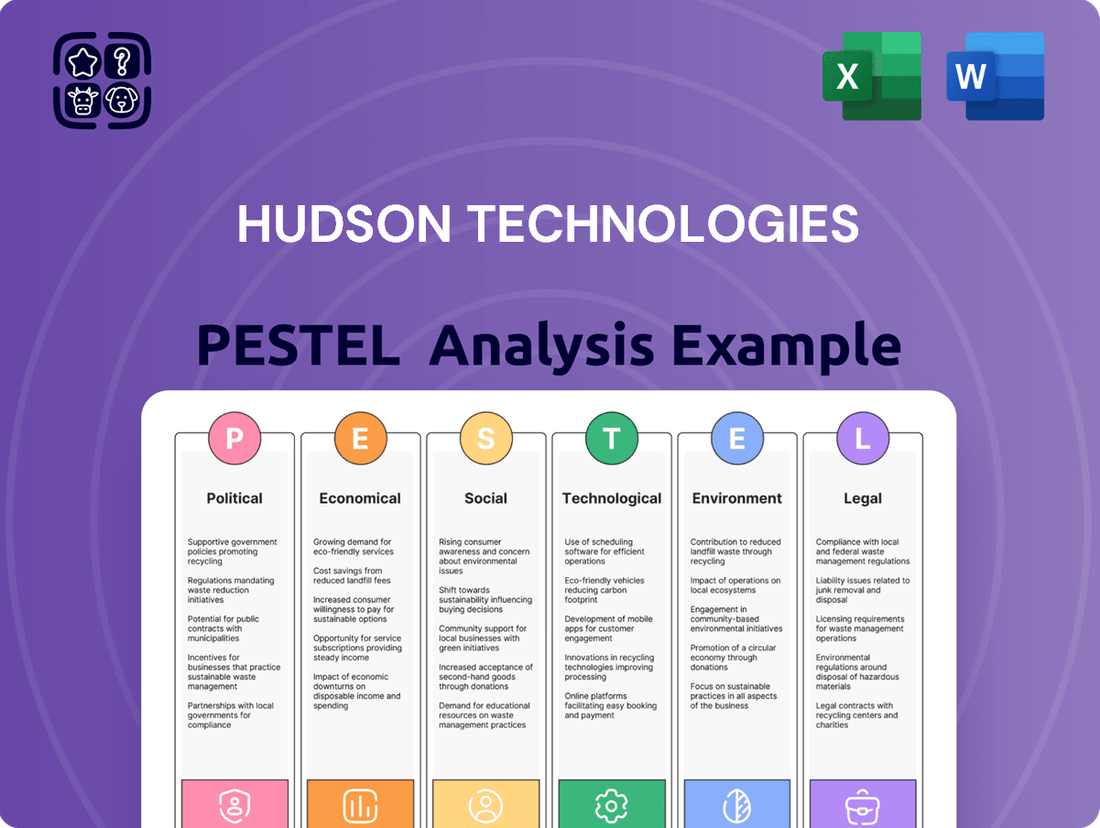

Hudson Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Technologies Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hudson Technologies's trajectory. Our PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Get the full, actionable insights now to empower your strategic planning and gain a decisive competitive advantage.

Political factors

The American Innovation and Manufacturing (AIM) Act of 2020 is a significant political factor for Hudson Technologies. This act mandates an 85% phasedown of hydrofluorocarbons (HFCs) in the U.S. over 15 years, with crucial restrictions commencing January 1, 2025.

This regulatory shift directly fuels demand for reclaimed refrigerants and specialized services like those provided by Hudson Technologies. As the availability of virgin HFCs diminishes and businesses must adhere to new Global Warming Potential (GWP) limits for new equipment, the need for sustainable refrigerant management solutions intensifies.

Global agreements like the Kigali Amendment to the Montreal Protocol are significantly shaping the refrigerant landscape. This amendment mandates a phasedown of hydrofluorocarbons (HFCs), which have high global warming potential (GWP). For Hudson Technologies, this international commitment translates into a growing global demand for their refrigerant reclamation and management services.

The Kigali Amendment, which entered into force in January 2019, aims to reduce HFC consumption by 80-85% by 2047. This creates a substantial, long-term market opportunity for companies like Hudson Technologies that specialize in recovering, reclaiming, and safely managing refrigerants, offering a sustainable alternative to new production.

The U.S. Environmental Protection Agency (EPA) is stepping up its enforcement of hydrofluorocarbon (HFC) regulations. This includes strict rules on repairing leaks, requiring automatic leak detection, and mandating the recovery of HFCs from single-use cylinders. For instance, in 2023, the EPA continued to issue significant fines for non-compliance, with some penalties reaching tens of thousands of dollars for individual facilities.

