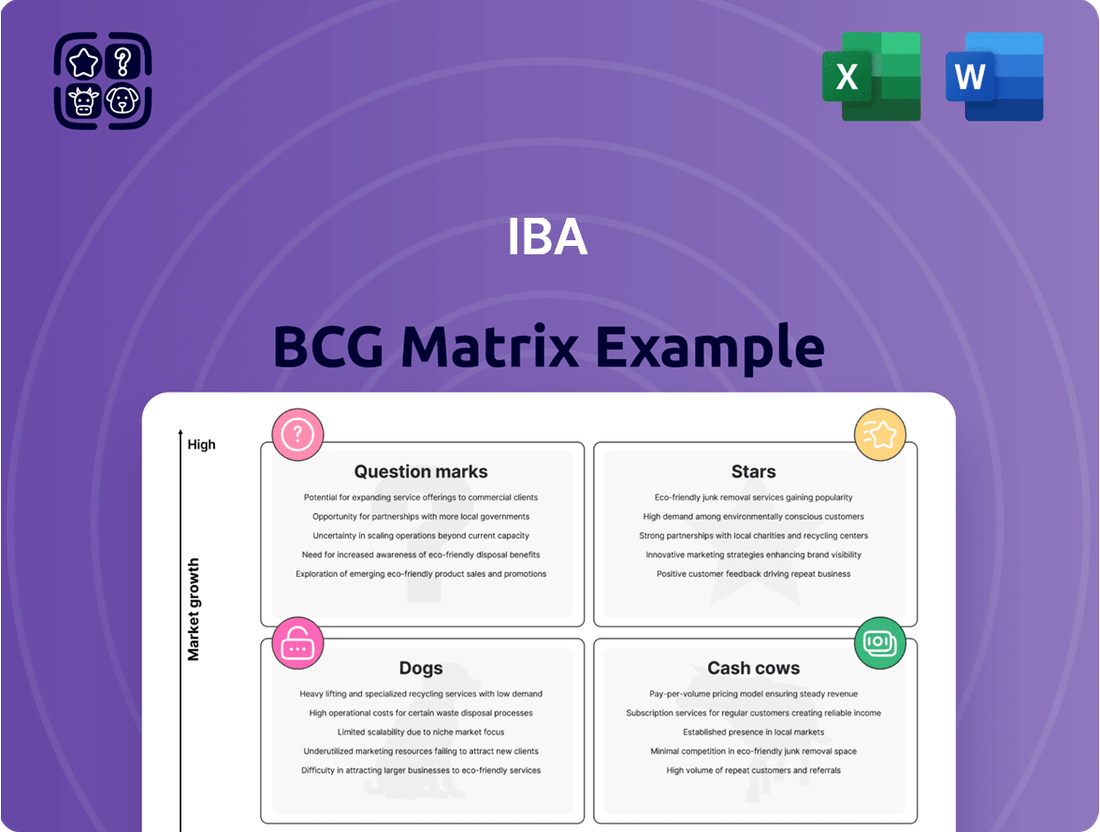

IBA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBA Bundle

Curious about the strategic positioning of a company's product portfolio? The BCG Matrix offers a powerful framework to categorize products as Stars, Cash Cows, Dogs, or Question Marks, guiding critical investment decisions. This glimpse provides a foundational understanding, but imagine unlocking the full potential of this analysis.

To truly leverage the BCG Matrix for your business, you need the complete picture. Purchase the full report to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your product strategy and resource allocation. Don't just understand the theory; implement it for tangible results.

Stars

IBA stands as the undisputed global leader in the proton therapy systems market. In 2024, the company captured an impressive 60% of all new systems sold, underscoring its market dominance. This strong performance translates to a substantial 42% share of all operational proton therapy rooms worldwide, highlighting IBA's extensive reach and impact.

The company's success is largely driven by its highly regarded Proteus®ONE and Proteus®PLUS systems. These innovative solutions are deployed across numerous healthcare facilities globally, reinforcing IBA's robust competitive edge in this advanced medical technology sector.

The proton therapy market is booming, with a projected growth from USD 572.5 million in 2024 to almost USD 2 billion by 2034. This represents a substantial Compound Annual Growth Rate (CAGR) of 10.9% to 13.3% from 2025 to 2034, fueled by rising cancer rates and better treatment tech. IBA's strong market position and ongoing innovation place it perfectly to benefit from this expansion.

