Hudson Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Technologies Bundle

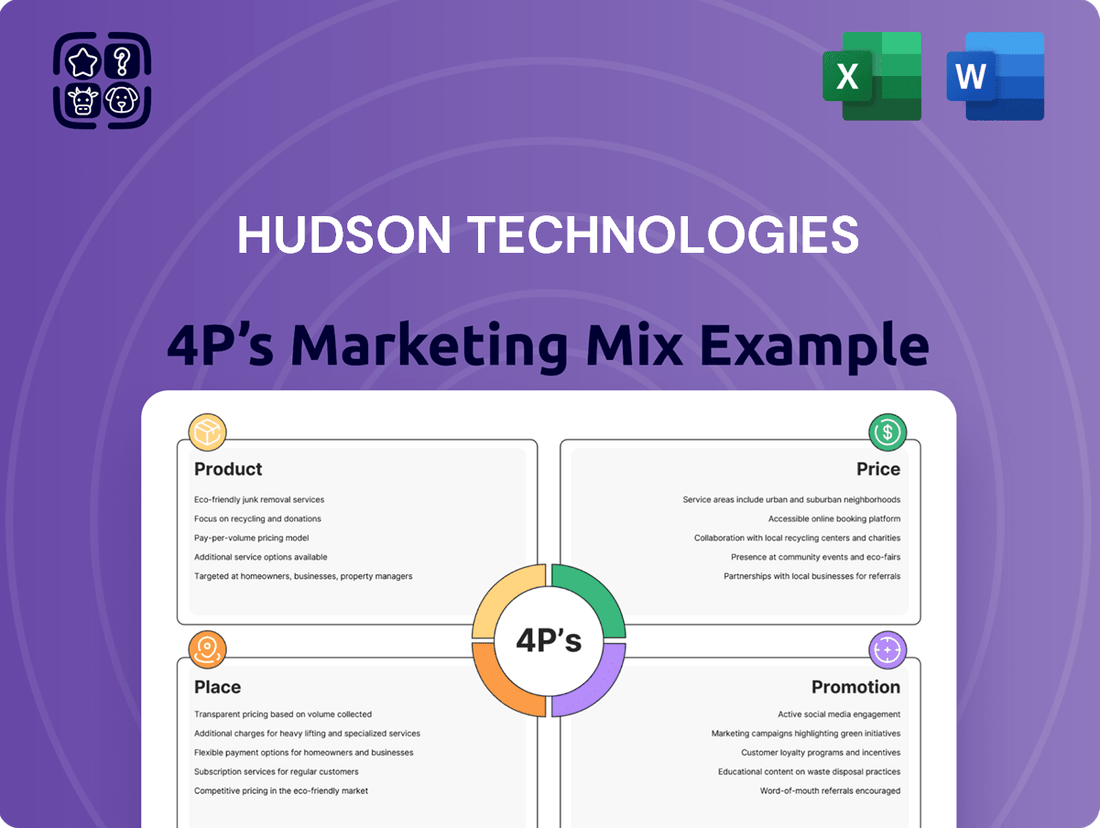

Hudson Technologies' marketing success hinges on a carefully crafted blend of its 4Ps. Understanding their product innovation, strategic pricing, efficient distribution, and targeted promotions is key to grasping their market dominance. This analysis dives deep into how these elements converge to create a powerful competitive advantage.

Ready to unlock the secrets behind Hudson Technologies' marketing prowess? Go beyond the surface and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Hudson Technologies' reclaimed refrigerants are central to their offering, presenting a greener choice for cooling systems. This product line directly tackles environmental issues by cutting down on the demand for newly manufactured refrigerants and promoting responsible management of these crucial substances. In 2023, the company processed over 20 million pounds of refrigerants, a testament to the growing market for sustainable cooling solutions.

Hudson Technologies' refrigerant management services go beyond simply supplying reclaimed refrigerants. They provide a complete solution for businesses needing to recover, store, and handle used refrigerants from diverse systems. This holistic approach ensures clients meet environmental compliance obligations and manage their refrigerant assets responsibly.

In 2023, Hudson processed approximately 10.5 million pounds of refrigerant, underscoring the scale of their management capabilities. These services are vital for industries like HVACR, where regulatory adherence and efficient inventory control are paramount. For instance, the EPA's AIM Act continues to drive demand for responsible refrigerant handling and reclamation.

