IGM Financial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGM Financial Bundle

Discover how IGM Financial masterfully blends its product offerings, pricing strategies, distribution channels, and promotional activities to capture and retain market share. This analysis reveals the core of their marketing effectiveness.

Unlock the complete picture of IGM Financial's marketing success with our in-depth 4Ps analysis. Go beyond the surface and gain actionable insights into their product development, pricing architecture, place strategies, and promotional campaigns.

Ready to elevate your own marketing strategy? Get instant access to a professionally crafted, editable report detailing IGM Financial's 4Ps. It's the perfect resource for students, professionals, and anyone seeking a competitive edge.

Product

IG Wealth Management, a key part of IGM Financial, provides comprehensive financial planning. Their 'IG Living Plan' offers personalized advice and investment solutions, adapting to individual client needs throughout their financial journey. This holistic approach aims to help clients achieve their long-term objectives.

The service integrates tax strategies and tailored investment advice across six crucial financial dimensions. This comprehensive strategy ensures all aspects of a client's financial life are considered for optimal planning. For instance, as of Q1 2024, IG Wealth Management reported approximately $118 billion in assets under management, highlighting the scale of their client base and the trust placed in their planning services.

IGM Financial's product strategy, particularly through Mackenzie Investments, emphasizes a broad spectrum of investment vehicles. This includes a diverse family of mutual funds, Exchange Traded Funds (ETFs), and bespoke managed solutions designed to meet various investor needs.

Mackenzie Investments actively innovates its product lineup. For instance, in June 2025, they introduced the Mackenzie International All Cap Equity Fund and the Mackenzie US Value Fund, demonstrating a commitment to expanding global investment opportunities and catering to evolving market demands.

IGM Financial's wealth and asset management division is a cornerstone of its business, catering to a broad clientele including individuals, families, and institutional investors. This segment offers comprehensive investment management, discretionary portfolio management, and a diverse array of investment funds designed to meet various financial goals.

The scale of their operations is substantial, with assets under management and advisement hitting an impressive $283.9 billion as of June 30, 2025. This significant figure underscores their position as a major player in the financial services landscape, demonstrating strong client trust and market penetration.

Specialized Financial Solutions

Beyond traditional investment management, IGM Financial, through its subsidiary Investors Group Trust Co. Ltd., provides crucial mortgage solutions, catering to a broader client financial need. This expansion into lending complements their core offerings, aiming to be a comprehensive financial partner.

IGM Financial also emphasizes a robust suite of insurance products, offering clients protection against various financial risks. Furthermore, their commitment to long-term client well-being is evident in their specialized estate planning services. These services are designed to help clients navigate complex legacy planning.

To bolster these estate planning capabilities, IG Wealth Management has strategically partnered with ClearEstate. This collaboration aims to streamline and enhance the estate planning and settlement processes for their clientele, reflecting a 2024/2025 focus on integrated client service delivery.

- Mortgage Solutions: Offered via Investors Group Trust Co. Ltd.

- Insurance Products: A diverse range to meet client protection needs.

- Estate Planning: Specialized services for legacy management.

- ClearEstate Partnership: Enhancing estate settlement services in 2024/2025.

Tax and Retirement Planning

Tax and retirement planning services are a cornerstone of IGM Financial's product suite, offering crucial guidance to Canadians navigating complex financial landscapes. These offerings are designed to help clients maximize their savings and ensure financial security throughout their lives.

IGM Financial's expertise extends to key registered savings vehicles like Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), which are vital for long-term wealth accumulation. For instance, in 2024, Canadians continued to leverage these accounts, with TFSA contribution limits increasing to $7,000 for the year, and RRSP contribution limits rising to $31,560. The company also provides insights into Registered Disability Savings Plans (RDSPs), supporting individuals with disabilities and their families.

- RRSP Contribution Limit (2024): $31,560

- TFSA Contribution Limit (2024): $7,000

- RDSP Contributions: Eligible for federal grants and bonds up to $3,500 annually, depending on family income.