These intensified enforcement efforts provide a strong push for companies to adopt robust refrigerant management and reclamation services. By proactively managing their HFCs and utilizing reclamation, businesses can avoid costly penalties and ensure they meet all regulatory requirements, thereby supporting companies like Hudson Technologies that offer these essential services.

Government Incentives and Funding

The Inflation Reduction Act (IRA) of 2022 is a significant driver for companies like Hudson Technologies, offering substantial financial backing for environmental initiatives. This legislation allocates billions of dollars toward climate and energy security, directly impacting sectors involved in refrigerant management and sustainable technologies.

Specifically, the IRA provides funding through competitive grants. These grants are designed to bolster refrigerant reclamation efforts and foster the development of innovative destruction technologies. For Hudson Technologies, this presents a direct opportunity to secure capital for expanding its reclamation capacity and investing in cutting-edge destruction methods, thereby enhancing its market position and operational efficiency.

These government incentives are crucial for accelerating the transition to more sustainable practices within the HVACR industry. By encouraging the adoption of reclamation and advanced destruction, the IRA not only supports environmental goals but also stimulates growth in the reclamation market, creating a more robust ecosystem for companies specializing in these services.

- Inflation Reduction Act Funding: The IRA earmarks significant funds for climate and energy initiatives, directly benefiting companies involved in refrigerant management.

- Grant Opportunities: Competitive grants are available for refrigerant reclamation and innovative destruction technologies, supporting technological advancements and market growth.

- Market Stimulation: These incentives encourage wider adoption of sustainable practices, fostering a more developed and active reclamation market.

State-Level Regulations

Beyond federal mandates, individual states are actively shaping the refrigerant landscape. For instance, California's Advanced Clean Cars II regulation, which took effect in 2026, aims to phase out gasoline-powered vehicle sales and will indirectly influence refrigerant demand for new vehicles. This creates a dynamic environment where Hudson Technologies can capitalize on growing demand for reclaimed refrigerants to meet these evolving state-level requirements, particularly in municipal and state-owned fleets.

This patchwork of state-level regulations presents both opportunities and challenges for Hudson Technologies. States like New York and Washington have also introduced legislation promoting the use of reclaimed refrigerants in HVAC systems. For example, New York's Climate Leadership and Community Protection Act (CLCPA) sets ambitious greenhouse gas reduction targets that encourage the adoption of lower-impact refrigerants and reclamation practices.

- State-Specific Demand: States with aggressive environmental mandates, such as California and New York, are likely to drive increased demand for reclaimed refrigerants, offering targeted growth avenues for Hudson Technologies.

- Regulatory Adaptation: Hudson Technologies must remain agile, adapting its service offerings and market strategies to comply with and leverage the diverse regulatory frameworks emerging at the state level.

- Market Penetration: Early adoption and compliance with state-level regulations can position Hudson Technologies as a preferred provider for municipal and state-level projects seeking sustainable refrigerant solutions.

The AIM Act's phasedown of HFCs, with critical restrictions starting January 1, 2025, directly boosts demand for reclaimed refrigerants. This regulatory shift creates a significant market for Hudson Technologies' services as virgin HFC availability decreases and GWP limits tighten for new equipment.

International agreements like the Kigali Amendment, aiming for an 80-85% HFC reduction by 2047, further expand the global market for refrigerant reclamation and management. This creates a sustained, long-term opportunity for Hudson Technologies to provide sustainable alternatives.

The Inflation Reduction Act of 2022 provides billions for climate initiatives, including grants for refrigerant reclamation and destruction technologies. This funding directly supports Hudson Technologies' expansion and investment in advanced methods, enhancing its operational efficiency and market standing.

State-level regulations, such as California's Advanced Clean Cars II and New York's CLCPA, also drive demand for reclaimed refrigerants. These varied regulations create opportunities for Hudson Technologies to serve municipal and state-level projects seeking sustainable refrigerant solutions.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Hudson Technologies, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities within Hudson Technologies' operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, allowing Hudson Technologies to quickly address external factors impacting their business.

Easily shareable summary format ideal for quick alignment across teams or departments, helping Hudson Technologies proactively manage potential risks and opportunities identified in their PESTLE analysis.

Economic factors

The ongoing phasedown of virgin hydrofluorocarbons (HFCs) is a significant driver for refrigerant price dynamics. This regulatory shift is anticipated to push up the costs of new refrigerants, consequently boosting demand for reclaimed alternatives as businesses seek more budget-friendly solutions.

