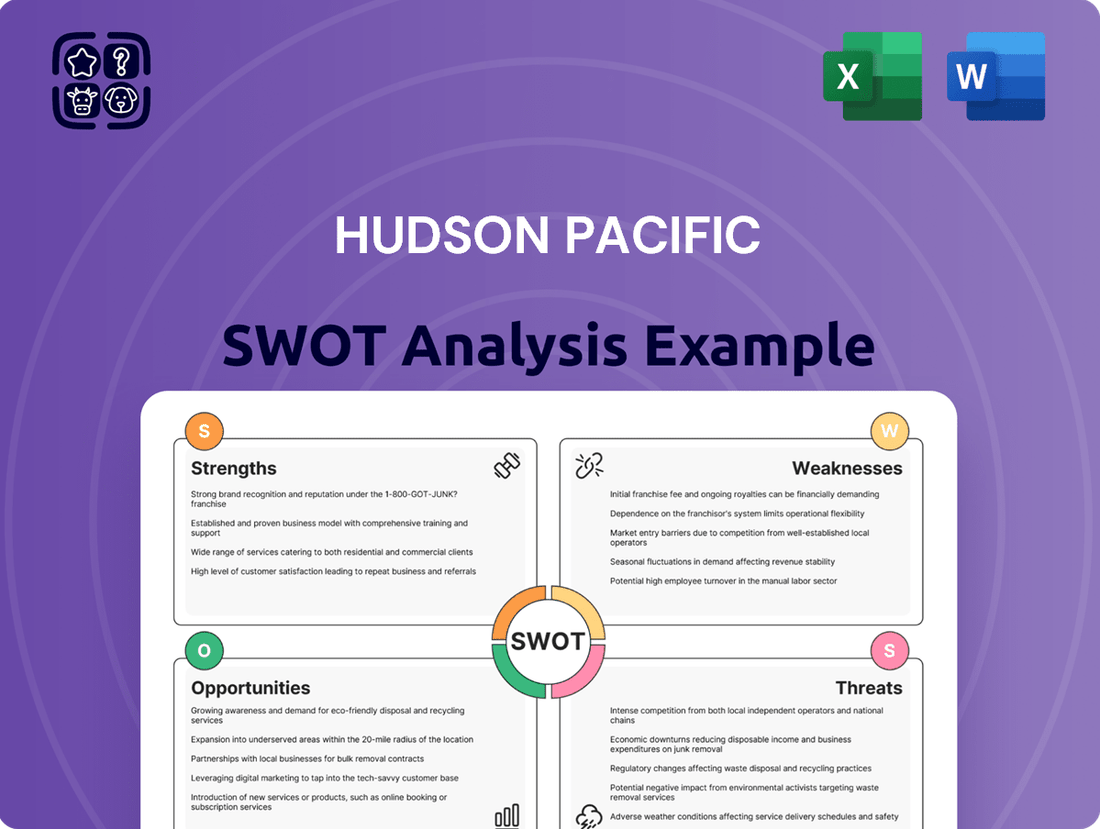

Hudson Pacific SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

Hudson Pacific's strategic position is shaped by its robust portfolio of tech and media properties, a key strength. However, understanding the full scope of its competitive landscape and potential market shifts is crucial for informed decision-making.

Want the full story behind Hudson Pacific's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hudson Pacific Properties' strength lies in its prime office and studio locations within key tech and media hubs like San Francisco, Los Angeles, and Seattle. This strategic positioning ensures consistent demand for its properties, reducing the risk of extended vacancies.

The company's portfolio is ideally situated to benefit from the ongoing expansion of technology and entertainment sectors. For instance, the demand for AI-focused office spaces and the robust film production activity in California, as seen in the state's estimated $50 billion film and television industry in 2024, directly supports Hudson Pacific's asset value and rental income.

Hudson Pacific Properties benefits from a diverse and high-quality tenant base, featuring prominent technology and media companies. This includes major players like Google and Netflix, providing significant revenue stability and mitigating risks associated with over-reliance on a single client or industry. The appeal of these top-tier tenants also elevates the desirability and value of Hudson Pacific's real estate portfolio.

