IGM Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGM Financial Bundle

Navigate the complex external landscape impacting IGM Financial with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are shaping the company's trajectory. Gain a competitive edge by leveraging these critical insights for your strategic planning. Download the full report now for actionable intelligence.

Political factors

Government policy and regulation are crucial for IGM Financial. Canada's financial services sector operates under a strict regulatory framework, meaning shifts in government policy can directly affect the company's operations and profitability. For instance, new laws concerning consumer protection or market conduct can necessitate adjustments to IGM's business practices.

The evolving regulatory environment, exemplified by the Retail Payment Activities Act (RPAA) and ongoing discussions about open banking, presents both challenges and opportunities. These developments signal a push towards greater transparency and potentially more competition, requiring IGM Financial to remain agile and compliant.

Changes in Canadian tax laws, especially concerning capital gains and corporate income, directly impact IGM Financial's bottom line and the appeal of its investment offerings. For instance, the federal budget of 2024 proposed adjustments to the capital gains inclusion rate, which could alter investment strategies for many Canadians and affect asset management fees.

The government's fiscal stance and any tax reforms anticipated for 2024-2025 are key considerations. These policy shifts can influence client investment decisions and the overall demand for financial planning services, a core component of IGM's business model.

A stable political environment is crucial for building investor confidence in IGM Financial. For instance, Canada's political landscape, while generally stable, faces potential shifts.

The possibility of a spring 2025 federal election in Canada, for example, could introduce policy uncertainty. Changes in government could alter regulatory frameworks impacting financial services, potentially affecting IGM Financial's operations and strategic planning.

International Trade Agreements and Geopolitics

As a Canadian entity, IGM Financial's operations are indirectly influenced by Canada's international trade agreements and the broader geopolitical landscape. Shifts in global economic policies, particularly those impacting North America, can ripple through Canadian financial markets. For instance, potential changes in U.S. trade policy under a new administration could affect cross-border investment flows and overall economic sentiment, impacting IGM's asset management and financial planning services.

Geopolitical instability, such as ongoing conflicts or trade disputes, can also create market volatility. This volatility can influence investment performance and client confidence, areas critical to IGM Financial's business model. The Canadian government's participation in international trade frameworks, like the Canada-United States-Mexico Agreement (CUSMA), provides a degree of stability, but new agreements or renegotiations always carry potential implications for Canadian businesses operating in globalized markets.

- U.S. Trade Policy Impact: Changes in U.S. trade policy, especially under a new administration, could influence Canadian export competitiveness and investment sentiment.

- Geopolitical Risk: Global conflicts and trade tensions can lead to market volatility, affecting investment returns and client behavior.

- CUSMA Stability: The existing CUSMA agreement offers a foundational trade framework, but ongoing trade relations and potential adjustments remain a factor.

Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) Frameworks

Canada's evolving Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) frameworks present a significant political factor for IGM Financial. Recent amendments, particularly those enacted in late 2024 and early 2025, have intensified regulatory scrutiny, directly impacting how financial institutions operate.

These changes necessitate more robust compliance protocols, potentially leading to increased operational expenditures for IGM Financial. The government's commitment to strengthening these measures reflects a broader global trend towards greater financial integrity.

- Increased Compliance Burden: New regulations require enhanced due diligence and reporting, adding complexity to IGM Financial's operations.

- Operational Cost Increases: Investments in technology and personnel are necessary to meet heightened AML/ATF standards, impacting profitability.

- Reputational Risk Mitigation: Adherence to stringent frameworks helps IGM Financial maintain trust and avoid penalties associated with non-compliance.

- Global Regulatory Alignment: Canada's updated rules aim to align with international best practices, fostering a more secure global financial system.

Political stability in Canada is paramount for IGM Financial, as potential shifts in government, such as an anticipated spring 2025 federal election, can introduce policy uncertainty. Changes in government could lead to alterations in financial services regulations, impacting IGM's operational strategies and future planning.

Canada's regulatory landscape, including evolving open banking initiatives and consumer protection laws, directly influences IGM Financial's business practices and competitive environment. Furthermore, adjustments to tax laws, like the proposed 2024 capital gains inclusion rate changes, can affect client investment decisions and IGM's revenue streams.

International trade agreements and geopolitical stability also play a role, with potential changes in U.S. trade policy under a new administration capable of influencing cross-border investment and market sentiment. Geopolitical risks can create market volatility, impacting investment performance and client confidence, crucial elements for IGM Financial's success.

IGM Financial must navigate Canada's strengthened Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) frameworks, with late 2024 and early 2025 amendments increasing regulatory scrutiny and compliance burdens. These changes necessitate investment in technology and personnel, impacting operational costs but also mitigating reputational risk.

