Hudson Pacific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

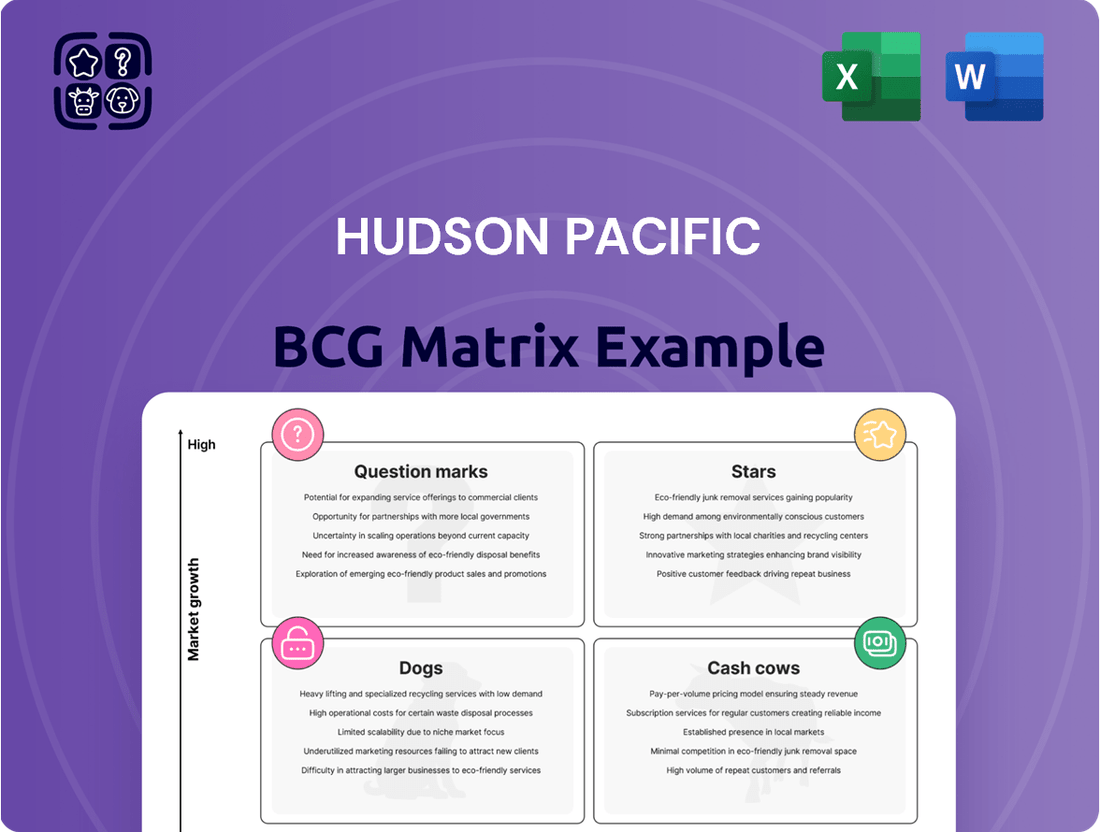

Hudson Pacific's BCG Matrix highlights its current product portfolio's market share and growth potential, offering a glimpse into strategic positioning. Understand which segments are poised for rapid expansion and which might require a closer look.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of Hudson Pacific's Stars, Cash Cows, Dogs, and Question Marks, along with actionable strategies to optimize your investment decisions.

Stars

Hudson Pacific's studio properties, especially in Los Angeles, are prime assets in a high-demand sector. These locations are considered stars because the need for sound stages in key production centers like LA consistently exceeds availability. This trend is expected to continue through 2025, fueled by the expansion of streaming services and overall content production.

Hudson Pacific's strategic focus on West Coast tech and media hubs, coupled with the burgeoning 'office-first AI industry' attracting significant venture capital, positions some of its office assets as Stars. These markets are showing improving fundamentals, indicating strong growth potential.

The company's established presence and ability to secure large leases, such as the 232,000 square feet with the City and County of San Francisco at 1455 Market in 2024, demonstrate its capacity to capture substantial market share in these high-growth areas.

Hudson Pacific's first quarter of 2025 demonstrated robust leasing momentum, securing 62 new and renewal leases encompassing 630,295 square feet. This represents their strongest office leasing performance in almost three years, underscoring a healthy demand for their properties.

The company's substantial leasing pipeline, standing at 2.1 million square feet with a significant portion already committed, signals continued growth and a strong market presence. This forward-looking pipeline is particularly advantageous as Hudson Pacific anticipates minimal lease expirations in the latter half of 2025, positioning them for sustained expansion.

High-Quality, Amenity-Rich Office Spaces

Hudson Pacific's portfolio is significantly bolstered by its high-quality, amenity-rich office spaces, a direct response to the prevailing flight to quality trend observed across West Coast office markets. Tenants are actively prioritizing premium environments that offer enhanced amenities, making Hudson Pacific's Class A and trophy properties highly desirable.

