ICA Gruppen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Gruppen Bundle

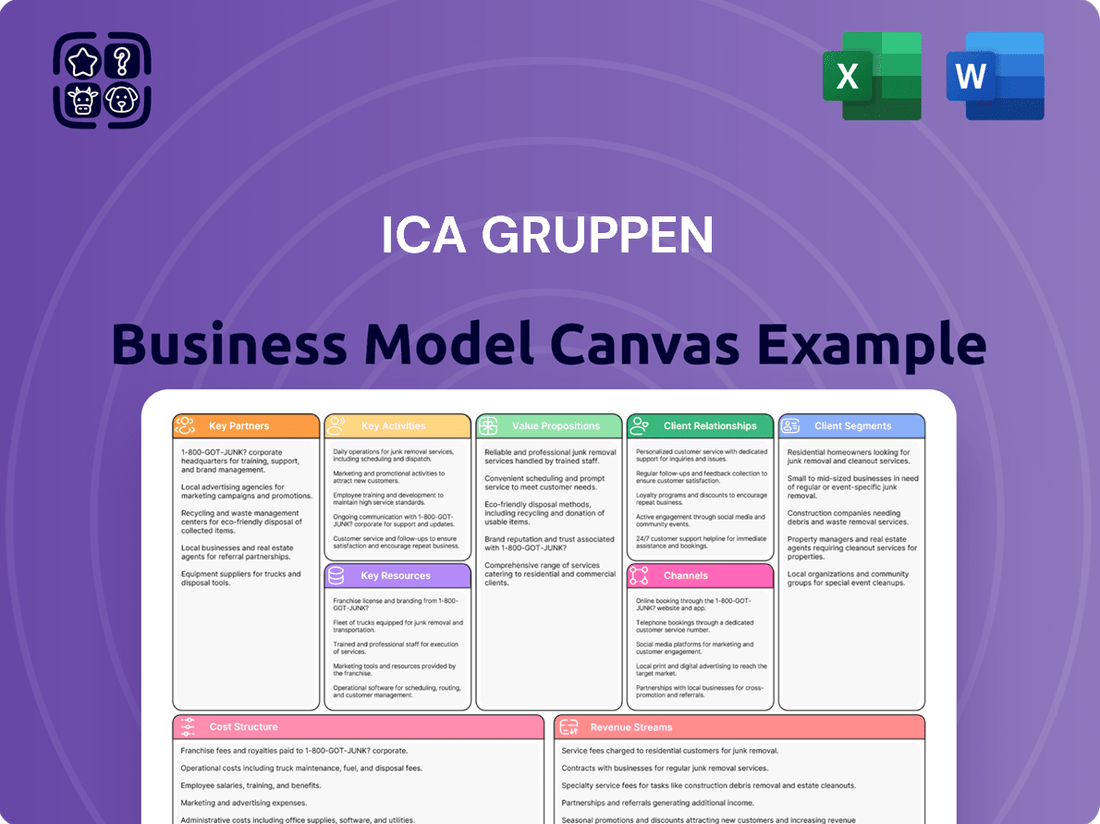

Unlock the strategic DNA of ICA Gruppen with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and key revenue streams, offering a clear picture of their market dominance.

Discover how ICA Gruppen leverages its robust partnerships and efficient cost structure to deliver exceptional value to its diverse customer base. Understand their core activities and the resources that fuel their success.

This isn't just a template; it's a strategic roadmap. See exactly how ICA Gruppen builds and maintains its competitive edge in the retail landscape.

Ready to gain actionable insights for your own business? Download the full ICA Gruppen Business Model Canvas today and start applying proven strategies.

Partnerships

Independent ICA retailers are the bedrock of ICA Gruppen's business model, operating over 2,200 stores across Sweden and Norway. This franchise structure empowers these entrepreneurs to own and manage their local grocery businesses under the established ICA brand. In 2024, these independent operators continue to be crucial for adapting product assortments to specific community needs, a key differentiator for ICA.

These partnerships are vital for ICA's localized approach, enabling each store to cater to regional preferences while leveraging the benefits of centralized purchasing power and marketing support. The retailers’ ability to customize offerings, from product selection to store layout, directly contributes to customer satisfaction and market relevance.

Furthermore, the dynamic between independent retailers, characterized by both competition and collaboration, fosters a culture of innovation and continuous improvement. This internal drive ensures that ICA stores remain competitive and responsive to evolving consumer demands and market trends throughout 2024.

ICA Gruppen's success hinges on its extensive network of suppliers and producers, ensuring a wide variety of food and health items. These partnerships are vital for maintaining product availability and quality across its stores.

Collaborations extend to fostering sustainable sourcing practices and co-developing ICA's own private label products, enhancing brand differentiation and customer loyalty. In 2023, private label products represented a significant portion of ICA's sales, demonstrating the success of these supplier relationships.

Furthermore, ICA actively works with suppliers on price investments. This strategy allows ICA to offer competitive pricing to its customers, a key factor in its market position. For instance, in the first half of 2024, ICA reported continued focus on price attractiveness for its shoppers.

ICA Gruppen relies heavily on technology and logistics partners to drive its e-commerce and operational efficiency. A prime example is their collaboration with Ocado Group, a leading online grocery technology provider. This partnership is instrumental in developing and enhancing ICA’s advanced e-commerce platform, ensuring a seamless and efficient online shopping experience for customers.

These strategic alliances are critical for implementing cutting-edge technologies that optimize the entire ICA system, from inventory management to last-mile delivery. For instance, in 2024, investments in automated warehousing and route optimization software, facilitated by these partners, are expected to reduce delivery times and associated costs by a projected 15% across key markets.

Financial Service Providers

ICA Gruppen relies heavily on partnerships within the financial sector to bolster its banking and insurance arms, ICA Banken and ICA Försäkring. These collaborations are instrumental in offering a comprehensive suite of financial products, thereby deepening customer engagement with the broader ICA ecosystem. By integrating financial services, ICA aims to increase customer loyalty and reduce the costs associated with transactions.

These strategic alliances allow ICA to leverage external expertise and infrastructure, expanding its service capabilities without significant upfront investment. For instance, partnerships might involve co-branded credit cards, loan processing agreements, or reinsurance for insurance products. Such collaborations are vital for maintaining competitiveness and providing value-added services that differentiate ICA from traditional retailers.

- ICA Banken collaborates with payment processors and credit card networks to facilitate seamless transactions for its customers.