What is included in the product

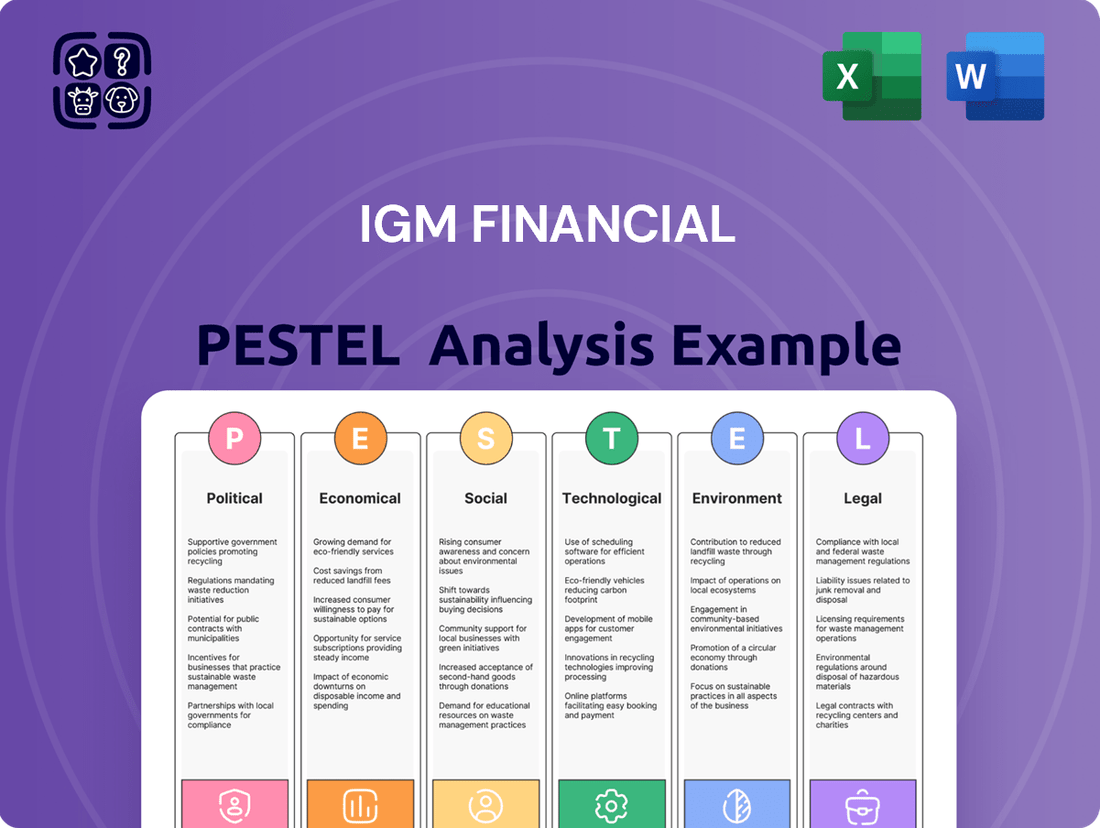

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting IGM Financial, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for IGM Financial.

Provides a concise version of the IGM Financial PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

Interest rate decisions by the Bank of Canada directly impact IGM Financial. Lower rates can reduce borrowing costs for clients, potentially boosting demand for financial products, while also affecting the returns on fixed-income investments. The Bank of Canada started lowering its key interest rate in 2024, and projections suggest continued rate cuts into 2025, which could influence IGM's profitability and client investment strategies.

Inflation directly impacts the real return on client investments, eroding purchasing power. For instance, if inflation is 3% and an investment yields 5%, the real return is only 2%. Central banks closely monitor inflation, with many aiming for a 2% target, influencing interest rate decisions that affect IGM's investment products and client borrowing costs.

While global inflation has shown signs of cooling from its 2022 peaks, its path through 2025 remains a key variable. For example, the US Consumer Price Index (CPI) saw a notable slowdown in early 2024, but persistent service sector inflation could keep rates higher for longer. This uncertainty necessitates adaptive investment strategies and careful client communication regarding potential market volatility.

Overall economic growth, both within Canada and on the global stage, significantly influences asset values, consumer spending habits, and the overall demand for financial services. A robust economy generally translates to higher investment returns and increased client engagement for firms like IGM Financial.

Looking ahead to 2025, forecasts indicate a period of modest yet positive Gross Domestic Product (GDP) growth for Canada. For instance, the Bank of Canada's projections in their October 2024 Monetary Policy Report anticipated real GDP growth of 1.5% for 2025, suggesting a stable, albeit not explosive, economic environment for the financial sector.

