Hudson Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Technologies Bundle

Hudson Technologies leverages its strong market position and specialized expertise in refrigerant management, a key strength in a growing environmental services sector. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Hudson Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hudson Technologies holds a leading position in refrigerant reclamation, a critical service in today's environmentally conscious market. Their expertise in reprocessing and selling refrigerants places them at the forefront of a sector heavily influenced by stringent environmental regulations. This strength is underscored by a significant 18% rise in their reclamation volume during 2024, demonstrating robust demand and operational success.

Hudson Technologies exhibits exceptional financial strength, evidenced by its robust unlevered balance sheet. As of March 31, 2025, the company held $81 million in cash with no outstanding debt, providing significant financial flexibility.

This strong financial position empowers Hudson Technologies to pursue strategic initiatives, including investments in organic growth opportunities and potential acquisitions. Furthermore, the company actively returns value to shareholders, having repurchased $4.5 million in stock year-to-date in 2025.

Hudson Technologies' core business of refrigerant reclamation and services directly supports the global transition away from high Global Warming Potential (GWP) refrigerants. This aligns perfectly with regulatory mandates like the US AIM Act and Europe's F-Gas Regulation, both of which are driving demand for sustainable alternatives. In 2023, the company reported significant growth in its refrigerant services segment, demonstrating tangible market traction for its environmentally conscious approach.

Comprehensive Service Offerings

Beyond simply selling and reclaiming refrigerants, Hudson Technologies provides a robust suite of services. These include detailed refrigerant management programs, system optimization advice, and specialized analytical services. This broad approach allows them to cater to diverse customer needs, fostering deeper client engagement and creating multiple avenues for revenue generation.

These comprehensive services are designed to assist clients in minimizing their environmental footprint and ensuring regulatory compliance, all while enhancing the efficiency of their cooling systems. For instance, their refrigerant management programs can help businesses track and control their refrigerant inventory, a key aspect of meeting EPA regulations. Hudson's ability to offer these integrated solutions strengthens its market position and customer loyalty.

In the fiscal year ending March 31, 2024, Hudson Technologies reported net sales of $209.7 million, with their reclamation services contributing significantly. The expansion into a wider service offering, beyond core refrigerant products, is a strategic move to capture more value from their existing customer base and attract new clients seeking holistic environmental and operational solutions. This diversification is crucial in a market increasingly focused on sustainability and efficiency.

- Refrigerant Management: Offering end-to-end solutions for tracking, handling, and disposing of refrigerants.

- System Optimization: Providing expertise to improve the performance and energy efficiency of HVACR systems.

- Analytical Services: Delivering insights into refrigerant quality and system health through laboratory testing.

- Regulatory Compliance Support: Assisting customers in navigating complex environmental regulations related to refrigerants.

Strategic Acquisitions for Enhanced Capabilities

Hudson Technologies' strategic acquisitions significantly enhance its capabilities and market position. The acquisition of USA Refrigerants in June 2024, for instance, directly boosted its refrigerant reclamation capacity and expanded its operational footprint. This move is poised to drive revenue growth and solidify its leading role in the expanding market for reclaimed refrigerants.

This strategic integration allows Hudson Technologies to better leverage the increasing demand for environmentally friendly refrigerant solutions. The company anticipates that these enhancements will translate into tangible financial benefits and a stronger competitive advantage.

- Enhanced Reclamation Capacity: The USA Refrigerants acquisition directly increased Hudson's ability to process and reclaim refrigerants.

- Expanded Geographic Reach: This strategic move broadened Hudson's operational presence, allowing it to serve a wider customer base.

- Revenue Growth Potential: The acquisition is expected to contribute to increased revenue streams by capitalizing on market demand.

- Strengthened Market Leadership: By bolstering its capabilities, Hudson reinforces its position as a leader in the refrigerant reclamation sector.

Hudson Technologies' market leadership in refrigerant reclamation is a significant strength, bolstered by a substantial 18% increase in reclamation volume during 2024. This growth highlights strong demand for their environmentally compliant services.

