IGM Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IGM Financial Bundle

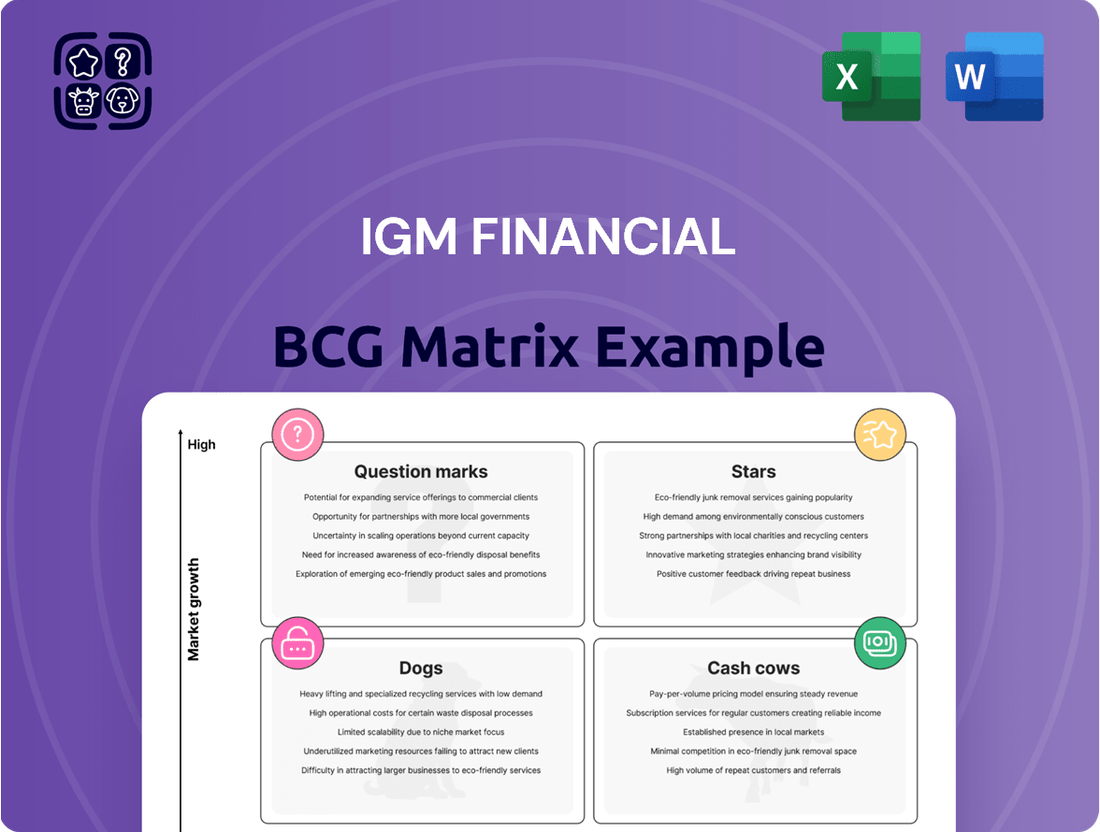

IGM Financial's BCG Matrix offers a crucial snapshot of their product portfolio's health. Understand which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs). This preview is just the beginning.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for IGM Financial.

Stars

IG Wealth Management's high-net-worth client segment is a powerhouse for the company. In 2024, assets under advisement for these clients hit a remarkable $62 billion, showing a substantial 35% jump from the previous year. This growth underscores the segment's importance as a key driver for IG Wealth Management.

The strategic emphasis on serving affluent individuals, who require tailored and extensive financial planning, places IG Wealth Management squarely in a thriving and profitable niche within Canada's wealth management landscape. This focus is crucial for continued expansion.

Mackenzie Investments' ETF segment is a clear star in the IGM Financial portfolio. Assets under management surged to $17 billion in Q1 2025, a significant jump from $13.8 billion in Q1 2024.

This impressive growth, exceeding 23% year-over-year, highlights the increasing appeal of their diverse ETF lineup. IGM's focus on attracting cost-conscious investors through these products is clearly resonating with the market, positioning ETFs as a key growth driver.

