ICA Gruppen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Gruppen Bundle

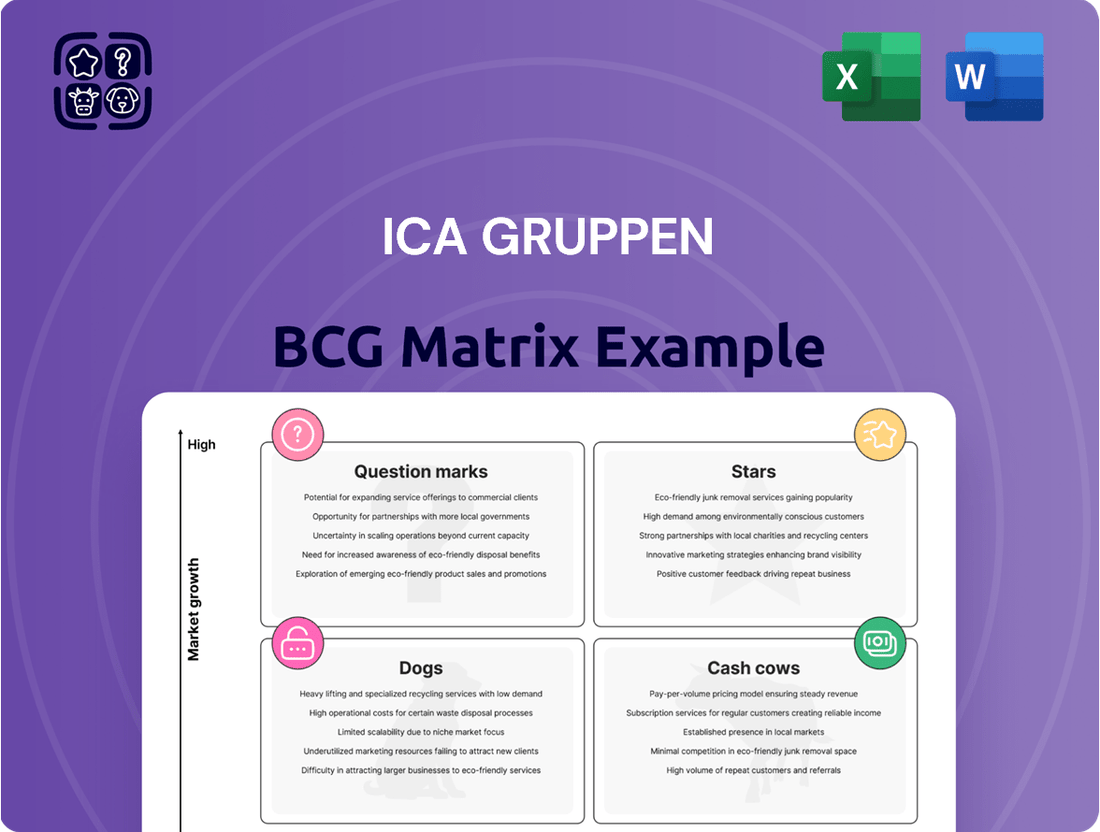

Curious about ICA Gruppen's strategic positioning? This snapshot offers a glimpse into how their diverse portfolio might be segmented using the BCG Matrix. Understanding where their brands fall as Stars, Cash Cows, Dogs, or Question Marks is crucial for navigating the competitive retail landscape.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for ICA Gruppen.

Stars

Apotek Hjärtat stands as the undisputed leader in the Swedish pharmacy sector, commanding a significant 32% market share as of 2024. This dominant position is a direct result of its expansive network of physical locations, which provides convenient access for a broad customer base, alongside a robust and expanding e-commerce platform. The overall Swedish pharmaceutical market is on a healthy upward trajectory, with forecasts indicating a 5.49% compound annual growth rate through 2030, a trend particularly amplified by the burgeoning online pharmacy segment. Apotek Hjärtat's forward-looking strategy includes substantial investments in IT infrastructure, designed to enhance customer experience and ensure continued market leadership.

