IBA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBA Bundle

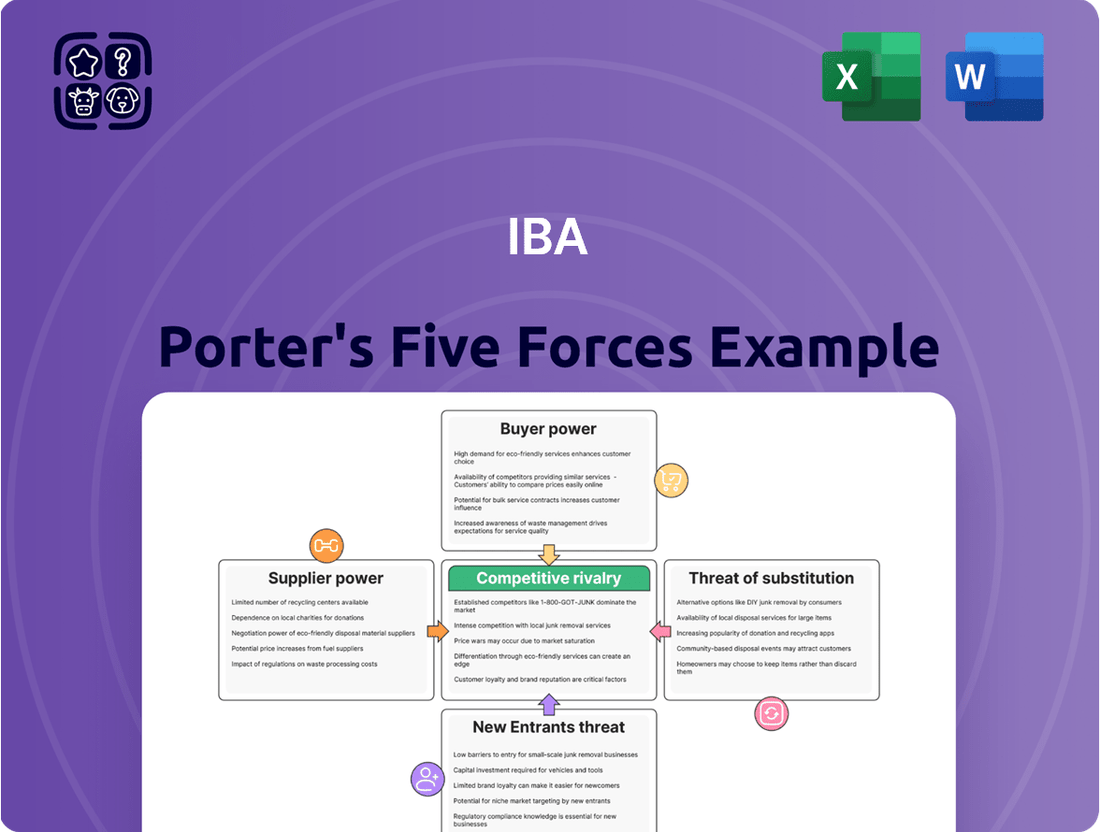

The IBA Porter's Five Forces Analysis highlights the intense competition and strategic challenges within its industry. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IBA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The medical technology sector, particularly for advanced equipment such as proton therapy systems, is heavily dependent on a small number of specialized component manufacturers and raw material suppliers. When the supply base for essential parts is limited, these few suppliers gain significant leverage, which can translate into increased costs for companies like IBA.

Suppliers offering proprietary or highly specialized components, like unique particle accelerator parts or specific materials for radiation shielding, wield considerable influence. IBA's dependence on these singular inputs for its cutting-edge technology directly amplifies supplier bargaining power.

Switching costs for critical components can significantly impact a company's flexibility. For instance, if IBA needs to re-engineer production lines or re-certify its products due to a supplier change, these expenses can easily run into millions of dollars. In 2024, the average cost for such industrial re-tooling and certification processes can range from $500,000 to over $2 million, depending on the complexity of the component and the industry's regulatory environment.

