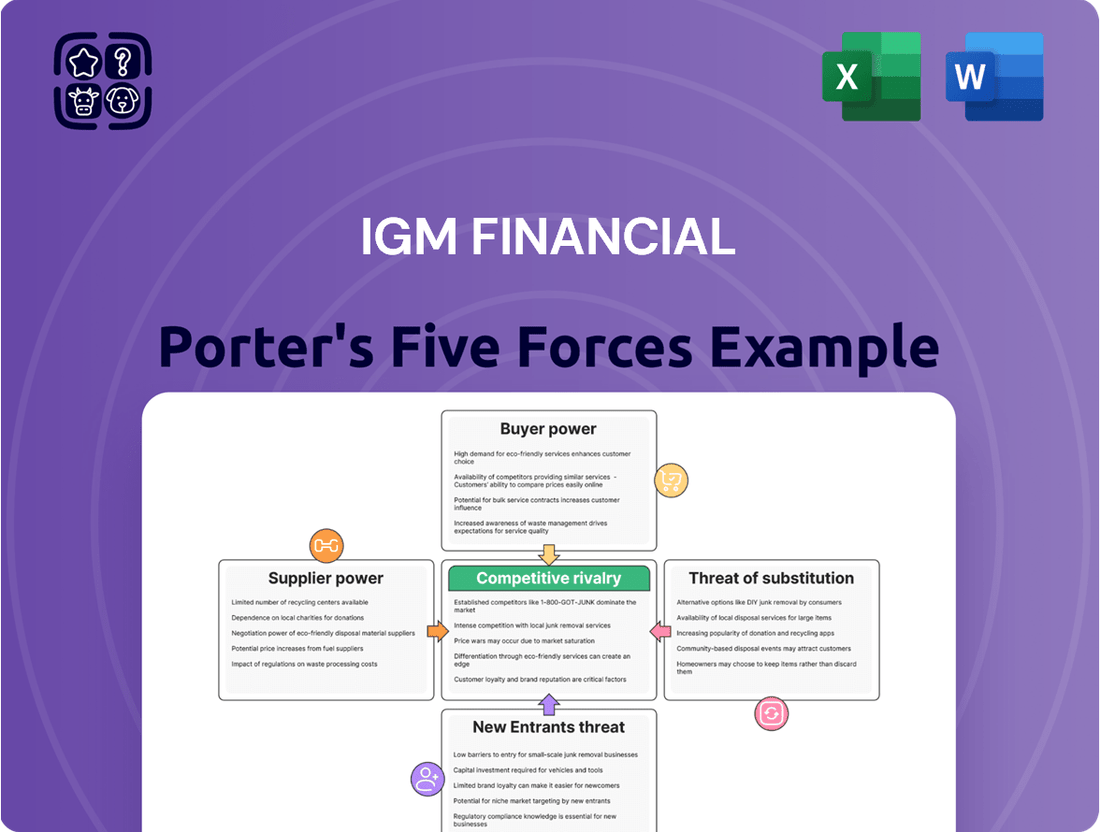

IGM Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGM Financial Bundle

IGM Financial navigates a landscape shaped by intense rivalry, the threat of new entrants, and the significant bargaining power of buyers. Understanding these forces is crucial for any investor or strategist looking to grasp the company's competitive position.

The complete report reveals the real forces shaping IGM Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

IGM Financial depends on technology and software suppliers for critical functions like portfolio management, client relations (CRM), and data analytics. The bargaining power of these suppliers can be significant, particularly when they offer unique or proprietary software that is challenging to replace.

For instance, the increasing complexity of financial regulations and the demand for sophisticated analytics mean that specialized software providers can command higher prices. In 2023, the global IT services market, which includes software, was valued at over $1.3 trillion, indicating a substantial market where specialized providers hold considerable sway.

If IGM Financial relies heavily on a limited number of technology vendors, these suppliers gain greater leverage, potentially influencing pricing and contract terms. This dependence can limit IGM's flexibility and increase operational costs, especially if switching providers involves substantial migration expenses and business disruption.