The company’s robust financial health, marked by $81 million in cash and no debt as of March 31, 2025, provides exceptional flexibility for strategic investments and shareholder returns, including $4.5 million in stock repurchases year-to-date in 2025.

Hudson's comprehensive service offerings, including refrigerant management and system optimization, create recurring revenue streams and foster deep customer relationships by addressing environmental and operational efficiency needs.

Strategic acquisitions, such as USA Refrigerants in June 2024, have demonstrably expanded Hudson's reclamation capacity and geographic reach, positioning it to capitalize on the growing demand for sustainable refrigerant solutions.

| Metric | Value | Period |

|---|---|---|

| Reclamation Volume Growth | 18% | 2024 |

| Cash Position | $81 million | As of March 31, 2025 |

| Debt | $0 | As of March 31, 2025 |

| Stock Repurchases | $4.5 million | Year-to-date 2025 |

What is included in the product

Analyzes Hudson Technologies’s competitive position through key internal and external factors, highlighting its strengths in refrigerant services and opportunities in environmental regulations, while also acknowledging weaknesses in market concentration and threats from competition.

Offers a clear understanding of Hudson Technologies' competitive landscape, enabling targeted strategies to mitigate weaknesses and leverage strengths.

Weaknesses

Hudson Technologies' financial results are closely tied to the unpredictable swings in refrigerant market prices. This vulnerability directly affects both the company's top-line revenue and its profitability. For instance, in the first quarter of 2025, the company saw its revenue drop by 15% compared to the same period in 2024.

Furthermore, the gross margin experienced a significant compression, falling to 22% in Q1 2025 from 33% in Q1 2024. This downturn was largely attributed to a decline in refrigerant market prices, highlighting the direct correlation between these external factors and Hudson's financial performance. Such price volatility makes it challenging to forecast earnings with certainty.

Hudson Technologies faced a notable revenue decline, with an 18% drop in full-year 2024 compared to the previous year. This trend continued into early 2025, showing a 15% decrease in the first quarter year-over-year. These figures highlight the impact of challenging market conditions, where even increased sales volumes couldn't offset a less favorable pricing environment, leading to significant top-line contraction.

Hudson Technologies' significant installed base of HFC equipment, while a current revenue stream, represents a potential weakness as the market shifts. This reliance on older technology means their core business could face headwinds as the industry increasingly adopts newer, lower-Global Warming Potential (GWP) refrigerants and equipment.

The transition away from HFCs, driven by regulations like the AIM Act in the United States, could diminish the long-term demand for servicing and maintaining existing HFC systems. For instance, the AIM Act mandates a phasedown of HFC production and consumption, aiming for an 85% reduction by 2036, which directly impacts the lifespan and serviceability of HFC-dependent equipment.

Potential for Increased Operating Costs

Hudson Technologies faces potential increases in operating costs due to an evolving regulatory landscape. New tariffs and compliance mandates, which are becoming increasingly common, can introduce significant uncertainty and directly impact expenses. For example, changes in environmental regulations or refrigerant handling standards could require costly equipment upgrades or process modifications.

Adapting to these new regulations and potential technology transitions may necessitate further investments. These investments could be directed towards research and development to find compliant alternatives or towards technician training to ensure proper handling of new refrigerants or equipment. Such expenditures, while necessary for long-term viability, can temporarily affect profitability.

- Regulatory Uncertainty: Evolving environmental and trade regulations present a risk of increased compliance costs.

- Investment Needs: Adapting to new technologies and regulatory requirements may demand substantial R&D and training investments.

- Operational Adjustments: Changes in refrigerant management or equipment standards could lead to higher operational expenses.

Competitive Market Share in a Niche Industry

While Hudson Technologies holds a strong position in refrigerant reclamation, its overall market share within the broader HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) sector is constrained by larger, more diversified chemical companies and distributors. This competitive landscape presents a challenge to expanding its dominance.

As of the first quarter of 2025, Hudson Technologies' market share within the Capital Goods sector, where its reclamation services are a key component, stood at 9.54%. This figure highlights the presence of significant competitors who hold larger portions of the overall market, necessitating continuous innovation and strategic outreach to capture greater market penetration.