Hudson Technologies' System Optimization and Analytical Services, under the Product aspect of their 4P's analysis, directly addresses customer needs for improved HVACR system efficiency. Their RefrigerantSide® Services and SmartEnergy OPS® are designed to reduce energy consumption, a key benefit for cost-conscious businesses. For instance, by ensuring cleaner refrigerant circuits and providing real-time monitoring, these services can lead to significant operational savings.

Emergency Cooling System Repairs

Hudson Technologies' emergency cooling system repair services address a critical customer need for immediate support during unexpected equipment failures. This offering directly tackles the Place aspect of their marketing mix by ensuring availability of essential services when and where customers need them most, mitigating costly operational disruptions.

The company's commitment to rapid response for cooling system emergencies underscores the Product aspect of their marketing mix. This service is designed to provide peace of mind and operational stability, a key benefit for businesses reliant on consistent temperature control. For instance, in 2024, industries such as data centers and food processing, which experienced significant growth, faced heightened risks of downtime due to cooling system failures, making such emergency services invaluable.

Pricing for these emergency services would typically reflect the urgency and specialized nature of the work, aligning with the Price element. This often involves premium rates for after-hours or rapid deployment, ensuring that the cost is justified by the avoidance of much larger financial losses from extended downtime. For example, a single hour of downtime in a large data center can cost upwards of $5,000, making prompt repair a cost-effective solution.

- Availability: 24/7 emergency response for critical cooling system issues.

- Service Scope: Rapid diagnosis and repair to minimize operational downtime.

- Value Proposition: Preventing significant financial losses associated with equipment failure.

- Target Industries: Data centers, healthcare, manufacturing, and other sectors with critical cooling needs.

Carbon Offset Projects

Hudson Technologies' carbon offset projects represent a key product offering, directly addressing the growing corporate demand for verifiable emissions reductions. These projects are designed to generate carbon credits, which companies can purchase to balance their own carbon footprint. For instance, as of early 2024, the voluntary carbon market has seen significant growth, with some estimates projecting it to reach tens of billions of dollars by the end of the decade, driven by increased corporate net-zero commitments.

This product line allows Hudson to actively participate in and facilitate global decarbonization efforts. By developing and managing these projects, Hudson Technologies not only provides a service but also embodies its commitment to environmental responsibility. Companies partnering with Hudson can leverage these offsets to meet their sustainability targets, enhancing their brand reputation and stakeholder confidence in their environmental performance.

The value proposition for clients is clear: tangible progress towards sustainability goals coupled with a reliable partner in environmental stewardship. Hudson's expertise in project development, verification, and retirement of carbon credits ensures the integrity and efficacy of the offsets provided. This strategic product focus positions Hudson Technologies as a facilitator of corporate climate action.

- Product: Carbon Offset Projects

- Contribution: Supports global greenhouse gas emission reduction efforts.

- Client Benefit: Enables companies to meet sustainability goals and enhance environmental reputation.

- Market Context: Aligns with a rapidly expanding voluntary carbon market, projected for significant growth in the coming years.

Hudson Technologies' product portfolio is anchored by its leadership in refrigerant reclamation and management. This core offering directly addresses environmental regulations and the growing demand for sustainable cooling solutions. By processing millions of pounds of refrigerants annually, Hudson provides a vital service that reduces the need for virgin refrigerants and promotes responsible lifecycle management.

Their System Optimization and Analytical Services further enhance their product value by focusing on energy efficiency in HVACR systems. Services like RefrigerantSide® and SmartEnergy OPS® aim to reduce operational costs for clients. This focus on efficiency is critical, especially as energy prices remain a significant concern for businesses in 2024 and beyond.

Furthermore, Hudson's emergency cooling system repair services offer immediate, critical support to industries reliant on uninterrupted temperature control. This product is designed to prevent substantial financial losses from downtime, a key concern for sectors like data centers and food processing which experienced notable growth and associated risks in 2024.

