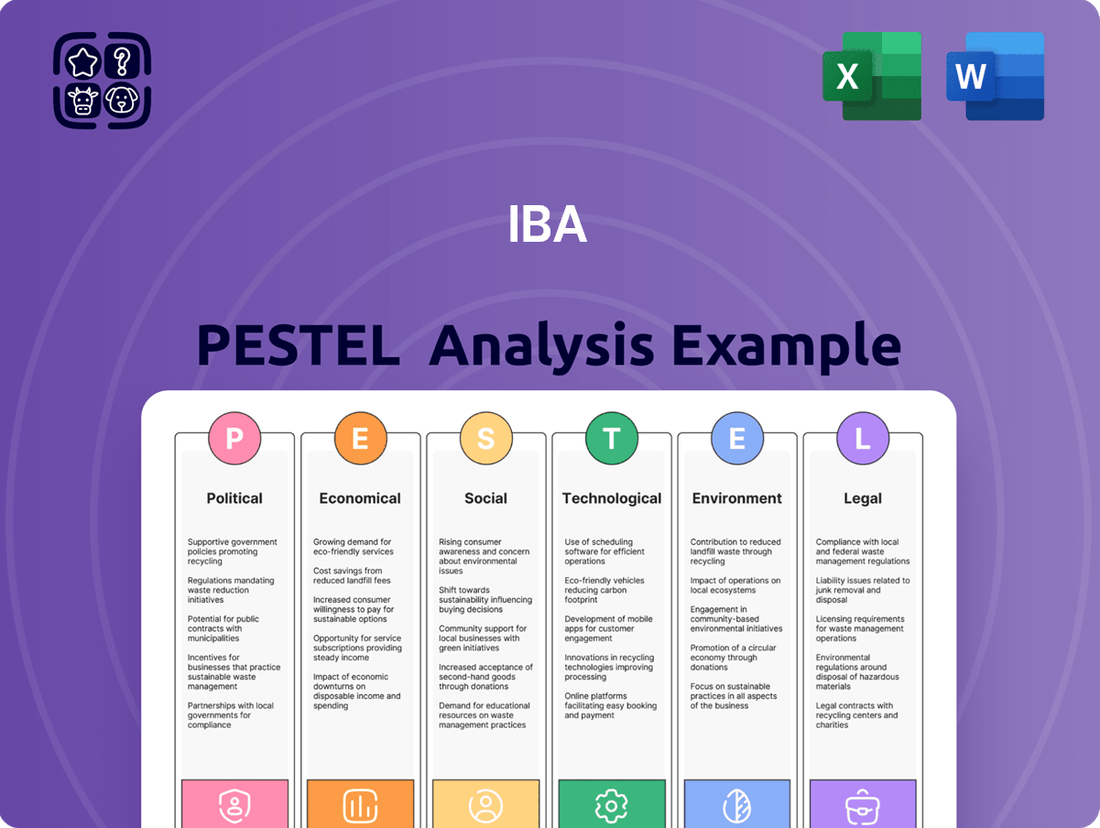

IBA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBA Bundle

Unlock the critical external factors shaping IBA's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges.

Gain a significant competitive advantage by leveraging our expert-researched insights into the social, environmental, and legal landscape impacting IBA. This detailed analysis is your roadmap to informed strategic decisions.

Don't get caught off guard by external forces; equip yourself with the knowledge to anticipate and adapt. Download the full IBA PESTLE analysis now and transform raw data into actionable intelligence for your business.

Political factors

Government funding plays a crucial role in the expansion of advanced cancer treatments. For instance, the US President's Fiscal Year 2025 budget proposal includes significant allocations for cancer research and prevention initiatives, such as the Cancer Moonshot Program. This increased investment directly benefits companies like IBA, which specialize in technologies like proton therapy.

These government budgets and funding policies directly influence the adoption and growth of sophisticated cancer therapies. A robust funding environment can accelerate the development and accessibility of proton therapy centers, thereby broadening patient access to these cutting-edge treatments. Conversely, budget reductions can impede market expansion and limit the reach of such medical technologies.

Healthcare policy and reimbursement are pivotal for proton therapy adoption, directly impacting IBA's market penetration. In 2024, the US Medicare coverage for proton therapy, while expanding, still presents varied reimbursement rates across different cancer types and patient populations, influencing hospital investment decisions. For instance, the Centers for Medicare & Medicaid Services (CMS) continues to review and update its coverage policies, with potential adjustments in 2025 expected to further clarify reimbursement pathways for specific oncological indications, a key driver for IBA's growth.