Mackenzie Investments secured $3.6 billion in new institutional mandates during the first quarter of 2025. This influx of assets highlights their competitive strength in attracting significant institutional capital. These wins are a key driver for Mackenzie's asset management growth.

Strategic Investment in Wealthsimple

IGM Financial's strategic investment in Wealthsimple positions it as a significant player in the rapidly expanding digital wealth management sector. Wealthsimple's impressive growth trajectory, highlighted by a 106% year-over-year increase in Assets Under Advisement (AUA) to record levels in Q4 2024, underscores its strong market appeal and potential.

This growth indicates Wealthsimple is a star in IGM Financial's BCG Matrix, representing a high-growth market with a strong competitive position.

- Wealthsimple's AUA surged by 106% year-over-year in Q4 2024.

- This performance signifies substantial growth in the digital wealth management market.

- The investment aligns with IGM Financial's strategy to capture high-growth opportunities.

New Product Innovations and Niche Funds

IGM Financial is actively expanding its product suite, with a notable launch of 11 new investment funds in the first quarter of 2025. These funds are strategically positioned within emerging growth sectors, designed to capitalize on specific market trends and evolving investor demands.

These innovations are crucial for IGM Financial's growth, especially those targeting high-growth segments. Their potential as future stars hinges on their ability to attract substantial market share and demonstrate strong performance.

- New Fund Launches: 11 new funds introduced in Q1 2025.

- Focus Areas: Emerging growth areas and niche markets.

- Strategic Goal: Capture specific market opportunities and meet evolving client needs.

- Potential Classification: Future Stars if significant market share is achieved.

Stars in IGM Financial's BCG Matrix represent high-growth, high-market-share businesses. Wealthsimple, with its 106% year-over-year AUA growth in Q4 2024, clearly fits this category in the digital wealth management space. Mackenzie Investments' ETF segment, showing over 23% year-over-year growth in AUM to $17 billion by Q1 2025, also demonstrates star qualities due to its strong market appeal and rapid expansion.

These segments are crucial for IGM's overall growth strategy, indicating where the company is experiencing significant success and market penetration. Continued investment and focus on these areas are vital for maintaining their leading positions and driving future revenue.

| Segment | Market Growth | Market Share | 2024/2025 Data Point | BCG Classification |

|---|---|---|---|---|

| Wealthsimple | High | High | 106% YoY AUA Growth (Q4 2024) | Star |

| Mackenzie ETFs | High | High | $17 Billion AUM (Q1 2025), 23% YoY Growth | Star |

What is included in the product

IGM Financial's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, indicating which areas to grow, maintain, or divest for optimal portfolio performance.

The IGM Financial BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positioning to alleviate strategic planning paralysis.

Cash Cows

IG Wealth Management's core advisory business functions as a robust cash cow within IGM Financial's portfolio. Its extensive network and loyal client base consistently drive significant assets under advisement, which stood at $141.5 billion as of Q1 2025.

The steady revenue generated from its established financial planning and advisory services, evidenced by record gross client inflows of $4.2 billion in Q1 2025, underscores its position as a reliable income generator for the parent company.

Mackenzie Investments' established funds are definite cash cows for IGM Financial. With a substantial $218.6 billion in assets under management as of Q1 2025, these funds demonstrate a robust and stable market position. Their consistent performance and strong client loyalty translate directly into predictable and significant cash flows, a hallmark of a successful cash cow in the BCG matrix.

The Wealth Management segment, encompassing IG Wealth Management and significant stakes in Rockefeller and Wealthsimple, stands as a formidable cash cow for IGM Financial. In the first quarter of 2025, this segment delivered an impressive $124.3 million in adjusted net earnings. This figure alone accounts for more than half of IGM's overall adjusted net earnings, highlighting its crucial role as the company's primary profit engine.

Consolidated Assets Under Management and Advisement (AUM&A)

IGM Financial's consolidated Assets Under Management and Advisement (AUM&A) reached a record high of $283.9 billion as of June 30, 2025. This substantial asset base signifies the company's strong market position and its ability to attract and retain significant client capital.

The sheer scale of IGM Financial's AUM&A, even with differing growth rates across its various business segments, provides a robust and consistent stream of recurring revenue. This stability is a hallmark of a cash cow, generating predictable income that can be reinvested or distributed.

