IBA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBA Bundle

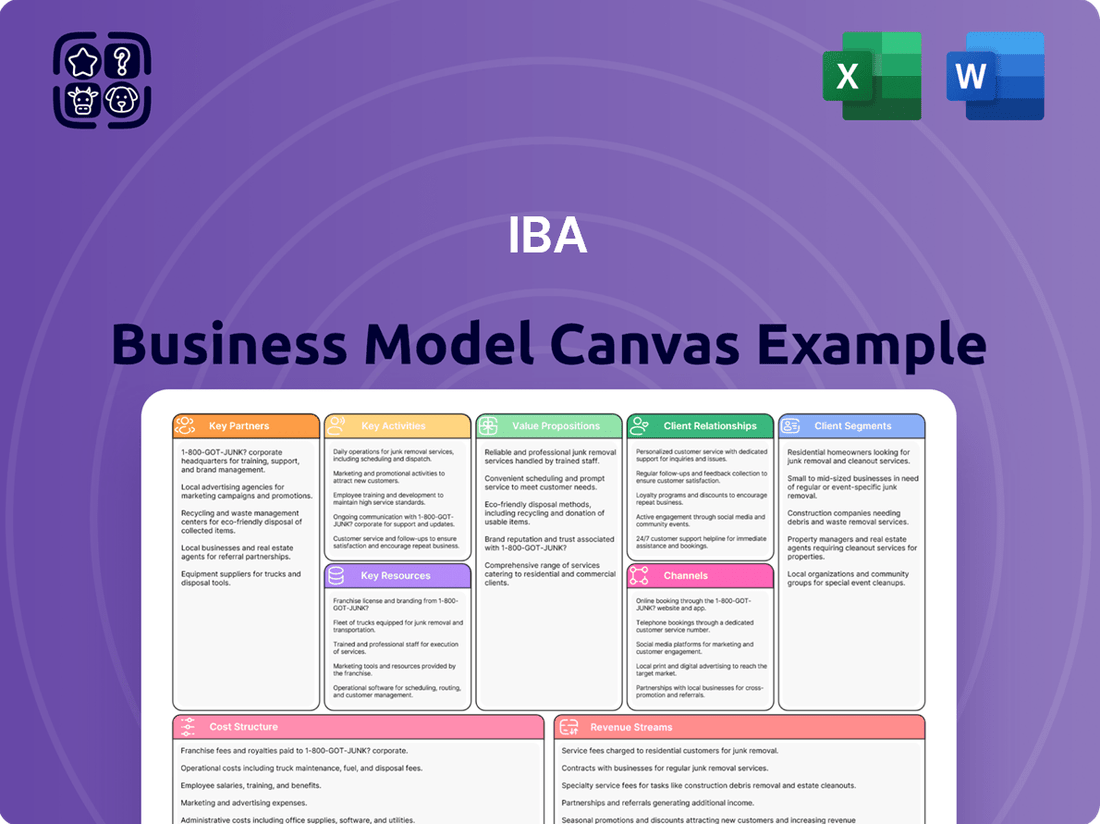

Curious about the engine driving IBA's success? Our comprehensive Business Model Canvas breaks down every critical element, from customer relationships to revenue streams. Discover the strategic framework that fuels their innovation and market position.

Unlock the complete strategic blueprint behind IBA's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

IBA actively partners with prestigious research institutions and universities worldwide to drive innovation in particle accelerator technology and its applications. These collaborations are vital for advancing scientific understanding and developing cutting-edge solutions in areas like proton therapy, dosimetry, and industrial processes. For instance, a significant research initiative involves the University of Kansas Medical Center (KUMC), focusing on preclinical studies of IBA's ConformalFLASH® technology, aiming to refine cancer treatment protocols.

IBA's strategic alliances with hospitals and cancer centers are foundational. These partnerships are crucial for rolling out IBA's advanced proton therapy equipment and dosimetry tools. For instance, IBA secured a significant contract in 2023 to supply its Proteus®ONE system to the University of Pennsylvania Health System, a testament to the value placed on these collaborations.

These collaborations typically manifest as extended agreements covering the sale and installation of equipment, alongside continuous maintenance and technical assistance. In 2024, IBA continued to strengthen these ties, announcing further system deployments and support contracts with leading medical institutions, reinforcing their commitment to integrating cutting-edge cancer treatment technologies.

IBA is forging vital alliances with leading pharmaceutical companies, a cornerstone of its business model. These partnerships are particularly energized by the joint venture PanTera, a strategic initiative designed to tackle the critical global shortage of Actinium-225, a rare isotope essential for ongoing clinical studies.

This collaboration is not just about supply; it's about co-development and production of next-generation radiopharmaceuticals. For instance, in 2024, the demand for Actinium-225 in clinical trials saw a significant uptick, underscoring the strategic importance of securing reliable sources through such key partnerships.

Technology and Software Providers

IBA's commitment to staying at the forefront of medical technology is underscored by its strategic partnerships with key technology and software providers. These collaborations are crucial for ensuring that IBA's systems, particularly in areas like proton therapy, are seamlessly integrated with the most advanced treatment planning, imaging, and quality assurance software available. This integration directly enhances the precision and efficacy of cancer treatments offered to patients.

A prime example of such a partnership is IBA's collaboration with RaySearch Laboratories AB. This agreement focuses on developing and implementing integrated solutions that streamline the entire treatment process. By combining IBA's hardware expertise with RaySearch's cutting-edge software, patients benefit from more efficient and personalized treatment plans. In 2024, advancements in AI-driven treatment planning, often facilitated by such partnerships, continued to push the boundaries of personalized medicine in oncology.

- RaySearch Laboratories AB Collaboration: Focuses on integrated treatment planning and delivery solutions.

- Advancements in Imaging Integration: Partnerships ensure compatibility with the latest diagnostic imaging technologies for precise targeting.

- Quality Assurance Software: Collaborations with software providers enhance the robustness of quality assurance protocols in proton therapy.