Apotek Hjärtat demonstrated impressive market share growth in its physical pharmacy segment during the initial four months of 2025. Its performance exceeded the overall market expansion, highlighting a solid competitive edge.

This success in brick-and-mortar locations is a key indicator of Apotek Hjärtat's strength. The company's ability to secure a larger slice of the pie, even as the market itself grows, suggests effective strategies and customer appeal.

While online sales saw a softer start in early 2025, the broader trend from 2024 points to robust e-commerce growth. This trajectory positions Apotek Hjärtat favorably for continued digital development and market penetration in the online space.

ICA Gruppen sees Apotek Hjärtat as a cornerstone for its health strategy, aiming for leadership in this growing sector. This integration allows for powerful cross-promotional opportunities, linking pharmacy offerings with their extensive grocery retail base, thereby boosting customer loyalty.

The emphasis on health and wellness is a direct response to evolving consumer demands, creating a strong foundation for market expansion and innovative product lines. For instance, in 2023, the health and beauty sector within grocery retail saw continued growth, with pharmacies playing an increasingly vital role in this ecosystem.

Strong Profitability Trajectory

Apotek Hjärtat is demonstrating a strong profitability trajectory within ICA Gruppen's portfolio. The pharmacy chain posted its best-ever operating profit in 2024, a testament to its operational efficiency and established market position.

While first quarter 2025 profits experienced a dip, this was attributed to significant investments in IT projects, crucial for future growth and development, rather than a fundamental performance decline. These strategic expenditures are anticipated to yield long-term benefits.

The solid profitability achieved in 2024 and the ongoing strategic investments position Apotek Hjärtat to capitalize on the expanding pharmacy market. This financial strength supports its ability to continue innovating and growing.

- 2024 Best-Ever Operating Profit: Apotek Hjärtat achieved record operating profit in 2024.

- Q1 2025 IT Project Impact: Lower profits in Q1 2025 were due to substantial IT project investments.

- Strategic Investment Focus: These IT costs are viewed as strategic, long-term development drivers.

- Capital for Growth: Robust profitability provides capital for continued expansion and innovation in a high-growth sector.

Outpacing Market Growth

Apotek Hjärtat, ICA Gruppen's pharmacy division, is a clear 'Star' in the BCG Matrix. Throughout 2024 and continuing into the first four months of 2025, this segment has demonstrated a growth rate exceeding that of the broader market. This consistent outperformance, coupled with its established high market share, solidifies its position as a star performer.

The pharmacy segment's success is attributable to several key factors. Strong brand recognition among consumers provides a solid foundation, while agile and effective market strategies have allowed it to capture and maintain its leading position. This strategic execution is crucial for its continued rapid expansion.

- Consistent above-market growth in 2024 and early 2025.

- High existing market share within the pharmacy sector.

- Key drivers include strong brand equity and effective market penetration strategies.

- Apotek Hjärtat's performance significantly contributes to ICA Gruppen's overall portfolio strength.

Apotek Hjärtat, as ICA Gruppen's pharmacy arm, firmly occupies the 'Star' quadrant of the BCG Matrix. Its performance in 2024 and the initial months of 2025 consistently outpaced the overall market. This strong growth, combined with its substantial existing market share, marks it as a high-growth, high-market-share business unit.

The pharmacy's market leadership is underpinned by its extensive physical presence and a developing e-commerce platform. In 2024, Apotek Hjärtat reported its highest-ever operating profit, underscoring its financial strength and operational efficiency. While Q1 2025 saw a dip due to strategic IT investments, these are foundational for future expansion in the growing health sector.

| Segment | Market Growth Rate (Est. 2024-2025) | Apotek Hjärtat Market Share (2024) | Apotek Hjärtat Performance vs. Market | BCG Matrix Quadrant |

|---|---|---|---|---|

| Pharmacies (Sweden) | ~5.5% (CAGR to 2030) | 32% | Exceeding market growth | Star |

| Grocery Retail (ICA) | Moderate | Dominant | Stable | Cash Cow/Question Mark (depending on sub-segment) |

What is included in the product

This BCG Matrix analysis clarifies ICA Gruppen's product portfolio, identifying which units to invest in, hold, or divest based on market growth and share.

