ICA Gruppen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Gruppen Bundle

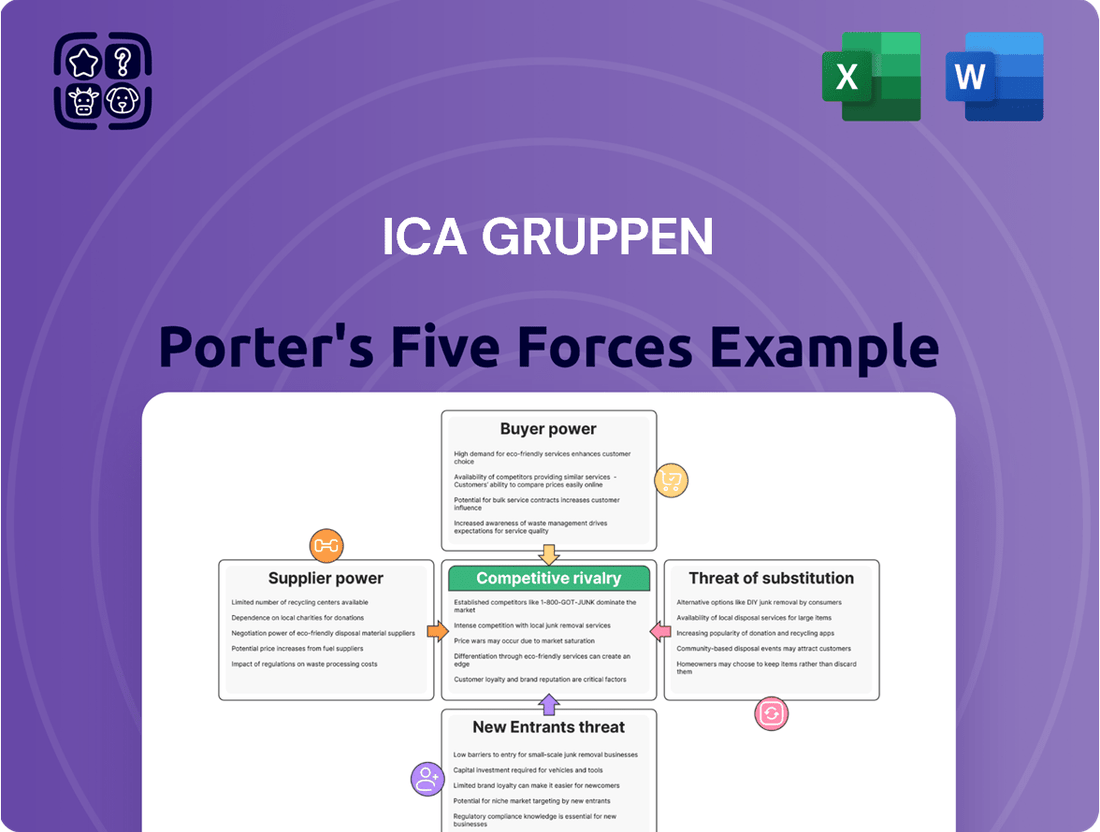

ICA Gruppen operates within a dynamic retail landscape, significantly influenced by several key competitive forces. Understanding the intensity of rivalry among existing competitors is crucial, as is the bargaining power wielded by both suppliers and buyers. The threat of new entrants and the availability of substitute products also play a significant role in shaping ICA Gruppen's strategic environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ICA Gruppen’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ICA Gruppen’s centralized purchasing model is a significant advantage, allowing it to negotiate better terms due to its sheer volume. This consolidation of demand across its vast network of stores, which numbered approximately 2,200 in 2024, effectively diminishes the bargaining power of individual suppliers.

By pooling purchasing needs, ICA can secure bulk discounts and ensure consistent quality standards. This concentrated buying power strengthens its position in negotiations, making it harder for suppliers to dictate terms or charge premium prices for their goods.

