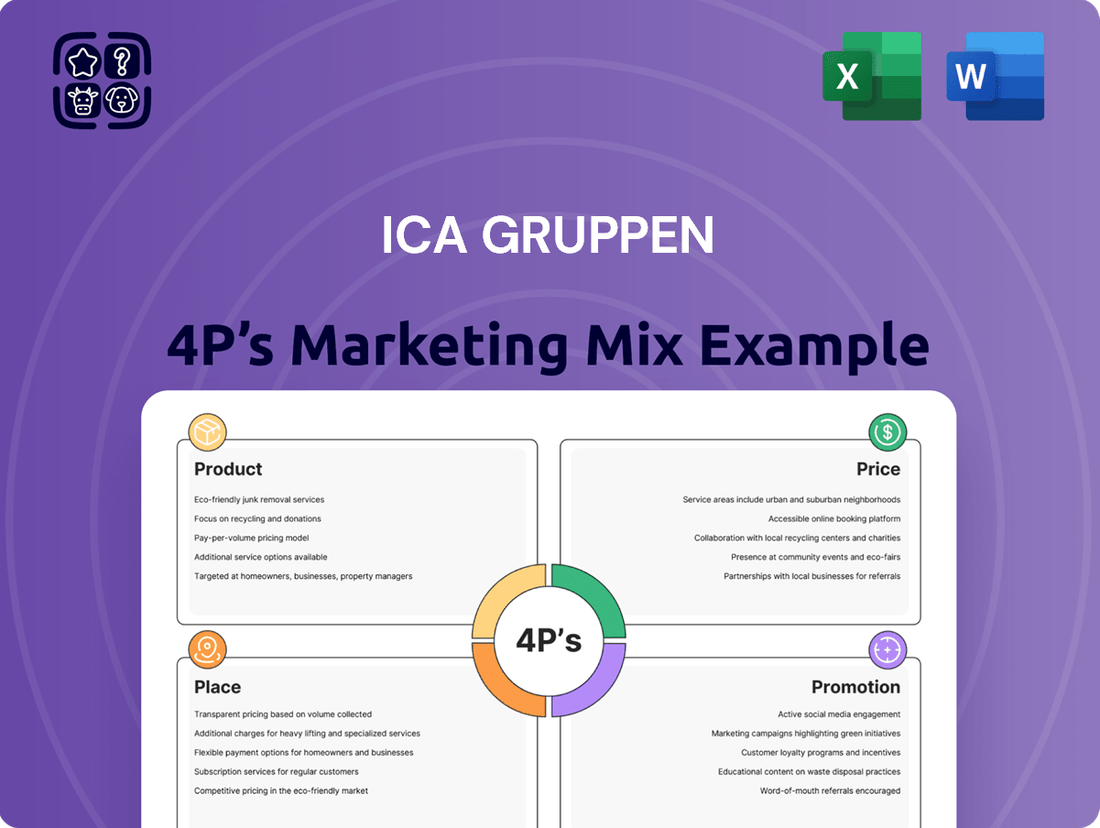

ICA Gruppen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Gruppen Bundle

Discover how ICA Gruppen masterfully navigates the market through its Product, Price, Place, and Promotion strategies. This analysis delves into their diverse product portfolio, competitive pricing, extensive store network, and impactful promotional campaigns. Understand the synergistic approach that cements their position as a retail leader.

Ready to elevate your own marketing acumen? This comprehensive report provides actionable insights into ICA Gruppen's 4Ps, offering a valuable blueprint for your business or academic pursuits. Save hours of research and gain a competitive edge.

For business professionals, students, and consultants, this ready-made analysis is an invaluable resource. It breaks down each element of the marketing mix with clarity and strategic depth, enabling you to benchmark and strategize effectively. Get instant access to an editable, presentation-ready document.

Product

ICA Gruppen's diverse retail portfolio is a cornerstone of its market strategy, encompassing everything from daily groceries to specialized health services. In 2023, the grocery segment, a major contributor, saw continued focus on fresh produce and a robust private label offering under the ICA brand, which consistently appeals to value-conscious consumers across Sweden, Norway, and the Baltic states.

