ICA Gruppen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Gruppen Bundle

ICA Gruppen, a retail giant, boasts significant brand recognition and a loyal customer base, key strengths in a competitive market. However, like many in the sector, they face evolving consumer preferences and the relentless pressure of online competition, presenting clear opportunities and threats. Their robust supply chain and established store network are crucial advantages.

To truly grasp ICA Gruppen's strategic position and unlock actionable insights, a deeper dive is essential. Our comprehensive SWOT analysis delves into these core elements, providing a detailed understanding of their internal capabilities and external market dynamics. This report is your roadmap to informed decision-making.

Want the full story behind ICA Gruppen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ICA Gruppen commands significant market leadership across the Nordic region, especially in Sweden where ICA Sweden stands as the dominant grocery retailer. This robust position is a key strength, translating into consistent customer engagement.

The company's market dominance is further solidified by its impressive performance in 2024 and early 2025, marked by a notable increase in customer visits. This heightened traffic directly contributes to the strengthening of market shares across both its grocery and pharmacy segments, demonstrating broad-based appeal and operational success.

ICA Gruppen's strength lies in its highly diversified business portfolio, which acts as a significant buffer against market fluctuations. This includes core grocery retail under the well-recognized ICA brand, expanding into pharmacies with Apotek Hjärtat, offering financial services through ICA Banken and ICA Försäkring, and managing real estate assets via ICA Real Estate.

This multi-segment strategy is crucial for generating multiple, stable revenue streams. For instance, in the first quarter of 2024, ICA Gruppen reported net sales of SEK 36.6 billion, with its retail operations forming the backbone, but contributions from other segments demonstrating the benefits of this spread. This diversification enhances financial resilience and provides a solid foundation for sustained performance.

ICA Gruppen demonstrated robust financial performance in 2024, with consolidated net sales hitting around SEK 157 billion. This growth was accompanied by significant gains in market share across both its grocery and pharmacy segments.

Apotek Hjärtat, a key part of ICA Gruppen, experienced a landmark year, achieving its highest operating profit and market share to date. This success firmly established Apotek Hjärtat as the dominant pharmacy chain in Sweden.

Robust Sustainability Commitments

ICA Gruppen's robust sustainability commitments are a significant strength, particularly evident in their forward-thinking climate targets. In 2024, they became one of the first Nordic grocery retailers to have their science-based net-zero climate targets officially approved by the Science Based Targets initiative (SBTi).

These ambitious goals are comprehensive, encompassing the entire value chain and demonstrating a deep commitment to environmental responsibility. Key targets include substantial emission reductions by 2030, with a clear roadmap to achieve net zero by 2050.

- SBTi Approval: ICA Gruppen secured SBTi approval for its net-zero targets in 2024.

- Value Chain Coverage: Targets span the entire ICA Gruppen value chain.

- 2030 Emission Reduction: Aims for significant emission cuts by 2030.

- Net Zero Goal: Committed to achieving net zero emissions by 2050.

Effective Loyalty Program and Local Adaptation

ICA Gruppen's loyalty program, Stammis, boasts over 5 million members, a significant base that generates invaluable data. This rich customer data allows ICA to craft highly personalized offers and promotions, directly addressing individual customer preferences and driving repeat business. The program is a cornerstone of their customer engagement strategy.

The company excels at local adaptation, a key strength stemming from its unique business model. By centralizing purchasing and marketing while empowering a vast network of independently owned retailers, ICA fosters a strong connection to local communities. This structure allows individual stores to respond swiftly to specific regional consumer needs and preferences, a crucial advantage in the diverse Nordic market.

- Loyalty Program Reach: Stammis membership exceeds 5 million, providing a substantial customer data pool.

- Data-Driven Insights: The program facilitates tailored offerings through detailed customer analytics.

- Decentralized Agility: Independent retailers enable rapid responses to local market demands.

- Hybrid Business Model: Centralized functions support a flexible, locally attuned retail network.

ICA Gruppen's market leadership in the Nordics, particularly in Sweden, is a significant strength, translating into consistent customer engagement and robust market share growth across its segments. The company's diversified business model, encompassing retail, pharmacies, banking, insurance, and real estate, provides financial resilience and stable revenue streams.