ICA Gruppen likely benefits from a diversified supplier base across its various business segments, including groceries, health, and financial services. This broad sourcing strategy means the company isn't overly dependent on any single supplier or a small group of them.

Having many suppliers for different product categories significantly weakens the bargaining power of individual suppliers. For instance, in 2023, ICA's net sales reached SEK 139,785 million, indicating a vast procurement volume spread across numerous vendors, making it harder for any one vendor to dictate terms.

This wide array of suppliers is crucial for ICA to maintain competitive pricing and ensure consistent product availability for its customers. A strong supplier network allows ICA to negotiate favorable terms and switch between suppliers if necessary, further limiting supplier leverage.

For many food and health product suppliers, ICA Gruppen is a vital distribution channel across the Nordic region. Its extensive network of stores provides unparalleled market reach, making ICA an essential partner for achieving broad penetration. In 2023, ICA Gruppen reported net sales of SEK 132.3 billion, highlighting the significant volume of goods passing through its channels.

This substantial market presence grants ICA considerable leverage. Suppliers who rely heavily on ICA for sales volume may find their power to negotiate favorable terms diminished. Losing ICA as a customer would represent a significant blow to a supplier's revenue and overall market visibility.

Threat of Backward Integration or Private Labels

ICA Gruppen's substantial portfolio of private label products significantly bolsters its bargaining power against suppliers. This extensive range acts as a potent threat of backward integration. Should supplier pricing or terms become disadvantageous, ICA can readily scale up its own-brand production, directly challenging and potentially displacing existing external suppliers.

This inherent capability serves as a powerful check against aggressive supplier demands, effectively reinforcing ICA's negotiating leverage. For instance, in 2024, ICA's private label share of sales across its grocery operations remained robust, contributing significantly to its overall profitability and market position. This allows ICA to dictate terms more effectively.

- Private Label Strength: ICA's extensive private label offerings represent a direct threat of backward integration.

- Deterrent to Suppliers: This capability discourages suppliers from imposing unfavorable price increases or terms.

- Competitive Advantage: ICA can directly compete with and replace suppliers by expanding its own-brand products.

- Reinforced Bargaining Power: The ability to produce in-house strengthens ICA's negotiating position with external suppliers.

Supplier Switching Costs

For a large retailer like ICA Gruppen, the costs associated with switching suppliers, such as establishing new logistics and implementing fresh quality control measures, are generally manageable. This is due to the inherently competitive landscape of the food and health product supply market.

The abundance of alternative suppliers, particularly for widely available commodity products, significantly curtails the bargaining power of individual suppliers. If their terms are not competitive, these suppliers run the tangible risk of being readily replaced by ICA.

- Supplier Switching Costs: While some costs are involved in changing suppliers, such as new logistics and quality checks, the competitive food and health product market allows large retailers like ICA to manage these expenses.

- Availability of Alternatives: Numerous suppliers, especially for commodity goods, exist, limiting the power of current suppliers to dictate terms without risking replacement.

- ICA's Negotiating Position: ICA's scale provides leverage, enabling them to seek competitive pricing and terms, as suppliers are aware of the readily available alternatives.

- Impact on Profitability: Low supplier switching costs and high supplier competition contribute to ICA's ability to maintain healthy gross margins by sourcing products effectively.

Suppliers generally hold limited bargaining power over ICA Gruppen due to the company's scale and strategic purchasing practices. ICA's centralized procurement and vast network, encompassing around 2,200 stores in 2024, allow it to leverage significant volume discounts, thereby reducing individual supplier leverage.

| Metric | Value (2023) | Implication for Supplier Bargaining Power |

|---|---|---|

| Net Sales | SEK 139,785 million | Indicates massive procurement volume, making it difficult for any single supplier to dictate terms. |

| Market Reach | Extensive Nordic network | Suppliers rely heavily on ICA for sales, diminishing their power to negotiate favorable terms. |

| Private Label Share | Robust and significant | Threat of backward integration weakens supplier pricing power. |

What is included in the product

This analysis unpacks the competitive intensity within ICA Gruppen's operating environment, assessing threats from new entrants, substitute products, buyer and supplier power, and existing rivals.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for ICA Gruppen.