The ongoing efforts by organizations like the International Medical Device Regulators Forum (IMDRF) to harmonize medical device regulations globally are crucial for companies like IBA. As of 2024, the IMDRF continues to work on aligning regulatory approaches, aiming to streamline market access. This harmonization directly impacts IBA's ability to efficiently introduce its innovative products across diverse international markets, potentially reducing the significant compliance costs associated with navigating disparate regulatory landscapes.

Specific regional developments also play a vital role. For instance, the UK's post-Brexit regulatory framework for medical devices, which is still evolving in 2024-2025, presents both opportunities and challenges for global manufacturers. Similarly, China's evolving regulatory environment for medical devices, including updates to its National Medical Products Administration (NMPA) requirements, directly influences IBA's market access strategies. Successfully navigating these varied requirements is key to expanding IBA's global footprint.

Geopolitical Stability and Trade Relations

Global geopolitical stability is a cornerstone for companies like IBA with extensive international operations. Stable relations between nations directly impact cross-border manufacturing, the efficiency of global supply chains, and the ease of accessing diverse markets. For instance, the ongoing trade tensions between major economies in 2024 continue to pose challenges for multinational corporations by potentially increasing tariffs and creating unpredictable market conditions.

Conversely, geopolitical friction or trade disputes can significantly disrupt these operations. Such disruptions can lead to increased operational costs due to supply chain bottlenecks, and can even limit access to crucial markets. For example, the imposition of new trade barriers in late 2024 could directly affect the cost of raw materials and the distribution of finished goods for companies with a global footprint.

- Supply Chain Resilience: In 2024, companies are investing heavily in supply chain diversification to mitigate risks arising from geopolitical instability.

- Trade Agreements: The renegotiation or establishment of trade agreements, such as those involving key Asian markets in late 2024, directly influences market access and operational costs.

- Geopolitical Risk Premiums: Financial markets often price in geopolitical risks, impacting the cost of capital for multinational firms.

- Market Access: Trade wars or sanctions can abruptly close off previously accessible markets, forcing strategic shifts in market entry and expansion plans.

Government Support for Innovation in Medical Technology

Government policies play a crucial role in fostering innovation within the medical technology sector, directly impacting companies like IBA. Initiatives such as direct grants, tax incentives for research and development, and the facilitation of collaborative research programs can significantly accelerate advancements in specialized fields like particle accelerator technology. This support is vital for companies to maintain their competitive edge.

In 2024, governments globally continued to prioritize healthcare innovation. For instance, the European Union's Horizon Europe program allocated substantial funding for health research and technological development, with a significant portion directed towards cutting-edge medical devices and therapies. This directly benefits companies like IBA by providing opportunities for grant funding and fostering partnerships that can drive their R&D forward.

These government-backed programs are designed to de-risk early-stage research and encourage private sector investment. By offering financial assistance and creating collaborative environments, governments help bridge the gap between scientific discovery and commercial application. This allows companies to invest more confidently in developing next-generation medical technologies.

- Government grants and tax credits: These financial incentives directly reduce the cost of R&D for companies, making ambitious projects more feasible.

- Collaborative research programs: By bringing together industry, academia, and government research institutions, these programs foster knowledge sharing and accelerate innovation.

- Regulatory support: Streamlined regulatory pathways for innovative medical devices can also be a form of government support, speeding up market entry.

Government funding and healthcare policy significantly shape the market for advanced medical technologies like proton therapy. For instance, the US President's Fiscal Year 2025 budget proposal includes substantial allocations for cancer research, directly benefiting companies like IBA. Reimbursement policies, such as those from the Centers for Medicare & Medicaid Services (CMS), continue to evolve, with potential adjustments in 2025 expected to clarify pathways for specific oncological indications, a key growth driver.

What is included in the product

The IBA PESTLE Analysis systematically examines the external macro-environmental forces impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of creating custom slides from scratch.

Economic factors

Global healthcare expenditure on oncology is a critical economic factor directly impacting the demand for advanced cancer treatment technologies like IBA's proton therapy systems and dosimetry solutions. Worldwide spending on cancer medicines and treatments is on a significant upward trajectory. Projections indicate this spending will reach an estimated $441 billion by 2029, highlighting a substantial and expanding market for innovative oncology care.

This escalating global investment in cancer treatment signifies a clear trend: healthcare systems are increasingly prioritizing and allocating greater resources towards effective cancer care. This growing capacity and willingness to invest in cutting-edge technologies, such as proton therapy, presents a favorable economic environment for companies like IBA that offer specialized solutions in this field.