- Retirement Income Optimization: Strategies to manage tax liabilities and draw down assets efficiently in retirement.

IGM Financial's product strategy, particularly through its subsidiaries like IG Wealth Management and Mackenzie Investments, offers a comprehensive suite of financial solutions. These include personalized financial planning, a wide array of investment vehicles such as mutual funds and ETFs, and specialized services like tax and retirement planning.

The company actively expands its product offerings to meet evolving client needs, demonstrated by the introduction of new investment funds and strategic partnerships. For instance, the collaboration with ClearEstate in 2024/2025 enhances estate planning services, integrating them into their broader financial advice framework.

Beyond investments, IGM Financial provides mortgage solutions through Investors Group Trust Co. Ltd., alongside robust insurance and estate planning services. This multi-faceted approach aims to serve as a complete financial partner for its clients, covering diverse needs from wealth accumulation to asset protection and legacy management.

| Product Category | Key Offerings | Supporting Data/Initiatives (2024/2025 Focus) |

|---|---|---|

| Financial Planning | IG Living Plan, Personalized Advice | $118 billion in assets under management (Q1 2024) by IG Wealth Management |

| Investment Management | Mutual Funds, ETFs, Managed Solutions | $283.9 billion in assets under management and advisement (June 30, 2025) |

| Ancillary Services | Mortgages, Insurance, Estate Planning | Partnership with ClearEstate to enhance estate settlement processes (2024/2025) |

| Tax & Retirement | RRSP, TFSA, RDSP Guidance | TFSA contribution limit $7,000 (2024), RRSP limit $31,560 (2024) |

What is included in the product

This analysis offers a comprehensive review of IGM Financial's marketing strategies, detailing their Product offerings, Pricing models, Place (distribution) channels, and Promotion tactics to understand their market positioning.

It's designed for professionals seeking a clear, actionable understanding of IGM Financial's marketing mix, grounded in real-world application and competitive context.

Provides a clear, actionable framework for IGM Financial's marketing strategy, addressing common pain points in aligning product, price, place, and promotion for maximum impact.

Simplifies complex marketing decisions by offering a structured approach to the 4Ps, alleviating confusion and enabling more confident strategic planning for IGM Financial.

Place

IGM Financial's extensive advisor network, primarily through IG Wealth Management, is a cornerstone of its marketing strategy. This network provides personalized, in-person guidance, fostering deep client relationships. As of late 2024, IG Wealth Management boasted over 4,500 advisors across Canada, underscoring the significant reach and accessibility of their services.

IGM Financial leverages digital platforms to offer clients seamless online access to manage their investments and financial plans. These portals are designed for convenience, allowing users to view account information and collaborate with advisors digitally.

In 2023, IGM Financial reported that over 70% of client interactions occurred through digital channels, highlighting the growing importance of these platforms. This digital accessibility not only streamlines operations but also enhances client engagement by providing 24/7 access to crucial financial data.

Mackenzie Investments leverages a multi-channel distribution strategy to connect with a broad client base. This approach ensures their investment solutions reach both individual retail investors and larger institutional entities effectively.

Key to this strategy is partnering with third-party dealers and financial advisors, who act as crucial intermediaries. In 2024, Mackenzie reported significant growth in advisor-distributed assets, highlighting the strength of these relationships.

Beyond retail, Mackenzie also serves institutional clients, managing mandates for significant investors like pension funds. This dual focus allows them to cater to diverse financial needs and investment scales.

Broad Geographic Reach

IGM Financial's geographic reach is predominantly Canadian, reflecting its status as a leading domestic wealth and asset management firm. This strong home-market focus is a cornerstone of its strategy.

However, through its subsidiary Mackenzie Investments, IGM extends its operational footprint internationally. Mackenzie maintains a presence in key global financial hubs to serve a broader client base and access diverse investment opportunities.