Hudson Pacific Properties holds a dominant position in the studio property sector, boasting a substantial portfolio of sound stages and offering comprehensive production services via its Quixote subsidiary. This integrated approach caters directly to the burgeoning media and entertainment industry, especially in key markets like Los Angeles.

The company's strategic focus on full-service solutions for content creators is a significant advantage. As demand for film and television production continues to surge, amplified by potential state and local tax incentives, Hudson Pacific is well-positioned to capitalize on these trends. For instance, in the first quarter of 2024, the company reported a 7.3% increase in same-property cash net operating income, reflecting strong tenant demand for its studio facilities.

Commitment to Sustainability and Innovation

Hudson Pacific's dedication to sustainability is a significant strength, evidenced by its substantial portfolio of LEED and ENERGY STAR certified office spaces. This commitment is further solidified by their achievement of 100% carbon neutral operations across their entire real estate portfolio, demonstrating a proactive approach to environmental responsibility.

The company has set aggressive targets for reducing greenhouse gas emissions, reflecting a forward-thinking strategy that resonates with environmentally conscious tenants. This strong ESG focus not only boosts market appeal but also aligns with the growing demand for sustainable business practices from corporate occupiers.

- LEED and ENERGY STAR Certified Portfolio: A substantial portion of Hudson Pacific's in-service office assets hold these prestigious environmental certifications.

- 100% Carbon Neutral Operations: The company has achieved carbon neutrality across its entire real estate operating portfolio.

- Ambitious Emission Reduction Goals: Hudson Pacific is actively pursuing significant reductions in greenhouse gas emissions.

- Enhanced Marketability through ESG: The company's commitment to Environmental, Social, and Governance principles attracts tenants prioritizing sustainability.

Strong Leasing Momentum and Pipeline

Hudson Pacific Properties has shown impressive leasing performance, securing a substantial volume of new and renewed leases towards the end of 2024 and into early 2025. This strong leasing momentum is a key strength, reflecting tenant demand for their premium office and media properties.

The company boasts a healthy leasing pipeline, particularly in key markets like the Bay Area and Los Angeles. This pipeline is bolstered by demand from AI-focused companies and a continued push for in-office work mandates, positioning Hudson Pacific for future occupancy gains.

- Leasing Activity: Signed significant new and renewal leases in late 2024/early 2025.

- Pipeline Strength: Healthy pipeline with a focus on AI-driven demand and in-office trends.

- Geographic Focus: Strong leasing potential in the Bay Area and Los Angeles markets.

Hudson Pacific's strategic real estate portfolio is anchored in prime locations within the tech and media epicenters of San Francisco, Los Angeles, and Seattle. This geographic advantage ensures consistent tenant interest and minimizes vacancy periods.

The company's assets are perfectly positioned to capitalize on the growth of the technology and entertainment industries. For example, the increasing demand for specialized office spaces catering to AI development, coupled with the vibrant film production scene in California, which contributed an estimated $50 billion to the state's economy in 2024, directly enhances Hudson Pacific's property values and rental income streams.

A significant strength is Hudson Pacific's roster of high-profile tenants, including major technology and media corporations like Google and Netflix. This diversification of its tenant base provides robust revenue stability and reduces the financial risk associated with over-reliance on any single entity or sector. The presence of these industry leaders also elevates the overall desirability and market value of Hudson Pacific's real estate holdings.

Hudson Pacific Properties commands a leading position in the studio real estate market, managing an extensive collection of sound stages and offering comprehensive production support services through its Quixote division. This vertically integrated model directly addresses the escalating needs of the media and entertainment sector, particularly in crucial markets such as Los Angeles.