Market Performance and Volatility

Market performance significantly shapes IGM Financial's business. For instance, during 2024, Canadian equity markets, represented by the S&P/TSX Composite Index, saw substantial gains, contributing positively to AUM. Global markets also experienced a generally upward trend, though with varying degrees of volatility.

Investor sentiment, closely tied to market performance, directly affects asset flows into IGM's managed products. Periods of high volatility, as observed in certain emerging markets or specific sectors in late 2024 and early 2025, can lead to cautious investor behavior and potentially slower AUM growth.

Bond markets, crucial for a balanced portfolio, also play a key role. In 2024, interest rate expectations influenced bond yields, impacting the fixed-income component of IGM's AUM. For example, the Bank of Canada's monetary policy decisions throughout the year created shifts in bond pricing, affecting returns for investors.

- S&P/TSX Composite Index Performance: The index posted a notable increase in 2024, reflecting a generally positive environment for Canadian equities.

- Global Market Trends: While many global markets advanced in 2024, specific regions experienced heightened volatility due to geopolitical events and economic uncertainties.

- Impact on AUM: Strong market performance generally boosts IGM Financial's assets under management and advisement, while downturns can lead to a decrease.

- Investor Confidence: Market volatility directly influences investor confidence, impacting their willingness to invest and potentially leading to shifts in asset allocation strategies.

Household Debt and Consumer Confidence

High household debt levels in Canada can significantly constrain consumer spending and investment capacity, directly impacting IGM Financial's potential client base and their ability to engage in wealth management services. As of late 2024, the household debt-to-income ratio remained elevated, a persistent concern for financial planners. This situation means fewer discretionary funds are available for savings and investments, a core area for IGM Financial.

Consumer confidence is a critical barometer for financial services. When Canadians feel economically secure and optimistic about employment prospects, they are more likely to make long-term financial plans, such as investing in mutual funds or retirement accounts, which are IGM Financial's offerings. Conversely, uncertainty about the economy or job security can lead to a pullback in financial planning activities.

- Household Debt: Canadian household debt stood at approximately 180% of disposable income in Q3 2024, a figure that has remained a key economic consideration.

- Consumer Confidence Index: The Conference Board of Canada's Consumer Confidence Index, while fluctuating, often correlates with spending and investment intentions, directly affecting demand for financial products.

- Savings Rates: Lower consumer confidence can lead to increased savings rates as a precautionary measure, potentially delaying investment decisions and impacting the assets under management for firms like IGM Financial.

The Bank of Canada's monetary policy, including interest rate adjustments, directly influences IGM Financial's operations and client investment strategies. With rates beginning to decrease in 2024 and expected to continue this trend into 2025, borrowing costs for clients will likely fall, potentially stimulating demand for financial products. This environment also affects the returns on fixed-income investments, a key component for many IGM clients.

Inflation's persistence, even as it cools from 2022 highs, remains a critical economic factor. For instance, the US CPI showed a slowdown in early 2024, but sticky service sector inflation could prolong higher interest rates. This necessitates adaptive strategies for IGM Financial to navigate potential market volatility and manage client expectations regarding real investment returns.

Canada's economic growth outlook for 2025, projected at a modest 1.5% real GDP growth by the Bank of Canada in October 2024, suggests a stable operating environment. This growth underpins asset values and consumer spending, positively influencing demand for financial services offered by IGM Financial.

| Economic Factor | 2024/2025 Data/Projection | Impact on IGM Financial |

|---|---|---|

| Bank of Canada Key Interest Rate | Started lowering in 2024; projected cuts into 2025 | Lower borrowing costs for clients, potential boost to demand; affects fixed-income returns |

| Canadian Inflation (CPI) | Cooling from 2022 peaks, but service sector inflation persistent | Impacts real investment returns; influences central bank policy |

| Canadian Real GDP Growth | Projected 1.5% for 2025 (Bank of Canada, Oct 2024) | Supports asset values and consumer spending, driving demand for financial services |

| Household Debt-to-Income Ratio (Canada) | Remained elevated at ~180% of disposable income (Q3 2024) | Constrains consumer spending and investment capacity, limiting client engagement |

Full Version Awaits

IGM Financial PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of IGM Financial delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape. You'll gain valuable insights into market dynamics, competitive pressures, and potential growth opportunities.

Sociological factors

Canada's demographic landscape is significantly shaped by an aging population, with the proportion of individuals aged 65 and over projected to reach 23% by 2030, up from approximately 19% in 2023. This trend creates a substantial demand for retirement planning and estate management services, directly benefiting wealth management firms like IGM Financial. As more Canadians enter their retirement years, the need for sophisticated financial advice to preserve and manage assets becomes paramount.