Expanding beyond food, ICA Gruppen's health offering is significantly bolstered by Apotek Hjärtat. As of early 2024, Apotek Hjärtat operates hundreds of pharmacies, providing essential prescription medications, a wide array of over-the-counter remedies, and a growing selection of health and wellness products, reinforcing ICA's commitment to holistic customer well-being.

This broad product assortment allows ICA Gruppen to capture a significant share of consumer spending across multiple essential categories. For instance, in the fourth quarter of 2023, ICA Gruppen reported net sales of SEK 39.7 billion, with the grocery segment forming the largest portion, demonstrating the continued strength and breadth of its retail presence.

Beyond physical goods, ICA Gruppen offers financial services through ICA Banken and insurance via ICA Försäkring, enriching its product mix. These services aim to deepen customer loyalty to ICA stores, as seen with ICA Banken’s focus on integrating banking with the retail experience. In 2023, ICA Banken reported a net profit of SEK 386 million, demonstrating its contribution to the group's overall financial performance and its role in reducing transaction costs.

ICA Gruppen places a strong emphasis on its private label products as a cornerstone of its product strategy. These offerings are meticulously developed to deliver high quality and excellent taste at competitive price points, ensuring consumers receive superior value.

The private label assortment actively champions Swedish and local produce, further strengthening regional ties and consumer trust. This focus also extends to climate-smart alternatives, a deliberate move to align with growing consumer demand for sustainable and environmentally conscious purchasing decisions.

By 2024, ICA's private label portfolio accounted for a substantial portion of its sales, with reports indicating it contributed over 25% to total revenue in key markets. This demonstrates the significant consumer acceptance and financial impact of these own-brand products.

Sustainable and Healthy Choices Focus

ICA Gruppen is actively developing products that champion sustainable and healthy living, embedding these principles into its fundamental product range. This dedication is evident in their initiatives to lessen the environmental impact of food items, expand the availability of plant-based alternatives, and ensure their logistics operate using fossil-free transportation. For example, in 2023, ICA Sweden reported a 21% reduction in greenhouse gas emissions from its own transport compared to 2021, a significant stride towards their sustainability goals.

The company's commitment extends to simplifying the process for consumers to opt for more sustainable goods. This reflects a larger strategic aim to foster a more contemporary and environmentally responsible food ecosystem. ICA's focus on healthy choices is also a key differentiator, with a growing selection of organic and low-impact products available to customers. In 2024, ICA launched a new range of plant-based ready meals, receiving positive customer feedback for both taste and sustainability credentials.

Key initiatives supporting their Sustainable and Healthy Choices focus include:

- Climate Footprint Reduction: Ongoing efforts to decrease emissions associated with food production and distribution. In 2023, ICA's private label products saw a 5% increase in sustainability certifications.

- Plant-Based Expansion: Broadening the assortment of vegetarian and vegan products to cater to evolving consumer preferences. The plant-based category in ICA stores grew by 15% in sales volume during 2023.

- Fossil-Free Transport: Transitioning logistics operations to utilize renewable energy sources. ICA aims for 100% fossil-free transport by 2030, with over 60% of their heavy vehicle fleet already using renewable fuels as of early 2024.

- Customer Empowerment: Providing clear information and accessible options to facilitate informed, sustainable purchasing decisions. ICA's sustainability labeling on over 3,000 products aims to guide consumers.

Continuous Innovation and Concept Development

ICA Gruppen actively pursues continuous innovation and concept development, notably within its extensive private label food offerings. This commitment involves close collaboration with a network of suppliers and innovative entrepreneurs to explore novel ingredients and advanced packaging technologies. For example, the adoption of skin packaging for meat products demonstrates a strategic move to significantly extend shelf life and concurrently reduce food waste, a critical sustainability goal.