The company's commitment to sustainability is a notable strength, with a substantial portion of its office properties holding LEED and ENERGY STAR certifications. Furthermore, Hudson Pacific has achieved carbon neutrality across its entire operational real estate portfolio, showcasing a proactive stance on environmental stewardship.

| Strength Category | Key Metric/Fact | Supporting Data/Example |

| Location Advantage | Prime Office & Studio Locations | San Francisco, Los Angeles, Seattle tech/media hubs |

| Industry Alignment | Benefit from Tech & Media Growth | California film industry valued at ~$50 billion (2024) |

| Tenant Quality | High-Profile Tenant Base | Includes Google, Netflix |

| Studio Dominance | Leading Studio Property Portfolio | Comprehensive production services via Quixote |

| Sustainability Focus | LEED/ENERGY STAR Certified Portfolio | 100% Carbon Neutral Operations |

What is included in the product

Analyzes Hudson Pacific’s competitive position through key internal and external factors, highlighting its strengths in tech-focused real estate and opportunities for expansion against potential market downturns.

Offers a clear, actionable framework to identify and address Hudson Pacific's strategic vulnerabilities and leverage its strengths for growth.

Weaknesses

Hudson Pacific's significant concentration in West Coast markets, particularly in California and Washington, presents a notable weakness. While these regions often boast strong demand, this geographical focus leaves the company highly susceptible to localized economic downturns or sector-specific challenges impacting the West Coast. For instance, a significant slowdown in the tech sector, a major driver of office demand in these areas, could disproportionately affect Hudson Pacific's rental income and property valuations.

Hudson Pacific Properties has grappled with a notable downturn in office occupancy, a significant weakness impacting its financial performance. In the first quarter of 2024, the company reported a consolidated office occupancy rate of 88.8%, a decrease from previous periods, reflecting a challenging market environment. This decline directly translates to reduced rental income, contributing to lower same-store cash net operating income (NOI) and impacting overall revenue streams.

Hudson Pacific faces challenges with high operating costs, particularly in maintaining its premium urban properties. These expenses directly affect profit margins, making it harder to achieve robust financial performance.

The company's financial results highlight these issues. For instance, in the first quarter of 2024, Hudson Pacific reported a Funds From Operations (FFO) per share of $0.27, a decrease from $0.30 in the same period of 2023. This trend, coupled with a net loss of $13.6 million for Q1 2024, signals potential difficulties in efficient cost management and sustained profitability.

Dependence on the Tech and Media Sectors

Hudson Pacific's significant concentration of tenants within the technology and media industries, while a core strength, also presents a notable weakness. This reliance makes the company susceptible to industry-specific downturns, such as workforce reductions or shifts in remote work policies that impact office space demand. For instance, the studio segment faced headwinds in 2023 due to the lingering effects of Hollywood strikes and wildfire disruptions, impacting production schedules and, consequently, studio space utilization.

This concentration means that adverse events affecting these specific sectors can disproportionately impact Hudson Pacific's revenue and occupancy rates. For example, a slowdown in tech hiring or a significant shift away from traditional media production could lead to increased vacancy and pressure on rental income across a substantial portion of their portfolio. The company's 2023 financial results reflected these pressures, with reported occupancy rates experiencing some fluctuation due to these sector-specific challenges.

- Sector Concentration Risk: Over-reliance on tech and media tenants exposes HPP to industry-specific volatility.

- Impact of Layoffs and Work Model Changes: Tech sector workforce adjustments and evolving hybrid work models can reduce demand for office and studio space.

- Studio Segment Vulnerabilities: The studio business has been directly affected by external factors like wildfires and the post-strike recovery pace, impacting revenue streams.

Debt Profile and Maturities

Hudson Pacific's debt profile presents a significant weakness. The company faces substantial debt maturities, with a considerable portion coming due in 2025 and 2026. This concentration of maturities puts pressure on the company to secure refinancing or generate sufficient cash flow to meet its obligations.

Furthermore, Hudson Pacific's debt-to-equity ratio, reported at approximately 1.4x as of Q1 2024, remains elevated compared to the REIT industry average, which hovers around 1.0x. While the company has strategically utilized asset sales and refinancing efforts to mitigate this, the reliance on leverage continues to be a key financial challenge.

