Hudson Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Technologies Bundle

Hudson Technologies' BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. This preview highlights key areas, but to truly unlock strategic advantages, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hudson Technologies' core business of refrigerant reclamation, especially for hydrofluorocarbons (HFCs), is a prime example of a Star in the BCG matrix. The market for reclaimed HFCs is experiencing robust growth, driven by the ongoing HFC phasedown mandated by regulations like the AIM Act. This phasedown directly impacts the supply of new HFCs, making reclaimed refrigerants increasingly vital for maintaining the existing HFC equipment base, which is expected to remain operational for many years.

Hudson's leadership in this expanding market, even amidst recent pricing fluctuations, underscores its strong position. As virgin HFC supply tightens due to regulatory mandates, the demand for reclaimed alternatives is set to climb significantly. For instance, the U.S. EPA's AIM Act aims to reduce HFC consumption by 85% by 2036, creating a sustained need for reclamation services to bridge the gap.

Hudson Technologies' strategic acquisition of USA Refrigerants in June 2024 was a pivotal move, significantly enhancing its capacity for refrigerant recovery and reclamation. This acquisition directly addresses the growing demand within an increasingly regulated market, positioning Hudson to capture a larger share of this expanding sector.

The integration of USA Refrigerants is expected to improve Hudson's gross margins. This is achieved through greater operational efficiencies and the ability to leverage economies of scale in its reclamation processes. By expanding its market presence, Hudson is well-positioned to benefit from the escalating need for environmentally sound refrigerant management solutions.

Hudson Technologies offers advanced refrigerant management solutions, a key component of its strategic positioning. These services, encompassing system optimization, analytical capabilities, and real-time monitoring through platforms like SmartEnergy OPS®, are increasingly critical for businesses aiming to reduce their environmental footprint and meet stringent regulatory requirements. This focus on sustainability and energy efficiency drives higher value-added offerings for the company.

Partnerships and Industry Influence

Hudson Technologies actively cultivates strategic alliances that solidify its industry standing. Collaborations with key players like LG Air Conditioning Technologies USA and RMI highlight Hudson's commitment to environmental stewardship, particularly in refrigerant reclamation, as detailed in their climate impact reports.

These partnerships not only bolster Hudson's reputation as a leader in sustainable HVACR practices but also position them favorably for future growth in an increasingly eco-conscious market. For example, the company's involvement in initiatives aimed at reducing greenhouse gas emissions underscores their influence.

- Industry Leadership: Partnerships with LG Air Conditioning Technologies USA and RMI showcase Hudson's influence in driving sustainable practices.

- Reputation Enhancement: Collaborations bolster Hudson's image as an environmentally responsible leader in the HVACR sector.

- Future Business: These alliances are crucial for securing opportunities in a market prioritizing environmental concerns.

- Climate Impact: Reports on refrigerant reclamation demonstrate Hudson's tangible contributions to reducing climate impact.

Carbon Offset Projects

Hudson Technologies' engagement in developing carbon offset projects represents a strategic move that capitalizes on the increasing global demand for sustainability solutions. This segment is poised for significant growth as more companies and governments prioritize emissions reduction targets.

This initiative not only diversifies Hudson's revenue streams but also enhances its brand reputation as a forward-thinking, environmentally conscious company. By offering carbon offset solutions, Hudson directly addresses the needs of clients aiming to mitigate their environmental impact.

- Growing Market: The voluntary carbon market saw significant growth, with an estimated value of over $2 billion in 2023, and is projected to expand substantially in the coming years.

- Regulatory Tailwinds: Increasing governmental regulations and corporate net-zero commitments are driving demand for credible carbon offset projects.

- Revenue Diversification: Carbon offset generation provides Hudson with a new avenue for revenue, complementing its core services and reducing reliance on any single market segment.

- Brand Enhancement: Participation in carbon offset projects positions Hudson as a leader in environmental solutions, attracting environmentally conscious clients and investors.