The proton therapy market is booming, with significant expansion expected. The global market was valued at $1.29 billion in 2024 and is projected to reach $1.44 billion in 2025, demonstrating a healthy compound annual growth rate of 10.9%.

This upward trend is anticipated to continue, with the market forecast to hit $2.15 billion by 2029. Such robust economic expansion creates a very positive outlook for companies like IBA, a key player in the proton therapy sector.

Healthcare providers are scrutinizing the cost-effectiveness of major medical equipment purchases. Proton therapy, despite its substantial upfront cost, presents a compelling case for long-term value due to improved patient outcomes and fewer side effects, potentially lowering overall treatment expenses.

IBA's development of more compact and affordable proton therapy systems directly addresses this economic consideration. For instance, IBA's ProteusONE system, designed for single-room use, offers a significantly reduced footprint and lower capital expenditure compared to traditional multi-room facilities, making it more accessible to a broader range of healthcare institutions.

Inflation and Supply Chain Costs

Inflationary pressures are significantly impacting the cost of raw materials, manufacturing processes, and logistics for complex medical devices. For instance, the US Producer Price Index for manufactured goods saw a notable increase in early 2024, reflecting these rising input costs. IBA must navigate these escalating operational expenses while striving to maintain competitive pricing for its advanced medical technologies to ensure sustained profitability.

The ability to manage these rising costs is directly tied to IBA's operational efficiency. For example, global shipping costs, a key component of logistics, experienced volatility throughout 2023 and into 2024, impacting the landed cost of components and finished goods. Strategic sourcing of materials and optimizing supply chain networks are therefore crucial strategies for IBA to effectively mitigate the economic headwinds brought on by persistent inflation.

- Rising Input Costs: Global inflation, as evidenced by a 3.4% year-over-year increase in the US CPI for goods in April 2024, directly inflates the cost of specialized components and manufacturing.

- Logistical Challenges: Fluctuations in freight rates, with some routes seeing double-digit percentage increases in early 2024 compared to the previous year, add to the overall cost of bringing complex medical devices to market.

- Pricing Strategy: Maintaining competitive pricing in a high-inflation environment requires careful cost management and potentially innovative pricing models to absorb some of the increased operational expenses.

- Supply Chain Resilience: Strategic partnerships with key suppliers and diversification of sourcing locations are vital to insulate IBA from supply chain disruptions exacerbated by economic instability.

Financial Performance and Backlog Conversion

IBA's financial health is robust, evidenced by a 7% increase in net sales, reaching €498.2 million in 2024. This growth, coupled with a return to profitability, highlights the company's strong economic standing.

The company's substantial backlog of €1.5 billion is a key indicator of future revenue stability. This high backlog signals consistent demand for IBA's offerings, setting a positive trajectory for 2025.

- Net Sales Growth: 7% increase to €498.2 million in 2024.

- Profitability: Return to profitability achieved in 2024.

- Backlog Value: €1.5 billion, ensuring future revenue visibility.

- Demand Indicator: High backlog signifies sustained customer demand.

Global healthcare spending on oncology continues to rise, with the cancer drug market alone projected to reach $441 billion by 2029. This expansion fuels demand for advanced treatment technologies like IBA's proton therapy systems, as healthcare providers increasingly invest in effective cancer care. The proton therapy market itself is experiencing robust growth, valued at $1.29 billion in 2024 and expected to reach $1.44 billion in 2025, with a projected compound annual growth rate of 10.9%.

Despite strong market growth, inflationary pressures are impacting operational costs. For instance, the US CPI for goods saw a 3.4% year-over-year increase in April 2024, affecting raw materials and logistics. IBA's ability to manage these rising input costs, evidenced by a 7% increase in net sales to €498.2 million in 2024 and a return to profitability, is critical. The company's substantial €1.5 billion backlog further underscores sustained demand and future revenue stability.

| Metric | 2024 Value | 2025 Projection | Trend |

| Global Oncology Drug Market | N/A | $441 Billion (by 2029) | Increasing |

| Proton Therapy Market Value | $1.29 Billion | $1.44 Billion | Growing (10.9% CAGR) |

| IBA Net Sales | €498.2 Million | N/A | Increased 7% |

| IBA Backlog | €1.5 Billion | N/A | High, indicating future demand |

| US CPI (Goods, YoY) | 3.4% (April 2024) | N/A | Inflationary Pressure |

Same Document Delivered

IBA PESTLE Analysis

The preview shown here is the exact IBA PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of the International Bar Association is delivered exactly as shown, no surprises, providing actionable insights.

The content and structure of this IBA PESTLE analysis shown in the preview is the same document you’ll download after payment, offering a complete strategic overview.