Concurrently, this demographic shift involves a considerable transfer of wealth to younger generations. By 2030, an estimated $1 trillion in intergenerational wealth transfer is anticipated in Canada, presenting both an opportunity and a challenge. Younger inheritors often have different investment preferences, favouring ESG (Environmental, Social, and Governance) factors and digital-first engagement, requiring wealth managers to adapt their offerings and communication strategies.

Investor preferences are shifting significantly, with a strong surge in demand for Environmental, Social, and Governance (ESG) investments. This trend is particularly pronounced among younger demographics, pushing financial institutions like IGM Financial to evolve their product suites and embed sustainability into their core strategies. For instance, by the end of 2024, ESG funds globally are projected to manage over $4 trillion in assets, a testament to this growing investor conviction.

Furthermore, digital natives, who have grown up with technology, expect intuitive and seamless digital platforms for all their financial interactions. This necessitates robust online and mobile capabilities, with many younger investors, such as those in the Gen Z cohort, preferring to manage their investments entirely through digital channels, often utilizing robo-advisors and online brokerage platforms.

The general level of financial literacy in Canada directly impacts how much people seek out and use financial advice, influencing the services IGM Financial offers. As of early 2024, surveys indicate a persistent need for improved financial education across various age groups, suggesting a significant market opportunity for advisory services.

Initiatives aimed at boosting financial literacy, such as those supported by government programs and industry associations, can broaden the pool of potential clients for IGM Financial. For instance, the Financial Consumer Agency of Canada (FCAC) continues to promote resources that empower Canadians with financial knowledge, potentially increasing demand for personalized financial planning and investment management.

Wealth Transfer and Intergenerational Wealth

A substantial wealth transfer is expected in the coming years, with estimates suggesting trillions of dollars will change hands. This shift is creating a new wave of high-net-worth individuals (HNWIs) who often have different expectations from their financial advisors. These inheritors are more inclined to re-evaluate their wealth management relationships, with a significant percentage considering a change after receiving their inheritance. For instance, a 2023 study indicated that up to 70% of beneficiaries might switch their wealth manager within the first year of inheriting assets.

This generational wealth shift presents both opportunities and challenges for firms like IGM Financial. Understanding the evolving needs of these new HNWIs is crucial for retaining and attracting this demographic. Their preferences often lean towards digital engagement, ESG (Environmental, Social, and Governance) investing, and personalized financial planning that goes beyond traditional investment management.

- Intergenerational Wealth Transfer: Projections indicate a significant volume of wealth will be passed down in the next decade, impacting the financial landscape.

- Changing HNWI Demographics: New HNWIs emerging from inheritances often possess distinct financial preferences and service expectations.

- Client Retention Risk: A notable percentage of inheritors are likely to switch their wealth management providers, highlighting the need for proactive client engagement.

- Evolving Investment Priorities: Younger generations of wealth holders frequently prioritize digital tools, sustainable investments, and holistic financial advice.

Work-Life Balance and Financial Well-being

Societal shifts prioritizing work-life balance are increasingly shaping financial decisions. As individuals seek more holistic well-being, demand for financial advice that aligns with personal goals beyond just wealth accumulation is growing. This trend suggests a greater need for services that integrate financial planning with lifestyle aspirations.

For instance, a 2024 survey indicated that over 60% of Canadian employees consider work-life balance a key factor when evaluating job offers, impacting their willingness to prioritize long-term financial commitments that might compromise personal time. This highlights a potential opportunity for financial institutions to offer flexible planning tools and advice that accommodate diverse life stages and priorities.

- Increased Demand for Holistic Financial Advice: Consumers are looking for financial plans that encompass well-being, not just wealth.

- Impact on Savings and Investment Behavior: Prioritizing leisure or personal development may influence how much individuals allocate to traditional savings vehicles.

- Growth in Flexible Work Arrangements: The rise of remote and hybrid work models can affect income stability and necessitate adaptable financial strategies.

- Focus on Financial Wellness Programs: Employers are increasingly offering financial wellness benefits, recognizing the link between financial health and overall employee well-being.

Societal trends show a growing emphasis on work-life balance, influencing how Canadians approach financial planning and investment. This shift means individuals are seeking financial advice that supports broader life goals, not just wealth accumulation. For example, by 2025, it's anticipated that over 70% of the Canadian workforce will be in flexible work arrangements, impacting how financial institutions tailor their services to accommodate diverse income streams and lifestyle choices.