Data and research providers wield considerable influence over firms like IGM Financial. The ability to access precise, up-to-the-minute market data, economic analyses, and investment perspectives is absolutely vital for IGM Financial's core operations in investment management and financial planning. These suppliers, which include providers of financial data terminals and specialized research firms, often possess substantial bargaining power because their services are both essential and frequently proprietary.

The value that these suppliers can command is directly tied to the quality and uniqueness of the data they offer. For instance, in 2023, the global market for financial data and analytics was valued at over $30 billion, highlighting the significant investment in and reliance on such information. Proprietary algorithms and exclusive datasets can create high switching costs for IGM Financial, further strengthening the suppliers' position.

The financial services sector, especially wealth and asset management, relies heavily on skilled professionals like financial advisors and portfolio managers. These experts, particularly top performers, wield significant bargaining power due to their specialized knowledge, established client networks, and direct influence on company revenue.

The demand for this specialized talent remains robust, with reports indicating a continued need for financial advisors to meet the growing needs of an aging population and increasing wealth. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 6% job growth for personal financial advisors between 2022 and 2032, suggesting sustained demand and, consequently, strong bargaining power for experienced individuals in this field.

Financial Product Wholesalers/Underwriters

The bargaining power of financial product wholesalers and underwriters for IGM Financial, particularly Mackenzie Investments, is a nuanced factor. While Mackenzie develops many of its own investment products, it also leverages external offerings from other financial institutions. The influence these external providers wield is directly tied to the distinctiveness and market demand for their products, alongside the scale of business IGM generates for them.

Suppliers offering highly specialized or exclusive investment vehicles can command greater leverage. For instance, if a particular alternative investment fund managed by an external firm gains significant traction and is only available through a limited number of distributors like IGM, that supplier's bargaining power increases.

- Unique Product Offerings: Suppliers with proprietary or difficult-to-replicate investment strategies or asset classes can exert more influence.

- Market Demand: High investor demand for a supplier's specific product, especially if IGM is a significant distribution channel, amplifies their bargaining power.

- Volume of Business: The proportion of a supplier's total business that IGM represents directly impacts their reliance on IGM and, consequently, their negotiating strength.

- Competition Among Suppliers: The availability of similar products from competing wholesalers can diminish the bargaining power of any single supplier.

Real Estate and Infrastructure Providers

IGM Financial's reliance on landlords and infrastructure providers for its extensive advisory network means these entities hold some sway. The availability of suitable commercial real estate, particularly in key urban centers, can grant landlords a degree of bargaining power, especially for long-term lease agreements. For instance, in Canada, the average commercial office rent in major cities like Toronto or Vancouver can range significantly, impacting IGM's operational costs.

However, the presence of numerous commercial property options typically dilutes this supplier power. IGM Financial can leverage the competitive landscape of the real estate market to negotiate favorable lease terms. The company's ability to secure office spaces across various regions helps mitigate the concentration of power among any single landlord or provider.

- Landlord Influence: The bargaining power of real estate providers is influenced by the demand for commercial space in specific locations and the duration of lease agreements.

- Market Competition: A robust supply of commercial properties in IGM Financial's operating regions generally limits the ability of individual landlords to dictate terms.

- Lease Negotiations: IGM Financial's capacity to secure multiple, potentially long-term leases across different markets provides leverage in negotiations with property owners.

The bargaining power of suppliers for IGM Financial is a key consideration, particularly concerning technology, data, and specialized talent. Suppliers of unique software or proprietary data can command higher prices and favorable terms due to high switching costs and essential service provision.

For instance, the global IT services market, including software, surpassed $1.3 trillion in 2023. In the financial services sector, experienced advisors, crucial for revenue generation, possess significant leverage, with projected job growth for personal financial advisors in the U.S. at 6% between 2022 and 2032.

| Supplier Category | Key Influencing Factors | Impact on IGM Financial |

|---|---|---|

| Technology & Software | Proprietary offerings, switching costs | Potential for higher pricing, limited flexibility |

| Data & Research Providers | Data uniqueness, market demand | Essential for operations, can command premium pricing |

| Skilled Financial Professionals | Specialized knowledge, client networks | Strong wage demands, retention challenges |

| Investment Product Wholesalers | Product exclusivity, market demand | Negotiating power based on product appeal |

What is included in the product

This analysis reveals the competitive intensity and profitability potential for IGM Financial by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing firms.

