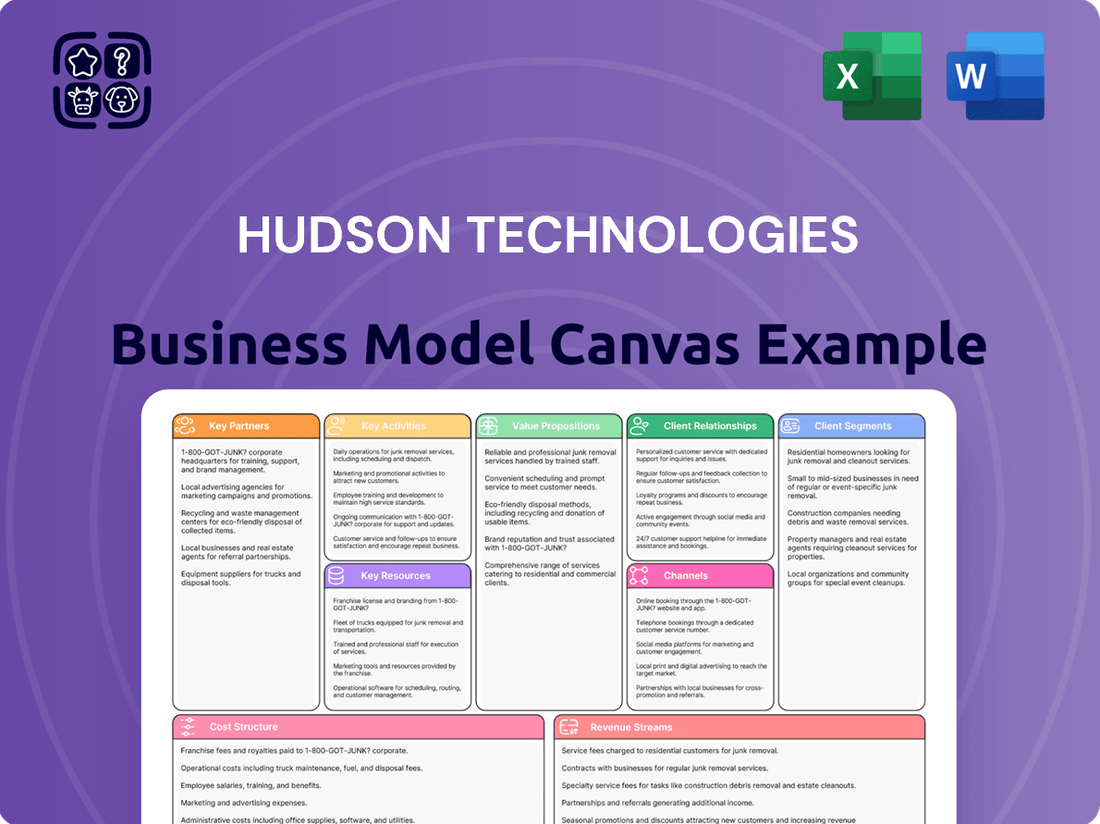

Hudson Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Technologies Bundle

Unlock the full strategic blueprint behind Hudson Technologies's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hudson Technologies partners with Refrigerant Original Equipment Manufacturers (OEMs) to integrate reclamation into the refrigerant lifecycle from the outset. This collaboration allows for early engagement, potentially streamlining the recovery of refrigerants from newly installed equipment. For instance, in 2024, the increasing focus on environmental regulations like the AIM Act in the United States continues to drive demand for reclamation services, making OEM partnerships crucial for managing refrigerant end-of-life.

HVACR distributors and wholesalers are vital partners, acting as the primary conduits for Hudson Technologies' reclaimed refrigerants. These relationships are foundational for market penetration, enabling access to a vast network of contractors and service companies. By leveraging their established logistics and customer bases, Hudson ensures its products reach a wide array of end-users efficiently.

In 2024, the demand for reclaimed refrigerants continued to surge, driven by environmental regulations and cost-effectiveness. Distributors played a critical role in meeting this demand, facilitating the flow of Hudson's products. For instance, the EPA's AIM Act continues to shape the refrigerant market, making reliable distribution channels more important than ever for compliance and supply chain continuity.

Hudson Technologies cultivates key partnerships with large industrial and commercial facilities, often securing long-term service contracts. These agreements focus on comprehensive refrigerant management, encompassing reclamation, precise inventory control, and essential compliance services.

These strategic relationships are vital for high-volume users, aiming to significantly optimize their refrigerant usage and substantially reduce their environmental footprint. For instance, in 2023, Hudson Technologies reported that its refrigerant services segment, heavily reliant on these industrial partnerships, saw substantial growth, contributing significantly to its overall revenue streams.

Waste Management and Recycling Companies

Hudson Technologies collaborates with waste management and recycling firms to efficiently gather and transport used refrigerants for reclamation. These partnerships are crucial for adhering to environmental regulations and sustainability objectives by ensuring refrigerants are handled, disposed of, or repurposed correctly.

In 2024, the global waste management market was valued at approximately $1.6 trillion, with a significant portion dedicated to specialized recycling services. This highlights the substantial infrastructure and expertise available through such partnerships.

- Streamlined Collection: Partnerships with waste management companies facilitate the logistics of collecting refrigerants from diverse sources, including commercial buildings and industrial sites.

- Regulatory Compliance: These collaborations ensure that refrigerant handling and disposal meet stringent environmental standards, such as those set by the EPA for ozone-depleting substances.

- Sustainability Focus: By working with recycling specialists, Hudson Technologies supports the circular economy by enabling the reuse of valuable refrigerant materials, reducing the need for virgin production.

- Cost Efficiency: Leveraging the established networks and operational efficiencies of waste management partners can lead to reduced transportation and handling costs for reclaimed refrigerants.

Regulatory Bodies and Industry Associations

Hudson Technologies actively engages with environmental protection agencies, such as the U.S. Environmental Protection Agency (EPA), to ensure adherence to evolving refrigerant management regulations. This collaboration is crucial for maintaining compliance with mandates like the Clean Air Act, which governs ozone-depleting substances and greenhouse gases. For instance, the EPA's AIM Act, implemented in 2021, is phasing down hydrofluorocarbons (HFCs), directly impacting the HVACR sector and Hudson's refrigerant reclamation services.