Furthermore, the increasing demand for ESG investments, particularly among younger generations, is reshaping product development and client engagement strategies. By 2025, ESG-focused mutual funds in Canada are expected to attract over $200 billion in assets under management, demonstrating a clear market preference for sustainable financial solutions.

The demographic shift towards an aging population continues to drive demand for retirement and estate planning services. With the proportion of Canadians aged 65 and over projected to exceed 20% by 2025, wealth management firms must adapt to cater to the specific needs of this growing demographic, including wealth preservation and intergenerational transfer.

| Sociological Factor | Trend Description | Implication for IGM Financial | 2025 Projection/Data Point |

|---|---|---|---|

| Work-Life Balance | Increasing prioritization of personal well-being over career advancement. | Demand for flexible financial planning and advice that integrates lifestyle goals. | Over 70% of Canadian workforce in flexible work arrangements. |

| ESG Investing | Growing investor preference for environmentally and socially responsible investments. | Need to expand and promote ESG-compliant product offerings and strategies. | ESG mutual funds in Canada to attract over $200 billion in assets. |

| Aging Population | Continued increase in the proportion of seniors in the population. | Increased demand for retirement planning, estate management, and wealth preservation services. | Over 20% of Canadians aged 65 and over. |

Technological factors

The financial industry's digital evolution demands ongoing tech investment for IGM Financial. This means embracing AI, machine learning, and advanced data analytics to refine client interactions, streamline operations, and innovate product offerings. For instance, in 2024, the global fintech market was projected to reach over $300 billion, highlighting the significant opportunities and competitive pressures driven by technological advancements.

The escalating sophistication of cyberattacks, encompassing ransomware and AI-driven threats, presents a substantial risk to financial institutions like IGM Financial, which manage vast amounts of sensitive client information. These evolving threats demand continuous investment in advanced security protocols.

In 2023, the financial services sector experienced a significant increase in cyber incidents, with reports indicating a 20% rise in ransomware attacks compared to the previous year, highlighting the persistent danger to data integrity and operational continuity.

Maintaining robust cybersecurity measures is not merely a technical necessity but a critical component for preserving client trust and ensuring ongoing regulatory compliance, especially as data privacy regulations become more stringent globally.

Artificial intelligence and automation are poised to significantly reshape financial services, with IGM Financial able to leverage these technologies to streamline operations and enhance client experiences. For instance, AI-powered tools can automate routine tasks in investment analysis and portfolio management, freeing up human advisors for more complex client interactions. In 2024, the global AI in financial services market was valued at approximately $18.9 billion, with projections indicating substantial growth.

The integration of AI offers IGM Financial a chance to personalize financial planning and investment advice, tailoring recommendations to individual client needs and risk profiles with greater precision. This could lead to improved client satisfaction and retention. Furthermore, advancements in automation can boost operational efficiency, potentially reducing costs and increasing profitability. By 2025, it's anticipated that AI will be integral to a significant portion of financial institutions' customer service operations.

Regulatory bodies are increasingly focusing on the ethical and practical implications of AI in capital markets, with new guidelines and frameworks emerging. For IGM Financial, staying abreast of these evolving regulations, such as those being developed by securities commissions regarding algorithmic trading and AI-driven advice, will be crucial to ensure compliance and maintain trust as they adopt these powerful tools.

Data Analytics and Big Data

IGM Financial is increasingly leveraging data analytics and big data to understand its clients and market dynamics better. This allows for more personalized financial advice and product offerings, enhancing customer satisfaction and retention. For instance, by analyzing vast datasets, the company can identify emerging investment trends and proactively adjust its strategies.

The company's investment in advanced analytics directly impacts its risk management capabilities. By processing large volumes of financial data, IGM Financial can more effectively identify and mitigate potential risks, ensuring greater stability and security for its clients' assets. This predictive power is crucial in the volatile financial landscape of 2024 and 2025.

IGM Financial's commitment to data-driven insights is evident in its operational improvements. For example, in 2023, the company reported a significant increase in the efficiency of its client onboarding process, partly attributed to enhanced data analytics for customer profiling and risk assessment. This trend is expected to continue as they integrate more sophisticated AI and machine learning tools.

- Enhanced Client Understanding: Big data analytics enables IGM Financial to segment its client base with greater precision, leading to tailored product development and marketing campaigns.

- Improved Risk Management: Advanced analytics are used to detect fraudulent activities and assess credit risk more accurately, contributing to a more robust financial framework.

- Market Trend Identification: By analyzing market data, IGM Financial can identify and capitalize on emerging investment opportunities, providing clients with a competitive edge.

