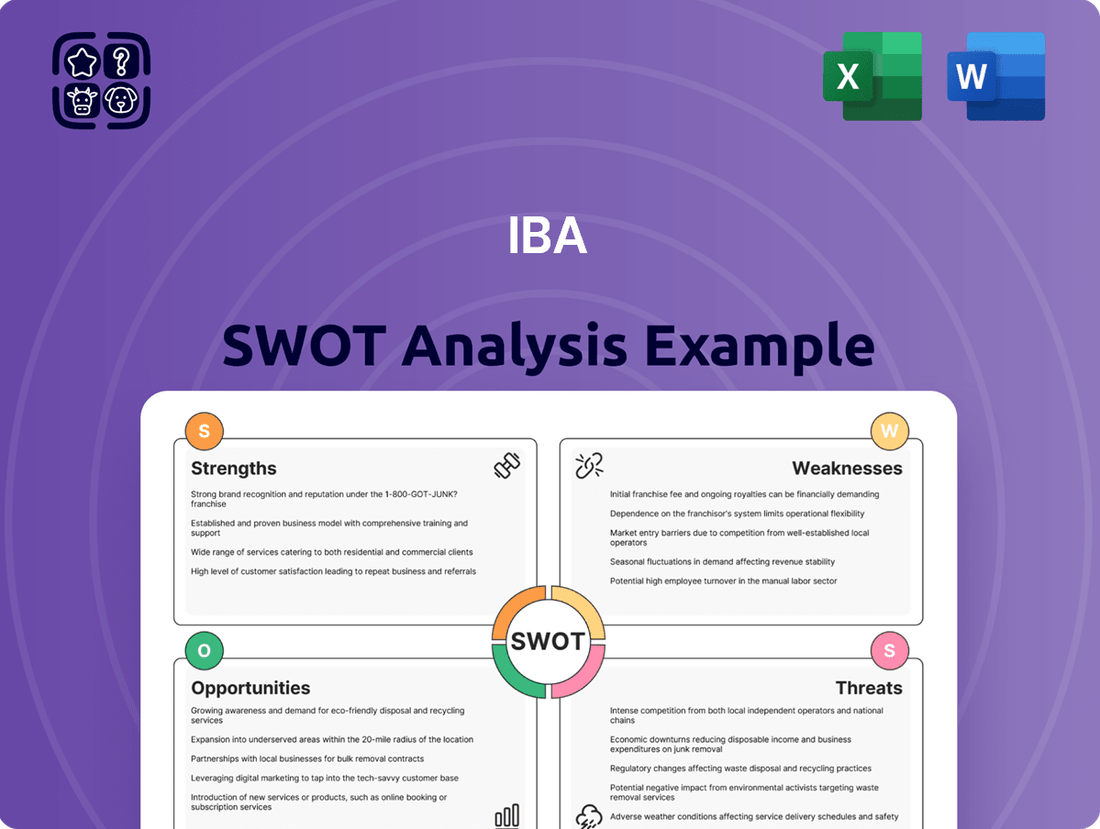

IBA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBA Bundle

Our IBA SWOT analysis reveals critical strengths, potential weaknesses, exciting opportunities, and looming threats. Understand the core drivers of IBA's current standing and future trajectory.

Want the full story behind IBA's market position and strategic advantages? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

IBA stands as a clear leader in the proton therapy market, capturing an impressive 60% of all systems sold in 2024. This strong market share highlights the company's technological prowess and its well-earned reputation in this cutting-edge medical sector.

The widespread adoption of IBA's Proteus®ONE and Proteus®PLUS systems is a key strength, with 38 projects currently in progress and 44 operational sites contributing to recurring service revenue.

IBA demonstrated exceptional financial strength in 2024, achieving a record revenue of €498.2 million, a notable 7% rise from the prior year. This growth also saw the company return to profitability, posting a net result of €9.3 million, a significant turnaround from its previous net loss.

This impressive financial showing was primarily fueled by the successful conversion of its substantial backlog, especially within the Other Accelerators segment where sales surged by 18%. The company's healthy backlog of €1.5 billion offers considerable visibility into future revenue streams, underpinning its ongoing financial stability.

IBA's strength lies in its diversified portfolio, extending beyond proton therapy to include essential dosimetry solutions for radiation therapy quality assurance and industrial sterilization. This broad offering mitigates reliance on a single market segment.