The specific international offices include locations in:

- Canada

- Boston

- Dublin

- London

- Hong Kong

- Beijing

This dual approach—deep Canadian roots combined with strategic global expansion via Mackenzie Investments—allows IGM Financial to leverage its expertise across different markets, aiming to capture growth and manage assets effectively on a wider scale.

Strategic Partnerships and Investments

IGM Financial actively cultivates growth and broadens its reach through strategic alliances and capital allocations. A prime example is its significant investment in Wealthsimple Financial Corp., a leading digital wealth management platform. This move, reported to be substantial, aims to bolster IGM's digital capabilities and tap into a younger demographic of investors.

Further demonstrating this strategy, IGM also invested in Rockefeller Capital Management, a move that diversifies its earnings streams and enhances its high-net-worth client service offerings. These investments are crucial for IGM's 2024 and 2025 strategic objectives, providing access to new markets and innovative financial technologies. The company's commitment to these partnerships underscores its forward-looking approach to market expansion and service enhancement.

- Investment in Wealthsimple: Enhances digital offerings and broadens client base.

- Rockefeller Capital Management: Diversifies earnings and strengthens high-net-worth services.

- Strategic Goal Alignment: Investments support IGM's 2024-2025 growth and innovation targets.

- Market Expansion: Access to new client segments and technological advancements.

IGM Financial's place strategy is deeply rooted in its Canadian foundation, primarily through its vast IG Wealth Management advisor network. This extensive physical presence ensures localized client support across the nation.

Complementing its physical footprint, IGM leverages digital platforms, allowing clients convenient access to manage investments and interact with advisors remotely. This hybrid approach caters to diverse client preferences.

The company's international reach is primarily channeled through Mackenzie Investments, which operates in key global financial centers. This allows IGM to tap into international markets and investment opportunities.

IGM's strategic investments, such as in Wealthsimple and Rockefeller Capital Management, further broaden its market access and service capabilities, reinforcing its multi-faceted place strategy for 2024-2025.

