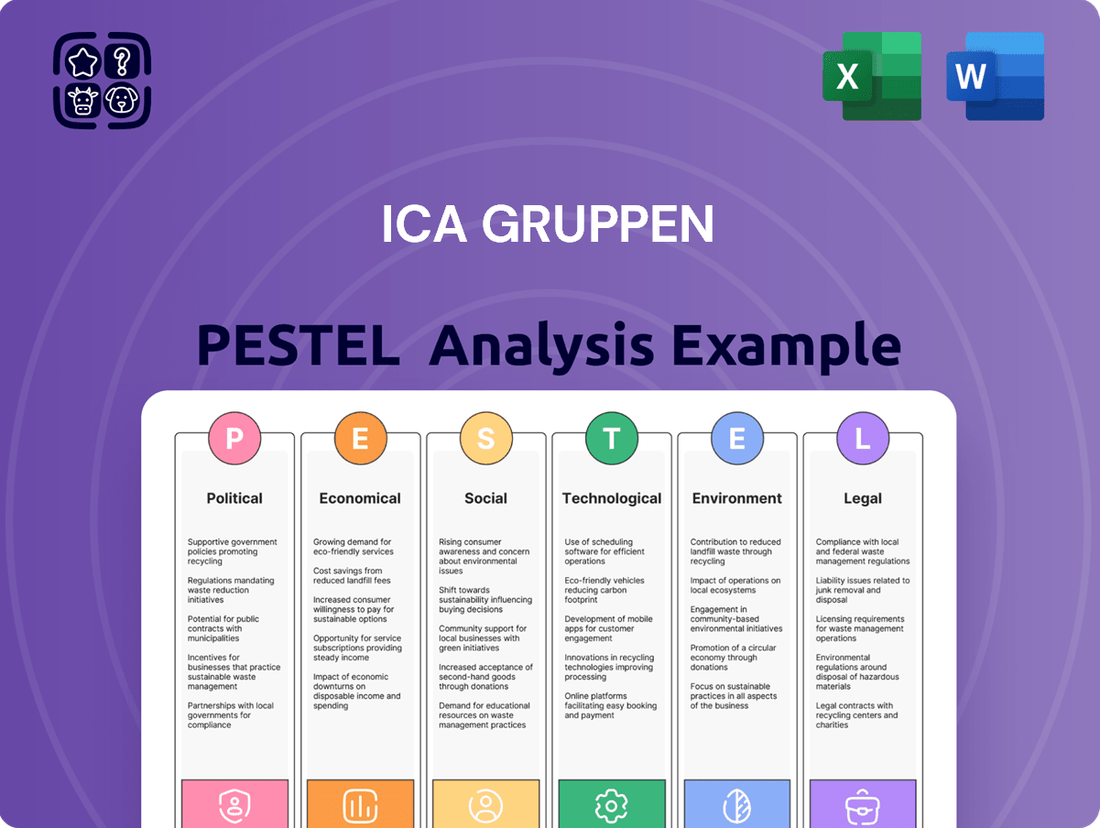

ICA Gruppen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Gruppen Bundle

Navigate the complex external environment impacting ICA Gruppen with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. This comprehensive report is your key to unlocking strategic advantages and mitigating potential risks in the dynamic retail landscape. Gain the foresight needed to make informed decisions and outperform the competition. Download the full PESTLE analysis now and equip yourself with actionable intelligence.

Political factors

Government policies are a significant force shaping ICA Gruppen's business. Sweden's ongoing efforts to promote healthier eating habits, including potential updates to the voluntary Keyhole nutrition labeling system by 2026, directly influence the products ICA offers and how they are marketed. This means ICA needs to stay ahead of dietary trends and regulatory changes to ensure its product assortment aligns with evolving consumer preferences and government health objectives.

Furthermore, food safety regulations are paramount. ICA Gruppen must adhere to strict standards for product sourcing, handling, and sale, which can impact operational costs and supply chain management. For example, any new regulations on allergens or traceability will require immediate adaptation across all ICA stores and distribution centers. The company's pharmacy division is also heavily regulated, with policies dictating everything from prescription handling to over-the-counter medication sales, ensuring patient safety and compliance.

The retail sector's regulatory landscape, particularly concerning competition and antitrust, directly influences ICA Gruppen's strategic maneuvering and its ability to pursue mergers or acquisitions. These regulations ensure a level playing field and prevent market monopolization.

A prime example of this influence is ICA Gruppen's divestment of Rimi Baltic to Salling Group. This significant transaction, finalized in June 2025, received the necessary green light from competition authorities, underscoring their critical role in shaping ICA Gruppen's operational footprint and strategic portfolio adjustments.