In 2024, ICA Gruppen reported consolidated net sales of approximately SEK 157 billion, underscoring its financial strength and market penetration. Apotek Hjärtat, its pharmacy chain, achieved record operating profit and market share, solidifying its position as Sweden's leading pharmacy. The Stammis loyalty program, with over 5 million members, fuels personalized marketing and customer retention, further solidifying ICA's competitive edge.

| Strength | Description | Supporting Data (2024/Early 2025) |

| Market Leadership | Dominant position in Nordic grocery retail, especially Sweden. | Increased customer visits and market share gains in grocery and pharmacy segments. |

| Diversified Portfolio | Operations span retail, pharmacies, banking, insurance, and real estate. | Net sales of SEK 36.6 billion in Q1 2024, with contributions from all segments. |

| Financial Performance | Strong revenue growth and market share expansion. | Consolidated net sales of ~SEK 157 billion in 2024. |

| Loyalty Program | Extensive customer base and data generation through Stammis. | Over 5 million members, enabling personalized offers and repeat business. |

What is included in the product

Maps out ICA Gruppen’s market strengths, operational gaps, and risks, providing a comprehensive view of its strategic position.

Simplifies complex strategic challenges by presenting ICA Gruppen's SWOT in an easily digestible format.

Weaknesses

Despite robust sales increases, ICA Sweden experienced a dip in its operating margin during 2024 and the initial four months of 2025. This decline is primarily attributed to significant strategic price investments and the costs linked to enhanced loyalty program benefits, such as the introduction of double bonus checks.

These deliberate investments, designed to boost sales volumes and capture greater market share, have inevitably placed considerable pressure on the company's profitability. For instance, in the first quarter of 2025, ICA Gruppen reported that ICA Sweden’s operating profit was SEK 1,023 million, a decrease from SEK 1,087 million in the same period of 2024, reflecting this margin pressure.

While ICA Banken saw positive momentum in 2024, with a notable increase in business volume and enhanced profitability, the broader financial services division presented a more varied picture. This mixed performance stems largely from ICA Försäkring's challenges.

ICA Försäkring faced headwinds in 2024 due to an adverse claims development, characterized by an uptick in both the frequency and severity of claims. This resulted in a significant impact on the overall earnings of the combined banking and insurance operations.

Apotek Hjärtat, despite its overall positive trajectory, faced headwinds in its e-commerce segment during the initial four months of 2025. While the brand secured significant market share and demonstrated robust growth across its physical footprint, its online sales lagged behind expectations.

This disparity suggests that Apotek Hjärtat encountered difficulties in translating its established brand strength into digital channel success, potentially due to competitive pricing, user experience issues, or logistical challenges in its online operations.

The weaker online performance points to a need for strategic re-evaluation within ICA Gruppen to enhance the profitability and competitiveness of Apotek Hjärtat's digital pharmacy offerings.

Significant Investments Impacting Profitability

ICA Gruppen's significant investments, especially in modernizing warehouses, enhancing logistics, and upgrading IT systems for Apotek Hjärtat, have weighed on its operating margin. While these initiatives are crucial for future competitiveness and efficiency gains, they temporarily reduce short-term profitability. For instance, the Group reported substantial capital expenditures in its 2024 interim reports, impacting the earnings per share.

These necessary expenditures create a drag on profitability, even as other areas of the business achieve cost savings. The strategy behind these investments aims for long-term operational excellence and market position, but the immediate financial impact is a recognized weakness.

- Warehouse modernization and logistics upgrades are key investment areas.

- IT system enhancements for Apotek Hjärtat also contribute to high capital outlay.

- These investments pressure the Group's operating margin in the short term.

- Long-term growth objectives are the primary driver for these financial commitments.

Increased Reliance on Swedish Market

ICA Gruppen's decision to divest its Baltic operations, finalized in June 2025, has significantly sharpened its strategic focus onto the Swedish market. This move, while freeing up capital for domestic investments, inherently elevates the company's dependence on a single national economy. The concentration risk is now more pronounced, making ICA Gruppen more susceptible to fluctuations within Sweden's retail landscape.