Provides a clear, visual map of ICA Gruppen's portfolio, easing the complexity of strategic decision-making.

Cash Cows

ICA Sweden stands as a formidable presence in the Swedish grocery sector, commanding an estimated market share of around 33% to 36% in 2024. This leadership in a well-established market translates into reliable and substantial sales volumes year after year.

The unique structure of independent ICA retailers, coupled with centralized purchasing and marketing power, creates a resilient business model. This strategy allows for localized customer engagement while leveraging economies of scale, reinforcing ICA's robust position in the market.

ICA Gruppen's grocery retail segment acts as a strong Cash Cow, consistently delivering substantial net sales. For the first four months of 2025, total net sales for the group saw a healthy increase of 5.5%, underscoring the segment's vital contribution.

Despite pressures on operating margins from strategic price investments and loyalty programs, the sheer volume of sales in this core business remains remarkably resilient. This steady generation of revenue translates directly into significant and reliable cash flow for the entire ICA Gruppen.

The Swedish food retail market is quite mature. Historically, it has seen growth rates around 2-3% annually. In 2024, this grew to 4.1%, largely due to increased sales volumes.

In a mature market like this, the focus shifts from rapid expansion to holding onto and increasing market share. This is crucial for maintaining profitability.

ICA Sweden, a major player, understands this. They are actively using competitive pricing strategies and robust loyalty programs to protect their leading market position. This approach is vital in a market where price sensitivity is high.

Strategic Price Investments

ICA Sweden, despite facing lower operating profits in early 2025 due to strategic price investments and loyalty program expenses, is employing a crucial tactic to manage inflation and enhance its pricing image with customers. This proactive strategy is designed to ensure sustained customer traffic and market share growth, even amidst a difficult economic environment.

These price investments are characteristic of a Cash Cow, a business unit with high market share and low growth potential, that needs ongoing investment to maintain its competitive edge. The goal is to solidify ICA's position as a value provider.

- Strategic Price Investments: ICA Sweden's commitment to price investments in early 2025, despite impacting short-term profits, aims to counter inflationary pressures.

- Customer Retention: These initiatives are vital for maintaining customer visits and securing market share in a competitive landscape.

- Loyalty Program Costs: The associated costs with loyalty programs are factored into this strategy to build long-term customer relationships.

- Cash Cow Strategy: Such investments are typical for a Cash Cow, focusing on sustaining leadership and competitive advantage rather than rapid expansion.

Efficient Operational Synergies

ICA Gruppen's grocery operations represent a prime example of a cash cow, driven by remarkable operational efficiencies. Extensive efforts in store development, procurement, supply chain management, and IT infrastructure have unlocked substantial economies of scale. These integrated efficiencies are crucial for generating robust cash flow, even amidst intense market competition.

The grocery segment’s strong performance, even in a challenging retail environment, is a testament to these well-honed operational synergies. For instance, in 2023, ICA Gruppen reported strong sales growth in its grocery segment, underscoring the continued demand and operational resilience.

- Economies of Scale: ICA leverages its large operational footprint to negotiate better terms with suppliers and optimize logistics, directly impacting profitability.

- Integrated Logistics: A sophisticated and integrated supply chain minimizes costs and ensures efficient product availability across its vast store network.

- IT Infrastructure: Investments in advanced IT systems streamline operations, from inventory management to customer data analysis, further enhancing efficiency.

ICA Sweden's grocery retail segment functions as a classic Cash Cow within the ICA Gruppen. Its substantial market share, estimated between 33% and 36% in 2024, combined with a mature market exhibiting modest growth, signifies a stable and predictable revenue stream.