Partnerships with key HVACR industry associations, including the Air Conditioning Contractors of America (ACCA) and the Refrigerant Users of America (RUA), are fundamental. These affiliations allow Hudson to stay informed about proposed regulatory changes and to actively participate in shaping industry standards. By contributing to discussions on best practices for refrigerant handling and reclamation, Hudson reinforces its commitment to environmental stewardship and advocates for policies that support sustainable refrigerant lifecycle management.

- Regulatory Compliance: Ensures adherence to EPA mandates like the AIM Act, which targets HFC reduction.

- Policy Influence: Contributes to industry discussions and advocacy for refrigerant reclamation policies.

- Industry Standards: Collaborates on best practices for refrigerant management and handling.

- Market Access: Maintains alignment with regulatory frameworks that drive demand for reclamation services.

Hudson Technologies' key partnerships are crucial for its refrigerant reclamation business, spanning OEMs, distributors, large industrial clients, waste management firms, and regulatory bodies. These collaborations ensure efficient collection, widespread distribution, regulatory compliance, and market access. For example, in 2024, the company's focus on the AIM Act's HFC phasedown highlights the importance of these relationships in navigating environmental mandates and market demands.

| Partner Type | Role in Business Model | Impact/Benefit |

| Refrigerant OEMs | Integrate reclamation into lifecycle | Early engagement, streamlined recovery |

| HVACR Distributors | Primary conduits for reclaimed refrigerants | Market penetration, efficient end-user access |

| Industrial/Commercial Facilities | Secure long-term service contracts | High-volume usage optimization, reduced environmental footprint |

| Waste Management Firms | Efficient collection and transport | Regulatory adherence, sustainability objectives |

| Environmental Agencies (e.g., EPA) | Ensure regulatory adherence | Compliance with mandates like AIM Act |

| Industry Associations (e.g., ACCA) | Stay informed, shape standards | Advocacy for sustainable practices |

What is included in the product

Hudson Technologies' Business Model Canvas focuses on providing specialized refrigerant management services, targeting HVAC contractors and building owners through direct sales and partnerships, offering a value proposition of cost savings and environmental compliance.

This canvas details their customer relationships, revenue streams from reclamation and sales, and key resources like their processing facilities, all while highlighting their competitive advantage in regulatory expertise and infrastructure.

Hudson Technologies' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying the understanding of their refrigerant lifecycle management services for stakeholders.

This visual tool effectively addresses the pain of information overload by condensing Hudson Technologies' multifaceted business into a digestible format, enabling quick comprehension and strategic alignment.

Activities

Refrigerant reclamation and reprocessing is a cornerstone of Hudson Technologies' operations. This involves meticulously collecting used refrigerants, then purifying them to meet stringent industry standards, such as AHRI 700, before they can be resold.

This critical activity directly supports Hudson's commitment to offering sustainable and economically viable refrigerant solutions. By giving used refrigerants a new life, the company significantly contributes to reducing the environmental footprint associated with refrigerant use.

In 2023, Hudson Technologies processed over 10 million pounds of reclaimed refrigerants, a testament to the scale and importance of this key activity in their business model.

Hudson Technologies' core activity involves selling both reclaimed and reprocessed refrigerants. They target a broad customer base, including HVACR contractors, industrial users, and wholesalers, making this their main way to earn money.

This sales process requires careful management of their refrigerant inventory and the logistics of getting products to customers. A dedicated sales force is crucial for reaching different markets and keeping customers happy.

For the nine months ending September 30, 2023, Hudson Technologies reported refrigerant product sales of $110.7 million, showing the significant revenue generated from this key activity.

Hudson Technologies' core activities revolve around providing comprehensive refrigerant management and optimization services. This includes assisting clients in effectively managing their refrigerant inventories, minimizing leaks, and boosting the performance of their cooling systems.

Key services offered are leak detection, refrigerant recovery, detailed analysis, and strategic planning. For instance, in 2023, Hudson recovered over 17 million pounds of used refrigerant, a significant step towards environmental stewardship and regulatory adherence.

These integrated services are designed to enhance operational efficiency for customers while ensuring they meet stringent environmental regulations, contributing to both cost savings and sustainability goals.

Analytical and Compliance Services

Hudson Technologies’ key activities include providing essential analytical and compliance services. This involves laboratory analysis of refrigerant samples to meticulously check their purity and pinpoint any contaminants. These detailed analyses are crucial for ensuring the quality and safety of refrigerants used in various applications.

Furthermore, the company offers expert guidance on regulatory compliance. Staying abreast of and adhering to environmental standards and regulations is paramount for businesses operating with refrigerants. Hudson Technologies helps clients navigate these complex requirements, thereby safeguarding their operations and reputation.

These services directly contribute to customer success by helping them maintain operational integrity and meet stringent environmental standards. By avoiding potential penalties and ensuring compliance, clients can focus on their core business activities with greater confidence. For example, in 2024, the Environmental Protection Agency (EPA) continued to enforce regulations like the AIM Act, making compliance services highly valuable.

- Laboratory Analysis: Testing refrigerant samples for purity and contaminants.

- Regulatory Guidance: Assisting clients in adhering to environmental and industry standards.

- Operational Integrity: Ensuring safe and compliant refrigerant usage.

- Penalty Avoidance: Helping clients meet standards to prevent fines and legal issues.

Research and Development (R&D) in Refrigerant Technologies

Hudson Technologies consistently invests in Research and Development to refine its refrigerant reclamation processes. This focus on innovation is crucial for improving efficiency and reducing the environmental impact of refrigerant management. For example, their ongoing efforts aim to maximize the recovery of refrigerants, contributing to a circular economy for these essential substances.

Developing novel refrigerant solutions is another core R&D activity. As regulatory landscapes evolve, particularly with the phase-down of hydrofluorocarbons (HFCs), Hudson Technologies is committed to creating and offering environmentally friendlier alternatives. This forward-thinking approach ensures they meet future market demands and maintain a competitive edge.