Preview the Actual Deliverable

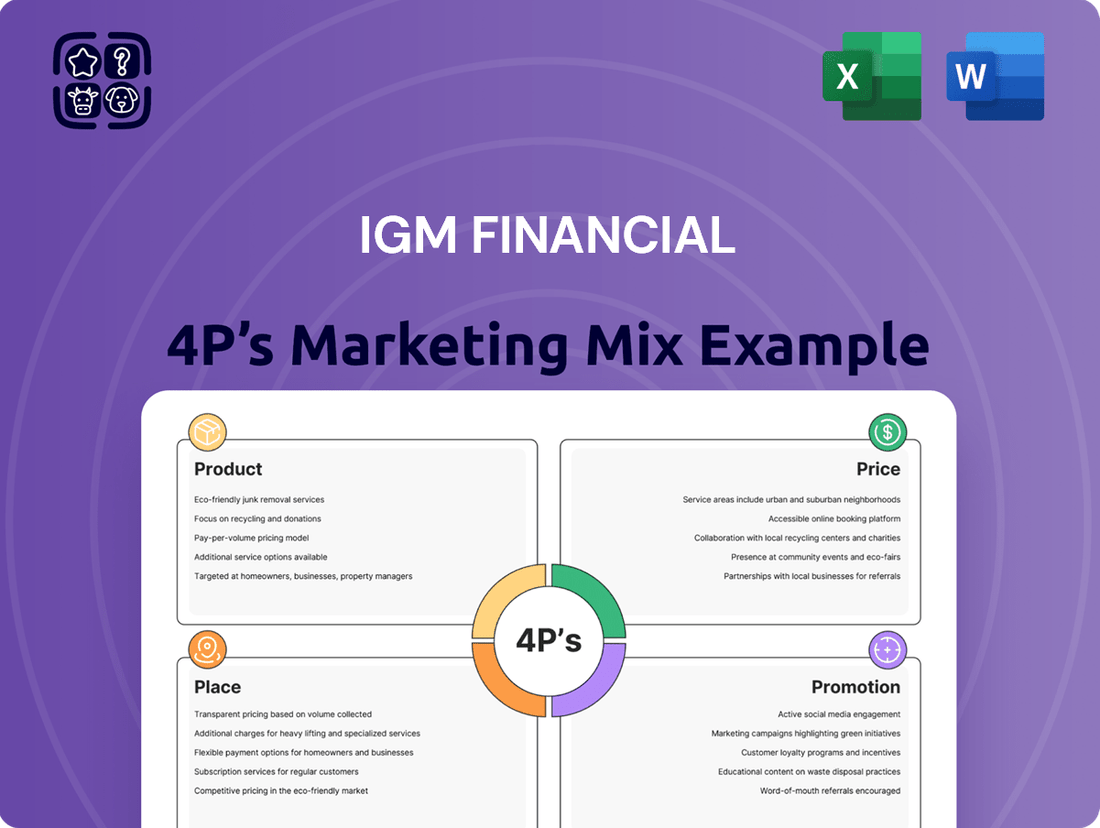

IGM Financial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive IGM Financial 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need to understand their strategy.

Promotion

IGM Financial's promotional strategy heavily relies on personalized advisor engagement. IG Advisors cultivate trust and lasting relationships by deeply understanding and proactively meeting clients' financial objectives. This human-focused method is key to their client acquisition and retention.

IGM Financial leverages content marketing to establish itself as a trusted source of financial expertise. Their publications, including market reviews like the Q2 2025 Market Review, offer valuable insights and analysis to a broad audience.

These resources, such as trending articles and expert advice, are designed to inform and engage both current and prospective clients, showcasing IGM's commitment to thought leadership in the financial sector.

By consistently providing high-quality content, IGM Financial not only educates its audience but also builds credibility, reinforcing its position in the market and attracting new business through demonstrated value.

IGM Financial actively uses corporate recognition and awards as a key part of its promotion strategy. This includes highlighting its standing as a top employer and its commitment to sustainability. For instance, the company has been recognized as one of Canada's Greenest Employers, underscoring its environmental stewardship.

Further bolstering its reputation, IGM Financial, through IG Wealth Management, proudly promotes its numerous FundGrade A+ Awards. These accolades demonstrate the consistent performance and quality of its investment products, appealing to a broad range of investors seeking reliable financial solutions.

The company also points to its inclusion in the Corporate Knights 2025 Global 100 Most Sustainable Corporations list. This prestigious recognition validates IGM Financial's dedication to integrating environmental, social, and governance (ESG) principles into its core business operations, resonating with increasingly conscious investors and stakeholders.

Digital Communication and Web Presence

IGM Financial leverages its digital channels, including igmfinancial.com, ig.ca, and mackenzieinvestments.com, to disseminate key company information. These platforms serve as primary conduits for sharing corporate updates, financial performance, and details about their diverse product offerings.

The company actively uses digital news releases to communicate significant achievements and operational milestones. This strategy ensures timely and widespread access to information for investors, advisors, and the general public, fostering transparency and engagement.

A crucial aspect of their digital communication is the regular announcement of assets under management and advisement. For instance, as of Q1 2024, IGM Financial reported total assets under management and advisement of $255.4 billion, a figure that underscores their market position and growth trajectory.

- Official Websites: IGM Financial, IG Wealth Management, and Mackenzie Investments maintain robust online presences for information dissemination.

- Digital News Releases: Used to announce financial results, company highlights, and product launches.

- Key Metric: Assets under management and advisement are a critical indicator of company performance, reaching $255.4 billion in Q1 2024.

Annual Reports and Investor Relations

IGM Financial leverages its annual reports and investor relations communications as crucial promotional elements. These documents, alongside regular news releases detailing financial performance like quarterly earnings and assets under management, provide essential insights for investors and stakeholders. For instance, in the first quarter of 2024, IGM Financial reported robust performance, with assets under management reaching $257.8 billion, demonstrating continued growth and investor confidence.