Hudson Technologies' refrigerant reclamation business is a clear Star, benefiting from strong market growth driven by regulatory mandates like the AIM Act's HFC phasedown. This creates a sustained demand for reclaimed refrigerants as virgin supply tightens, with the U.S. EPA aiming for an 85% HFC reduction by 2036. Hudson's acquisition of USA Refrigerants in June 2024 further solidifies its leading position in this expanding, environmentally critical sector.

| Metric | 2023 Data | 2024 Projections/Data | Significance for Star Status |

|---|---|---|---|

| Refrigerant Reclamation Volume | Not explicitly stated, but company reports indicate significant growth. | The acquisition of USA Refrigerants is expected to increase capacity. | Increased volume directly correlates with growing market demand. |

| HFC Phasedown Impact | Ongoing, driving demand for reclaimed products. | AIM Act continues to mandate reductions, increasing reliance on reclamation. | Regulatory tailwinds are a primary growth driver for this segment. |

| Market Share in Reclamation | Hudson is a leading player. | Acquisitions aim to capture a larger share of the expanding market. | Strong market position in a high-growth area defines a Star. |

What is included in the product

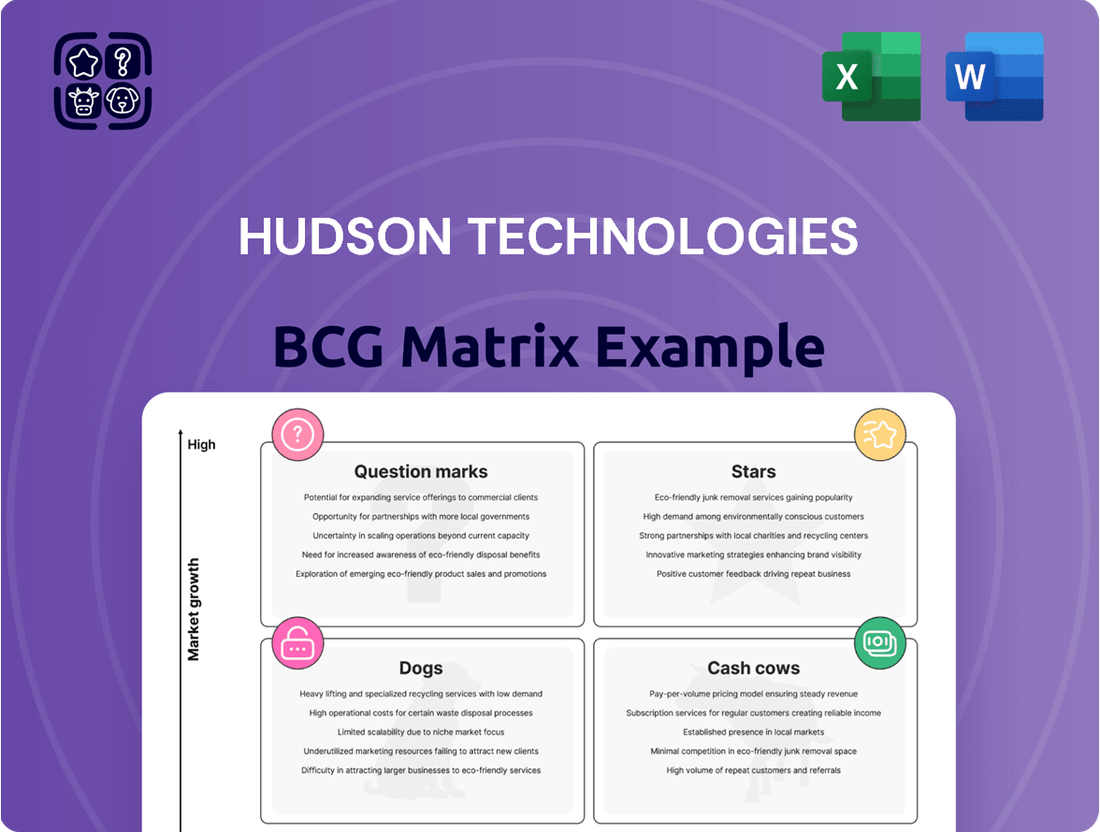

Hudson Technologies' BCG Matrix analysis categorizes its business units by market share and growth, guiding strategic investment decisions.

A clear BCG Matrix visualization for Hudson Technologies instantly clarifies which business units require investment, which are generating cash, and which may need divestment, easing strategic decision-making.