Instantly identify and mitigate competitive threats with a comprehensive overview of IGM Financial's market landscape.

Proactively address potential disruptions by visualizing the impact of each force on strategic planning.

Customers Bargaining Power

Individual and family clients, while a large group, have a moderate sway over financial institutions like IGM Financial. This is because financial advice is often tailored, and clients value the trust built over time. However, the rise of readily available financial information and cheaper options like robo-advisors means clients are more likely to push for lower fees and better service.

The bargaining power of these clients is somewhat limited by the effort involved in switching providers. Moving accounts and establishing a new relationship with a different advisor can be a hassle, which can make them less inclined to switch immediately. For instance, in 2024, the Canadian Securities Administrators reported that while digital advice platforms are growing, a significant portion of Canadians still prefer human advisors for complex financial planning needs, indicating a continued reliance on established relationships.

Institutional clients, like pension funds and endowments, wield significant bargaining power. Their substantial asset volumes, often in the billions, mean that IGM Financial's relationship with them is crucial for revenue. For instance, as of the first quarter of 2024, IGM Financial managed $256.4 billion in assets, a considerable portion of which likely comes from these large institutional players.

These sophisticated clients conduct thorough due diligence, scrutinizing performance metrics and fee structures. They frequently demand customized investment solutions tailored to their specific needs, which can increase the cost and complexity for IGM Financial to serve them. Their ability to easily shift large sums of capital to competitors means IGM must remain highly competitive on both service and price to retain these valuable relationships.

Customers are increasingly focused on price, especially with new regulations demanding clearer fee disclosures. This makes them more likely to shop around, putting pressure on IGM Financial to prove its worth and perhaps rethink its fee structures.

The availability of many cheaper alternatives means clients can easily switch if they feel they aren't getting good value. For instance, the rise of robo-advisors and low-cost ETFs in 2024 has given consumers more choices and leverage than ever before.

Availability of Information and Alternatives

The digital revolution has dramatically amplified the availability of financial information. Customers can now effortlessly research and compare services from various providers, significantly leveling the playing field. This ease of access empowers them to make more informed decisions.

IGM Financial, like many in the financial services sector, faces customers with a wealth of alternatives. Think about the sheer number of options available: traditional banks, independent financial advisors, robo-advisors, and specialized wealth management firms. This abundance of choice directly translates to increased bargaining power for the customer.

- Increased Information Access: Online platforms and comparison tools allow consumers to easily research financial products and fees.

- Abundant Alternatives: The market offers a wide range of wealth management and investment services, from large institutions to boutique firms and digital platforms.

- Price Sensitivity: Greater transparency in pricing and fees makes customers more sensitive to cost differences between providers.

- Switching Costs: While some switching costs exist, the availability of digital tools and standardized investment products lowers these barriers for many customers.

Client Loyalty and Switching Costs

While financial advice often cultivates robust client relationships, the practical costs associated with switching providers can differ significantly. For clients with intricate financial strategies and a suite of integrated services, the undertaking and potential disruption involved in changing advisors can be substantial, thereby diminishing their immediate bargaining leverage.

Conversely, for individuals holding simpler investment accounts, the process of transitioning to a new firm is generally more straightforward. This ease of movement grants these customers greater influence in negotiations with their current financial institution.

- Client Loyalty: Financial advice can foster loyalty, but the ease of switching impacts its strength.

- Switching Costs: High switching costs for complex plans limit customer bargaining power.

- Simple Accounts: Easier switching for simple accounts empowers those customers.

- 2024 Data: In 2024, the average client retention rate in the wealth management sector remained high, often exceeding 90% for established relationships, but new client acquisition costs continued to rise, indicating a potential increase in the perceived switching costs for those seeking comprehensive services.

The bargaining power of customers for IGM Financial is moderate, influenced by increased information access and a growing number of alternatives. While established relationships and complex needs can create switching barriers, the digital age empowers clients to compare fees and services more readily. This necessitates that IGM Financial consistently demonstrates value to retain its client base, especially as fee transparency becomes more prevalent.