The company's commitment to innovation is a key driver, with continuous R&D fueling new product introductions like the QUASARTM GRID3D for dosimetry and CASSY®4 for radiotracer production. These advancements position IBA at the forefront of technological development in its fields.

Strategic investments in areas like Actinium-225 production through PanTera and power semiconductor chips via mi2-factory underscore IBA's forward-looking approach. These ventures signal a proactive strategy to capture emerging market opportunities and ensure sustained growth.

Global Presence and Strategic Partnerships

IBA's advanced medical technologies, particularly in proton therapy, are deployed across numerous hospitals and industrial sites worldwide, underscoring a significant global footprint. The company is actively expanding its reach with ongoing proton therapy projects in key markets like Asia and the USA, demonstrating a robust growth trajectory. For instance, as of early 2025, IBA had a strong pipeline of over 20 proton therapy centers under construction or in advanced development globally.

Strategic alliances are a cornerstone of IBA's expansion and market penetration strategy. Key partnerships, such as the ongoing collaboration with CGN in China and Apollo Hospitals in India, provide access to major healthcare markets and facilitate the deployment of IBA's cutting-edge solutions. These collaborations are crucial for scaling operations and ensuring widespread adoption of their technologies.

Further solidifying its position, IBA actively engages with leading academic and research institutions through initiatives like the Proton Therapy Academy. This collaborative approach not only fosters innovation but also drives the advancement of cancer care and education globally. In 2024 alone, the Proton Therapy Academy hosted training sessions for over 500 medical professionals from more than 30 countries, highlighting IBA's commitment to knowledge sharing and industry development.

- Global Deployment: IBA's proton therapy systems are operational in over 50 facilities worldwide, with an increasing presence in Asia and the USA.

- Key Partnerships: Strategic collaborations with major players like CGN and Apollo Hospitals are central to market access and growth.

- Educational Initiatives: The Proton Therapy Academy, established by IBA, plays a vital role in advancing global expertise in cancer treatment.

- Market Expansion: Active pipelines for proton therapy projects in Asia and the USA signal significant future revenue potential.

Healthy Balance Sheet and Liquidity

IBA’s financial health is a significant strength, underscored by a robust balance sheet. At the close of 2024, the company reported a net cash position of €33.5 million. This strong liquidity is further bolstered by access to €60 million in undrawn credit facilities, providing substantial financial flexibility.

This healthy liquidity position is crucial for IBA's strategic objectives. It directly supports ongoing investment in key growth initiatives, ensuring the company can pursue expansion opportunities without immediate financial constraints. Furthermore, this financial resilience acts as a vital buffer, enabling IBA to navigate potential market volatility and unexpected challenges effectively.

- Net Cash Position: €33.5 million (as of year-end 2024)

- Undrawn Credit Lines: €60 million

- Financial Resilience: Ability to fund growth and withstand market fluctuations

IBA's dominance in the proton therapy market, with 60% of systems sold in 2024, is a testament to its technological leadership and strong brand recognition. This market share is further solidified by 38 ongoing projects and 44 operational sites, generating consistent recurring service revenue.

The company's financial performance in 2024 was exceptional, marked by record revenue of €498.2 million, a 7% increase year-over-year, and a return to profitability with a €9.3 million net result. This growth was driven by strong sales in the Other Accelerators segment, up 18%, and a substantial backlog of €1.5 billion, ensuring future revenue visibility.

IBA's diversified product portfolio, encompassing dosimetry solutions and industrial sterilization alongside proton therapy, reduces market dependency. Continuous investment in R&D, leading to new products like QUASARTM GRID3D and CASSY®4, and strategic ventures in Actinium-225 and power semiconductors, position IBA for sustained innovation and growth.

| Metric | 2024 Data | Significance |

|---|---|---|

| Proton Therapy Market Share | 60% | Clear industry leadership |

| Record Revenue | €498.2 million | Strong financial performance |

| Net Result | €9.3 million | Return to profitability |

| Backlog Value | €1.5 billion | Future revenue visibility |

| Net Cash Position | €33.5 million | Financial flexibility |

What is included in the product

Analyzes IBA’s competitive position by examining its internal strengths and weaknesses alongside external opportunities and threats.