Cash Cows

Hudson Technologies' established sales of non-HFC refrigerants and industrial gases likely fit the Cash Cows quadrant. This segment operates in a mature, low-growth market where the company holds a significant market share, ensuring consistent cash flow despite potential pricing pressures.

Hudson Technologies' RefrigerantSide® Services represent a classic Cash Cow within its business portfolio. These services, primarily focused on HVACR system decontamination and maintenance, consistently generate robust and predictable cash flow.

The demand for these essential maintenance and decontamination services remains steady, as they are critical for the efficient and ongoing operation of existing HVACR systems. This stability is characteristic of a mature market where the services provide a reliable recurring revenue stream for the company.

In 2023, Hudson Technologies reported that its Refrigerant Services segment, which includes RefrigerantSide®, contributed significantly to its overall revenue, demonstrating the segment's strong performance and its role as a dependable income generator for the company.

Cylinder tracking and logistics, exemplified by solutions like Cylinder Quickscan™, are Hudson Technologies' cash cows. This technology streamlines the management of refrigerant cylinders, a mature but essential part of their business. By minimizing losses and speeding up cylinder turnaround, these systems generate consistent, stable cash flow.

In 2024, efficient logistics are paramount. Hudson Technologies reported that their asset utilization, heavily influenced by cylinder management, remained a key driver of profitability. While specific figures for Cylinder Quickscan™ aren't publicly broken out, the company's overall operational efficiency, which this system directly supports, contributed significantly to their robust financial performance.

Long-standing Customer Relationships

Hudson Technologies' long-standing customer relationships are a key driver of its Cash Cow status. The company has cultivated deep ties within the commercial and industrial sectors over nearly three decades. This stability translates into predictable revenue streams.

These established relationships ensure a consistent demand for Hudson Technologies' offerings, particularly in the relatively stable segments of the market. For instance, in 2023, the company reported that a significant portion of its revenue was derived from recurring service contracts with its existing customer base. This dependability is a hallmark of a Cash Cow.

- Nearly 30 years of industry presence

- Strong base of commercial and industrial customers

- Consistent demand due to established relationships

- Reliable source of revenue and profit

Operational Efficiency in Reclamation

Hudson Technologies' dedication to reclamation efficiency, honed over decades through substantial investment in reclamation plants and sophisticated separation technologies, positions its reclamation services as a prime cash cow. This focus ensures cost-effective operations even amidst fluctuating market prices for reclaimed refrigerants.

The company's operational excellence translates directly into robust profit margins and consistent, strong cash flow. For instance, in 2023, Hudson reported a significant increase in its reclamation services revenue, underscoring the market demand and the effectiveness of their established processes.

- High Profitability: Decades of investment in advanced separation technology drive down per-unit reclamation costs, yielding superior profit margins.

- Strong Cash Generation: The mature and efficient reclamation market provides a steady and predictable stream of cash flow for Hudson.

- Market Leadership: Hudson's established infrastructure and expertise in reclamation solidify its dominant position, further reinforcing its cash cow status.

Hudson Technologies' established non-HFC refrigerant sales and industrial gas offerings operate in a mature, low-growth market where the company holds a significant share. This stability ensures consistent cash flow despite potential pricing pressures.

The RefrigerantSide® Services, focusing on HVACR system decontamination and maintenance, consistently generate robust and predictable cash flow. Demand for these critical services remains steady, providing a reliable recurring revenue stream.

Cylinder tracking and logistics, like Cylinder Quickscan™, streamline refrigerant cylinder management, a mature but essential business function. By minimizing losses and speeding up turnaround, these systems generate consistent, stable cash flow, contributing to overall operational efficiency and profitability.