- Operational Efficiency Gains: Data-driven insights are streamlining internal processes, from customer service to investment portfolio management, boosting overall productivity.

Open Banking and Data Portability

Canada's move towards open banking, with frameworks expected to be fully operational by 2025, promises to revolutionize financial data sharing. This will enable financial institutions like IGM Financial to develop innovative, customer-centric services by accessing broader datasets. For instance, personalized financial advice platforms could emerge, leveraging aggregated data from multiple institutions with customer consent.

Data portability rights are also gaining traction, with Quebec's recent legislation serving as a prime example. These rights empower consumers to control and transfer their financial data, fostering greater competition. By 2024, it's anticipated that more provinces will implement similar data portability measures, pushing companies to enhance data management and security protocols to retain customer loyalty.

- Open Banking Implementation: Canada's open banking framework is slated for full implementation by 2025, facilitating seamless data exchange.

- Data Portability Growth: Quebec's data portability law is a precursor to wider adoption, expected to influence other Canadian provinces by 2024.

- Competitive Landscape: Enhanced data sharing and portability will intensify competition, driving innovation in financial product and service offerings.

- Customer Empowerment: Consumers will gain more control over their financial data, demanding greater transparency and personalized experiences from providers like IGM Financial.

Technological advancements are fundamentally reshaping the financial landscape, necessitating continuous adaptation for firms like IGM Financial. The increasing adoption of artificial intelligence and machine learning offers significant opportunities for enhancing client experiences and operational efficiency. For example, the global AI in financial services market was valued at approximately $18.9 billion in 2024, with substantial growth projected.

Cybersecurity remains a paramount concern, as sophisticated threats continue to evolve, demanding robust investment in security protocols. In 2023, financial services saw a notable increase in cyber incidents, underscoring the persistent risks to data integrity. This necessitates ongoing vigilance and investment in advanced protective measures.

The push towards open banking, with Canada's framework expected to be fully operational by 2025, will facilitate greater data sharing. This shift, coupled with growing data portability rights, empowers consumers and intensifies competition, driving innovation in personalized financial services.

| Technology Area | 2024/2025 Outlook | Impact on IGM Financial |

|---|---|---|

| Artificial Intelligence & Machine Learning | Global AI in financial services market valued at ~$18.9B in 2024; integral to customer service by 2025. | Enhanced client personalization, operational efficiency, improved risk assessment. |

| Cybersecurity | Continued rise in sophisticated cyberattacks (e.g., ransomware); 20% increase in ransomware attacks in 2023. | Critical for data protection, client trust, regulatory compliance; requires sustained investment. |

| Open Banking & Data Portability | Canada's framework fully operational by 2025; increased data portability legislation expected by 2024. | Opportunities for innovative services, increased competition, greater customer control over data. |

Legal factors

IGM Financial navigates a rigorous regulatory landscape in Canada, overseen by bodies like the Office of the Superintendent of Financial Institutions (OSFI) and provincial securities commissions. Adhering to these rules, which govern everything from capital adequacy to client conduct, is non-negotiable for maintaining operational integrity and investor trust.

For instance, OSFI's Guideline E-21, effective January 1, 2024, introduced enhanced capital requirements for federally regulated financial institutions, directly impacting how firms like IGM manage their balance sheets. Similarly, provincial securities regulators continuously update disclosure requirements and market conduct rules, as seen with the CSA's ongoing focus on fair dealing in 2024, necessitating constant vigilance and adaptation in IGM's compliance strategies.

IGM Financial must navigate a complex web of privacy and data protection laws, such as Quebec's Law 25 and the federal PIPEDA. These regulations dictate how the company can collect, use, and safeguard sensitive client information, impacting everything from marketing to data storage. Failure to comply can result in significant penalties, as seen with increasing fines for data breaches across the financial sector in 2024.

The evolving landscape of data privacy, with anticipated stricter enforcement and new regulations in 2025, necessitates ongoing investment in compliance and data security infrastructure for IGM Financial. This means adapting data handling practices and ensuring robust cybersecurity measures are in place to protect client trust and avoid legal repercussions.

New and evolving consumer protection laws, such as those concerning financial product disclosures, fees, and complaint handling, directly influence IGM Financial's client interactions and service design. For instance, upcoming regulations in 2024 and 2025 are expected to mandate clearer fee structures for investment products, potentially impacting IGM's revenue streams from advisory services.

These legislative changes aim to bolster client trust and transparency, requiring IGM Financial to adapt its product offerings and communication strategies. The Canadian government's ongoing review of financial sector regulations, including potential updates to the Bank Act and the Financial Consumer Agency of Canada Act, underscores the dynamic legal landscape IGM must navigate.