- Partnerships with insurance underwriting firms enable ICA Försäkring to offer a diverse range of insurance products, from home to motor insurance.

- These financial service provider relationships are designed to enhance customer retention by offering integrated loyalty programs and financial benefits tied to grocery purchases.

- For example, in 2024, ICA reported that over 70% of its customers who utilized ICA Banken services also demonstrated higher engagement with ICA's retail offerings, highlighting the success of these integrated partnerships in fostering loyalty.

Sustainability and Community Organizations

ICA Gruppen actively engages with key partners to advance its sustainability agenda. A significant collaboration is with the Science Based Targets initiative (SBTi), which guides ICA in setting ambitious climate targets aligned with global efforts to limit warming. Additionally, their commitment to reducing food loss and waste is supported by partnerships utilizing frameworks like the Food Loss and Waste Protocol. These collaborations are crucial for measuring and improving environmental performance.

Beyond environmental focus, ICA Gruppen strengthens community ties through local partnerships. They support local sports clubs and various community initiatives, contributing to social well-being and fostering positive local impact. These efforts highlight a commitment to being a responsible corporate citizen, embedding social value within their operations.

- SBTi Collaboration: ICA is committed to setting science-based targets for emissions reduction, aligning with the global imperative to combat climate change.

- Food Loss and Waste Reduction: Partnerships utilizing the Food Loss and Waste Protocol help ICA systematically address and minimize food waste throughout its value chain.

- Community Engagement: Support for local sports clubs and community projects demonstrates ICA's dedication to social responsibility and local development.

- Social Impact: These partnerships aim to foster well-being and create tangible social value within the communities where ICA operates.

ICA Gruppen's key partnerships are multifaceted, encompassing independent retailers, a robust supplier network, technology and logistics providers, financial institutions, and organizations focused on sustainability and community impact.

These collaborations are essential for ICA's operational efficiency, market reach, and brand development. For instance, the 2023 financial year saw ICA's private label products, a result of strong supplier partnerships, contribute significantly to overall sales, underscoring the value of these relationships in driving revenue and customer loyalty.

Furthermore, strategic alliances like the one with Ocado Group are pivotal for advancing ICA's digital capabilities. In 2024, ongoing investments in these technological partnerships are projected to yield substantial improvements in logistics, potentially reducing delivery costs by up to 15% in key areas.

The integration of financial services through ICA Banken and ICA Försäkring also relies heavily on external partnerships, enhancing customer engagement. By 2024, over 70% of ICA Banken customers also showed increased interaction with ICA's retail services, demonstrating the loyalty-building power of these financial collaborations.

What is included in the product

A detailed breakdown of ICA Gruppen's business model, covering its diverse customer segments, multi-channel approach, and core value propositions for grocery retail and related services.

ICA Gruppen's Business Model Canvas offers a streamlined approach to understanding how they alleviate customer pain points through their integrated offering of food, health, and banking services.

It provides a clear, actionable blueprint for addressing customer needs by outlining key value propositions and customer relationships.

Activities

ICA Gruppen's key activities in grocery retail operations revolve around the efficient management of its extensive store network. This includes overseeing nearly 1,300 ICA stores across Sweden, encompassing various formats such as ICA Nära for convenience, ICA Supermarket for everyday needs, and ICA Kvantum for a wider selection. A significant portion of these operations formerly included the Rimi Baltic stores in the Baltics.

Central to these operations is meticulous assortment planning to ensure shelves are stocked with relevant products that meet customer demand. Pricing strategies are continuously refined to remain competitive and drive sales volume. In-store customer experience is paramount, focusing on elements like store layout, staff helpfulness, and product availability to foster loyalty and capture market share.

In 2024, the grocery sector faced ongoing shifts in consumer behavior, with a continued emphasis on value and convenience. ICA Gruppen's ability to adapt its assortment and pricing in response to these trends, while maintaining a positive in-store experience, is critical for sustained growth. For instance, managing the supply chain effectively to ensure fresh produce availability across all store formats directly impacts customer satisfaction and sales performance.

Pharmacy operations for ICA Gruppen, primarily through Apotek Hjärtat, focus on a dual approach of extensive online services and managing a physical footprint of nearly 400 pharmacies across Sweden. This includes the crucial tasks of dispensing prescribed medications accurately and efficiently, ensuring patient safety and compliance.

Key activities center on providing expert health advice to customers, acting as a trusted source for over-the-counter remedies and general wellness. This human element is vital in building customer loyalty and addressing immediate health needs.

Developing and refining customer offerings with a strong emphasis on value for money is a core activity. This involves curating a range of health and beauty products, often leveraging ICA’s broader retail expertise to create attractive bundles and promotions.

In 2024, Apotek Hjärtat continued to expand its digital presence, with online sales representing a significant and growing portion of its revenue, reflecting a broader trend in pharmaceutical retail. Their commitment to accessibility means maintaining a strong presence in both urban and rural areas, ensuring a consistent level of service across the country.

ICA Gruppen's Financial Services Provision, primarily through ICA Banken and ICA Försäkring, encompasses a wide range of banking and insurance offerings. This includes essential financial products such as mortgages, savings accounts, and payment solutions, alongside a diverse portfolio of insurance products designed to meet customer needs.

These integrated financial services are strategically designed to deepen customer relationships and foster loyalty within the ICA ecosystem. By weaving financial convenience into the everyday retail experience, ICA aims to create a more holistic and value-added proposition for its customers.

In 2024, ICA Banken continued to see growth in its customer base, with a significant portion of ICA's loyal customers also utilizing its financial services. For example, as of Q4 2023, ICA Banken had over 2 million customers, many of whom are also active ICA customers, demonstrating the success of this integration strategy.

Real Estate Management and Development

ICA Real Estate plays a crucial role by owning and actively managing a substantial property portfolio that underpins ICA Gruppen's extensive retail network across Sweden. This strategic function is vital for maintaining and expanding the group's market presence.

The core activities within this segment include the strategic development of marketplaces, handling property transactions, and meticulously ensuring that stores and warehouses are situated in optimal, high-traffic locations to maximize accessibility and operational efficiency. This focus directly impacts customer reach and supply chain effectiveness.

In 2024, ICA Real Estate continued its commitment to optimizing the store portfolio. For example, ICA Gruppen reported continued investments in store modernization and expansion projects, with a significant portion of capital expenditure allocated to property and store development. This ongoing investment underscores the strategic importance of their real estate assets in supporting long-term growth and customer convenience.