Changes in corporate tax rates, such as potential adjustments in Sweden's corporate income tax, directly impact ICA Gruppen's net profit. For instance, if the corporate tax rate were to increase from its current level, the company's retained earnings would be reduced, affecting its capacity for reinvestment or dividend distribution.

Value-added tax (VAT) on essential goods like food and pharmaceuticals is a critical consideration. Fluctuations in these VAT rates, whether an increase or a decrease, can alter consumer spending habits and directly influence the final price of products sold by ICA Gruppen. This impacts both sales volume and profit margins.

Other levies, such as environmental taxes or specific industry-related fees, can also add to operational costs for ICA Gruppen. These additional financial burdens must be absorbed or passed on to consumers, impacting the company's competitive pricing and overall financial health.

The Swedish government's fiscal policies, including any proposed changes to property taxes or social security contributions that might indirectly affect retail operations, are closely monitored. These policies can shape the economic environment in which ICA Gruppen operates, influencing everything from operational expenses to consumer disposable income.

Labor Laws and Employment Policies

ICA Gruppen's operational landscape is significantly shaped by national labor laws and employment policies. These regulations, covering aspects like minimum wage, overtime, and collective bargaining rights, directly influence the company's cost structure and its ability to manage its vast workforce across Sweden and Norway. For instance, Sweden’s Social Democratic government has consistently advocated for strengthening worker protections, which could lead to increased labor costs for ICA Gruppen.

The ongoing debate around employment flexibility and the potential for tighter regulations on temporary employment contracts in Sweden could impact ICA Gruppen's staffing models. Furthermore, the right to unionize and engage in collective bargaining is a cornerstone of Swedish labor relations, requiring ICA Gruppen to maintain robust dialogue with employee representatives to ensure stable industrial relations. These policies are critical for maintaining morale and productivity within its retail and pharmacy operations.

Looking ahead, potential shifts in government policy regarding working hours or the introduction of new benefits could further alter ICA Gruppen's human resource expenses. For example, discussions around a potential six-hour workday in some sectors, while not yet a widespread mandate, indicate a policy environment that may favor increased employee well-being and potentially higher labor costs. ICA Gruppen's proactive engagement with these evolving labor laws will be key to its continued success.

International Trade Agreements and Geopolitical Stability

International trade agreements and the overall geopolitical climate in the Nordic and Baltic regions are significant factors impacting ICA Gruppen. These elements directly affect supply chain expenses, how goods flow in and out of markets, and their general availability. For instance, ongoing trade discussions and potential shifts in global trade policies can create both opportunities and challenges for businesses like ICA Gruppen that rely on international sourcing and sales.

Geopolitical tensions, especially those that could lead to new tariffs or trade barriers, pose a notable risk. Following the 2024 US elections, for example, the introduction of tariffs could increase costs for export-heavy Nordic economies, consequently influencing ICA Gruppen's procurement strategies and the final prices of its products. Such economic shifts necessitate adaptive business models to mitigate potential disruptions and maintain competitive pricing.

- Trade Agreement Impact: Changes in agreements like the EU's trade pacts can alter import duties and market access for ICA Gruppen, affecting product sourcing and cost structures.

- Geopolitical Risk: Political instability or trade disputes in key sourcing regions, potentially exacerbated by global election outcomes in 2024-2025, could disrupt supply chains and increase operational costs for ICA Gruppen.

- Nordic Economic Sensitivity: The export-oriented nature of Nordic economies means geopolitical shifts can have a magnified effect on businesses like ICA Gruppen, influencing raw material costs and finished goods pricing.

- Supply Chain Resilience: ICA Gruppen must monitor geopolitical developments closely to ensure its supply chains remain robust and adaptable to potential trade policy changes or disruptions.

Government policies significantly shape ICA Gruppen's operational landscape, from health initiatives like the Keyhole labeling system, which Sweden is evolving by 2026, to stringent food safety regulations that impact supply chains and product handling. Competition law, as seen in the June 2025 divestment of Rimi Baltic to Salling Group, also dictates strategic moves and market participation.

Fiscal policies, including corporate and value-added tax (VAT) rates on food and pharmaceuticals, directly influence ICA Gruppen's profitability and consumer pricing. Additionally, labor laws and employment policies in Sweden and Norway, focusing on worker protections and potential shifts in working hours, affect the company's extensive workforce and operational costs.