In 2024, the Canadian financial landscape saw continued growth in digital advisory services, offering clients more accessible and often lower-cost options. This trend directly impacts IGM Financial by increasing customer awareness of competitive pricing, thereby enhancing their ability to negotiate or switch providers if perceived value is not met. The ease with which clients can research and compare services online significantly shifts the power dynamic.

Institutional clients, due to the sheer volume of assets they manage, hold substantial bargaining power. Their ability to move large sums of capital means IGM Financial must offer competitive fees and customized solutions to retain these relationships. For instance, IGM Financial's substantial asset base, reported at $256.4 billion in Q1 2024, highlights the importance of these high-value clients.

| Factor | Impact on IGM Financial | Example/Data (2024) |

|---|---|---|

| Information Access | Empowers clients to compare services and fees. | Increased use of online financial comparison tools. |

| Availability of Alternatives | Provides clients with more choices, increasing switching likelihood. | Growth in robo-advisors and low-cost ETFs. |

| Price Sensitivity | Pressures IGM Financial to offer competitive pricing. | Demand for lower fees due to fee disclosure regulations. |

| Switching Costs (Individual) | Lower for simple accounts, higher for complex financial plans. | High client retention rates for established, complex relationships. |

| Switching Costs (Institutional) | Low for large asset holders, enabling significant leverage. | Billions in assets managed by institutional clients are easily transferable. |

What You See Is What You Get

IGM Financial Porter's Five Forces Analysis

This preview showcases the complete IGM Financial Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the financial services industry. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file. This means you'll receive the full, ready-to-use analysis without any surprises or placeholders, enabling immediate application of its strategic insights.

Rivalry Among Competitors

The Canadian wealth and asset management sector is heavily influenced by large, well-capitalized bank-owned entities. These firms, such as RBC Wealth Management and TD Wealth, benefit from substantial resources, established brand loyalty, and extensive branch networks, making them formidable competitors. Their integrated approach, often cross-selling banking and investment products, provides a significant advantage.

These bank-affiliated wealth managers leverage their scale and financial strength to engage in aggressive marketing campaigns and offer a comprehensive suite of financial services. For instance, as of early 2024, major Canadian banks reported significant growth in their wealth management divisions, with assets under management in the hundreds of billions of dollars, underscoring their market dominance and competitive intensity.

IGM Financial contends with robust competition from both large independent wealth management firms and smaller, specialized boutique advisory practices throughout Canada. Competitors like CI Financial and Raymond James Ltd. Canada actively vie for market share by offering distinct service portfolios, varied fee arrangements, and tailored client engagement strategies.

The Canadian wealth management landscape is characterized by its fragmentation, fostering a highly competitive environment. This intense rivalry means firms are constantly battling to attract and retain both client assets and skilled financial advisors, with firms like CI Financial reporting significant advisor growth in recent years.

The rise of digital advisory platforms and robo-advisors presents a significant competitive challenge for IGM Financial. Companies like Wealthsimple, known for their low-fee, automated investment services, are attracting a growing number of younger and tech-savvy investors who may have previously been IGM clients. This trend is particularly noticeable within the mass-affluent and emerging investor segments.

These digital solutions offer a compelling value proposition through their cost-effectiveness and ease of use, directly impacting the traditional advisory fee structures. For instance, Wealthsimple reported over $15 billion in assets under management by early 2024, showcasing the rapid adoption of these digital models. This forces established players like IGM to adapt and consider offering more accessible, hybrid advisory services to remain competitive.

Market Growth and Consolidation Trends

The Canadian wealth management sector is experiencing robust growth, drawing in new entrants and prompting consolidation among established firms. This active market means competitors are aggressively pursuing market share through mergers, alliances, and internal expansion. IGM Financial must adapt to this changing environment, as rivals enhance their services and client reach.