Customers Bargaining Power

Customers in the grocery sector exhibit significant price sensitivity, particularly for everyday essentials. This means they are quick to switch stores if they find better deals elsewhere, putting pressure on companies like ICA Gruppen to stay competitive on price. For instance, in 2024, grocery inflation remained a key concern for consumers, driving many to seek out promotions and lower-cost alternatives.

This price sensitivity directly impacts ICA Gruppen’s strategies, compelling them to allocate resources towards price reductions to retain their customer base. The company's 2025 strategic focus on lowering prices is a direct response to this ongoing consumer behavior. Evidence from 2024 shows that promotions and loyalty programs offering price advantages were critical in maintaining market share across the industry.

Customers in the grocery sector often face low switching costs. For instance, in 2024, consumers can easily shift between ICA, Coop, or other regional grocery chains with minimal effort or expense, perhaps just a change in loyalty program or preferred shopping app. This ease of transition directly amplifies their power.

The Nordic retail landscape, particularly for groceries and health products, is highly competitive. ICA Gruppen operates in markets with numerous players, including established chains and emerging online grocers. This availability of alternatives means customers have plenty of options to meet their needs, from fresh produce to household essentials, further strengthening their negotiating position.

With a multitude of choices readily available, customers can readily compare prices, product quality, and promotions across different retailers. This heightened awareness and accessibility to alternatives compel ICA to remain competitive, often through pricing strategies, loyalty programs, and product assortment to retain its customer base.

ICA Gruppen's loyalty program, Stammis, is designed to lock in customers and make them less likely to shop elsewhere. By offering perks like bonus cheques, ICA aims to lessen the impact of price fluctuations on customer loyalty. This strategy is crucial in competitive markets where price is a major factor for shoppers.

However, the cost of these loyalty programs can be significant, especially during periods of economic strain like the inflation seen in 2024. For example, in 2023, ICA reported that the bonus points redemption cost them SEK 2.5 billion. This highlights the delicate balance ICA must strike between appeasing customers and managing operational expenses.

Information Transparency and Price Comparison

The digital age has dramatically amplified customer bargaining power by fostering unprecedented information transparency. Consumers can now effortlessly compare prices and product specifications across numerous retailers, including ICA, using readily available online platforms and dedicated apps. This ease of access empowers shoppers to make well-informed decisions, compelling retailers to maintain competitive pricing and deliver superior value to retain their business.

This heightened transparency directly impacts ICA's pricing strategies and necessitates a focus on value proposition. For instance, in 2024, e-commerce penetration continued to grow, with online grocery sales in Sweden, ICA's primary market, showing a significant upward trend. This allows customers to quickly identify price discrepancies and seek out the best deals.

- Increased Price Sensitivity: Customers are more aware of price differentials, leading to greater sensitivity to even small variations.

- Access to Reviews and Ratings: Online platforms provide access to peer reviews and product ratings, influencing purchasing decisions beyond just price.

- Direct Comparison Tools: Apps and websites allow for side-by-side comparisons of identical or similar products from various competitors.

- Promotional Awareness: Customers can easily track and compare promotions and discounts offered by different retailers.

Segmented Customer Base Across Offerings

ICA Gruppen’s customer base is notably segmented across its various business units, including grocery, pharmacy, and financial services. This diversity means that the bargaining power of customers isn't uniform. For instance, grocery shoppers are often more attuned to price differences, a characteristic that can amplify their power to demand lower prices.

Conversely, customers seeking specialized pharmacy services or financial products might place a higher value on factors like convenience, established trust, or unique service features rather than solely on price. This differing emphasis across segments necessitates that ICA Gruppen employs distinct strategies to engage and retain customers in each area, recognizing that a one-size-fits-all approach to customer relations would be ineffective.