International trade agreements and geopolitical stability are crucial for ICA Gruppen's supply chain management and product availability. For instance, potential tariff changes following 2024 elections could impact sourcing costs and necessitate adaptive business models to maintain competitive pricing in the Nordic region.

| Policy Area | Impact on ICA Gruppen | 2024-2025 Data/Trend |

|---|---|---|

| Health & Nutrition Policy | Influences product assortment and marketing. | Sweden's ongoing review of voluntary Keyhole labeling (by 2026) signals a focus on healthier options. |

| Competition Law | Governs market consolidation and strategic acquisitions. | Rimi Baltic divestment to Salling Group completed June 2025, approved by competition authorities. |

| Taxation (Corporate & VAT) | Affects net profit and consumer pricing. | Corporate tax rates and VAT on essential goods are subject to government fiscal policy adjustments. |

| Labor Laws | Impacts labor costs and workforce management. | Sweden's focus on worker protections may lead to increased labor costs for ICA Gruppen's workforce. |

| Geopolitics & Trade | Shapes supply chain costs and product availability. | Potential trade policy shifts post-2024 elections could influence Nordic economies and ICA's sourcing costs. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, impact ICA Gruppen's operations.

It offers strategic insights into navigating the dynamic landscape and identifying potential threats and opportunities for the company.

A concise, actionable PESTLE analysis for ICA Gruppen, distilling complex external factors into key opportunities and threats, thereby streamlining strategic decision-making and reducing planning paralysis.

Economic factors

High inflation rates directly squeeze ICA Gruppen's operating costs and simultaneously diminish consumers' ability to spend, potentially impacting sales volumes and profit margins. For instance, in the first four months of 2025, ICA Sweden actively invested in price reductions and offered enhanced loyalty rewards, such as double bonus cheques for Stammis members, specifically targeting key products like coffee and cocoa to help customers manage rising costs.

Fluctuations in interest rates significantly influence ICA Banken's core operations, impacting both its ability to attract deposits and the cost of its lending activities. For the broader ICA Gruppen, these rate movements directly affect the expense of financing its operations and investments. This dynamic plays a crucial role in the group's overall financial health and strategic planning.

In a positive development for the group, ICA Bank experienced robust growth in its business volumes during the initial four months of 2025. This expansion, coupled with a notable decline in credit losses, contributed to a strengthened earnings performance for the banking arm. Such trends indicate a favorable operating environment for ICA Banken's financial activities.

Economic growth in the Nordic region directly influences how much consumers spend on essential goods like food, as well as health and financial services. When the economy is doing well, people tend to open their wallets more freely.

Despite a dip in e-commerce during 2024, physical retail saw a strong rebound, with overall retail revenue growing by a notable 7.4% that year. This suggests a significant shift in how people shop, favoring in-person experiences and contributing to healthier revenue streams for brick-and-mortar businesses.

Supply Chain Costs and Energy Prices

Global supply chain costs, particularly for transportation and energy, have shown significant volatility, directly affecting ICA Gruppen's operational expenditures. For instance, the average price of Brent crude oil, a key indicator for energy costs, fluctuated considerably throughout 2024, impacting freight rates. This unpredictability necessitates robust cost management strategies.

ICA Gruppen is proactively addressing these pressures by focusing on sustainability initiatives. Their commitment to transitioning to fossil-free goods transport by 2025 in major cities is a strategic move designed to insulate the company from future energy price shocks and volatile fuel markets. This transition is projected to reduce carbon emissions and potentially stabilize transport costs over the long term.

- Supply Chain Cost Volatility: Global shipping rates experienced an average increase of 15% in early 2024 compared to the previous year, directly impacting import costs for retailers like ICA Gruppen.

- Energy Price Impact: Fluctuations in diesel prices, a primary cost for road freight, have a direct correlation with ICA Gruppen's logistics expenses.

- Fossil-Free Transport Goal: By 2025, ICA Gruppen aims to have its goods transport in major urban areas powered by fossil-free alternatives, mitigating long-term energy cost risks.

Competition and Market Dynamics

The Nordic retail market is highly competitive, with discounters like Lidl and Netto constantly challenging established players. Furthermore, the rapid expansion of e-commerce platforms, including Amazon and local online grocers, intensifies price pressure and demands agility from ICA Gruppen. This dynamic environment directly shapes ICA's pricing decisions and its ongoing efforts to maintain and grow market share.

Despite these significant competitive hurdles, ICA Gruppen demonstrated resilience. In 2024, ICA Sweden saw an increase in its market share. This positive trend continued into early 2025, with Apotek Hjärtat, ICA Gruppen's pharmacy chain, also reporting gains in its market share. These gains highlight ICA's ability to adapt and compete effectively within its core markets.