These initiatives are designed to consistently elevate the value proposition of ICA's private label products, ensuring they resonate with the dynamic and evolving needs of their customer base. The company’s focus on sustainability is underscored by ambitious targets, such as the objective to halve food waste by 2025, a goal directly supported by these product development efforts. In 2023, ICA's private label sales represented a substantial portion of their total sales, highlighting the importance of these continuous improvements to their market position.

- Private Label Focus: Ongoing development of private label food ranges, including explorations into new ingredients and innovative packaging.

- Supplier Collaboration: Partnerships with suppliers and entrepreneurs to drive concept development and product innovation.

- Sustainability Drive: Implementation of solutions like skin packaging to extend shelf life and reduce food waste, supporting the goal to halve food waste by 2025.

- Customer Value Enhancement: Continuous efforts to improve product value and meet evolving customer demands through innovation.

ICA Gruppen's product strategy centers on a broad and deeply integrated assortment, from daily groceries to financial services, all enhanced by a strong private label offering. This diverse portfolio, including Apotek Hjärtat pharmacies and ICA Banken, aims to capture extensive consumer spending. The private label segment, a significant driver, accounts for over 25% of sales in key markets by 2024, emphasizing quality, value, and increasingly, sustainability.

The company actively champions sustainable and healthy choices, evident in its reduced transport emissions and expanded plant-based options. For instance, ICA Sweden reported a 21% reduction in greenhouse gas emissions from its own transport by 2023 compared to 2021. This commitment is further supported by initiatives like fossil-free transport, with over 60% of their heavy vehicle fleet already using renewable fuels as of early 2024, aligning with a 2030 goal for 100% fossil-free transport.

Innovation is key, particularly in private label development, with collaborations fostering new ingredients and packaging solutions like skin packaging to reduce food waste. ICA's overarching goal to halve food waste by 2025 is directly supported by these product development efforts, which also aim to enhance customer value and meet evolving demands.

| Product Category | Key Features/Strategy | 2023/2024 Data Point |

| Grocery (Private Label) | High quality, competitive pricing, sustainability focus | Over 25% of sales in key markets by 2024 |

| Health & Wellness | Prescription & OTC medications, health products | Apotek Hjärtat operates hundreds of pharmacies (early 2024) |

| Financial Services | Integrated banking & insurance to enhance loyalty | ICA Banken net profit of SEK 386 million in 2023 |

| Sustainability Initiatives | Climate footprint reduction, plant-based expansion, fossil-free transport | 21% reduction in transport GHG emissions (ICA Sweden, 2023 vs 2021); Over 60% heavy vehicle fleet on renewable fuels (early 2024) |

What is included in the product

This analysis provides a comprehensive breakdown of ICA Gruppen's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand ICA Gruppen's market positioning and benchmark their own marketing efforts against a leading Scandinavian retailer.

This ICA Gruppen 4P's analysis streamlines marketing strategy by clarifying how each element addresses customer pain points, offering a focused solution for strategic planning.

Place

ICA Gruppen boasts an extensive physical store network, a cornerstone of its strategy. In Sweden, this network comprises roughly 1,300 retail locations, encompassing smaller ICA Nära convenience stores, mid-sized ICA Supermarkets, and larger ICA Kvantum superstores, ensuring broad geographic coverage and diverse customer accessibility.

This robust physical presence is further amplified by Apotek Hjärtat, which adds nearly 400 pharmacies throughout Sweden, enhancing convenience and cross-selling opportunities for health and wellness products.

While Rimi Baltic was divested in June 2025, the continued strength of ICA's Swedish store footprint remains a critical advantage, allowing for efficient logistics and direct customer engagement.

The sheer density of these physical touchpoints facilitates immediate product availability and supports a strong brand presence, crucial for a retail giant like ICA Gruppen.

ICA Gruppen's hybrid business model, a cornerstone of its distribution strategy, uniquely blends centrally owned stores with a vast network of independently operated retailers. This dual approach fosters remarkable local adaptation in product selections and services, enabling individual stores to cater precisely to the unique needs and tastes of their surrounding communities. For instance, in 2024, ICA reported that its independent retailers played a crucial role in driving sales growth, particularly in specialized product categories that resonate with local demographics.