For example, in the competitive grocery sector, ICA has historically focused on loyalty programs and private label offerings to mitigate price-based customer power. In 2024, ICA’s Swedish grocery sales saw continued growth, underscoring the importance of these customer retention strategies. The pharmacy segment, operating under brands like Apotek Hjärtat, benefits from a different customer dynamic where health needs and accessibility play a larger role.

- Diverse Customer Priorities: Grocery customers often prioritize price, while pharmacy and financial services customers may value convenience and trust more highly.

- Varied Bargaining Power: This segmentation leads to differing levels of customer bargaining power across ICA Gruppen's offerings.

- Tailored Retention Strategies: ICA must develop specific approaches for each customer segment to maintain loyalty and attract new business.

- 2024 Market Dynamics: In 2024, ICA's grocery segment continued to navigate price sensitivities, while pharmacy services relied on accessibility and specialized care to retain customers.

Customers in the grocery sector exhibit significant price sensitivity, amplified by low switching costs and widespread access to competitor information. This means they can easily move between retailers for better deals, forcing ICA Gruppen to focus on competitive pricing and loyalty programs. In 2024, continued grocery inflation further heightened this price awareness among consumers.

The digital age empowers customers with transparent pricing and easy comparison tools, compelling retailers like ICA to offer strong value propositions. This heightened awareness means customers can quickly identify and exploit price discrepancies across various platforms. For instance, the growing e-commerce penetration in Sweden in 2024 facilitated this direct comparison of offerings.

ICA Gruppen's customer base is diverse, with grocery shoppers typically prioritizing price, while pharmacy and financial services customers may value convenience and trust more. This segmentation leads to varied levels of bargaining power across ICA's offerings, necessitating tailored retention strategies for each segment. In 2024, ICA's grocery segment continued to navigate price sensitivities, while pharmacy services relied on accessibility and specialized care.

| Customer Segment | Primary Driver | Bargaining Power Factor | 2024 Impact |

|---|---|---|---|

| Grocery Shoppers | Price | High (due to price sensitivity & low switching costs) | Increased demand for promotions and discounts |

| Pharmacy Customers | Convenience, Trust, Service | Moderate (less price-sensitive, more value-focused) | Focus on accessibility and specialized care |

| Financial Services Customers | Trust, Service Features | Moderate (value-driven, less frequent switching) | Emphasis on relationship management and tailored offerings |

Full Version Awaits

ICA Gruppen Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details ICA Gruppen's competitive landscape through Porter's Five Forces, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services. This comprehensive analysis provides actionable insights into the strategic positioning of ICA Gruppen within the retail sector.

Rivalry Among Competitors

The Nordic retail landscape, especially within the grocery sector, is a battleground with formidable regional and international players. ICA Gruppen faces stiff competition from established chains, aggressive discounters, and niche retailers, all vying for consumer attention and loyalty.

This crowded market means ICA Gruppen is under continuous pressure to offer competitive pricing, introduce innovative products, and enhance its overall customer experience. For instance, in 2023, the discount segment continued to gain traction across the Nordics, with players like Lidl reporting strong sales growth, directly challenging larger players on price.

The sheer number of well-resourced competitors necessitates constant strategic adjustments. ICA Gruppen must remain agile, adapting to evolving consumer preferences and the strategic moves of rivals like Coop and Axfood in Sweden, and Rema 1000 in Norway, which consistently invest in store upgrades and digital capabilities.

The Nordic grocery retail landscape is largely mature, meaning substantial growth for companies like ICA Gruppen typically involves taking business from rivals. This maturity fuels intense competitive rivalry, as players vie for existing customer bases.

To gain an edge, ICA Gruppen and its competitors increasingly rely on strategies like aggressive price investments and robust loyalty programs. These initiatives are designed to win over shoppers and keep them coming back, even if it means accepting lower profit margins in the short term. For instance, in 2023, grocery price inflation in Sweden, ICA Gruppen's primary market, remained a significant factor influencing consumer behavior and competitive pricing strategies.