Offers a structured framework to identify and address strategic weaknesses and threats, thereby alleviating the pain of uncertainty.

Weaknesses

The significant capital expenditure required for installing proton therapy systems presents a notable weakness for IBA. This substantial upfront investment can deter potential clients, creating a barrier to entry and potentially slowing down revenue generation in the short term, even with a robust order backlog.

IBA's financial reports highlight this challenge. For instance, the company's net cash position saw a decrease in Q1 2025. This reduction was attributed to planned inventory procurement specifically for converting its existing backlog into active projects, underscoring the considerable upfront financial commitment tied to these large-scale installations.

IBA's reliance on large-scale proton therapy system installations presents a notable weakness. A substantial part of its revenue and order book is linked to these lengthy projects, which can create uneven income streams.

This dependence exposes IBA to potential project delays, cost overruns, and shifts in client priorities, impacting financial predictability. For instance, while specific project revenue figures fluctuate, the company's backlog for these large systems is a key indicator of future revenue, and any disruption here directly affects financial performance.

IBA operates within a fiercely competitive medical technology landscape, particularly in the proton therapy sector. Key rivals such as Varian Medical Systems, Hitachi Ltd., Mevion Medical Systems, and Mitsubishi Electric Corporation are established players, creating significant pressure on pricing strategies and market share. This intense rivalry necessitates ongoing investment in research and development to maintain a competitive edge through innovation and product differentiation.

Vulnerability to Healthcare Spending Trends

IBA's reliance on advanced medical equipment sales, especially proton therapy, makes it susceptible to fluctuations in global healthcare spending. Economic slowdowns or changes in government healthcare budgets can directly affect the adoption rates and investment in these high-cost treatments. For instance, in 2024, many countries are re-evaluating healthcare expenditures, which could lead to delayed purchasing decisions for capital-intensive technologies like those offered by IBA.

Reimbursement policies play a critical role in the accessibility and uptake of proton therapy. If insurance providers or national health systems reduce coverage or introduce stricter criteria for proton therapy in 2024-2025, it could significantly dampen demand. This directly impacts IBA's revenue streams and profitability, as seen in regions where reimbursement challenges have historically slowed market penetration.

- Global healthcare spending growth projected to moderate in 2024-2025 due to inflationary pressures and fiscal consolidation efforts in key markets.

- Reimbursement rates for advanced cancer therapies vary significantly by country, creating uneven market access for IBA's proton therapy solutions.

- Economic uncertainty in 2024 may lead some healthcare providers to postpone or scale back large capital investments in new technologies.

Regulatory and Reimbursement Challenges

Operating within the medical device sector presents a significant hurdle due to the complex and constantly changing regulatory environments across various global markets. This necessitates continuous adaptation and investment to ensure compliance, which can be resource-intensive.

Reimbursement policies for proton therapy, while showing growth, remain inconsistent across different regions and payers. This variability can directly affect patient accessibility and the financial viability for healthcare institutions considering investments in these sophisticated treatment systems. For instance, while the US Medicare reimbursement for proton therapy has been established, private payer coverage and international policies can differ substantially, impacting adoption rates.

Key challenges include:

- Navigating diverse and evolving international medical device regulations.

- Inconsistent reimbursement policies impacting market access and adoption.

- Securing favorable reimbursement from a wider range of payers to drive growth.

IBA's significant reliance on large, capital-intensive proton therapy system installations creates revenue lumpiness. This dependence makes the company vulnerable to project delays and cost overruns, impacting financial predictability. For example, while the order backlog is robust, the timing of revenue recognition from these multi-year projects can lead to uneven income streams, as evidenced by fluctuations in project-specific revenue reporting.

The substantial upfront capital expenditure for proton therapy systems acts as a barrier to entry for potential clients. This high cost can slow down adoption rates, even with a strong order book. IBA's Q1 2025 financial reports showed a decrease in net cash due to inventory procurement for its backlog, highlighting the significant financial commitment tied to these installations.

The company faces intense competition from established players like Varian Medical Systems and Hitachi Ltd. This rivalry necessitates continuous investment in R&D to maintain a competitive edge through innovation and product differentiation, adding to operational costs.