The segment’s resilience is further bolstered by ongoing investments in competitive pricing and loyalty programs, strategies designed to defend market share rather than fuel rapid expansion. This approach, while impacting short-term margins, ensures sustained customer traffic and reinforces its position as a leader.

ICA's operational efficiencies, spanning store development, procurement, and supply chain management, unlock significant economies of scale. These efficiencies are critical for generating robust and consistent cash flow, a hallmark of a successful Cash Cow, even in a competitive retail environment.

| Metric | Value (2024/Early 2025) | Significance for Cash Cow Status |

|---|---|---|

| Estimated Market Share (ICA Sweden) | 33%-36% | Indicates high market penetration and dominance. |

| Swedish Grocery Market Growth | 4.1% (2024) | Mature market, limiting aggressive expansion potential but ensuring stability. |

| Group Net Sales Growth (First 4 Months 2025) | 5.5% | Demonstrates the ongoing revenue generation capacity of the core business. |

| Strategic Price Investments | Implemented in early 2025 | Defensive strategy to maintain market share, typical of a Cash Cow needing upkeep. |

Full Transparency, Always

ICA Gruppen BCG Matrix

The ICA Gruppen BCG Matrix analysis you are previewing is the identical, fully formatted document you will receive immediately after your purchase, offering a comprehensive strategic overview without any watermarks or demo content. This preview accurately represents the final, ready-to-use report, meticulously crafted to provide clear insights into ICA Gruppen's business units and their market positions, ensuring you receive exactly what you need for informed strategic decision-making. The detailed analysis within this preview is what you'll download, allowing you to leverage expert-backed insights for your business planning and competitive strategy without any further revisions or delays. What you see here is the actual, professionally designed BCG Matrix file for ICA Gruppen, which will be instantly downloadable and ready for immediate application in your strategic discussions or presentations upon purchase.

Dogs

ICA Försäkring, operating under ICA Banken, has faced significant headwinds. Unfavorable claims outcomes in late 2024 and early 2025 directly impacted its earnings, leading to a negative contribution to the financial services segment's profitability.

Despite strategic efforts to increase market share, ICA Försäkring's profitability has been consistently weak, acting as a drain on the broader financial services division. This performance indicates a cash-consuming operation that is not generating adequate returns to justify its resource allocation.

While ICA Försäkring may be reporting gains in market share, its overall position within the highly competitive insurance landscape remains relatively modest when compared to entrenched, larger competitors. This limited market share in a mature industry presents a significant hurdle, making it challenging to leverage economies of scale and achieve robust profitability.

The insurance segment faces difficulties in carving out a distinct identity and effectively differentiating its offerings from those of its rivals. This lack of clear differentiation can hinder customer acquisition and retention efforts, further solidifying its position as a player with a low relative market share.

ICA Insurance has been grappling with a persistent negative claims trend. This has directly impacted its profitability, resulting in diminished earnings and, in certain periods, outright losses. This ongoing operational hurdle suggests the segment is consuming more resources than it generates, failing to produce adequate positive cash flow.

For instance, during 2023, ICA Insurance reported a significant increase in claims payouts relative to premiums earned, a trend that continued into early 2024. This situation highlights a fundamental issue that requires a thorough examination of the insurance segment's underlying business model and its underwriting strategies to identify areas for improvement and potential restructuring.

Limited Contribution to Group Profitability

ICA Banken reported improved profitability in the first quarter of 2025, largely driven by business expansion and a reduction in credit losses. This suggests that ICA Insurance's financial input to the group’s overall performance was either negligible or detrimental.

Given this limited or negative contribution to the group’s profitability, ICA Insurance warrants a closer examination within the ICA Gruppen's BCG Matrix.

- Limited Profitability: ICA Insurance's impact on ICA Gruppen's overall profit in Q1 2025 was minimal or negative, despite the bank's positive performance.

- Re-evaluation Candidate: The low contribution positions ICA Insurance as a potential candidate for strategic review due to its weak financial input.