The company also leverages its expertise to develop carbon offset projects, aligning with corporate sustainability goals. This product line taps into the expanding voluntary carbon market, estimated to be worth tens of billions of dollars by 2030, offering clients a tangible way to achieve their environmental targets.

| Product Category | Key Offering | 2023 Volume/Impact | 2024 Focus/Growth Area | Market Relevance |

|---|---|---|---|---|

| Refrigerant Reclamation | Reclaimed Refrigerants | Processed 20+ million lbs | Continued expansion of reclamation capacity | Environmental compliance, cost savings |

| Refrigerant Management | Recovery, Storage, Handling | Processed 10.5 million lbs | Enhanced digital tracking and reporting | Regulatory adherence, asset management |

| System Optimization | Energy Efficiency Services | Reduced energy consumption for clients | Increased adoption of SmartEnergy OPS® | Operational cost reduction |

| Emergency Services | Cooling System Repair | Mitigated downtime for critical industries | Serving growing data center & food processing sectors | Operational stability, loss prevention |

| Sustainability Solutions | Carbon Offset Projects | Facilitating corporate decarbonization | Growth in voluntary carbon market | ESG goals, brand reputation |

What is included in the product

This analysis provides a comprehensive breakdown of Hudson Technologies' marketing strategies, detailing their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts.

This 4P's analysis for Hudson Technologies simplifies complex marketing strategies, offering a clear roadmap to address market challenges and drive growth.

It provides a concise, actionable framework for understanding Hudson Technologies' marketing approach, easing the burden of detailed strategic planning.

Place

Hudson Technologies primarily utilizes a direct sales approach, leveraging a robust network of facilities concentrated within the United States. This direct engagement model enables them to effectively cater to the varied needs of their clientele in the HVACR sector.

Their distribution strategy is finely tuned for logistical efficiency, ensuring that products are readily accessible to customers precisely when and where they are required. This focus on supply chain optimization is critical for maintaining customer satisfaction and market responsiveness.

For fiscal year 2023, Hudson Technologies reported net sales of $182.7 million, reflecting the reach and effectiveness of their direct sales and distribution network in serving the HVACR market.

Hudson Technologies strategically enhances its market presence through targeted acquisitions, exemplified by the June 2024 purchase of USA Refrigerants. This move significantly bolstered Hudson's refrigerant reclamation capacity and broadened its operational footprint across new geographic regions. The integration of USA Refrigerants is poised to improve Hudson's service delivery to a more extensive customer network and reinforce its supply chain resilience.

Hudson Technologies leverages its website as a key informational hub, detailing its comprehensive range of products and services. This digital platform is crucial for customer education and engagement, offering valuable resources that support their refrigerant management solutions. For instance, tools like Cylinder Quickscan™ QR Tracking are prominently featured, highlighting the company's commitment to technological advancement and operational efficiency for its clients.

Industry Partnerships and Collaborations

Hudson Technologies actively fosters industry partnerships to advance sustainable refrigerant practices. A key collaboration with LG Air Conditioning Technologies USA exemplifies this, focusing on promoting the adoption of lower Global Warming Potential (GWP) refrigerants across the HVACR sector. These alliances are crucial for expanding Hudson's market influence and driving broader industry change towards more environmentally responsible refrigerant management.

These strategic collaborations enhance Hudson Technologies' market penetration and advocacy for sustainable solutions. By working with major players like LG, they can more effectively influence industry standards and encourage the transition to refrigerants with reduced environmental impact. This approach not only strengthens their position but also contributes to the overall sustainability goals of the HVACR industry.

- Partnership Focus: Promoting sustainable refrigerant management and the use of lower GWP refrigerants.

- Key Collaborator: LG Air Conditioning Technologies USA.

- Impact: Extended reach and influence within the HVACR sector, driving industry-wide adoption of greener alternatives.

Compliance-Driven Market Access

The regulatory environment, especially the AIM Act's phasedown of hydrofluorocarbons (HFCs) and state-specific mandates for reclaimed refrigerant usage, significantly dictates Hudson Technologies' market access. These rules directly translate into guaranteed demand for their reclaimed refrigerants, fostering growth and market penetration.

This compliance-driven placement creates a unique market dynamic. Hudson's ability to provide certified reclaimed refrigerants positions them as a crucial supplier within this evolving regulatory framework.

- AIM Act Mandates: The American Innovation and Manufacturing (AIM) Act, enacted in 2020, is progressively phasing down the production and consumption of HFCs by 85% by 2036. This creates a structural deficit in virgin refrigerant supply, driving demand for reclaimed alternatives.

- State-Level Requirements: Several states, including California and New York, have implemented their own regulations requiring a percentage of reclaimed refrigerant to be used in new equipment installations or servicing, further bolstering demand for Hudson's offerings. For example, California's CARB regulations have been instrumental in this space.

- Certified Reclaimers: Hudson Technologies is an EPA-certified reclaimer, ensuring their products meet stringent purity standards required by regulations, which is a critical factor for market acceptance.