This relentless pursuit of market share, even at the expense of immediate profitability, underscores the fiercely competitive nature of the Nordic grocery sector. Companies are willing to invest heavily to secure their position and expand their reach within a market that offers limited organic expansion opportunities.

ICA Gruppen faces significant hurdles in differentiating its core grocery offerings, despite its private label brands and integrated services like pharmacies and banking. The fundamental nature of many grocery items means that true product innovation is often limited, pushing competition towards price and convenience as primary differentiators.

This inherent lack of deep product differentiation intensifies the rivalry among players in the grocery sector. For instance, in 2023, the Swedish grocery market saw intense price competition, with major players like Coop and Axfood actively engaging in promotional activities to capture market share, directly impacting ICA's pricing strategies and margins.

To stand out, retailers like ICA Gruppen are compelled to explore avenues beyond product features. Enhancing the overall customer shopping experience, investing in sustainable practices and sourcing, and leveraging digital platforms for personalized offers are becoming crucial battlegrounds to capture consumer loyalty and mitigate the impact of price-driven competition.

Online Retail and Omnichannel Competition

The competitive landscape for ICA Gruppen is intensified by the burgeoning online retail and omnichannel competition. While brick-and-mortar stores in the Nordics have shown resilience in 2024, the digital marketplace continues to capture a substantial market share. Retailers are compelled to offer integrated, smooth customer journeys across both physical and online touchpoints.

ICA's strategic emphasis on developing robust digital platforms and expanding its online sales capabilities directly addresses this persistent competitive pressure. The company recognizes that a seamless omnichannel experience is no longer optional but a critical differentiator in attracting and retaining customers in today's market.

- Online Grocery Growth: In 2023, online grocery sales in Sweden accounted for approximately 10% of the total grocery market, a figure expected to continue its upward trajectory.

- Omnichannel Investment: Retailers are significantly increasing investments in technology and logistics to support click-and-collect services and home delivery, aiming for greater efficiency and customer convenience.

- Customer Expectations: Consumers increasingly expect personalized offers and consistent service whether shopping in-store or online, forcing retailers to unify their brand experience across all channels.

- Digital Transformation: ICA's ongoing digital transformation initiatives, including app development and data analytics, are crucial for staying competitive against digitally native players and adapting to evolving consumer behaviors.

Strategic Investments and Innovation

Competitors in the retail sector are locked in a perpetual race, consistently pouring resources into technological advancements, optimizing their supply chains, and pioneering novel business concepts to outmaneuver rivals. This relentless pursuit of advantage fuels a high degree of competitive rivalry.

ICA Gruppen's strategic maneuvers, such as its significant investments in digital platforms and sustainability programs, alongside divesting assets like Rimi Baltic in 2021 for approximately SEK 2.5 billion (around $240 million USD at the time), directly reflect this intensely competitive landscape. These actions are crucial for maintaining market share and relevance.

- Technological Investment: Competitors are investing heavily in AI for personalized shopping and automation in warehouses.

- Supply Chain Optimization: Focus on reducing delivery times and costs through advanced logistics.

- Innovation in Concepts: Development of new store formats, online services, and private label brands.

- ICA Gruppen's Response: Investments in e-commerce capabilities and sustainability initiatives are key to staying competitive.

The competitive rivalry within the Nordic grocery sector, ICA Gruppen's primary operating environment, is exceptionally intense. This stems from a mature market where growth is largely achieved by capturing market share from rivals. Competitors like Coop and Axfood in Sweden, and Rema 1000 in Norway, are formidable players consistently investing in price, innovation, and digital capabilities. For example, discount retailers saw significant growth in 2023, directly pressuring established players on price, and online grocery sales in Sweden reached approximately 10% of the total market in 2023, highlighting the shift towards omnichannel competition.