- Focus on Core Strengths: This situation might prompt ICA Gruppen to reassess resource allocation, potentially shifting focus towards more profitable segments.

Potential for Divestiture Consideration

ICA Försäkring, within the ICA Gruppen BCG Matrix, presents a strong case for divestiture consideration. Its limited market share in the insurance sector, coupled with low growth projections for its niche, places it in a less favorable position.

Furthermore, persistent profitability challenges stemming from claims management have been a recurring issue. In 2023, for instance, the insurance segment reported a profit of SEK 196 million, a decrease from SEK 253 million in 2022, highlighting ongoing financial strains.

This scenario suggests that ICA Försäkring could be categorized as a Dog. Divesting or undertaking a substantial restructuring would enable ICA Gruppen to strategically redeploy capital and management focus toward more robust and high-growth business units within the conglomerate.

- Low Market Share: ICA Försäkring operates in a competitive insurance landscape with a smaller footprint compared to other ICA segments.

- Low Growth Prospects: The specific niche ICA Försäkring serves is not anticipated to experience significant expansion in the near to medium term.

- Profitability Issues: Persistent challenges in managing claims have impacted the financial performance of the insurance arm.

- Resource Reallocation: Divestiture would free up resources for investment in more lucrative and strategically aligned areas of ICA Gruppen.

ICA Försäkring, characterized by its low market share and persistent profitability issues, aligns with the "Dog" category in the BCG Matrix. Its struggles with claims management, evidenced by a profit decline from SEK 253 million in 2022 to SEK 196 million in 2023, indicate a cash-consuming business unit. The segment's limited growth prospects further solidify its position as a candidate for divestiture or significant restructuring to allow for capital redeployment to more promising ICA Gruppen ventures.

| BCG Category | ICA Segment | Market Share | Market Growth | Profitability Trend | Strategic Implication |

|---|---|---|---|---|---|

| Dog | ICA Försäkring | Low | Low | Negative/Declining (e.g., 2023 Profit: SEK 196M vs. 2022: SEK 253M) | Consider divestiture or restructuring |

Question Marks

Within ICA Gruppen's portfolio, emerging online grocery sales are positioned as a Star. While ICA Sweden's broader grocery operations function as a Cash Cow, the digital segment is a high-growth sector. In 2024, online grocery sales held a 4.1% share of the Swedish market, a figure expected to climb as the e-commerce food retail sector expanded by 4.9% during the same year.

ICA's early 2025 online sales data suggests robust potential, but this segment currently has a relatively low market share. To capitalize on this dynamic and expanding market, significant investment is necessary. This strategic focus aims to secure a larger portion of the rapidly growing online grocery market.

ICA Banken is demonstrating robust growth in its mortgage offerings, positioning this segment as a star performer within ICA Gruppen's financial services. This expansion is particularly noteworthy given the prevailing interest rate environment in the Nordic region, where loan growth is anticipated to accelerate.

The bank's success in increasing business volumes and simultaneously lowering credit losses highlights its strong operational potential. For instance, in the first quarter of 2024, ICA Banken reported a net profit of SEK 316 million, a significant increase from SEK 199 million in the same period of 2023, reflecting improved efficiency and risk management.

Despite this impressive growth trajectory, ICA Banken's mortgage market share remains modest when benchmarked against long-established banking institutions. This suggests that while it is a strong contender, there is still considerable room for further penetration and market share acquisition in the coming years.

ICA Banken, as part of ICA Gruppen, exhibits significant synergistic growth potential, primarily driven by its deep integration with the core grocery retail operations. This connection allows ICA Banken to tap into a vast and loyal customer base, facilitating cost-effective customer acquisition and retention in the competitive financial services sector. For instance, in 2024, ICA's loyalty program members numbered in the millions, providing a ready audience for banking products and services.

The advantage of this integrated model is evident in how ICA Banken can leverage cross-selling opportunities. By offering financial products directly to existing grocery shoppers, the bank can reduce marketing expenses and build stronger customer relationships. This synergy aims to convert the extensive reach into tangible market share and profitability within the financial services landscape.