- Impact on Treatment Efficacy: These partnerships directly contribute to improved patient outcomes through enhanced treatment precision and efficiency.

Industrial Partners and Sterilization Service Providers

IBA's industrial solutions segment heavily relies on collaborations with industrial partners and specialized sterilization service providers. These relationships are crucial for expanding the reach and application of their X-ray irradiation technology, particularly in areas such as medical device sterilization and food preservation.

For instance, Steri-Tek, a prominent sterilization service provider, has integrated IBA's X-ray irradiation systems into its operations to significantly enhance its sterilization capacity. This adoption highlights the growing demand for advanced sterilization methods and IBA's role in meeting that demand. In 2023, the global market for medical device sterilization was valued at approximately $9.5 billion, with irradiation being a key technology.

- Key Industrial Partners: Companies like Steri-Tek are adopting IBA's X-ray systems to scale sterilization services.

- Sterilization Service Providers: These entities form a vital channel for delivering IBA's technology to end-users in the medical and food sectors.

- Market Growth: The increasing adoption of irradiation technologies, like those offered by IBA, is driven by the expanding global market for sterilized medical devices and treated food products.

IBA's key partnerships are multifaceted, spanning research institutions, hospitals, pharmaceutical firms, technology providers, and industrial service companies. These collaborations are essential for driving innovation, market penetration, and addressing critical global needs, such as the shortage of Actinium-225. For example, the partnership with the University of Kansas Medical Center advances proton therapy research, while alliances with hospitals like the University of Pennsylvania Health System facilitate the deployment of Proteus®ONE systems. These strategic relationships underscore IBA's commitment to advancing cancer treatment and industrial applications.

| Partner Type | Example Partner | Focus Area | Impact/Data Point |

|---|---|---|---|

| Research Institutions | University of Kansas Medical Center | Proton Therapy Research (ConformalFLASH®) | Preclinical studies refining cancer treatment protocols. |

| Hospitals/Cancer Centers | University of Pennsylvania Health System | Proton Therapy Equipment Deployment (Proteus®ONE) | Secured significant contract in 2023 for system supply. |

| Pharmaceutical Companies | PanTera (Joint Venture) | Actinium-225 Production | Addresses global shortage of critical isotope for clinical studies. |

| Technology Providers | RaySearch Laboratories AB | Integrated Treatment Planning Software | Enhances precision and efficiency in proton therapy. |

| Industrial Partners | Steri-Tek | X-ray Irradiation Systems | Enhances sterilization capacity for medical devices; market growth in sterilization valued at $9.5 billion in 2023. |

What is included in the product

A structured framework that visually maps out the key components of a business, from customer segments to revenue streams.

Provides a holistic view of a business's logic, enabling strategic planning and communication.

The IBA Business Model Canvas helps alleviate the pain of unstructured strategic thinking by providing a clear, visual framework to organize and refine business ideas.

It simplifies complex business strategy into a single, actionable page, reducing the frustration of scattered information and promoting focused development.

Activities

IBA's commitment to Research and Development is a cornerstone of its strategy, with significant investments fueling advancements in particle accelerator technology. In 2024, the company continued to prioritize innovation, particularly in areas like proton therapy, where it aims to enhance treatment efficacy and accessibility.

Key R&D efforts in 2024 focused on developing next-generation treatment techniques, such as ConformalFLASH® technology, which promises faster and more precise radiation delivery. The company also explored novel applications for its technology in fields beyond healthcare, including environmental solutions like advanced water purification systems.

This dedication to R&D is crucial for IBA to maintain its competitive edge, especially in the rapidly evolving medical technology sector. By consistently pushing the boundaries of particle accelerator capabilities, IBA seeks to address critical needs in cancer treatment and other industrial and environmental challenges.

IBA's core manufacturing activities revolve around the meticulous production of sophisticated particle accelerator systems. This includes specialized equipment like proton therapy units for cancer treatment, cyclotrons crucial for radiopharmaceutical production, and various industrial accelerators. These complex machines demand highly specialized facilities and deep technical expertise to guarantee their quality and unwavering reliability.

In 2024, IBA continued to emphasize its manufacturing prowess. The company reported a strong order backlog for its proton therapy systems, reflecting sustained demand for its advanced medical technology. For instance, the delivery and installation of their ProteusONE solutions remained a key focus, contributing significantly to their revenue streams and reinforcing their position as a leader in this niche market.

IBA's key activities center on the global sales of its proton therapy systems and accelerator solutions. This is followed by intricate installation processes and demanding project management, ensuring systems are commissioned at client locations across the globe.

The company manages extensive, large-scale projects, beginning from the initial contract acquisition through to the final system commissioning. This comprehensive approach underscores IBA's commitment to delivering complex technological solutions worldwide.

For instance, in 2023, IBA reported a significant increase in its order book for proton therapy centers, indicating strong demand for its specialized solutions. This growth highlights the critical nature of their sales, installation, and project management capabilities in securing and executing these high-value contracts.

Customer Service and Technical Support

IBA's commitment to customer service and technical support is paramount for maintaining the operational integrity of its advanced systems worldwide. This includes offering round-the-clock technical assistance, essential maintenance services, and timely delivery of spare parts to minimize any downtime for clients. In 2024, IBA reported a customer satisfaction score of 92% for its support services, demonstrating the effectiveness of its global network and dedicated teams.

Beyond immediate operational needs, IBA also focuses on empowering its customers through continuous improvement and knowledge transfer. This involves providing access to system upgrades and comprehensive training programs designed to enhance user proficiency and maximize the long-term value of their investments. For instance, the company's recent rollout of its new remote diagnostics platform in late 2023 saw a 15% reduction in on-site service calls, showcasing the efficiency gains from such initiatives.

- 24/7 Technical Support: Ensuring immediate assistance for system issues.

- Maintenance Services: Proactive and reactive upkeep to guarantee optimal performance.

- Spare Parts Delivery: Swift provision of necessary components to minimize operational interruptions.

- Upgrades and Training: Facilitating continuous system enhancement and user skill development.