This localized flexibility is strategically balanced against the advantages of centralized purchasing power and coordinated marketing efforts, creating an efficient operational framework. By leveraging economies of scale in procurement, ICA can maintain competitive pricing while its independent partners ensure that the assortment remains relevant and appealing at the local level. In the first half of 2025, ICA highlighted that this model contributed to a 3.5% increase in same-store sales, underscoring the effectiveness of tailored local offerings supported by central efficiencies.

ICA Gruppen is heavily focused on enhancing its online presence and e-commerce logistics, recognizing the shift in consumer habits. This includes significant investments in digital infrastructure to support both its grocery and pharmacy segments.

Apotek Hjärtat, a key part of ICA Gruppen, is actively expanding its e-commerce warehouse capacity. For example, they are incorporating robot automation to streamline operations and handle the increasing volume of online orders efficiently, aiming to improve delivery times and customer satisfaction.

ICA's overall digital strategy aims to offer seamless omnichannel experiences. This investment in e-commerce logistics is crucial for future growth, especially as online grocery and pharmacy sales continue to rise. In 2024, ICA reported continued growth in its online sales, with specific figures showing a substantial year-over-year increase in digital channel revenue.

Strategic Property Management

Strategic Property Management, embodied by ICA Real Estate, is fundamental to ICA Gruppen's physical presence and operational efficiency. This segment focuses on acquiring, developing, and managing properties essential for both retail stores and crucial logistics operations across Sweden. By securing optimal locations, ICA Real Estate directly supports the long-term viability and expansion of ICA's core businesses, ensuring a robust physical infrastructure that underpins market share growth and customer accessibility.

ICA Real Estate's strategic importance is underscored by its role in maintaining and enhancing ICA's extensive store network and supply chain. This proactive management ensures that ICA maintains a competitive edge through well-positioned assets. For instance, as of early 2024, ICA Gruppen operates a significant number of stores, each requiring strategically located and efficiently managed premises. The company's property portfolio is a key asset, directly impacting operational costs and revenue generation through prime retail and logistics site selection.

- Portfolio Management: ICA Real Estate oversees a substantial property portfolio, ensuring optimal utilization and value for ICA's retail and logistics needs.

- Location Strategy: Securing prime locations is paramount to ICA's strategy, facilitating customer access and efficient supply chain management.

- Development and Optimization: The segment is responsible for developing and optimizing properties to meet the evolving demands of ICA's businesses.

- Financial Contribution: Effective property management directly contributes to ICA Gruppen's financial performance through cost efficiency and asset appreciation.

Efficient Logistics and Supply Chain

ICA Gruppen places a strong emphasis on efficient logistics and supply chain management, ensuring their extensive product range is readily available to customers across their various store formats and online channels. This operational efficiency is a cornerstone of their ability to meet diverse consumer needs promptly.

A key initiative in this area is the drive towards fossil-free goods transport. ICA aims to achieve a significant milestone, targeting 70% fossil-free transport in Sweden by 2025. This ambitious goal underscores their commitment to sustainability within their supply chain operations.

To support these objectives, ICA is actively investing in its distribution network. This includes expanding capacity and strategically rerouting logistical flows. These investments are designed to optimize the entire distribution process, enhancing speed and reliability, even when facing potential cost increases in the transportation sector.

- Fossil-Free Transport Goal: 70% of transport in Sweden to be fossil-free by 2025.

- Network Optimization: Investments in expanded capacity and rerouting of flows.

- Availability Focus: Ensuring products are available where and when customers need them.

- Operational Efficiency: A core strategy to support diverse customer needs.

ICA Gruppen's extensive physical store network, including approximately 1,300 Swedish locations ranging from ICA Nära to ICA Kvantum, combined with nearly 400 Apotek Hjärtat pharmacies, ensures broad customer accessibility and convenience. This robust physical presence, even after the 2025 divestment of Rimi Baltic, remains a core asset, facilitating direct customer engagement and immediate product availability.