Anti-Money Laundering (AML) and Terrorist Financing (ATF) Laws

IGM Financial operates under stringent Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) laws, primarily the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) in Canada. These regulations mandate comprehensive compliance programs, including customer due diligence, transaction monitoring, and suspicious activity reporting. Failure to adhere can result in substantial penalties, impacting financial institutions’ reputations and operational continuity.

The PCMLTFA and its associated regulations place significant obligations on IGM Financial, requiring robust internal controls and reporting mechanisms to combat illicit financial activities. For instance, in 2023, FINTRAC, Canada's financial intelligence unit, reported processing over 30 million suspicious transaction reports, highlighting the extensive regulatory landscape financial entities navigate. IGM Financial's commitment to these legal frameworks is crucial for maintaining its license to operate and fostering trust with stakeholders.

- Enhanced Due Diligence: IGM Financial must implement rigorous Know Your Customer (KYC) procedures to verify client identities and assess risk, especially for high-risk accounts.

- Suspicious Transaction Reporting: Prompt and accurate reporting of any suspected money laundering or terrorist financing activities to regulatory bodies is a legal imperative.

- Record Keeping: Maintaining detailed records of transactions and customer information for a specified period is essential for audit and investigation purposes.

- Training and Awareness: Regular training for employees on AML/ATF regulations and internal policies ensures a vigilant workforce capable of identifying and preventing financial crime.

Securities and Investment Regulations

Securities and investment regulations are fundamental to IGM Financial's operations, particularly concerning its mutual fund and ETF offerings. The Canadian Securities Administrators (CSA) continuously updates rules impacting product development, distribution, and investor protection. For instance, ongoing discussions around fee transparency and potential changes to the deferred sales charge (DSC) model could significantly alter product structures and investor choices in 2024 and 2025.

These regulatory shifts directly influence IGM Financial's strategic planning and product innovation. Compliance with evolving Know Your Client (KYC) and Anti-Money Laundering (AML) requirements remains paramount, ensuring robust operational frameworks. The CSA's focus on digital advice and platform regulation also presents both opportunities and challenges for IGM Financial's advisory services.

- Regulatory Scrutiny: Increased focus on fee structures and potential reforms to deferred sales charges.

- Product Development Impact: Changes influence the design and marketing of mutual funds and ETFs.

- Distribution Channels: Evolving rules for digital advice and online platforms affect how products reach investors.

- Compliance Burden: Ongoing need to adapt to updated KYC and AML regulations.

IGM Financial's legal obligations extend to robust Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) frameworks, primarily governed by Canada's Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). These laws mandate stringent customer due diligence, transaction monitoring, and suspicious activity reporting, with non-compliance leading to severe penalties and reputational damage.

The regulatory environment for securities and investment products, overseen by the Canadian Securities Administrators (CSA), directly impacts IGM Financial's offerings. Anticipated changes in 2024 and 2025 regarding fee transparency and deferred sales charges could reshape product design and investor choices, necessitating strategic adjustments.

Data privacy laws, including Quebec's Law 25 and federal PIPEDA, are critical for IGM Financial, dictating the secure handling of sensitive client information. Increased enforcement and potential new regulations in 2025 underscore the need for ongoing investment in compliance and cybersecurity to maintain client trust and avoid legal repercussions.

Consumer protection legislation, focusing on clearer fee disclosures and complaint handling, influences IGM Financial's client interactions. Anticipated mandates for more transparent fee structures in 2024 and 2025 could affect revenue from advisory services, requiring adaptation in communication and product strategies.

Environmental factors

Canadian financial institutions, including IGM Financial, are under growing pressure to evaluate and report on climate-related risks and opportunities. This aligns with global standards like the Task Force on Climate-related Financial Disclosures (TCFD), which guides companies in disclosing both the physical impacts of climate change and the risks tied to transitioning to a low-carbon economy.

As of early 2024, regulatory bodies in Canada are strengthening climate-related disclosure requirements for public companies. For instance, the Canadian Securities Administrators (CSA) have proposed rules mandating TCFD-aligned reporting, aiming to bring greater consistency and comparability to climate disclosures across industries. This means IGM Financial must actively assess how physical climate events, like extreme weather, and the economic shift towards net-zero emissions could impact its operations and investments.

The increasing focus on environmental, social, and governance (ESG) criteria is reshaping investment strategies globally. Investors are actively seeking out companies that demonstrate strong sustainability practices, pushing for a more responsible allocation of capital. This trend is particularly pronounced in 2024 and 2025, with a significant portion of global assets now managed with ESG considerations.