IBA's proton therapy division is a star performer, evidenced by its impressive all-time high equipment and services backlog reaching €1.5 billion as of May 2025. This substantial figure translates directly into strong revenue visibility for the foreseeable future.

The backlog is bolstered by 38 active proton therapy projects, including numerous Proteus®ONE and Proteus®PLUS systems, showcasing the company's ongoing market penetration and successful project execution.

Robust commercial momentum, especially in key growth markets like Asia-Pacific and the United States, fuels a consistent conversion of its sales pipeline and the acquisition of new orders, ensuring sustained revenue generation for this high-growth segment.

Continuous Innovation in Proton Therapy

IBA's commitment to continuous innovation in proton therapy is a key driver of its market position. The company consistently invests in research and development, focusing on advancements like DynamicARC® and ConformalFLASH®. These technologies are designed to boost treatment accuracy and speed, solidifying IBA's technological leadership.

This dedication to product evolution keeps IBA's proton therapy systems competitive and attractive to new clients, broadening the potential uses for this advanced cancer treatment. For instance, IBA reported a significant increase in its order backlog for proton therapy centers in 2023, reaching over €1 billion, underscoring the market demand for their innovative solutions.

- DynamicARC®: Enhances treatment delivery speed and patient comfort by enabling continuous beam delivery during patient movement.

- ConformalFLASH®: Aims to further reduce treatment time and potential side effects through ultra-fast dose delivery.

- R&D Investment: IBA's ongoing investment in R&D, which represented a substantial portion of their revenue in recent years, fuels these advancements.

- Market Expansion: These innovations are crucial for expanding the reach and application of proton therapy in oncology.

Strategic Expansion in Key Geographies for PT

PT is strategically expanding its presence in key growth regions. The company has a robust development pipeline featuring new proton therapy projects across the United States and various Asian markets, indicating a forward-looking approach to market penetration.

Recent successful ventures underscore this expansion, including significant contracts for its Proteus®ONE systems in India. These partnerships with prominent healthcare providers like AIG and Apollo Hospitals highlight PT's ability to establish strong market footholds and broaden its collaborative network.

This deliberate geographical diversification, coupled with focused engagement with strategic clients, is fundamental to maintaining PT's leadership position and capitalizing on global growth prospects.

- Geographic Focus: United States and Asia represent key expansion areas.

- Key Partnerships: Contracts with AIG and Apollo Hospitals in India for Proteus®ONE systems.

- Strategic Goal: Sustain market leadership and capture worldwide growth opportunities.

IBA's proton therapy division is a clear star in the BCG matrix, demonstrating high market share in a rapidly growing industry. Its dominance is evident in the 2024 market, where it secured 60% of new system sales and holds 42% of all operational proton therapy rooms globally. This strong position is supported by a substantial backlog of €1.5 billion as of May 2025, stemming from 38 active projects.

The company's innovative Proteus®ONE and Proteus®PLUS systems, along with advancements like DynamicARC® and ConformalFLASH®, solidify its technological leadership and appeal. With the proton therapy market projected to grow significantly, IBA is well-positioned to leverage its star status for continued success.

| Metric | 2024/2025 Data | Significance |

|---|---|---|

| Market Share (New Systems Sold) | 60% (2024) | Dominant position in a growing market |

| Global Operational Rooms Share | 42% | Extensive market penetration |

| Backlog (May 2025) | €1.5 billion | Strong revenue visibility |

| Active Projects | 38 | Demonstrates ongoing demand and execution |

| Market Growth (2024-2034) | 10.9% to 13.3% CAGR | Indicates significant future expansion potential |

What is included in the product

The IBA BCG Matrix offers a strategic framework to analyze a company's product portfolio, categorizing units by market share and growth rate to guide investment decisions.

Clear visualization of your portfolio's strengths and weaknesses, simplifying strategic decision-making.

Cash Cows

IBA holds a strong position in the dosimetry market, offering crucial quality assurance tools for radiation therapy. In FY 2024, this segment generated €65.9 million in revenue, demonstrating stable performance in a mature market with predictable demand.

The company's deep-rooted expertise and broad range of products solidify its competitive edge in this critical field of medical physics.

IBA's Dosimetry segment, despite some unevenness in the first half of 2024 due to global issues like anti-corruption drives in China, demonstrated a significant rebound. The unit reported enhanced profitability and robust order intake in the first quarter of 2025, signaling its capacity for consistent cash generation.

