IGM Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGM Financial Bundle

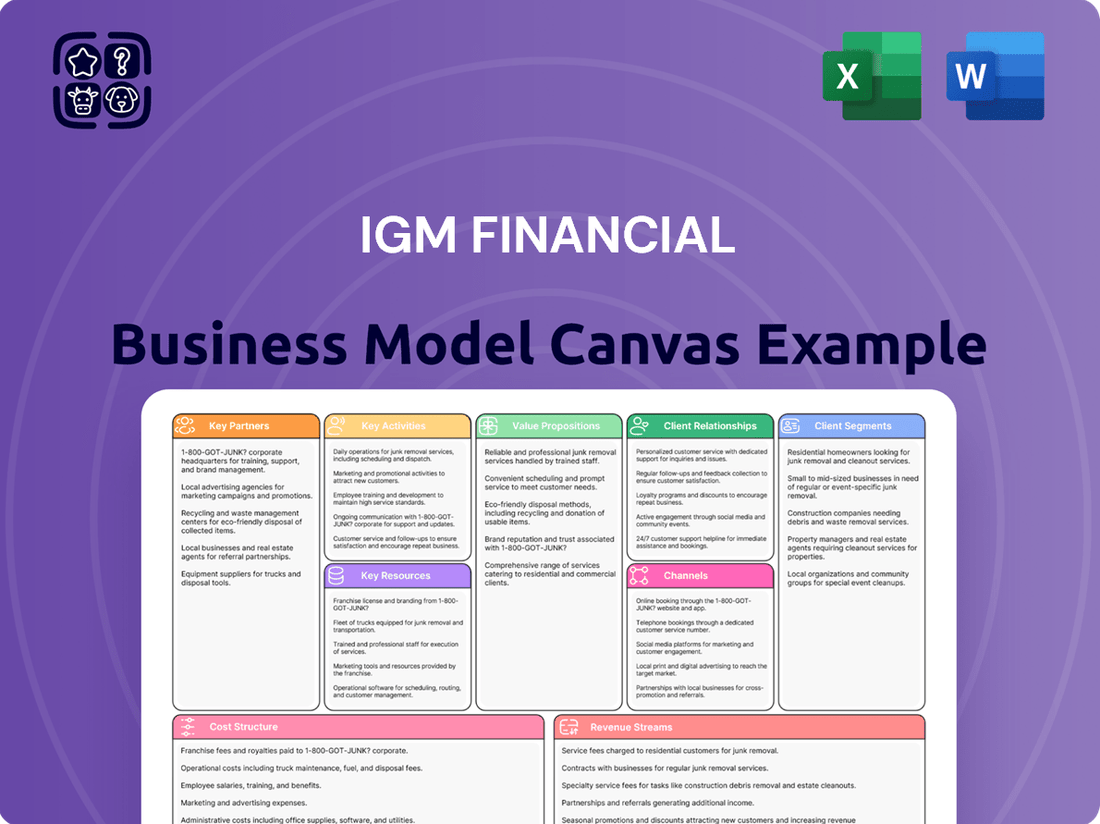

Curious about IGM Financial's strategic framework? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Download the full, editable version to gain actionable insights for your own ventures.

Partnerships

IGM Financial strategically invests in key players like ChinaAMC, Northleaf Capital, Rockefeller Capital Management, and Wealthsimple. These alliances are crucial for diversifying income streams and enhancing operational capabilities.

These partnerships grant IGM access to burgeoning markets, notably Chinese capital markets through ChinaAMC, and expand its reach into private markets via Northleaf. This strategic alignment in 2024 allows for the development of innovative investment solutions.

Mackenzie Investments, a cornerstone of IGM Financial, relies heavily on a robust network of third-party financial advisors and dealers to distribute its diverse range of investment products. This partnership model is fundamental to their market reach.

These advisors act as crucial intermediaries, connecting IGM Financial's offerings with a broad spectrum of individual investors. In 2023, Mackenzie Investments reported approximately $198.5 billion in assets under management, a significant portion of which is attributed to sales through these external channels.

The strategic importance of these relationships lies in their ability to penetrate various market segments and expand IGM Financial's client base effectively. This distribution strategy allows for greater market penetration and brand visibility across Canada.

IGM Financial actively partners with a wide array of product suppliers and sub-advisors to broaden its investment offerings. This strategic approach ensures clients have access to a diverse portfolio of financial products and solutions designed to meet varied investment goals.

By cultivating relationships with trusted global asset managers, IGM Financial aims to secure competitive returns for its clientele. These collaborations are crucial for enhancing the breadth and depth of the company's product lineup, providing clients with access to specialized expertise and investment strategies.

For instance, IGM Financial's subsidiary, Mackenzie Investments, frequently leverages sub-advisory relationships to manage specific asset classes or strategies, bringing in external talent to complement its internal capabilities. This allows for a more dynamic and comprehensive product suite, reflecting the latest market insights and opportunities.

Technology and Digital Solution Providers

IGM Financial leverages key partnerships with technology and digital solution providers to bolster its operational efficiency and client engagement. These collaborations are instrumental in driving the company's digital transformation, ensuring it remains competitive in an evolving financial landscape.

For instance, partnerships with firms like Slalom are crucial for advancing IGM's digital capabilities. This includes expertise in areas such as data strategy, artificial intelligence, cloud migration, and the implementation of new systems. These initiatives directly contribute to an improved customer experience and the acceleration of digital transformation projects.

These strategic alliances allow IGM Financial to tap into specialized knowledge and resources, which are essential for:

- Enhancing digital platforms and customer interfaces.