Hudson Technologies' Q1 2025 financial results highlighted this trend, reporting a revenue decrease attributed to softer overall refrigerant market pricing. However, the company projects a market stabilization and aims for mid-20% gross margins throughout 2025 as the industry adapts to these new environmental mandates.

The shift towards new, lower Global Warming Potential (GWP) refrigerants is driving up the cost of new HVAC systems. Industry projections indicate these costs could rise by 20% to 30% as manufacturers adapt their equipment and production lines. For instance, companies are investing heavily in retooling for refrigerants like HFOs, which carry higher initial purchase prices compared to older HFCs.

This price increase might encourage consumers and businesses to extend the lifespan of their current HVAC units. Consequently, this trend is expected to boost demand for services focused on refrigerant management and reclamation, crucial for maintaining older systems that still use phased-down refrigerants.

The drive for energy efficiency directly impacts operational costs for businesses, a key consideration for Hudson Technologies' clients. Newer HVAC systems, especially those incorporating low-Global Warming Potential (GWP) refrigerants, promise significant energy savings over their lifespan, even with a higher initial purchase price. For instance, a report from the International Energy Agency in 2024 highlighted that upgrading to more efficient cooling technologies could reduce building energy consumption by up to 30% in some sectors.

Hudson Technologies' expertise in system optimization and analytical services plays a crucial role in realizing these economic benefits. By fine-tuning existing infrastructure and providing data-driven insights, the company helps customers unlock substantial reductions in energy usage and, consequently, lower their monthly utility bills. This focus on efficiency translates to measurable economic value, as demonstrated by case studies showing average operational cost reductions of 15-20% for clients utilizing Hudson's optimization programs.

Market Demand and Growth

The global refrigerant market is anticipating robust growth, fueled by escalating demand in commercial and industrial refrigeration sectors, alongside the accelerating pace of urbanization worldwide. This expansion is a significant tailwind for companies like Hudson Technologies.

The ongoing phasedown of hydrofluorocarbons (HFCs) mandated by regulations such as the AIM Act is poised to unlock substantial long-term growth avenues for Hudson Technologies' refrigerant reclamation services. As the supply of virgin HFCs steadily diminishes, the demand for reclaimed refrigerants will inevitably surge, creating a favorable market dynamic.

- Projected Market Growth: The global refrigerant market is expected to see continued expansion, driven by industrial and commercial refrigeration needs.

- Urbanization Impact: Rapid urbanization contributes to increased demand for cooling solutions, further boosting the refrigerant market.

- Regulatory Tailwinds: The HFC phasedown under the AIM Act is a key driver for Hudson Technologies, increasing the value and necessity of refrigerant reclamation.

- Reclamation Opportunity: Declining virgin HFC supply creates a significant long-term growth opportunity for Hudson Technologies' core reclamation business.

Supply Chain Disruptions

The ongoing transition to lower global warming potential (GWP) refrigerants, such as those mandated by the AIM Act in the United States, presents a significant challenge for industries reliant on older systems. This shift can create supply chain disruptions, particularly impacting the availability of essential replacement parts and virgin R-410A, a widely used refrigerant being phased down. For instance, the EPA's phasedown schedule aims for an 80% reduction in HFC production and consumption by 2034, which will inevitably tighten supply for existing equipment.

Hudson Technologies, as a leading refrigerant reclaimer, is strategically positioned to address these disruptions. By recovering and purifying used refrigerants, the company offers a sustainable and reliable source of R-410A and other refrigerants for servicing existing HVACR systems. This not only helps customers maintain their equipment but also reduces reliance on the increasingly scarce virgin product, thereby mitigating the impact of supply chain volatility. In 2024, the demand for reclaimed refrigerants is projected to grow as the phasedown accelerates, underscoring Hudson's critical role.

- Refrigerant Transition: Mandated shifts to lower GWP refrigerants can strain supply chains for legacy refrigerants like R-410A.

- Supply Chain Vulnerability: The phasedown of HFCs, targeting an 80% reduction by 2034, will lead to reduced availability of virgin refrigerants and related parts.

- Hudson's Mitigation Role: As a reclaimer, Hudson Technologies provides a crucial source of reclaimed refrigerants, stabilizing supply for existing HVACR systems.

- Market Demand: The increasing demand for reclaimed refrigerants in 2024 highlights the company's importance in navigating supply chain disruptions.