Sociological factors

The increasing global incidence of cancer, projected to affect millions more individuals annually, directly fuels demand for sophisticated treatments. For instance, the World Health Organization (WHO) estimated 19.3 million new cancer cases globally in 2020, a figure expected to rise significantly by 2030.

Coupled with this, the aging population demographic is expanding worldwide, with a greater proportion of people living into their later years. This demographic shift means more individuals are entering age groups with higher cancer prevalence, further amplifying the need for advanced medical interventions.

Consequently, there's a growing market for precise and effective therapies, such as proton therapy. These advanced treatments offer the potential for improved patient outcomes and fewer side effects compared to traditional methods, making them increasingly sought after by patients and healthcare providers alike.

Healthcare professionals and patients are increasingly recognizing proton therapy's advantages, like its pinpoint accuracy and capacity to protect surrounding healthy tissues. This growing understanding is a significant driver for its wider implementation.

Educational efforts and documented positive patient results are boosting demand for proton therapy. For instance, by the end of 2024, the number of proton therapy centers globally is projected to exceed 50, reflecting this heightened awareness and investment.

Societal preferences are strongly shifting towards treatments that minimize patient discomfort and recovery time. The demand for non-invasive or minimally invasive medical procedures is on the rise, with patients actively seeking options that reduce side effects and enhance their overall quality of life. This trend directly benefits advanced therapies like proton therapy.

Proton therapy’s ability to deliver highly precise radiation to tumor sites, sparing surrounding healthy tissue, makes it an exceptionally attractive option. This precision is particularly crucial for treating cancers located near vital organs, where traditional radiation methods carry a higher risk of collateral damage. In 2024, the global proton therapy market was valued at approximately $700 million, with projections indicating significant growth driven by this patient-centric demand.

Healthcare Accessibility and Equity

Societal concerns about fair access to advanced medical treatments, like proton therapy, directly impact the market for specialized equipment. Disparities in treatment options highlight the need for broader accessibility. For instance, in 2024, reports indicated that while the number of proton therapy centers was growing, patient access remained concentrated in specific geographic and socioeconomic groups, underscoring equity challenges.

Efforts to improve healthcare equity, such as developing more compact proton therapy systems or expanding insurance reimbursement policies, are crucial for reaching a wider patient base. By 2025, several initiatives are expected to be in place to address these issues, potentially lowering costs and increasing availability. This would allow more individuals to benefit from these cutting-edge therapies.

- Growing demand for equitable healthcare access: Public discourse and patient advocacy groups are increasingly focused on ensuring all individuals have access to the best available medical treatments, regardless of their background or location.

- Impact of reimbursement policies: Changes in insurance coverage and government healthcare programs significantly influence patient affordability and, consequently, the market penetration of high-cost medical technologies like proton therapy.

- Technological advancements for accessibility: Innovations in medical device engineering, aiming for smaller, more cost-effective systems, are key to democratizing access to advanced treatments by the mid-2020s.

Public Perception and Trust in Advanced Medical Technologies

Public trust is a cornerstone for the adoption of advanced medical technologies like proton therapy. Positive clinical outcomes, like improved survival rates and reduced side effects compared to traditional treatments, directly influence public perception. For instance, a 2024 study indicated that patient satisfaction scores for proton therapy centers often exceed 90%, a key indicator of trust.

IBA's focus on safety and efficacy, coupled with transparent communication about the benefits and risks of its proton therapy solutions, is vital. The company's B Corp certification, a testament to its commitment to social and environmental responsibility, further bolsters this trust. This certification, which requires rigorous assessment of governance, employees, community, and environment, signals a dedication beyond profit, resonating with a public increasingly concerned with ethical business practices.

- Public trust in proton therapy is directly linked to demonstrated clinical success and robust safety records.

- Clear communication about the benefits, such as reduced long-term side effects, is essential for societal acceptance.

- IBA's B Corp certification enhances its reputation for ethical operations, fostering greater public confidence.

- Patient satisfaction rates, often exceeding 90% in proton therapy centers, reflect positive public perception and trust.

Societal preferences are increasingly leaning towards treatments that minimize patient suffering and shorten recovery periods, directly boosting the appeal of advanced therapies like proton therapy. This growing demand for less invasive procedures that enhance quality of life is a key driver for market expansion.

Public concern for equitable access to cutting-edge medical care is growing, highlighting disparities in treatment availability. Initiatives aimed at making proton therapy more affordable and accessible, such as the development of more compact systems, are crucial for broader adoption by 2025.

Public trust in advanced medical technologies is built on proven clinical efficacy and transparent communication regarding benefits and risks. Patient satisfaction rates exceeding 90% in proton therapy centers underscore this positive public perception.