This heightened reliance on Sweden means that any economic downturn or significant shift in consumer behavior within the country could have a more substantial impact on ICA Gruppen's overall performance. For instance, if Swedish consumer spending were to decline by, say, 5% in 2026 due to inflationary pressures, the impact on ICA Gruppen would be more direct and magnified compared to a period when its operations were more geographically diversified.

- Increased Exposure to Swedish Economic Volatility: Post-divestment, ICA Gruppen's financial health is more closely tied to the economic stability and growth trajectory of Sweden.

- Concentration Risk Amplified: The absence of the Baltic markets means a single national market now bears the full weight of ICA's operational and revenue generation.

- Sensitivity to Swedish Regulatory Changes: New regulations or tax policies implemented in Sweden will have a more direct and potentially greater impact on the company's profitability.

- Reduced Diversification Benefits: The company loses the buffer that international operations previously provided against localized market downturns.

ICA Sweden's competitive pricing strategy and enhanced loyalty programs in 2024 and early 2025, while driving sales, have squeezed operating margins. The first quarter of 2025 saw ICA Sweden's operating profit decrease to SEK 1,023 million from SEK 1,087 million in the prior year, highlighting this profitability pressure.

ICA Försäkring experienced a challenging 2024 due to a higher frequency and severity of insurance claims, negatively impacting the financial services division. Apotek Hjärtat's e-commerce segment also underperformed in early 2025, failing to match the robust growth seen in its physical stores.

Significant investments in warehouse modernization, logistics, and IT systems for Apotek Hjärtat, though crucial for long-term competitiveness, have pressured ICA Gruppen's operating margin in the short term. The divestment of Baltic operations in mid-2025 has increased ICA Gruppen's reliance on the Swedish market, amplifying concentration risk and susceptibility to national economic fluctuations.