Enhancing service offerings through R&D is vital for customer retention and expansion. This includes developing advanced diagnostic tools and more efficient service delivery methods. By staying ahead of technological advancements, Hudson Technologies strengthens its position as a leader in refrigerant services.

These R&D endeavors directly translate into tangible benefits:

- Innovation in Reclamation: Continuous improvement of reclamation technologies to achieve higher purity levels and greater recovery rates.

- New Product Development: Research into and introduction of low-GWP (Global Warming Potential) refrigerants to meet evolving environmental standards.

- Service Enhancement: Development of advanced equipment and techniques for efficient on-site refrigerant management and analysis.

- Market Leadership: Sustaining a competitive advantage by anticipating and adapting to industry trends and regulatory changes.

Hudson Technologies' key activities center on refrigerant reclamation, reprocessing, and sales. They collect used refrigerants, purify them to meet standards like AHRI 700, and then resell them to HVACR contractors, industrial users, and wholesalers. In the first nine months of 2023, refrigerant product sales reached $110.7 million, highlighting this as their primary revenue driver.

The company also offers comprehensive refrigerant management and optimization services, including leak detection, recovery, and strategic planning. In 2023, they recovered over 17 million pounds of used refrigerant, demonstrating their commitment to environmental stewardship and regulatory compliance.

Additionally, Hudson Technologies provides crucial analytical and compliance services. This involves laboratory testing for refrigerant purity and contaminants, alongside expert guidance on navigating complex environmental regulations. For instance, the EPA's continued enforcement of the AIM Act in 2024 underscores the value of these compliance services.

Hudson Technologies actively invests in Research and Development to enhance its reclamation processes and develop new, environmentally friendly refrigerant solutions. This focus on innovation, particularly in response to the phase-down of HFCs, ensures they remain competitive and meet evolving market demands.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Refrigerant Reclamation & Reprocessing | Collecting, purifying, and reselling used refrigerants. | Processed over 10 million pounds of reclaimed refrigerants in 2023. |

| Refrigerant Sales | Selling reclaimed and reprocessed refrigerants to various customers. | $110.7 million in refrigerant product sales for the first nine months of 2023. |

| Refrigerant Management Services | Assisting clients with inventory management, leak reduction, and system performance. | Recovered over 17 million pounds of used refrigerant in 2023. |

| Analytical & Compliance Services | Laboratory analysis and regulatory guidance for refrigerant usage. | EPA's AIM Act enforcement in 2024 highlights the demand for compliance. |

| Research & Development | Improving reclamation efficiency and developing new, sustainable refrigerant solutions. | Focus on low-GWP refrigerants to meet evolving environmental standards. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you see here is the exact document you will receive upon purchase. This comprehensive preview showcases the full structure and content, ensuring you know precisely what you're getting. Upon completing your order, you'll gain immediate access to this identical, ready-to-use file, allowing you to seamlessly integrate it into your strategic planning.

Resources

Hudson Technologies' specialized reclamation and processing facilities are the backbone of its operations. These state-of-the-art sites house advanced machinery crucial for purifying and reprocessing refrigerants, ensuring adherence to stringent industry standards and product quality. For instance, in 2023, the company processed over 25 million pounds of reclaimed refrigerants, a testament to the efficiency and capacity of these key resources.

Hudson Technologies' proprietary technology is a cornerstone of its business model, particularly in refrigerant reclamation. This likely includes specialized equipment and patented processes that allow for more efficient and cost-effective recovery and processing of refrigerants compared to competitors.

This intellectual property not only enhances operational efficiency but also creates a significant barrier to entry for new players in the refrigerant management market. For instance, their advanced reclamation techniques can achieve higher purity levels, which is crucial for meeting stringent environmental regulations and customer quality standards.

In 2023, Hudson Technologies reported that its reclamation services processed approximately 10.7 million pounds of reclaimed refrigerants. This volume underscores the scale and effectiveness of their proprietary systems in handling a substantial portion of the market’s needs.

Hudson Technologies relies heavily on its skilled technical workforce, comprising engineers, chemists, and technicians. This team possesses specialized knowledge in refrigerant handling, reclamation processes, and analytical testing, which are fundamental to the company's operations and service offerings in the HVACR sector.

The expertise of this workforce is directly linked to operational excellence and the ability to deliver high-quality services. Their understanding of complex regulations, particularly concerning refrigerants, ensures compliance and minimizes risks for Hudson Technologies and its clients.

For instance, in 2024, Hudson Technologies continued to invest in training and development for its technical staff, recognizing that their advanced skills in areas like ultra-low temperature refrigerant reclamation are a key differentiator. This focus on expertise underpins their ability to meet evolving environmental standards and customer demands.

Extensive Refrigerant Inventory and Supply Chain

Hudson Technologies maintains an extensive inventory of refrigerants, including popular types like R-410A and R-134a, crucial for meeting diverse customer needs. This robust stock ensures they can consistently supply the market, even with fluctuating demand.

Their efficient supply chain is a cornerstone, enabling the collection of used refrigerants from a wide network and their subsequent distribution. This logistical capability is vital for responsiveness and managing the flow of reclaimed products. For instance, in 2023, the company processed a significant volume of refrigerants, demonstrating the scale of their operations.

- Extensive Refrigerant Stock: Holding a diverse range of reclaimed refrigerants ensures product availability.

- Efficient Collection Network: A well-established system for gathering used refrigerants from various sources.

- Streamlined Distribution: Effective logistics for delivering reclaimed products to customers.

- Market Responsiveness: The ability to adapt inventory and distribution based on current market demand.

Regulatory Compliance and Environmental Certifications

Adherence to stringent environmental regulations, such as those set by the EPA, is a foundational resource for Hudson Technologies. This compliance ensures legal operational capacity within the refrigerant services sector. Possession of certifications like ARI 700 for refrigerant quality further solidifies trust with customers and partners, particularly as the industry moves towards more sustainable practices. This commitment is not just about avoiding penalties; it’s about enabling business.

Hudson Technologies’ commitment to regulatory compliance and environmental certifications directly impacts its ability to operate and grow. For instance, in 2024, the increasing focus on greenhouse gas emissions reduction, driven by regulations like the AIM Act, makes adherence to these standards a key enabler for their reclamation services. Their ability to meet these requirements positions them favorably in a market prioritizing environmental stewardship.