IBA's commitment to social responsibility, evidenced by its B Corp certification, further solidifies public trust by demonstrating ethical business practices beyond profit motives.

Technological factors

Continuous innovation in particle accelerator technology is fundamental to IBA's core business, directly impacting the precision and efficiency of cancer treatments. For instance, IBA's proton therapy systems are seeing advancements toward more compact designs, making them more accessible and cost-effective for a wider range of medical facilities.

These technological strides extend to enhancing radiopharmaceutical production capabilities and refining dosimetry solutions, which are critical for accurately delivering radiation doses. The company's commitment to R&D in this area is evident in its ongoing development of next-generation accelerators, aiming to further broaden the reach and application of proton therapy globally.

The increasing integration of artificial intelligence (AI) and machine learning into medical devices is a significant technological trend, with AI in healthcare projected to reach $187.95 billion by 2030, growing at a compound annual growth rate of 37.3% from 2023. For IBA, this translates to opportunities for AI-driven enhancements in treatment planning, image guidance, and predictive analytics for patient outcomes, ultimately boosting the precision and effectiveness of their proton therapy systems.

These advancements allow for more personalized treatment strategies and potentially better patient prognoses. However, the evolving regulatory landscape for AI in medical devices, including guidelines from bodies like the FDA, presents a crucial compliance challenge that IBA must navigate to ensure the safe and effective deployment of these technologies.

Sustained investment in research and development (R&D) is crucial for IBA to maintain its competitive edge in the particle accelerator market. The company has demonstrated a commitment to future growth through ongoing R&D initiatives. For instance, its joint venture, PanTera, is dedicated to the production of Actinium-225, a key radioisotope for cancer therapy, highlighting a strategic focus on innovation in medical applications.

IBA's dedication to R&D is further evidenced by the launch of new products like CASSY®4, designed for radiotracer production. This continuous introduction of advanced solutions ensures IBA remains at the forefront of technological advancements in its field, catering to evolving market needs and solidifying its leadership position.

Miniaturization and Cost Reduction of Systems

The ongoing trend towards miniaturization and cost reduction in proton therapy systems, including cyclotrons and linear accelerators, is a significant technological driver. This makes the advanced cancer treatment more accessible. For instance, by 2024, some vendors were showcasing compact cyclotron designs aimed at reducing the footprint and installation complexity, potentially lowering capital expenditure by 15-20% compared to earlier generations.

These advancements are pivotal for expanding market penetration beyond major research institutions. Smaller, more affordable systems can enable community hospitals and specialized cancer centers to adopt proton therapy. This shift is anticipated to broaden patient access, with projections suggesting a 10% increase in the number of operational proton therapy centers globally by the end of 2025, driven by these technological efficiencies.

- Miniaturized cyclotrons are reducing the physical space and infrastructure requirements for proton therapy centers.

- Cost reduction efforts are making the technology financially viable for a wider array of healthcare providers.

- Technological efficiencies are expected to increase the number of accessible proton therapy treatment sites.

Innovation in Dosimetry and Sterilization Solutions

IBA's commitment to technological advancement is evident beyond its proton therapy systems, with significant developments in dosimetry and sterilization. In 2023, IBA continued to strengthen its dosimetry offerings, crucial for quality assurance in radiation therapy, by integrating new technologies to ensure precise radiation delivery. This focus on innovation is a key driver for their diversified growth strategy.

The company's sterilization solutions, serving both medical devices and the food industry, also benefit from ongoing technological upgrades. A notable example of this strategic expansion was the acquisition of RadCal, a move designed to enhance IBA's dosimetry capabilities. This acquisition directly bolsters their technological portfolio, demonstrating a clear path toward expanding market reach and revenue streams in these adjacent sectors.

- Dosimetry Enhancement: IBA's acquisition of RadCal in early 2024 significantly expanded its dosimetry product line, aiming to capture a larger share of the quality assurance market in radiation oncology.

- Sterilization Market Growth: The global market for radiation sterilization solutions, a key area for IBA, was projected to reach approximately $1.1 billion by 2025, driven by increasing demand for sterile medical devices.

- Innovation Pipeline: IBA consistently invests in R&D for both dosimetry and sterilization, with a pipeline of new products expected to launch between 2024 and 2025 to address evolving industry standards and customer needs.

Technological advancements are central to IBA's strategy, particularly in making proton therapy more accessible. Miniaturization efforts are leading to smaller, more cost-effective accelerator designs, with some vendors showcasing compact cyclotrons by 2024 that could reduce capital expenditure by up to 20%. This trend is projected to increase the number of operational proton therapy centers globally by 10% by the end of 2025.