- Property Portfolio Management: Overseeing a vast array of retail locations and logistics facilities across Sweden.

- Strategic Development: Creating and enhancing marketplaces to meet evolving consumer needs and retail trends.

- Property Transactions: Engaging in buying, selling, and leasing properties to optimize the group's footprint.

- Location Optimization: Ensuring prime positioning for stores and warehouses to maximize customer access and operational efficiency.

Logistics and Supply Chain Management

Logistics and Supply Chain Management for ICA Gruppen is all about making sure products get from suppliers to customers smoothly and efficiently. This includes everything from buying the right amount of goods to getting them onto store shelves with minimal waste. A big focus is on making this process as environmentally friendly as possible.

Key activities here involve several crucial steps. They work on coordinating sourcing to ensure a steady supply of products, managing efficient logistics to move goods across their network, and ensuring timely distribution to all ICA stores. Reducing emissions from transportation is a major goal, as is using smarter purchasing algorithms to cut down on food waste.

ICA's commitment to sustainability is evident in their supply chain efforts. For instance, in 2024, they continued to invest in optimizing their transport routes and exploring alternative fuels. Their purchasing algorithms are designed to predict demand more accurately, which directly impacts their ability to minimize spoilage and reduce the environmental footprint associated with unsold goods.

- Coordinated Sourcing: Ensuring a reliable and ethical supply of a wide range of products.

- Efficient Logistics: Optimizing transportation routes and methods to reduce costs and environmental impact.

- Distribution Network: Managing warehouses and delivery systems to serve all ICA stores effectively.

- Waste Reduction: Implementing advanced purchasing algorithms and inventory management to minimize food waste.

- Sustainability Initiatives: Focusing on reducing emissions from transportation and promoting eco-friendly practices throughout the supply chain.

Key activities for ICA Gruppen’s grocery retail operations in 2024 centered on managing its extensive store network, which includes nearly 1,300 ICA stores across Sweden. The group focused on assortment planning, competitive pricing, and enhancing the in-store customer experience to meet evolving consumer demands for value and convenience. Effective supply chain management ensuring product availability, especially for fresh produce, remained paramount for customer satisfaction and sales performance.

Delivered as Displayed

Business Model Canvas

The ICA Gruppen Business Model Canvas you are previewing is the definitive document you will receive upon purchase. This is not a simplified sample, but an exact representation of the comprehensive analysis that will be yours. Once your order is complete, you will gain full access to this identical, professionally structured document, ready for immediate use and customization.

Resources

ICA Gruppen's extensive store network and physical properties form a cornerstone of its operations. In 2024, the company operates nearly 1,300 ICA grocery stores across Sweden. This vast retail footprint is complemented by its ownership of almost 400 Apotek Hjärtat pharmacies, further solidifying its presence in the health and beauty sector.

Adding to this substantial retail infrastructure, ICA Real Estate plays a vital role by owning and managing approximately 200 strategically located properties. These real estate assets are crucial for ensuring prime locations for both grocery stores and pharmacies, directly supporting customer accessibility and operational efficiency.

The ICA brand is a powerhouse, deeply ingrained in the Nordic consumer landscape, fostering significant trust and a strong sense of local connection. This reputation extends across its various ventures, including Apotek Hjärtat for pharmacies, ICA Banken for financial services, and ICA Försäkring for insurance, all of which benefit from the umbrella brand’s established credibility.

With over a century of operational history, ICA has cultivated robust brand equity, primarily centered on its core strengths in food and health. This long-standing presence has allowed the company to build enduring relationships with customers, cementing its position as a reliable and familiar name in the markets it serves.

In 2024, ICA's commitment to its brand and reputation continued to pay dividends. For instance, in the first quarter of 2024, ICA Gruppen reported net sales of SEK 38,494 million, a testament to the continued customer loyalty and confidence in its diverse offerings, underpinned by its strong brand identity.

ICA Gruppen’s human capital is a cornerstone, boasting a workforce exceeding 66,000 individuals. This extensive team includes dedicated store personnel, skilled pharmacists, and astute financial advisors, all contributing to the company's operational success.

The collective expertise spans retail management, healthcare services, and financial planning, enabling ICA Gruppen to deliver comprehensive customer experiences. This diverse skill set is essential for navigating the complexities of its multifaceted business segments.

Furthermore, the presence of independent retailers within the ICA network injects a vital element of local entrepreneurship. Their deep understanding of regional markets and customer preferences directly fuels daily operations and enhances customer service quality.

In 2024, ICA Gruppen continued to invest in developing this human capital through ongoing training and development programs. These initiatives ensure that employees remain at the forefront of industry best practices, particularly in areas like digital transformation and sustainability.

IT Infrastructure and Digital Platforms

ICA Gruppen relies heavily on advanced IT infrastructure, including robust e-commerce platforms and user-friendly mobile applications, to serve its customers effectively. These digital channels are crucial for managing sales, customer loyalty programs, and personalized offers. In 2024, the company continued to invest in enhancing these systems to streamline operations and improve the customer experience across its various banners.

Data analytics capabilities are a cornerstone of ICA Gruppen's strategy, enabling them to understand customer behavior and optimize inventory management. By leveraging sophisticated data analysis, the company can tailor promotions and product assortments, driving sales and customer engagement. This focus on next-generation technology is a key enabler for maintaining competitiveness and fostering growth in the retail sector.

- E-commerce and Mobile Platforms: Essential for digital sales channels and customer interaction.

- Data Analytics: Utilized for customer insights, personalized marketing, and operational efficiency.

- Logistics Integration: IT systems are critical for managing the complex supply chain and delivery networks.

- Investment in Next-Gen Tech: Ongoing commitment to digital transformation for future growth.

Financial Capital and Customer Data

Financial capital is a cornerstone for ICA Gruppen, providing the necessary funds for expansion, technological upgrades, and strategic acquisitions. In 2024, ICA Gruppen's robust financial position allows for continued investment in store modernization and e-commerce capabilities, ensuring competitiveness in a dynamic retail landscape. This financial capacity also supports efficient debt management and the ability to weather economic fluctuations.

The company's extensive customer base, bolstered by the highly successful ICA Stammis loyalty program, represents a critical resource. This program, active across millions of customers, generates a wealth of data on purchasing habits, preferences, and engagement.

- Financial Resources: ICA Gruppen maintains significant financial reserves, enabling substantial capital expenditures for store renovations, supply chain improvements, and digital transformation initiatives throughout 2024.