- Implementing advanced data analytics and AI solutions for personalized services.

- Streamlining operations through cloud adoption and system upgrades.

Industry Organizations and Regulatory Bodies

IGM Financial actively engages with key industry organizations like the Canadian Investment Regulatory Organization (CIRO) to ensure adherence to evolving compliance standards and to contribute to the development of best practices within the financial services sector. This collaboration is vital for maintaining client trust and safeguarding market integrity.

Participation in forums and events hosted by these bodies allows IGM Financial to stay informed about emerging market trends and anticipate regulatory shifts, enabling proactive strategy adjustments. For instance, in 2024, CIRO continued its focus on enhancing investor protection through updated rules on suitability and disclosures, areas where IGM’s engagement is crucial.

- CIRO Engagement: IGM Financial’s commitment to working with CIRO underscores its dedication to regulatory compliance and investor protection.

- Industry Standard Shaping: Involvement in industry discussions helps IGM Financial influence and adapt to new standards.

- Market Trend Awareness: Participation in forums ensures the company remains current on market dynamics and regulatory changes impacting its operations in 2024 and beyond.

IGM Financial's key partnerships extend to third-party financial advisors and dealers, a critical channel for distributing Mackenzie Investments' products. This network is essential for reaching a broad base of individual investors, with Mackenzie reporting approximately $198.5 billion in assets under management in 2023, a significant portion flowing through these external relationships.

What is included in the product

A detailed breakdown of IGM Financial's operations, covering its diverse client base, distribution networks, and the financial solutions it offers.

This model outlines IGM's strategic approach to wealth management, showcasing its key partnerships and revenue streams.

The IGM Financial Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to dissect complex financial strategies. It simplifies the process of identifying and addressing operational inefficiencies, allowing for targeted improvements and clearer strategic direction.

Activities

A core activity for IGM Financial is offering comprehensive financial planning and personalized advice, largely via IG Wealth Management. This encompasses creating custom financial plans, guiding clients on debt management, and supporting tax and estate planning needs.

In 2024, IG Wealth Management continued to be a significant driver, managing approximately $119 billion in assets under management. This scale allows them to deliver sophisticated planning services to a broad client base, from individuals to larger institutions.

The advisory services focus on optimizing clients' financial well-being, addressing everything from day-to-day budgeting and debt reduction strategies to long-term wealth accumulation and legacy planning, ensuring a holistic approach to financial health.

IGM Financial's core activities revolve around managing a wide array of investment products through its key operating companies, Mackenzie Investments and IG Wealth Management. These products span mutual funds, exchange-traded funds (ETFs), and specialized institutional mandates, catering to a broad client base.

A significant part of this involves the ongoing development of innovative investment solutions. For instance, Mackenzie Investments launched several new ETFs in 2024, focusing on areas like sustainable investing and thematic growth, aiming to capture evolving investor preferences.

In 2024, IG Wealth Management continued to expand its suite of actively managed mutual funds, with a particular emphasis on income-generating and balanced strategies. Their product development pipeline is driven by extensive market research and client feedback, ensuring relevance and appeal in a dynamic financial landscape.

IGM Financial prioritizes building and nurturing enduring client connections, primarily through its extensive advisor network at IG Wealth Management. This involves consistent, proactive communication and a deep understanding of individual client aspirations.

A core activity is adapting financial plans to evolving life circumstances, ensuring ongoing relevance and client satisfaction. This client-centric approach is fundamental to long-term retention.

In 2024, IG Wealth Management advisors continued to focus on this, with client retention rates remaining a key performance indicator, reflecting the success of these relationship-building efforts.

Distribution Network Management

IGM Financial’s distribution network management is a cornerstone of its business model, focusing on nurturing and expanding its reach in both wealth and asset management. This involves actively supporting and recruiting independent financial advisors for its IG Wealth Management brand, encouraging their entrepreneurial spirit and growth. For Mackenzie Investments, the strategy centers on cultivating robust relationships with a diverse array of third-party advisors and financial institutions, ensuring broad market access.

In 2024, IGM Financial continued to emphasize advisor growth and retention. IG Wealth Management reported a stable number of advisors, with a focus on enhancing their digital tools and support systems to improve client engagement and operational efficiency. Mackenzie Investments, meanwhile, saw continued success in its third-party distribution channels, with assets under management from these partnerships growing steadily throughout the year, reflecting strong advisor confidence and product demand.

- IG Wealth Management Advisor Support: Focus on attracting and retaining entrepreneurial advisors through enhanced digital platforms and comprehensive support services.

- Mackenzie Investments Third-Party Relationships: Cultivating and strengthening partnerships with external financial advisors and institutions to broaden market penetration.

- 2024 Performance Indicators: Stable advisor numbers at IG Wealth Management and growth in third-party AUM for Mackenzie Investments underscore network strength.

- Strategic Focus: Continued investment in advisor technology and relationship management to drive organic growth across both segments.

Market Analysis and Investment Strategy

IGM Financial's core activities revolve around rigorous market analysis and the strategic deployment of investment capital. This includes a deep dive into global economic indicators and anticipating sector-specific movements to inform client portfolios.

The firm actively monitors economic data, such as projected GDP growth rates and inflation figures, to construct robust investment strategies. For instance, in 2024, many analysts focused on the impact of central bank policies on equity markets, with a particular emphasis on interest rate trajectories.

- Economic Trend Assessment: Continuously evaluating macroeconomic factors like inflation, interest rates, and geopolitical events that influence asset prices.