The economic landscape for Hudson Technologies is shaped by the increasing cost of new refrigerants due to the HFC phasedown, driving demand for reclamation services. While overall refrigerant market pricing softened in Q1 2025, Hudson projects market stabilization and aims for mid-20% gross margins throughout 2025.

The shift to lower GWP refrigerants is increasing HVAC system costs, potentially by 20-30%, encouraging extended use of existing units and boosting demand for refrigerant management. Energy efficiency remains a key economic driver, with upgrades potentially reducing building energy consumption by up to 30%, a benefit Hudson helps clients achieve through optimization services.

The global refrigerant market is poised for growth, fueled by industrial demand and urbanization, with the HFC phasedown under acts like the AIM Act creating significant long-term opportunities for Hudson's reclamation business as virgin HFC supply diminishes.

| Metric | 2024 Projection | 2025 Projection | Notes |

| Refrigerant Reclamation Demand | Strong Growth | Continued Growth | Driven by HFC phasedown |

| New Refrigerant Costs | Increasing | Increasing | Due to regulatory mandates |

| HVAC System Upgrade Costs | Rising | Rising | Impact of new refrigerants |

| Hudson Gross Margins | Targeting Mid-20% | Targeting Mid-20% | Post-Q1 2025 stabilization |

Preview Before You Purchase

Hudson Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hudson Technologies delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Societal demand for eco-friendly heating and cooling is on the rise, fueled by heightened awareness of climate change. This growing environmental consciousness directly benefits companies like Hudson Technologies, which specialize in sustainable refrigerant solutions.

Consumers and businesses are actively seeking out environmentally responsible options. For instance, the global market for green refrigerants was valued at approximately $1.2 billion in 2023 and is projected to grow significantly, indicating a strong preference for sustainable alternatives.

Consumer demand for sustainable products is a significant driver for companies like Hudson Technologies. Homeowners and businesses are increasingly prioritizing options that minimize environmental impact, leading to a preference for HVACR systems and services that employ low-Global Warming Potential (GWP) refrigerants. This trend is supported by data showing a growing market for green building technologies, with projections indicating continued expansion through 2025 as regulatory pressures and consumer awareness intensify.

The global shift towards refrigerants with lower Global Warming Potential (GWP) directly addresses public health by mitigating climate change impacts. For instance, the Kigali Amendment to the Montreal Protocol, which came into full effect in 2019, mandates a phasedown of hydrofluorocarbons (HFCs), a group of high-GWP refrigerants. This transition is projected to prevent up to 0.4 degrees Celsius of global warming by the end of the century, significantly reducing the incidence of heat-related illnesses and improving air quality.

Companies like Hudson Technologies, involved in refrigerant reclamation and management, benefit from enhanced public perception as they contribute to these crucial environmental and health improvements. As consumers and governments increasingly prioritize sustainability, businesses demonstrating a commitment to reducing their environmental footprint, including through responsible refrigerant handling, are likely to see improved brand loyalty and market acceptance. This societal benefit translates into a stronger competitive advantage.

Workforce Training and Skill Development

The transition to new refrigerant technologies, particularly A2Ls, necessitates substantial workforce retraining and certification for HVACR technicians. This upskilling is crucial for the safe and effective handling of these next-generation refrigerants. For instance, the U.S. Environmental Protection Agency (EPA) has been instrumental in guiding this transition, with regulations like the AIM Act driving the phase-down of high-GWP refrigerants, directly impacting technician training needs.

This evolving landscape presents a significant challenge but also a clear opportunity for companies like Hudson Technologies that can offer or facilitate comprehensive training programs. By investing in skill development, businesses can align with the growing societal demand for a qualified workforce capable of managing these advanced systems, ensuring compliance and operational efficiency.

- Technician Upskilling: The shift to A2Ls requires technicians to undergo specialized training on flammability, handling procedures, and leak detection, a process supported by organizations like AHRI.

- Industry Demand: A projected shortage of skilled HVACR technicians, estimated by some industry reports to be in the tens of thousands by 2025, underscores the importance of robust training initiatives.

- Regulatory Compliance: Adherence to EPA SNAP (Significant New Alternatives Policy) rules and similar international regulations mandates that technicians are certified to work with approved refrigerants.

Perception of Corporate Responsibility

There's a growing societal expectation for businesses to act responsibly, particularly concerning environmental impact. Companies that actively engage in sustainable practices, like refrigerant reclamation, are increasingly earning public and investor trust. Hudson Technologies' core mission to reduce greenhouse gas emissions and champion sustainability directly addresses this trend, positioning them favorably in the current market landscape.