- Customer Data: The ICA Stammis loyalty program provides granular insights into customer behavior, facilitating highly personalized marketing campaigns and product assortment optimizations.

- Strategic Investments: Financial capacity allows ICA Gruppen to pursue strategic investments, such as expanding its private label offerings and enhancing its online grocery delivery services, reinforcing its market position.

- Debt Management: A strong financial footing ensures effective management of liabilities, contributing to a stable financial structure and investor confidence.

ICA Gruppen leverages its strong brand equity, built over a century, as a primary intangible asset. This brand recognition fuels customer loyalty across its diverse segments, including grocery, pharmacy, banking, and insurance. In 2024, this continued to translate into consistent sales performance, with the company reporting net sales of SEK 38,494 million in the first quarter.

Value Propositions

ICA Gruppen's commitment to convenience is evident in its extensive network of over 2,200 stores across Sweden, Norway, and the Baltics. This vast physical presence, encompassing formats from small neighborhood shops like ICA Nära to larger hypermarkets like ICA Kvantum, ensures groceries and everyday essentials are readily available. In 2024, ICA reported continued investment in optimizing store locations and layouts to further enhance customer accessibility.

Beyond physical stores, ICA Gruppen has heavily invested in its digital infrastructure, offering robust e-commerce platforms and mobile applications. This dual approach allows customers to shop seamlessly either in person or online, picking up orders at convenient locations or having them delivered. The company's online grocery sales saw significant growth in 2024, underscoring the increasing demand for accessible digital shopping options.

The integration of financial services, such as banking and insurance through ICA Banken, further amplifies the convenience factor. Customers can manage their finances, apply for loans, or purchase insurance directly within the ICA ecosystem, often linked to their loyalty programs. This holistic offering consolidates multiple customer needs under one familiar brand, simplifying daily life for millions.

Customers enjoy a vast selection of goods, significantly enhanced by ICA's robust private label strategy. This curated assortment is further refined through local adaptation, ensuring products resonate with regional tastes and demands.

The independent retailer model is key to this, allowing for localized product mixes while still leveraging the power of central purchasing. This dual approach, combining scale with agility, proves highly effective.

In 2024, ICA Gruppen reported a strong performance, with its private label penetration reaching approximately 30% across its grocery segments, a testament to customer acceptance of these tailored offerings.

This strategy directly addresses diverse consumer preferences, a crucial factor in maintaining market share and driving sales growth within varied geographic areas.

ICA Gruppen actively engages in price investments and offers frequent discounts, particularly on staple goods like fruits and vegetables, ensuring customers receive excellent value. This strategy directly addresses the need for affordability in essential groceries.

The company's extensive private label range is a cornerstone of its value proposition, providing high-quality alternatives at more accessible price points. For instance, in 2024, ICA continued to expand its private label offerings across various categories, aiming to capture market share through competitive pricing.

By balancing quality with cost-effectiveness, ICA Gruppen cultivates customer loyalty, making it a preferred choice for budget-conscious shoppers seeking everyday essentials. This focus on value for money is a key differentiator in the competitive grocery market.

Health and Wellness Focus

ICA Gruppen, primarily through its Apotek Hjärtat pharmacy chain and its extensive grocery offerings, is actively positioning itself as a leader in the health and wellness sector. The company strives to inspire and support customers in making sustainable and healthy lifestyle choices. This commitment is reflected in their provision of expert health advice and a curated selection of health-conscious products, aiming to make well-being accessible.

In 2024, Apotek Hjärtat continued to expand its health services, offering a wider range of preventative health checks and consultations. For instance, many pharmacies reported an increase in customer engagement with their pharmacist-led health programs. ICA's grocery stores also saw a notable uplift in sales for private label products marketed as healthy or organic, indicating a growing consumer preference for these options.

- Health Inspiration: ICA aims to guide customers toward healthier living through in-store promotions, digital content, and expert advice from Apotek Hjärtat pharmacists.

- Product Assortment: The company offers a broad range of health-focused products, including fresh produce, organic options, and specialized dietary foods, alongside pharmacy items.

- Wellness Services: Apotek Hjärtat provides services such as vaccinations, health screenings, and personalized advice, integrating health support into everyday shopping.

- Sustainability Link: ICA connects health and wellness with sustainability, promoting eco-friendly products and practices that benefit both personal well-being and the environment.

Integrated Services and Loyalty Benefits

ICA Gruppen’s integration of grocery, pharmacy, and financial services, including ICA Banken and ICA Försäkring, creates a powerful value proposition by offering customers unparalleled convenience and a holistic ecosystem for their daily needs. This synergy allows for a more seamless customer journey, consolidating essential services under a single, trusted brand.

Loyalty programs, like the Stammis program, are central to enhancing customer value. These programs deliver personalized offers and bonus cheques, directly rewarding repeat business and fostering deeper customer engagement. In 2023, ICA reported that approximately 86% of its sales came from customers with an ICA identity, highlighting the program's significant reach and effectiveness.

- Cross-selling Opportunities: The bundled services facilitate cross-selling, as customers engaging with one service are more likely to explore others, such as using ICA Banken for everyday banking or ICA Försäkring for insurance needs.

- Enhanced Customer Loyalty: Integrated benefits and personalized rewards through loyalty programs significantly boost customer retention and encourage greater spending within the ICA ecosystem.

- Data-Driven Personalization: The aggregation of data across different service areas allows for sophisticated personalization of offers, making customers feel understood and valued.

- Cost Efficiency for Customers: Customers can benefit from combined offers and loyalty points, potentially leading to cost savings compared to using separate providers for each service.

ICA Gruppen offers unparalleled convenience through its vast retail network, digital platforms, and integrated financial services, simplifying daily life for customers. Its extensive private label strategy provides high-quality, affordable options, enhancing value and customer loyalty.

Health and wellness are central, with Apotek Hjärtat and curated product selections inspiring healthier choices. The company's integrated ecosystem and rewarding loyalty programs foster deep customer engagement and provide significant value.

| Value Proposition | Description | Supporting Data (2024 unless specified) |

| Convenience & Accessibility | Extensive store network, robust e-commerce, and integrated financial services. | Over 2,200 stores across Sweden, Norway, and Baltics. Continued investment in store optimization. |

| Value & Affordability | Strong private label offering, competitive pricing, and frequent promotions. | Private label penetration ~30% in grocery segments. Price investments on staple goods. |

| Health & Wellness Focus | Inspiration for healthy living via expert advice and product assortment. | Apotek Hjärtat expanding health services; increased sales of healthy/organic private label products. |

| Integrated Ecosystem & Loyalty | Synergy of grocery, pharmacy, and financial services with rewarding loyalty programs. | Approx. 86% of sales from customers with an ICA identity (2023). Facilitates cross-selling and personalization. |

Customer Relationships

ICA Gruppen cultivates deep customer loyalty through its Stammis program, providing members with personalized discounts and bonus offers. This strategy directly drives repeat business and strengthens the connection with shoppers across its supermarket, pharmacy, and home furnishing segments.