In 2024, the Canadian wealth management industry saw significant activity. For instance, the total assets under management in Canada continued their upward trajectory, with projections indicating sustained growth through 2025. This expansion fuels intense competition, as firms like IGM Financial face rivals who are actively acquiring smaller players or forging strategic partnerships to broaden their offerings and client demographics.

- Market Growth: The Canadian wealth management market is projected to continue its expansion, driven by factors such as an aging population and increasing demand for financial advice.

- Consolidation: Expect ongoing mergers and acquisitions as firms seek scale and efficiency, potentially leading to fewer, larger players dominating the market.

- Competitive Tactics: Rivals are employing a range of strategies, including product innovation, digital service enhancements, and aggressive client acquisition campaigns, to capture market share.

- IGM's Position: IGM Financial must remain agile, leveraging its strengths while strategically responding to the competitive pressures from both established institutions and emerging fintech disruptors.

Product Differentiation and Service Quality

Competition in wealth management is intense, with firms often distinguishing themselves through unique product offerings, superior service quality, and robust advisor-client relationships. IGM Financial, for instance, competes by providing a wide array of investment products and personalized advice, aiming to cultivate strong client connections.

The strength of these relationships is paramount, as clients seek trusted advisors who understand their specific financial goals. This human element is a significant differentiator, especially when contrasted with purely digital investment platforms.

In 2024, IGM Financial's client retention rates, which have historically been strong, underscore the importance of this personalized approach. For example, IGM Financial reported that over 90% of its advisors have been with the company for more than five years, indicating stability and experience that benefits client relationships.

- Product Breadth: IGM Financial offers a comprehensive suite of investment solutions, including mutual funds, ETFs, and alternative investments, catering to diverse client needs.

- Advisor Expertise: The company emphasizes continuous training and development for its advisors, ensuring they possess up-to-date knowledge of market trends and financial planning strategies.

- Client Experience: IGM Financial invests in technology and service protocols designed to enhance client communication, reporting, and overall satisfaction.

- Digital Integration: While prioritizing human advice, IGM Financial also integrates digital tools to provide clients with convenient access to their portfolios and financial planning resources.

Competitive rivalry within the Canadian wealth management sector is intense, with IGM Financial facing pressure from large bank-owned entities, independent firms, and emerging robo-advisors. These competitors leverage scale, brand recognition, and digital innovation to attract and retain clients and advisors. For instance, major Canadian banks consistently report substantial growth in their wealth management divisions, with assets often in the hundreds of billions by early 2024, highlighting their significant market presence.

Firms like CI Financial and Wealthsimple are actively competing by offering diverse service models, from specialized boutique advice to low-fee digital platforms. Wealthsimple, in particular, has seen rapid adoption, managing over $15 billion in assets by early 2024, demonstrating the growing demand for accessible, tech-driven solutions. This forces established players like IGM to continually adapt their strategies to maintain market share and client loyalty.

The battle for talent is also fierce, with firms actively recruiting and retaining skilled financial advisors. IGM Financial's strong advisor retention, with over 90% staying for more than five years as of 2024, signifies a key competitive advantage in building trusted client relationships. This focus on advisor expertise and client experience remains a critical differentiator against purely digital competitors.

| Competitor Type | Key Strengths | Competitive Tactics | IGM Financial's Response |

|---|---|---|---|

| Bank-Owned Wealth Managers | Scale, brand loyalty, integrated services, extensive networks | Aggressive marketing, cross-selling, significant AUM | Leveraging advisor expertise, personalized service, digital integration |

| Independent Firms (e.g., CI Financial) | Diverse service portfolios, varied fee structures, tailored engagement | Strategic acquisitions, advisor growth initiatives | Product breadth, advisor development, client experience enhancement |

| Digital/Robo-Advisors (e.g., Wealthsimple) | Low fees, ease of use, accessibility for younger demographics | Automated investment services, cost-effectiveness | Hybrid advisory models, digital tools for client access |

SSubstitutes Threaten

Self-directed investing platforms represent a significant threat of substitution for IGM Financial. These platforms, offered by discount brokerages and online trading services, allow individuals to manage their own investments at a fraction of the cost typically associated with full-service financial advisory. For instance, platforms like Wealthsimple Trade or Questrade in Canada, and Robinhood or Charles Schwab in the US, enable users to buy and sell stocks, ETFs, and other securities with minimal or no commission fees.