Hudson Technologies' reclamation services, backed by decades of investment in reclamation plants and separation technologies, are a prime cash cow. This focus ensures cost-effective operations, leading to robust profit margins and strong cash flow, as evidenced by increased reclamation services revenue in 2023.

| Business Segment | BCG Quadrant | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Non-HFC Refrigerants & Industrial Gases | Cash Cow | Mature market, significant market share, stable demand | Contributes significantly to overall revenue |

| RefrigerantSide® Services | Cash Cow | Essential HVACR maintenance, predictable recurring revenue | Demonstrated strong performance and dependable income generation |

| Cylinder Tracking & Logistics | Cash Cow | Streamlined operations, minimized losses, consistent cash flow | Key driver of profitability through asset utilization |

| Reclamation Services | Cash Cow | High profitability, strong cash generation, market leadership | Significant revenue increase in 2023 due to market demand and efficient processes |

What You See Is What You Get

Hudson Technologies BCG Matrix

The Hudson Technologies BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready strategic report for your business planning needs.

Dogs

Legacy Virgin Refrigerant Sales (High GWP) represent products with declining market share due to environmental regulations. The demand for these refrigerants is shrinking as the industry transitions to more sustainable alternatives, impacting sales volume and pricing power.

Hudson Technologies, a key player in refrigerant management, has seen its legacy refrigerant segment face headwinds. For instance, in the first quarter of 2024, the company noted a continued decline in sales for refrigerants with high Global Warming Potential (GWP) as regulatory pressures intensified globally. This trend is expected to persist as the phase-down of HFCs continues under international agreements like the Kigali Amendment.

Hudson Technologies' Defense Logistics Agency (DLA) contracts appear to be a weak point in their portfolio. Revenue from these contracts reportedly saw a dip in 2024 compared to the previous year, suggesting a segment that is not expanding.

If these DLA contracts continue to underperform and don't fit with Hudson's main focus on refrigerant reclamation, they could be considered "dogs" in a BCG matrix. This classification means they might be consuming resources without generating significant returns, potentially hindering overall growth.

Hudson Technologies might find itself with a Dog in its BCG Matrix if it holds substantial inventory of refrigerants that are rapidly losing value. This can happen due to sharp price drops or new regulations making older types obsolete. For instance, the phase-down of hydrofluorocarbons (HFCs) under regulations like the AIM Act in the US means that refrigerants with high global warming potential are becoming less desirable and harder to sell.

Holding onto these outdated refrigerants ties up valuable capital that could be invested elsewhere. In 2024, companies are increasingly focused on efficient capital allocation, and such inventory represents a drain on resources. The risk of needing to write down the value of this inventory, as its market demand shrinks, directly impacts profitability and cash flow, making it a classic 'Dog' in strategic portfolio analysis.

Any Non-Core, Low-Margin Services

Hudson Technologies' non-core, low-margin services would likely be categorized as Dogs in the BCG Matrix. These are services that don't directly leverage their primary refrigerant reclamation capabilities and operate in markets with limited growth and low market share for Hudson. For instance, if Hudson offered a minor consulting service related to HVAC system maintenance that wasn't a significant part of their business, it might fall here.

These types of services often require investment but yield minimal returns, draining resources that could be better allocated to their core, high-potential offerings. In 2023, Hudson Technologies reported revenue of $156.9 million, with their core reclamation services being the primary driver. Any ventures outside this core that don't show significant traction or profitability would be candidates for the Dog quadrant.

- Low Market Share: These services capture a small portion of their respective markets.

- Low Market Growth: The industries these peripheral services cater to are not expanding rapidly.

- Minimal Profit Margins: They contribute little to overall profitability, often just covering their own costs.

- Resource Drain: They consume management attention and capital without strategic upside.

Inefficient Regional Operations

Inefficient regional operations at Hudson Technologies can be categorized as Dogs within the BCG Matrix. These are segments or facilities that exhibit low market share in their respective local areas and struggle with consistent profitability. This underperformance often stems from a combination of factors, including elevated operational costs and insufficient demand for their services.

These underperforming units represent a drain on the company's resources, diverting capital and management attention without generating substantial returns or contributing meaningfully to Hudson's overall market position. For instance, if a particular regional service center in 2024 reported a 5% year-over-year revenue decline while its operating expenses increased by 8%, it would exemplify a Dog.

- Low Market Penetration: These regions fail to capture a significant share of their local markets.

- Profitability Challenges: High operational costs and limited demand lead to persistent losses or minimal profits.

- Resource Drain: They consume capital and management focus without commensurate contribution to growth.

