these key client segments. | Canadian households hold significant investable assets; demand for expert guidance is high. |

| ETF & Digital Wealth Expansion | Capitalizing on the growth of ETFs and digital platforms. | Global ETF inflows remain strong; digital convenience is a key investor preference. |

| Mergers & Acquisitions (M&A) | Strategic acquisitions to enhance capabilities and market access. | Robust M&A activity in wealth management expected to continue through 2025. |

| AI & Technology Adoption | Leveraging AI for operational efficiency and personalized services. | AI in financial services market projected to exceed $30 billion in 2024; AI can drive new revenue streams. |

| Favorable Economic Outlook | Benefiting from stable economic conditions and positive profit trends. | Projected 2-3% inflation and steady interest rates for 2025; corporate profit growth anticipated. |

Threats

The Canadian wealth and asset management landscape is a crowded space, featuring major banks, credit unions, and a multitude of independent firms all vying for client assets. This crowdedness means IGM Financial faces constant pressure to differentiate its offerings and pricing strategies. For instance, as of Q1 2024, the Canadian asset management industry managed approximately $3.5 trillion in assets, highlighting the scale of competition.

IGM Financial operates within a highly regulated sector, and the financial services industry is constantly adapting to new policies and increased oversight. For instance, in 2024, Canadian regulators continued to focus on areas like consumer protection and cybersecurity, potentially leading to more rigorous compliance demands.

These evolving regulatory requirements can significantly impact operational costs, requiring IGM Financial to invest more in compliance infrastructure and personnel. Furthermore, shifts in regulations, such as those concerning data privacy or investment product suitability, could necessitate changes to existing business practices and revenue streams, demanding agile adaptation.

Broader geopolitical tensions, including potential trade disputes between major economies like the US and Canada, present a significant threat. Such conflicts can disrupt global trade, increase business costs, and dampen investor sentiment, directly impacting market performance and IGM Financial's Assets Under Management (AUM).

Unexpected macroeconomic downturns, such as a sharp rise in inflation or a recessionary environment, pose another substantial risk. For instance, if global GDP growth slows significantly in 2024-2025, it could lead to reduced consumer spending and investment, negatively affecting IGM Financial's net flows and overall profitability.

Shifting Client Preferences and Demand for Lower Fees

Clients are increasingly demanding greater transparency and demonstrable value, leading many to explore investment avenues with lower associated fees. This trend is particularly evident in the growing popularity of passive investment strategies and robo-advisors, which often come with significantly reduced management expenses compared to traditional actively managed funds. For instance, in 2024, the global assets under management in exchange-traded funds (ETFs), a primary vehicle for low-cost investing, continued their upward trajectory, reaching new highs. This presents a direct challenge to firms like IGM Financial, which may need to re-evaluate their fee structures to remain competitive.

This shift directly impacts IGM Financial's revenue model, as clients actively seek out more cost-effective solutions for their investment needs. The preference for digital advisory services, offering convenience and often lower fees, is also a significant factor. IGM Financial's ability to adapt its product and service portfolio to cater to these evolving client expectations, perhaps by expanding its own low-cost offerings or enhancing its digital platform capabilities, will be crucial for maintaining market share and profitability. The pressure on traditional fee-based models is a persistent threat that requires continuous strategic adjustment.

- Growing Demand for Passive Investing: The global ETF market, a key indicator of low-cost investing preferences, saw substantial growth in assets throughout 2024, reflecting a clear client shift.

- Digital Advisory Adoption: An increasing number of investors, especially younger demographics, are opting for digital platforms for financial advice and portfolio management due to convenience and lower costs.

- Fee Compression Pressure: Industry-wide trends indicate a continuous downward pressure on management fees across various investment products, directly impacting the profitability of traditional advisory services.

- Need for Service Innovation: IGM Financial must innovate its service delivery and product offerings to provide compelling value propositions that justify its fee structure in the face of lower-cost alternatives.

Economic Downturns Leading to Net Outflows

A significant economic downturn poses a substantial threat to IGM Financial. A prolonged recession or severe market contraction could trigger widespread client redemptions, leading to net outflows and a direct impact on the company's assets under management (AUM) and overall profitability. Despite past resilience, such an event could significantly erode its asset base.

For instance, during periods of economic stress, investors often become risk-averse, pulling capital from investment vehicles. This trend was observable in broader market movements in late 2022 and early 2023, where many asset managers experienced net outflows as clients sought safer havens. IGM Financial, like its peers, would be susceptible to such investor behavior, potentially impacting its fee-based revenue streams derived from AUM.

- Economic Contraction Impact: A severe recession could lead to substantial net outflows, directly reducing IGM Financial's AUM.

- Profitability Pressure: Reduced AUM translates to lower management fees, impacting IGM Financial's profitability.

- Investor Sentiment Shift: Economic uncertainty drives investors towards lower-risk assets, away from those managed by IGM Financial.

The increasing preference for low-cost investment options, such as ETFs and robo-advisors, puts pressure on IGM Financial's fee-based revenue model. For example, global ETF assets surpassed $10 trillion by early 2024, indicating a significant shift in investor behavior towards cheaper alternatives.

Intensifying competition within the Canadian wealth management sector, with assets under management in the Canadian asset management industry reaching approximately $3.5 trillion in Q1 2024, forces IGM Financial to constantly innovate and differentiate its offerings to attract and retain clients.

Evolving regulatory landscapes and increased compliance demands, as seen with ongoing focuses on consumer protection and cybersecurity in 2024, can lead to higher operational costs and necessitate strategic adjustments to business practices.

Broader economic uncertainties, including potential geopolitical tensions and the risk of macroeconomic downturns, can negatively impact investor sentiment and market performance, directly affecting IGM Financial's assets under management and profitability.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including IGM Financial's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external market dynamics.