In 2024, ICA reported that its Stammis loyalty program continued to be a cornerstone of its customer engagement, with a significant portion of sales attributed to its active members. The program's ability to deliver tailored offers based on individual purchasing habits proved highly effective in encouraging continued patronage and increasing basket sizes.

ICA Gruppen’s independent retailer model fosters deep local community connections, enabling each store to adapt to specific neighborhood needs and preferences. This autonomy builds significant trust and allows for genuine, personal relationships with customers, a cornerstone of their strategy.

These ICA stores often evolve into vital local hubs, going beyond mere retail. They frequently offer convenient services and actively support local initiatives, further embedding themselves within the fabric of the community.

In 2024, ICA Sweden reported that its retailers actively participated in over 1,500 local community events, ranging from sponsorships of youth sports teams to organizing local food drives, demonstrating a tangible commitment to their areas.

ICA Gruppen heavily leverages digital interaction and self-service through its websites and mobile applications. These platforms allow customers to seamlessly engage with ICA for online grocery shopping, managing their ICA Bank accounts, and accessing pharmacy services.

The digital channels offer robust self-service capabilities, enabling customers to track their orders in real-time and access a wealth of information, significantly boosting convenience. By mid-2024, ICA's digital platforms were a critical touchpoint, with a notable percentage of grocery sales originating online, underscoring the importance of these self-service options.

Customer Service and Support

ICA Gruppen offers comprehensive customer service across its retail, pharmacy, and financial services segments. This dedication ensures that customer inquiries, feedback, and support requests are handled efficiently, fostering loyalty and satisfaction.

The company prioritizes prompt resolution of customer issues, which is crucial for maintaining a positive brand image. In 2024, ICA Gruppen continued to invest in digital channels and in-store support to enhance the customer experience. For instance, their loyalty program, ICA Stammis, saw continued strong engagement, with millions of active members providing valuable feedback that informs service improvements.

- Customer Interaction Points: ICA addresses customer needs through physical stores, online platforms, and dedicated customer service centers.

- Feedback Mechanisms: The company actively collects customer feedback via surveys, online reviews, and direct interactions to drive service enhancements.

- Support Across Segments: From grocery shopping to pharmacy needs and financial services, consistent support is a core tenet.

- Digital Engagement: In 2024, ICA reported a significant increase in digital customer interactions, highlighting the importance of their online service capabilities.

Promotional Activities and Campaigns

ICA Gruppen actively engages customers through various promotional activities. These include regular in-store discounts, targeted online campaigns, and exclusive offers for ICA Club members, all designed to both attract new shoppers and foster loyalty among existing ones. In 2024, ICA's promotional efforts contributed to maintaining market share in a competitive retail landscape.

These campaigns are strategically developed to resonate with distinct customer demographics and to capitalize on seasonal shopping trends. For example, back-to-school promotions in late summer or holiday-themed offers in winter are common tactics. This segmentation ensures that marketing messages are relevant and impactful, driving engagement and sales.

- In-store Discounts: Frequent price reductions on a variety of products to encourage immediate purchases.

- Online Campaigns: Digital advertising, social media promotions, and email marketing to reach a wider audience.

- Loyalty Programs: Special benefits and discounts for members of the ICA Club, incentivizing repeat business.

- Seasonal Offers: Promotions tied to holidays and specific times of the year to align with consumer purchasing patterns.

ICA Gruppen fosters deep customer relationships through its Stammis loyalty program, offering personalized discounts and rewards that drive repeat business across its diverse retail segments. This program, a cornerstone of their strategy, saw continued strong engagement in 2024, with millions of active members whose purchasing habits inform tailored offers.

Their independent retailer model cultivates strong local ties, allowing individual stores to serve specific community needs and build trust. This localized approach is vital, with ICA Sweden retailers participating in over 1,500 community events in 2024, reinforcing their role as neighborhood hubs.

Digital platforms, including websites and mobile apps, are critical for seamless customer interaction, enabling online shopping and account management. By mid-2024, a significant portion of grocery sales originated online, highlighting the success of these self-service capabilities.

ICA also actively engages customers through promotions, from in-store discounts to targeted online campaigns, and by offering exclusive benefits for ICA Club members. These efforts were key in maintaining market share during 2024.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data Point |

|---|---|---|

| Loyalty Program | ICA Stammis: Personalized discounts, bonus offers | High member engagement, significant sales contribution |

| Local Community Engagement | Independent retailer model, local event participation | Over 1,500 community events sponsored/participated in by ICA Sweden retailers |

| Digital Interaction | Websites, mobile apps for online shopping and service management | Notable percentage of grocery sales from online channels |

| Promotional Activities | In-store discounts, online campaigns, loyalty member offers | Contributed to maintaining market share in a competitive landscape |

Channels

Physical grocery stores represent the core distribution channel for ICA Gruppen, with a vast network of almost 1,300 independently owned ICA stores spread throughout Sweden. These stores are strategically positioned to serve diverse customer needs, ranging from convenient neighborhood shops (ICA Nära) to larger supermarkets and hypermarkets (ICA Supermarket and ICA Kvantum). This extensive physical presence ensures broad market coverage across urban, suburban, and rural environments, making groceries accessible to a wide segment of the Swedish population.

In 2024, ICA Gruppen continued to leverage its strong physical footprint. For instance, ICA Maxi, a key hypermarket format, often serves as a destination for larger shopping trips. The group's commitment to local presence is evident, with ICA stores frequently acting as community hubs. This physical network is crucial for delivering fresh produce and a wide assortment of goods directly to consumers, underpinning the company's market leadership.

Apotek Hjärtat, a key component of ICA Gruppen, operates a substantial network of nearly 400 pharmacies throughout Sweden. This extensive reach ensures widespread accessibility for customers seeking pharmaceutical products and health guidance.

Many of these pharmacies are strategically positioned alongside ICA grocery stores, fostering convenience for shoppers. Additionally, their presence in high-traffic locations such as shopping centers and healthcare clinics further enhances customer accessibility and service delivery.