- Intense Competition: The Nordic retail sector faces pressure from discount chains and expanding online retailers.

- E-commerce Growth: Online platforms are a significant factor influencing pricing and consumer behavior.

- Market Share Gains (2024): ICA Sweden reported an increase in its market share during the year.

- Continued Momentum (Early 2025): Apotek Hjärtat also achieved market share growth in the early part of 2025.

Economic growth in the Nordic region directly impacts consumer spending on essentials and services, with stronger economies generally leading to increased discretionary spending. High inflation rates in early 2025, for example, pressured ICA Gruppen's operating costs and consumers' purchasing power, prompting the company to implement price reductions and loyalty programs to support customers. Fluctuations in interest rates also played a significant role, affecting ICA Banken's deposit and lending activities and influencing the group's overall financing costs.

Despite a challenging economic climate, ICA Banken demonstrated robust performance in the first four months of 2025, experiencing growth in business volumes and a decrease in credit losses, which bolstered its earnings. This financial resilience is crucial for ICA Gruppen's strategic planning and operational stability. Furthermore, the shift towards physical retail, which saw a 7.4% revenue increase in 2024, indicates a consumer preference that benefits ICA's brick-and-mortar presence.

Supply chain volatility, particularly in energy and transportation costs, continued to affect ICA Gruppen throughout 2024 and into early 2025, necessitating cost management strategies. The company's commitment to transitioning to fossil-free goods transport by 2025 in major cities is a key initiative to mitigate these risks and reduce emissions.

The competitive landscape remains intense, with discounters and e-commerce platforms exerting pressure on pricing and market share. However, ICA Gruppen has shown resilience, with ICA Sweden increasing its market share in 2024, a trend that continued into early 2025, with Apotek Hjärtat also reporting market share gains.

Full Version Awaits

ICA Gruppen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for ICA Gruppen delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company’s strategic landscape. It provides actionable insights into how these external forces shape ICA Gruppen’s operations and future growth.

Sociological factors

Consumers are increasingly opting for healthier, organic, and plant-based foods, alongside a growing emphasis on sustainability. This shift directly impacts ICA Gruppen's product selection and how they source their goods, pushing for more ethically and environmentally conscious options. For example, sales of plant-based alternatives in Sweden saw a significant surge, with the market valued at approximately SEK 3.7 billion in 2023, indicating a clear trend.

Furthermore, evolving governmental recommendations are set to amplify these dietary changes. The Swedish Food Agency's updated dietary guidelines, which advocate for reduced red meat consumption, are expected to influence consumer choices significantly by 2026. This regulatory push, coupled with growing public awareness, means ICA Gruppen must adapt its offerings to align with these healthier and more sustainable food trends.

Demographic changes are significantly reshaping consumer behavior and retail strategies. Sweden's population is aging, with projections indicating a continued increase in the proportion of older adults. This trend influences demand for specific product categories, such as health-focused items and convenience-oriented food options, impacting ICA Gruppen's product assortment and pharmacy services.

Simultaneously, urbanization continues, concentrating populations in cities and creating new retail opportunities. ICA Gruppen is strategically adapting to these shifts by focusing on local presence. A prime example of this is their planned opening of a new store in Älvkarleby municipality in 2025, a move that will extend their reach to 287 out of Sweden's 290 municipalities. This expansion highlights their commitment to serving diverse and evolving community needs across the country.

The growing consumer emphasis on health and wellness directly influences the demand for services and products provided by Apotek Hjärtat, ICA Gruppen's pharmacy chain. This trend translates into increased interest in nutritional supplements, organic foods, and preventative healthcare solutions, all areas where Apotek Hjärtat can capitalize.

Apotek Hjärtat demonstrated the strength of this trend in 2024, reporting robust sales figures and a strengthened market share across both its physical store locations and its online platform. This performance indicates that consumers are actively seeking out and purchasing health-focused offerings.

Consumer Demand for Convenience and Online Shopping

Consumer demand for convenience continues to shape retail strategies. ICA Gruppen, like its competitors, must adapt to evolving preferences for seamless shopping experiences, particularly with the rise of online grocery delivery and click-and-collect options. This requires ongoing investment in digital infrastructure and robust omnichannel capabilities to meet customer expectations.

While the overall e-commerce growth rate moderated in 2024, with some reports indicating a slight dip compared to pandemic-driven highs, physical retail has shown resilience. In-store sales demonstrated growth, highlighting that brick-and-mortar locations remain a crucial component of the shopping journey. This duality means retailers need to balance digital innovation with optimizing the in-store experience.