- Market Access Advantage: By adhering to and anticipating these regulatory shifts, Hudson secures a vital 'place' in the market, transforming compliance into a competitive advantage and ensuring consistent demand for their reclaimed products.

Hudson Technologies' 'Place' strategy centers on its extensive network of facilities strategically located across the United States, ensuring proximity to its HVACR customer base. This physical presence is complemented by a robust direct sales force and efficient logistics, facilitating timely product and service delivery. The company's recent acquisition of USA Refrigerants in June 2024 further expanded its operational footprint, enhancing its ability to serve a wider geographic area and meet growing demand.

Regulatory compliance, particularly the AIM Act's HFC phasedown, solidifies Hudson's market position by creating a consistent demand for its EPA-certified reclaimed refrigerants. This regulatory tailwind, coupled with state-level mandates for reclaimed refrigerant usage, ensures Hudson's products are a necessity for many HVACR operations.

Hudson Technologies' market access is significantly influenced by its adherence to stringent environmental regulations, such as the AIM Act, which mandates an 85% reduction in HFCs by 2036. This regulatory landscape directly translates into a guaranteed market for their reclaimed refrigerants, as evidenced by the growing demand driven by these mandates.

| Key Aspect | Description | Impact on Place |

| Facility Network | Concentrated facilities across the US | Ensures efficient service delivery and customer accessibility. |

| Direct Sales & Logistics | Leveraging direct sales and optimized supply chain | Guarantees product availability and responsiveness to market needs. |

| Acquisitions | USA Refrigerants acquisition (June 2024) | Broadened geographic reach and increased service capacity. |

| Regulatory Environment | AIM Act phasedown, state mandates for reclaimed refrigerants | Creates a compliant and essential market for Hudson's reclaimed products. |

What You See Is What You Get

Hudson Technologies 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Hudson Technologies' 4P's Marketing Mix is fully complete and ready to use. You can confidently assess the detailed breakdown of Product, Price, Place, and Promotion strategies before making your purchase.

Promotion

Hudson Technologies leverages industry conferences and investor presentations as key promotional tools, fostering direct engagement with the financial community. For instance, their participation in events like the 37th Annual Roth Conference and the 45th Annual Canaccord Genuity Growth Conference in 2025 offers a vital avenue for leadership to communicate corporate progress and future strategies.

Hudson Technologies leverages press releases and financial reporting as a key component of its marketing mix, specifically within the Promotion element. The company actively disseminates information regarding its financial performance, strategic direction, and operational advancements through these channels.

These communications are crucial for fostering transparency and ensuring that investors, analysts, and the broader public are well-informed about Hudson Technologies' progress. For instance, in its fiscal year 2024 reporting, the company highlighted significant revenue growth, a testament to its effective communication strategy.

Availability of these updates through platforms like GlobeNewswire and Nasdaq ensures broad accessibility. This consistent flow of information, including details from their Q1 2025 earnings call, plays a vital role in shaping stakeholder perceptions and maintaining confidence in the company's future prospects.

Hudson Technologies places a significant emphasis on sustainability, actively promoting its role in reducing greenhouse gas emissions. Their mission statement underscores a commitment to improving environmental quality and fostering a healthier planet through the recovery and reuse of natural resources. This focus deeply resonates with a growing segment of environmentally conscious consumers and investors alike.

Thought Leadership and Industry Reports

Hudson Technologies actively cultivates thought leadership through strategic industry collaborations. Their partnership with RMI to publish a comparative report on the climate impact of refrigerant reclamation versus virgin refrigerants is a prime example. This initiative not only highlights the environmental advantages of their services but also solidifies their position as a knowledgeable leader in the sustainable refrigerant management sector.

This approach directly supports their marketing efforts by providing credible data and expert analysis. The report serves as a valuable tool for educating stakeholders and influencing market perception. For instance, such reports often cite data on greenhouse gas emissions, demonstrating tangible benefits. The Environmental Protection Agency (EPA) has increasingly focused on refrigerant management, making this type of informational content highly relevant for 2024 and beyond.

Key takeaways from this thought leadership strategy include:

- Establishing Authority: Publishing data-driven reports positions Hudson as an expert in refrigerant lifecycle management.

- Promoting Solutions: The content directly showcases the environmental and economic benefits of refrigerant reclamation.

- Influencing Policy and Practice: Informing the industry and policymakers about sustainable alternatives can drive market adoption.

- Enhancing Brand Reputation: Association with reputable organizations like RMI bolsters trust and credibility.