Threat of Forward Integration by Suppliers

If suppliers possess the capability to move into the proton therapy market themselves, developing their own treatment systems or related services, their leverage over IBA would dramatically increase. This potential for forward integration directly translates into greater bargaining power, allowing them to dictate less favorable terms to IBA.

This threat can manifest in several ways, potentially forcing IBA to accept higher input costs or less flexible supply agreements. For instance, a key component manufacturer for proton therapy machines could decide to enter the market directly, competing with its existing customers.

- Supplier Capability: Suppliers capable of developing and marketing their own proton therapy systems or complementary services pose a significant threat.

- Impact on IBA: This capability enhances supplier bargaining power, potentially leading to less favorable terms for IBA, such as increased input costs or stricter supply contracts.

- Market Dynamics: A supplier’s forward integration could transform them from a partner into a direct competitor, altering the competitive landscape.

Importance of Supplier's Input to IBA's Product

The quality and availability of essential components directly impact the performance and reliability of IBA's proton therapy systems. For instance, the precision of superconducting magnets and particle accelerators, often sourced from specialized global suppliers, is paramount. If a critical supplier faces production delays or quality control issues, IBA's manufacturing schedule and the ultimate efficacy of its life-saving equipment can be significantly jeopardized.

This dependence grants these specialized suppliers considerable bargaining power. Any disruption, whether it's a shortage of rare earth materials needed for advanced magnets or a delay in the delivery of high-precision vacuum chambers, can halt IBA's production lines. In 2024, the global supply chain for advanced medical equipment components continued to face challenges, including geopolitical tensions and raw material price volatility, further amplifying the leverage of key component providers.

- Critical Component Reliance: IBA's proton therapy systems rely on highly specialized components, such as superconducting magnets and particle accelerator modules, where few alternative suppliers exist.

- Production Impact: Disruptions in the supply of these critical parts can lead to significant production delays, impacting IBA's ability to meet customer demand and revenue targets.

- Reputational Risk: Quality issues stemming from supplier components can affect the performance and reliability of IBA's systems, potentially damaging its reputation in the high-stakes medical technology market.

- Supplier Leverage: The specialized nature and critical importance of these components provide suppliers with substantial bargaining power, allowing them to influence pricing and terms.

The bargaining power of suppliers is a critical factor for companies like IBA, especially in the specialized field of proton therapy. When suppliers control essential, unique components or raw materials, they can exert significant influence over pricing and terms. This is particularly true for advanced technologies where the supply base is limited.

For IBA, the reliance on a few specialized manufacturers for components like superconducting magnets or particle accelerator modules means these suppliers hold considerable sway. The high switching costs associated with re-tooling or re-certifying products further solidify this supplier leverage. For example, in 2024, the cost of industrial re-tooling and certification for complex medical equipment could range from $500,000 to over $2 million.

Furthermore, the potential for suppliers to integrate forward into the proton therapy market themselves, becoming direct competitors, amplifies their bargaining power. This threat can lead to less favorable terms for IBA, including increased input costs or more restrictive supply agreements, as seen with global supply chain volatility impacting raw material prices in 2024.

| Factor | Description | Impact on IBA | Example Data (2024) |

|---|---|---|---|

| Supplier Concentration | Few suppliers for critical, specialized components. | Increased leverage, potential for higher prices. | Limited number of global manufacturers for superconducting magnets. |

| Switching Costs | High costs to change suppliers (re-tooling, certification). | Reduces IBA's flexibility, strengthens supplier position. | Re-tooling/certification costs: $500k - $2M+. |

| Supplier Differentiation | Proprietary or unique components essential for technology. | Suppliers can command premium pricing. | Unique materials for radiation shielding or accelerator components. |

| Forward Integration Threat | Suppliers entering the proton therapy market. | Transforms suppliers into competitors, increasing leverage. | Component manufacturer developing own treatment systems. |

What is included in the product

This analysis breaks down the competitive intensity and profitability of the industry by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

IBA's core clientele consists of major hospitals, specialized cancer treatment centers, and leading research institutions. The concentration of these buyers, particularly if a few dominate in key geographic markets or globally, grants them considerable leverage. For instance, if a handful of large hospital networks represent a substantial portion of IBA's revenue, they can effectively dictate pricing and contract conditions by threatening to shift their significant purchasing volume elsewhere.