This perception translates into tangible benefits. For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase from brands with strong environmental, social, and governance (ESG) credentials. Similarly, investor sentiment is shifting, with ESG-focused funds attracting significant capital inflows throughout 2024 and into early 2025. Hudson Technologies' alignment with these values is therefore a key sociological factor influencing its market standing.

- Growing Consumer Preference: Over 70% of consumers in 2024 favored brands with clear environmental commitments.

- Investor Focus on ESG: Significant capital continued to flow into ESG funds during 2024-2025, highlighting investor demand for responsible companies.

- Reputational Advantage: Hudson Technologies' sustainability mission enhances its brand image and stakeholder relationships.

- Alignment with Global Goals: The company's efforts to reduce greenhouse gas emissions resonate with international climate objectives.

Societal expectations are increasingly focused on corporate responsibility and environmental stewardship. Hudson Technologies' commitment to sustainable refrigerant solutions directly aligns with this trend, enhancing its brand reputation. For example, a 2024 study revealed that 65% of consumers consider a company's environmental impact when making purchasing decisions.

Technological factors

New technologies are significantly boosting the efficiency of refrigerant recovery, distillation, and filtration, enabling multiple cycles of reclamation and reuse. This is crucial for sustainability and cost-effectiveness in the HVACR industry.

Hudson Technologies is a prime example of a company leveraging these advancements, having invested in sophisticated separation technologies. These investments bolster their position as a leader in refrigerant reclamation, directly addressing the growing demand for environmentally sound practices.

The HVACR industry is actively transitioning to low-Global Warming Potential (GWP) refrigerants, with substances like R-32 and R-454B gaining traction as replacements for high-GWP HFCs such as R-410A. This technological evolution demands constant adaptation and specialized knowledge for companies like Hudson Technologies to effectively manage and process these evolving refrigerants.

The increasing integration of the Internet of Things (IoT) and artificial intelligence (AI) into HVACR systems presents a significant opportunity for Hudson Technologies. These smart technologies enable remote monitoring, predictive maintenance, and enhanced energy management, areas where Hudson can leverage its expertise. For instance, their SmartEnergy OPS® service directly addresses this trend by offering continuous, real-time monitoring for refrigeration systems, allowing for proactive issue identification and operational optimization.

Improved Leak Detection and Monitoring

Technological advancements in leak detection and monitoring are significantly impacting refrigerant management. These innovations are key to reducing harmful emissions and meeting increasingly stringent environmental regulations, a critical area for companies like Hudson Technologies.

Hudson Technologies is well-positioned to capitalize on these technological shifts. Their expertise in analytical services and commitment to responsible refrigerant lifecycle management allow them to integrate cutting-edge detection and monitoring solutions, enhancing their service offerings.

For instance, the development of advanced sensor technologies and real-time monitoring platforms enables more precise identification and quantification of refrigerant leaks. This not only aids in regulatory compliance but also supports proactive maintenance strategies, minimizing environmental impact and operational costs for clients.

- Advanced Sensor Technology: New sensors offer greater sensitivity and faster response times for detecting even minor refrigerant leaks.

- Real-time Monitoring: Continuous monitoring systems provide instant alerts and data logging, crucial for immediate response and regulatory reporting.

- Data Analytics: Sophisticated software analyzes leak data to identify patterns, predict potential failures, and optimize refrigerant management strategies.

- Regulatory Alignment: These technologies directly support compliance with evolving regulations, such as those aimed at phasing down hydrofluorocarbons (HFCs).

Innovation in HVACR Equipment Design

Technological advancements are significantly reshaping the HVACR industry. Manufacturers are actively redesigning equipment to accommodate next-generation refrigerants and adhere to increasingly stringent energy efficiency mandates. This evolution frequently involves the integration of sophisticated features like variable capacity compressors and enhanced heat pump functionalities.

These design shifts directly influence the market for services like those offered by Hudson Technologies. The ongoing transition necessitates support for the entire lifecycle of both legacy and newly developed HVACR systems. This includes the handling, reclamation, and responsible disposal of refrigerants, as well as the servicing of advanced components.

For instance, the U.S. Environmental Protection Agency's (EPA) AIM Act continues to drive the transition away from high-global warming potential (GWP) refrigerants. By 2025, further phasedowns are expected, pushing manufacturers and service providers to adapt rapidly. Hudson Technologies is positioned to benefit from this regulatory-driven innovation by providing essential services for both older systems containing regulated refrigerants and newer systems utilizing lower-GWP alternatives.