IBA's investment in R&D, including its joint venture PanTera for Actinium-225 production and new products like CASSY®4 for radiotracer production, underscores its commitment to innovation. Furthermore, the acquisition of RadCal in early 2024 bolstered IBA's dosimetry capabilities, a critical component in the radiation sterilization market which was projected to reach $1.1 billion by 2025.

| Technological Area | Key Advancement | Impact on IBA | Market Projection/Data Point |

|---|---|---|---|

| Proton Therapy Systems | Miniaturization and cost reduction of cyclotrons and linear accelerators | Increased accessibility for healthcare providers, broader market penetration | 10% increase in operational centers by end of 2025; potential 15-20% reduction in capital expenditure by 2024 |

| Radiopharmaceutical Production | Development of key radioisotopes (e.g., Actinium-225) and radiotracer production systems | Expansion of therapeutic offerings, enhanced R&D capabilities | PanTera joint venture for Actinium-225 production |

| Dosimetry & Sterilization | Integration of new technologies for precise radiation delivery and acquisition of RadCal | Strengthened quality assurance offerings, expanded sterilization market reach | Global radiation sterilization market projected at $1.1 billion by 2025; RadCal acquisition in early 2024 |

| Artificial Intelligence | Integration of AI/ML into medical devices for treatment planning and analytics | Enhanced precision and effectiveness of proton therapy systems, personalized treatment strategies | AI in healthcare projected to reach $187.95 billion by 2030 (37.3% CAGR from 2023) |

Legal factors

The medical device industry, including companies like IBA, faces a complex and dynamic legal landscape. The EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have significantly tightened requirements, impacting product lifecycle management and market access. For instance, the MDR implementation has led to a backlog of device certifications, with many manufacturers needing to re-evaluate their entire product portfolio.

In the United States, the Food and Drug Administration (FDA) continues to enforce stringent premarket approval processes and post-market surveillance. Changes in FDA guidance, such as those related to cybersecurity for medical devices, necessitate ongoing investment in compliance and product updates. Similarly, the UK's Medicines and Healthcare products Regulatory Agency (MHRA) has its own set of evolving rules post-Brexit, requiring manufacturers to navigate distinct conformity assessment routes.

The increasing interconnectedness of medical devices has propelled cybersecurity to the forefront of regulatory concerns. New laws like the EU AI Act and updated guidance from the FDA are imposing rigorous cybersecurity mandates on medical device manufacturers. For instance, in 2024, the FDA released updated premarket cybersecurity guidance, emphasizing the need for manufacturers to address vulnerabilities throughout a device's lifecycle.

IBA must fortify its systems against evolving cyber threats to adhere to these escalating requirements. Non-compliance can lead to significant penalties and reputational damage. The global cybersecurity market for healthcare is projected to reach $34.1 billion by 2025, highlighting the substantial investment and attention this area commands.

IBA, a producer of advanced medical technology, faces stringent global regulations regarding product liability and safety. Compliance with standards such as ISO 13485, which aligns with the FDA's QMSR, is critical for guaranteeing device efficacy and patient well-being. This adherence not only mitigates legal exposure but also underpins IBA's market standing.

Failure to meet these rigorous safety benchmarks can result in substantial financial penalties and reputational damage. For instance, in 2023, medical device recalls due to safety concerns led to an estimated $1.5 billion in costs for the industry, highlighting the significant financial implications of non-compliance.

Intellectual Property Rights and Patent Protection

Protecting its substantial intellectual property, especially concerning particle accelerator technology, is paramount for IBA's ongoing competitive edge. This involves actively managing and defending its patent portfolio to deter unauthorized use and ensure it can capitalize on its significant research and development expenditures.

A strong patent strategy is essential for IBA to maintain its market leadership. For instance, in 2023, the company continued to invest heavily in R&D, with a focus on developing next-generation proton therapy systems, underscoring the importance of safeguarding these advancements.

- Patent Portfolio Strength: IBA actively manages a global portfolio of patents covering its core technologies in particle acceleration and medical applications.

- R&D Investment Protection: Robust patent enforcement is critical to recouping the substantial investments made in developing innovative solutions, such as their latest compact proton therapy systems.

- Market Exclusivity: Patents provide IBA with a period of market exclusivity, allowing it to benefit from its technological innovations and maintain a competitive advantage in specialized healthcare sectors.

- Litigation and Enforcement: In 2024, the company remained vigilant against potential infringements, ready to pursue legal avenues to protect its intellectual property rights.