- Market Outlook Development: Creating forward-looking views on various asset classes and geographical regions based on thorough research.

- Investment Strategy Formulation: Designing and adapting investment plans to align with identified market opportunities and client risk profiles.

- Performance Monitoring: Regularly reviewing portfolio performance against benchmarks and market expectations to make necessary adjustments.

IGM Financial's key activities include managing a diverse range of investment products, such as mutual funds and ETFs, through Mackenzie Investments and IG Wealth Management. They also focus on providing personalized financial planning and advisory services, covering debt management, tax, and estate planning.

A significant effort is placed on building and maintaining strong client relationships, primarily through the IG Wealth Management advisor network, ensuring ongoing client satisfaction and retention.

The company actively manages its distribution networks, supporting independent advisors at IG Wealth Management and fostering partnerships with third-party advisors for Mackenzie Investments.

Furthermore, IGM Financial conducts thorough market analysis and strategic capital deployment, closely monitoring economic indicators to inform investment strategies and portfolio adjustments.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Investment Product Management | Offering a wide array of investment products. | Mackenzie launched new ETFs; IG Wealth expanded actively managed funds. |

| Financial Planning & Advisory | Providing personalized financial advice and planning. | IG Wealth managed approx. $119 billion in AUM. |

| Client Relationship Management | Building and nurturing enduring client connections. | Focus on client retention rates at IG Wealth. |

| Distribution Network Management | Supporting and expanding advisor networks. | Stable advisor numbers at IG Wealth; growth in third-party AUM for Mackenzie. |

| Market Analysis & Strategy | Rigorous market analysis and capital deployment. | Monitoring economic indicators and sector movements. |

Delivered as Displayed

Business Model Canvas

The IGM Financial Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means all sections, formatting, and content are identical to the final deliverable. You can trust that what you see is precisely what you will get, ready for immediate use and customization.

Resources

IGM Financial's business model heavily relies on its extensive network of skilled financial advisors and investment professionals. These experts, spread across subsidiaries like IG Wealth Management and Mackenzie Investments, are crucial for delivering personalized financial advice and managing client portfolios.

As of the first quarter of 2024, IG Wealth Management reported having approximately 4,000 advisors. This robust advisor force is instrumental in fostering strong client relationships and driving asset growth, which reached $104.5 billion for IG Wealth Management at the end of March 2024.

IGM Financial's substantial client assets, both managed and advised, are a cornerstone of its business. This significant volume, reaching a record $283.9 billion as of June 30, 2025, directly fuels revenue streams and serves as a powerful indicator of client confidence and market standing.

IGM Financial leverages advanced digital platforms and proprietary tools, like the IG Living Plan, to offer highly personalized financial planning. These technologies are central to delivering an enhanced client experience.

These platforms are designed for efficient service delivery, providing advisors with data-driven insights to better serve clients. For instance, in 2023, IGM reported significant growth in digital engagement, with a substantial portion of client interactions occurring through these advanced platforms.

Brand Reputation and Trust

IGM Financial's strong brand reputation, built through its core operating companies like IG Wealth Management and Mackenzie Investments, is a cornerstone of its business model. This established trust is a significant intangible asset, drawing in clients and solidifying its position as a leader in Canadian wealth and asset management.

This reputation directly translates into client confidence, a crucial factor in the financial services industry. In 2024, IGM Financial continued to leverage this trust, which underpins its ability to attract and retain assets under management and administration.

- Client Confidence: The established brand name fosters a sense of security and reliability among clients, encouraging long-term relationships and asset retention.

- New Business Acquisition: A strong reputation acts as a powerful marketing tool, reducing the cost of acquiring new clients and driving organic growth.

- Competitive Advantage: In a crowded market, IGM's trusted brand differentiates it from competitors, allowing for premium service offerings and client loyalty.

- Talent Attraction: A reputable firm is more attractive to top financial advisors and employees, further strengthening its service delivery and market position.

Intellectual Capital and Market Research

Intellectual capital, particularly the in-depth market research and economic outlooks generated by IGM Financial's internal strategists and investment teams, forms a core resource. This expertise is crucial for guiding investment decisions and establishing thought leadership within the financial community.

This internal knowledge base directly informs strategic asset allocation and product development, ensuring offerings align with current market dynamics and future projections.

For instance, in 2024, IGM Financial's research highlighted a growing emphasis on sustainable investing, with a significant portion of Canadian investors expressing interest in ESG-focused portfolios.

- Market Research: Comprehensive analysis of economic trends, industry performance, and consumer behavior.

- Investment Insights: Proprietary research and forecasts from internal portfolio managers and strategists.

- Thought Leadership: Published reports, white papers, and client communications disseminating expertise and market views.

- Client Education: Resources and guidance provided to advisors and clients to enhance financial literacy and investment understanding.

IGM Financial's key resources are its extensive network of financial advisors, substantial client assets, advanced digital platforms, strong brand reputation, and deep intellectual capital. These elements collectively support its strategy of providing personalized financial solutions and achieving sustained growth.

Value Propositions

IGM Financial provides personalized financial planning that extends beyond investments to include tax efficiency, risk management, and estate planning. This comprehensive approach is delivered by dedicated financial advisors who work with clients to achieve their lifelong financial objectives.

IGM Financial offers a wide array of investment products, including mutual funds and exchange-traded funds (ETFs). This diverse range allows clients to tailor portfolios to their specific financial goals and comfort levels with risk.