What You See Is What You Get

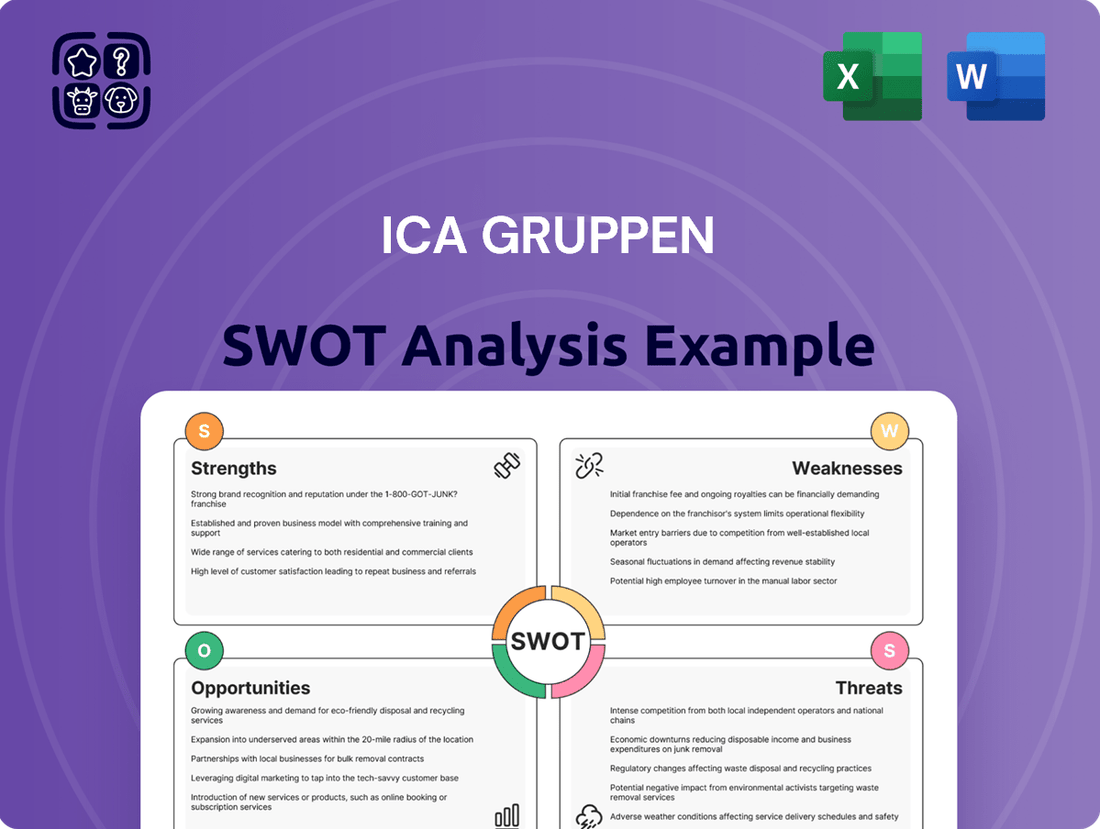

ICA Gruppen SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis of ICA Gruppen covers their internal Strengths and Weaknesses, alongside external Opportunities and Threats. You'll gain insights into their market position, competitive landscape, and strategic considerations. Purchasing unlocks the complete, actionable document.

Opportunities

Physical retail is experiencing a resurgence in the Nordic region, with in-store sales showing robust growth in 2024. This trend is notably fueled by younger consumers, particularly Generation Z, indicating a sustained preference for tangible shopping experiences.

The booming health and pharmaceutical sectors offer a complementary avenue for growth. This presents a significant opportunity for ICA Gruppen to capitalize on its established physical footprint and the strong market presence of its pharmacy chain, Apotek Hjärtat.

By integrating health and wellness offerings within its extensive store network, ICA Gruppen can cater to evolving consumer demands. This strategic alignment is expected to enhance customer loyalty and drive increased foot traffic across its various retail formats.

Despite a temporary resurgence in physical retail, ICA Gruppen has a substantial runway for expanding its e-commerce and omnichannel capabilities. This includes further leveraging its partnership with Ocado, focusing on enhancing its central e-commerce platform.

Continued investment in connecting more physical stores to its fulfillment network is crucial for improving customer convenience and extending its delivery reach. This strategic move aims to capture a larger share of the growing online grocery market, which saw significant growth in 2024, with online grocery sales in Sweden projected to reach approximately SEK 50 billion by the end of the year.

ICA Gruppen's Stammis loyalty program, boasting over 4 million active members in Sweden, presents a significant opportunity. The wealth of purchasing data collected allows for granular customer segmentation. This enables ICA to tailor promotions and product recommendations, thereby boosting engagement and purchase frequency.

By analyzing purchasing patterns within Stammis, ICA can anticipate customer needs and proactively offer relevant products or services. For instance, identifying a customer who frequently buys organic produce could lead to targeted offers on new organic arrivals. This personalization fosters a stronger connection, increasing customer lifetime value.

Furthermore, the data from Stammis can inform inventory management and new product development. Understanding which products are popular among specific loyalty segments allows ICA to optimize stock levels and identify gaps in the market. This data-driven approach minimizes waste and maximizes sales potential across its diverse store formats.

Strategic Reinvestment into Core Swedish Operations

The recent divestment of Rimi Baltic operations is a significant opportunity for ICA Gruppen, unlocking substantial financial flexibility. This move generated an estimated capital gain of SEK 7 billion, providing a strong foundation for strategic reinvestment.

This influx of capital can be directly channeled into bolstering ICA Gruppen's core Swedish market presence. Key areas for investment include enhancing customer value through competitive pricing strategies and accelerating digital transformation initiatives to meet evolving consumer demands.

Specific opportunities arising from this financial strengthening include:

- Enhanced Price Competitiveness: Utilizing capital for strategic price reductions or loyalty programs to win market share in Sweden.

- Digital Innovation Acceleration: Investing in e-commerce platforms, data analytics, and personalized customer experiences.

- Strengthening Own Brands: Allocating resources to develop and promote ICA's private label products, improving margins and customer loyalty.

- Supply Chain Optimization: Investing in technology and infrastructure to improve efficiency and reduce costs within the Swedish supply chain.

Sustainability Leadership and Brand Differentiation

ICA Gruppen's commitment to sustainability, exemplified by its science-based net-zero climate targets validated by the Science Based Targets initiative (SBTi), sets it apart in the Nordic food retail landscape. This leadership position offers a significant opportunity for brand differentiation, appealing to a growing segment of consumers who prioritize environmental responsibility. By clearly communicating these efforts, ICA can cultivate deeper brand loyalty and attract new customers who align with its values.