Direct Marketing and Customer Education

Hudson Technologies likely engages in direct marketing by reaching out to HVACR professionals and businesses directly. This approach is crucial for educating them on the value of their specialized services. For instance, their refrigerant reclamation and management solutions directly address the needs of technicians and facility managers.

The company's focus on sustainable solutions and regulatory compliance, such as those mandated by the AIM Act for phasedown of hydrofluorocarbons (HFCs), necessitates direct customer education. Hudson probably uses direct sales teams and targeted communication to explain the advantages of their services, like reduced environmental impact and cost savings for their clients.

Consider these points regarding Hudson's direct marketing and customer education:

- Direct Engagement: Hudson's business model inherently involves direct interaction with HVACR service providers and commercial end-users.

- Educational Focus: Their services, like refrigerant lifecycle management and system efficiency, require educating customers on environmental benefits and operational advantages.

- Regulatory Tailwinds: The ongoing phase-down of HFCs under regulations like the AIM Act (which aims for a 40% reduction by 2024 compared to 2021 levels) creates a strong need for Hudson to educate the market on compliant and sustainable refrigerant solutions.

- Value Proposition: Direct communication likely highlights how Hudson's offerings help clients achieve regulatory compliance, reduce operating costs, and enhance system performance.

Hudson Technologies actively utilizes digital platforms for promotion, including their corporate website and social media channels, to disseminate information about their services and sustainability initiatives. This digital presence is crucial for reaching a broad audience of potential clients and investors, especially in light of growing environmental concerns and regulatory changes impacting the HVACR industry.

The company's website likely serves as a central hub for detailed information on refrigerant reclamation, repair, and management services, alongside financial reports and sustainability metrics. For instance, their commitment to environmental stewardship, evidenced by their role in recovering millions of pounds of refrigerants, is a key message amplified online. This digital outreach complements their participation in industry events and direct marketing efforts, ensuring a comprehensive promotional strategy.

Hudson Technologies' promotional strategy also emphasizes thought leadership and educational content. By publishing reports and engaging in collaborations, such as their work with RMI on refrigerant reclamation's climate impact, they position themselves as experts. This content, often backed by data like the EPA's increasing focus on refrigerant management, educates the market and highlights the benefits of their sustainable solutions, a critical aspect for 2024 and beyond.

Furthermore, direct marketing and customer education are vital. Hudson likely reaches out directly to HVACR professionals and businesses to explain their specialized services, particularly in the context of regulatory compliance like the AIM Act. This direct approach helps clients understand the environmental and economic advantages of Hudson's offerings, especially as the HFC phase-down progresses, aiming for a significant reduction by 2024.

| Promotional Channel | Key Activities | Target Audience | 2024/2025 Relevance |

|---|---|---|---|

| Industry Conferences | Presentations, Networking | Investors, Financial Analysts, Industry Professionals | Roth Conference, Canaccord Genuity Growth Conference participation |

| Financial Reporting & Press Releases | Disseminating Performance Data, Strategic Updates | Investors, Analysts, General Public | Fiscal Year 2024 Revenue Growth highlights, Q1 2025 Earnings Call insights |

| Digital Presence (Website, Social Media) | Information Dissemination, Sustainability Messaging | Clients, Investors, General Public | Highlighting millions of pounds of refrigerants recovered, environmental impact reduction |

| Thought Leadership & Collaborations | Publishing Reports, Industry Partnerships | Policymakers, Industry Professionals, Environmentally Conscious Stakeholders | RMI collaboration on refrigerant reclamation vs. virgin refrigerant impact, EPA focus |

| Direct Marketing & Customer Education | Targeted Outreach, Service Explanation | HVACR Professionals, Businesses | AIM Act compliance, HFC phase-down education, cost savings emphasis |

Price

Hudson Technologies' refrigerant pricing strategy is deeply embedded within market-driven forces, reflecting a keen awareness of supply and demand. This is particularly evident in the pricing of hydrofluorocarbons (HFCs), which saw a notable decrease in late 2024 and into early 2025. This trend underscores Hudson's ability to adjust its pricing in response to shifts in the broader refrigerant landscape.

Hudson Technologies is actively managing its gross margin in a fluctuating market. The company experienced a dip to 22% in Q1 2025, down from 33% in Q1 2024, reflecting significant pricing pressures.

Despite this recent challenge, management anticipates a recovery, projecting gross margins for the full year 2025 to settle around the mid-20% range. This indicates a strategic effort to navigate competitive pricing while striving to maintain profitability.