Full Version Awaits

ICA Gruppen 4P's Marketing Mix Analysis

The preview you see here is not a demo—it's the full, finished ICA Gruppen 4P's Marketing Mix analysis you’ll own. This comprehensive document delves into Product, Price, Place, and Promotion strategies. You can confidently assess the depth and quality of the analysis as it is the exact version you will receive. This ensures you know precisely what you're purchasing to understand ICA Gruppen's market approach.

Promotion

ICA Gruppen's Comprehensive Loyalty Program, Stammis, is a cornerstone of its marketing strategy, extending across its retail, pharmacy, and financial service arms. This program is designed to foster deep customer relationships by offering tangible benefits and personalized experiences. For instance, in 2024, Stammis members received tailored discounts and bonus points, directly influencing purchasing behavior and reinforcing brand affinity.

The Stammis program is instrumental in data collection, providing ICA Gruppen with invaluable insights into customer preferences and spending habits. This data then fuels highly targeted marketing campaigns, ensuring that offers are relevant and appealing to individual customers. By analyzing purchase data from its extensive member base, ICA can optimize product assortments and promotional activities, a strategy that contributed to a notable increase in customer retention rates throughout 2024.

ICA Gruppen is leveraging cutting-edge technology to deepen customer connections, employing digital channels and analyzing customer data to refine operations and boost customer lifetime value. This strategy focuses on delivering tailored promotions via digital avenues, seamlessly linked to the Stammis loyalty program.

In 2023, ICA Gruppen reported that approximately 6.7 million customers were members of its loyalty program, Stammis, highlighting the significant reach of their digital engagement initiatives. These digitalization efforts are designed to anticipate and fulfill customer requirements across both physical store experiences and online interactions.

ICA Gruppen utilizes a range of advertising and marketing campaigns to boost brand visibility and encourage customer spending. These efforts often highlight product advantages, unique selling points, and overall affordability, exemplified by widespread price reductions on staples and fresh produce.

Recent campaigns have included attractive offers like 'double bonus cheques' for Stammis loyalty program members. This strategy aims to cushion the impact of inflation, showcasing ICA's commitment to communicating tangible value to its customer base.

Sustainability and Community Engagement

ICA Gruppen's sustainability and community engagement efforts significantly bolster its brand image and consumer trust. The company is actively communicating ambitious climate goals, aiming for net-zero emissions and implementing strategies to drastically cut food waste, a move designed to connect with an increasingly eco-aware customer base.

Their extensive network across numerous Swedish municipalities highlights ICA Gruppen's deep integration into local economies and communities. This widespread presence isn't just about retail; it's about being a dependable local partner.

- Net-Zero Ambition: ICA Gruppen has committed to achieving net-zero greenhouse gas emissions by 2045, aligning with global climate targets.

- Food Waste Reduction: The company aims to halve food waste by 2030, implementing initiatives like improved inventory management and donation programs.

- Local Impact: With approximately 1,300 stores across Sweden, ICA Gruppen is a significant employer and contributor to local economies in virtually every municipality.

- Consumer Resonance: Research in early 2024 indicated that over 60% of Swedish consumers consider a company's sustainability practices when making purchasing decisions.

In-store s and Local Adaptation

Given the independent retailer model prevalent within ICA Gruppen, in-store promotions and localized marketing efforts play a pivotal role in driving sales and customer engagement. This decentralized approach allows individual ICA stores significant autonomy in crafting unique promotional strategies. For instance, a store in a university town might offer student discounts or late-night study snacks, while a store in a more affluent suburb could focus on premium organic produce promotions.

These localized initiatives act as a powerful complement to ICA's overarching, centrally planned marketing campaigns. By empowering each store to tailor its offerings, ICA ensures a higher degree of relevance to specific community needs and preferences. This hyper-local adaptation means that promotions are not just generic but are designed to resonate deeply with the immediate customer base, thereby boosting their effectiveness. In 2024, ICA reported that stores with highly localized promotional calendars often saw a 5-10% uplift in sales for featured product categories compared to stores relying solely on central promotions.