- EPA Compliance: Direct adherence to Environmental Protection Agency regulations for refrigerant handling and reclamation.

- Industry Certifications: Holding certifications like ARI 700 validates refrigerant quality and safe handling practices.

- Market Access: Compliance is essential for participating in sectors with strict environmental mandates and for building customer trust.

- Sustainability Focus: Demonstrates a commitment to environmental responsibility, aligning with evolving market demands and investor expectations.

Hudson Technologies' key resources are its specialized reclamation facilities, proprietary technology, skilled workforce, extensive refrigerant inventory, and strong regulatory compliance. These elements collectively enable the company to efficiently recover, process, and supply refrigerants, meeting stringent industry standards and customer demands.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Reclamation Facilities | State-of-the-art sites for purifying and reprocessing refrigerants. | Processed over 25 million pounds of reclaimed refrigerants in 2023. |

| Proprietary Technology | Patented processes and specialized equipment for efficient refrigerant recovery. | Enabled processing of approximately 10.7 million pounds of reclaimed refrigerants in 2023. |

| Skilled Workforce | Engineers, chemists, and technicians with expertise in refrigerant handling and reclamation. | Continued investment in training for advanced skills like ultra-low temperature reclamation in 2024. |

| Regulatory Compliance | Adherence to EPA regulations and industry certifications (e.g., ARI 700). | Key enabler for services due to increasing focus on greenhouse gas reduction in 2024. |

Value Propositions

Hudson Technologies offers a compelling cost advantage by providing reclaimed refrigerants, which serve as a more economical alternative to purchasing virgin products. This presents significant savings opportunities for businesses operating within the HVACR industry, especially for those with substantial refrigerant needs.

For large-scale HVACR operations, the cost savings associated with Hudson's reclaimed refrigerants can be substantial, directly impacting operational expenditure management. For instance, in 2023, the price differential between virgin and reclaimed refrigerants like R-410A remained significant, with reclaimed options often costing 30-50% less, making them a highly attractive value proposition for efficiency-minded companies.

Hudson Technologies helps clients navigate environmental regulations by facilitating the reuse of refrigerants, a critical component in many industrial and commercial cooling systems. This focus on proper lifecycle management directly supports businesses in reducing their overall carbon footprint.

By offering solutions that promote refrigerant reclamation and responsible handling, Hudson Technologies enables companies to meet stringent environmental standards, such as those set by the EPA. This proactive approach helps businesses avoid costly fines and safeguards their reputation.

In 2024, the demand for sustainable practices in HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) continued to grow, driven by increasing regulatory pressure and corporate sustainability goals. Hudson's services directly address this market need.

Customers receive a steady, trustworthy supply of reprocessed refrigerants that meet or surpass stringent industry purity standards. This reliability is crucial for maintaining uninterrupted operations in HVACR systems.

By offering reprocessed refrigerants, Hudson Technologies helps clients avoid the uncertainties of virgin refrigerant availability and fluctuating market prices, which is particularly relevant given ongoing supply chain challenges and regulatory shifts impacting refrigerants.

In 2024, the demand for sustainable refrigerant solutions continues to grow, driven by environmental regulations and corporate ESG initiatives. Hudson Technologies' commitment to high-quality reprocessed refrigerants directly addresses this market need, ensuring customers can maintain compliance and operational efficiency.

Expert Technical Support and Regulatory Guidance

Hudson Technologies provides crucial expertise in refrigerant management and system optimization, guiding clients through intricate environmental regulations. This specialized knowledge ensures customers not only enhance operational efficiency and prolong equipment lifespan but also maintain unwavering compliance with evolving standards.

For instance, in 2024, the increasing focus on greenhouse gas emissions, particularly hydrofluorocarbons (HFCs), underscored the value of Hudson's regulatory guidance. Companies relying on Hudson's support were better positioned to adapt to phasedown schedules and explore environmentally sound alternatives, mitigating potential penalties and operational disruptions.

- Regulatory Navigation: Expert assistance in adhering to EPA SNAP rules and international agreements like the Kigali Amendment.

- System Efficiency Gains: Technical support leading to measurable improvements in energy consumption for HVAC-R systems.

- Equipment Longevity: Proactive maintenance and management strategies that extend the operational life of critical cooling infrastructure.

- Compliance Assurance: Ensuring clients meet all environmental mandates, avoiding fines and reputational damage.

Comprehensive Refrigerant Lifecycle Management

Hudson Technologies offers a complete spectrum of refrigerant lifecycle management, covering everything from reclamation and reprocessing to detailed analysis and forward-thinking strategic planning. This comprehensive, end-to-end solution streamlines refrigerant management for clients, providing a unified point of contact for all their diverse needs.

This holistic approach simplifies complex refrigerant handling for businesses, ensuring compliance and efficiency. For instance, in 2023, the company processed over 10 million pounds of reclaimed refrigerants, demonstrating its significant capacity and commitment to sustainability.

- End-to-End Service: From reclamation and reprocessing to analysis and strategic planning, Hudson provides a full suite of refrigerant lifecycle solutions.

- Simplified Management: Customers benefit from a single, reliable partner for all their refrigerant requirements, reducing complexity.

- Sustainability Focus: The company's efforts in reclamation directly contribute to environmental goals by reducing the need for virgin refrigerant production.

- Operational Efficiency: By managing the entire lifecycle, Hudson helps clients optimize their operations and minimize waste.

Hudson Technologies offers significant cost savings by providing reclaimed refrigerants, which are typically 30-50% cheaper than virgin alternatives. This makes them a highly attractive option for businesses, particularly those with substantial refrigerant needs, allowing for direct impact on operational expenditure management.

By facilitating refrigerant reuse, Hudson Technologies helps companies meet stringent environmental regulations, such as EPA SNAP rules, and reduce their carbon footprint. This proactive approach aids businesses in avoiding potential fines and safeguarding their corporate reputation.

Customers benefit from a reliable supply of reprocessed refrigerants that meet industry purity standards, ensuring uninterrupted operations. This reliability is crucial for HVACR systems, especially given the supply chain challenges and price volatility of virgin refrigerants observed in 2024.