| Competitor | Primary Market | Key Competitive Strategy (2023/2024 Focus) | Market Share Trend (Indicative) |

|---|---|---|---|

| Coop | Sweden | Price promotions, loyalty programs, digital integration | Stable to slightly declining |

| Axfood | Sweden | Store upgrades, private label expansion, convenience focus | Growing |

| Rema 1000 | Norway | Aggressive pricing, efficient operations, expansion | Growing |

| Lidl | Nordics | Discount pricing, private label strength, store network expansion | Growing |

SSubstitutes Threaten

Consumers increasingly explore alternatives to traditional grocery stores, such as local farmers' markets and specialty food shops. These options, while sometimes niche, can siphon off consumer spending, particularly for those with specific dietary requirements or a desire for unique products. For instance, the direct-to-consumer meal kit delivery sector, which saw significant growth, presents a convenient substitute for some shoppers.

The expanding frozen food market further contributes to the threat of substitutes by offering convenience and longer shelf life, appealing to busy consumers. By 2023, the global frozen food market was valued at over $300 billion, indicating a substantial and growing alternative for traditional grocery purchases.

The rise of online pharmacies and direct drug delivery services presents a significant threat of substitutes for ICA Gruppen's Apotek Hjärtat. These digital platforms, often leveraging more streamlined supply chains, can offer greater convenience and potentially lower prices, directly competing with the traditional pharmacy model. For instance, by 2024, the global online pharmacy market was projected to reach substantial figures, indicating a strong consumer shift towards these alternative channels.

This shift is fueled by increasing consumer comfort with e-commerce and a desire for faster, more accessible healthcare solutions. Apotek Hjärtat, as part of ICA Gruppen, must contend with this evolving landscape where customers can easily compare prices and order medications from their homes, bypassing the need for a physical store visit. The Swedish market, in particular, has seen strategic adaptations and advancements in digital healthcare services, amplifying this competitive pressure.

Fintech and digital banking pose a significant threat to traditional players like ICA Banken. These alternatives offer streamlined, often lower-cost services in payments, lending, and investments, directly competing for customer engagement. For instance, the Nordic financial sector is prioritizing tech adoption for 2025, aiming to boost customer experience through digital channels, which can divert business from incumbent banks.

Specialized Retailers and Niche Markets

Beyond broad-appeal supermarkets, specialized retailers represent a significant threat of substitution for ICA Gruppen. These niche players, focusing on organic foods, ethnic cuisines, or health-specific products, directly address segments of consumer demand that ICA also aims to fulfill. This growing fragmentation of consumer preferences means that shoppers can often find tailored solutions elsewhere, diverting sales from ICA's more generalist offerings.

For instance, the global market for organic food alone reached an estimated USD 250 billion in 2023, demonstrating a substantial segment actively seeking alternatives to conventional grocery options. Similarly, the increasing popularity of online specialty food retailers, offering curated selections of imported goods or artisanal products, further intensifies this competitive pressure. These specialized channels cater to specific tastes and dietary needs, presenting a direct substitute for shoppers prioritizing unique or particular product categories.

- Niche Market Focus: Specialized retailers concentrate on specific product categories like organic, ethnic, or health foods, directly competing with parts of ICA Gruppen's product mix.

- Consumer Preference Segmentation: These niche players cater to distinct consumer tastes and dietary requirements, capturing market share that might otherwise go to ICA.

- Market Fragmentation: The rise of specialized retailers contributes to a fragmented retail landscape, increasing the overall threat of substitution for larger, more generalized grocery chains.

- E-commerce Influence: Online specialty food stores amplify this threat by offering convenient access to a wide array of unique and niche products, providing accessible substitutes.

Changing Consumer Habits and Home Consumption Trends

Shifts in consumer habits present a significant threat of substitution for traditional grocery retailers like ICA Gruppen. For instance, a growing preference for convenience, leading to more frequent, smaller shopping trips or a greater reliance on ready-made meals from specialized outlets, directly competes with the traditional large weekly grocery shop. This trend can be seen in the increasing market share of meal kit services and prepared food sections within convenience stores.