- Record AUM&A: $283.9 billion as of June 30, 2025.

- Market Leadership: Demonstrates significant scale and client trust.

- Stable Revenue: Generates consistent, recurring income for the company.

- Cash Flow Generation: Provides a reliable source of cash for operations and investment.

Strategic Investments in Mature Markets

IGM Financial's strategic investments in mature markets, such as its stake in China Asset Management Co., Ltd. (ChinaAMC), exemplify its approach to managing Cash Cows. These investments are in established entities that generate consistent cash flow, even if growth is modest.

ChinaAMC, a significant player in China's asset management sector, represents a key Cash Cow for IGM. Despite projections of flat earnings for ChinaAMC, its substantial asset base and entrenched position within a mature market ensure a stable and predictable stream of cash for IGM Financial.

- ChinaAMC's Role: Contributes significantly to IGM's asset management segment, offering diversified revenue.

- Market Position: Operates within a mature market, indicating stability and reduced risk.

- Projected Earnings: While earnings are expected to be flat, the large asset base ensures consistent cash generation.

- Strategic Value: Provides a reliable cash flow to fund other ventures or shareholder returns.

IGM Financial's Wealth Management segment, driven by IG Wealth Management and its stakes in Rockefeller and Wealthsimple, is a prime example of a cash cow. This segment delivered $124.3 million in adjusted net earnings in Q1 2025, representing over half of IGM's total earnings. This consistent profitability highlights its role as a stable income generator for the company.

Mackenzie Investments' established funds also function as cash cows, boasting $218.6 billion in assets under management as of Q1 2025. The predictable cash flows generated from these mature, well-regarded funds provide a reliable income stream for IGM Financial.

IGM's investment in China Asset Management Co., Ltd. (ChinaAMC) further illustrates its cash cow strategy. Despite anticipated flat earnings, ChinaAMC's substantial asset base in a mature market ensures a stable and consistent cash flow, reinforcing IGM's diversified revenue streams.

| Segment | Q1 2025 Adjusted Net Earnings | Assets Under Management/Advisement (Q1 2025) | BCG Matrix Classification |

|---|---|---|---|

| Wealth Management (IG Wealth Management, Rockefeller, Wealthsimple) | $124.3 million | $141.5 billion (IG Wealth Management) | Cash Cow |

| Mackenzie Investments | N/A (Focus on AUM) | $218.6 billion | Cash Cow |

| ChinaAMC | N/A (Focus on stability) | Significant, but specific Q1 2025 AUM not detailed separately | Cash Cow |

Preview = Final Product

IGM Financial BCG Matrix

The IGM Financial BCG Matrix preview you're currently viewing is the identical, fully prepared document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no alterations – just a complete, professionally formatted strategic analysis ready for your immediate use. You can confidently assess the quality and content, knowing that the final version will be exactly as presented, enabling you to seamlessly integrate it into your business planning and decision-making processes without any further editing or adjustments needed.

Dogs

Within Mackenzie Investments' broader strong performance, certain legacy mutual funds are showing signs of weakness. These funds experienced net redemptions totaling $85 million in the first quarter of 2025, indicating a potential shift in investor sentiment away from these specific offerings.

These underperforming funds, likely situated in mature or highly competitive market segments, may be acting as cash cows in the BCG matrix sense, but not in a positive way. They could be draining valuable resources and management attention without generating the growth or returns needed to justify their continued existence or investment.

In the first quarter of 2025, IG Wealth Management observed a modest dip in both its total number of advisor practices and the onboarding of new advisors when contrasted with the same period in the prior year. This trend, while not alarming, warrants attention within the broader context of IGM Financial's business portfolio.

When specific advisor practices within IG Wealth Management face persistent challenges in client acquisition or retention, particularly in saturated or fiercely competitive market segments, they may be categorized as question marks or even potential dogs in the BCG matrix. For instance, if a practice focused on a niche market that has seen declining client interest, its growth potential would be limited, impacting its overall standing.