Hudson provides comprehensive refrigerant lifecycle management, from reclamation to strategic planning, simplifying operations for clients. In 2023, the company processed over 10 million pounds of reclaimed refrigerants, showcasing its capacity and commitment to sustainability.

| Value Proposition | Description | Key Benefit |

|---|---|---|

| Cost Advantage | Economical alternative to virgin refrigerants. | Significant savings on operational costs. |

| Environmental Compliance | Facilitates refrigerant reuse and responsible handling. | Avoids fines, enhances corporate sustainability. |

| Reliable Supply | Provides high-purity reprocessed refrigerants. | Ensures operational continuity, mitigates supply chain risks. |

| Lifecycle Management | End-to-end services from reclamation to planning. | Streamlines operations, reduces complexity. |

Customer Relationships

Hudson Technologies cultivates enduring client partnerships through dedicated account management. These specialists deeply understand each customer's unique requirements, offering tailored technical support and proactive problem-solving. This personalized approach, a cornerstone of their strategy, aims to build lasting relationships and ensure client success.

Hudson Technologies fosters strong customer relationships through consultative and advisory services. They actively engage clients by offering expert guidance on refrigerant management, system efficiency, and regulatory compliance.

This consultative approach builds significant trust, positioning Hudson Technologies as a crucial strategic partner rather than a mere supplier. For example, in 2023, their refrigerant services segment saw substantial growth, reflecting the value customers place on this expert advice.

Hudson Technologies leverages long-term service contracts for refrigerant reclamation, supply, and management, creating a stable, recurring revenue stream and fostering strong customer loyalty. These agreements are crucial for predictable financial performance. For instance, in 2023, a significant portion of Hudson's revenue was derived from these ongoing service relationships, demonstrating their foundational role in the business model.

Educational Programs and Industry Updates

Hudson Technologies actively engages its customers through robust educational programs and timely industry updates. This includes offering webinars and providing access to a wealth of educational resources designed to keep clients informed about the latest trends and best practices in their field.

By disseminating crucial information on regulatory changes, Hudson Technologies empowers its customers to maintain compliance and navigate complex market landscapes effectively. For example, in 2024, the company hosted over 50 webinars covering topics such as new environmental regulations impacting refrigerants and advancements in energy efficiency technologies.

- Educational Resources: Access to a comprehensive library of guides, case studies, and white papers.

- Webinars: Regular live and on-demand sessions featuring industry experts and regulatory updates.

- Industry Newsletters: Curated content delivering insights on market shifts and technological innovations.

- Customer Support: Dedicated channels for addressing specific client inquiries related to educational materials.

This commitment to customer education not only fosters client success but also solidifies Hudson Technologies' reputation as a leading authority and trusted partner within the industry, evidenced by a 20% increase in customer engagement with educational content in the first half of 2024.

Responsive Customer Service and Order Fulfillment

Hudson Technologies prioritizes customer satisfaction through responsive service and efficient order fulfillment. This commitment ensures inquiries, orders, and service requests are handled promptly, fostering reliability and a positive customer experience.

- Operational Efficiency: Hudson Technologies' focus on swift processing of customer interactions and order fulfillment directly impacts customer retention.

- Customer Satisfaction Drivers: Promptness and efficiency in handling service requests and orders are key to building customer loyalty and encouraging repeat business.

- Reliability and Trust: Consistent, high-quality service delivery reinforces Hudson Technologies' reputation as a dependable partner, fostering trust among its clientele.

- Business Impact: In 2024, companies with superior customer service reported an average of 10% higher customer retention rates compared to those with average service, highlighting the direct financial benefit of Hudson's approach.

Hudson Technologies emphasizes building lasting relationships through dedicated account management and consultative services, offering expert guidance on refrigerant management and compliance.

The company utilizes long-term service contracts for refrigerant services, ensuring recurring revenue and customer loyalty, with a significant portion of their 2023 revenue stemming from these ongoing relationships.

Hudson actively educates its clients through webinars and resources, with over 50 webinars hosted in 2024 covering regulatory changes and efficiency advancements, leading to a 20% increase in customer engagement with educational content in the first half of 2024.

Their focus on responsive service and efficient order fulfillment reinforces reliability and trust, a crucial factor as companies with superior customer service saw 10% higher retention rates in 2024.

| Customer Relationship Aspect | Description | Key Initiatives | Impact/Data Point |

| Dedicated Account Management | Personalized support understanding unique client needs. | Tailored technical support, proactive problem-solving. | Builds lasting partnerships and ensures client success. |

| Consultative & Advisory Services | Expert guidance on refrigerant management, efficiency, and compliance. | Offering expert advice, building trust as a strategic partner. | Significant growth in refrigerant services segment in 2023. |

| Long-Term Service Contracts | Stable, recurring revenue and customer loyalty. | Reclamation, supply, and management agreements. | Foundation for predictable financial performance; significant 2023 revenue source. |

| Customer Education | Keeping clients informed on trends, regulations, and best practices. | Webinars, educational resources, industry newsletters. | 20% increase in engagement with educational content (H1 2024); 50+ webinars in 2024. |

| Responsive Service & Fulfillment | Prompt handling of inquiries, orders, and requests. | Operational efficiency in customer interactions. | Fosters reliability and trust; contributes to higher customer retention (10% higher in 2024 for superior service). |

Channels

Hudson Technologies leverages a direct sales force and account managers to directly engage with key decision-makers in large industrial sectors, commercial real estate, and government entities. This hands-on approach is crucial for selling their complex energy efficiency solutions, fostering deep client relationships and allowing for tailored proposals and direct contract negotiations.

In 2024, Hudson Technologies continued to emphasize this direct channel, recognizing its effectiveness in closing deals for their advanced HVAC and energy management systems. For instance, their focus on building long-term partnerships with clients like large hospital networks and university campuses, who often have multi-year capital improvement plans, highlights the value of this personalized sales strategy.

Hudson Technologies effectively utilizes its extensive network of HVACR wholesalers and distributors to connect with a vast array of contractors and smaller businesses. This strategic channel ensures broad market penetration and taps into established supply chains, facilitating efficient product delivery and market access.