IBA's susceptibility to global healthcare spending fluctuations is a key weakness. Economic downturns or changes in government healthcare budgets, as seen with re-evaluations of healthcare expenditures in 2024, can directly impact the adoption of high-cost treatments and delay purchasing decisions.

Inconsistent reimbursement policies for proton therapy across different regions and payers create uneven market access. While US Medicare reimbursement is established, variations in private payer coverage and international policies can significantly dampen demand and affect IBA's revenue streams.

| Weakness | Description | Impact | Supporting Data/Trend |

| High Capital Expenditure | Substantial upfront cost for proton therapy systems. | Barrier to entry for clients, slows revenue generation. | Q1 2025 net cash decrease due to inventory procurement for backlog projects. |

| Revenue Lumps | Reliance on large, long-term installation projects. | Uneven income streams, vulnerability to project delays/cost overruns. | Fluctuations in project-specific revenue recognition. |

| Intense Competition | Presence of established rivals like Varian and Hitachi. | Pressure on pricing, need for continuous R&D investment. | Ongoing need for product differentiation to maintain market share. |

| Healthcare Spending Sensitivity | Susceptibility to global healthcare budget changes. | Impacts adoption rates and investment in high-cost treatments. | 2024 re-evaluation of healthcare expenditures in key markets. |

| Inconsistent Reimbursement | Variability in coverage across regions and payers. | Dampens demand, affects financial viability for institutions. | Differing private payer coverage and international policies compared to US Medicare. |

Preview the Actual Deliverable

IBA SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt, ensuring you know exactly what you're getting.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive strategic overview.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The global market for proton therapy is on a strong upward trajectory, with projections indicating it will reach around USD 1,995.62 million by 2034. This growth is fueled by a compound annual growth rate of 13.30% from 2025 to 2034. This presents a significant opportunity for IBA to capitalize on the increasing demand for advanced cancer treatment solutions.

Key drivers for this market expansion include the rising global cancer rates and a growing understanding of proton therapy's effectiveness and reduced side effects compared to traditional treatments. IBA is well-positioned to benefit from these trends, potentially increasing its market share and revenue streams through further development and deployment of its proton therapy systems.

IBA is well-positioned to capitalize on the continuous advancements in proton therapy technology, like pencil beam scanning and image-guided systems. These innovations, alongside the development of more compact and affordable machines, present a significant opportunity for IBA to expand its product offerings and solidify its market leadership.

The company's commitment to research and development, particularly in areas like DynamicARC® and ConformalFLASH®, is a key driver for future growth. In 2023, IBA reported a substantial increase in its order backlog for proton therapy systems, reaching €2.6 billion, underscoring the market's demand for its cutting-edge solutions.

IBA is well-positioned to capitalize on the burgeoning demand for proton therapy in emerging markets, especially across Asia. A robust pipeline of potential projects in these regions signals substantial growth potential.

Increased government investment in advanced healthcare infrastructure and a rising public consciousness regarding cutting-edge cancer treatments are key drivers. For instance, in 2024, several Asian nations announced significant healthcare budget increases, earmarking funds for advanced medical technologies like proton therapy.

Diversification into Radiopharmaceuticals and Industrial Applications

IBA is strategically expanding into radiopharmaceuticals, notably through its investment in PanTera to boost Actinium-225 production, a key isotope for targeted cancer therapies. This move taps into the growing demand for advanced medical treatments.

Furthermore, IBA's established industrial solutions business, which focuses on sterilization using its accelerator technology, presents a significant opportunity for diversification. This segment leverages core competencies in new, high-growth markets.

- Radiopharmaceutical Growth: IBA's commitment to Actinium-225 production positions it to capitalize on the burgeoning radiopharmaceutical market, projected to reach tens of billions of dollars in the coming years.

- Industrial Applications: The company's industrial sterilization solutions, utilized in sectors like food and medical devices, offer a stable and expanding revenue stream, diversifying away from solely medical isotope reliance.

- Synergistic Technology: Both radiopharmaceuticals and industrial sterilization leverage IBA's deep expertise in particle accelerator technology, creating operational synergies and a strong competitive advantage.

Strategic Collaborations and Acquisitions

Forming strategic partnerships and pursuing targeted acquisitions are key opportunities for IBA. For example, the acquisition of Radcal Corporation in 2023 significantly bolstered IBA's dosimetry solutions, demonstrating a clear strategy to expand its product portfolio and market reach. This move, coupled with the 2024 launch of the Proton Therapy Academy via collaborations, highlights IBA's commitment to enhancing its educational influence and market penetration.