Leveraging this strong sustainability profile can translate into tangible business advantages. For instance, in 2023, consumer spending on sustainable products continued to rise across Europe, with reports indicating double-digit growth in certain categories. ICA can capitalize on this trend by:

- Highlighting SBTi-approved targets in marketing campaigns to attract eco-conscious shoppers.

- Developing private label products with clear sustainability credentials, such as reduced packaging or lower carbon footprints.

- Partnering with suppliers who also demonstrate strong environmental commitments, reinforcing the brand's overall sustainable image.

- Exploring innovative solutions for waste reduction and circular economy principles, further solidifying its leadership.

The strengthening of ICA Gruppen's financial position following the Rimi Baltic divestment, which generated approximately SEK 7 billion, offers significant opportunities. This capital can be strategically reinvested to enhance price competitiveness in Sweden, accelerate digital transformation, and bolster the development of its own-brand products, thereby improving margins.

Furthermore, the ongoing resurgence of physical retail, particularly among younger demographics, combined with the growth in health and pharmaceutical sectors, presents avenues for ICA to leverage its extensive store network and pharmacy chain, Apotek Hjärtat. Capitalizing on the loyalty data from its Stammis program, which has over 4 million active members, allows for personalized marketing and product development, driving customer engagement and lifetime value.

ICA's validated science-based net-zero climate targets by SBTi provide a distinct advantage in attracting environmentally conscious consumers, a growing market segment. This sustainability leadership can be translated into marketing efforts, product development, and supplier partnerships, reinforcing brand loyalty and market appeal.

Threats

The Nordic grocery sector is a battleground, with ICA Gruppen constantly contending with both long-standing rivals and emerging disruptors. This intense competition, particularly in key markets like Sweden, forces significant investment in pricing strategies and operational efficiencies, directly impacting profit margins. For instance, in 2023, the Swedish grocery market saw continued price sensitivity among consumers, a trend expected to persist through 2024 and 2025, putting pressure on retailers to balance market share with profitability.

Economic uncertainties, such as the persistent inflation seen throughout 2024, are significantly impacting consumer spending habits across Sweden. Households facing strained finances are prioritizing value, leading to a heightened demand for lower-priced products and promotions. This trend directly affects retailers like ICA Gruppen, potentially squeezing sales volumes and impacting profit margins.

For instance, during early 2024, inflation rates remained a concern, prompting many Swedish consumers to re-evaluate their grocery budgets. ICA Gruppen needs to carefully adjust its pricing strategies and product assortment to cater to this price-sensitive environment, ensuring it remains competitive while managing its own operational costs.

ICA Gruppen, like other major retailers, faces ongoing risks from global supply chain disruptions and fluctuating commodity prices. Events such as geopolitical tensions or extreme weather can interrupt the flow of goods, impacting everything from fresh produce to packaged items. For instance, the price of cocoa, a key ingredient for many food products, saw significant increases in early 2024, with futures contracts trading at record highs due to poor harvests in West Africa.

This volatility directly affects ICA Gruppen's procurement costs. When the cost of raw materials like coffee beans, sugar, or grains rises sharply, the company must decide whether to absorb these increases, impacting its profit margins, or pass them on to consumers, potentially affecting sales volume. Managing these external economic pressures is a constant challenge for ensuring stable pricing and profitability.

Changing Regulatory Landscape and Scrutiny

ICA Gruppen operates within a retail sector, especially in the Nordics, that faces significant governmental oversight concerning market concentration and pricing. This scrutiny can lead to potential new regulations or enhanced surveillance, directly affecting ICA Gruppen's operational agility and profitability. For instance, ongoing discussions around competition in Nordic grocery markets could signal future regulatory shifts that might necessitate adjustments to business strategies or pricing models.

The risk of increased regulatory burdens, such as stricter antitrust laws or new consumer protection measures, poses a tangible threat. Such changes could limit ICA Gruppen's ability to leverage its market position or influence pricing, potentially impacting its revenue streams. For example, if new regulations were to cap certain pricing strategies, it could directly affect margins, especially in a competitive environment where price is a key differentiator.