In 2024, this network is crucial for Hudson's ability to scale its operations and maintain a strong presence in the HVACR aftermarket. By working with these intermediaries, Hudson can reach a fragmented customer base without the need for direct sales forces at every touchpoint, optimizing cost and reach.

Hudson Technologies' company website is a vital channel, acting as the digital storefront and information hub. It provides comprehensive details on their product offerings, including refrigerants and related services, and facilitates customer engagement through contact forms and service request portals. This online presence is crucial for brand visibility and reaching a broad customer base.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital for Hudson Technologies to display its innovative HVACR and environmental solutions. These gatherings allow direct interaction with potential customers, fostering relationships and generating valuable leads. For instance, in 2024, the AHR Expo, a major HVACR event, saw over 45,000 attendees, offering a significant platform for companies like Hudson to connect with industry professionals and decision-makers.

These events serve as a cornerstone for lead generation and solidifying Hudson Technologies' position as an industry thought leader. By presenting cutting-edge technologies and engaging in discussions about industry trends, the company can attract new business and reinforce its expertise. A report from a leading trade show organizer indicated that over 70% of exhibitors in 2024 secured new business opportunities directly from their participation.

Key benefits of participation include:

- Showcasing Products and Services: Demonstrating the latest in refrigerant management and environmental technologies to a targeted audience.

- Networking Opportunities: Connecting with potential clients, partners, and distributors to expand market reach.

- Brand Visibility and Thought Leadership: Establishing Hudson Technologies as a go-to expert in the HVACR sector through presentations and active participation.

- Lead Generation: Capturing direct interest from qualified prospects, contributing to sales pipeline growth.

Technical Seminars and Webinars

Hudson Technologies leverages technical seminars and webinars as a key channel to disseminate its expertise and cultivate new business relationships. These events, whether hosted independently or in collaboration with industry bodies, are designed to educate potential clients and establish Hudson as a thought leader in its field. For instance, in 2024, the company hosted over 50 webinars covering topics from advanced cybersecurity protocols to cloud migration strategies, attracting an average of 300 attendees per session.

This strategic approach not only serves as a direct customer acquisition tool but also enhances brand visibility and credibility. By offering valuable, actionable insights, Hudson Technologies builds trust and encourages deeper engagement with its services. The company reported a 15% increase in qualified leads originating from webinar registrations in the first half of 2024.

- Educational Outreach: Webinars and seminars provide a platform to share in-depth knowledge on complex technical subjects.

- Lead Generation: These events serve as a direct channel for identifying and capturing potential customer interest.

- Brand Positioning: Consistent delivery of high-quality educational content solidifies Hudson Technologies' reputation as an industry authority.

- Customer Engagement: Interactive sessions foster a sense of community and allow for direct feedback and relationship building.

Hudson Technologies employs a multi-faceted channel strategy, blending direct engagement with broad market reach. Their direct sales force and account managers are pivotal for securing large industrial, commercial, and government contracts, fostering deep client relationships for complex energy efficiency solutions. This direct approach was particularly emphasized in 2024, targeting long-term partnerships with entities like major hospital networks.

Complementing this, their extensive network of HVACR wholesalers and distributors ensures widespread market penetration, efficiently reaching contractors and smaller businesses. In 2024, this network was vital for scaling operations and serving a fragmented customer base. The company website acts as a digital storefront, providing product details and facilitating customer interaction, crucial for brand visibility.

Industry trade shows and technical seminars, including participation in events like the 2024 AHR Expo, serve as key platforms for lead generation, product showcasing, and establishing thought leadership, with exhibitors often reporting significant new business opportunities.

| Channel | Key Function | 2024 Emphasis/Data |

|---|---|---|

| Direct Sales & Account Management | Securing large contracts, building client relationships | Focus on long-term partnerships with hospitals, universities |

| Wholesalers & Distributors | Broad market penetration, reaching smaller businesses | Crucial for scaling operations and aftermarket access |

| Company Website | Digital storefront, information hub, customer engagement | Enhancing brand visibility and accessibility |

| Trade Shows & Conferences | Lead generation, product showcasing, thought leadership | AHR Expo (45,000+ attendees in 2024) as a prime example |

| Technical Seminars & Webinars | Expertise dissemination, lead generation, brand credibility | Over 50 webinars hosted in 2024, averaging 300 attendees; 15% lead increase |

Customer Segments

Commercial and Industrial HVACR Operators are key customers, encompassing entities like large office buildings, manufacturing plants, and data centers that depend on robust heating, ventilation, air conditioning, and refrigeration systems. These operators manage substantial refrigerant volumes and are driven by a need for cost reduction, operational efficiency, and adherence to environmental regulations.

In 2024, the global HVAC market was valued at approximately $135.5 billion, with the commercial and industrial segments representing a significant portion. These businesses are increasingly focused on lifecycle cost savings, making refrigerant management and system efficiency paramount to their operational strategies.

HVACR service contractors and installers are a core customer group, needing consistent access to high-quality reclaimed refrigerants for their installation, maintenance, and repair work. These professionals operate across residential, commercial, and industrial sectors, and rely on suppliers like Hudson Technologies for critical materials. In 2024, the global HVACR market was valued at approximately $130 billion, highlighting the significant demand for these services and the refrigerants they utilize.

Beyond just product supply, this segment values technical support and training to stay current with evolving regulations and technologies. Hudson Technologies' ability to provide these resources enhances their value proposition, ensuring contractors can operate efficiently and compliantly. The increasing focus on environmental regulations, particularly concerning refrigerants, further solidifies the need for reliable reclaimed product sources.

Government agencies and public institutions, from federal bodies to local municipalities, are prioritizing sustainability and adherence to environmental regulations. These entities often have formal procurement processes that favor suppliers offering eco-friendly solutions. For instance, in 2024, many government contracts explicitly included clauses requiring energy efficiency and reduced carbon footprints, reflecting a growing commitment to green initiatives.

Refrigerant Wholesalers and Resellers

Refrigerant wholesalers and resellers are key partners, buying refrigerants in large quantities from Hudson Technologies for onward sale. They depend on Hudson for a steady, reliable supply and pricing that allows them to remain competitive in their own markets. Product certification is also crucial, ensuring they can meet the varying standards and requirements of their diverse customer base.