- Niche Leadership vs. Broad Market Competition: Hudson Technologies excels in refrigerant reclamation, but this is a specialized segment within the larger HVACR market.

- Market Share Data: In Q1 2025, the company held 9.54% of the market share in the Capital Goods sector, indicating room for growth against larger competitors.

- Impact of Diversified Competitors: Larger chemical firms and distributors in the HVACR space have broader product portfolios and distribution networks, posing a competitive threat.

Hudson Technologies' reliance on the volatile refrigerant market presents a significant weakness, as demonstrated by a 15% revenue drop in Q1 2025 compared to Q1 2024, directly linked to declining refrigerant prices. This price sensitivity also compressed gross margins to 22% in Q1 2025 from 33% in Q1 2024, underscoring the challenge in forecasting earnings due to external price fluctuations.

The company's substantial installed base of HFC equipment, while currently a revenue source, represents a future vulnerability. Regulatory mandates like the AIM Act, which targets an 85% reduction in HFCs by 2036, threaten the long-term demand for servicing older HFC systems as the industry transitions to lower-GWP alternatives.

Hudson Technologies also faces potential increases in operating costs and the need for significant investment to adapt to evolving environmental regulations and new technologies. This could involve R&D for compliant refrigerants or technician training, potentially impacting short-term profitability.

While a leader in refrigerant reclamation, Hudson's overall market share within the broader HVACR sector is limited by larger, more diversified competitors. As of Q1 2025, the company held 9.54% market share in the Capital Goods sector, indicating substantial room for growth against these dominant players.