Need for Continued Investment

For ICA Gruppen's online grocery and ICA Banken, continued investment is crucial. These segments, positioned as Stars or Question Marks in the BCG Matrix due to their high growth potential, require ongoing funding to maintain momentum and capture market share. This investment fuels essential technological advancements, targeted marketing campaigns, and the expansion of their service portfolios to remain competitive.

- Online Grocery Growth: In 2024, the online grocery market continued its upward trajectory, with ICA reporting a significant increase in online sales. For instance, through Q3 2024, ICA’s online grocery sales saw a substantial year-over-year increase, underscoring the need for sustained investment in logistics and platform development.

- ICA Banken's Digital Push: ICA Banken is actively enhancing its digital offerings, aiming to attract and retain customers in a competitive financial landscape. By investing in new digital tools and personalized banking solutions, they can solidify their position and expand their customer base.

- Competitive Landscape: Failure to invest adequately in these high-potential areas could see them transition into 'Dogs,' characterized by low growth and market share. This would necessitate a strategic re-evaluation, potentially leading to divestment or significant restructuring.

- Strategic Investment Allocation: Continued investment in technology, data analytics, and customer experience for both online grocery and banking services is paramount to realizing their full potential and ensuring long-term profitability for ICA Gruppen.

Balancing Growth and Profitability

Question Marks, in the context of ICA Gruppen's BCG Matrix, represent business units with low market share in a high-growth industry. These segments consume a significant amount of cash due to the ongoing need for investment to fuel expansion, often resulting in initially low returns. The strategic dilemma for ICA Gruppen is to decide whether to inject substantial capital to elevate these units into 'Stars,' capable of generating substantial future revenue, or to consider divesting them if the anticipated growth trajectory proves unsustainable or unachievable.

For ICA Gruppen, managing these Question Marks involves a careful balancing act. The company must assess the long-term viability of the market and the specific unit's potential to capture a larger share.

- Investment Decision: ICA Gruppen must evaluate if the potential for market leadership justifies the high cash outflow required for development.

- Market Analysis: Thorough research into industry growth rates and competitive positioning is crucial for these segments.

- Divestment Consideration: If the prospects for turning a Question Mark into a Star are dim, divesting might be a more prudent financial decision.

- Resource Allocation: Funds allocated to Question Marks must be weighed against opportunities in other BCG matrix categories, like Stars or Cash Cows.

Question Marks represent areas within ICA Gruppen that are in high-growth markets but currently hold a small market share, demanding significant investment. These segments, like certain niche online services or new geographic expansions, require careful consideration for future resource allocation. The core challenge is to determine if these units can successfully evolve into Stars by capturing a substantial portion of their growing markets, or if they risk becoming Dogs if they fail to gain traction.

For ICA Gruppen, the strategic decision regarding Question Marks involves a critical assessment of their potential to scale and compete effectively. This means evaluating the competitive landscape, the unit's ability to differentiate itself, and the overall return on investment from further capital injection. The goal is to transform these high-potential but uncertain ventures into profitable, market-leading operations.

Ultimately, the success of managing Question Marks hinges on ICA Gruppen's ability to accurately forecast market trends and the internal capabilities to execute growth strategies. A misstep could lead to wasted resources, while a well-executed plan could unlock significant future value, as seen in the evolution of successful digital ventures in other retail sectors.

| ICA Gruppen Segment | Market Growth | Market Share | Investment Need | Strategic Outlook |

|---|---|---|---|---|

| Emerging Digital Services | High | Low | High | Potential Star/Divest |

| Niche Product Lines | High | Low | High | Potential Star/Divest |

| New Geographic Ventures | High | Low | High | Potential Star/Divest |

BCG Matrix Data Sources

Our ICA Gruppen BCG Matrix is constructed using a blend of internal financial reports, publicly available sales data, and industry-specific market research to ensure accurate business unit analysis.