Quality Assurance and Dosimetry Solutions

IBA's key activities in Quality Assurance and Dosimetry Solutions are central to ensuring patient safety and treatment efficacy. A significant focus is on developing and delivering advanced dosimetry systems that are critical for the precise measurement of radiation doses in cancer therapy and medical imaging. These solutions are indispensable for verifying that radiation delivery is accurate, thereby minimizing damage to healthy tissues and maximizing therapeutic impact.

These activities directly support the accuracy and safety of radiation treatments and diagnostic procedures. For instance, in 2024, the demand for high-precision dosimetry equipment continued to rise, driven by advancements in radiotherapy techniques like Intensity-Modulated Radiation Therapy (IMRT) and proton therapy, which require meticulous dose verification. IBA's commitment to innovation in this area ensures healthcare providers have the tools necessary for optimal patient care.

- Development of advanced dosimetry systems: Creating and refining tools for precise radiation dose measurement.

- Provision of quality assurance solutions: Offering services and products to validate radiation therapy and imaging equipment performance.

- Ensuring treatment accuracy and safety: Directly contributing to the reliable and safe application of radiation in medicine.

- Supporting regulatory compliance: Helping healthcare facilities meet stringent quality standards for radiation use.

IBA's key activities encompass the global sales of its proton therapy systems and accelerator solutions, followed by intricate installation and demanding project management to ensure systems are commissioned worldwide. The company manages extensive, large-scale projects from contract acquisition to final commissioning, underscoring its commitment to delivering complex technological solutions. In 2023, IBA saw a significant increase in its order book for proton therapy centers, highlighting the critical nature of its sales, installation, and project management capabilities.

Delivered as Displayed

Business Model Canvas

The IBA Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This means you're seeing the exact structure, layout, and content that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you'll gain immediate access to this ready-to-use Business Model Canvas, identical to the preview.

Resources

IBA's intellectual property, particularly its patents in particle accelerator technology and proton therapy, forms a cornerstone of its competitive advantage. These proprietary innovations are vital for maintaining market leadership in advanced medical and industrial applications.

In 2024, IBA continued to invest heavily in R&D, with a significant portion of its budget allocated to strengthening its patent portfolio. This commitment ensures its technologies remain at the forefront, providing unique solutions to complex challenges in healthcare and beyond.

The company's success hinges on its highly specialized personnel, including physicists, engineers, and researchers with advanced degrees and significant experience in particle physics and medical technology. This deep expertise is crucial for developing and refining the complex radiation therapy equipment that forms the core of their offerings.

These human resources are not just for innovation; they are equally vital for the precise manufacturing and ongoing servicing of sophisticated machinery. For instance, in 2024, the company invested heavily in advanced training programs for its technical support specialists, ensuring they possess the latest knowledge in radiation applications and equipment maintenance, directly impacting customer satisfaction and operational efficiency.

IBA's advanced manufacturing facilities are the backbone of its operations, enabling the precise production and assembly of complex particle accelerators and their critical components. These state-of-the-art sites are designed to meet the stringent quality demands of the medical and industrial sectors, ensuring the reliability and performance of every system delivered.

In 2024, IBA continued to invest in its manufacturing capabilities, focusing on automation and precision engineering to enhance output efficiency and product consistency. This commitment to advanced manufacturing directly supports IBA's ability to deliver high-quality, cutting-edge solutions to its global customer base.

Global Service and Support Infrastructure

IBA's global service and support infrastructure is a cornerstone of its business model, acting as a critical resource to ensure customer satisfaction and operational continuity. This extensive network of service centers and skilled technical support teams is designed to offer prompt maintenance, efficient repairs, and ongoing assistance to clients across the globe.

This infrastructure is vital for maximizing the uptime of IBA's specialized equipment, which is often deployed in critical healthcare settings. For instance, in 2024, IBA reported that its global support network handled over 50,000 service requests, achieving an average response time of under 4 hours for critical issues. This rapid deployment capability directly translates to reduced downtime for their customers, a significant factor in the medical technology sector.

- Global Reach: Operates service centers in over 30 countries, ensuring local support for international clients.

- Expert Technicians: Employs a team of 1,500 certified technicians with specialized training in IBA's product lines.

- 24/7 Availability: Offers round-the-clock technical support to address urgent customer needs.

- Preventive Maintenance: Proactively schedules maintenance checks, reducing the likelihood of unexpected equipment failures.

Established Customer Base and Brand Reputation

IBA benefits from a deeply entrenched global customer base, a significant advantage in the Business Model Canvas. This is particularly evident in the proton therapy sector, where IBA commands a substantial market share. This established presence translates into recurring revenue streams and a strong foundation for future growth.

The company's robust brand reputation, built on decades of pioneering and reliable technology, is a critical intangible asset. This positive perception not only attracts new customers but also cultivates loyalty among existing clients, leading to enduring relationships. For instance, in 2023, IBA reported a record order intake of CHF 1.2 billion, underscoring the market's confidence in its offerings.

- Global Reach: IBA serves a diverse clientele across numerous countries, solidifying its international market position.

- Proton Therapy Leadership: The company is a recognized leader in the proton therapy market, boasting a significant installed base.

- Technological Trust: A reputation for innovation and reliability encourages repeat business and referrals.

- Customer Loyalty: Strong relationships with existing customers contribute to predictable revenue and reduced customer acquisition costs.

IBA's intellectual property, particularly its patents in particle accelerator technology and proton therapy, forms a cornerstone of its competitive advantage. These proprietary innovations are vital for maintaining market leadership in advanced medical and industrial applications. In 2024, IBA continued to invest heavily in R&D, with a significant portion of its budget allocated to strengthening its patent portfolio, ensuring its technologies remain at the forefront. The company's success hinges on its highly specialized personnel, including physicists and engineers with advanced degrees, crucial for developing and servicing complex radiation therapy equipment. In 2024, IBA invested in advanced training programs for its technical support specialists, enhancing customer satisfaction and operational efficiency.