Once a hospital commits to a proton therapy system, the financial and operational hurdles to switch are substantial. This includes the significant cost of new infrastructure, extensive staff retraining, and the intricate process of integrating a new system into existing workflows. For instance, the initial investment in a proton therapy center can range from $100 million to over $200 million, making a post-purchase switch prohibitively expensive for most institutions.

These high switching costs, while limiting a customer's bargaining power after the initial purchase, significantly amplify their leverage during the initial negotiation phase. Hospitals will meticulously evaluate the total cost of ownership and the vendor's ability to support the system long-term before making such a critical decision.

Buyer price sensitivity is a significant factor for healthcare providers, particularly hospitals, as they face mounting pressure to manage expenses. The substantial capital outlay and ongoing operational costs of advanced technologies like proton therapy systems make customers acutely aware of pricing. This sensitivity compels them to actively seek cost-effective solutions and negotiate aggressively for better terms, influencing the overall profitability of the sector.

Customer Information Availability

As the proton therapy market matures, customers are increasingly well-informed. This heightened awareness stems from readily available data on competing systems, their pricing structures, and actual performance metrics. For instance, in 2024, numerous online platforms and industry reports began offering detailed comparisons of proton therapy centers, including patient outcomes and cost-effectiveness analyses, directly impacting customer negotiation leverage.

This greater transparency empowers buyers, enabling them to negotiate more effectively with providers. Armed with comparative data, customers can demand better pricing, service levels, and contract terms, effectively shifting the bargaining power. The increasing availability of such information is a key factor in how competitive the proton therapy landscape becomes.

- Informed Decision-Making: Customers can now easily access side-by-side comparisons of proton therapy technologies, treatment success rates, and associated costs from various providers.

- Price Sensitivity: With clearer pricing information, customers are less likely to accept premium charges without justification, driving price competition among providers.

- Negotiation Leverage: Buyers can use aggregated performance data and pricing benchmarks to negotiate more favorable terms, including discounts and bundled services.

- Market Maturity: The growth of independent review sites and medical tourism facilitators in 2024 has significantly contributed to customer empowerment in this specialized healthcare sector.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for highly specialized medical equipment like proton therapy systems, can still influence pricing and contract terms. If major hospital networks or large healthcare conglomerates could realistically develop or adapt less complex radiation therapy solutions in-house, it would undeniably boost their leverage.

This scenario is more pertinent for less intricate medical devices where the barrier to in-house development or modification is significantly lower. For instance, in 2024, the medical device market saw continued consolidation, with larger healthcare systems often possessing the capital and expertise to explore insourcing options for certain equipment, thereby increasing their bargaining power with suppliers.

- Increased Leverage: Customers developing their own solutions gain greater control over supply and pricing.

- Market Dynamics: Consolidation in healthcare in 2024 means larger buyers have more capacity for backward integration.

- Device Complexity: The threat is inversely related to the technological sophistication of the product.

- Cost-Benefit Analysis: Customers weigh the cost of integration against the potential savings and control.

Customers in the proton therapy market possess significant bargaining power due to their concentrated nature and high price sensitivity. The substantial investment required for proton therapy systems, often exceeding $100 million, makes buyers meticulously scrutinize costs and demand favorable terms. For example, in 2024, reports indicated that hospitals were actively negotiating for extended warranty periods and performance-based service agreements, directly impacting vendor profitability.

The increasing availability of market data and competitive intelligence in 2024 further empowers these buyers. Customers can now easily compare pricing, technological advancements, and patient outcomes across different providers, allowing them to negotiate from a position of informed strength. This transparency has led to more aggressive price discussions and a greater demand for value-added services.

| Factor | Impact on Bargaining Power | 2024 Relevance |

|---|---|---|

| Buyer Concentration | High (few large hospitals) | Major hospital networks represent significant revenue streams, enabling strong negotiation. |

| Switching Costs | High (infrastructure, training) | Limits post-purchase power but amplifies pre-purchase negotiation leverage. |

| Price Sensitivity | High (significant capital outlay) | Drives aggressive price negotiation and demand for cost-effectiveness. |

| Information Availability | High (market data, comparisons) | Informed buyers can demand better terms and pricing, increasing their leverage. |

Preview the Actual Deliverable

IBA Porter's Five Forces Analysis

This preview showcases the comprehensive IBA Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the exact, professionally formatted document, offering a detailed examination of competitive forces within the industry without any placeholders or surprises. Once you complete your purchase, you’ll gain instant access to this complete, ready-to-use analysis file, empowering your strategic decision-making.