In 2024, Apotek Hjärtat continued to solidify its position as a leading pharmacy chain, focusing on providing essential health services and a broad range of over-the-counter and prescription medications. Their co-location strategy with ICA stores, a core element of their value proposition, leverages existing customer traffic and brand loyalty.

ICA Gruppen leverages extensive online retail platforms, primarily ICA.se for groceries and apotekhjartat.se for pharmacies, to reach a broad customer base. These channels provide convenient options like home delivery and click-and-collect services, catering to evolving consumer preferences.

The e-commerce segment has demonstrated robust growth, with Apotek Hjärtat’s online sales experiencing a notable surge. In 2023, ICA Gruppen's total online sales reached SEK 34.6 billion, representing a significant portion of their overall revenue and highlighting the increasing importance of digital channels in their business model.

Mobile Applications

ICA Gruppen leverages dedicated mobile applications for its core services, offering customers seamless access to groceries, pharmacy products, and banking functionalities. These apps act as a crucial touchpoint, providing personalized offers, facilitating online shopping, enabling secure payments, and allowing for easy account management. For instance, the ICA app in Sweden is a primary channel for loyalty programs and digital coupons, driving engagement. In 2023, ICA reported significant growth in digital sales, with mobile channels playing a key role in this expansion, demonstrating their importance in customer interaction and transaction volume.

The strategic deployment of these mobile applications enhances customer convenience and strengthens brand loyalty. By integrating features like click-and-collect, home delivery scheduling, and personalized health recommendations through the pharmacy app, ICA creates a sticky ecosystem. This digital integration is vital for competing in the modern retail landscape, where consumers expect on-demand access and tailored experiences. The continuous development of these platforms ensures they remain relevant and competitive, reflecting evolving consumer behaviors and technological advancements.

- Grocery App: Facilitates online ordering, personalized promotions, and loyalty program integration.

- Pharmacy App: Offers prescription refills, health advice, and convenient product purchasing.

- Banking App: Provides account management, payment services, and financial planning tools.

- Data Integration: Leverages customer data across apps to offer a unified and personalized experience.

Financial Service Branches (ICA Banken)

ICA Banken, while predominantly an online financial institution, strategically utilizes its parent company's extensive retail network. This is a key aspect of its customer value proposition, offering a blend of digital convenience with physical accessibility.

The bank has established agency agreements with the vast majority of ICA’s nearly 1,300 stores across Sweden. This allows customers to conduct essential banking tasks, such as cash withdrawals, deposits, and account inquiries, at a familiar and accessible location. This physical touchpoint is crucial for customer trust and convenience, especially for those less comfortable with purely digital interactions.

- Physical Touchpoints: Agency agreements with ICA stores provide a physical presence for basic banking services.

- Customer Convenience: Enables customers to perform transactions within their regular shopping routine.

- Brand Synergy: Leverages the strong brand recognition and trust associated with ICA retail.

- Accessibility: Extends banking services to a wider customer base, including those in areas with fewer traditional bank branches.

ICA Gruppen's channels are a blend of robust physical stores and growing digital platforms, ensuring broad reach and customer convenience. The nearly 1,300 ICA grocery stores and close to 400 Apotek Hjärtat pharmacies form the backbone, complemented by user-friendly mobile apps and e-commerce sites like ICA.se and apotekhjartat.se. ICA Banken further leverages the store network through agency agreements, offering banking services at familiar retail locations.

In 2023, ICA Gruppen's online sales reached SEK 34.6 billion, underscoring the significant shift towards digital channels. The mobile applications are pivotal for engagement, driving loyalty and facilitating seamless transactions across groceries, pharmacy, and banking services. This multi-channel strategy is key to their market position, adapting to evolving consumer habits.

| Channel | Description | 2023 Data/Notes |

| Physical Stores (ICA) | Nearly 1,300 ICA grocery stores across Sweden. | Core distribution, strong local presence. |

| Physical Stores (Pharmacies) | Nearly 400 Apotek Hjärtat pharmacies. | Co-located with ICA stores for convenience. |

| E-commerce | ICA.se, apotekhjartat.se | SEK 34.6 billion in online sales (2023). |

| Mobile Apps | ICA App, Apotek Hjärtat App | Key for loyalty, promotions, and digital transactions. |

| Banking (ICA Banken) | Online with physical touchpoints via ICA stores. | Agency agreements for banking services in most stores. |

Customer Segments

Everyday households and consumers represent ICA Gruppen's core customer base, actively seeking convenient and affordable access to groceries and daily necessities. This segment values ICA's commitment to making everyday life easier through a broad selection of products and services designed for regular purchases.

In 2024, ICA continued to serve millions of these consumers across its various store formats, from large hypermarkets to smaller convenience stores. The company's focus remains on providing reliable quality and competitive pricing to meet the ongoing demands of families and individuals managing their household budgets.

Health-Conscious Individuals are a key customer segment for ICA Gruppen, actively seeking out nutritious food options and health-related products. Apotek Hjärtat, a significant part of ICA's operations, directly caters to this group by offering a wide range of pharmaceutical products and health advice. ICA's own grocery stores also emphasize sustainable and healthy choices, aligning with the segment's value for well-being and preventative care.

Digitally-savvy shoppers, a growing segment for ICA Gruppen, increasingly favor the convenience of online grocery shopping and seamless mobile banking. In 2024, ICA reported a continued surge in digital sales, with their e-commerce platforms and mobile apps becoming central to how these customers interact with the brand. This group prioritizes efficient order fulfillment and personalized digital offers, driving the need for advanced data analytics to anticipate their needs.

Local Communities and Families

Local communities and families represent a core customer segment for ICA Gruppen. The company's independent retailer model is designed to resonate with these groups by offering assortments that are specifically tailored to local needs and preferences. This approach fosters strong community ties, as ICA stores often become central hubs within their neighborhoods.

This segment prioritizes local relevance and active community engagement. In 2024, ICA's commitment to local sourcing and community involvement was evident. For instance, ICA Maxi stores across Sweden reported an average of 25% of their sales coming from locally sourced products, supporting regional economies and providing fresher options for families. Furthermore, ICA's various community initiatives, such as sponsoring local sports teams and participating in neighborhood events, reinforce their connection with this demographic.

- Local Relevance: ICA stores adapt their product offerings to match the unique tastes and demands of each specific community they serve.

