IBA Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBA Bundle

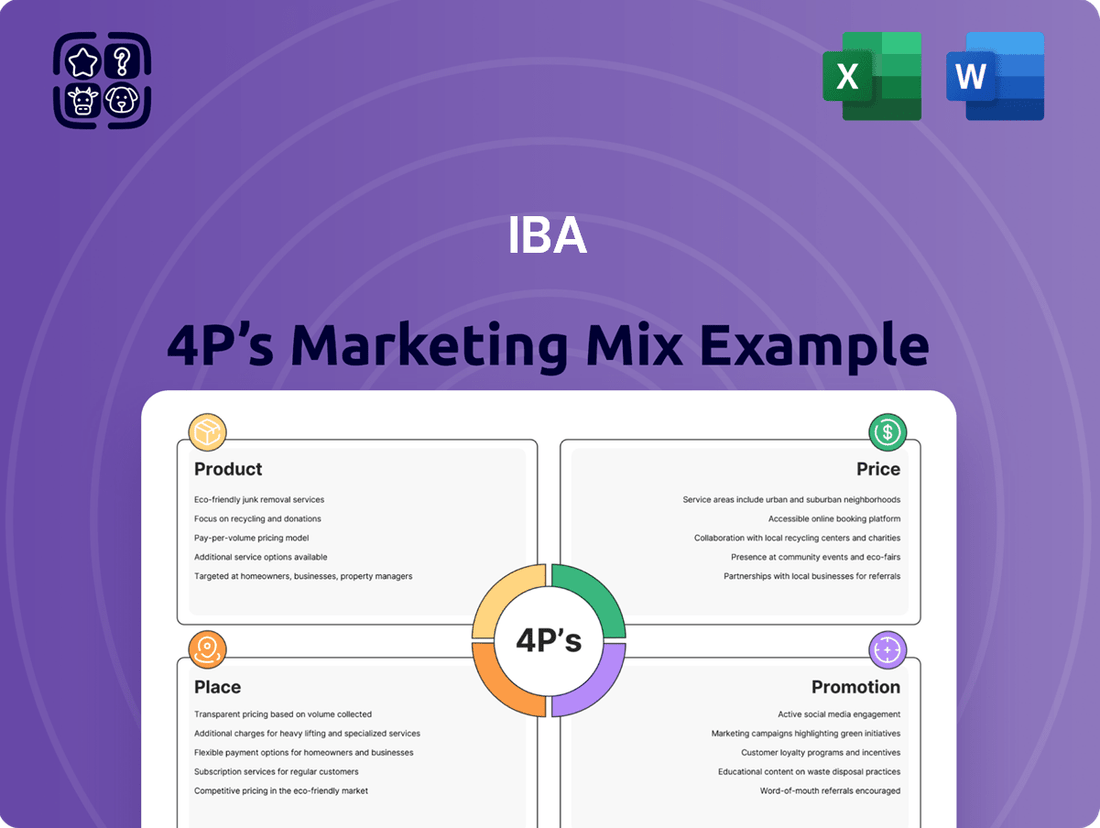

Uncover the strategic brilliance behind IBA's marketing with our comprehensive 4Ps analysis, dissecting their Product, Price, Place, and Promotion. This in-depth report goes beyond the surface, revealing the interconnected strategies that drive their market dominance.

Gain a competitive edge by understanding how IBA crafts its product offerings, sets its pricing, chooses its distribution channels, and executes its promotional campaigns. This analysis is your key to unlocking actionable insights.

Save valuable time and resources. Access a professionally written, editable, and presentation-ready 4Ps Marketing Mix Analysis of IBA, perfect for business professionals, students, and consultants seeking strategic advantage.

Product

IBA's proton therapy systems, such as ProteusONE and ProteusPLUS, represent a significant product offering in cancer treatment. These advanced machines deliver highly targeted radiation, a key differentiator for minimizing harm to surrounding healthy tissues. This precision is crucial for improving patient outcomes and reducing side effects.

The market for proton therapy systems saw IBA solidify its position as a dominant player. In 2024, IBA captured an impressive approximately 60% of the global market share for these specialized medical devices. This substantial market penetration underscores IBA's technological leadership and the widespread adoption of its innovative solutions.