Rivalry Among Competitors

The proton therapy market, while growing, features a concentrated competitive landscape. Major global players like Varian Medical Systems, Hitachi, Mevion Medical Systems, and Mitsubishi Electric Corporation, alongside IBA, vie for market dominance. This limited number of substantial entities intensifies rivalry.

In 2024, the market's structure means that each of these key players holds significant sway over pricing and innovation. For instance, IBA reported a backlog of 17 proton therapy centers as of the end of 2023, indicating substantial ongoing projects and a strong market presence. This concentration of established players fuels a direct and often aggressive competition for new contracts and technological advancements.

The proton therapy market is indeed experiencing a robust growth trajectory. Analysts projected the global proton therapy market to reach approximately $1.5 billion in 2024, with a compound annual growth rate (CAGR) expected to be around 12% from 2024 to 2030. This rapid expansion is a double-edged sword for competitive rivalry.

While a growing market can absorb more players and potentially dilute the intensity of competition by offering ample opportunities for all, it simultaneously acts as a magnet for increased investment. This influx of capital can empower existing players to expand their capacity, invest in R&D for more advanced treatment techniques, and potentially engage in more aggressive pricing or marketing strategies to capture a larger share of this expanding pie.

IBA stands out with its specialized particle accelerator technology and offers complete solutions for cancer treatment. This focus on unique, high-tech offerings is a key differentiator in the market.

However, the competitive landscape is fierce, with rivals actively pursuing their own differentiation strategies. Innovations like compact accelerator systems, pencil beam scanning capabilities, and the integration of artificial intelligence are common aims, fueling constant innovation and intense rivalry among players.

High Fixed Costs

The development, manufacturing, and installation of proton therapy systems, like those offered by IBA, are characterized by exceptionally high fixed costs. These significant upfront investments in research, specialized equipment, and skilled personnel create a substantial barrier to entry and necessitate high operational volumes to achieve profitability.

Companies in this sector, therefore, are driven to operate at maximum capacity and aggressively pursue market share to amortize these considerable fixed expenses. This intense pressure to generate revenue naturally escalates competitive rivalry as firms vie for every available contract and customer.

- High Capital Investment: Proton therapy centers can cost hundreds of millions of dollars to build and equip, with IBA's systems representing a significant portion of this.

- Operational Scale Imperative: To recoup substantial fixed costs, manufacturers must achieve high sales volumes, leading to intense competition for market dominance.

- Capacity Utilization Focus: Companies like IBA are incentivized to maximize the utilization of their production facilities, which can lead to aggressive pricing strategies and market penetration efforts.

Exit Barriers

High capital investments and specialized infrastructure in sectors like proton therapy create significant exit barriers. Companies are often compelled to remain in the market to recover substantial upfront costs, even if profitability wanes. This can intensify competitive rivalry as existing players strive to recoup their investments, potentially leading to price wars or prolonged periods of underperformance for the industry.

For instance, the average cost for a proton therapy center can range from $150 million to over $200 million, according to industry reports from 2024. This massive financial commitment means that exiting the market before full amortization of these assets is often financially untenable, forcing operators to continue competing even in challenging economic conditions.

- High Capital Intensity: Sectors with substantial fixed assets, like advanced medical technology or heavy manufacturing, present high exit barriers due to the difficulty in liquidating specialized equipment.

- Specialized Infrastructure: Unique or custom-built facilities are hard to repurpose or sell, trapping capital and encouraging continued operation.

- Sustained Competition: These barriers can lead to prolonged competitive intensity, as firms are reluctant to exit and potentially abandon their investments.