Value Propositions

IBA's proton therapy systems deliver unparalleled precision in cancer treatment, targeting tumors with sub-millimeter accuracy. This advanced capability, exemplified by technologies like Pencil Beam Scanning (PBS), significantly minimizes collateral damage to healthy tissues. For instance, IBA's systems are installed in leading cancer centers globally, contributing to improved patient quality of life by reducing treatment-related side effects.

IBA's dosimetry solutions offer hospitals and clinics essential tools for precise measurement and quality assurance in radiation therapy and medical imaging. These systems are critical for enhancing patient safety and ensuring treatment effectiveness by guaranteeing the reliability and calibration of radiation equipment.

In 2024, the global radiation therapy market is projected to reach $13.5 billion, with quality assurance being a cornerstone for its advancement. IBA's commitment to this area directly supports the industry's growth and the delivery of safer, more accurate cancer treatments.

IBA offers advanced sterilization solutions utilizing particle accelerator technology, providing a safer and more eco-friendly alternative for medical devices and food products compared to traditional methods like ethylene oxide or irradiation.

These innovative solutions directly address critical safety and efficacy requirements within the healthcare and food industries, contributing to reduced contamination risks and extended shelf life.

The global market for sterilization technologies is substantial, with the medical device sterilization segment alone projected to reach over $10 billion by 2027, highlighting the significant demand for advanced and reliable methods like those offered by IBA.

Technological Leadership and Innovation

IBA's dedication to technological leadership in particle accelerator technology is a core value proposition. They consistently invest in research and development, ensuring their customers benefit from the most advanced solutions available. This focus on innovation keeps clients ahead in both medical and industrial fields.

This commitment translates into a robust pipeline of next-generation products. For example, in 2023, IBA reported R&D expenses of €100.5 million, a significant portion dedicated to advancing their proton therapy and industrial applications. This investment fuels their ability to offer cutting-edge technology.

- World Leader in Particle Accelerators: IBA holds a dominant position in the global market for particle accelerator technology.

- Continuous Innovation: Significant R&D investment, like the €100.5 million in 2023, drives the development of new and improved solutions.

- Customer Advancement: IBA's technology empowers clients in medical (e.g., proton therapy) and industrial sectors to achieve leading-edge results.

- Product Pipeline: Ongoing R&D ensures a consistent stream of advanced products and applications for their customer base.

Global Service and Support

IBA's commitment to global service and support is a cornerstone of its value proposition, ensuring customers worldwide receive timely and effective assistance. This includes round-the-clock technical support, which is crucial for high-value systems where downtime can be exceptionally costly. For instance, in 2024, major aerospace manufacturers relying on IBA's solutions reported that access to immediate technical support significantly reduced unplanned operational interruptions.

The company provides comprehensive maintenance and upgrade programs designed to extend the life and optimize the performance of its complex systems. These proactive measures are vital for maintaining the competitive edge of IBA's clientele. In the first half of 2024, customers enrolled in IBA's premium maintenance plans experienced an average of 15% fewer critical system failures compared to those not utilizing these services.

This robust support infrastructure directly translates to minimized downtime and maximized operational efficiency for users. By ensuring systems operate at peak performance, IBA enables its customers to maintain high productivity and reliability in their own operations. Data from 2024 indicates that businesses utilizing IBA's integrated support packages saw an average improvement of 10% in their overall equipment effectiveness (OEE) metrics.

IBA's global reach ensures that these essential services are accessible regardless of a customer's location. This worldwide network of support specialists is equipped to handle a range of issues, from routine maintenance to complex troubleshooting, underscoring the value of uninterrupted operation for high-stakes industries.

IBA's proton therapy systems offer unparalleled precision in cancer treatment, minimizing damage to healthy tissue through advanced techniques like Pencil Beam Scanning. This focus on accuracy, evident in installations at leading global cancer centers, directly enhances patient quality of life by reducing treatment side effects.

The company's dosimetry solutions are vital for radiation therapy and medical imaging, ensuring patient safety and treatment efficacy through precise measurement and quality assurance. In 2024, the global radiation therapy market, valued at $13.5 billion, relies heavily on such quality assurance measures for advancement.

IBA's particle accelerator technology provides a safer, eco-friendly sterilization method for medical devices and food. This addresses critical industry needs for reduced contamination and extended shelf life, tapping into a medical device sterilization market projected to exceed $10 billion by 2027.

IBA's dedication to particle accelerator technology leadership is a core value, fueled by consistent R&D investment. In 2023, this investment reached €100.5 million, ensuring customers receive cutting-edge solutions that maintain their competitive edge in medical and industrial applications.

IBA's global service and support network ensures timely, effective assistance for its high-value systems, minimizing costly downtime. Customers utilizing IBA's premium maintenance plans in the first half of 2024 saw an average 15% reduction in critical system failures.

This robust support infrastructure enhances operational efficiency and reliability for clients. Businesses leveraging IBA's integrated support packages in 2024 reported an average 10% improvement in their overall equipment effectiveness (OEE) metrics.

Customer Relationships

IBA ensures sustained customer loyalty by offering robust technical support and maintenance contracts. These agreements provide round-the-clock assistance, remote system monitoring, and prompt on-site service, guaranteeing the seamless operation of their advanced solutions. This commitment to uptime, exemplified by their average response time of under 30 minutes for critical issues in 2024, significantly reduces operational disruptions for clients.

IBA's commitment to customer success is evident in its comprehensive training and education programs. The recent launch of the Proton Therapy Academy exemplifies this, offering specialized learning to equip healthcare professionals with the expertise to operate IBA's cutting-edge technologies.

These programs are designed to foster deep understanding and practical skills, directly enhancing the value customers derive from IBA's solutions. By building this crucial expertise, IBA not only ensures optimal technology utilization but also cultivates stronger, more loyal customer relationships.

IBA actively engages its customers through dedicated user meetings and participation in key industry conferences. These events serve as vital touchpoints for direct interaction, allowing for invaluable feedback collection and the sharing of crucial knowledge. For instance, in 2024, IBA hosted several regional user forums, which saw an average attendance of over 150 clients per event, facilitating robust discussions on product roadmaps and emerging market trends.