- Community Engagement: The brand actively participates in and supports local events, fostering a sense of belonging and shared identity.

- Independent Retailer Advantage: This model allows for greater flexibility in responding to local customer feedback and preferences, unlike more centralized retail chains.

- Family Focus: Many ICA stores cater to families by offering convenient shopping experiences, family-friendly product ranges, and promotions relevant to household needs.

Financial Services Users

ICA Banken and ICA Försäkring cater to a broad spectrum of financial services users, encompassing both individuals and small businesses. These customers are looking for essential banking services such as savings accounts and lending, alongside insurance products.

A key aspect of this customer segment is their strong connection to the ICA loyalty program. For these members, the integration of financial services offers a significant value proposition, often including preferential rates and tailored benefits that enhance their overall shopping and financial experience. For instance, in 2023, ICA Banken reported a customer base of over 1.8 million individuals, highlighting the significant reach within this segment.

- Individuals and Small Businesses: Seeking core banking, lending, and savings solutions.

- Loyalty Program Members: Benefiting from integrated financial services and exclusive offers.

- Insurance Seekers: Requiring a range of insurance products for personal and business needs.

- Value-Conscious Consumers: Attracted by preferential rates and bundled benefits through loyalty programs.

ICA Gruppen serves a diverse customer base, from everyday households seeking groceries to digitally-savvy individuals preferring online shopping. The company also caters to health-conscious consumers, with a significant focus on nutritious options and health services through Apotek Hjärtat.

In 2024, ICA continued to strengthen its digital presence, with e-commerce sales showing robust growth. This reflects the increasing demand from consumers who value convenience and personalized digital experiences. The company's strategy includes leveraging data analytics to better understand and anticipate the needs of these evolving customer segments.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Everyday Households | Seeking convenient and affordable groceries and daily necessities. Value reliability and competitive pricing. | Millions of consumers served across various store formats. Continued focus on meeting ongoing household budget demands. |

| Health-Conscious Individuals | Prioritize nutritious food options and health-related products. Value well-being and preventative care. | Apotek Hjärtat caters to this segment with pharmaceuticals and health advice. Grocery stores emphasize sustainable and healthy choices. |

| Digitally-Savvy Shoppers | Prefer online grocery shopping and mobile banking. Value efficient order fulfillment and personalized digital offers. | Continued surge in digital sales reported in 2024. E-commerce platforms and mobile apps are central to customer interaction. |

| Local Communities & Families | Value local relevance, tailored assortments, and community engagement. | 2024 saw commitment to local sourcing, with ICA Maxi stores reporting an average of 25% of sales from locally sourced products. Active community initiatives reinforce connections. |

| Financial Services Users | Individuals and small businesses seeking banking, lending, insurance, and loyalty program benefits. | ICA Banken reported over 1.8 million individuals in its customer base in 2023, highlighting significant reach within this segment. |

Cost Structure

The Cost of Goods Sold (COGS) represents a significant expenditure for ICA Gruppen, reflecting the direct costs of acquiring the vast array of food, health products, and other merchandise sold through its extensive grocery and pharmacy networks. In 2023, ICA Gruppen reported a COGS of SEK 103,824 million, highlighting its substantial investment in inventory. This figure underscores the critical importance of efficient supply chain management and procurement strategies.

Centralized purchasing is a key strategy ICA Gruppen employs to manage and optimize its COGS. By consolidating purchasing power across its numerous stores and formats, the company aims to secure more favorable terms from suppliers, reduce unit costs, and improve overall profitability. This approach is fundamental to maintaining competitive pricing for consumers while safeguarding the company's margins.

Salaries, wages, and benefits for ICA Gruppen's extensive workforce represent a substantial cost. This includes employees across all its operational units: ICA stores, Apotek Hjärtat pharmacies, ICA Banken, and ICA Real Estate, as well as central administrative functions.

In 2023, ICA Gruppen reported a significant portion of its revenue dedicated to personnel costs, reflecting its large employee base. For instance, the total personnel expenses in 2023 amounted to approximately SEK 36,000 million. This figure underscores the importance of human capital in delivering services across its diverse business segments.

ICA Gruppen's logistics and distribution costs are a significant component of their operating expenses, encompassing warehousing, transportation, and the final delivery of goods to stores and customers. These costs are directly impacted by the efficiency of their supply chain operations and their ongoing investments in sustainable practices.

A key focus for ICA Gruppen is the transition to fossil-free transport, aiming to reduce environmental impact and potentially long-term operational costs. For instance, in 2024, they continued to expand their fleet of electric vehicles for last-mile deliveries in urban areas, contributing to a greener footprint.

Optimizing the entire supply chain, from sourcing to store delivery, is crucial for managing these expenses. This includes strategies to reduce food waste, as spoiled or unsaleable products represent a direct financial loss that adds to overall distribution inefficiency and cost.

The company's commitment to efficient warehousing and inventory management, coupled with smart route planning for their transportation network, directly influences the final logistics and distribution cost per unit. These efforts are essential for maintaining competitive pricing and profitability in the retail sector.

Rent, Property Management, and Store Operations

ICA Gruppen incurs significant costs related to its extensive network of physical store locations, including rent for leased properties and expenses associated with owning real estate. These costs extend to warehouses and administrative offices, forming a substantial portion of their operational outlay.

Operational expenses are also a major factor. This includes utilities to keep stores and facilities running, ongoing maintenance to ensure facilities are in good condition, and store development, which covers renovations, upgrades, and new store openings. ICA Real Estate is instrumental in managing these physical assets, aiming to optimize their cost-effectiveness and operational efficiency.

- Rent and Leasing: Costs associated with securing and maintaining physical store spaces across Sweden and Norway.

- Property Management: Expenses related to the upkeep, administration, and efficient operation of owned and leased properties by ICA Real Estate.

- Utilities and Maintenance: Ongoing costs for electricity, water, heating, and general repairs for all operational sites.

- Store Development: Investments in new store openings, refurbishments, and modernizing existing store formats to enhance customer experience and operational flow.

Marketing and IT Investments

ICA Gruppen dedicates substantial resources to marketing and IT to drive customer acquisition and retention. Expenditure includes advertising across various media, loyalty programs designed to foster repeat business, and promotional activities to attract new shoppers. For example, in 2024, ICA continued its focus on digital marketing channels, leveraging data analytics to personalize offers and reach a wider audience.