Furthermore, the rise of online food delivery platforms, offering everything from restaurant meals to curated grocery boxes, acts as a direct substitute. In 2024, the online grocery market continued its robust growth, with many consumers finding these services a convenient alternative to visiting a physical supermarket. While ICA has invested in its own e-commerce capabilities, the sheer variety and speed of some third-party delivery services pose a persistent competitive challenge.

- Changing Consumer Habits: An increasing number of consumers are opting for convenience, leading to a decline in traditional large weekly grocery shops.

- Ready-Made Meals: The market for prepared foods and meal kits is expanding, offering a direct substitute for home-cooked meals typically purchased at supermarkets.

- Online Food Delivery: Platforms offering restaurant meals and grocery delivery services provide a convenient alternative, impacting traditional grocery sales volumes.

- Lifestyle Shifts: Broader societal trends favoring convenience and experiences over traditional home-based activities can reduce the demand for extensive grocery shopping.

Beyond traditional supermarkets, specialized retailers focusing on organic, ethnic, or health foods present a significant substitute threat to ICA Gruppen. These niche players cater to specific consumer demands, fragmenting the market and diverting sales from ICA's broader offerings. The global organic food market, valued at approximately USD 250 billion in 2023, exemplifies this trend.

The increasing popularity of online specialty food stores further amplifies this threat. These platforms provide convenient access to a wide array of unique products, directly competing with ICA's generalist approach by fulfilling niche preferences and dietary needs.

Shifting consumer habits, such as a preference for convenience and more frequent, smaller shopping trips, also act as substitutes. The growing market for meal kits and prepared foods, alongside the robust growth of the online grocery market in 2024, demonstrates a clear move away from traditional large grocery shops.

| Category | Market Size (Approx.) | Key Substitute Channels |

|---|---|---|

| Organic Food | USD 250 Billion (2023) | Specialty organic stores, farmers' markets |

| Meal Kits | Significant growth | Direct-to-consumer services |

| Online Grocery | Robust growth (2024) | E-commerce platforms, third-party delivery |

Entrants Threaten

The substantial capital required to build and maintain a widespread retail presence, including numerous physical stores, sophisticated distribution centers, and efficient logistics networks, acts as a significant deterrent for potential new entrants looking to compete with ICA Gruppen. This high upfront cost, covering everything from prime real estate acquisition to stocking vast inventories, creates a formidable barrier to entry.

For instance, the sheer scale of ICA's operations necessitates massive investment in supply chain infrastructure and technology, making it exceedingly difficult for newcomers to match the existing efficiency and reach. ICA Real Estate's strategic ownership and management of properties further entrench this advantage, locking in prime locations and controlling a crucial component of the retail infrastructure.

ICA Gruppen's deep roots in the Nordic region translate to significant brand recognition and customer loyalty, a formidable barrier for potential new entrants. For instance, in 2023, ICA's grocery sales in Sweden alone reached approximately SEK 130 billion, underscoring its market dominance. Newcomers face the daunting task of matching this decades-long investment in marketing and customer relationships to even begin to chip away at ingrained consumer preferences.

The challenge is further amplified by observed shifts in consumer behavior. Data from 2024 indicates a growing tendency for Swedish consumers to stick with established retailers, making the prospect of attracting them to a new brand increasingly difficult. This increasing brand stickiness means that any new entrant would likely require substantial capital for extensive promotional campaigns and potentially aggressive pricing strategies to gain initial traction.

ICA Gruppen's substantial size enables significant economies of scale in purchasing, marketing, and overall operations. For instance, in 2024, ICA Sweden reported a turnover of SEK 128.5 billion, a testament to its purchasing power. New entrants face a considerable hurdle in matching these cost efficiencies, immediately placing them at a disadvantage.

The capacity to negotiate more favorable terms with suppliers, driven by sheer volume, is a critical advantage. Smaller, emerging competitors find it exceptionally difficult to replicate this leverage, impacting their ability to compete on price or margin.