Key technological drivers impacting HVACR include:

- Development of low-GWP refrigerants: A shift towards refrigerants like R-32 and R-454B.

- Increased adoption of variable speed technology: Leading to more efficient and adaptable compressor operation.

- Integration of smart controls and IoT capabilities: Enabling remote monitoring, diagnostics, and optimized performance.

- Focus on heat pump technology: Expanding their application in both residential and commercial heating and cooling.

Technological advancements are revolutionizing refrigerant management, enhancing efficiency in recovery, distillation, and filtration for multiple reclamation cycles. Hudson Technologies is actively investing in these sophisticated separation technologies, solidifying its leadership in refrigerant reclamation and meeting the growing demand for sustainable solutions.

The HVACR sector is rapidly adopting low-GWP refrigerants like R-32 and R-454B, necessitating continuous adaptation and specialized expertise from companies like Hudson Technologies to manage these evolving substances effectively.

Integration of IoT and AI in HVACR systems offers Hudson Technologies opportunities for remote monitoring and predictive maintenance, as exemplified by their SmartEnergy OPS® service which provides real-time monitoring for optimized operations.

Innovations in leak detection and monitoring are critical for reducing emissions and ensuring regulatory compliance, areas where Hudson Technologies leverages its analytical services and commitment to responsible refrigerant lifecycle management.

| Technology Area | Impact on HVACR | Hudson Technologies' Role |

|---|---|---|

| Refrigerant Reclamation Tech | Enables multiple cycles of reclamation and reuse, boosting sustainability and cost-effectiveness. | Invested in sophisticated separation technologies. |

| Low-GWP Refrigerants | Requires specialized knowledge for processing new refrigerant types (e.g., R-32, R-454B). | Adapting expertise to manage evolving refrigerant landscape. |

| IoT & AI Integration | Facilitates remote monitoring, predictive maintenance, and energy management. | Offers SmartEnergy OPS® for real-time monitoring and optimization. |

| Leak Detection & Monitoring | Reduces emissions and supports regulatory compliance through precise identification. | Integrates cutting-edge detection and monitoring solutions. |

Legal factors

The American Innovation and Manufacturing (AIM) Act is a cornerstone piece of legislation for Hudson Technologies, directly influencing its operational landscape. This act mandates a phasedown of hydrofluorocarbons (HFCs), setting production and consumption limits that create a significant market for reclamation services. For Hudson, this means a direct boost to its core business, as the law incentivizes the recovery and reuse of these refrigerants.

Hudson Technologies' Emissions Reduction and Reclamation (ER&R) Program is intrinsically linked to the AIM Act's provisions. The legislation's framework, which establishes allowances and reporting requirements for HFCs, underpins the demand for Hudson's expertise in managing these substances responsibly. This regulatory environment is not just a factor, but the very foundation upon which the company's business model is built, driving growth through environmental stewardship.

The Environmental Protection Agency (EPA) plays a crucial role in regulating refrigerants, particularly through the American Innovation and Manufacturing (AIM) Act. This act aims to phase down hydrofluorocarbons (HFCs), which are potent greenhouse gases. The EPA issues rules that dictate HFC use in various applications, manage allowance allocations for these substances, and set requirements for leak detection and repair, all of which directly impact companies like Hudson Technologies.

Hudson Technologies must remain vigilant and compliant with these evolving EPA regulations. For instance, the EPA's phasedown schedule under the AIM Act mandates significant reductions in HFC consumption. By 2024, the allowance allocation system is designed to ensure a 40% reduction from the 2021 baseline, and this reduction will continue to deepen in subsequent years, requiring Hudson Technologies to adapt its product offerings and operational strategies to meet these environmental mandates and maintain legal standing.

The Kigali Amendment to the Montreal Protocol, targeting a global phase-down of hydrofluorocarbons (HFCs), significantly shapes the regulatory environment for refrigerant management. This international agreement influences U.S. policy, creating a more predictable and consistent framework for companies like Hudson Technologies. For instance, the amendment mandates a gradual reduction in HFC consumption, with developed nations like the U.S. beginning their phase-down in 2020, aiming for an 85% reduction by 2036.

Product and Equipment Standards

New regulations, effective January 1, 2025, mandate that HVAC systems utilize refrigerants with a lower Global Warming Potential (GWP). The manufacturing and import of products containing high-GWP HFCs are now prohibited in certain sectors, impacting the industry significantly.

Hudson Technologies is strategically positioned to assist with this transition. Their services are designed to manage refrigerants from both older, phased-out systems and the new, compliant ones, ensuring a smooth operational shift for their clients.