Significant ongoing costs are associated with IT infrastructure and digital transformation initiatives. These investments are crucial for enhancing operational efficiency, improving the customer experience, and maintaining a competitive edge in the evolving retail landscape. ICA's commitment to e-commerce platforms, including app development and online store enhancements, represents a key area of financial outlay.

- Marketing Expenditure: Funds allocated to advertising, promotions, and customer loyalty programs.

- IT Infrastructure: Costs related to maintaining and upgrading technology systems.

- Digital Transformation: Investment in e-commerce platforms, apps, and data analytics.

- Competitiveness Enhancement: Spending aimed at improving online presence and customer engagement.

ICA Gruppen's cost structure is heavily influenced by the Cost of Goods Sold (COGS), which in 2023 reached SEK 103,824 million, reflecting the significant investment in inventory. Personnel costs, including salaries and benefits for its large workforce across retail, pharmacy, and banking, amounted to approximately SEK 36,000 million in 2023. Logistics and distribution expenses are also substantial, with ongoing investments in sustainable transport, such as expanding their electric vehicle fleet in 2024.

Furthermore, costs related to the extensive network of physical stores, including rent, property management, utilities, and maintenance, represent a major outlay. The company also invests heavily in marketing and IT to maintain competitiveness, with a significant focus on digital transformation and e-commerce platforms in 2024.

| Cost Category | 2023 (SEK million) | Key Activities |

|---|---|---|

| Cost of Goods Sold (COGS) | 103,824 | Inventory acquisition, procurement |

| Personnel Costs | ~36,000 | Salaries, wages, benefits for all employees |

| Logistics & Distribution | Varies | Warehousing, transportation, delivery, sustainable transport initiatives |

| Property & Operations | Varies | Rent, maintenance, utilities, store development |

| Marketing & IT | Varies | Advertising, loyalty programs, digital transformation, e-commerce |

Revenue Streams

Grocery sales are ICA Gruppen's core revenue engine, stemming from the vast network of ICA stores across Sweden, encompassing both independently owned and company-operated locations. This fundamental revenue stream is further diversified by sales through their increasingly important online grocery channels.

In 2024, ICA Sweden continued to be the dominant contributor to the group's overall revenue. The company reported strong performance in its grocery segment, driven by both increased customer traffic and a focus on private label products which typically offer higher margins.

ICA's strategy to cater to different consumer needs through various store formats, from large hypermarkets to smaller convenience stores, ensures broad market penetration and consistent revenue generation. Online sales, while still a smaller portion, saw significant growth, reflecting shifting consumer habits.

The average basket size in ICA stores remained a key metric, with efforts focused on encouraging larger purchases through loyalty programs and targeted promotions. This direct sales activity from food and daily necessities forms the bedrock of ICA Gruppen's financial health.

Pharmacy sales, primarily through Apotek Hjärtat, are a core revenue driver for ICA Gruppen. This segment encompasses both prescription and over-the-counter medications, alongside a range of health and wellness products. The online channel is increasingly contributing to this revenue stream, reflecting a growing shift in consumer behavior.

In 2024, ICA Gruppen reported that its pharmacy segment, Apotek Hjärtat, continued to demonstrate robust performance. For instance, during the first quarter of 2024, Apotek Hjärtat saw a comparable net sales increase of 4.4%, reaching SEK 7,281 million. This growth highlights the segment's resilience and its expanding market presence.

ICA Gruppen generates significant revenue through its financial services arm, ICA Banken. This includes substantial interest income from mortgages and various loans extended to customers, contributing to a stable revenue stream. For instance, in 2023, ICA Banken reported net interest income of SEK 2,034 million, showcasing the profitability of its lending activities.

Beyond interest, fees from payment services and card transactions represent another important income source. These operational fees, while perhaps smaller individually, accumulate to provide a consistent revenue contribution. Furthermore, ICA Försäkring’s insurance products, offering everything from home to car insurance, generate premium income, solidifying customer relationships and creating diversified revenue.

Wholesale and Distribution to Independent Retailers

This revenue stream is generated by ICA Gruppen selling a wide range of goods, from groceries to home furnishings, to its network of independently owned ICA stores. It also encompasses fees for centralized services such as bulk purchasing, efficient logistics, and coordinated marketing campaigns. This symbiotic relationship is fundamental to the ICA Idea, fostering a strong cooperative model that benefits both the central organization and its member retailers.

In 2024, ICA Gruppen's wholesale and distribution segment remained a significant contributor to its overall financial performance. For instance, the company reported substantial revenue figures driven by these sales, reflecting the continued reliance of independent retailers on ICA's purchasing power and supply chain expertise. This model allows individual store owners to focus on local customer needs while leveraging the scale and support of the larger ICA organization.

Key aspects of this revenue stream include:

- Sales of Goods: Revenue derived from the direct sale of products to independently owned ICA stores.

- Service Fees: Income generated from providing centralized purchasing, logistics, and marketing services to the retail network.

- Cooperative Model: This revenue stream is intrinsically linked to ICA's cooperative structure, where profits from central operations are often reinvested or shared.

- Market Reach: The broad network of independent stores ensures consistent demand and revenue generation across various geographical locations.

Real Estate Rental Income and Property Sales

ICA Real Estate plays a dual role in generating revenue for ICA Gruppen. Primarily, it earns income by leasing its properties to ICA stores, ensuring a stable rental income stream. Beyond internal leases, these properties are also rented out to external tenants, diversifying the rental income portfolio.

In addition to consistent rental income, ICA Gruppen also benefits from strategic property sales. These divestments, often of non-core or underutilized assets, provide significant capital injections. For instance, in 2023, ICA Real Estate completed several property transactions, contributing positively to the Group's overall financial flexibility.

- Rental Income: Revenue from leasing properties to ICA stores and third-party tenants.

- Property Sales: Income generated from the strategic divestment of real estate assets.

- Financial Contribution: Both rental income and property sales enhance ICA Gruppen's financial capacity and flexibility.

ICA Gruppen also generates revenue from its other business segments, including energy sales and digital services. These ventures, while smaller in scale compared to grocery and pharmacy, contribute to the group's diversified income streams and strategic growth initiatives.

In 2024, the group continued to explore and invest in new digital platforms and services, aiming to capture emerging revenue opportunities and enhance customer engagement. These initiatives are crucial for future growth and adapting to evolving market demands.

Business Model Canvas Data Sources

The ICA Gruppen Business Model Canvas is meticulously constructed using a blend of internal financial reports, extensive market research, and operational data. This ensures each component, from customer segments to revenue streams, is grounded in factual evidence.