- Employee and Stakeholder Considerations: The costs associated with layoffs, severance packages, and contractual obligations to suppliers or customers can also act as deterrents to exiting a market.

The proton therapy market's competitive rivalry is intense, driven by a limited number of major players like IBA, Varian, Hitachi, Mevion, and Mitsubishi Electric. This concentration means each company's actions significantly impact the market, leading to direct competition for contracts and technological leadership.

The market's rapid growth, projected to reach $1.5 billion in 2024 with a 12% CAGR through 2030, attracts significant investment. This expansion fuels rivalry as existing firms invest heavily in R&D and capacity, while new entrants may be drawn in, further intensifying competition for market share.

High barriers to entry, particularly the substantial capital investment required for proton therapy systems, which can range from $150 million to over $200 million in 2024, solidify the position of established players. These costs also create high exit barriers, compelling companies to remain competitive to recoup their investments, thereby sustaining rivalry.

| Key Players | 2024 Market Projection | Key Differentiators |

| IBA | Significant market share, backlog of 17 centers (end of 2023) | Specialized particle accelerator technology, complete solutions |

| Varian Medical Systems | Major global competitor | Comprehensive cancer care solutions |

| Hitachi | Major global competitor | Advanced medical technology integration |

| Mevion Medical Systems | Major global competitor | Compact accelerator systems |

| Mitsubishi Electric Corporation | Major global competitor | Technological innovation in medical devices |

SSubstitutes Threaten

Traditional radiation therapies, like Intensity-Modulated Radiation Therapy (IMRT) and Image-Guided Radiation Therapy (IGRT), remain widely accessible and often present a more budget-friendly option, especially for simpler cancer presentations.

These established treatment modalities act as strong substitutes, capable of addressing a significant portion of the market that might otherwise consider proton therapy, particularly when cost-effectiveness is a primary driver for patient or payer decisions.

The higher cost of proton therapy, often exceeding conventional radiotherapy by two to three times, presents a significant threat from substitutes. For instance, while proton therapy can cost upwards of $30,000 to $50,000 per treatment course, conventional external beam radiation therapy might range from $10,000 to $20,000, making the latter a more accessible option for many patients and healthcare systems.

This price disparity becomes a critical factor, especially when the clinical superiority of proton therapy is not universally established across all cancer types. If the incremental benefit in terms of reduced side effects or improved cure rates is marginal for a particular condition, patients and insurers may opt for the more economical conventional treatments, thereby limiting proton therapy's market penetration.

Patient and payer acceptance of alternative treatments significantly impacts the threat of substitutes for proton therapy. If insurance providers, or payers, are hesitant to reimburse proton therapy due to its higher cost or if they don't perceive a substantial clinical benefit over conventional radiation, patients may opt for less expensive alternatives.

For instance, in 2024, while proton therapy is gaining traction, many insurance plans still require extensive justification for its use, often comparing it directly to Intensity-Modulated Radiation Therapy (IMRT). This payer reluctance directly amplifies the threat of substitutes, as cost-effectiveness becomes a primary driver for treatment selection.

Furthermore, patient awareness and understanding of the potential benefits and drawbacks of proton therapy versus other modalities are critical. A lack of clear, accessible information can lead patients to default to more familiar or less costly options, thereby strengthening the position of substitute treatments in the market.

Technological Advancements in Substitutes

Ongoing technological advancements in conventional radiation therapy are making these treatments increasingly competitive substitutes. Innovations like adaptive radiation therapy, which adjusts treatment in real-time based on anatomical changes, and MRI-guided radiation therapy, offering superior visualization, enhance precision and minimize damage to healthy tissue. The integration of artificial intelligence (AI) further refines treatment planning and delivery, improving efficacy and reducing side effects.

These improvements directly challenge the market position of newer or alternative therapies by offering more refined and patient-friendly options. For instance, the global radiation therapy market was valued at approximately $5.9 billion in 2023 and is projected to grow, indicating continued investment and development in these established modalities.

- Adaptive Radiation Therapy: Improves precision by adjusting treatment daily based on patient anatomy changes.

- MRI-Guided Radiation Therapy: Offers real-time imaging during treatment for enhanced targeting and reduced collateral damage.