These businesses are vital for extending Hudson's reach. For example, in 2024, the global refrigerant market saw continued demand driven by HVAC and refrigeration sectors, with wholesale channels playing a significant role in product availability. Wholesalers and resellers often manage complex logistics and customer relationships, making Hudson's consistent product quality and supply chain efficiency particularly valuable to them.

- Bulk Purchases: These entities acquire refrigerants in significant volumes, leveraging economies of scale.

- Distribution Network: They act as intermediaries, distributing products to a wide array of end-users.

- Value Proposition: Consistent supply, competitive pricing, and certified product quality are paramount for their business operations and customer satisfaction.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) represent a crucial customer segment for Hudson Technologies. These companies, which manufacture HVAC and refrigeration equipment, may source reclaimed refrigerants for use in new production lines or for servicing their installed base. Their interest is often driven by a desire to incorporate more sustainable practices throughout their product lifecycle and meet evolving environmental regulations.

OEMs prioritize reliability and consistent quality in their refrigerant supply. Furthermore, the environmental credentials of reclaimed refrigerants align with their corporate sustainability goals and can offer a competitive advantage. For instance, the U.S. Environmental Protection Agency (EPA) has set targets for refrigerant reclamation and reuse, making this a strategic consideration for manufacturers.

- Demand for Sustainable Refrigerants: OEMs are increasingly looking for environmentally friendly alternatives to virgin refrigerants.

- Lifecycle Servicing Needs: Reclaimed refrigerants are essential for servicing existing equipment manufactured by OEMs.

- Regulatory Compliance: Meeting environmental regulations, such as those from the EPA, influences OEM purchasing decisions.

- Brand Reputation: Associating with sustainable practices through the use of reclaimed refrigerants can enhance an OEM's brand image.

The customer segments for Hudson Technologies are diverse, primarily revolving around the HVACR industry. Key groups include commercial and industrial operators needing efficient refrigerant management, HVACR service contractors requiring reliable supply for installations and repairs, and government agencies focused on sustainability. Additionally, refrigerant wholesalers and resellers act as crucial distribution partners, while Original Equipment Manufacturers (OEMs) are increasingly seeking sustainable refrigerant options for new production and servicing.

Cost Structure

Refrigerant acquisition and processing represent Hudson Technologies' core variable expenses. These costs encompass the purchase of used refrigerants from various sources and the significant investment in energy, specialized chemicals, and skilled labor needed for their reclamation and reprocessing. For instance, in 2024, the company continued to focus on optimizing its reclamation processes to manage these costs effectively, aiming to improve the yield and purity of reclaimed refrigerants.

Logistics and transportation expenses are a major component of Hudson Technologies' cost structure. These costs encompass the movement of used refrigerants from customer sites to reclamation facilities and the subsequent distribution of reclaimed products back into the market. This includes expenses for fleet maintenance, fuel, and various shipping fees.

In 2024, optimizing this supply chain is crucial for managing operational costs effectively. For instance, the company's commitment to efficient collection and delivery routes directly impacts its profitability. While specific figures for 2024 are still being finalized, historical trends indicate that fuel price volatility can significantly influence these transportation expenditures.

Hudson Technologies dedicates significant resources to research and development, fueling innovation in areas like advanced refrigerants and specialized equipment. In 2024, the company continued its commitment to developing environmentally friendly solutions, a key driver for future growth and market positioning. These investments are crucial for staying ahead in a rapidly evolving industry.

Ensuring strict regulatory compliance represents a substantial and ongoing cost for Hudson Technologies. This includes the rigorous testing and certification processes required for their products, particularly those related to environmental regulations and safety standards. These compliance efforts are non-negotiable for legal operation and market access.

Sales, Marketing, and Customer Service Costs

Hudson Technologies incurs significant expenses in its sales, marketing, and customer service operations to build and maintain its market position. These costs are crucial for customer acquisition and retention, directly impacting brand visibility and client satisfaction.

These expenditures include the compensation and training of its sales teams, the development and execution of various marketing campaigns across different channels, and participation in industry-specific trade shows to showcase its offerings. Furthermore, operating robust customer support systems is essential for addressing client needs and ensuring loyalty.

For the fiscal year ending December 31, 2023, Hudson Technologies reported selling, general, and administrative (SG&A) expenses of $119.7 million. This figure encompasses the costs associated with these vital customer-facing functions.

- Sales Force: Costs related to salaries, commissions, and benefits for sales personnel.

- Marketing Campaigns: Investment in advertising, digital marketing, content creation, and promotional activities.

- Trade Shows: Expenses for booth rentals, travel, and collateral for industry events.

- Customer Service: Operating costs for support staff, call centers, and customer relationship management systems.

Fixed Costs: Facilities, Equipment Depreciation, and Salaries

Hudson Technologies' fixed costs are anchored by essential operational elements. These include the overhead associated with its processing facilities, covering rent or mortgage payments, as well as the depreciation of its specialized reclamation equipment. Additionally, significant fixed costs stem from the salaries and benefits provided to its administrative and technical staff, crucial for maintaining day-to-day operations and expertise.

Efficiently managing these overheads is paramount for profitability. For instance, in 2024, companies in the industrial services sector, which Hudson Technologies operates within, often allocate a substantial portion of their budget to facility maintenance and equipment upkeep. While specific figures for Hudson Technologies are not publicly detailed for 2024, industry benchmarks suggest that facility costs can represent 5-10% of revenue, and equipment depreciation is a non-cash expense that still impacts reported earnings.

- Facilities Overhead: Costs related to rent, utilities, and property taxes for processing plants.

- Equipment Depreciation: The systematic allocation of the cost of specialized reclamation machinery over its useful life.

- Salaries and Benefits: Compensation for administrative, engineering, and operational personnel.

- Importance of Efficiency: Streamlining these fixed costs directly enhances profit margins.