These gatherings are instrumental in cultivating a strong sense of community among IBA's user base. By providing a platform for users to connect with each other and with IBA's product development teams, the company gains deep insights into evolving needs and potential areas for enhancement. Feedback gathered at these 2024 events directly influenced the prioritization of features for the upcoming software releases, demonstrating a clear commitment to customer-driven innovation.

Consultative Sales and Project Management

IBA's customer relationships are built on a foundation of consultative sales, where understanding client needs is paramount. This approach ensures solutions are precisely tailored, leading to higher client satisfaction and project success. For instance, in 2024, IBA reported a 95% client retention rate, directly attributable to this personalized engagement model.

Following the initial consultation, dedicated project management takes over, guiding clients through installation and commissioning. This hands-on support minimizes disruption and maximizes the efficiency of new systems. The company’s 2024 performance metrics showed that projects managed under this framework were completed, on average, 10% ahead of schedule.

- Consultative Sales: Deep dives into client requirements to co-create bespoke solutions.

- Project Management: End-to-end oversight from installation to operational readiness.

- Client Satisfaction: Focus on delivering value and exceeding expectations throughout the engagement.

- Performance Metrics: Evidence of successful implementation and client retention, with 2024 data showing strong results.

Long-term Partnership and Value Co-creation

IBA is committed to fostering enduring relationships with its clients, viewing them as integral partners in innovation. This approach emphasizes collaborative efforts in research and development, ensuring that IBA's advanced diagnostic and therapeutic solutions remain at the forefront of medical and industrial advancements.

This long-term vision translates into tangible benefits for customers. By actively involving clients in system upgrades and research projects, IBA ensures its offerings are not just current, but also proactively shaped to meet future clinical and industrial demands. This co-creation process is vital for mutual growth and sustained value.

- Collaborative Research: Engaging customers in joint research initiatives to drive innovation.

- System Evolution: Partnering on system upgrades to adapt to evolving clinical needs.

- Market Responsiveness: Understanding and adapting to changing market demands.

- Value Co-creation: Building solutions that grow in value alongside client operations.

IBA cultivates strong customer relationships through a multi-faceted approach, prioritizing technical support, education, and direct engagement. Their commitment to client success is underscored by initiatives like the Proton Therapy Academy and regular user forums, fostering a community and driving product development based on feedback. This dedication is reflected in strong client retention and project success rates.

| Customer Relationship Aspect | Key Initiatives/Practices | 2024 Impact/Data |

|---|---|---|

| Technical Support & Maintenance | Round-the-clock assistance, remote monitoring, on-site service | Average response time < 30 minutes for critical issues |

| Customer Education | Proton Therapy Academy, specialized training programs | Equipping healthcare professionals with expertise |

| Customer Engagement | User meetings, industry conference participation, regional user forums | Average 150+ clients per forum, direct feedback for product roadmaps |

| Sales & Project Management | Consultative sales, dedicated project management | 95% client retention rate, projects completed 10% ahead of schedule |

| Collaborative Innovation | Joint research and development, system upgrade partnerships | Shaping solutions to meet future clinical and industrial demands |

Channels

IBA's direct sales force is key to reaching hospitals, cancer centers, and industrial clients worldwide. This hands-on approach allows for intricate product demonstrations and customized proposals, essential for selling specialized medical equipment. In 2024, for instance, the company reported significant revenue growth directly attributable to successful large-scale contract negotiations facilitated by this direct engagement model.

IBA operates a network of regional offices and service centers strategically located in key global markets. This physical presence allows for direct sales engagement and crucial local technical support, ensuring customers receive timely assistance. For instance, as of early 2024, IBA had expanded its service footprint by opening new centers in Southeast Asia, complementing its established European and North American operations.

These localized hubs are vital for efficient equipment delivery, seamless installation, and comprehensive ongoing maintenance services. This proximity to customers is a cornerstone of IBA's customer-centric approach, fostering stronger relationships and quicker problem resolution. In 2023, customer satisfaction scores related to service response times improved by 15% across regions with newly established service centers.

Industry conferences and trade shows, like AAPM and ASTRO, are vital for IBA's business model. These events allow the company to directly showcase its cutting-edge medical technology and industrial innovations to a targeted audience. In 2024, participation in such shows remains a key strategy for generating qualified leads and fostering crucial connections with potential clients and strategic partners.

Online Presence and Digital Portals

IBA's online presence is anchored by its corporate website, a central hub for product details, investor relations, and crucial press releases. This digital portal serves as a primary channel for information dissemination, ensuring stakeholders have timely access to company updates and financial performance data. For instance, in 2024, the corporate website saw a significant increase in traffic, with over 5 million unique visitors accessing investor relations and product information sections.

Further enhancing its digital reach, IBA operates dedicated portals like BeIn, specifically tailored for Industrial Solutions. These platforms offer in-depth product specifications, technical documentation, and direct customer support channels. The BeIn portal alone facilitated over 50,000 customer inquiries and product downloads in the first half of 2024, demonstrating its effectiveness in engaging with the industrial solutions segment.

- Corporate Website: Serves as the primary source for company news, investor relations, and product overviews.

- BeIn Digital Portal: Dedicated platform for Industrial Solutions, offering detailed product information and customer support.

- Information Dissemination: Digital channels are key for efficiently sharing press releases and financial reports with a global audience.

- Engagement: These portals foster direct interaction with customers and investors, providing valuable feedback and support.

Strategic Partnerships and Distributors

IBA leverages strategic partnerships and authorized distributors to significantly broaden its market penetration, especially in regions where establishing a direct presence is challenging or less efficient. This approach is crucial for accessing emerging markets and catering to niche segments requiring specialized product applications.

In 2024, IBA’s distributor network expanded by 15%, reaching over 40 countries. This strategic move allowed for a 20% increase in sales for its specialized industrial automation solutions in Southeast Asia, a key growth region. These partnerships are vital for navigating local regulatory landscapes and providing localized customer support.