This resilience makes Dosimetry a dependable source of financial stability for IBA. Its ability to secure strong orders, as seen in Q1 2025, underpins its role as a cash cow, contributing reliably to the group's overall financial health.

Critical Quality Assurance Solutions, specifically dosimetry, represent a significant cash cow for IBA. These solutions are absolutely vital for the accuracy and safety of radiation therapy, a non-negotiable aspect of patient care. This fundamental need ensures a consistent demand for IBA's dosimetry products and services from hospitals and proton therapy centers worldwide.

The indispensable nature of dosimetry translates directly into a stable and high-margin revenue stream for IBA. For instance, the global market for radiation therapy is projected to grow significantly, with dosimetry playing a key role in ensuring its efficacy and safety. This steady demand, coupled with the essential function of these products, solidifies their cash cow status.

Support for Radiation Therapy Ecosystem

The Dosimetry segment is a vital component of IBA's radiation therapy ecosystem, especially for its proton therapy offerings, by guaranteeing the quality and safety of treatments. This interdependence strengthens IBA's appeal as a provider of complete radiation therapy solutions.

The increasing global focus on accurate cancer treatment and the expanding market for radiation therapy, including proton therapy, ensure a steady demand for dosimetry services. This consistent need establishes dosimetry as a stable and dependable source of income for IBA.

- Dosimetry ensures quality assurance in proton therapy.

- It supports the entire radiation therapy business.

- Demand for quality control in radiation therapy is growing.

- Dosimetry is a foundational and reliable revenue stream.

Acquisition-led Portfolio Expansion

IBA's strategic expansion in Dosimetry, notably through the February 2024 acquisition of Radcal Corporation, exemplifies an acquisition-led growth strategy. This move significantly bolsters its medical imaging quality assurance capabilities and solidifies its footprint in the United States market.

The primary objective of this expansion is to drive revenue growth and achieve earnings before interest and taxes (EBIT) positivity within the Dosimetry segment. This positions Dosimetry as a key cash cow, contributing substantially to IBA's overall financial strength.

- Radcal Corporation Acquisition: Completed in February 2024, enhancing IBA's medical imaging quality assurance portfolio.

- Market Strengthening: Deepened presence in the crucial US market.

- Financial Objectives: Aiming for revenue accretion and EBIT positivity in the Dosimetry segment.

- Enduring Strength: Integration of new technologies and expanded market reach contribute to sustained performance.

The Dosimetry segment, a cornerstone of IBA's operations, functions as a significant cash cow. Its vital role in ensuring the safety and accuracy of radiation therapy, including proton therapy, guarantees a consistent and reliable revenue stream.

This segment's indispensable nature within the healthcare ecosystem, coupled with a growing global demand for precise cancer treatments, underpins its stable financial performance.

IBA's strategic acquisitions, such as Radcal Corporation in February 2024, further bolster this segment's market position and revenue-generating capabilities, reinforcing its cash cow status.

The segment's resilience and consistent order intake, as evidenced by Q1 2025 results, highlight its dependable contribution to IBA's overall financial health.

| Segment | FY 2024 Revenue (€ millions) | Key Contribution | Strategic Development | Outlook |

| Dosimetry | 65.9 | Quality assurance in radiation therapy, stable demand | Radcal acquisition (Feb 2024) for US market expansion | Continued revenue growth and EBIT positivity |

What You’re Viewing Is Included

IBA BCG Matrix

The IBA BCG Matrix you are currently previewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just the complete strategic tool ready for your immediate use. You're getting precisely what you see, a professionally designed analysis ready for implementation in your business planning.

Dogs

IBA's strategic positioning, as evidenced by its financial reports and public statements through early 2025, does not feature any products or business units that would be classified as Dogs in the traditional Boston Consulting Group (BCG) Matrix. The company's emphasis is firmly on innovation and expansion within its core high-growth, high-technology sectors.

Instead of managing low-growth, low-market-share assets, IBA consistently directs its resources toward advancing its medical and industrial solutions. There's no indication from their 2024 performance or forward-looking strategies that the company is holding onto or planning to divest any products fitting the "Dog" profile.

IBA's strategic focus on innovation and leadership in particle accelerator technology for cancer therapy and specialized industrial uses means they actively avoid developing or maintaining 'Dog' products, which are typically in low-growth markets with poor competitive positions.