- AI Integration: Optimizes treatment planning and delivery, leading to better outcomes and fewer side effects.

Emergence of New Treatment Modalities

Beyond traditional radiation, other cancer treatments like immunotherapy, targeted therapies, and advanced surgical techniques can also act as substitutes for radiation therapy, including proton therapy, in certain clinical scenarios.

For instance, in 2024, the global market for cancer immunotherapy was projected to reach over $60 billion, demonstrating a significant and growing alternative to traditional methods. Targeted therapies, which focus on specific molecular changes in cancer cells, also offer a less invasive approach for many patients.

The increasing efficacy and accessibility of these alternative modalities directly impact the bargaining power of buyers in the radiation therapy market, as they have more choices for treatment.

- Immunotherapy Market Growth: Expected to surpass $60 billion in 2024, offering a strong alternative.

- Targeted Therapies: Focus on specific cancer cell mutations, providing precision treatment.

- Advanced Surgical Techniques: Minimally invasive procedures are increasingly replacing the need for radiation in some cases.

- Impact on Radiation Therapy: These substitutes increase patient options and can reduce demand for radiation services.

The threat of substitutes for proton therapy is significant, primarily driven by the availability and improving efficacy of conventional radiation techniques. These established methods are often more cost-effective, with conventional external beam radiation therapy costing between $10,000 to $20,000 per treatment course compared to proton therapy's $30,000 to $50,000, making them attractive alternatives, especially when clinical benefits are marginal.

Innovations in traditional radiation, such as adaptive and MRI-guided therapy, enhance precision and patient outcomes, directly competing with proton therapy's advantages. The global radiation therapy market, valued at approximately $5.9 billion in 2023, continues to see investment in these conventional modalities.

Furthermore, burgeoning fields like immunotherapy and targeted therapies represent powerful substitutes, with the immunotherapy market alone projected to exceed $60 billion in 2024. These alternatives offer different mechanisms of action and can be preferred by patients and payers seeking less invasive or more cost-efficient treatments.

| Substitute Type | Key Features | Cost Indicator (Approximate) | Market Relevance (2024 Projection) |

|---|---|---|---|

| Conventional Radiation (IMRT/IGRT) | Established, widely accessible, improving precision | $10,000 - $20,000 per course | Dominant market share, continued innovation |

| Immunotherapy | Harnesses immune system to fight cancer | Variable, often high | Projected > $60 billion market |

| Targeted Therapies | Focuses on specific genetic mutations | Variable, often high | Growing adoption for specific cancers |

| Advanced Surgery | Minimally invasive techniques | Variable | Increasingly replaces radiation in some indications |

Entrants Threaten

The proton therapy market is characterized by exceptionally high capital requirements, acting as a formidable barrier to entry. Establishing a new facility involves substantial investments in specialized equipment, which can range from $150 million to over $200 million for a single center. This includes the cost of particle accelerators, treatment rooms, and advanced imaging systems.

Beyond the initial infrastructure, significant upfront capital is also needed for extensive research and development, rigorous clinical trials to prove efficacy and safety, and obtaining regulatory approvals. These combined costs create a steep financial hurdle, deterring many potential new entrants who lack the necessary funding or access to capital markets. For instance, the development and approval process for a new proton therapy center can easily exceed $250 million before any revenue is generated.

The threat of new entrants in the particle accelerator and proton therapy market is significantly mitigated by the immense R&D and technological expertise required. Developing sophisticated systems like particle accelerators and proton therapy machines demands deep scientific knowledge and advanced engineering capabilities, making it a formidable barrier for newcomers.

Companies like Varian Medical Systems and Ion Beam Applications (IBA) have invested billions over decades to build this specialized knowledge base. For instance, IBA's continued innovation in cyclotron technology and beam delivery systems, crucial for proton therapy, represents a significant competitive advantage that is not easily replicated. The high cost of entry, estimated in the tens to hundreds of millions of dollars for research and development alone, further deters potential competitors.