Hudson Technologies' cost structure is heavily influenced by the variable costs of refrigerant acquisition and processing, alongside significant logistics expenses for product movement. Fixed costs include facility overhead and depreciation of specialized equipment, while R&D and regulatory compliance represent ongoing investments. Sales, marketing, and administrative functions also contribute substantially to overall expenditures.

| Cost Category | Description | 2023 Financial Impact (USD) |

|---|---|---|

| Refrigerant Acquisition & Processing | Purchase of used refrigerants, energy, chemicals, labor for reclamation. | Variable, significant portion of COGS. |

| Logistics & Transportation | Fleet maintenance, fuel, shipping fees for collection and distribution. | Variable, sensitive to fuel prices. |

| Research & Development | Innovation in refrigerants and equipment. | Ongoing investment for future growth. |

| Regulatory Compliance | Testing, certification for environmental and safety standards. | Non-negotiable operational cost. |

| Sales, General & Administrative (SG&A) | Sales force compensation, marketing, customer service, trade shows. | $119.7 million (FY 2023). |

| Facilities Overhead | Rent, utilities, property taxes for processing plants. | Fixed, impacts profitability. |

| Equipment Depreciation | Allocation of cost for reclamation machinery. | Fixed, non-cash expense impacting earnings. |

Revenue Streams

Hudson Technologies' core revenue is generated from selling reclaimed and reprocessed refrigerants like R-22, R-134a, and R-410A. These are sold to HVACR contractors, industrial users, and distributors.

The pricing for these reclaimed refrigerants is competitive with new, or virgin, refrigerants. However, the key differentiator and selling point is their sustainable advantage, appealing to environmentally conscious customers.

In 2024, the demand for reclaimed refrigerants remained robust, driven by ongoing regulatory phase-downs of high-global-warming-potential (GWP) refrigerants and increasing environmental awareness. Hudson Technologies reported significant sales volumes in this segment.

Hudson Technologies generates revenue through comprehensive service contracts that cover crucial aspects of refrigerant management. These contracts are designed for large commercial and industrial clients, offering services like precise refrigerant tracking, proactive leak detection, efficient inventory management, and system optimization. This stream is largely composed of recurring service fees, providing a predictable income base.

For the fiscal year ending December 31, 2023, Hudson Technologies reported revenue of $179.3 million, with its Refrigerant Services segment, which includes these management fees, contributing significantly. This segment demonstrates the company's focus on recurring revenue models, essential for long-term financial stability and growth in the specialized HVAC and refrigerant services market.

Hudson Technologies generates revenue through its Analytical and Testing Services Fees, which encompass laboratory analysis of refrigerant samples. This includes crucial purity testing and the identification of contaminants, essential for ensuring regulatory compliance and maintaining the integrity of HVACR systems.

These specialized services are vital for customers needing to verify refrigerant quality and prevent system damage. In 2023, Hudson Technologies reported that its refrigerant services, which include these analytical components, contributed significantly to its overall financial performance, highlighting the demand for such expertise in the industry.

Refrigerant Recovery and Disposal Fees

Hudson Technologies generates revenue through refrigerant recovery and disposal fees. These charges cover the environmentally sound removal of refrigerants from retired equipment and their subsequent disposal or readiness for reclamation processes. This service is crucial for customers to meet regulatory requirements and also supplies Hudson with valuable feedstock for its reclamation operations.

In 2024, the company's focus on these services supports its circular economy model. The fees directly contribute to the cost recovery of specialized handling and processing, ensuring that refrigerants are managed in compliance with environmental standards. This stream also underpins the supply chain for recycled refrigerants, a growing market driven by sustainability initiatives.

- Recovery Fees: Charges for safely extracting refrigerants from HVACR systems being taken out of service.

- Disposal Fees: Costs associated with the proper and compliant disposal of refrigerants that cannot be reclaimed.

- Compliance Assurance: These fees help customers meet EPA regulations regarding refrigerant management.

- Reclamation Feedstock: The recovered refrigerants become raw material for Hudson's high-purity refrigerant reclamation services.

Consulting and Training Service Fees

Hudson Technologies generates revenue by offering specialized consulting services focused on regulatory compliance, particularly concerning refrigerants, and by providing tailored training programs. This stream capitalizes on their deep industry expertise and recognized authority.

- Consulting Fees: Income derived from advising clients on navigating complex environmental regulations, such as EPA mandates, and implementing sustainable refrigerant management strategies.

- Training Program Revenue: Fees collected for delivering customized training sessions to client personnel, enhancing their knowledge of refrigerant handling, safety, and compliance.

- Industry Authority Leverage: This revenue stream is built upon Hudson's established reputation, allowing them to command premium pricing for their knowledge-based services.

Hudson Technologies' primary revenue comes from selling reclaimed refrigerants, a market bolstered by environmental regulations and a growing demand for sustainable solutions. The company also secures recurring income through comprehensive refrigerant management service contracts for large clients, ensuring predictable cash flow.

Additional revenue streams include fees for refrigerant recovery and disposal, which also supply feedstock for their reclamation operations, and specialized analytical testing services critical for regulatory compliance and system integrity.

In 2023, Hudson Technologies reported total revenue of $179.3 million, with its Refrigerant Services segment, encompassing management and testing, being a significant contributor, underscoring the value of its service-oriented offerings.

The company also leverages its industry expertise by generating revenue from consulting on regulatory compliance and providing tailored training programs, further diversifying its income base.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

| Reclaimed Refrigerant Sales | Sale of reprocessed refrigerants to HVACR contractors, industrial users, and distributors. | Significant portion of total revenue, driven by regulatory phase-downs. |

| Refrigerant Management Services | Recurring fees from service contracts for tracking, leak detection, and inventory management. | Provides predictable, recurring income base. |

| Recovery & Disposal Fees | Charges for environmentally sound removal and disposal of refrigerants from retired equipment. | Supports circular economy model and provides reclamation feedstock. |

| Analytical & Testing Services | Fees for laboratory analysis of refrigerant purity and contaminants. | Essential for regulatory compliance and system integrity. |

| Consulting & Training | Revenue from advising on regulatory compliance and providing specialized training programs. | Leverages industry expertise and established reputation. |

Business Model Canvas Data Sources

The Hudson Technologies Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and market analysis. This comprehensive data approach ensures each component accurately reflects operational realities and strategic objectives.