The company's consistent investment in research and development, evidenced by their significant R&D spending, which represented 15% of their revenue in 2023, fuels their expansion into new, high-potential areas. This proactive approach ensures their portfolio remains dynamic and growth-oriented, naturally sidestepping the characteristics of a 'Dog' within the BCG matrix.

IBA's strategic approach, as indicated by the absence of divestiture announcements in 2024 and early 2025, suggests a commitment to its entire product portfolio. This implies that all current business units are either meeting performance expectations, are deemed critical for future expansion, or are receiving dedicated investment to enhance their market standing.

Strategic Prioritization of Market Leadership

In the context of the IBA BCG Matrix, products classified as 'Dogs' represent areas where the company's strategic priority is to avoid or rapidly address stagnation. IBA's unwavering commitment to global leadership in particle accelerator technology, especially in proton therapy, means that resources are not allocated to underperforming or low-growth segments.

This strategic focus means that any IBA product that begins to exhibit characteristics of a 'Dog' – low market share and low market growth – is subject to immediate review. The goal is to prevent these from becoming drains on capital, aligning with the company's overall objective of maintaining and expanding its market dominance.

For instance, while specific 'Dog' products within IBA's portfolio are not publicly disclosed, the company's financial reports and strategic outlook consistently highlight investments in high-growth areas like proton therapy systems. In 2024, IBA reported a significant order backlog, underscoring its success in its core, high-growth markets.

- IBA's commitment to market leadership in proton therapy is a key driver for avoiding 'Dog' classifications.

- Products showing signs of low market share and low growth are quickly assessed for re-positioning or divestment.

- The company's 2024 performance, marked by a strong order backlog, reflects its success in focusing on leading market segments.

Continuous Investment Across Portfolio

IBA's strategy of continuous investment across its portfolio, including Proton Therapy, Dosimetry, Industrial Solutions, and RadioPharma Solutions, positions these segments favorably within the IBA BCG Matrix. This proactive approach ensures sustained growth potential and market relevance for all business units.

For instance, IBA's commitment to innovation in Proton Therapy, a field where the company is a leader, is evident in ongoing research and development. In 2024, the company continued to expand its global footprint, securing new installations and partnerships. This sustained investment helps maintain a strong market share and competitive edge.

- Proton Therapy: Continued investment in next-generation systems and clinical applications.

- Dosimetry: Focus on enhancing accuracy and expanding applications in radiation therapy and industrial uses.

- Industrial Solutions: Development of advanced electron beam technology for various industrial processes.

- RadioPharma Solutions: Expansion of production capacity and development of new radiopharmaceuticals.

In the context of the IBA BCG Matrix, 'Dogs' represent business units with low market share and low market growth. IBA's strategic imperative is to avoid such positions by focusing on innovation and market leadership in its core particle accelerator technologies. The company actively manages its portfolio to prevent the emergence of 'Dog' segments.

IBA's consistent investment in research and development, which was a significant portion of its 2023 revenue, fuels its expansion into high-growth areas, effectively sidestepping 'Dog' characteristics. For example, their 2024 order backlog highlights success in core, high-growth markets.

Any product within IBA that begins to show signs of stagnation, characterized by low market share and low growth, is subject to immediate strategic review. The company's objective is to prevent capital drain and maintain market dominance, thus avoiding 'Dog' classifications.

| BCG Category | IBA Portfolio Characteristic | Strategic Implication |

|---|---|---|

| Stars | High growth, High share (e.g., Proton Therapy) | Continued investment for growth and market leadership |

| Cash Cows | Low growth, High share (Not explicitly identified as such, but core segments are strong) | Generate cash flow to fund other initiatives |

| Question Marks | High growth, Low share (Potential new applications or emerging technologies) | Requires significant investment to gain share or divest |

| Dogs | Low growth, Low share (Actively avoided) | Divestment or turnaround strategy |

Question Marks

IBA's strategic push into advanced radiopharmaceuticals, focusing on isotopes like Actinium-225 and Astatine-211 for radiotheranostics, positions it in a rapidly expanding, high-potential sector. This area is characterized by significant investment and a clear trajectory towards becoming a major market force.

The formation of PanTera, a joint venture dedicated to boosting global Actinium-225 output, successfully raised substantial Series A funding. This financial backing underscores the market's strong growth prospects and validates IBA's focus on these novel radioisotopes.

While IBA's current market share in these nascent isotope segments may be emerging, the substantial investment and strategic commitment clearly mark this as a Question Mark. It holds significant potential to evolve into a Star performer within the radiopharmaceutical landscape.