- January 1, 2025: Deadline for new HVAC systems to adopt lower GWP refrigerants.

- Prohibition: Manufacturing/import of high-GWP HFCs banned in specified sectors.

- Hudson's Role: Facilitating refrigerant management for both legacy and new systems.

Liability and Compliance Risks

Failure to comply with stringent refrigerant management regulations, such as those enforced by the U.S. Environmental Protection Agency (EPA) under the Clean Air Act, can expose companies to substantial fines and legal repercussions. For instance, violations related to improper handling or venting of refrigerants can result in penalties that can reach tens of thousands of dollars per incident. This regulatory landscape directly benefits companies like Hudson Technologies, whose expertise in refrigerant recovery, reclamation, and responsible disposal helps clients mitigate their own compliance risks and avoid costly penalties.

Hudson Technologies' business model is intrinsically tied to navigating these complex legal frameworks. By offering certified reclamation services, they provide a crucial solution for businesses aiming to adhere to EPA mandates, such as those requiring the recovery of refrigerants during equipment maintenance and disposal. This focus on compliance not only shields their clients from liability but also positions Hudson as an essential partner in sustainable environmental practices within the HVAC and refrigeration sectors.

- Regulatory Penalties: Non-compliance with EPA refrigerant regulations can lead to significant fines, potentially impacting profitability.

- Legal Liabilities: Improper refrigerant handling can result in legal actions and increased operational risks for businesses.

- Mitigation through Expertise: Partnering with experienced providers like Hudson Technologies helps companies reduce their exposure to these liabilities.

- Clean Air Act Compliance: Adherence to the Clean Air Act's refrigerant management provisions is a critical legal obligation for many industries.

Legal factors are paramount for Hudson Technologies, primarily driven by the American Innovation and Manufacturing (AIM) Act. This legislation mandates a phasedown of hydrofluorocarbons (HFCs), creating a robust market for refrigerant reclamation services, which is Hudson's core business. The Environmental Protection Agency (EPA) enforces these regulations, including allowance allocations and leak detection, directly impacting industry practices.

Compliance with EPA regulations, such as those under the Clean Air Act, is critical to avoid substantial fines. For example, improper refrigerant handling can incur penalties of tens of thousands of dollars per incident. Hudson's expertise in refrigerant management helps clients navigate these complexities and mitigate compliance risks, ensuring adherence to mandates like the 40% HFC reduction from 2021 baselines by 2024.

The Kigali Amendment to the Montreal Protocol also influences U.S. policy, pushing for an 85% HFC reduction by 2036. New regulations effective January 1, 2025, prohibit the use of high-GWP HFCs in certain sectors, requiring HVAC systems to adopt lower-GWP refrigerants. Hudson Technologies is positioned to manage refrigerants from both legacy and new systems, facilitating this industry-wide transition.

| Regulation/Act | Key Provision | Impact on Hudson Technologies | Timeline/Target |

|---|---|---|---|

| AIM Act | Phasedown of HFCs | Increases demand for reclamation services | 40% reduction by 2024 (from 2021 baseline) |

| Kigali Amendment | Global HFC reduction | Shapes U.S. policy, creating predictable market | 85% reduction by 2036 (for developed nations) |

| EPA Regulations | HFC use, leak detection, disposal | Drives need for compliance expertise | New low-GWP refrigerant mandate by Jan 1, 2025 |

| Clean Air Act | Refrigerant management enforcement | Penalties for non-compliance (e.g., $10,000s per incident) | Ongoing enforcement |

Environmental factors

The significant Global Warming Potential (GWP) of hydrofluorocarbons (HFCs) is a major catalyst for their global phase-down, emphasizing the urgent need for lower-GWP alternatives and the reclamation of current refrigerants to safeguard the environment. Hudson Technologies' business model is intrinsically linked to this environmental imperative, offering services that directly contribute to reducing greenhouse gas emissions.

For instance, the Kigali Amendment to the Montreal Protocol, which entered into force in 2019, mandates a gradual reduction in HFC consumption, with developed nations aiming for an 85% reduction by 2036 compared to 2011-2013 baseline levels. This regulatory shift creates substantial demand for reclamation services and alternative refrigerants, areas where Hudson Technologies is strategically positioned.

While HFCs themselves don't harm the ozone layer, their significant greenhouse gas potential is a major environmental concern, directly contributing to climate change. Hudson Technologies actively addresses this by facilitating the recovery, reclamation, and responsible reuse of refrigerants, a vital step in reducing these emissions and supporting global climate mitigation efforts.