Anti-Corruption and Compliance with Healthcare Laws

Operating globally, IBA must navigate a complex web of anti-corruption and healthcare-specific laws. This includes adhering to regulations like the U.S. Foreign Corrupt Practices Act (FCPA) and similar anti-bribery statutes worldwide, alongside stringent healthcare compliance mandates such as the U.S. Anti-Kickback Statute and the False Claims Act.

Non-compliance can lead to severe penalties. For instance, in 2023, a major pharmaceutical company paid over $300 million to settle allegations of violating anti-kickback statutes, highlighting the significant financial risks involved. IBA's commitment to robust compliance programs, including thorough due diligence on partners and agents, is therefore paramount to safeguarding its operations and reputation.

- Global Anti-Corruption Laws: Adherence to regulations like the FCPA and UK Bribery Act is critical for international business.

- Healthcare Specific Regulations: Compliance with anti-kickback and fraud statutes within the healthcare sector is non-negotiable.

- Financial Repercussions: Significant fines and legal penalties, often in the hundreds of millions of dollars, can be imposed for violations.

- Reputational Risk: Breaches of anti-corruption and healthcare laws can severely damage a company's standing and trust.

Navigating the intricate legal frameworks governing medical devices is crucial for IBA's global operations. Regulations like the EU's MDR and IVDR, alongside the FDA's stringent approval processes, demand continuous adaptation and investment in compliance. The increasing focus on cybersecurity, exemplified by updated FDA guidance in 2024, necessitates robust protection measures for connected medical technologies.

Product liability and safety standards, such as ISO 13485, are paramount. Failure to meet these benchmarks can result in substantial financial penalties, as seen with industry recalls costing an estimated $1.5 billion in 2023. Protecting intellectual property, particularly for advanced technologies like proton therapy systems, remains a key legal imperative for IBA, with ongoing vigilance against infringement in 2024.

Global operations also require strict adherence to anti-corruption and healthcare-specific laws, including the FCPA and anti-kickback statutes. Violations can lead to significant fines, with settlements in the hundreds of millions of dollars, as demonstrated in 2023, underscoring the critical need for comprehensive compliance programs.

| Regulatory Area | Key Regulations/Focus | Impact on IBA | Example/Data Point (2023-2024) |

|---|---|---|---|

| Medical Device Regulation | EU MDR/IVDR, FDA Approval, MHRA | Market access, product lifecycle management, compliance costs | MDR implementation backlog; FDA cybersecurity guidance update (2024) |

| Product Liability & Safety | ISO 13485, QMSR | Patient safety, legal exposure, reputational risk | Industry recalls cost ~$1.5 billion (2023) |

| Intellectual Property | Patent Law, R&D Protection | Competitive advantage, market exclusivity, R&D recoupment | Continued investment in proton therapy R&D (2023) |

| Anti-Corruption & Healthcare Compliance | FCPA, UK Bribery Act, Anti-Kickback Statute | Financial penalties, reputational damage, operational integrity | Pharma settlement of >$300 million for anti-kickback violations (2023) |

Environmental factors

As a certified B Corporation, IBA is deeply committed to robust social and environmental performance, actively developing its 2024-25 ESG strategy to meet these obligations.

The MedTech sector, including companies like IBA, faces growing regulatory demands and heightened investor scrutiny, pushing for more transparent sustainability reporting and the integration of environmental factors into core business practices.

For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, mandates detailed ESG disclosures, impacting supply chains and operational strategies across the industry.

The environmental impact of medical device waste, particularly specialized plastics and components from particle accelerators, is a significant concern. IBA must implement comprehensive strategies for waste reduction, sorting, and recycling to meet stringent environmental regulations and public demand for sustainable practices throughout a product's life cycle.

In 2023, the global medical waste management market was valued at approximately $40 billion, with a projected compound annual growth rate (CAGR) of 6.5% through 2030, highlighting the increasing focus on proper disposal and recycling. This trend underscores the critical need for companies like IBA to invest in advanced waste management solutions, potentially including partnerships with specialized recycling firms to handle complex materials.

Particle accelerators are notoriously energy-hungry, with large facilities consuming megawatts of power. This makes energy efficiency a critical environmental factor for companies like IBA. For instance, the Large Hadron Collider (LHC) at CERN, a prime example of a large-scale accelerator, has an annual energy consumption comparable to that of a small city.

IBA's focus on reducing its carbon footprint through optimized energy consumption in manufacturing and product design is therefore paramount. This commitment not only addresses environmental responsibility but also directly impacts operational costs, a crucial element in their business strategy as global decarbonization efforts intensify. Their development of more efficient accelerator technologies directly contributes to lowering the environmental impact of scientific research and medical applications.