- Strategic Review Needed: Such units require careful evaluation for potential turnaround, divestiture, or consolidation.

Hudson Technologies' legacy Virgin Refrigerant Sales (High GWP) represent products with declining market share due to environmental regulations, making them potential Dogs. The demand for these refrigerants is shrinking as the industry transitions to more sustainable alternatives, impacting sales volume and pricing power. In the first quarter of 2024, the company noted a continued decline in sales for refrigerants with high Global Warming Potential (GWP) as regulatory pressures intensified globally.

Hudson Technologies' Defense Logistics Agency (DLA) contracts may also be considered Dogs if they continue to underperform and do not align with the company's core refrigerant reclamation focus. These contracts could be consuming resources without generating significant returns, potentially hindering overall growth. Revenue from these contracts reportedly saw a dip in 2024 compared to the previous year, suggesting a segment that is not expanding.

Non-core, low-margin services that do not leverage Hudson's primary refrigerant reclamation capabilities and operate in markets with limited growth and low market share are also candidates for the Dog quadrant. These ventures, if they don't show significant traction or profitability, would be considered Dogs. For instance, any ventures outside the core reclamation business that don't show significant traction or profitability would be candidates for the Dog quadrant, especially given that in 2023, Hudson Technologies reported revenue of $156.9 million, with their core reclamation services being the primary driver.

Inefficient regional operations with low market share and persistent profitability challenges also fit the Dog classification. These units consume capital and management focus without commensurate contribution to growth, requiring careful evaluation for potential turnaround, divestiture, or consolidation. For example, a regional service center experiencing a revenue decline while operating expenses increase exemplifies a Dog.

| BCG Category | Hudson Technologies Example | Characteristics | 2024/2023 Data Impact |

|---|---|---|---|

| Dogs | Legacy Virgin Refrigerant Sales (High GWP) | Low Market Share, Low Market Growth, Declining Demand | Continued sales decline in Q1 2024 due to intensified regulatory pressures on high GWP refrigerants. |

| Dogs | Underperforming DLA Contracts | Low Market Share, Low Profitability, Not Core Focus | Reported revenue dip in 2024 compared to previous year, indicating lack of expansion. |

| Dogs | Non-Core, Low-Margin Services | Low Market Share, Low Profit Margins, Resource Drain | Minimal contribution to overall profitability; core reclamation services drove $156.9 million revenue in 2023. |

| Dogs | Inefficient Regional Operations | Low Market Penetration, Profitability Challenges, Resource Drain | Potential for revenue decline and increased operating expenses, diverting capital without substantial returns. |

Question Marks

Hudson Technologies is strategically positioning itself within the emerging market for reclaiming lower Global Warming Potential (GWP) refrigerants, such as R-454B and R-32. This sector is experiencing rapid expansion, driven by increasingly stringent regulatory mandates aimed at reducing environmental impact. Hudson's stated commitment to acquiring all refrigerant types, including these next-generation products, places them at the forefront of a high-growth opportunity where their market share is still in its formative stages.

Expanding Hudson Technologies into new geographic markets, beyond its current stronghold in the United States, particularly the Northeast, would likely position this venture as a Question Mark within the BCG Matrix. These new territories present significant growth opportunities, but they also demand substantial capital outlay for market penetration and the development of essential infrastructure. The initial returns on these investments are inherently uncertain, reflecting the inherent risks associated with entering unfamiliar competitive landscapes.

Hudson Technologies' Chiller Chemistry® and Chill Smart® represent a strategic move into the burgeoning smart HVAC market. These predictive and diagnostic services offer innovative solutions designed to optimize chiller performance and predict potential issues, a capability highly valued in today's efficiency-driven environment.

While these services hold substantial promise for future growth, their current market penetration and revenue impact may still be in the early stages. This positions them as question marks within Hudson's BCG matrix, indicating a need for continued investment and market development to realize their full potential.

The smart HVAC market is projected for significant expansion, with estimates suggesting a compound annual growth rate exceeding 15% through 2028, underscoring the opportunity for services like Chiller Chemistry® and Chill Smart®. Hudson's ability to effectively scale these offerings will be crucial in capturing a meaningful share of this evolving sector.