Dosimetry Solutions are a cornerstone of IBA's offering, providing critical tools for quality assurance in radiation therapy and medical imaging. These solutions, encompassing both devices and software, ensure accurate radiation dose measurement, directly impacting patient safety and the effectiveness of treatments. In Q1 2024, IBA bolstered this segment significantly with the acquisition of Radcal Corporation, enhancing their medical imaging capabilities and expanding their footprint in the United States.

RadioPharma Solutions, a key division of IBA, focuses on providing essential equipment and expertise for the production of radioisotopes. These isotopes are vital for advancements in medical imaging and cancer treatment, directly impacting patient care. IBA's commitment to innovation is evident with the Q1 2025 launch of CASSY, a compact synthesizer designed to streamline radiotracer production, especially for radiometals, promising greater efficiency for healthcare providers.

Further solidifying its market position, IBA is a significant player in PanTera, a collaborative effort to combat the global scarcity of actinium-225. This initiative, with a major production facility slated for commercial operations by 2029, underscores IBA's strategic approach to addressing critical supply chain challenges in the radiopharmaceutical sector.

Industrial Solutions (Other Accelerators)

IBA's industrial solutions leverage particle accelerator technology for diverse applications beyond healthcare, including the crucial sterilization of medical devices and food products. This highlights a strategic expansion of their core competency into vital industrial processes.

The company is actively exploring innovative environmental uses for its Rhodotron accelerators, notably in water purification to tackle persistent pollutants like PFAS, often referred to as 'forever chemicals'. This demonstrates a commitment to addressing pressing global environmental challenges.

The growth in this sector is particularly noteworthy, with IBA reporting the sale of 14 industrial accelerator systems in the first half of 2024. By the third quarter of 2024, the company had achieved a total of 30 machines sold year-to-date, indicating strong market demand and successful commercialization of these industrial applications.

- Product: Industrial accelerators for sterilization and environmental solutions.

- Applications: Medical device sterilization, food irradiation, water purification (PFAS treatment).

- Growth: 14 systems sold in H1 2024, 30 machines sold YTD as of Q3 2024.

- Innovation: Rhodotron technology targeting 'forever chemicals'.

Services and Innovation

Beyond just selling equipment, IBA provides crucial services like maintenance contracts, installation, and system upgrades for their proton therapy and accelerator technologies. These services are a substantial revenue driver. For instance, IBA saw a 7% increase in Proton Therapy service sales in 2024 compared to the previous year.

Innovation is a cornerstone of IBA's strategy. The company consistently allocates resources to research and development, ensuring they remain at the forefront of medical technology. This commitment is evident in their ongoing investments aimed at future growth and the introduction of new products, such as the CASSY system.

- Service Revenue Growth: Proton Therapy service sales grew by 7% in 2024 over 2023.

- R&D Investment: Continuous investment in R&D fuels future growth and innovation.

- New Product Development: Recent launches, like CASSY, showcase ongoing product innovation.

- Comprehensive Offerings: Services complement equipment sales, providing a complete solution for customers.

IBA's product portfolio spans advanced proton therapy systems like ProteusONE and ProteusPLUS, alongside Dosimetry and RadioPharma Solutions critical for radiation therapy and isotope production. Their industrial accelerators are also key, serving sterilization and environmental applications. This diverse product range positions IBA as a leader in specialized medical and industrial technologies, with significant market share in proton therapy.

| Product Category | Key Offerings | Market Position/Key Data (2024/2025) |

|---|---|---|

| Proton Therapy Systems | ProteusONE, ProteusPLUS | ~60% global market share (2024) |

| Dosimetry Solutions | Quality assurance devices & software | Acquisition of Radcal Corporation (Q1 2024) |

| RadioPharma Solutions | Isotope production equipment | Launch of CASSY synthesizer (Q1 2025) |

| Industrial Accelerators | Sterilization, environmental solutions | 30 machines sold YTD as of Q3 2024 |

What is included in the product

This analysis provides a comprehensive, data-driven examination of an IBA's marketing strategies across Product, Price, Place, and Promotion.

It's designed for professionals seeking actionable insights into an IBA's market positioning and competitive landscape.

Simplifies complex marketing strategies by providing a clear, actionable framework for understanding and improving product, price, place, and promotion.

Place

IBA leverages a global direct sales force to directly engage with key clients like hospitals, cancer centers, and industrial facilities. This strategy facilitates in-depth consultations and the development of customized solutions for intricate medical and industrial needs.

The company's technologies are deployed across numerous regions, demonstrating a substantial worldwide footprint in both healthcare and industrial sectors. For instance, in 2024, IBA reported a significant portion of its revenue derived from its global sales network, underscoring the effectiveness of its direct market approach.