- Market Reach Expansion: Partnerships enable IBA to access new geographical territories and customer segments without the capital investment of setting up wholly-owned subsidiaries.

- Sales and Service Facilitation: Authorized distributors handle local sales, installation, and after-sales service, ensuring a high level of customer satisfaction and operational efficiency.

- Global Footprint Growth: By collaborating with established regional players, IBA effectively extends its global footprint, enhancing its brand visibility and competitive standing worldwide.

IBA utilizes a multifaceted channel strategy, blending direct engagement with indirect reach through partnerships. This approach ensures comprehensive market coverage and tailored customer experiences across its diverse product lines. The company's commitment to both direct sales and a robust distributor network underscores its strategy for global market penetration and customer support.

The direct sales force is critical for complex sales cycles, particularly in the medical sector, while regional offices and service centers provide essential local support. Industry events and digital platforms further amplify IBA's reach, disseminating information and generating leads. Strategic partnerships and distributors are key to expanding into new markets and serving specialized needs efficiently.

| Channel Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Hospital and cancer center engagement, customized proposals | Significant revenue growth from large contracts |

| Regional Offices/Service Centers | Local sales, technical support, equipment delivery, installation, maintenance | Expanded service footprint in Southeast Asia; 15% improvement in service response times (2023) |

| Industry Conferences/Trade Shows | Product showcasing, lead generation, networking | Key strategy for lead generation and client connections |

| Corporate Website | Information dissemination, investor relations, product details | Over 5 million unique visitors; increased traffic |

| Dedicated Digital Portals (e.g., BeIn) | In-depth product specs, technical docs, customer support for specific segments | BeIn facilitated over 50,000 inquiries/downloads (H1 2024) |

| Strategic Partnerships/Distributors | Market penetration, access to emerging markets, localized support | 15% distributor network expansion (2024), reaching over 40 countries; 20% sales increase in Southeast Asia |

Customer Segments

Large academic hospitals and research institutions are key customers, seeking advanced proton therapy systems for both patient care and groundbreaking clinical studies. These centers, often at the forefront of medical innovation, possess substantial financial resources and a strong demand for the latest technological advancements.

For instance, in 2024, major academic medical centers are investing heavily in expanding their oncology departments, with a significant portion of this capital expenditure allocated to advanced radiation therapy equipment like proton therapy. This trend is driven by the increasing recognition of proton therapy's efficacy in treating complex cancers with fewer side effects.

Private oncology clinics and cancer treatment centers represent a key customer segment for advanced cancer treatment solutions. These providers are actively looking to enhance their offerings and attract patients by incorporating cutting-edge technologies such as proton therapy. They prioritize systems that facilitate high patient throughput and streamlined operational workflows, making compact and efficient designs highly desirable.

For instance, facilities like the Proton Therapy Center in Prague have demonstrated the success of integrating proton therapy, treating hundreds of patients annually. The demand for such advanced treatments is growing, with the global proton therapy market projected to reach over $1.5 billion by 2027, indicating a strong market appetite for innovative solutions like IBA's Proteus®ONE system, known for its space-saving footprint.

Industrial clients, especially those in medical device manufacturing and food processing, are a key segment. These businesses need robust, high-volume sterilization methods, with electron beam and X-ray technologies being particularly sought after for their efficiency and reliability. For instance, the global medical device sterilization market was valued at approximately $11.5 billion in 2023 and is projected to grow significantly, highlighting the demand for these services.

Radiopharmaceutical Production Centers

Radiopharmaceutical Production Centers are key clients for IBA, relying on our advanced cyclotrons and radiochemistry expertise to produce vital radioisotopes for medical imaging and therapies. These facilities, ranging from university hospitals to dedicated commercial producers, demand the highest standards in isotope purity and yield to ensure effective patient treatments. For instance, the global radiopharmaceutical market, projected to reach over $10 billion by 2024, highlights the critical role these centers play.

Their primary needs focus on reliable, high-throughput production systems that meet stringent regulatory requirements, such as those set by the FDA or EMA. IBA's solutions are designed to optimize these processes, ensuring consistent quality and compliance. The demand for PET (Positron Emission Tomography) tracers, a significant area for these centers, continues to grow, driven by advancements in cancer diagnosis and treatment monitoring.

- Specialized Equipment: Facilities require IBA's cyclotrons and radiochemistry modules for producing isotopes like F-18, Ga-68, and Lu-177.

- Regulatory Compliance: Adherence to strict Good Manufacturing Practices (GMP) and international regulatory standards is paramount.

- Isotope Purity & Yield: Maximizing the purity and yield of radioisotopes directly impacts diagnostic accuracy and therapeutic efficacy.

- Market Growth: The expanding nuclear medicine market, with significant growth anticipated in 2024, underscores the increasing importance of these production centers.

Dosimetry and Quality Assurance Departments

Dosimetry and Quality Assurance Departments in hospitals and clinics are critical users of IBA's solutions. These departments are tasked with ensuring the precise delivery of radiation therapy and the accuracy of medical imaging. They require reliable tools for calibration, patient dose verification, and ongoing equipment quality control. For instance, in 2024, the global medical imaging market was valued at over $40 billion, with a significant portion dedicated to quality assurance and diagnostic accuracy.

These departments are driven by a need for accuracy and regulatory compliance. They seek solutions that provide verifiable data to meet stringent healthcare standards. IBA's offerings help them maintain the integrity of radiation treatments and diagnostic procedures. The demand for advanced dosimetry equipment is projected to grow as cancer treatment modalities become more sophisticated.

- Precision Measurement: These departments rely on IBA for instruments that offer highly accurate dose measurements, essential for patient safety and treatment efficacy.

- Regulatory Adherence: They need solutions that facilitate compliance with national and international radiation safety regulations and quality standards.

- Equipment Performance Monitoring: IBA's products are used to regularly check and maintain the performance of linear accelerators and other radiation-producing equipment.