- Significant Debt Maturities: Approximately $1.6 billion in debt matures between 2025 and 2026.

- Elevated Leverage: Debt-to-equity ratio of 1.4x as of Q1 2024, exceeding industry norms.

- Refinancing Risk: Dependence on favorable market conditions for successful debt management.

- Interest Rate Sensitivity: A substantial portion of debt carries variable rates, increasing vulnerability to rising interest rates.

Hudson Pacific's substantial debt load and upcoming maturities represent a significant weakness. The company faces approximately $1.6 billion in debt maturing between 2025 and 2026, requiring successful refinancing or substantial cash generation. As of Q1 2024, its debt-to-equity ratio stood at 1.4x, notably higher than the REIT industry average of around 1.0x, indicating a greater reliance on leverage.

The company's financial performance in early 2024 highlighted these pressures. For instance, Funds From Operations (FFO) per share decreased to $0.27 in Q1 2024 from $0.30 in Q1 2023, and the company reported a net loss of $13.6 million for Q1 2024, signaling challenges in managing costs and debt effectively.

| Metric | Q1 2024 | Q1 2023 | Industry Average (approx.) |

| FFO per Share | $0.27 | $0.30 | N/A |

| Net Loss | $13.6 million | N/A (Profit reported) | N/A |

| Debt-to-Equity Ratio | 1.4x | N/A | 1.0x |

| Upcoming Debt Maturities (2025-2026) | ~$1.6 billion | N/A | N/A |

Same Document Delivered

Hudson Pacific SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting a direct look at the comprehensive SWOT analysis for Hudson Pacific, ensuring transparency and quality. Purchase unlocks the full, detailed report.

Opportunities

The burgeoning AI sector, especially companies prioritizing physical office spaces, offers a prime growth avenue for Hudson Pacific. This is particularly evident in their San Francisco Bay Area portfolio, a hub for AI innovation.

Hudson Pacific has noted robust demand from these AI firms, signaling strong leasing potential. Venture capital funding in AI reached a staggering $27.1 billion in the first half of 2024, according to PitchBook, directly translating to increased office space needs for these expanding companies.

This trend is expected to fuel occupancy growth and leasing activity for Hudson Pacific, solidifying their position in key tech markets.

The studio business is poised for a rebound, with expectations of heightened production activity. This optimism is fueled by the recent ratification of crucial union contracts, which had previously stalled many projects, and the ongoing availability of attractive tax credit programs in California. These incentives, offered at federal, state, and local levels, significantly reduce the cost of production, making the state a more competitive filming location.

Hudson Pacific's strategic positioning within this recovering market is strong. The company boasts a substantial pipeline of studio projects and offers comprehensive, end-to-end services that cater to the diverse needs of production companies. This integrated approach allows Hudson Pacific to capture more value as the industry gears up for increased output.

For instance, California's Film and Television Tax Credit Program, which was extended through 2030, provides a vital financial lifeline. In 2023 alone, the program supported over 80 projects, injecting billions into the state's economy and directly benefiting studio operators like Hudson Pacific. As production ramps up in 2024 and 2025, the demand for studio space and services is expected to surge, creating significant revenue opportunities.

Hudson Pacific's strategic asset sales are a key opportunity. In 2023, the company completed $300 million in dispositions, significantly boosting its liquidity. This focus on shedding non-core properties allows for a stronger balance sheet and greater financial maneuverability.

Continuing this disciplined approach to asset sales, coupled with ongoing cost management, presents a clear path to further de-leveraging. By reducing debt, Hudson Pacific can enhance its financial flexibility, making it more resilient to market fluctuations and better positioned to pursue growth opportunities.

In-Office Mandates and Flight to Quality

Major employers, especially in technology, are increasingly pushing for a return to the office. This trend, combined with a tenant preference for prime locations and top-tier amenities, creates a significant opportunity for Hudson Pacific. The company's focus on high-quality, well-amenitized properties positions it to capitalize on this flight to quality, potentially boosting occupancy and rental income.