These solutions are overseen by a global network of experienced and reputable asset managers. As of the first quarter of 2024, IGM Financial's managed assets reached $264.8 billion, showcasing the scale and trust placed in their professionally managed offerings.

IGM Financial offers clients unparalleled access to seasoned financial experts and up-to-the-minute market intelligence. This expertise is crucial for navigating the complexities of today's financial world, ensuring clients receive strategic guidance tailored to their needs.

In 2024, IGM Financial's commitment to providing deep market insights was evident in their proactive analysis of evolving economic conditions. For instance, their outlooks highlighted the impact of shifting interest rate environments on various asset classes, empowering investors to adjust their portfolios effectively.

The firm's ability to translate intricate market data into actionable advice is a cornerstone of its value proposition. This strategic guidance helps clients not only understand market trends but also capitalize on opportunities, as demonstrated by their clients’ portfolio performance in the first half of 2024.

Long-Term Client Relationships and Trust

IGM Financial prioritizes cultivating enduring client relationships grounded in trust and a thorough grasp of their changing financial requirements. This focus is a cornerstone of their business model, fostering loyalty and repeat engagement.

Advisors at IGM Financial are committed to proactively adjusting financial plans, ensuring they remain relevant and supportive as clients' lives and market conditions evolve. This adaptive approach is key to maintaining client satisfaction and confidence.

- Client Retention: IGM Financial’s emphasis on long-term relationships contributes to a strong client retention rate, a critical factor in stable revenue generation.

- Advisor Loyalty: The supportive environment for advisors encourages them to build deep connections with clients, reducing advisor turnover and enhancing client continuity.

- Trust as Capital: Trust is viewed as a form of social and financial capital, enabling deeper client engagement and a greater willingness for clients to entrust IGM with more of their financial lives.

Digital Tools and Convenient Access

IGM Financial enhances client engagement through robust digital tools, offering seamless online access to financial plans and accounts. This digital layer provides unparalleled convenience, allowing clients to monitor their progress and interact with their advisors anytime, anywhere.

This digital accessibility fosters a more collaborative planning environment, where clients and advisors can work together efficiently. For instance, in 2024, IGM Financial reported a significant increase in digital platform usage, with over 70% of client interactions occurring through their online portals, demonstrating a strong preference for this convenient channel.

- Enhanced Digital Experience: Clients benefit from intuitive online platforms for managing their finances.

- Convenient Account Access: Real-time viewing of financial plans and account balances is readily available.

- Collaborative Planning: Digital tools facilitate seamless interaction and joint decision-making with advisors.

- Digital Efficiency: The integration of technology complements the human advisory model, streamlining processes and improving service delivery.

IGM Financial's value proposition centers on delivering comprehensive, personalized financial planning that extends beyond investments to encompass tax efficiency, risk management, and estate planning. This holistic approach is facilitated by dedicated financial advisors who foster enduring client relationships built on trust and a deep understanding of evolving client needs.

The firm provides access to a diverse range of investment products, including mutual funds and ETFs, managed by a global network of experienced asset managers. As of the first quarter of 2024, IGM Financial managed assets totaling $264.8 billion, underscoring the scale and trust clients place in their professionally managed offerings.

IGM Financial empowers clients with unparalleled access to seasoned financial experts and up-to-the-minute market intelligence, translating complex data into actionable advice. This strategic guidance, evident in their 2024 market outlooks on shifting interest rates, helps clients navigate financial complexities and capitalize on opportunities.

| Value Proposition Element | Description | Supporting Data/Fact (as of Q1 2024) |

|---|---|---|

| Comprehensive Financial Planning | Personalized planning covering investments, tax efficiency, risk management, and estate planning. | Delivered by dedicated financial advisors. |

| Diverse Investment Offerings | Wide array of mutual funds and ETFs tailored to client goals and risk tolerance. | Managed by a global network of experienced asset managers. |

| Expert Market Insights & Guidance | Access to seasoned experts and real-time market intelligence for actionable advice. | Proactive analysis of evolving economic conditions, including interest rate impacts in 2024. |

| Strong Client Relationships | Cultivating enduring relationships based on trust and understanding evolving financial needs. | Focus on client retention and advisor loyalty. |

| Enhanced Digital Experience | Seamless online access to financial plans and accounts for convenience and collaboration. | Over 70% of client interactions via online portals in 2024. |

Customer Relationships

IG Wealth Management cultivates enduring connections by pairing clients with dedicated financial advisors. These advisors invest time in understanding clients and their families, enabling them to proactively adjust financial strategies as life evolves.

In 2023, IG Wealth Management reported that 89% of their clients felt their advisor understood their unique financial needs, a testament to this personalized approach. This focus on deep, ongoing engagement is crucial for adapting plans to life events like career changes or retirement planning.

IGM Financial prioritizes proactive communication, with advisors regularly engaging clients based on their preferred schedules to address all wealth management needs. This consistent outreach builds client confidence and ensures they feel consistently supported in their financial journey.

In 2024, IGM Financial reported that a significant portion of its client base experienced enhanced financial well-being due to this structured engagement model, with client retention rates remaining strong.

IGM Financial clients benefit from a robust digital platform, offering seamless collaboration on financial plans and convenient online account access. This digital engagement complements personalized advice, providing clients with supplementary information and services at their fingertips.

In 2024, IGM Financial reported a significant increase in digital adoption, with over 70% of client interactions occurring through digital channels. This trend underscores the growing importance of self-service options in meeting client needs for information and account management.