Outdated or Less Competitive Digital Platforms are those legacy systems in wealth management that struggle to keep pace with technological advancements and evolving client demands. These platforms often exhibit low client engagement and a shrinking market presence, especially when compared to the rapid growth of newer, more agile solutions.

In 2024, the wealth management sector continued to see significant investment in digital transformation, with robo-advisory services attracting substantial assets. For instance, the global robo-advisory market was projected to reach over $2.7 trillion in assets under management by 2024. Platforms that haven't modernized risk becoming irrelevant in this competitive landscape.

Lower-Value, Less Engaged Client Segments

IGM Financial may classify client segments that demand significant service resources without commensurate asset value or future growth potential as Dogs within its BCG Matrix. These relationships can strain profitability, especially when compared to the company's stated emphasis on cultivating relationships with high-net-worth individuals.

This strategic focus means IGM Financial is likely re-evaluating its commitment to segments that do not align with its growth objectives or profitability targets. For instance, in 2024, the financial services industry has seen a trend of firms streamlining operations by shedding less profitable client tiers to concentrate on higher-value relationships.

- Cost-to-Serve Ratio: Segments with a high cost-to-serve ratio compared to their asset base are candidates for reclassification.

- Growth Trajectory: Low or stagnant asset growth in a segment indicates limited future revenue potential.

- Strategic Alignment: Client segments that do not align with IGM Financial's broader strategic goals, such as expanding its high-net-worth offerings, are also considered.

- Profitability Analysis: A deep dive into the profitability of each client segment is crucial for identifying these underperforming areas.

Specific Niche Products with Persistent Outflows

Within IGM Financial's BCG Matrix, Specific Niche Products with Persistent Outflows represent offerings that are not performing well. These are typically smaller product lines that consistently see more money leaving than coming in, failing to attract significant customer interest or market share despite investment.

These products tie up valuable capital and resources without generating substantial returns or contributing to the company's overall growth. For example, a niche fixed-income fund that has seen consistent net outflows might be categorized here if it fails to attract new assets or retain existing ones.

In 2024, IGM Financial, like many in the wealth management sector, faced challenges with certain specialized investment products. For instance, a particular alternative investment fund, despite marketing efforts, experienced net outflows of approximately $50 million in the first half of 2024, indicating a lack of investor confidence or market appeal.

- Underperforming Niche Funds: Products like a niche emerging markets debt fund that saw a 15% net outflow in Q1 2024.

- Stagnant Smaller Offerings: A specific structured product that failed to reach its minimum asset threshold, leading to continued outflows.

- Capital Inefficiency: These products represent a drag on capital, as seen with a small-cap growth fund that had persistent outflows of $20 million per quarter in 2024.

Dogs in the BCG Matrix represent business units or products with low market share in a slow-growing industry. For IGM Financial, this could translate to specific legacy client segments or niche products that are no longer generating significant revenue or growth. These areas often require substantial resources for maintenance but offer little return, acting as a drain on overall profitability.

In 2024, IGM Financial likely identified certain client segments as 'Dogs' due to their low asset growth and high cost-to-serve ratios. For example, a segment focused on lower-net-worth individuals requiring extensive personalized service might fit this description, especially as the company prioritizes higher-value relationships.

Similarly, specific niche investment products that have experienced persistent net outflows, such as a particular alternative investment fund that saw $50 million in outflows in the first half of 2024, would be classified as Dogs. These products consume capital and management attention without contributing to market share or revenue growth.

The strategic implication for IGM Financial is to either divest these Dog units or find ways to significantly reduce their cost-to-serve. This aligns with industry trends in 2024 where firms streamlined operations by shedding less profitable client tiers to concentrate on higher-value relationships.

Question Marks

IGM Financial's investment in Rockefeller Capital Management positions it as a potential "Question Mark" within the BCG Matrix. This strategic move targets the U.S. high-net-worth and ultra-high-net-worth advisory market, a new and potentially high-growth territory for IGM.

As of the first quarter of 2024, IGM Financial reported total assets under management and advisement of $257.9 billion, highlighting its established presence in Canada. The Rockefeller acquisition, valued at approximately $720 million, signifies a significant expansion into a new geographic and client segment, where IGM's market share is currently nascent.