IBA actively cultivates strategic partnerships to broaden its market presence and enrich its product and service portfolio. A key example is its collaboration with Apollo Hospitals Enterprise Ltd (AHEL), designed to deliver specialized proton therapy training and educational programs for IBA's clientele across Asia, with a specific focus on India.

Further solidifying its forward-looking strategy, IBA participated in a joint strategic investment in mi2-factory, a German startup specializing in power semiconductor chips, during the first quarter of 2025. This move underscores IBA's commitment to innovation and its expansion into critical technological sectors.

IBA's commitment to its customers extends through a comprehensive installation and service network, crucial for the high-value particle accelerator systems it provides. This robust infrastructure ensures clients receive expert support from initial setup through ongoing operations.

As of the first quarter of 2025, IBA is actively engaged in 38 proton therapy projects, with 9 installations currently in progress. Furthermore, 44 existing IBA proton therapy sites are actively generating service revenues globally, underscoring the extensive reach and operational efficiency of their support system.

Regional Market Focus

IBA's marketing strategy zeroes in on specific geographical regions with significant growth opportunities for proton therapy. Their active pipelines and concentrated efforts are particularly evident in the United States and Asia, reflecting a deliberate choice to maximize impact in these key markets.

This regional focus is crucial for efficient resource deployment and tailored marketing campaigns. By concentrating on areas with high demand and favorable regulatory environments, IBA can better address the unique needs and challenges of each market, fostering stronger relationships and driving adoption.

- United States: A leading market for proton therapy, with a significant number of operational centers and ongoing development projects.

- Asia: Showing rapid expansion, with countries like China and South Korea investing heavily in advanced cancer treatment technologies.

- Market Penetration: IBA's strategy aims to capture a substantial share of these growing markets through targeted sales and support initiatives.

Participation in Industry Events and Trade Shows

Participation in industry events and trade shows, while not a direct sales channel, is crucial for IBA's marketing strategy. These events allow them to demonstrate their technological advancements and connect with potential customers and investors. For instance, their Capital Markets Day in April 2025 provided a prime opportunity to highlight their innovations and build crucial industry relationships.

These gatherings are vital for raising awareness and cultivating connections within the medical technology and industrial sectors. By actively participating, IBA can reinforce its brand presence and foster a deeper understanding of its offerings among key stakeholders.

- Technology Showcase: Events serve as a stage to exhibit IBA's cutting-edge technology to a targeted audience.

- Relationship Building: Direct engagement at conferences facilitates stronger connections with potential clients and investors.

- Market Insight: Participation offers valuable opportunities to gather market intelligence and understand competitor activities.

- Brand Visibility: Increased presence at industry events directly contributes to enhanced brand recognition and reputation.

IBA's place strategy focuses on direct engagement with key clients in specific high-growth regions, particularly the United States and Asia. This targeted approach is supported by a robust installation and service network, ensuring comprehensive customer support. Strategic partnerships and investments further enhance market penetration and technological advancement.

| Region | IBA Projects (Q1 2025) | Installations in Progress (Q1 2025) | Active Service Sites (Proton Therapy) |

|---|---|---|---|

| United States | Significant | Ongoing | Substantial |

| Asia | Rapidly Expanding | Increasing | Growing |

| Global Footprint | 38 Proton Therapy Projects | 9 Installations | 44 Sites |

What You See Is What You Get

IBA 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive IBA 4P's Marketing Mix Analysis document you will receive instantly after purchase. This means you can confidently assess its quality and relevance before committing. You'll gain immediate access to the complete, ready-to-use analysis, ensuring no surprises and a seamless experience.

Promotion

Direct sales and technical consultations are critical for promoting IBA's specialized, high-value products. This approach facilitates detailed discussions on the technology's advantages, customization, and specific applications for hospitals and industrial clients, directly addressing their needs.

IBA's focus on direct engagement is crucial given the significant investment and technical complexity of their solutions. This personal interaction ensures clients fully understand the value proposition and potential ROI, a strategy that has proven effective in their active project pipeline.

In 2024, IBA reported a strong pipeline of potential projects, underscoring the success of their direct sales model. This direct engagement allows for tailored solutions, crucial for products with long sales cycles and substantial upfront costs, ensuring alignment with customer requirements.