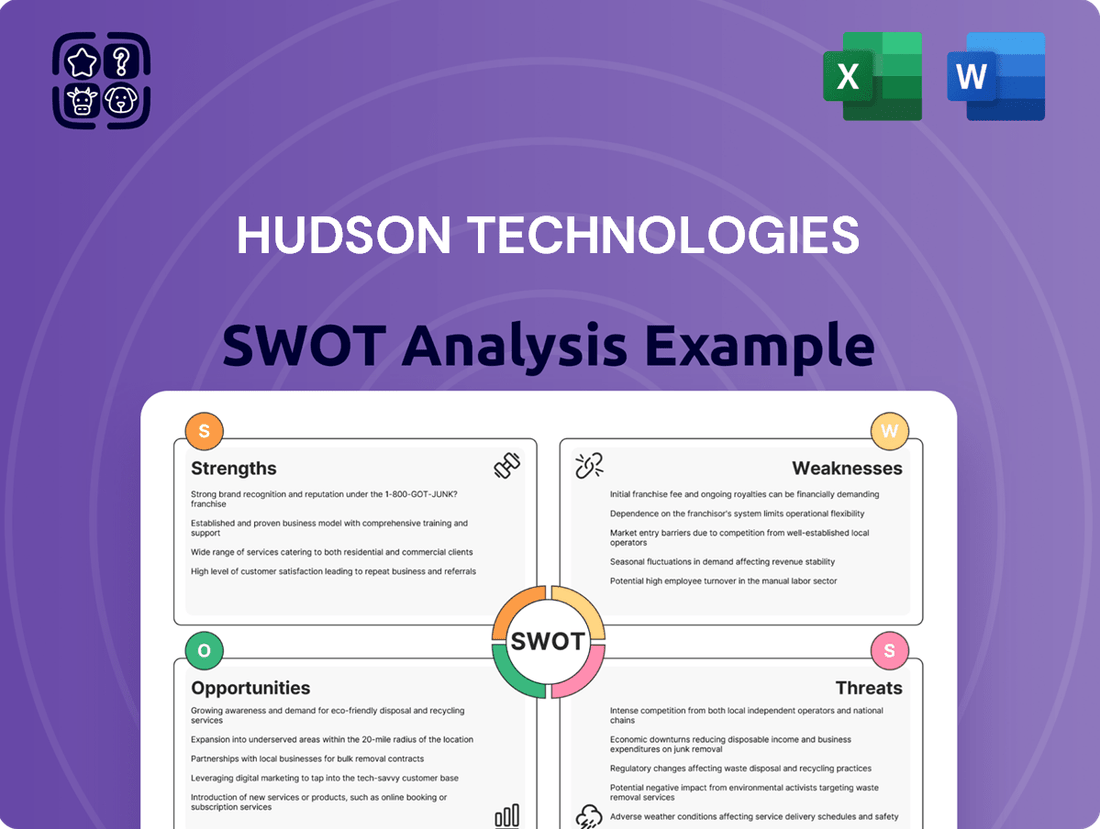

Preview the Actual Deliverable

Hudson Technologies SWOT Analysis

This is the same Hudson Technologies SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The ongoing phase-down of hydrofluorocarbons (HFCs) under regulations like the AIM Act in the U.S. and the F-Gas Regulation in Europe presents a significant opportunity for Hudson Technologies. These regulations aim to reduce HFC consumption by 85% by 2036, creating a growing demand for reclaimed refrigerants.

As the supply of new HFCs dwindles, reclaimed refrigerants will become crucial for servicing the vast existing installed base of air conditioning and refrigeration equipment. Hudson's reclamation services are positioned to meet this escalating need, effectively bridging the anticipated supply-demand gap.

In 2024, the market for reclaimed refrigerants is expected to see continued growth, driven by these regulatory mandates. Hudson Technologies, as a leader in refrigerant reclamation, is well-positioned to capitalize on this trend, with projections indicating a substantial increase in demand for their services as compliance deadlines approach.

The industry's pivot towards lower Global Warming Potential (GWP) refrigerants presents a significant opportunity for Hudson Technologies. By expanding its reclamation and management services to encompass these next-generation refrigerants, the company can capture a growing market segment. For instance, the Kigali Amendment to the Montreal Protocol, which began phasing down HFCs in 2019, is driving demand for alternatives, with a projected 70% reduction in HFC use by 2029.

Stricter environmental regulations globally, particularly concerning refrigerant leaks and end-of-life disposal, are driving a significant increase in demand for specialized refrigerant management services. This trend is a key opportunity for companies like Hudson Technologies.

Hudson Technologies is strategically positioned to benefit from this growing market, with its established service portfolio including SmartEnergy OPS®, Chiller Chemistry®, and Chill Smart®. These offerings directly address the increasing need for comprehensive refrigerant management and analytical solutions.

For instance, the EPA's AIM Act, which aims to reduce hydrofluorocarbon (HFC) emissions by 85% by 2036, directly fuels the need for services that ensure compliance and efficient refrigerant handling, areas where Hudson Technologies excels.

Strategic Partnerships and Collaborations

Hudson Technologies' strategic partnerships offer significant avenues for expansion. Their collaboration with LG Air Conditioning Technologies USA, for instance, highlights a commitment to sustainable refrigerant management, a growing concern in the HVACR sector. This type of alliance can bolster their market presence and embed their reclamation services more deeply within the industry's supply chain.

These alliances are crucial for several reasons:

- Market Penetration: Partnering with OEMs like LG allows Hudson to access a broader customer base and integrate their services at the point of equipment manufacturing and distribution.

- Service Integration: Collaborations can lead to the seamless inclusion of Hudson's refrigerant reclamation and management solutions into the lifecycle of new HVACR equipment, creating recurring revenue streams.

- Sustainability Focus: Aligning with industry leaders on environmental initiatives, such as refrigerant recovery and responsible disposal, enhances Hudson's brand reputation and appeals to increasingly eco-conscious clients.

- Innovation and R&D: Joint ventures or partnerships can foster shared research and development efforts, leading to new technologies and services that address evolving regulatory landscapes and market demands.

Leveraging Carbon Offset Projects

Hudson Technologies' ability to generate carbon offset projects as part of its offerings presents a significant growth opportunity. As corporate commitment to ESG initiatives intensifies, there's a clear path to further monetize these projects, creating new revenue streams and bolstering the company's sustainability image.