Educational Resources and Market Insights

IGM Financial offers a wealth of educational resources and market insights, aiming to equip its clients with the knowledge needed to navigate financial markets effectively. This includes access to expert analysis, comprehensive market reviews, and tailored educational content designed to demystify investment strategies and market dynamics.

By providing these resources, IGM Financial empowers its clients to make more informed decisions. For instance, in 2024, the company's digital platforms saw a significant increase in engagement with educational modules, reflecting a growing demand for accessible financial literacy. This proactive approach helps clients understand evolving trends and build confidence in their investment journeys.

- Expert Insights: Access to commentary and analysis from IGM Financial's seasoned investment professionals.

- Market Reviews: Regular updates and in-depth reports on current market conditions and economic outlooks.

- Educational Content: A library of articles, webinars, and guides covering a wide range of investment topics and strategies.

- Client Empowerment: Tools and information designed to enhance financial understanding and support informed decision-making.

Client Service and Support Teams

Beyond the direct relationship with individual financial advisors, IGM Financial’s robust client service and support teams act as a crucial layer of assistance. These teams are structured to handle a wide array of client inquiries, from administrative matters to more complex service requests. This ensures that clients receive timely and efficient support, regardless of their primary point of contact.

- Dedicated Support Channels: Clients have access to specialized teams for various needs, ensuring expertise is readily available.

- Client Satisfaction Focus: In 2023, IGM Financial reported high levels of client satisfaction, with support teams playing a significant role in achieving these results.

- Accessibility and Responsiveness: The availability of these support functions underscores a commitment to client accessibility and prompt resolution of issues.

IGM Financial fosters deep client loyalty through personalized advisor relationships and proactive communication, ensuring financial plans adapt to life changes. In 2023, 89% of clients felt understood by their advisor, highlighting the effectiveness of this tailored approach.

Digital engagement is also key, with over 70% of client interactions occurring via digital channels in 2024, offering convenient access to information and account management.

Educational resources and expert insights further empower clients, with increased engagement in digital learning modules observed in 2024, promoting financial literacy.

Dedicated support teams provide essential assistance, contributing to high client satisfaction levels reported in 2023.

| Aspect | Description | 2023 Data | 2024 Data |

|---|---|---|---|

| Personalized Advice | Dedicated financial advisors understanding client needs. | 89% client satisfaction with advisor understanding. | Continued strong client retention. |

| Digital Engagement | Online platforms for collaboration and account access. | N/A | Over 70% of interactions via digital channels. |

| Client Education | Resources and insights for financial literacy. | N/A | Increased engagement with educational modules. |

| Support Services | Client service and support teams. | High client satisfaction reported. | N/A |

Channels

IG Wealth Management leverages its vast network of dedicated financial advisors across Canada as a core channel for delivering personalized financial planning services. This direct-to-client approach allows for tailored advice and product distribution, fostering strong relationships with individuals and families.

In 2024, IG Wealth Management's advisor network continued to be a cornerstone of its business, facilitating direct engagement and building trust. This personalized channel is crucial for understanding and meeting the unique financial needs of a diverse client base, from novice investors to those with complex wealth management requirements.

Mackenzie Investments leverages a vast network of third-party financial advisors and dealers to distribute its investment products, including mutual funds and exchange-traded funds. This strategy significantly broadens its market penetration, reaching investors who may not be clients of IGM Financial's internal advisory services.

In 2024, this third-party channel remained a critical component of IGM Financial's distribution. While specific figures for Mackenzie's product distribution through these channels are proprietary, the broader Canadian mutual fund industry saw substantial net sales, indicating the continued importance of advisor networks. For instance, Canadian mutual fund industry assets under management were reported to be over $2.2 trillion by the end of 2023, with a significant portion flowing through these advisor relationships.

IGM Financial offers robust online platforms and digital portals, providing clients with 24/7 access to view their accounts, track investments, and manage their financial planning. This digital accessibility is crucial for modern client engagement, allowing for seamless interaction and information retrieval.

These digital channels, such as the client portals for Mackenzie Investments and IG Wealth Management, facilitate collaborative financial planning. Clients can review progress, upload documents, and communicate with their advisors, enhancing the overall client experience and fostering a more dynamic relationship.

In 2024, IGM Financial continued to invest in enhancing these digital capabilities, recognizing their importance in complementing the company's core in-person advisory model. This hybrid approach caters to diverse client preferences and ensures that advice and service are delivered through the most effective channels.

Institutional Sales and Strategic Alliances

IGM Financial's institutional sales and strategic alliances are crucial for reaching larger clients. They utilize dedicated sales teams to offer investment management services and products specifically designed for institutional needs, such as pension funds and endowments.

These alliances also allow IGM to tap into new markets and client segments, expanding their reach beyond individual investors. For instance, in 2023, IGM's asset management arm, Mackenzie Investments, reported significant net inflows from institutional mandates, reflecting the success of these channels.

- Direct Institutional Sales: Dedicated teams engage with large organizations, pension plans, and endowments, offering customized investment solutions.

- Strategic Alliances: Partnerships with other financial institutions or specialized firms to broaden product offerings and market access.

- Tailored Products: Development of investment products and services that meet the specific, often complex, requirements of institutional clients.

- Growth in Institutional Assets: In the first half of 2024, Mackenzie Investments saw a notable increase in institutional assets under management, driven by these strategic outreach efforts.

Direct-to-Consumer Digital (via Wealthsimple investment)

IGM Financial’s direct-to-consumer digital channel, primarily through its investment in Wealthsimple, allows it to reach a growing segment of clients who favor online platforms and automated investment advice. This strategic move positions IGM within the burgeoning robo-advisory market, offering a streamlined and accessible approach to wealth management.