These prime assets are strategically located in resilient submarkets, particularly those that have proven attractive to major technology tenants. This concentration of demand allows Hudson Pacific to secure higher rental rates and maintain robust occupancy levels, underscoring their strength in a sought-after market segment.

- Flight to Quality: In 2024, the demand for premium office spaces with extensive amenities continued to rise, with tenants showing a clear preference for Class A and trophy properties.

- Resilient Submarkets: Hudson Pacific's focus on submarkets with strong tech sector presence, such as Silicon Valley and Seattle, has allowed them to navigate market fluctuations effectively.

- Rental Premiums: Properties offering superior amenities and prime locations in 2024 commanded rental premiums, with some Class A spaces seeing year-over-year rent growth exceeding 5% in key West Coast markets.

- Occupancy Rates: High-quality, amenity-rich buildings in Hudson Pacific's portfolio maintained strong occupancy rates, often outperforming the broader office market average.

Potential for Accelerated Production Demand with Incentives

Hudson Pacific's studio segment is positioned for a potential surge in production demand, especially as we look towards late 2025. This optimism is fueled by the possibility of significant financial incentives from various government levels, including federal, state, and local entities.

California's ongoing consideration of expanding its film and television production tax credit program is a key factor. Such an expansion could directly benefit Hudson Pacific, given its substantial studio infrastructure. This could translate into a stronger pipeline of high-quality production projects, solidifying its leading market position in a sector that shows signs of accelerating growth.

The studio segment's potential for accelerated demand is underpinned by several factors:

- Incentive Programs: Anticipated financial support from federal, state, and local governments could significantly boost production activity.

- California Tax Credits: An expanded film and TV production tax credit program in California is expected to drive more projects to the state.

- Infrastructure Advantage: Hudson Pacific's extensive studio facilities are well-positioned to capture increased demand from these enhanced incentives.

- Market Leadership: The company's existing market-leading position is likely to be reinforced as it attracts more high-caliber production leads.

Hudson Pacific's studio properties, particularly those in Los Angeles, are classified as Stars due to consistent high demand for sound stages in key production hubs. This demand is projected to remain strong through 2025, supported by the growth of streaming services and overall content creation.

Certain office assets also qualify as Stars, benefiting from the company's strategic placement in West Coast tech and media centers, and the emergence of the AI industry. These markets are exhibiting improving fundamentals and substantial growth potential.

Hudson Pacific's leasing success in 2024, including a 232,000 square foot lease with the City and County of San Francisco, highlights its ability to secure significant tenants in these expanding sectors. The company's first quarter 2025 leasing performance, with 630,295 square feet secured, marks its strongest office leasing in nearly three years.

The company's substantial leasing pipeline of 2.1 million square feet, with a significant portion already committed, further solidifies its Star status. This robust pipeline, coupled with minimal lease expirations in late 2025, positions Hudson Pacific for continued growth and market dominance.

| Asset Type | Reason for Star Status | Key Data/Facts |

|---|---|---|

| Studio Properties (LA) | High demand, limited supply in production hubs | Continued growth in streaming, potential for expanded tax credits in California (2024-2025) |

| Office Properties (Tech/Media Hubs) | Strategic location, growing AI industry | Strong leasing momentum Q1 2025 (630,295 sq ft), 2.1M sq ft leasing pipeline |

What is included in the product

Hudson Pacific's BCG Matrix analyzes its portfolio, identifying growth opportunities and areas for strategic resource allocation.

Hudson Pacific's BCG Matrix offers a clear, one-page overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Hudson Pacific's stabilized core office portfolio, primarily in mature West Coast tech and media hubs, acts as a cash cow. These properties, often with long-term leases to creditworthy tenants, reliably generate significant cash flow. For instance, in the first quarter of 2024, their same-store cash net operating income (NOI) demonstrated resilience, even amidst broader market fluctuations, highlighting their consistent performance.

Hudson Pacific's strategy of securing long-term leases with creditworthy tenants, like the 20-year agreement with the City and County of San Francisco, positions these assets as cash cows. These arrangements generate stable, predictable revenue streams, minimizing the need for ongoing investment in promotion and placement.

This focus on reliable income streams, exemplified by such long-term commitments, ensures consistent cash flow for the company. It also effectively insulates these assets from significant market volatility, a hallmark of successful cash cow assets.

Hudson Pacific's efficiently managed studio operations represent a significant cash cow within its business portfolio. These established, well-utilized facilities are a reliable source of consistent revenue, demanding minimal further investment for growth or promotion due to their strong market presence and high occupancy rates.