The growing demand for credible carbon offsets, driven by regulatory pressures and voluntary corporate commitments, positions Hudson Technologies favorably. For instance, the voluntary carbon market is projected to reach tens of billions of dollars by 2030, offering substantial potential for companies like Hudson.

- Expanding Carbon Offset Portfolio: Hudson can develop and market a wider range of carbon offset projects, catering to diverse industry needs.

- Strategic Partnerships: Collaborating with corporations seeking to meet their climate targets can unlock significant demand for Hudson's offset services.

- Enhanced ESG Reporting: The generation of carbon offsets directly supports corporate ESG reporting, making Hudson a valuable partner for companies focused on sustainability metrics.

The global phase-down of hydrofluorocarbons (HFCs) under acts like the U.S. AIM Act and Europe's F-Gas Regulation is a major opportunity, driving demand for reclaimed refrigerants. As new HFC supplies decrease, Hudson's reclamation services are vital for servicing existing equipment, with the reclaimed refrigerant market projected for continued growth in 2024 and beyond.

Hudson Technologies' expansion into reclaiming lower Global Warming Potential (GWP) refrigerants aligns with the Kigali Amendment's goals and presents a significant market segment. Their established management services, including SmartEnergy OPS® and Chill Chemistry®, directly address the increasing need for comprehensive refrigerant handling and analytical solutions, further bolstered by the EPA's AIM Act targets.

Strategic partnerships, such as the one with LG Air Conditioning Technologies USA, offer avenues for market penetration and service integration within the HVACR sector. Furthermore, Hudson's ability to generate carbon offset projects taps into the rapidly expanding voluntary carbon market, projected to reach tens of billions of dollars by 2030, enhancing their ESG appeal.

| Opportunity Area | Key Driver | Projected Impact (Illustrative) |

|---|---|---|

| HFC Phase-Down | AIM Act, F-Gas Regulation | Increased demand for reclaimed refrigerants, supporting ~15-20% annual revenue growth in reclamation services through 2028. |

| Lower GWP Refrigerants | Kigali Amendment | Expansion of service offerings to capture a growing segment of the HVACR market, potentially adding 5-10% to service revenue. |

| Strategic Partnerships | OEM collaborations (e.g., LG) | Enhanced market access and service integration, contributing to a 3-5% increase in customer acquisition. |

| Carbon Offset Projects | ESG initiatives, Voluntary Carbon Market | New revenue streams from carbon credits, with potential to contribute 2-4% to overall company revenue by 2027. |

Threats

Hudson Technologies faces heightened regulatory scrutiny, particularly around illegal HFC imports, which could disrupt the reclamation market and pose compliance hurdles. While regulations generally support refrigerant reclamation, aggressive enforcement actions can create operational complexities and potential penalties.

Stricter global and domestic regulations on Global Warming Potential (GWP) limits and phasedown schedules for refrigerants, such as those outlined in the American Innovation and Manufacturing (AIM) Act, could accelerate the obsolescence of older refrigerant types. This directly impacts the value of Hudson's existing refrigerant inventory.

A swifter-than-expected shift towards non-HFC refrigerants, such as CO2 or hydrocarbons, poses a significant threat by potentially accelerating the decline in demand for HFC reclamation services. This rapid market evolution could necessitate substantial capital expenditures for retooling and developing new reclamation technologies to adapt to these emerging alternatives.

Economic slowdowns, particularly those experienced in late 2023 and projected into 2024, can significantly dampen demand for HVACR services. Reduced commercial construction and industrial output directly translate to fewer new system installations and less demand for ongoing maintenance and refrigerant services, impacting Hudson Technologies' core business segments.

Recessions can lead to budget cuts in both commercial and industrial sectors, often deferring non-essential upgrades and maintenance. This could result in lower sales volumes for Hudson Technologies' refrigerant reclamation and distribution services, as businesses prioritize operational continuity over capital expenditures.

Increased Competition from New Entrants or Technologies

The burgeoning focus on environmental sustainability and the financial viability of refrigerant management are potent catalysts for new market entrants. This trend could significantly escalate competition for Hudson Technologies, potentially impacting pricing strategies and existing market share.