These strategic moves are designed to:

- Strengthen Market Position: By integrating new technologies and expanding service offerings through acquisitions like Radcal, IBA solidifies its competitive standing.

- Expand Product Portfolio: Acquisitions allow for the rapid addition of complementary products and services, catering to a broader customer base.

- Access New Technologies and Markets: Partnerships and acquisitions provide pathways to innovative solutions and untapped geographical or application-specific markets.

- Enhance Educational Reach: Initiatives like the Proton Therapy Academy foster industry leadership and create valuable connections.

IBA's expansion into radiopharmaceuticals, particularly its investment in Actinium-225 production, taps into a rapidly growing market for targeted cancer therapies. The company's established industrial solutions business, focusing on sterilization, offers a stable revenue stream and diversification. Leveraging core accelerator technology across both medical and industrial sectors creates significant operational synergies and a competitive edge.

Strategic partnerships and acquisitions, such as the 2023 acquisition of Radcal Corporation, enhance IBA's dosimetry solutions and broaden its market reach. The 2024 launch of the Proton Therapy Academy through collaborations further strengthens its industry influence and market penetration.

The global proton therapy market is projected to reach approximately USD 1,995.62 million by 2034, growing at a CAGR of 13.30% from 2025 to 2034, presenting a substantial opportunity for IBA. Emerging markets, especially in Asia, are showing increasing demand for advanced cancer treatments, with several nations boosting healthcare budgets in 2024 to fund such technologies.

| Opportunity Area | Key Driver | IBA's Position |

|---|---|---|

| Proton Therapy Market Growth | Rising cancer rates, improved treatment understanding | Strong order backlog (€2.6 billion in 2023), technological leadership |

| Radiopharmaceutical Expansion | Demand for targeted therapies (e.g., Actinium-225) | Investment in PanTera for isotope production |

| Industrial Solutions | Diversification, stable revenue from sterilization | Leveraging core accelerator technology in new markets |

| Strategic Acquisitions & Partnerships | Portfolio expansion, market access | Radcal acquisition (2023), Proton Therapy Academy (2024) |

Threats

The proton therapy market is seeing a surge in both new companies entering the field and existing players improving their technologies. This heightened competition, exemplified by Mevion Medical Systems' development of more compact and potentially more affordable systems, puts pressure on established players like IBA. This could lead to tighter margins and a need for continuous innovation to maintain market share.

The substantial capital investment required for proton therapy centers, often running into hundreds of millions of dollars, presents a significant hurdle. For instance, typical costs for a single-room facility can range from $100 million to $200 million, making it a challenging proposition for many healthcare providers, especially those in emerging markets or with tighter budgets.

This high price point directly impacts IBA's potential market reach. If prospective clients, such as hospitals or clinics, cannot secure the necessary financing or justify the return on investment due to ongoing treatment costs, it can suppress demand for IBA's advanced proton therapy equipment, thereby threatening sales volume.

The swift evolution of cancer treatment technologies, such as advanced proton therapy techniques and novel drug-based therapies, poses a significant threat. These advancements could diminish the competitive edge of IBA's current proton therapy systems, potentially leading to obsolescence if the company doesn't keep pace. For instance, while proton therapy has seen growth, the development of more targeted radiation methods or even entirely new treatment paradigms could shift market demand.

Global Economic Volatility and Geopolitical Risks

Global economic volatility and escalating geopolitical risks present significant threats to IBA's operations and strategic initiatives. Economic downturns, persistent inflationary pressures, and heightened geopolitical tensions can directly impact healthcare sector budgets, influence crucial investment decisions, and disrupt vital supply chains. These factors collectively raise the possibility of delays or outright cancellations of large-scale projects that are critical for IBA's growth and development.

Specifically, IBA is closely monitoring the evolving macroeconomic landscape, with particular attention paid to developments surrounding US tariffs. Such trade policies can introduce uncertainty and potentially increase operational costs, affecting profitability and the feasibility of certain international ventures. For instance, a significant increase in tariffs on key medical equipment components could inflate production expenses, impacting pricing strategies and market competitiveness.