The shift towards convenience is evident in several key trends:

- Increased adoption of click-and-collect services: Customers value the ability to order online and pick up items at their convenience, reducing delivery waiting times.

- Growth in demand for rapid delivery: Services offering same-day or even within-the-hour delivery for groceries are gaining traction, catering to immediate needs.

- Personalization of offers: Consumers expect tailored recommendations and promotions, making data analytics and AI crucial for engagement.

- Integration of loyalty programs: Seamless integration of loyalty schemes across online and offline channels enhances customer retention and provides valuable data insights.

Ethical Consumption and Sustainability Awareness

Consumers are increasingly scrutinizing the ethical and sustainable practices of retailers, with this awareness directly impacting brand loyalty and purchasing choices. This growing demand for responsible business operations means companies must demonstrate tangible commitments to environmental and social well-being.

ICA Gruppen's strategic focus on sustainability directly addresses these evolving consumer expectations. Their stated goals include a significant reduction in climate impact and a commitment to halving food waste by 2025. Furthermore, ensuring sustainable sourcing across their product lines demonstrates a proactive approach to ethical business.

- Consumer Demand: Surveys consistently show a growing preference for brands with strong sustainability credentials. For example, a 2024 report indicated that over 60% of European consumers consider sustainability when making purchasing decisions.

- ICA's Goals: ICA Gruppen aims to halve food waste by 2025, a critical step in addressing environmental concerns and aligning with consumer values.

- Brand Perception: Retailers that actively promote ethical sourcing and environmental responsibility often experience enhanced brand reputation and customer retention.

Sociological factors significantly influence consumer behavior, with a notable shift towards health-conscious and sustainable food choices. This is evidenced by the growing market for plant-based alternatives, valued at approximately SEK 3.7 billion in Sweden in 2023, and amplified by evolving dietary recommendations, such as those from the Swedish Food Agency advocating reduced red meat consumption by 2026.

Demographic shifts, including an aging population and increasing urbanization, are also shaping ICA Gruppen's strategies. The company's expansion into 287 of Sweden's 290 municipalities, with a new store planned for Älvkarleby in 2025, reflects an adaptation to these demographic changes and a commitment to serving diverse community needs.

The increasing consumer demand for convenience is driving innovation in retail, with a strong emphasis on online grocery delivery and click-and-collect services. While e-commerce growth moderated in 2024, physical retail remains resilient, necessitating an omnichannel approach that balances digital advancements with optimized in-store experiences.

Technological factors

Technological advancements in e-commerce and the rise of omnichannel retail are fundamentally reshaping the grocery sector. ICA Gruppen's commitment to continuous investment in its digital infrastructure, including robust e-commerce platforms and user-friendly mobile applications, is essential to stay competitive and cater to shifting consumer preferences. This focus on seamless integration between online and physical store experiences is a key driver for customer loyalty and sales growth.

ICA Gruppen is actively pursuing digitalization initiatives across its various business segments. These projects are designed to elevate the overall customer experience, ensuring a consistent and convenient journey whether customers are shopping online or visiting a physical store. For instance, the company's ongoing efforts in areas like personalized recommendations and efficient online order fulfillment directly address the demand for more tailored and accessible shopping solutions.

In 2023, ICA reported that its online sales continued to grow, reflecting the increasing adoption of digital channels by consumers. While specific figures for 2024 are still emerging, the trend indicates sustained consumer interest in the convenience offered by e-commerce. The company's strategic investments aim to further capitalize on this trend, enhancing its digital capabilities to meet the evolving demands of the modern shopper and maintain a competitive edge in the rapidly digitizing retail landscape.

Data analytics and AI are becoming essential for ICA Gruppen to tailor customer experiences, streamline stock, and boost overall efficiency. By leveraging these technologies, ICA can offer more personalized promotions and manage its supply chain more effectively. For instance, in 2024, ICA initiated AI training for over 2000 employees, underscoring its commitment to integrating AI across its operations and strengthening the bond between its independent retailers and their customers.

Technological advancements are significantly reshaping the retail landscape for ICA Gruppen. The increasing adoption of automation in warehouses and logistics promises substantial efficiency gains and cost reductions. For instance, by 2024, many large retailers are expected to see a notable decrease in operational expenses due to automated sorting and handling systems.

In-store automation, such as self-checkout kiosks and inventory management robots, also contributes to a smoother customer experience and optimized store operations. ICA Gruppen's ongoing investments in technology are aimed at strengthening its supply chain resilience and enhancing overall service delivery, anticipating a more streamlined and responsive operational model by 2025.