Complex Regulatory Environment, Especially in Pharmacy and Finance

Entering sectors like pharmacy through Apotek Hjärtat and financial services with ICA Banken and ICA Försäkring involves navigating a maze of strict regulations and licensing procedures. These demanding legal and compliance requirements serve as substantial entry barriers, effectively shielding established companies like ICA Gruppen from effortless market invasion by new competitors. For instance, the Swedish pharmaceutical market is particularly heavily regulated, demanding extensive product approvals and operational standards.

The complexity of these regulatory frameworks significantly deters potential new entrants. Acquiring the necessary licenses for pharmacy operations, for example, requires substantial investment in time, resources, and expertise to meet stringent quality and safety standards. Similarly, establishing and operating a bank or insurance company involves adhering to capital adequacy ratios, consumer protection laws, and anti-money laundering regulations, all of which are critical deterrents.

These barriers are not static; they evolve with new legislation and supervisory directives, requiring continuous adaptation and investment from existing players and presenting an even higher hurdle for newcomers. For example, ongoing discussions and potential changes in financial technology (FinTech) regulations in Sweden could introduce new compliance burdens.

- Pharmaceutical Regulation: Strict rules govern drug approval, dispensing, and storage in Sweden.

- Financial Services Licensing: Banks and insurance companies require authorization from the Swedish Financial Supervisory Authority (Finansinspektionen).

- Compliance Costs: Meeting these regulatory demands incurs significant operational and legal expenses for any new entrant.

- Market Protection: These hurdles protect established entities like ICA Gruppen by limiting the ease with which new competitors can enter and operate.

Established Supply Chains and Distribution Networks

For potential new entrants eyeing the Nordic grocery market, establishing efficient and robust supply chains and distribution networks presents a significant hurdle. ICA Gruppen has already cultivated an optimized logistics system that spans the region, a complex feat requiring substantial time and capital to replicate. For instance, in 2023, ICA Gruppen reported its logistics operations handled millions of product movements annually, underscoring the scale and efficiency of their existing infrastructure.

The sheer investment needed to build a comparable network, from warehousing to last-mile delivery, acts as a powerful deterrent. This deep-rooted infrastructure, honed over years of operation, allows ICA Gruppen to achieve economies of scale and maintain competitive pricing, which is incredibly difficult for newcomers to match initially.

- Significant Capital Investment: Replicating ICA Gruppen's extensive logistics network requires tens to hundreds of millions in upfront capital for warehouses, fleet, and technology.

- Operational Expertise: Years of experience have equipped ICA Gruppen with invaluable know-how in inventory management, route optimization, and supplier relations within the Nordic context.

- Economies of Scale: Their established volume allows for lower per-unit logistics costs, a competitive advantage that new entrants struggle to achieve in their early stages.

- Time to Market: Building a fully functional and efficient supply chain can take many years, delaying a new entrant's ability to compete effectively.

The threat of new entrants for ICA Gruppen is generally considered low due to several significant barriers. The substantial capital required for infrastructure, such as extensive store networks and sophisticated logistics, along with established brand loyalty and economies of scale, makes market entry very challenging. Furthermore, regulatory hurdles in sectors like pharmacy and financial services add another layer of difficulty for potential competitors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of establishing retail presence, logistics, and technology. | Deters entry due to significant upfront investment. |

| Brand Loyalty & Recognition | Decades of marketing and customer relationship building. | Makes it difficult for new brands to attract and retain customers. |

| Economies of Scale | ICA's size leads to cost advantages in purchasing and operations. | New entrants face higher per-unit costs, impacting competitiveness. |

| Regulatory Hurdles | Strict regulations in pharmacy and financial services. | Requires significant time, resources, and expertise to comply. |

Porter's Five Forces Analysis Data Sources

Our analysis of ICA Gruppen's competitive landscape leverages data from their official annual and sustainability reports, alongside insights from reputable retail industry analysis firms and macroeconomic data providers.