These reports are instrumental in showcasing the company's strategic initiatives and overall performance, building trust and attracting further investment. They offer a transparent look at:

- Growth Trajectory: Highlighting key financial metrics and progress against strategic goals.

- Strategic Developments: Detailing new product launches, acquisitions, or market expansions.

- Financial Health: Presenting clear financial statements and performance indicators.

IGM Financial's promotional strategy is multifaceted, blending personal advisor relationships with robust digital content and corporate recognition. Their emphasis on thought leadership through market reviews and expert advice, such as the Q2 2025 Market Review, aims to establish credibility and attract clients by showcasing financial acumen. Awards and sustainability recognitions, like being named one of Canada's Greenest Employers and receiving FundGrade A+ Awards for investment products, further enhance their brand reputation and appeal to a broad investor base.

Digital channels are pivotal, with igmfinancial.com, ig.ca, and mackenzieinvestments.com serving as central hubs for company information, financial performance updates, and product details. The consistent communication of key metrics, such as assets under management and advisement, which reached $257.8 billion by Q1 2024, demonstrates market strength and growth. This transparent approach, supported by annual reports and investor relations communications, builds trust and reinforces their position as a leading financial services provider.

| Promotional Tactic | Key Channels/Examples | Supporting Data/Impact |

| Personalized Advisor Engagement | IG Advisors, Client Relationship Building | Client acquisition and retention |

| Content Marketing & Thought Leadership | Market Reviews (e.g., Q2 2025 Market Review), Expert Advice, Articles | Establishes credibility, educates audience |

| Corporate Recognition & Awards | Canada's Greenest Employers, FundGrade A+ Awards, Corporate Knights Global 100 | Enhances brand reputation, appeals to conscious investors |

| Digital Presence & Communication | igmfinancial.com, ig.ca, mackenzieinvestments.com, Digital News Releases | Disseminates company info, financial results |

| Key Performance Indicators | Assets Under Management & Advisement | $257.8 billion (Q1 2024) - indicates market position and growth |

Price

IGM Financial's fee-based advisory and management services are structured to reflect the value of personalized financial planning and ongoing investment management. This model ensures that client fees are directly tied to the comprehensive advice and tailored solutions they receive, fostering a clear alignment of interests.

For instance, in 2023, IGM Financial reported that its advisory fees, a significant component of its revenue, contributed substantially to its overall financial performance, demonstrating the market's acceptance of this value-driven pricing approach.

IGM Financial prioritizes transparent pricing for its mutual funds and ETFs. This includes clearly outlining management fees, trailing commissions, and other operational expenses. For instance, as of early 2024, the average Management Expense Ratio (MER) for Canadian equity ETFs hovered around 0.40%, with mutual funds often slightly higher, reflecting the underlying costs and services provided.

Managed asset programs, like IGM Financial's iProfile™, feature a structured pricing model. This pricing encompasses various components, including advisor commissions, trailing commissions, and management fees.

These fees also cover the operational expenses of the underlying mutual funds or investment pools and the asset allocation services provided. For instance, in 2024, management expense ratios (MERs) for actively managed equity funds typically ranged from 1.5% to 2.5%, reflecting these bundled costs.

Clients should always consult the program's prospectus for a comprehensive breakdown of all associated fees and charges. This transparency ensures a clear understanding of the investment costs involved.

Value-Driven Pricing Strategy

IGM Financial’s value-driven pricing strategy focuses on the comprehensive and personalized nature of its financial planning services. Instead of engaging in price wars, the company positions its fees to reflect the significant value delivered through tailored advice and client experience.

This approach is supported by IGM Financial's commitment to building long-term client relationships, where the perceived benefits of expert guidance and customized strategies outweigh a simple cost comparison. For instance, in 2024, the company continued to highlight its advisor-led model as a key differentiator, aiming to justify its fee structures through superior service and demonstrable client outcomes.