IBA actively cultivates its industry presence by engaging in prominent conferences and publishing scientific findings. This strategic approach, including presentations at key medical and scientific gatherings, reinforces IBA's position as an innovator and expert in its field.

The company's commitment to showcasing clinical efficacy and technological advancements through peer-reviewed publications and symposia directly targets the global medical and scientific community. This outreach is crucial for building credibility and awareness.

Furthermore, IBA's Capital Markets Day, scheduled for April 2025, is a significant promotional event designed to articulate the company's strategic direction and future vision to investors and stakeholders, highlighting its forward-looking approach.

IBA leverages public relations to communicate key developments, such as securing new contracts or achieving technological advancements. For instance, their full-year 2024 earnings report and Q1 2025 business updates were disseminated through press releases, ensuring transparency for investors and stakeholders.

These communications are crucial for shaping market perception and demonstrating IBA's progress. By highlighting milestones and financial performance, they aim to build investor confidence and support the company's valuation.

Digital Presence and Content Marketing

IBA cultivates a robust digital presence, anchored by its corporate website, a vital conduit for product details, service offerings, investor relations, and company news. This platform is crucial for disseminating in-depth information, including technical specifications and compelling case studies, thereby educating potential clients and stakeholders on the tangible benefits of their technological solutions.

Content marketing plays a significant role in this strategy, with efforts likely focused on creating and sharing valuable, relevant content to attract and retain a clearly defined audience. This could encompass white papers, blog posts, and webinars designed to showcase expertise and thought leadership within their industry.

As of early 2024, businesses are increasingly investing in digital content, with global digital ad spending projected to exceed $600 billion. For companies like IBA, a strong digital footprint and strategic content marketing are essential for building brand awareness, generating leads, and fostering customer loyalty in a competitive landscape.

- Website as Information Hub: Centralizes product, service, and investor information.

- Content for Education: Utilizes case studies and white papers to demonstrate value.

- Digital Marketing Investment: Reflects the broader trend of increased spending on online presence.

- Lead Generation and Brand Building: Content marketing aims to attract and engage potential customers.

Customer Testimonials and Success Stories

Leveraging customer testimonials, especially from leading hospitals and medical centers that have successfully integrated IBA's proton therapy systems, serves as a potent promotional strategy. These real-world success stories vividly illustrate the tangible benefits and positive patient outcomes achieved, effectively building crucial trust and credibility within the stringent medical sector.

For instance, the adoption of IBA's proton therapy by institutions like the Mayo Clinic and the University Medical Center Groningen highlights the technology's proven efficacy. These high-profile implementations, often accompanied by published outcomes data showing improved treatment results and reduced side effects, directly support IBA's market position.

- Demonstrated Efficacy: Testimonials from facilities reporting successful patient treatments underscore the clinical value of IBA's proton therapy solutions.

- Credibility Building: Endorsements from reputable medical institutions in 2024 and early 2025 enhance IBA's reputation in a highly regulated industry.

- Market Validation: Success stories act as powerful social proof, validating IBA's technology and encouraging wider adoption among prospective clients.

Promotion for IBA heavily relies on direct sales and technical consultations, especially for their complex, high-value proton therapy systems. This personalized approach allows for in-depth discussions about the technology's benefits and ROI, crucial for securing large hospital and industrial contracts. The company's active project pipeline in 2024 demonstrates the effectiveness of this strategy.

IBA also enhances its promotional efforts through active participation in scientific conferences and publishing research, reinforcing its image as an industry innovator. Their Capital Markets Day in April 2025 is a key event for communicating strategic direction to investors.

Leveraging customer testimonials from leading institutions, such as the Mayo Clinic, provides powerful social proof of their proton therapy systems' efficacy and positive patient outcomes. This builds significant credibility within the medical sector.

IBA maintains a strong digital presence, with its corporate website serving as a central hub for product information, news, and investor relations. Content marketing, including white papers and case studies, further educates potential clients and builds brand awareness, aligning with the growing global investment in digital content in 2024.

Price

IBA's pricing strategy for its advanced technology, especially proton therapy systems, is firmly rooted in value-based principles. This approach acknowledges the unparalleled clinical advantages and precision offered by these systems, positioning them as the pinnacle of radiation therapy. The significant investment reflects the extensive research, development, and intricate manufacturing processes essential for such cutting-edge medical equipment.