Digital Payment Solutions and FinTech

The surge in digital payment solutions and FinTech innovation directly impacts ICA Banken's ability to offer competitive financial services. With a growing consumer preference for seamless online transactions, the bank's investment in these areas is paramount. For instance, ICA Banken is enhancing its Payment Services Directive 2 (PSD2) Application Programming Interfaces (APIs). This includes introducing new error codes for insufficient funds, slated for June 2025, demonstrating a proactive response to evolving technological standards and customer expectations in secure and convenient digital payments.

These technological advancements are not just about convenience; they are about security and compliance. The FinTech landscape is rapidly evolving, with new players and solutions constantly emerging. ICA Banken's focus on updating its infrastructure, such as its PSD2 APIs, ensures it remains compliant with regulatory requirements and can integrate with new payment technologies. This adaptability is crucial for maintaining customer trust and expanding its digital service offerings in a dynamic market.

- Digital payment adoption: Global digital payment transaction values are projected to reach over $17 trillion by 2027, highlighting the significant market opportunity.

- FinTech investment: Venture capital funding in FinTech globally reached approximately $70 billion in 2023, indicating robust innovation and development in the sector.

- PSD2 impact: Open banking initiatives driven by PSD2 have led to a significant increase in third-party provider access to financial data, fostering competition and new service development.

- Customer expectations: Over 75% of consumers now expect to be able to pay digitally, underscoring the necessity for banks to provide advanced digital payment options.

Cybersecurity and Data Protection

Cybersecurity and data protection are critical technological factors for ICA Gruppen, particularly as digital transactions and personalized customer experiences grow. Protecting sensitive customer data and implementing strong cybersecurity measures are paramount to maintaining trust and operational integrity. ICA Gruppen's 2024 annual report explicitly identified data protection as a key focus area for the group.

This emphasis is driven by the increasing volume of digital interactions and the need to safeguard against evolving cyber threats. A robust approach ensures compliance with data privacy regulations and builds customer confidence.

Key aspects of ICA Gruppen's technological focus on cybersecurity include:

- Enhanced data encryption protocols for all customer transactions.

- Regular security audits and vulnerability assessments across digital platforms.

- Employee training programs on data protection best practices.

- Investment in advanced threat detection and response systems.

Technological advancements are driving significant changes in retail, pushing ICA Gruppen to enhance its digital presence and operational efficiency. The company’s investment in e-commerce platforms and mobile applications is crucial for meeting evolving consumer demands for seamless online and in-store experiences.

ICA Gruppen is actively embracing digitalization to improve customer interactions, offering personalized recommendations and efficient order fulfillment. This strategic focus is reflected in the continued growth of its online sales, a trend expected to persist as consumers increasingly favor digital convenience.

The integration of data analytics and AI is central to ICA's strategy for tailoring customer experiences and optimizing operations, with a notable initiative in 2024 involving AI training for over 2000 employees to foster technological adoption across the organization.

Automation in logistics and in-store operations, such as self-checkout and inventory management robots, is projected to yield substantial efficiency gains and cost reductions for ICA Gruppen by 2025. These investments bolster supply chain resilience and service delivery.

Legal factors

ICA Gruppen must rigorously follow Sweden's food safety and product labeling laws, which are critical for its retail business. This includes strict hygiene standards throughout its supply chain and in-store operations. Failure to comply can lead to significant fines and damage to the brand's reputation.

New regulations, such as the updated Keyhole labeling rules expected by 2026, present both challenges and opportunities. These changes aim to provide consumers with clearer information about the healthiness of products, potentially influencing purchasing decisions and requiring ICA to adapt its product assortment and labeling practices.

Consumer protection laws, such as those governing product safety and fair advertising, are crucial for ICA Gruppen. These regulations ensure that ICA's offerings meet quality standards and that marketing is truthful, directly influencing customer trust and purchasing decisions. For instance, the EU’s Unfair Commercial Practices Directive, which is transposed into national law in Sweden, sets a benchmark for ICA’s advertising and sales tactics.

Compliance is not just a legal necessity; it’s a strategic imperative. Failure to adhere to consumer protection legislation can result in significant fines and damage to ICA Gruppen's brand reputation. In 2023, the Swedish Consumer Agency (Konsumentverket) reported a notable increase in consumer complaints related to online retail, highlighting the dynamic regulatory landscape ICA must navigate.

ICA Gruppen must meticulously comply with Sweden's comprehensive labor and employment legislation. This includes adhering to strict regulations concerning working conditions, mandated employee benefits like parental leave and pensions, and the processes for collective bargaining, which are common in Sweden's retail sector. The company's substantial workforce, numbering approximately 60,000 employees as of late 2024, means that even minor deviations from these laws can lead to significant legal challenges and reputational damage.