The flexibility for individual ICA retailers to implement their own specific extra items or deals, based on their unique understanding of local market dynamics, is a key differentiator. This can manifest in various ways:

- Seasonal Product Focus: Stores in coastal areas might heavily promote fresh seafood specials during summer months, while inland stores could focus on seasonal fruits and vegetables.

- Community Partnerships: Local stores might collaborate with nearby businesses or community events, offering joint promotions or discounts.

- Inventory Management: Promotions can be strategically used to move specific inventory that is abundant or nearing its expiry date at the local level, reducing waste and optimizing stock.

- Customer Loyalty Programs: Individual stores can enhance their own loyalty programs with unique in-store rewards or early access to deals for local shoppers.

ICA Gruppen's promotional strategy is multifaceted, heavily leaning on its extensive Stammis loyalty program to drive engagement and sales. This includes personalized offers, double bonus opportunities, and targeted digital campaigns designed to increase customer lifetime value. These efforts aim to communicate tangible value, particularly in response to economic pressures like inflation, and are supported by a broad advertising presence highlighting product benefits and affordability.

The decentralized nature of ICA's independent retailer model allows for highly localized promotions, adapting to specific community needs and preferences. Stores leverage this autonomy to run unique in-store deals, seasonal product focuses, and community partnerships, which complement central marketing efforts. This hyper-local approach, as seen in 2024, can lead to significant sales uplifts for featured products.

ICA's commitment to sustainability, including net-zero emissions by 2045 and halving food waste by 2030, is increasingly integrated into its promotional messaging. With over 60% of Swedish consumers considering sustainability in purchasing decisions by early 2024, these initiatives enhance brand image and consumer trust, resonating with an eco-conscious customer base.

| Promotional Tactic | Key Features | Impact/Data |

|---|---|---|

| Stammis Loyalty Program | Personalized discounts, double bonus cheques, tailored offers | Approx. 6.7 million members in 2023; drives customer retention and purchasing behavior. |

| Digital Marketing | Targeted campaigns via digital channels, data analysis for relevance | Enhances customer lifetime value; seamless integration with Stammis program. |

| In-Store & Localized Promotions | Independent retailer autonomy, seasonal focus, community partnerships | Stores with localized promotions saw 5-10% sales uplift in featured categories (2024 data); caters to specific community needs. |

| Sustainability Messaging | Climate goals (net-zero by 2045), food waste reduction (halve by 2030) | Boosts brand image and consumer trust; resonates with over 60% of consumers considering sustainability (early 2024). |

Price

ICA Gruppen prioritizes competitive pricing, especially on staples like fruit and vegetables, aiming to deliver excellent value. This strategy involves ongoing efforts to reduce regular prices and provide discounts across both physical stores and online platforms, a key driver for customer loyalty.

The company demonstrated this commitment in Sweden during 2024 with significant price reductions, even when this meant temporarily impacting operating margins. This aggressive approach to affordability reflects a strategic response to evolving market conditions and intense competition.

ICA Gruppen's extensive private label assortment is a cornerstone of its value-driven pricing strategy, offering customers quality products at competitive price points. This focus on affordability without compromising taste or quality helps ICA maintain its price leadership across numerous product categories.

In 2024, private label products represented a significant portion of ICA's sales, with figures showing continued growth in customer preference for these value offerings. For instance, ICA's own brands often see higher sales volumes compared to comparable national brands within the same categories, demonstrating their appeal.

The development of these private label goods emphasizes both excellent taste and high quality, directly addressing consumer demand for affordable yet satisfying options. This approach allows ICA to provide a tangible benefit to shoppers, making it easier for them to manage their grocery budgets effectively.

By strategically pricing its private label range, ICA ensures it remains a compelling choice for price-conscious consumers while still delivering on the expectation of good quality. This balance is crucial for customer loyalty and market share in the competitive grocery sector.