Wealthsimple, a key component of IGM's digital strategy, reported significant growth, with assets under management reaching approximately $20 billion by the end of 2023. This demonstrates strong client adoption and the effectiveness of its digital-first model in attracting and retaining customers.

- Digital Reach: Wealthsimple serves a broad client base, including younger investors and those seeking lower-cost investment solutions, expanding IGM's market penetration.

- Asset Growth: By the first quarter of 2024, Wealthsimple's assets under management surpassed $25 billion, highlighting continued strong performance in the digital wealth space.

- Client Acquisition: The platform continues to attract new clients, with a focus on user experience and accessible investment tools.

- Service Offering: Beyond robo-advisory, Wealthsimple offers a suite of digital financial products, including high-interest savings accounts and trading services, further solidifying its direct-to-consumer presence.

IGM Financial utilizes a multi-channel approach to reach its diverse client base. This includes its extensive network of IG Wealth Management advisors for personalized service, and Mackenzie Investments' distribution through third-party advisors to broaden market reach.

Digital platforms offer clients 24/7 access and facilitate collaborative planning, complementing the in-person model. Furthermore, direct institutional sales and strategic alliances target larger organizations, while the investment in Wealthsimple captures the growing robo-advisory market.

These channels collectively ensure IGM Financial can cater to various investor preferences, from traditional advice to digital-first solutions, driving growth across different segments of the financial services industry.

Customer Segments

Mass affluent and high-net-worth individuals represent a key customer base for IG Wealth Management. These clients typically have investable assets ranging from $250,000 to over $1 million, and they are actively seeking tailored financial planning and sophisticated investment strategies to manage wealth and achieve significant life goals like retirement, estate planning, and philanthropic endeavors.

In 2024, the demand for personalized financial advice among this demographic remains strong, driven by market volatility and the increasing complexity of financial landscapes. Many high-net-worth families are also looking for integrated wealth management services that go beyond basic investment advice, encompassing tax planning, legal considerations, and intergenerational wealth transfer.

IGM Financial caters to Canadian families and individuals looking for comprehensive financial guidance. This includes crucial areas like planning for retirement, making taxes work efficiently, and organizing estates, all facilitated by a dedicated advisor.

In 2024, the demand for integrated financial planning remains strong. Many Canadians are navigating complex financial landscapes, seeking advice to secure their future and manage wealth effectively across generations.

Mackenzie Investments serves a broad base of retail investors who typically engage with financial products through intermediaries. These investors are looking for diverse investment options like mutual funds and exchange-traded funds (ETFs) to meet their financial goals.

In 2024, the Canadian retail investment landscape continued to see strong engagement through advisor channels, with Mackenzie Investments leveraging its extensive network of financial advisors and dealer networks to reach these clients. This strategy allows them to offer a wide array of investment solutions tailored to individual needs.

Institutional Clients

Institutional clients, a cornerstone for Mackenzie Investments, encompass a broad range of large entities such as pension funds, endowments, foundations, and sovereign wealth funds. These sophisticated investors often seek highly customized investment strategies and dedicated support to meet their long-term financial objectives. For instance, in 2024, the global pension fund market continued its significant growth, with assets under management projected to reach trillions, underscoring the substantial opportunity within this segment.

Mackenzie Investments caters to these institutional needs by offering specialized investment management services and bespoke financial solutions. This includes access to a diverse range of asset classes and the expertise of seasoned portfolio managers. The firm's commitment to providing tailored approaches allows it to effectively serve the unique requirements of these large-scale investors, who are crucial to the overall asset base.

- Global Pension Fund Assets: Expected to exceed $55 trillion by the end of 2024, representing a significant pool of capital for institutional asset managers.

- Endowment and Foundation Growth: Many large endowments and foundations are actively seeking diversified investment strategies to enhance returns and preserve capital.

- Sovereign Wealth Fund Investments: These funds, managing substantial global assets, often engage in long-term, strategic investments across various markets.

- Demand for Bespoke Solutions: Institutional investors increasingly demand tailored investment mandates and customized reporting to align with their specific risk appetites and fiduciary duties.

Digitally-Savvy Investors (via Wealthsimple investment)

IGM Financial, through its stake in Wealthsimple, is actively engaging digitally-savvy investors. This segment prioritizes seamless online experiences for managing their finances and investments. Wealthsimple’s user-friendly platform, offering robo-advisory services and a digital brokerage, directly appeals to this demographic.

By leveraging technology, IGM Financial is tapping into a market that values convenience and accessibility. This digital-first approach is crucial as more investors, particularly younger ones, are comfortable conducting all their financial activities online. In 2024, Wealthsimple reported significant growth in its user base, with millions of Canadians actively using its platform for investing and banking.

- Digital Preference: Caters to investors who prefer online platforms for investment and financial management.

- Wealthsimple's Role: Leverages Wealthsimple's digital-first approach and robo-advisory services.

- Market Growth: Addresses the increasing demand for accessible and convenient digital financial solutions.

- User Engagement: Wealthsimple's platform saw substantial user growth in 2024, indicating strong adoption by tech-savvy individuals.

IGM Financial serves diverse client segments, including mass affluent and high-net-worth individuals seeking personalized financial planning and sophisticated investment strategies. Additionally, the company caters to Canadian families and individuals needing comprehensive guidance on retirement, tax efficiency, and estate planning, often facilitated by dedicated advisors.