- Emphasis on Personalized Solutions: IGM Financial's pricing reflects the bespoke nature of its financial plans.

- Client Experience as a Value Driver: The company invests in delivering exceptional service to justify its fee structures.

- Focus on Long-Term Value: Pricing is set to capture the enduring benefits of expert financial management.

Consideration of Market and Economic Factors

IGM Financial's pricing strategies are deeply intertwined with external market and economic forces. They meticulously analyze competitor pricing, ensuring their fee structures remain competitive while accurately reflecting the value and comprehensiveness of their financial planning and investment management services. This careful balancing act is crucial for maintaining market share and attracting a broad client base.

The company also closely monitors market demand for various financial products and services. During periods of high demand, pricing might be adjusted to reflect increased value or scarcity, whereas softer demand could necessitate more competitive pricing to stimulate growth. This dynamic approach ensures IGM Financial remains accessible and attractive across different market cycles.

Furthermore, overall economic conditions significantly influence IGM Financial's pricing decisions. Factors like inflation rates, interest rate movements, and the general economic outlook are considered. For instance, in a high-inflation environment, the company might adjust fees to account for rising operational costs and to ensure the real value of its services is maintained for clients. As of the first quarter of 2024, Canada's inflation rate was hovering around 2.7%, a key indicator considered in setting service fees.

Consideration of these external factors leads to pricing policies that are both strategic and responsive:

- Competitive Benchmarking: IGM Financial regularly compares its fees against those of major competitors in the Canadian wealth management sector to ensure price parity or a clear value proposition.

- Demand Elasticity: The company assesses how sensitive client demand is to price changes for different service tiers, from basic financial planning to comprehensive wealth management.

- Economic Sensitivity: Pricing models are adapted to reflect prevailing economic conditions, such as interest rate environments and market volatility, impacting the perceived value of investment advisory services.

- Service Value Alignment: Fees are structured to align with the perceived quality, expertise, and breadth of services offered, ensuring clients understand the value they receive for the price paid.

IGM Financial’s pricing strategy centers on the value derived from its personalized financial planning and investment management services, rather than competing solely on cost. This approach emphasizes the comprehensive advice and tailored solutions provided, ensuring fees directly correlate with client benefits.

The company’s fee structures for managed asset programs, like iProfile™, are designed to encompass advisor commissions, trailing commissions, and management fees. These fees cover operational expenses of underlying funds and asset allocation services, reflecting the bundled value provided to clients.

As of early 2024, IGM Financial's pricing reflects market realities, with management expense ratios (MERs) for actively managed equity funds typically ranging from 1.5% to 2.5%. This demonstrates a commitment to transparently communicating the costs associated with their premium services.

IGM Financial’s pricing is also influenced by external market dynamics, including competitor analysis and demand for financial products. For instance, in Q1 2024, with Canada's inflation around 2.7%, the company adjusted its fee considerations to maintain the real value of its services amidst rising operational costs.

| Service Component | Typical Fee Range (as of early 2024) | Value Proposition |

|---|---|---|

| Advisory Fees | Reflects personalized planning value | Directly tied to comprehensive advice and tailored solutions |

| Mutual Fund MERs | Often slightly higher than ETFs | Covers underlying costs and services for managed funds |

| ETF MERs (Canadian Equity) | Around 0.40% | Represents operational costs and services for passive investments |

| Managed Asset Programs (e.g., iProfile™) | Bundled (advisor commission, trailing commission, management fees) | Encompasses asset allocation and underlying fund expenses |

4P's Marketing Mix Analysis Data Sources

Our IGM Financial 4P's Marketing Mix Analysis is built on a foundation of verified, up-to-date information. We reference credible public filings, investor presentations, IGM Financial's official brand website, and comprehensive industry reports to capture their product offerings, pricing strategies, distribution channels, and promotional activities.