Supply Chain Sustainability and Ethical Sourcing

Ensuring a sustainable and ethically sourced supply chain is a critical environmental consideration for medical technology firms. This involves actively reducing the ecological footprint associated with raw material acquisition, manufacturing processes, and logistics. For instance, companies are increasingly scrutinizing their suppliers for responsible waste management and reduced carbon emissions in production, with many aiming for net-zero targets by 2040 or earlier.

IBA's commitment to enhanced supply chain oversight directly addresses these evolving environmental expectations. This focus is crucial as consumers and regulators alike demand greater transparency regarding a product's lifecycle impact. Reports from 2024 indicate a significant rise in investor interest in companies demonstrating robust ESG (Environmental, Social, and Governance) practices, particularly within the healthcare sector.

- Supply Chain Footprint: Medical tech companies are under pressure to quantify and reduce the environmental impact of their entire supply chain, from raw material extraction to end-of-life product disposal.

- Ethical Sourcing Mandates: There's a growing trend towards mandatory ethical sourcing policies, ensuring that materials are not linked to human rights abuses or environmental degradation.

- Circular Economy Integration: Companies are exploring circular economy principles, aiming to design products for longevity, repairability, and recyclability to minimize waste.

- Regulatory Scrutiny: Environmental regulations concerning supply chain transparency and sustainability are becoming more stringent globally, impacting sourcing decisions and operational practices.

Climate Change and Resource Scarcity

Climate change and the increasing scarcity of natural resources pose significant operational risks for businesses like IBA. Fluctuations in weather patterns can disrupt supply chains, impacting the availability and cost of raw materials. For instance, the International Energy Agency reported in 2024 that extreme weather events, intensified by climate change, led to a 7% increase in global commodity prices in the preceding year, directly affecting input costs for many industries.

To mitigate these environmental factors, IBA must proactively adapt. Investing in renewable energy sources, such as solar or wind power, can secure a more stable and cost-effective energy supply, reducing reliance on fossil fuels which are subject to price volatility and environmental regulations. By 2025, the global renewable energy market is projected to reach over $1.5 trillion, highlighting the significant economic opportunity in this transition.

Furthermore, adopting resource-efficient production methods is paramount for long-term sustainability and competitiveness. This includes minimizing waste, optimizing water usage, and exploring circular economy principles. Companies that prioritize these strategies in 2024 and 2025 are better positioned to navigate regulatory changes and growing consumer demand for environmentally responsible products.

- Supply Chain Disruption: Extreme weather events, linked to climate change, caused a 7% global commodity price hike in 2023.

- Energy Transition: The renewable energy market is expected to exceed $1.5 trillion globally by 2025.

- Resource Efficiency: Implementing waste reduction and water optimization strategies enhances resilience and market appeal.

- Regulatory Landscape: Evolving environmental regulations necessitate proactive adaptation for sustained operations.

Environmental factors significantly shape IBA's operational landscape, from energy consumption to waste management. The increasing global focus on sustainability, driven by both regulatory pressures like the EU's CSRD and investor demand for ESG performance, compels companies like IBA to integrate eco-friendly practices. This includes addressing the energy intensity of particle accelerators and managing specialized medical waste.

IBA's commitment to a sustainable supply chain is crucial, with a growing emphasis on ethical sourcing and circular economy principles. The company must navigate the risks posed by climate change, such as supply chain disruptions and resource scarcity, while capitalizing on opportunities in the burgeoning renewable energy market, projected to exceed $1.5 trillion by 2025.

| Environmental Factor | Impact on IBA | Mitigation/Opportunity | Relevant Data (2023-2025) |

|---|---|---|---|

| Energy Consumption | High operational costs, carbon footprint | Invest in energy-efficient technologies, renewable energy sources | Large accelerators consume megawatts; global renewable energy market >$1.5T by 2025 |

| Waste Management | Regulatory compliance, public perception | Implement robust waste reduction, sorting, and recycling programs | Global medical waste market ~$40B (2023), CAGR 6.5% |

| Supply Chain Sustainability | Reputational risk, regulatory compliance | Enhance supplier oversight, promote ethical sourcing and circular economy | Increased investor interest in ESG; net-zero targets by 2040 |

| Climate Change & Resource Scarcity | Supply chain disruption, cost volatility | Diversify energy sources, optimize resource usage | Extreme weather caused 7% commodity price hike (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading economic institutions, governmental bodies, and reputable market research firms. We integrate insights from global economic indicators, technological advancements, and evolving social trends to provide a comprehensive view.