Mackenzie Investments engages with retail investors through intermediaries, offering a variety of investment products like mutual funds and ETFs. The firm also targets institutional clients, such as pension funds and endowments, providing specialized and customized investment management services to meet their long-term objectives.

Through its stake in Wealthsimple, IGM Financial is also reaching digitally-savvy investors who value convenient online experiences for managing their finances. This digital-first approach appeals to a growing market segment prioritizing accessibility and ease of use in financial management.

| Customer Segment | Key Characteristics | 2024 Focus/Activity |

|---|---|---|

| Mass Affluent & High-Net-Worth | Investable assets $250k+, seeking tailored planning, wealth management, estate planning. | Continued strong demand for personalized advice amidst market volatility; focus on integrated wealth services. |

| Canadian Families & Individuals | Seeking comprehensive financial guidance (retirement, tax, estate). | High demand for integrated planning to navigate complex financial landscapes and secure future wealth. |

| Retail Investors (via Intermediaries) | Engage through advisors, seeking diverse investment options (mutual funds, ETFs). | Strong engagement through advisor networks; leveraging extensive product offerings. |

| Institutional Clients | Pension funds, endowments, foundations, SWFs; seeking customized strategies. | Significant growth in global pension fund assets (projected >$55T in 2024); demand for bespoke solutions. |

| Digitally-Savvy Investors | Prioritize online experiences, convenience, accessibility (via Wealthsimple). | Significant user growth for Wealthsimple in 2024; tapping into tech-first financial management. |

Cost Structure

Employee compensation and benefits represent a substantial cost for IGM Financial, reflecting its reliance on skilled human capital. This includes remuneration for a diverse workforce, from financial advisors and portfolio managers to essential administrative and technology personnel. In 2023, IGM Financial reported total employee compensation and benefits expenses of approximately CAD 1.5 billion, underscoring the human-capital-intensive nature of its wealth and asset management operations.

Distribution and sales commissions represent a significant cost for IGM Financial, directly impacting profitability. These expenses are primarily tied to compensating the vast network of financial advisors at IG Wealth Management and the fees paid to third-party channels that distribute Mackenzie Investments products.

For instance, in 2023, IGM Financial reported total operating expenses of $2.2 billion. A considerable portion of this is allocated to advisor compensation and distribution fees, reflecting the company's reliance on its sales force and external partners to drive revenue.

IGM Financial consistently invests in its technology and infrastructure to maintain a competitive edge and enhance client experience. In 2024, the company continued its focus on digital transformation, allocating significant resources to upgrading its client portals and internal systems. This commitment ensures robust cybersecurity measures and advanced data analytics capabilities.

These ongoing investments are crucial for operational efficiency and fostering innovation within IGM Financial. The costs encompass a wide range, from software licenses and hardware procurement to the salaries of specialized IT personnel. For instance, the company's drive towards cloud-based solutions and AI-powered tools reflects a strategic allocation of capital to future-proof its operations and service delivery.

Marketing and Brand Building

IGM Financial allocates significant resources to marketing and brand building to drive client acquisition and retention across its diverse financial services. These expenditures are crucial for maintaining a strong market presence and effectively communicating the value proposition of its operating companies like IG Wealth Management and Mackenzie Investments.

In 2024, IGM Financial continued its investment in digital marketing, content creation, and advisor support programs. For instance, Mackenzie Investments launched several targeted campaigns in early 2024 to highlight its new exchange-traded fund (ETF) offerings, contributing to increased brand awareness in that segment.

- Marketing Expenditures: IGM Financial's marketing efforts encompass advertising, digital campaigns, sponsorships, and public relations.

- Brand Visibility: Initiatives aim to enhance the recognition and reputation of IGM Financial and its subsidiaries.

- Client Attraction: Marketing strategies are designed to attract new clients to IGM's wealth and asset management platforms.

- Promotional Activities: These include showcasing new investment products and services to existing and potential customers.

Regulatory Compliance and Operational Overhead

Meeting stringent regulatory requirements is a significant cost for IGM Financial. This includes obtaining and maintaining various licenses, adhering to capital adequacy rules, and investing in compliance technology and personnel. For example, in 2023, Canadian financial institutions collectively spent billions on compliance, a trend that continued into 2024 as regulations evolved.

Beyond regulatory burdens, general operational overheads form a substantial part of the cost structure. These expenses encompass maintaining physical office spaces, engaging legal counsel for advice and contract management, and covering essential administrative functions that keep the business running smoothly. These costs are fundamental to providing secure and reliable financial services.

- Regulatory Compliance: Costs associated with adhering to financial regulations, licensing fees, and compliance reporting.

- Operational Overhead: Expenses for office leases, utilities, salaries for administrative staff, and general business upkeep.

- Legal and Professional Fees: Costs for legal counsel, auditing services, and other professional advice necessary for operations.

- Technology Infrastructure: Investment in IT systems, cybersecurity, and software to support business operations and compliance.

IGM Financial's cost structure is heavily influenced by its compensation models and the need for robust technological infrastructure. Employee compensation, including benefits, represented a significant outlay, with total expenses around CAD 1.5 billion in 2023. This reflects the company's reliance on a skilled workforce across its advisory and asset management divisions.

Distribution and sales commissions are another major cost driver, directly linked to revenue generation through its extensive network of financial advisors and third-party distributors. In 2023, operating expenses totaled $2.2 billion, with a substantial portion attributable to these sales-related costs.