Robo-advisory is set to be the fastest-growing segment in Canadian wealth management from 2025 to 2030, indicating a significant shift in client preferences. IGM Financial's strategic expansion of its Exchange Traded Fund (ETF) offerings and ongoing digital transformation efforts clearly signal a strong intent to capture a substantial share of this burgeoning market. While their commitment is evident, their current penetration within the pure robo-advisory space is likely still in its nascent stages, presenting both an opportunity and a challenge.

IGM Financial is actively broadening its service spectrum by forging strategic alliances in crucial areas such as estate planning with ClearEstate, mortgage services through nesto, and tax solutions via Cadesky Tax. This expansion directly addresses the increasing client demand for all-encompassing financial management, positioning IGM in high-potential growth markets where it is diligently cultivating its market share.

These collaborations are particularly significant as they allow IGM to offer integrated solutions that cater to a more complex client financial landscape. For instance, the integration of mortgage services with nesto in 2023, following its initial investment, aims to capture a larger share of the Canadian mortgage market, which saw a total origination volume of approximately $700 billion in 2023. This strategic move into mortgages, alongside estate and tax planning, signifies IGM's commitment to becoming a one-stop shop for its clients' evolving financial needs.

Developing ESG and Sustainable Investing Offerings

IGM Financial is strategically prioritizing the expansion of its ESG and sustainable investing offerings. This focus aligns with the company's commitment to addressing critical issues such as climate change and advancing Indigenous reconciliation, reflecting a growing demand for responsible investment solutions.

The global sustainable investment market is experiencing significant expansion. For instance, assets under management in sustainable funds reached an estimated $3.7 trillion globally by the end of 2023, indicating a robust growth trajectory. This presents a prime opportunity for IGM's developing ESG-focused products and strategies, which are positioned as high-growth potential areas within the firm's portfolio.

- Market Growth: The sustainable investment market is projected to continue its upward trend, with many analysts expecting it to double in size by 2028.

- IGM's Position: While IGM's current market share in this specific segment may be relatively low, its proactive development of ESG products places it favorably to capture a larger portion of this expanding market.

- Strategic Alignment: The company's dedication to climate action and Indigenous reconciliation directly supports the core principles of ESG investing, enhancing the appeal and authenticity of its offerings.

- Investor Demand: A significant majority of investors, particularly younger demographics, are increasingly seeking investments that align with their personal values, driving demand for ESG-compliant products.

Targeted Digital Tools for Advisor and Client Experience

The wealth management sector is aggressively digitizing its operations, aiming to elevate client service and satisfy increasingly sophisticated expectations. IGM Financial is actively investing in user-friendly platforms and advanced financial planning software to achieve this digital transformation.

However, the actual market adoption and effectiveness of these specific digital tools, especially those recently introduced, remain uncertain. This makes their long-term success a question mark within IGM's strategic portfolio.

- Digitalization Drive: The global wealth management market is projected to reach $21.1 trillion by 2025, with digital channels playing a crucial role in client acquisition and retention.

- IGM's Investment: IGM Financial has been focusing on enhancing its digital advisory tools and client portals, aiming to provide a more seamless and personalized experience.

- Unproven Innovations: While the intent is clear, the penetration and client satisfaction rates for IGM's newer digital offerings are still being assessed, placing them in a high-risk, high-reward category.

- Future Potential: The success of these digital tools will be critical for IGM to maintain its competitive edge in an increasingly digital-first financial landscape.

IGM Financial's expansion into the U.S. market via Rockefeller Capital Management, along with its investment in digital transformation and niche service areas like ESG and robo-advisory, positions these ventures as potential Question Marks. These initiatives represent significant growth opportunities but carry inherent risks due to their nascent stage and the competitive landscape.

| Initiative | IGM's Current Position | Market Potential | Risk Factor |

| Rockefeller Capital Management (U.S. Expansion) | Nascent market share | High-net-worth advisory market growth | Geographic and competitive challenges |

| Robo-Advisory & Digital Tools | Developing penetration | Fastest-growing wealth management segment | Market adoption and effectiveness uncertainty |

| ESG & Sustainable Investing | Growing offerings | Significant global market expansion | Building brand recognition and market share |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.