Hudson Pacific's portfolio is strategically aligned with these evolving tenant demands. For instance, their properties in key tech hubs like the San Francisco Bay Area and Los Angeles are already attracting tenants seeking modern, collaborative workspaces. As of Q1 2024, the demand for Class A office space in these markets has shown resilience, with vacancy rates for premium properties outperforming the broader market.

- Increased Occupancy Potential: In-office mandates are driving demand for physical office spaces, benefiting landlords with desirable assets.

- Rental Rate Growth: The flight to quality allows landlords like Hudson Pacific to command higher rental rates for their premium properties.

- Tenant Retention and Attraction: High-quality amenities and prime locations enhance tenant satisfaction, leading to better retention and attracting new, high-credit tenants.

- Portfolio Alignment: Hudson Pacific's existing portfolio is well-positioned to meet the criteria of companies seeking superior office environments.

Development and Repositioning

Hudson Pacific is actively pursuing opportunities through the development of new properties and the strategic repositioning of its existing portfolio. This approach aims to capture increasing real estate values and meet the growing demand for modern, adaptable workspaces.

A key example of this strategy is the transformation of the former Westside Pavilion into a premier creative office campus. Additionally, the company is developing new studio facilities, which are crucial for expanding its presence and generating value in the competitive media and entertainment sector. As of early 2024, Hudson Pacific’s development pipeline includes projects designed to enhance its portfolio’s overall appeal and rental income potential.

- Strategic Redevelopment: Transforming underutilized assets into high-demand creative office and media spaces.

- New Development Pipeline: Expanding the company’s footprint with state-of-the-art studio facilities and office campuses.

- Value Creation: Capitalizing on market trends to enhance property value and rental yields.

- Market Responsiveness: Adapting to evolving tenant needs for flexible and innovative workspaces.

The growing AI sector presents a significant opportunity, with companies in this space actively seeking physical office locations, particularly in tech hubs like the San Francisco Bay Area. This demand is underscored by substantial venture capital investment, with $27.1 billion flowing into AI in the first half of 2024, directly fueling the need for expanded office footprints.

The studio business is also poised for a strong recovery, bolstered by the resolution of union contract disputes and the continued availability of attractive tax credit programs in California. These incentives make production more cost-effective, driving increased activity and demand for studio facilities.

Hudson Pacific's strategic approach to asset sales, which generated $300 million in dispositions in 2023, enhances its financial flexibility and de-leveraging capabilities. This focus on optimizing the portfolio allows for greater resilience and strategic pursuit of growth.

A notable trend is the push by major employers, especially in technology, for a return to the office, favoring prime locations and top-tier amenities. Hudson Pacific's portfolio is well-aligned with this flight to quality, positioning the company to benefit from increased occupancy and rental rates in its Class A properties.

Furthermore, Hudson Pacific is actively developing new properties and repositioning existing ones, such as the transformation of the former Westside Pavilion into a creative office campus. This development pipeline, including new studio facilities, is designed to capture evolving market demands and enhance long-term value.

Threats

The commercial real estate sector, especially in expensive West Coast markets where Hudson Pacific operates, is vulnerable to economic slowdowns and changing market conditions. For instance, rising interest rates in 2023 and early 2024 have increased borrowing costs for real estate companies, potentially impacting development and acquisition strategies.

These economic shifts can reduce tenant demand, leading to higher vacancy rates and downward pressure on rents. Hudson Pacific's net effective rents saw some pressure in certain submarkets during 2023, reflecting this sensitivity to economic headwinds.

The persistent adoption of remote and hybrid work models remains a significant threat to Hudson Pacific's office portfolio. Despite initiatives to revitalize office spaces, the continued preference for flexible work arrangements could keep occupancy rates suppressed, directly impacting rental income and the overall financial health of its core business segment.

As of Q1 2024, the national office vacancy rate hovered around 19.6%, a figure that has remained stubbornly high since the pandemic's onset. This trend directly challenges Hudson Pacific's ability to achieve optimal occupancy and rental growth in its key markets, potentially leading to prolonged periods of underperformance for its office assets.