Investments in technology and marketing are crucial for maintaining competitiveness and client engagement. The company continued its digital transformation efforts in 2024, focusing on upgrading client portals and internal systems, alongside targeted marketing campaigns for product launches, such as new ETFs from Mackenzie Investments.

Regulatory compliance and general operational overheads also contribute significantly to the cost base. These include licensing, compliance technology, office upkeep, and professional fees, all essential for secure and compliant financial service delivery.

| Cost Category | 2023 (CAD billions) | Key Drivers | 2024 Focus |

| Employee Compensation & Benefits | ~1.5 | Skilled workforce, advisory network | Talent retention, performance incentives |

| Distribution & Sales Commissions | Significant portion of $2.2B operating expenses | Advisor network, third-party distribution | Optimizing sales channel efficiency |

| Technology & Infrastructure | Ongoing investment | Digital transformation, cybersecurity | Cloud migration, data analytics enhancement |

| Marketing & Brand Building | Consistent investment | Client acquisition, product promotion | Digital marketing, ETF campaign support |

| Regulatory Compliance & Overhead | Substantial | Licensing, compliance tech, office space | Adapting to evolving regulations |

Revenue Streams

IGM Financial's core revenue comes from management fees, calculated as a percentage of the assets they oversee. This means as more clients entrust their money to IGM, and as those asset values grow, the company's revenue naturally increases. In 2023, IGM reported total revenue of $2.38 billion, with a significant portion attributable to these asset-based fees.

IGM Financial generates significant revenue through fees for comprehensive financial planning and personalized advisory services, primarily through its IG Wealth Management division. These fees reflect the value clients receive from ongoing guidance and strategic financial advice.

In 2024, IGM Financial's asset and wealth management segment, which includes these advisory services, reported substantial fee-based revenue, demonstrating the continued demand for expert financial guidance. This revenue stream is crucial to the company's stable and predictable income.

IGM Financial generates revenue through commissions earned on the sale of a wide array of financial products, including mutual funds, exchange-traded funds (ETFs), and insurance policies. These commissions represent a significant portion of their income, driven by client investment and protection needs.

Transaction fees also contribute to IGM's revenue streams, charged for various investment activities undertaken by clients. These fees are typically applied to trades, portfolio rebalancing, and other operational aspects of managing investments, reflecting the cost of facilitating these financial transactions.

For instance, in the first quarter of 2024, IGM Financial reported strong performance, with fee and commission income reflecting the ongoing client engagement and activity across their platforms, underscoring the importance of these revenue sources.

Performance Fees (for certain mandates)

For certain investment mandates, especially within asset management and institutional services, IGM Financial can generate revenue through performance fees. These fees are directly tied to the investment returns achieved on the assets they manage.

This performance-based fee structure is designed to align IGM Financial's interests with those of its clients, rewarding the company for exceeding specific investment benchmarks. For example, in 2023, IGM Financial's asset management segment, which includes Mackenzie Investments, saw a significant portion of its revenue influenced by market performance and asset growth, directly impacting the realization of such fees.

- Performance Fees: Earned when investment returns surpass predefined benchmarks.

- Client Alignment: Incentivizes IGM Financial to maximize client portfolio growth.

- Revenue Driver: Directly linked to the success of specific asset management mandates.

- 2023 Impact: Market conditions in 2023 influenced the potential for these fees based on asset performance.

Strategic Investment Income

IGM Financial generates revenue through strategic investments in other wealth and asset management firms. This includes income derived from dividends and profit sharing from companies like ChinaAMC, Northleaf, Rockefeller, and Wealthsimple.

For instance, IGM Financial's investment in ChinaAMC, a significant asset manager in China, provides a stream of income through profit participation. Similarly, its stake in Northleaf Capital Partners, a global private markets investment firm, contributes to this revenue category.

- Strategic Investment Income: Revenue from dividends and profit sharing from equity stakes in wealth and asset management companies.

- Key Investment Holdings: Includes ChinaAMC, Northleaf Capital Partners, Rockefeller Asset Management, and Wealthsimple.

- **Contribution to Revenue**: These investments bolster IGM Financial's overall earnings through distributed profits and capital appreciation, as seen in the consistent performance of its portfolio companies.

IGM Financial diversifies its income through various fee structures beyond asset management. These include commissions from selling financial products like mutual funds and insurance, as well as transaction fees for investment activities. In the first quarter of 2024, fee and commission income demonstrated robust client engagement.

Performance fees are a key component, earned when investment returns exceed set benchmarks, aligning IGM's success with client outcomes. Strategic investments in other financial firms, such as ChinaAMC and Northleaf, also generate income through dividends and profit sharing, contributing to overall revenue stability.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Management Fees | Percentage of assets under management | Significant portion of $2.38 billion total revenue in 2023 |

| Advisory & Planning Fees | For comprehensive financial guidance | Substantial fee-based revenue in 2024 asset and wealth management segment |

| Commissions | From sale of financial products (funds, insurance) | Key income driver reflecting client needs |

| Transaction Fees | For investment activities (trades, rebalancing) | Reflects cost of facilitating client transactions |

| Performance Fees | Based on investment returns exceeding benchmarks | Influenced by market conditions and asset growth in 2023 (Mackenzie Investments) |

| Strategic Investment Income | Dividends/profit sharing from investments (ChinaAMC, Northleaf) | Bolsters earnings through distributed profits |

Business Model Canvas Data Sources

The IGM Financial Business Model Canvas is constructed using a blend of internal financial disclosures, comprehensive market research reports, and insights gleaned from industry expert analysis. These diverse data sources ensure a robust and accurate representation of the company's strategic framework.