Integration of AI/IoT in Refrigerant Management

The integration of AI and IoT in refrigerant management is a significant growth area for Hudson Technologies. This trend allows for remote monitoring and predictive maintenance within HVAC systems, a market poised for expansion.

Developing sophisticated AI/IoT solutions for refrigerant tracking and lifecycle management presents a substantial opportunity for Hudson to differentiate its services. However, achieving market leadership in this segment, akin to a Star in the BCG matrix, will necessitate considerable investment and a strategic push for widespread adoption.

- AI/IoT in HVAC: The global IoT in HVAC market was valued at approximately $13.5 billion in 2023 and is projected to reach over $30 billion by 2028, indicating a strong growth trajectory.

- Predictive Maintenance: AI-powered predictive maintenance can reduce HVAC system downtime by up to 30%, leading to significant cost savings for clients and enhanced service revenue for providers like Hudson.

- Refrigerant Efficiency: Advanced analytics from AI/IoT can optimize refrigerant usage, potentially leading to a 10-15% reduction in refrigerant consumption and associated environmental benefits.

- Hudson's Opportunity: By scaling its AI/IoT capabilities, Hudson can capture a larger share of this growing market, moving its refrigerant management services towards a Star position.

New Technology for Enhanced Energy Efficiency

Hudson Technologies' exploration into new technologies for enhanced energy efficiency in refrigeration systems, particularly those exceeding current capabilities, positions them within the Question Mark quadrant of the BCG matrix. This strategic move taps into a robust market demand for sustainable and cost-saving solutions. For instance, the global energy-efficient HVAC market was valued at approximately $115 billion in 2023 and is projected to grow significantly, highlighting the potential upside for innovative technologies.

The company's potential investments in developing or commercializing advanced refrigerants or system designs that drastically reduce energy consumption represent a classic Question Mark scenario. While the demand for such innovations is strong, driven by increasing environmental regulations and operational cost concerns, the path to market success is uncertain. The success hinges on substantial research and development investment and effective market penetration strategies.

- High Market Demand: The global push for sustainability and reduced energy costs fuels a strong demand for energy-efficient refrigeration.

- R&D Intensive: Developing novel technologies requires significant upfront investment in research and development.

- Market Adoption Uncertainty: The success of new technologies depends on customer acceptance and the competitive landscape.

- Potential for High Growth: If successful, these ventures could capture a significant share of the growing energy-efficient market.

Hudson Technologies' venture into new geographic markets, especially outside its established US base, represents a classic Question Mark. These regions offer high growth potential but require significant investment and face unknown competitive dynamics, making initial returns uncertain. The company’s focus on next-generation refrigerants like R-454B and R-32, while aligning with a growing regulatory trend, also places these efforts in the Question Mark category due to their early market stage.

The company's innovative Chiller Chemistry® and Chill Smart® services, while positioned in a rapidly expanding smart HVAC market projected to grow over 15% annually through 2028, are still building market share. This means they require continued investment to solidify their position and achieve the scale needed to become market leaders.

Hudson's strategic investments in AI/IoT for refrigerant management and new energy-efficient refrigeration technologies also fall into the Question Mark quadrant. While the global IoT in HVAC market was valued at approximately $13.5 billion in 2023 and the energy-efficient HVAC market at $115 billion in 2023, the success of these specific ventures depends heavily on R&D, market adoption, and overcoming competitive hurdles.

| Business Unit/Initiative | Market Growth | Market Share | BCG Quadrant | Strategic Implication |

|---|---|---|---|---|

| Next-Gen Refrigerants (R-454B, R-32) | High | Low | Question Mark | Requires investment to build share. |

| International Market Expansion | High | Low | Question Mark | Capital intensive, uncertain returns. |

| Chiller Chemistry® / Chill Smart® | High | Low-Medium | Question Mark | Needs further development and market penetration. |

| AI/IoT in Refrigerant Management | High | Low | Question Mark | Significant R&D and adoption push needed. |

| New Energy-Efficient Technologies | High | Low | Question Mark | High R&D, market adoption risk. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analysis, and sales performance metrics to accurately position Hudson Technologies' offerings.