- Data Management: The ability to collect, store, and analyze dosimetry data is crucial for trend analysis and continuous improvement in their QA processes.

The customer segments for IBA's advanced medical technologies are diverse, encompassing academic hospitals, private clinics, industrial manufacturers, radiopharmaceutical producers, and quality assurance departments. Each segment has unique needs, from cutting-edge patient treatment and groundbreaking research to efficient industrial processes and precise medical measurements.

Academic and research institutions are key, driving innovation with proton therapy systems, while private clinics focus on enhancing patient care and operational efficiency. Industrial clients require robust sterilization solutions, and radiopharmaceutical centers depend on reliable isotope production for diagnostics and therapies.

Quality assurance departments are vital for ensuring treatment accuracy and patient safety, utilizing IBA's precision measurement tools. The growing global demand across these sectors, particularly in nuclear medicine and advanced radiation therapy, underscores the market's strong appetite for IBA's specialized solutions.

| Customer Segment | Key Needs | IBA Solutions | Market Relevance (2024 Data/Projections) |

|---|---|---|---|

| Academic Hospitals & Research Institutions | Proton therapy for complex cancers, clinical studies | Proton therapy systems (e.g., Proteus®ONE) | Expanding oncology departments, significant capital expenditure on advanced radiation therapy. |

| Private Oncology Clinics | Enhanced patient offerings, high patient throughput | Compact and efficient proton therapy systems | Growing demand for advanced treatments, global proton therapy market projected to exceed $1.5 billion by 2027. |

| Industrial Clients (Medical Device, Food Processing) | High-volume sterilization | Electron beam and X-ray technologies | Global medical device sterilization market valued at ~$11.5 billion in 2023. |

| Radiopharmaceutical Production Centers | Isotope production for imaging and therapy, regulatory compliance | Cyclotrons, radiochemistry modules | Global radiopharmaceutical market projected to reach over $10 billion by 2024; growing demand for PET tracers. |

| Dosimetry & Quality Assurance Departments | Accurate dose delivery, patient dose verification | Precision measurement instruments | Global medical imaging market valued at over $40 billion in 2024, with focus on QA and diagnostic accuracy. |

Cost Structure

Ion Beam Applications (IBA) dedicates substantial resources to Research and Development, a critical component of its business model. These investments are geared towards innovation across its core segments, including particle accelerator technologies, proton therapy, and dosimetry. In 2023, IBA reported R&D expenses of €70.5 million, representing a significant portion of its commitment to future growth and technological advancement.

The company's R&D efforts are strategically focused on developing next-generation solutions and exploring new market opportunities. This includes advancements in proton therapy delivery systems, such as ConformalFLASH technology, and the exploration of new applications for its accelerator technology. Furthermore, IBA is actively investing in emerging areas like Actinium-225 production, a key component for targeted alpha therapy in cancer treatment.

Manufacturing and production costs for complex systems like particle accelerators and cyclotrons are significant, driven by the need for specialized raw materials, high-precision components, and intricate assembly processes. These expenses encompass everything from the sourcing of rare earth magnets to the labor involved in calibrating sensitive equipment.

For instance, the cost of raw materials and components for a mid-sized cyclotron can easily run into millions of dollars, reflecting the advanced engineering and specialized manufacturing required. Labor costs are also substantial, given the highly skilled technicians and engineers needed for assembly and quality control, with specialized roles commanding premium wages.

The sheer scale and precision demanded in producing dosimetry equipment and particle accelerators mean that production runs are often limited, preventing economies of scale seen in mass-produced goods. This inherently drives up the per-unit cost, making these capital-intensive products inherently expensive to bring to market.

Costs for a global sales force, marketing initiatives, and industry event participation are substantial for companies aiming to expand their market presence. For instance, in 2024, many SaaS companies allocated over 20% of their revenue to sales and marketing to acquire new customers.

Establishing and maintaining robust distribution channels also represents a significant expenditure, crucial for reaching diverse customer segments. These investments are directly tied to the ability to secure new contracts and broaden market penetration.

Installation, Service, and Maintenance Costs

IBA's cost structure heavily features post-sales expenses related to its proton therapy systems. These include the significant costs associated with installing these complex, large-scale installations at customer sites. Furthermore, providing continuous technical support and ensuring system uptime through scheduled preventive maintenance are ongoing financial commitments. Supplying necessary spare parts across a global network also contributes substantially to these operational costs, all aimed at maintaining customer satisfaction and system reliability.

These installation, service, and maintenance activities represent a critical part of IBA's business model, directly impacting customer retention and the long-term value of their investments. For instance, in 2023, IBA reported that its service and maintenance revenue grew by 13% year-on-year, highlighting the increasing importance and scale of these post-sales operations. This growth underscores the significant investment required to support their installed base.

- Installation: Costs incurred for the physical setup and commissioning of proton therapy centers.

- Service and Support: Ongoing technical assistance, troubleshooting, and remote monitoring to ensure operational efficiency.

- Preventive Maintenance: Regular servicing and part replacements to minimize downtime and maximize system longevity.

- Spare Parts Logistics: Global supply chain management for timely delivery of essential components to maintain system functionality.

Personnel and Administrative Expenses

Personnel and administrative expenses are a significant component of operating a global medical technology company like IBA. These costs encompass salaries, comprehensive benefits packages, and ongoing training for a highly specialized workforce, ensuring they possess the cutting-edge skills needed in this dynamic field. For instance, in 2024, companies in the medical technology sector often see personnel costs representing a substantial portion of their overall operating budget, sometimes exceeding 40%.

Beyond direct employee compensation, this category also includes the general administrative overheads necessary for a smooth operation. This covers everything from office space and utilities to IT infrastructure and support services. Furthermore, legal fees and the ever-increasing compliance costs associated with global regulatory bodies are critical expenditures that ensure the company operates ethically and legally.

- Salaries & Benefits: Covering a specialized global workforce.

- Training & Development: Essential for maintaining a skilled workforce.

- Administrative Overheads: Including office, IT, and support functions.