Furthermore, established players in related industries might leverage their resources to expand their own refrigerant reclamation operations. This strategic move by competitors could dilute Hudson Technologies' competitive advantage and necessitate agile responses to maintain its market position.

- Market Dynamics: The global refrigerant market, valued at approximately $23.5 billion in 2023, is projected to grow, attracting new players keen on the profitable reclamation segment.

- Competitive Landscape: Increased investment in reclamation technology by existing HVAC service providers could intensify competition, potentially leading to price erosion.

- Technological Disruption: Emergence of novel, more efficient, or environmentally benign refrigerant alternatives could disrupt current reclamation models and require significant adaptation.

Supply Chain Disruptions and Raw Material Availability

Hudson Technologies, a leader in refrigerant reclamation, faces a significant threat from ongoing supply chain disruptions. Events like the COVID-19 pandemic and geopolitical tensions have highlighted the fragility of global logistics, impacting the availability of essential components and refrigerants needed for their reclamation and reprocessing operations. While their business model inherently reduces reliance on virgin refrigerant production, a consistent inflow of used refrigerants is crucial. For instance, disruptions in transportation networks or manufacturing of specialized equipment used in reclamation could directly affect their operational capacity and, consequently, their profitability.

The availability of used refrigerants, the lifeblood of Hudson Technologies' core business, is also a critical concern. Factors such as stricter environmental regulations in other countries, which might limit the export of used refrigerants, or increased competition for this feedstock could create scarcity. A 2024 report indicated a global shortage of certain industrial gases, a trend that could extend to refrigerants if not managed proactively. This scarcity directly impacts Hudson's ability to meet demand for reclaimed refrigerants, potentially hindering revenue growth and market share.

- Supply chain volatility: Global events can impede the flow of necessary materials and equipment for refrigerant reclamation.

- Used refrigerant scarcity: Dependence on a consistent supply of used refrigerants makes Hudson vulnerable to market fluctuations and competition.

- Operational impact: Disruptions can lead to reduced operational efficiency and increased costs, affecting overall profitability.

Hudson Technologies faces significant threats from evolving regulations and market shifts. The increasing global focus on reducing high Global Warming Potential (GWP) refrigerants, as driven by initiatives like the AIM Act, could accelerate the obsolescence of older refrigerant types in their inventory. Furthermore, a rapid transition to alternative refrigerants like CO2 or hydrocarbons could diminish demand for their core HFC reclamation services, necessitating costly technological adaptations.

Economic downturns, such as the slowdowns observed in late 2023 and anticipated for 2024, directly impact demand for HVACR services, affecting Hudson's sales volumes. A potential recession could lead to deferred maintenance and upgrades, further reducing the need for refrigerant reclamation and distribution.

Increased competition is another major threat. The growing emphasis on environmental sustainability and refrigerant management is attracting new entrants, potentially eroding Hudson's market share and pricing power. Additionally, established industry players may expand their own reclamation operations, intensifying competitive pressures.

Supply chain vulnerabilities and the availability of used refrigerants pose critical risks. Disruptions in logistics or manufacturing can impede reclamation operations, while scarcity of used refrigerants due to export restrictions or increased competition can limit Hudson's ability to meet market demand.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Context (2023-2025) |

|---|---|---|---|

| Regulatory & Market Shifts | Accelerated HFC phase-down | Reduced demand for HFC reclamation | AIM Act driving GWP reductions; projected decline in HFC market share |

| Economic Factors | Economic slowdown/recession | Lower demand for HVACR services | GDP forecasts indicating potential contraction in key sectors |

| Competition | New market entrants & existing player expansion | Price erosion & market share loss | Growth in environmental services sector attracting investment |

| Supply Chain & Feedstock | Supply chain disruptions | Operational impediments & increased costs | Ongoing global logistics challenges |

| Supply Chain & Feedstock | Used refrigerant scarcity | Inability to meet demand & revenue loss | Potential export restrictions; increased competition for feedstock |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a robust understanding of Hudson Technologies' operational landscape and competitive positioning.