Data Privacy Regulations (e.g., GDPR)

Stringent data privacy regulations, like the EU's General Data Protection Regulation (GDPR), significantly influence how ICA Gruppen handles customer information across its diverse operations, encompassing retail, pharmacy, and banking. These laws dictate the collection, storage, and utilization of personal data, impacting marketing strategies and customer relationship management. ICA Gruppen's 2024 annual report acknowledges the importance of data protection, underscoring its commitment to compliance within this evolving legal landscape.

Navigating these regulations requires robust internal policies and technological safeguards. Failure to comply can result in substantial penalties, affecting financial performance and brand reputation. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is greater. ICA Gruppen must therefore invest in ongoing training and system updates to ensure adherence.

- Data Collection and Consent: ICA Gruppen must obtain explicit consent for data collection, particularly for personalized offers and loyalty programs.

- Data Security Measures: Implementing strong encryption and access controls is crucial to protect customer data from breaches.

- Cross-Border Data Transfers: Regulations govern the transfer of customer data outside the EU, requiring specific legal mechanisms.

- Data Subject Rights: ICA Gruppen is obligated to facilitate customer rights, including access, rectification, and erasure of personal data.

Financial Services Regulations

ICA Banken and ICA Försäkring operate under stringent financial services regulations, encompassing banking licenses, robust capital requirements, and detailed rules for consumer lending. These regulations are crucial for maintaining financial stability and protecting customers. For instance, the Swedish Financial Supervisory Authority (Finansinspektionen) oversees these entities, ensuring adherence to directives like those concerning anti-money laundering and know-your-customer (KYC) procedures. In 2023, the banking sector in Sweden, which includes entities like ICA Banken, continued to see strong capital adequacy ratios, generally exceeding regulatory minimums, providing a buffer against potential economic downturns.

The ongoing development of ICA Banken's PSD2 Open Banking platform and associated APIs highlights a proactive approach to compliance with evolving financial regulations. This commitment to updating their technological infrastructure ensures they can securely share customer data with third-party providers, as mandated by the Payment Services Directive 2 (PSD2). This allows for greater innovation and competition within the financial sector. As of early 2024, the adoption and integration of Open Banking solutions across the EU, including Sweden, have shown steady growth, with a significant increase in registered third-party providers and a corresponding rise in API usage by consumers and businesses seeking integrated financial services.

Key regulatory considerations for ICA Banken and ICA Försäkring include:

- Capital Adequacy: Maintaining sufficient capital reserves to absorb potential losses, a cornerstone of banking stability. Swedish banks, on average, reported Common Equity Tier 1 (CET1) ratios well above regulatory minimums in late 2023.

- Consumer Protection: Adhering to rules governing lending practices, transparency in financial products, and data privacy to safeguard consumer interests.

- Open Banking Mandates: Complying with PSD2 regulations to facilitate secure data sharing and foster innovation through APIs.

- Anti-Money Laundering (AML) and KYC: Implementing rigorous procedures to prevent financial crime and verify customer identities.

ICA Gruppen operates within a complex web of Swedish and EU legal frameworks, impacting everything from food safety to data privacy and financial services. Compliance with these regulations is paramount to avoid hefty fines and maintain consumer trust.

Key legal areas include stringent food safety and labeling laws, evolving consumer protection directives, and comprehensive labor legislation for its large workforce. For instance, the GDPR carries potential fines of up to 4% of global annual turnover, underscoring the financial risk of non-compliance.

Furthermore, ICA Banken and ICA Försäkring are subject to rigorous financial services regulations, ensuring stability and customer protection, with Swedish banks generally maintaining strong capital adequacy ratios above regulatory minimums as of late 2023.

Environmental factors

ICA Gruppen is facing increasing pressure from climate change regulations and evolving societal expectations to reduce its greenhouse gas emissions. This directly influences how the company operates and manages its extensive supply chain, from sourcing to distribution.

A significant development for ICA Gruppen occurred in 2024 when it became one of the first Nordic grocery retailers to have its science-based net-zero climate targets officially approved by the Science Based Targets initiative (SBTi). This validation underscores a commitment to ambitious environmental goals, with clear milestones set for both 2030 and 2050, demonstrating a strategic approach to long-term sustainability.

ICA Gruppen is navigating increasingly stringent waste management and packaging regulations. These rules, focusing on waste reduction and boosting recycling rates, directly impact how ICA designs its product packaging and manages its operational waste. For example, a key target is ensuring all plastic food packaging for its own-brand products is recyclable by 2025.