- Regulatory Scrutiny: Nordic governments are increasingly watchful of market concentration in retail, potentially leading to new legislation.

- Pricing Impact: Future regulations on pricing practices could constrain ICA Gruppen's ability to set competitive prices and maintain margins.

- Operational Flexibility: Increased surveillance and compliance requirements may reduce ICA Gruppen's strategic maneuverability and increase operational costs.

- Market Share Concerns: Regulators might target large players like ICA Gruppen if market share concentration is deemed detrimental to consumer welfare or fair competition.

Shifting Consumer Preferences and Digital Adoption

Consumer preferences are a moving target, and staying ahead is crucial for ICA Gruppen. While brick-and-mortar stores are seeing renewed interest, the demand for personalized experiences and seamless omnichannel engagement continues to rise. For instance, a recent study in late 2024 indicated that over 60% of consumers expect retailers to offer a consistent experience across all channels, from online browsing to in-store pickup.

The pace of digital adoption directly impacts how consumers interact with brands. ICA Gruppen must therefore continuously evolve its digital strategies to meet these changing expectations. Failure to do so could lead to a loss of market share, as competitors who effectively leverage technology and personalized approaches gain traction. By early 2025, e-commerce sales in the grocery sector are projected to account for nearly 15% of total sales in many European markets, highlighting the urgency of digital integration.

- Evolving Expectations: Consumers increasingly prioritize personalized shopping experiences and integrated online-offline journeys.

- Digital Dominance: The rapid adoption of digital channels necessitates robust e-commerce and omnichannel capabilities.

- Brand Loyalty Factors: Personalization and convenient digital access are becoming key drivers of customer loyalty in the retail sector.

- Competitive Landscape: Retailers failing to adapt to shifting preferences and digital trends risk falling behind competitors who do.

ICA Gruppen faces intense competition in the Nordic grocery market, with price sensitivity a major concern for consumers through 2024 and into 2025. Economic uncertainties, like persistent inflation in early 2024, are forcing shoppers to prioritize value, impacting sales volumes and profit margins for retailers. This necessitates careful adjustments to pricing and product assortments to remain competitive amidst rising procurement costs, such as the significant increases in cocoa prices observed in early 2024.

The company also navigates a landscape of evolving consumer preferences, with a growing demand for personalized experiences and seamless omnichannel engagement. By early 2025, e-commerce is projected to capture nearly 15% of grocery sales in many European markets, making robust digital strategies and efficient online-offline integration critical for maintaining market share against digitally adept competitors.

Furthermore, ICA Gruppen is subject to increasing governmental scrutiny regarding market concentration and pricing practices in the Nordics. Potential new regulations or enhanced surveillance could limit strategic maneuverability and impact revenue streams, especially if future rules cap pricing strategies in a market where price remains a key differentiator.

| Threat Category | Specific Threat | Impact on ICA Gruppen | Data Point/Example (2024/2025) |

|---|---|---|---|

| Competition | Intense Rivalry & Price Wars | Erodes profit margins, necessitates aggressive promotional activity. | Swedish grocery market experienced continued price sensitivity in 2023, expected to persist through 2024-2025. |

| Economic Factors | Inflation & Reduced Consumer Spending | Decreased sales volumes, shift towards lower-priced products. | Inflation remained a concern in early 2024, prompting consumers to re-evaluate grocery budgets. |

| Supply Chain | Disruptions & Volatile Commodity Prices | Increased procurement costs, potential for price increases or margin squeeze. | Cocoa futures hit record highs in early 2024 due to poor West African harvests. |

| Regulatory Environment | Increased Oversight & Potential New Legislation | Limits pricing flexibility, reduces strategic maneuverability, increases compliance costs. | Ongoing discussions about competition in Nordic grocery markets may signal future regulatory shifts. |

| Consumer Behavior | Shifting Preferences & Digital Adoption | Risk of losing market share to digitally advanced competitors, need for investment in omnichannel. | Over 60% of consumers expect consistent cross-channel experiences (late 2024 study). E-commerce projected for ~15% of European grocery sales by early 2025. |

SWOT Analysis Data Sources

This ICA Gruppen SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and insights from industry experts to ensure a robust and accurate assessment.