The pricing is directly tied to the substantial long-term benefits patients and healthcare providers receive, including improved treatment outcomes and operational efficiencies. The global proton therapy market is projected to grow substantially, reaching an estimated US$ 2.44 billion in 2024 and is anticipated to climb to US$ 7.19 billion by 2033, underscoring the high perceived value and demand for these advanced solutions.

IBA's approach to pricing its complex proton therapy centers and industrial accelerator solutions is fundamentally project-based. This strategy is essential because each installation is unique, requiring tailored system configurations, site-specific installation planning, and customized service and support packages.

This customized pricing reflects the significant investment and intricate engineering involved in delivering these advanced technologies. The company's substantial backlog of €1.5 billion in equipment and services as of Q1 2025 underscores the high value and scale of these individual projects.

Service contracts are a cornerstone of IBA's revenue, offering a predictable and consistent income. These agreements ensure customers receive ongoing maintenance and support for their proton therapy systems, fostering long-term relationships and customer loyalty.

The recurring revenue generated from these contracts is crucial for financial stability. In 2024, IBA saw a healthy 7% increase in service revenues for its Proton Therapy segment compared to the previous year, highlighting the growing importance of this revenue stream.

Competitive Landscape and Market Share

IBA operates within a dynamic and competitive global proton therapy market. Key rivals include Varian Medical Systems, Hitachi Ltd., Mevion Medical Systems, and Mitsubishi Electric Corporation.

IBA has established a commanding presence, securing approximately 60% of all proton therapy systems sold in 2024. This strong market share indicates significant competitive advantage.

To maintain this leadership and secure future growth, IBA's pricing strategies must be carefully calibrated. This involves a thorough analysis of competitor pricing, technological advancements, and overall market demand to ensure continued attractiveness to new clients.

- Market Share: IBA held an estimated 60% of the global proton therapy systems market in 2024.

- Key Competitors: Varian Medical Systems, Hitachi Ltd., Mevion Medical Systems, Mitsubishi Electric Corporation.

- Strategic Pricing: Pricing must consider competitor offerings and market dynamics to remain competitive.

Financing Options and Investment Considerations

Financing these substantial capital expenditures, such as proton therapy systems, is a critical consideration. IBA actively collaborates with clients to explore and facilitate various financing options, recognizing the significant upfront investment required. This partnership ensures that healthcare providers can acquire advanced technology through structured financial solutions.

The justification for such an investment hinges on a clear understanding of the potential return on investment (ROI). IBA provides insights and data to help hospitals and healthcare systems build robust financial cases for these systems. This analytical approach supports informed decision-making, crucial for the long-term viability of the technology.

- Financing Facilitation: IBA assists clients in navigating complex financing structures for large capital equipment.

- ROI Analysis: The company provides data-driven insights to demonstrate the economic benefits and payback periods for proton therapy systems.

- Investment Justification: Detailed financial planning and ROI projections are essential for securing the necessary capital.

- Market Trends: As of early 2024, the global market for proton therapy is experiencing growth, with an increasing number of centers seeking to implement this advanced treatment, underscoring the importance of accessible financing.

IBA's pricing strategy for its advanced proton therapy systems is value-based, reflecting the significant clinical benefits and the extensive R&D investment. The pricing is project-specific due to the custom nature of each installation, with service contracts forming a crucial recurring revenue stream. The company's substantial backlog of €1.5 billion in Q1 2025 highlights the scale and value of these bespoke projects.

The global proton therapy market is robust, projected to reach US$ 2.44 billion in 2024 and grow to US$ 7.19 billion by 2033, indicating strong demand and perceived value. IBA's pricing must remain competitive, considering rivals like Varian Medical Systems and Hitachi Ltd., while maintaining its dominant 60% market share in 2024. Financing options and clear ROI analysis are essential for clients undertaking these significant capital expenditures.

| Metric | Value | Year | Notes |

|---|---|---|---|

| Global Proton Therapy Market Size | US$ 2.44 billion | 2024 | Projected growth |

| Projected Market Size | US$ 7.19 billion | 2033 | Significant expansion expected |

| IBA Equipment & Services Backlog | €1.5 billion | Q1 2025 | Indicates strong project pipeline |

| IBA Proton Therapy Service Revenue Growth | 7% | 2024 | Year-over-year increase |

| IBA Market Share (Proton Therapy Systems) | 60% | 2024 | Dominant market position |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is meticulously crafted using a blend of primary and secondary data sources. We leverage official company disclosures, including annual reports and investor presentations, alongside direct observations of product offerings, pricing strategies, and distribution channels.