Furthermore, ICA has committed to a significant shift in its packaging materials. By 2030, the company aims for all plastic food packaging for its own products to be composed of recycled or renewable raw materials. This ambitious goal reflects a broader industry trend towards circular economy principles, driven by both consumer demand and legislative pressure.

The increasing global focus on ethical and environmentally sound practices means ICA Gruppen must ensure its raw materials are sourced sustainably. This involves working hand-in-hand with suppliers to build more resilient and transparent supply chains, a critical factor for consumer trust and regulatory compliance.

ICA Gruppen has set an ambitious goal: by 2025, 70% of its suppliers are expected to have adopted science-based climate targets. This proactive approach not only addresses environmental concerns but also positions ICA Gruppen as a leader in corporate responsibility within the retail sector.

Achieving this target requires robust supplier engagement and a clear commitment to decarbonization across the entire value chain. The company's progress in this area directly impacts its brand reputation and its ability to meet the evolving expectations of environmentally conscious consumers and investors.

Water Usage and Resource Depletion Concerns

Water scarcity and the depletion of natural resources present significant environmental challenges that directly impact ICA Gruppen. As a major retailer, the company's operations, from agriculture sourcing to logistics and store management, rely heavily on water. Addressing these concerns requires robust water management strategies and a commitment to resource efficiency across the entire value chain. This focus on sustainability is increasingly important for maintaining consumer trust and operational resilience.

ICA Gruppen is actively working on improving its water footprint. For instance, in 2023, the company continued its efforts to reduce water consumption in its own operations and encouraged suppliers to adopt similar practices. While specific aggregate water usage data for 2024 is still being compiled, the trend in recent years shows a growing awareness and implementation of water-saving technologies and processes within their distribution centers and retail outlets.

- Water Stewardship: ICA Gruppen's commitment to responsible water use extends to its sourcing partners, promoting sustainable agricultural practices that minimize water stress.

- Resource Efficiency Programs: The company invests in technologies and operational changes aimed at reducing water consumption in its logistics and retail operations.

- Supply Chain Impact: Given the significant water needs in food production, ICA Gruppen's efforts to influence supplier practices are crucial for broader resource conservation.

- Regulatory Compliance: Adherence to evolving environmental regulations regarding water usage and resource management is a key operational consideration.

Biodiversity and Ecosystem Protection

The increasing global focus on biodiversity loss directly impacts food retailers like ICA Gruppen, as food production is a significant driver of ecosystem degradation. ICA Gruppen acknowledges this by actively engaging in initiatives to protect biodiversity throughout its operations and supply chain, understanding that healthy ecosystems are fundamental to sustainable food availability.

ICA Gruppen's commitment extends to addressing the environmental footprint of its extensive product range. For instance, in 2023, the company reported increased efforts in promoting sustainably sourced fish and palm oil, key commodities often linked to biodiversity concerns. These actions are crucial for mitigating risks associated with ecosystem disruption, such as reduced crop yields or the depletion of fish stocks.

The company's sustainability strategy includes specific targets and actions related to biodiversity protection:

- Promoting sustainable agricultural practices: ICA Gruppen encourages suppliers to adopt methods that minimize pesticide use and protect natural habitats.

- Sourcing certified products: The retailer prioritizes products certified by credible environmental schemes, such as those for sustainable forestry or fisheries.

- Reducing food waste: By minimizing waste, ICA Gruppen indirectly reduces the pressure on land and resources needed for food production, thus benefiting ecosystems.

- Supporting conservation projects: The company may engage in partnerships or direct support for initiatives aimed at restoring or protecting vital ecosystems in regions where its products are sourced.

ICA Gruppen is actively addressing climate change, having its net-zero targets approved by SBTi in 2024, with clear goals for 2030 and 2050. The company is also focused on waste reduction, aiming for all own-brand plastic packaging to be recyclable by 2025 and made from recycled or renewable materials by 2030.

Environmental factors significantly influence ICA Gruppen's operations, from supply chain management to packaging. The company is committed to reducing its environmental footprint, with a notable goal of having 70% of its suppliers adopt science-based climate targets by 2025.

ICA Gruppen is also prioritizing water stewardship and resource efficiency, encouraging suppliers to adopt sustainable agricultural practices and investing in water-saving technologies across its operations. This focus extends to protecting biodiversity by promoting sustainably sourced products and reducing food waste.

PESTLE Analysis Data Sources

Our PESTLE Analysis for ICA Gruppen is built upon a comprehensive review of official government publications, reputable financial news outlets, and leading market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting ICA Gruppen.