Hudson Technologies' service offerings, such as refrigerant management, system optimization, and analytical services, are prime candidates for value-based pricing. This approach focuses on the economic benefits delivered to the customer rather than just the cost of providing the service.

These specialized services offer tangible advantages like enhanced energy efficiency and guaranteed regulatory compliance, which directly translate into cost savings and risk mitigation for clients. For instance, improved system efficiency can lead to significant reductions in energy bills, a quantifiable benefit that supports a premium price point.

In 2023, the industrial refrigeration market, where Hudson operates, saw continued emphasis on energy efficiency. Companies actively sought solutions that could lower operational costs, making services that promise such improvements highly valuable. Hudson's ability to demonstrate ROI through these services is key to their pricing strategy.

Impact of Regulatory Environment on Pricing

The ongoing HFC phase-down, driven by the AIM Act and various state-level mandates encouraging reclaimed refrigerant use, is a significant factor influencing Hudson Technologies' pricing strategy. This regulatory push is anticipated to bolster long-term demand for Hudson's core products, thereby strengthening its pricing power.

This regulatory tailwind is expected to translate into more stable, and potentially increased, pricing for reclaimed refrigerants in the coming years. For instance, projections suggest the U.S. HFC refrigerant market will see significant shifts due to these regulations, creating opportunities for companies like Hudson that specialize in reclamation services.

- AIM Act Mandates: Accelerating the phase-down of HFCs, increasing demand for reclaimed alternatives.

- State-Level Reclaimed Refrigerant Use: Specific state regulations, like those in California and New York, directly boost the market for reclaimed refrigerants.

- Pricing Power: The supply-demand imbalance created by the phase-down is likely to support higher and more stable pricing for Hudson's reclaimed products.

- Market Growth: Analysts project substantial growth in the refrigerant reclamation market, driven by these environmental regulations, benefiting Hudson's revenue streams.

Capital Allocation and Share Repurchase Programs

Hudson Technologies' robust financial position, characterized by a strong balance sheet with significant cash reserves and no outstanding debt, underpins its capacity for strategic capital allocation. This financial flexibility is crucial for navigating competitive market pricing and demonstrating management's conviction in the company's intrinsic value.

The company's ability to engage in share repurchase programs, while not a direct pricing tactic for its services, serves as a powerful signal to the market. Such actions can enhance shareholder value by reducing the number of outstanding shares, potentially increasing earnings per share, and reflecting confidence in future profitability.

- Financial Strength: As of Q1 2024, Hudson Technologies reported approximately $160 million in cash and cash equivalents, with no long-term debt, providing substantial capital for strategic initiatives.

- Share Repurchases: The company has an active share repurchase program, demonstrating a commitment to returning capital to shareholders and supporting its stock valuation.

- Market Signal: Consistent buybacks signal management's belief that the stock is undervalued, which can influence investor perception and potentially stabilize or increase market pricing for its services indirectly.

- Strategic Flexibility: This debt-free status allows Hudson Technologies to pursue growth opportunities or weather economic downturns without the burden of interest payments, indirectly supporting its pricing power.

Hudson Technologies' pricing strategy is a dynamic interplay of market forces and strategic value. The company navigates fluctuating refrigerant prices, as seen with the notable decrease in HFCs in late 2024 and early 2025, demonstrating an ability to adapt to supply and demand shifts.

Gross margins have seen pressure, dipping to 22% in Q1 2025 from 33% in Q1 2024, yet management projects a recovery to the mid-20% range for the full year 2025, highlighting a focus on margin management amidst competitive pricing.

Value-based pricing is applied to specialized services like refrigerant management, where benefits such as energy efficiency and regulatory compliance translate into tangible cost savings for clients, supporting premium pricing.

The ongoing HFC phase-down, driven by the AIM Act and state mandates, is a key factor, expected to increase demand for reclaimed refrigerants and bolster Hudson's pricing power in the long term.

| Metric | Q1 2024 | Q1 2025 | FY 2025 Projection |

|---|---|---|---|

| Gross Margin | 33% | 22% | Mid-20% Range |

| Cash & Equivalents | ~$160 million | N/A | N/A |

| Long-term Debt | $0 | $0 | $0 |

4P's Marketing Mix Analysis Data Sources

Our Hudson Technologies 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor relations materials. We also incorporate insights from industry reports and competitive intelligence to ensure a holistic understanding of their market strategy.