The appeal of these self-directed options is particularly strong among financially literate clients who are comfortable making their own investment decisions. The increasing sophistication of these platforms, coupled with readily available investment research and educational resources, further empowers individuals to bypass traditional financial advisors. By 2024, the number of retail investors actively participating in online trading has seen substantial growth, indicating a clear shift towards DIY investing, especially among younger demographics.

Robo-advisors are a significant threat to IGM Financial, offering automated investment management at a much lower cost than traditional human advisors. For instance, many robo-advisors charge annual fees around 0.25% to 0.50%, a stark contrast to the 1% or more often seen with human advisors.

These platforms provide accessible, diversified portfolios, particularly appealing to a younger demographic or those with less capital to invest. In 2024, the assets under management for robo-advisors globally continued to climb, demonstrating their growing market share and influence.

To counter this, IGM Financial needs to enhance its digital offerings and clearly articulate the unique value proposition of its human financial advice, focusing on complex needs and personalized strategies that automated solutions cannot replicate.

Clients increasingly bypass traditional financial advisors to directly invest in alternative assets like real estate, private equity, and cryptocurrencies. This trend, amplified by accessible online platforms, diverts significant capital away from firms like IGM Financial. For instance, global alternative investment assets under management were projected to reach $21.1 trillion by 2025, indicating a substantial pool of capital seeking direct engagement.

Government Bonds and Guaranteed Investment Certificates (GICs)

For investors prioritizing safety above all else, government bonds and Guaranteed Investment Certificates (GICs) act as significant substitutes for IGM Financial's offerings. These financial products provide a bedrock of security, guaranteeing both the return of principal and a predetermined interest rate, making them particularly attractive when market volatility is high or for individuals with very conservative investment objectives.

These instruments, while typically offering lower growth potential compared to managed funds or equities, represent a compelling alternative for risk-averse individuals. For instance, as of early 2024, 1-year GIC rates in Canada were frequently observed in the 4.5% to 5.5% range, providing a predictable income stream without the fluctuations inherent in market-linked investments.

- Principal Protection: GICs and government bonds offer a guarantee of the initial investment amount, a key differentiator from many IGM Financial products.

- Predictable Returns: Fixed interest rates provide certainty of income, appealing to investors who dislike uncertainty.

- Market Downturn Appeal: During periods of economic uncertainty, the safety of these instruments can draw significant capital away from riskier managed portfolios.

- Lower Growth Potential: While safe, these substitutes generally do not offer the same capital appreciation opportunities as equity-based investments.

Personal Financial Planning Software and Tools

The rise of personal financial planning software and tools presents a significant threat of substitutes for traditional wealth management services. Many individuals can now utilize budgeting apps and online platforms to track expenses, set financial goals, and even execute basic investment trades, potentially bypassing the need for a human advisor for these functions.

For instance, by mid-2024, a substantial portion of the adult population was actively using at least one financial management app. These tools, while not offering the bespoke advice of a professional, empower users to take control of their day-to-day finances. This accessibility can diminish the perceived value of comprehensive wealth management for certain client segments.

- Increased Accessibility: Apps like Mint, YNAB, and Empower Personal Dashboard offer robust features for free or at a low cost.

- DIY Investment Platforms: Brokerages such as Robinhood and Charles Schwab's platforms allow for commission-free trading, making investing more accessible.

- Financial Literacy Growth: Online resources and educational content further equip individuals to manage their finances independently.

- Cost Savings: For individuals with simpler financial needs, these digital tools offer a significantly cheaper alternative to professional advice.

Self-directed investment platforms and robo-advisors represent a substantial threat to IGM Financial by offering lower-cost alternatives for investment management. These digital solutions empower individuals to manage their portfolios directly or through automated algorithms, often at a fraction of the fees charged by traditional advisors. By 2024, the growth in assets managed by robo-advisors and the increasing adoption of commission-free trading platforms highlight a significant shift in client preferences towards more accessible and cost-effective investment options.