Hudson Pacific faces significant competition in its core markets, particularly in the technology and media sectors where demand for specialized office space is high. Established players and new entrants are vying for prime locations and high-quality tenants, which can impact leasing rates and occupancy levels. For instance, as of Q1 2024, the overall office vacancy rate in San Francisco, a key market for HPP, stood at approximately 25%, reflecting the intense competition for available space.

Industry-Specific Challenges in Tech and Media

The tech and media sectors, a core focus for Hudson Pacific, are characterized by swift transformations. These include frequent mergers, acquisitions, and evolving business models, such as the dynamic content strategies of streaming services. For instance, the ongoing consolidation within the media landscape could alter tenant needs and space utilization.

Potential labor disputes or budget limitations within the entertainment industry also pose risks. In 2023, Hollywood faced significant labor actions, impacting production schedules and, consequently, studio demand. These events can directly affect tenant demand and the efficient utilization of studio facilities, a key asset for Hudson Pacific.

- Rapid Industry Shifts: Tech and media are volatile, with M&A activity and changing business models impacting space requirements.

- Streaming Service Dynamics: Content spending and strategy shifts by major streaming platforms can influence demand for studio and office space.

- Labor and Budgetary Concerns: Potential labor disputes or budget cuts in the entertainment sector can lead to decreased tenant demand and studio utilization.

Increased Interest Rates and Debt Refinancing Risks

Rising interest rates present a significant challenge for Hudson Pacific, directly increasing the cost of its substantial debt obligations. This heightened borrowing expense can erode profitability, especially as the company faces upcoming debt maturities that will likely require refinancing at higher rates. For instance, as of the first quarter of 2024, Hudson Pacific reported total debt of approximately $3.4 billion, with a considerable portion maturing in the coming years.

While Hudson Pacific has proactively addressed its debt structure, continuing upward pressure on interest rates, as anticipated by many economists throughout 2024 and into 2025, could still strain its financial flexibility. Adverse shifts in the interest rate environment could negatively impact the company's ability to manage its debt efficiently and maintain its financial stability.

- Increased Borrowing Costs: Higher interest rates directly inflate the expense of new loans and variable-rate debt.

- Debt Refinancing Challenges: Refinancing maturing debt in a high-rate environment will likely result in higher interest payments.

- Impact on Profitability: Elevated interest expenses can reduce net income and overall financial performance.

- Potential Financial Instability: Persistent high rates could stress the company's ability to service its debt obligations.

The ongoing preference for remote and hybrid work models continues to be a significant headwind for Hudson Pacific's office portfolio. National office vacancy rates remained elevated, hovering around 19.6% in Q1 2024, directly impacting occupancy and rental income for the company's assets.

Intense competition in key West Coast markets, particularly San Francisco where vacancy reached approximately 25% in Q1 2024, further pressures leasing rates and occupancy. Rapid shifts within the tech and media sectors, including M&A and evolving content strategies, also create uncertainty for tenant demand and space utilization.

Rising interest rates present a substantial threat, increasing borrowing costs for Hudson Pacific's $3.4 billion in debt as of Q1 2024. This financial pressure is exacerbated by upcoming debt maturities that will likely require refinancing at higher rates, potentially impacting profitability and financial flexibility.

| Threat Category | Specific Impact | Data Point (Q1 2024 or latest available) |

|---|---|---|

| Workplace Trends | Suppressed office occupancy due to remote/hybrid work | National office vacancy rate: ~19.6% |

| Market Competition | Intensified competition for tenants in key markets | San Francisco office vacancy rate: ~25% |

| Industry Volatility | Uncertainty in tech/media space needs from M&A and strategy shifts | N/A (qualitative impact) |

| Interest Rate Environment | Increased cost of debt and refinancing challenges | Total Debt: ~$3.4 billion |

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including Hudson Pacific's official financial filings, comprehensive market research reports, and expert industry commentary to ensure an accurate and insightful SWOT assessment.