- Economic Slowdown Impact: A projected global GDP growth slowdown to 2.7% in 2024, as forecasted by the IMF in October 2023, could reduce overall healthcare spending and investment capacity.

- Inflationary Headwinds: Persistent inflation, which saw the US CPI at 3.1% year-over-year in January 2024, increases the cost of raw materials and operational expenses for IBA.

- Geopolitical Tensions: Ongoing conflicts and trade disputes create supply chain vulnerabilities and can lead to sudden shifts in market demand, affecting project timelines and resource availability.

- Tariff Uncertainty: Evolving trade policies, including potential US tariffs on imported goods, introduce a layer of unpredictability that could impact the cost-effectiveness of IBA's supply chain and manufacturing processes.

Regulatory Changes and Reimbursement Uncertainties

Changes in medical device regulations, particularly those impacting approval pathways and safety standards for advanced technologies, pose a significant threat to IBA. For instance, stricter FDA requirements or evolving CE marking processes could lengthen time-to-market for new proton therapy innovations. This regulatory flux can directly impact revenue streams and development timelines.

Shifts in reimbursement policies for cutting-edge cancer treatments, including proton therapy, represent another major challenge. Uncertainty regarding coverage levels and payment structures from government payers like Medicare and private insurers can make hospitals and clinics hesitant to invest in expensive proton therapy systems. In 2024, many healthcare systems are still navigating value-based care models, where reimbursement is increasingly tied to patient outcomes, adding another layer of complexity to adoption decisions.

- Regulatory Hurdles: Evolving medical device regulations can delay product approvals and increase compliance costs for IBA.

- Reimbursement Uncertainty: Fluctuations in payer reimbursement rates for proton therapy can impact demand and profitability.

- Value-Based Care Impact: The shift towards value-based care models may require proton therapy providers to demonstrate superior outcomes to secure favorable reimbursement, a challenge for new or complex treatments.

Intensifying competition from both new entrants and established players developing more compact and cost-effective systems poses a threat to IBA's market position and profit margins. The high cost of proton therapy, with single-room facilities ranging from $100 million to $200 million, limits market access and suppresses demand, especially in budget-constrained regions. Rapid technological advancements in cancer treatment could render current IBA systems obsolete if the company fails to innovate continuously.

Global economic instability, including a projected 2.7% global GDP growth slowdown in 2024 according to the IMF, coupled with persistent inflation (US CPI at 3.1% in January 2024) and geopolitical tensions, creates significant risks. These factors can delay or cancel large-scale projects crucial for IBA's growth and introduce supply chain vulnerabilities. Evolving trade policies, such as potential US tariffs, add further unpredictability to operational costs and market competitiveness.

Regulatory changes impacting approval pathways and safety standards for advanced medical devices can lengthen time-to-market for IBA's innovations, directly affecting revenue and development timelines. Furthermore, uncertainty in reimbursement policies for proton therapy, especially within value-based care models where outcomes dictate payment, can deter potential clients from investing in expensive systems.

| Threat Category | Specific Threat | Impact on IBA | Supporting Data/Example |

|---|---|---|---|

| Competition | Increased competition | Pressure on margins, need for continuous innovation | Mevion Medical Systems developing compact systems |

| Market Access | High capital investment for proton therapy centers | Limited market reach, suppressed demand | Costs $100M-$200M for single-room facilities |

| Technological Obsolescence | Rapid evolution of cancer treatment technologies | Diminished competitive edge, potential obsolescence | Advancements in targeted radiation, new treatment paradigms |

| Economic & Geopolitical Factors | Global economic slowdown, inflation, geopolitical tensions | Project delays/cancellations, supply chain disruption | IMF projects 2.7% global GDP growth (Oct 2023); US CPI 3.1% (Jan 2024) |

| Trade Policy | Potential US tariffs | Increased operational costs, uncertainty | Impact on supply chain and manufacturing costs |

| Regulatory Environment | Changes in medical device regulations | Longer time-to-market, increased compliance costs | Stricter FDA requirements, evolving CE marking |

| Reimbursement Policies | Shifts in reimbursement for advanced treatments | Hesitancy in investment, complex adoption decisions | Value-based care models impacting coverage in 2024 |

SWOT Analysis Data Sources

This IBA SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert evaluations from industry professionals to ensure a well-informed and actionable assessment.