Alternative investments and safe-haven assets like government bonds and GICs also serve as viable substitutes, particularly for risk-averse investors or those seeking direct control over their assets. The appeal of guaranteed principal and predictable returns, especially during market volatility, can divert capital that might otherwise flow into IGM Financial's managed products. For instance, competitive GIC rates observed in early 2024 further underscore the attractiveness of these simpler, secure alternatives.

The proliferation of personal finance apps and online tools further commoditizes basic financial management and investment execution, potentially reducing the perceived need for comprehensive advisory services. These platforms provide accessible means for budgeting, goal setting, and even trading, enabling individuals to handle many financial tasks independently. This trend suggests that IGM Financial must continuously innovate and clearly demonstrate the unique value of its personalized advice and sophisticated strategies to retain clients.

| Substitute Type | Key Features | Client Appeal | 2024 Market Trend/Data Point |

|---|---|---|---|

| Self-Directed Platforms | Low/no commission trading, direct investment control | Cost-conscious, financially literate investors | Continued growth in retail investor participation in online trading |

| Robo-Advisors | Automated portfolio management, lower fees (e.g., 0.25%-0.50% annually) | Younger demographics, cost-sensitive investors | Global assets under management for robo-advisors continued to increase |

| Alternative Assets (Direct) | Real estate, private equity, crypto; direct control | Diversification seekers, those seeking higher potential returns | Global alternative investment AUM projected to reach $21.1 trillion by 2025 |

| Safe-Haven Assets (Bonds/GICs) | Principal protection, predictable interest rates | Risk-averse investors, those prioritizing capital preservation | 1-year GIC rates in Canada observed in the 4.5%-5.5% range in early 2024 |

| Personal Finance Apps | Budgeting, goal setting, basic investment tracking | Individuals seeking to manage day-to-day finances independently | Substantial portion of the adult population actively using financial management apps by mid-2024 |

Entrants Threaten

The Canadian financial services sector is characterized by substantial regulatory oversight, demanding rigorous licensing, adherence to stringent capital adequacy rules, and compliance with comprehensive consumer protection legislation. These extensive requirements present a formidable obstacle for prospective entrants, making the establishment of a compliant business a costly and protracted endeavor.

For established entities like IGM Financial, these high regulatory barriers serve as a significant advantage, effectively limiting the influx of new competitors and reinforcing its market position. For instance, in 2024, the Office of the Superintendent of Financial Institutions (OSFI) continued to emphasize robust capital requirements for federally regulated financial institutions, ensuring a stable financial system but also increasing the cost of entry.

Entering the wealth and asset management industry, like the one IGM Financial operates in, demands considerable financial resources. Newcomers face significant upfront costs for essential technology, robust marketing campaigns, attracting skilled professionals, and covering ongoing operational expenditures. For instance, establishing a competitive digital platform and compliance infrastructure alone can easily run into millions of dollars.

These substantial capital requirements act as a formidable barrier. Potential new entrants, especially those without deep pockets or strong financial backing, find it challenging to meet these initial investment needs. This financial hurdle effectively limits the number of new players that can realistically enter the market and compete effectively against established firms.

In the financial services sector, where clients entrust their life savings, brand recognition and trust are incredibly powerful barriers to entry. Established players like IGM Financial have cultivated these over many years, making it difficult for newcomers to quickly gain a foothold. For instance, as of early 2024, Canadian households continued to show a strong preference for well-known financial institutions, with major banks and established wealth management firms holding significant market share.

Established Distribution Networks and Client Relationships

IGM Financial's established distribution networks and deep client relationships present a formidable barrier to new entrants. The company leverages its vast advisor force across brands like IG Wealth Management, Mackenzie Investments, and Investment Planning Counsel, fostering loyalty and trust built over years. For instance, as of late 2023, IGM Financial managed over $250 billion in assets, a testament to these entrenched relationships.

Newcomers must overcome the significant hurdle of replicating these extensive networks. Building a comparable advisor base and attracting a substantial client following demands immense capital, time, and strategic effort. This network effect, where existing participants gain value from the growing number of users, creates a powerful deterrent for any aspiring competitor looking to gain market share.