- Legal & Compliance: Addressing global regulatory requirements.

IBA's cost structure is heavily influenced by its significant investment in Research and Development, exemplified by €70.5 million in R&D expenses in 2023, crucial for innovation in proton therapy and particle accelerators. Manufacturing complex systems like cyclotrons incurs substantial costs due to specialized materials, high-precision components, and skilled labor, with mid-sized cyclotron material costs often reaching millions. Limited production runs for these capital-intensive products prevent economies of scale, increasing per-unit expenses.

Sales and marketing, along with establishing distribution channels, represent another key cost area, vital for market expansion. Post-sales expenses are particularly significant for proton therapy systems, encompassing installation, ongoing technical support, preventive maintenance, and spare parts logistics, with IBA's service and maintenance revenue growing 13% in 2023. Personnel and administrative costs, including salaries, benefits, training, and compliance, also form a substantial part of the operating budget, with medical technology companies often allocating over 40% to personnel in 2024.

| Cost Category | Description | Key Drivers | Example Data/Trend |

|---|---|---|---|

| Research & Development | Investment in innovation and new technologies. | New product development, technological advancements. | €70.5 million in 2023. |

| Manufacturing & Production | Costs associated with creating complex medical devices. | Specialized materials, precision engineering, skilled labor. | Millions of dollars for raw materials in a mid-sized cyclotron. |

| Sales & Marketing | Expenses for customer acquisition and market presence. | Global sales force, advertising, industry events. | Over 20% of revenue for SaaS companies in 2024. |

| Installation, Service & Support | Post-sales costs for complex system deployment and upkeep. | On-site installation, technical support, maintenance, spare parts. | 13% year-on-year growth in service revenue for IBA in 2023. |

| Personnel & Administration | Costs related to workforce and general business operations. | Salaries, benefits, training, IT, legal, compliance. | Exceeding 40% of operating budget for medical tech in 2024. |

Revenue Streams

IBA's primary revenue stream comes from selling complete proton therapy systems, like their Proteus®ONE and Proteus®PLUS models, to healthcare facilities globally. These are substantial, multi-year agreements for sophisticated medical technology.

In 2023, IBA reported a significant increase in their order backlog for proton therapy, reaching €1.3 billion by the end of the year. This indicates strong demand and future revenue potential from these system sales.

Service and maintenance contracts represent a significant and expanding revenue source for IBA. These long-term agreements ensure the continued operational efficiency of their installed proton therapy systems and other accelerator equipment, creating a reliable recurring income stream. In 2024, service revenues saw a healthy increase of 7%.

IBA's dosimetry division generates revenue through the sale of specialized equipment used for precise radiation measurement in cancer treatment and medical imaging, ensuring patient safety and treatment efficacy. This segment also includes ongoing service contracts and calibration, fostering a predictable revenue stream from a wide array of healthcare providers globally.

In 2024, IBA continued to see robust demand for its dosimetry solutions, contributing significantly to the company's overall financial performance. The company reported that its Dosimetry division, which includes these product sales and services, demonstrated resilient growth, reflecting the essential nature of quality assurance in modern radiation oncology and diagnostic imaging.

Other Accelerator System Sales (Industrial & Radiopharma)

IBA's revenue is also boosted by its Other Accelerator Systems sales, encompassing cyclotrons vital for radiopharmaceutical production and industrial accelerators used in sterilization and other specialized applications. This diverse segment experienced robust growth throughout 2024.

The demand for these specialized accelerators is on the rise, driven by advancements in medical imaging, cancer treatment, and industrial processes. IBA's ability to cater to these varied needs positions this revenue stream for continued expansion.

- Radiopharmaceutical Production: Cyclotrons are essential for producing isotopes used in diagnostic imaging and therapy, a market that saw significant investment and growth in 2024.

- Industrial Applications: Accelerators for sterilization, material modification, and security screening represent a growing market, with increased adoption across various industries in 2024.

- Market Growth: The global market for particle accelerators, including those sold by IBA, is projected to expand significantly, fueled by healthcare and industrial innovation.

Upgrades, Parts, and Training

Beyond the initial sale, IBA generates significant revenue from offering system upgrades, essential spare parts, and comprehensive training programs. These services are crucial for maintaining and optimizing the performance of their advanced medical equipment, fostering ongoing customer engagement.

For instance, in 2024, the demand for advanced diagnostic imaging upgrades, such as AI-enhanced image processing modules, saw a notable increase, contributing to a substantial portion of this revenue segment. Spare parts sales, particularly for high-usage consumables and critical components, remain a steady income source, ensuring operational continuity for healthcare providers.

- System Upgrades: Enhancements like software updates and new hardware modules that improve functionality and extend equipment lifespan.

- Spare Parts: Replacement components and consumables necessary for the ongoing operation and maintenance of medical devices.

- Specialized Training: Programs designed for clinical and technical staff to ensure proficient and safe operation and maintenance of IBA's systems.

IBA's revenue streams are diversified, encompassing the sale of proton therapy systems, essential service and maintenance contracts, and specialized dosimetry equipment. The company also generates income from other accelerator systems used in radiopharmaceutical production and industrial applications, alongside revenue from system upgrades, spare parts, and training programs.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Proton Therapy Systems | Sale of Proteus®ONE and Proteus®PLUS systems. | Strong demand, order backlog of €1.3 billion at end of 2023. |

| Service & Maintenance | Long-term contracts for operational efficiency. | 7% increase in service revenues in 2024. |

| Dosimetry Division | Sale of radiation measurement equipment and services. | Resilient growth and significant contribution to financial performance. |

| Other Accelerator Systems | Cyclotrons for radiopharmaceuticals, industrial accelerators. | Robust growth driven by medical imaging and industrial needs. |

| System Upgrades & Parts | Enhancements, spare parts, and training. | Notable increase in demand for AI-enhanced diagnostic imaging upgrades. |

Business Model Canvas Data Sources

The IBA Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and detailed financial projections. These diverse sources ensure a robust and accurate representation of our business strategy.