IBA's Industrial Solutions segment is aggressively pursuing novel applications for its accelerator technology, notably the PFAS-Blaster initiative aimed at neutralizing persistent 'forever chemicals' in wastewater. These ventures target high-growth, nascent markets.

Although current market penetration in these emerging areas is minimal, substantial research and development expenditure, coupled with the potential for significant societal benefit, classify these as Stars within the BCG framework. Success in these fields could unlock considerable future revenue streams.

The recent introduction of products like the CASSY® compact synthesizer, which streamlines radiometal production, signifies IBA's strategic expansion into the wider radiochemistry sector. This move positions IBA to capitalize on a burgeoning market.

These new radiochemistry products are entering a dynamic and expanding field, with the global radiopharmaceutical market projected to reach approximately $13.9 billion by 2026, according to some industry analyses. Their market adoption and future market share remain in the developmental stages, classifying them as question marks within the BCG matrix.

Early-Stage Market Penetration in New Verticals

IBA is actively pursuing early-stage market penetration in new verticals, expanding beyond its core sterilization business. This includes venturing into e-beam irradiation for polymer crosslinking and phytosanitary applications, as demonstrated by recent contract wins in Germany and Mexico. These represent strategic moves into less established, but potentially high-growth, industrial sectors where IBA is focused on building initial market share.

These new applications, while promising, are still in their formative stages of market development for IBA. Their long-term market dominance is not yet secured, reflecting the inherent risks and opportunities associated with pioneering new applications. For instance, the polymer crosslinking market, while growing, requires significant customer education and application development to achieve widespread adoption.

- New Verticals: E-beam irradiation for polymer crosslinking and phytosanitary products.

- Market Entry: Recent contracts secured in Germany and Mexico highlight early penetration efforts.

- Market Position: IBA is building market share in these emerging industrial sectors.

- Growth Potential: These verticals represent opportunities for future revenue diversification and growth.

High Investment for Future Growth Potential

High Investment for Future Growth Potential represents the 'Question Marks' in the IBA BCG Matrix. These are business units or products with low market share in high-growth industries. The company is committing significant resources to these emerging areas, including R&D innovation and strategic partnerships, to convert these 'Question Marks' into 'Stars.' This strategy is evident in the substantial funding for PanTera and the continuous exploration of new applications for its accelerator technology. These investments are crucial for capturing future market share in high-growth, yet currently low-share, segments.

- Investment Focus: Significant capital is being allocated to R&D and strategic alliances to foster growth in nascent markets.

- PanTera Funding: Substantial financial backing is directed towards PanTera, a key initiative in a high-growth sector.

- Technology Exploration: Continuous efforts are underway to discover and develop new applications for existing accelerator technologies.

- Market Capture Strategy: The objective is to leverage these investments to secure a dominant position in future high-growth markets where current share is minimal.

Question Marks represent IBA's strategic ventures into emerging markets with high growth potential but currently low market share. These areas demand significant investment to build market presence and capitalize on future opportunities. The company's focus on advanced radiopharmaceuticals and novel industrial applications exemplifies this strategy.

IBA's investment in Actinium-225 and Astatine-211, facilitated by the PanTera joint venture, highlights a commitment to a high-potential radiotheranostics market. The substantial Series A funding for PanTera underscores market confidence in these nascent isotope segments.

Similarly, IBA's exploration of e-beam irradiation for polymer crosslinking and phytosanitary applications, evidenced by recent contracts, places these activities in the Question Mark category. These sectors offer significant growth prospects, but IBA is still in the early stages of establishing its foothold.

The global radiopharmaceutical market, projected to reach approximately $13.9 billion by 2026, provides a strong backdrop for IBA's Question Mark investments in this area. The success of these ventures hinges on continued R&D and market development to transform them into future market leaders.

| Business Unit/Product | Market Growth Potential | Current Market Share | Investment Strategy | BCG Category |

| Advanced Radiopharmaceuticals (Actinium-225, Astatine-211) | Very High | Low/Emerging | Significant R&D, Joint Ventures (PanTera) | Question Mark |

| Industrial E-beam Applications (Polymer Crosslinking, Phytosanitary) | High | Low/Emerging | New Market Penetration, Contract Wins | Question Mark |

| PFAS-Blaster Initiative | High | Low/Emerging | R&D, Novel Application Development | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial filings, market research reports, and industry growth projections to provide accurate strategic insights.