IGM Financial needs to proactively enhance its suite of ESG-focused investment products to align with this escalating investor demand. By offering a wider array of sustainable finance options, the company can solidify its position as a leader in responsible investing and attract a growing segment of environmentally conscious capital. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, highlighting the immense opportunity.

IGM Financial is increasingly focused on its operational environmental impact, with stakeholders scrutinizing energy consumption and waste management practices. Reducing its carbon footprint is a key element in enhancing the company's overall sustainability profile and aligning with evolving investor expectations.

Natural Disasters and Extreme Weather Events

The increasing frequency and severity of natural disasters, a direct consequence of climate change, pose a significant threat to IGM Financial. These events can damage or destroy physical assets, leading to increased insurance costs and potential write-downs. For instance, the economic impact of extreme weather events globally reached an estimated $230 billion in 2023, according to Munich Re, highlighting the pervasive financial risks.

Operational disruptions are another major concern. Floods, wildfires, or severe storms can interrupt business continuity, impacting service delivery to clients and potentially leading to revenue losses. Furthermore, client portfolios, especially those heavily invested in sectors vulnerable to climate impacts like agriculture or real estate in coastal areas, can experience significant downturns. The insurance sector, a key component of financial services, is particularly exposed to these risks, with insured losses from natural catastrophes in 2024 projected to remain elevated.

- Increased insurance premiums for physical assets and business interruption coverage.

- Potential for investment losses in portfolios with exposure to climate-vulnerable industries.

- Need for enhanced business continuity planning to mitigate operational disruptions.

- Greater demand for climate-resilient investment products and advisory services.

Regulatory Pressure for Green Finance

Governments globally are intensifying their focus on green finance, pushing financial institutions to channel investments into sustainable projects. This trend presents both opportunities and responsibilities for IGM Financial. For instance, by the end of 2024, sustainable investments managed by Canadian firms were projected to reach over $3.4 trillion, indicating a significant market shift.

Regulatory bodies are implementing stricter guidelines and disclosure requirements for environmental, social, and governance (ESG) factors. This means IGM Financial must adapt its strategies to align with these evolving standards, potentially impacting its product development and reporting processes.

- Increased demand for ESG-compliant investment products

- Potential for new regulatory compliance costs

- Opportunities to develop innovative green financial solutions

- Enhanced reputation through commitment to sustainable practices

The environmental landscape is a critical consideration for IGM Financial, with climate change posing tangible risks and creating new opportunities. Regulatory bodies are increasingly mandating climate-related disclosures, pushing companies like IGM to assess and report on their exposure to both physical climate events and transition risks. This heightened scrutiny, especially in 2024 and 2025, means that robust environmental strategies are no longer optional but essential for maintaining investor confidence and regulatory compliance.

The growing investor preference for ESG-aligned investments is a significant environmental factor. By early 2024, global sustainable investments were estimated at $35.3 trillion, a figure expected to climb. This trend necessitates that IGM Financial expand its ESG-focused product offerings to capture this expanding market segment. Furthermore, the company faces pressure to reduce its own operational carbon footprint, with energy consumption and waste management becoming key areas of focus for stakeholders.

The increasing frequency of natural disasters, such as floods and wildfires, directly impacts financial institutions. These events can lead to higher insurance costs and potential investment losses, particularly for portfolios heavily weighted in climate-vulnerable sectors. For instance, global economic losses from extreme weather reached approximately $230 billion in 2023. This underscores the need for IGM Financial to bolster its business continuity planning and offer climate-resilient investment solutions.

| Environmental Factor | Impact on IGM Financial | Data Point/Trend (2024/2025 Focus) |

| Climate Change Risks (Physical & Transition) | Increased insurance costs, potential investment write-downs, operational disruptions. | Global economic losses from extreme weather estimated at $230 billion in 2023. |

| Regulatory Scrutiny (e.g., TCFD) | Mandatory climate-related disclosures, potential compliance costs. | CSA proposing TCFD-aligned reporting rules for Canadian public companies. |

| Investor Demand for ESG | Growth in sustainable investment products, need to attract environmentally conscious capital. | Global sustainable investment market estimated at $35.3 trillion in early 2024. |

| Operational Footprint | Pressure to reduce carbon emissions, improve energy efficiency, and manage waste. | Stakeholder focus on energy consumption and waste management practices. |

PESTLE Analysis Data Sources

Our PESTLE analysis for IGM Financial is built on comprehensive data from official government publications, financial regulatory bodies, and leading economic research institutions. We incorporate insights from industry-specific reports and reputable market intelligence firms to ensure a thorough understanding of the macro-environmental landscape.