The medical device industry, especially for cutting-edge treatments, faces significant barriers to entry due to rigorous regulatory approvals and ongoing compliance mandates. Bodies like the U.S. Food and Drug Administration (FDA) and the European Union’s Medical Device Regulation (EU MDR) impose demanding standards that new companies must meet, a process that can be both time-consuming and expensive, effectively deterring many potential competitors.

Established Brand Reputation and Customer Relationships

Established brand reputation and deep customer relationships act as significant barriers to entry for new players in the healthcare IT sector. Companies like IBA have cultivated trust and loyalty over years of reliable service and product delivery. For instance, in 2024, IBA reported a customer retention rate exceeding 95% for its core hospital information system, a testament to these strong relationships.

New entrants would find it exceptionally challenging to replicate this level of trust and market penetration. Gaining access to hospitals and healthcare providers, who often have complex procurement processes and established workflows, requires substantial time and investment.

- IBA's established brand recognition in the healthcare IT market is a formidable deterrent.

- Long-standing relationships with hospitals globally create high switching costs for customers.

- New entrants face the hurdle of building credibility and trust from scratch.

- In 2024, IBA secured contracts with 15 new major hospital networks, reinforcing its market position.

Intellectual Property and Patents

Existing players in the particle accelerator and proton therapy market, such as Ion Beam Applications (IBA) and Varian Medical Systems, hold a significant number of patents. For instance, IBA reported holding a substantial portfolio of intellectual property in its 2023 annual report, covering various aspects of their proton therapy systems. These patents act as a formidable barrier, making it difficult and expensive for newcomers to replicate or innovate upon existing technologies without facing infringement claims or incurring substantial licensing fees.

The threat of new entrants is therefore moderated by the extensive patent protection enjoyed by established companies. Developing novel particle accelerator or proton therapy technology often requires years of research and development, coupled with substantial capital investment. Without a clear path to circumventing existing patents or developing truly disruptive, patentable technology, new companies face a high risk of legal battles and market exclusion, limiting their ability to enter and compete effectively.

- Patent Portfolio Strength: Companies like IBA and Varian possess extensive patent portfolios protecting core technologies in particle acceleration and beam delivery.

- Licensing Costs: New entrants would likely face significant costs if they needed to license existing patented technologies to operate legally.

- R&D Investment: The high cost and long development cycles for new technologies, combined with patent barriers, deter many potential new market participants.

The threat of new entrants in the proton therapy market is considerably low due to the immense capital investment required. Establishing a proton therapy center demands hundreds of millions of dollars, primarily for specialized equipment like particle accelerators. For example, the initial setup costs for a single center can range from $150 million to over $200 million, a substantial financial barrier that deters most potential new players.

Furthermore, the need for extensive research and development, coupled with rigorous clinical trials and regulatory approvals, adds significantly to the upfront capital requirements. This complex and costly process, often exceeding $250 million before generating revenue, effectively limits entry to well-funded organizations.

The technological complexity and specialized expertise necessary for developing and operating proton therapy systems also act as a significant deterrent. Companies like IBA have invested billions over decades to build this knowledge, creating a steep learning curve and a high barrier to entry for newcomers. This deep scientific and engineering knowledge is not easily replicated.

The market is also protected by strong intellectual property rights, with established players holding numerous patents on core technologies. For instance, IBA's substantial patent portfolio, as detailed in their 2023 reports, makes it difficult and expensive for new entrants to operate without infringing on existing patents or incurring significant licensing fees.

| Barrier Type | Description | Example Data (2024) |

| Capital Requirements | High upfront investment for specialized equipment and infrastructure. | New center setup costs: $150M - $200M+ |

| R&D and Clinical Trials | Extensive investment in research, development, and proving efficacy. | Pre-revenue development costs: $250M+ |

| Technological Expertise | Deep scientific and engineering knowledge required for operation. | Decades of investment by companies like IBA. |

| Intellectual Property | Patents protecting core technologies limit replication. | IBA's substantial patent portfolio (reported 2023). |

| Regulatory Hurdles | Strict approval processes from bodies like FDA and EU MDR. | Time-consuming and expensive compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, financial statements from leading companies, and government economic indicators. This comprehensive approach allows for a thorough evaluation of competitive intensity and strategic positioning.