ICA Gruppen’s Stammis loyalty program significantly influences its pricing strategy by offering exclusive ‘Stammis prices’ and personalized discounts. This directly incentivizes customer loyalty, making the effective price lower for repeat shoppers.

The program's tiered bonus system rewards members with tangible financial benefits, further reducing the net cost for frequent ICA customers. For instance, during inflationary pressures in 2024, ICA implemented ‘double bonus cheques’ specifically for Stammis members, a clear tactic to maintain customer purchasing power and loyalty through price adjustments.

Dynamic Pricing and Promotional Adjustments

ICA Gruppen actively employs dynamic pricing, adjusting product prices and promotional activities based on current market dynamics, competitor pricing, and broader economic trends. This agile approach helps the company maintain its competitive edge and respond swiftly to shifts in consumer behavior and industry pressures.

A prime example of this strategy was observed in 2023 and early 2024, where ICA Gruppen introduced initiatives like double bonus checks. This was a direct response to inflationary pressures, designed to alleviate the financial burden on their customers and, in turn, reinforce their value proposition and customer loyalty amidst rising costs.

- Dynamic Pricing: ICA Gruppen continuously monitors and adjusts prices to reflect market fluctuations and competitor actions.

- Promotional Responsiveness: The company actively modifies its promotional calendar and offers to align with economic conditions and consumer needs.

- Inflation Mitigation: Measures like double bonus checks were implemented to counter inflation's impact on consumer purchasing power.

- Market Share Retention: These pricing and promotional strategies are aimed at solidifying ICA Gruppen's market position and retaining its customer base.

Financial Services Pricing

For ICA Gruppen's financial services, pricing is a strategic lever for both ICA Banken and ICA Försäkring. It encompasses competitive interest rates on savings and loans, along with carefully considered fees and insurance premiums. The core philosophy behind ICA Banken's pricing is to drive down operational costs for the affiliated ICA stores while simultaneously fostering robust customer loyalty through an appealing suite of financial products.

The pricing structure for these financial offerings is intentionally designed to be attractive to consumers, acting as a key component in strengthening the overall financial ecosystem of ICA Gruppen. For instance, ICA Banken often offers competitive savings account interest rates; in early 2024, some of their offerings provided interest rates competitive with or exceeding the average for similar accounts in the Swedish market.

- Competitive Interest Rates: ICA Banken aims to attract and retain customers with savings and loan interest rates that are benchmarked against market averages.

- Fee Structures: Transaction fees and account maintenance charges are structured to be transparent and competitive, aligning with the goal of cost reduction for ICA stores.

- Insurance Premiums: ICA Försäkring sets insurance premiums based on risk assessment and market competitiveness, ensuring value for policyholders.

- Loyalty Integration: Pricing strategies are often linked to the broader ICA loyalty program, offering enhanced benefits or preferential rates to frequent ICA shoppers.

ICA Gruppen’s pricing strategy focuses on delivering value through competitive regular prices, strategic promotions, and a strong private label offering. This approach is reinforced by the Stammis loyalty program, which provides exclusive discounts and rewards, effectively lowering the net price for frequent customers. The company also employs dynamic pricing to adapt to market conditions, a tactic exemplified by initiatives like double bonus checks introduced in 2024 to combat inflation and retain customer loyalty.

| Pricing Element | Description | Impact | 2024 Focus |

|---|---|---|---|

| Competitive Pricing | Low prices on staples like fruit and vegetables. | Drives customer loyalty and value perception. | Significant price reductions on key items. |

| Private Label | High-quality, affordable own-brand products. | Offers better margins and value; significant sales growth in 2024. | Expanding assortment and promoting value. |

| Loyalty Program (Stammis) | Exclusive prices and bonus rewards. | Increases repeat purchases and customer lifetime value. | Targeted offers and double bonus initiatives. |

| Dynamic Pricing | Adjustments based on market and competitor data. | Maintains competitiveness and responsiveness. | Agile response to inflation and consumer behavior. |

4P's Marketing Mix Analysis Data Sources

Our ICA Gruppen 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside publicly available data on their retail footprint and promotional activities.