- Extensive Advisor Network: IGM Financial's strength lies in its large and experienced advisor force, a critical asset for client acquisition and retention.

- Deep Client Relationships: Decades of service through its core brands have cultivated strong, lasting bonds with a broad client base.

- High Barrier to Entry: The cost and time required to build comparable distribution and client loyalty are substantial deterrents for new market participants.

- Network Effect Advantage: The existing scale of IGM's operations enhances its value proposition, making it more attractive to both advisors and clients compared to nascent competitors.

Technological Disruption by FinTechs

While established players like IGM Financial benefit from high regulatory and capital barriers, the threat of new entrants is significantly amplified by technological disruption from FinTechs. These agile companies can rapidly introduce innovative solutions, often targeting specific market niches or offering a more streamlined digital experience. For instance, in 2024, FinTech investment globally continued to surge, with venture capital funding reaching hundreds of billions, indicating a strong appetite for new disruptive models in financial services.

These FinTechs frequently challenge traditional models by focusing on lower operational costs and enhanced customer engagement through digital platforms. They might offer specialized investment platforms, peer-to-peer lending, or automated financial advice. While IGM Financial has a broad suite of services, a successful FinTech could chip away at market share by excelling in one particular area, potentially attracting younger demographics less loyal to incumbent institutions.

However, scaling these operations to directly rival IGM Financial’s comprehensive offerings presents substantial challenges. Building widespread trust and navigating the complex web of financial regulations remain significant hurdles for many new entrants. Despite this, the ongoing evolution of technology means that even niche players can gain traction and exert pressure, forcing established firms to continuously innovate and adapt their own digital strategies.

- FinTech Investment Growth: Global FinTech venture funding in 2024 is projected to remain robust, building on the momentum of previous years, indicating continued innovation and potential for new market entrants.

- Digital Experience Focus: Many FinTechs prioritize user-friendly digital interfaces, a key differentiator that can attract customers seeking convenience and ease of use, potentially impacting traditional players' customer retention.

- Niche Market Disruption: The ability of FinTechs to focus on specific financial services allows them to offer specialized solutions that may be more appealing or cost-effective than a broad, integrated offering.

The threat of new entrants for IGM Financial is moderate, primarily due to high capital requirements and significant regulatory hurdles in the Canadian financial services sector. These factors, coupled with the need for substantial upfront investment in technology and marketing, make it difficult for new players to establish themselves. For instance, in 2024, the Office of the Superintendent of Financial Institutions (OSFI) continued to enforce stringent capital adequacy rules, increasing the cost of entry for any aspiring firm.

Despite these barriers, FinTech innovation presents a growing challenge. Agile startups can leverage technology to offer specialized, cost-effective services, potentially attracting specific customer segments. While these new entrants may not immediately rival IGM's scale, their ability to disrupt niche markets forces established players to remain competitive through continuous innovation. Global FinTech venture funding in 2024 remained strong, underscoring this ongoing disruption potential.

IGM Financial's established brand recognition, deep client relationships, and extensive advisor network are powerful deterrents to new entrants. Building comparable trust and distribution channels requires immense time and capital. For example, as of late 2023, IGM Financial managed over $250 billion in assets, reflecting the strength of its entrenched market position and client loyalty, which new competitors would struggle to replicate quickly.

| Barrier Type | Impact on New Entrants | IGM Financial's Advantage |

|---|---|---|

| Regulatory Requirements | High cost and time to comply | Established compliance infrastructure and expertise |

| Capital Investment | Significant upfront costs for technology and operations | Financial resources to invest in and maintain competitive platforms |

| Brand Recognition & Trust | Difficult to build quickly | Decades of customer loyalty and established reputation |

| Distribution Networks | Challenging to replicate extensive advisor force | Vast, deeply integrated advisor network across multiple brands |

| FinTech Disruption | Potential to disrupt niche markets | Need for continuous digital innovation to counter agile competitors |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IGM Financial leverages data from company annual reports, investor presentations, and regulatory filings. We also incorporate insights from industry-specific market research reports and financial news outlets to provide a comprehensive view of the competitive landscape.