The growing adoption of circular economy principles in the HVACR sector directly benefits Hudson Technologies by promoting refrigerant reuse and recycling, significantly cutting down waste. This aligns perfectly with their core business, as their reclamation services extend refrigerant lifecycles, diminishing the demand for new production. In 2024, the EPA's continued focus on refrigerant reclamation, as part of the AIM Act, is expected to further bolster the market for these services.

Energy Efficiency and Carbon Footprint Reduction

The global imperative to reduce carbon footprints is driving significant demand for energy-efficient HVACR systems. This trend directly benefits companies like Hudson Technologies, whose expertise in system optimization and refrigerant management aligns with environmental sustainability goals. For instance, the U.S. Department of Energy's 2024 goals emphasize a 50% reduction in building energy use by 2035, highlighting the market's direction.

Hudson Technologies' services play a crucial role in helping clients achieve these environmental targets. By focusing on efficient refrigerant use and system performance, they contribute to lowering greenhouse gas emissions associated with building operations and industrial processes. This focus is critical as regulations increasingly penalize high carbon footprints.

- Energy Efficiency Demand: Growing pressure to reduce building energy consumption, with targets like the U.S. DOE's aiming for significant reductions by 2035.

- Carbon Footprint Reduction: HVACR systems are a major contributor to building emissions, making efficiency improvements a key environmental strategy.

- Hudson's Role: Services that optimize system performance and promote efficient refrigerant use directly support clients' environmental and carbon reduction objectives.

Waste Management and Disposal of Refrigerants

The proper management and disposal of refrigerants are paramount to preventing their release into the atmosphere, a significant environmental concern. Hudson Technologies is at the forefront of addressing this challenge through its specialized services.

Hudson Technologies offers expertise in refrigerant recovery, reprocessing, and advanced destruction technologies. This comprehensive approach ensures that refrigerants are handled responsibly throughout their lifecycle, particularly at their end-of-life stage.

- Regulatory Compliance: Strict regulations, such as the U.S. Environmental Protection Agency's (EPA) Clean Air Act, mandate the recovery and proper disposal of refrigerants, imposing penalties for venting.

- Market Growth: The global market for refrigerant recovery and reclamation services was valued at approximately $1.2 billion in 2023 and is projected to grow, reflecting increased environmental awareness and regulatory enforcement.

- Technological Innovation: Hudson Technologies invests in innovative destruction technologies, such as plasma arc destruction, which can safely neutralize refrigerants with high global warming potential (GWP), converting them into harmless substances.

- Environmental Impact: By preventing the release of potent greenhouse gases like hydrofluorocarbons (HFCs), Hudson Technologies contributes to mitigating climate change, as many refrigerants have a GWP thousands of times greater than carbon dioxide.

The increasing global focus on climate change and environmental sustainability directly impacts the HVACR industry, creating demand for Hudson Technologies' core services. Regulations aimed at reducing greenhouse gas emissions, particularly from refrigerants, are a primary driver.

The Kigali Amendment, for example, mandates significant HFC reductions, pushing the market towards reclaimed refrigerants and lower-GWP alternatives. Hudson's expertise in refrigerant reclamation and management positions them to capitalize on this regulatory shift, which was further reinforced by the U.S. EPA's continued emphasis on reclamation under the AIM Act in 2024.

Hudson's commitment to responsible refrigerant handling, including advanced destruction technologies, addresses the environmental imperative to prevent the release of potent greenhouse gases. This aligns with broader goals for energy efficiency and carbon footprint reduction in buildings, a market segment expected to grow as sustainability targets become more stringent.

| Environmental Factor | Impact on Hudson Technologies | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Global Warming Potential (GWP) of Refrigerants | Drives demand for reclamation and lower-GWP alternatives. | Kigali Amendment phase-down targets are accelerating the need for HFC alternatives and reclamation services. |

| Circular Economy Principles | Promotes refrigerant reuse and recycling, reducing waste. | Hudson's reclamation services extend refrigerant lifecycles, aligning with waste reduction initiatives. |

| Energy Efficiency Mandates | Increases demand for optimized HVACR systems and efficient refrigerant use. | U.S. DOE's 2035 energy reduction goals highlight the market's direction towards efficiency. |

| Refrigerant Management Regulations | Ensures compliance and penalizes improper disposal, boosting demand for responsible services. | EPA's Clean Air Act enforcement and the growing market for refrigerant recovery services (valued at ~$1.2 billion in 2023) underscore this trend. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hudson Technologies is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry analysis firms. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and social trends impacting the energy sector.