As of the first quarter of 2025, these studio assets boast an impressive 88% occupancy or contractual commitment. This high utilization rate underscores their status as dependable cash generators, providing a stable income stream that supports other ventures within the company.

Strategic Debt Refinancing and Liquidity Management

Hudson Pacific's strategic debt refinancing, exemplified by its $475 million CMBS issuance for office properties, highlights its capability to manage its debt obligations effectively. This financial maneuver, coupled with a robust liquidity position of $838.5 million as of Q1 2025, provides the company with the flexibility to optimize its capital structure.

- Strategic Financing: Completion of a $475 million CMBS financing for a portfolio of office properties.

- Liquidity Position: $838.5 million in liquidity as of Q1 2025.

- Debt Management: Ability to efficiently manage and refinance existing debt obligations.

- Cash Flow Generation: Financial stability supports passive cash generation from core assets.

Properties with High Profit Margins

Hudson Pacific's established properties, particularly those boasting high occupancy and a consistent track record of robust rental income, are prime examples of cash cows. These assets have likely cultivated a competitive advantage, leading to substantial profit margins. Their ongoing capital expenditure requirements are often lower relative to their revenue generation, making them highly efficient contributors to the company's bottom line.

These cash cows are the bedrock of Hudson Pacific's financial strength, playing a critical role in funding growth initiatives and other strategic ventures. For instance, as of the first quarter of 2024, Hudson Pacific reported a portfolio occupancy rate of 94.3%, indicating a stable revenue stream from its established assets. The company's focus on premium office and studio properties in key markets like Los Angeles and the San Francisco Bay Area further solidifies the cash-generating potential of these holdings.

- High Occupancy Rates: Properties consistently maintain high occupancy, ensuring predictable rental income.

- Strong Rental Income History: A proven ability to generate substantial rental revenue over time.

- Competitive Advantage: Established market position and desirable locations contribute to pricing power.

- Lower Relative Capex: Mature assets often require less significant ongoing capital investment compared to revenue.

Hudson Pacific's core office and studio assets function as its cash cows, consistently generating stable income. These properties benefit from long-term leases with creditworthy tenants and high occupancy rates, minimizing the need for significant new investment. For example, in Q1 2025, their studio assets reported an impressive 88% occupancy or contractual commitment, showcasing their reliable revenue-generating capacity.

These mature assets are crucial for funding the company's growth strategies and maintaining financial stability. Their strong rental income history and competitive market positions contribute to substantial profit margins. The company's overall portfolio occupancy was 94.3% in Q1 2024, underscoring the dependable cash flow from these holdings.

Hudson Pacific's ability to manage its debt effectively, as seen in its $475 million CMBS refinancing for office properties, further supports the cash cow status of its core assets. Coupled with a robust liquidity position of $838.5 million in Q1 2025, the company is well-positioned to leverage these stable income streams.

| Asset Type | Key Characteristic | Q1 2025 Data Point | Significance |

|---|---|---|---|

| Office Properties | Long-term leases, creditworthy tenants | $475M CMBS financing completed | Demonstrates stable cash flow and debt management |

| Studio Operations | High occupancy, established facilities | 88% occupancy/contractual commitment | Reliable, consistent revenue generation |

| Overall Portfolio | Mature, premium locations | 94.3% occupancy (Q1 2024) | Underpins dependable income for strategic initiatives |

Preview = Final Product

Hudson Pacific BCG Matrix

The Hudson Pacific BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report prepared for your strategic decision-making. You can confidently use this preview to understand the depth and quality of the insights contained within the complete BCG Matrix, ensuring it meets your business planning needs without any further revisions or modifications required. Once purchased, this exact file will be yours to download and implement directly into your business strategy or presentations.

Dogs

Hudson Pacific's office holdings in softer markets, especially those with persistent high vacancy and negative net absorption, are showing signs of underperformance. This has contributed to a net loss in Q1 2025, with occupancy and revenue dipping in certain locations.

Specifically, older or less desirable Class B office spaces that aren't attracting tenants in the current flight to quality trend are most vulnerable. These properties may struggle to maintain value and generate consistent income.

Hudson Pacific is strategically divesting non-core assets, aiming to raise between $125 million and $150 million. This move is primarily focused on deleveraging the company's balance sheet.

These assets, likely representing underperformers or those with uncertain future returns, are prime candidates for sale. By shedding these properties, Hudson Pacific can redirect capital and reduce financial strain.

Properties experiencing significant tenant downsizing due to hybrid work, leading to smaller average lease sizes, are prime candidates for the Dogs category in the Hudson Pacific BCG Matrix. This trend, accelerated in 2024, has seen many businesses re-evaluate their physical space needs, impacting older or less flexible office buildings.

For instance, a substantial portion of the office market now grapples with extended vacancies as companies opt for reduced footprints. Properties that cannot easily accommodate new tenant demands for flexible layouts or updated amenities are particularly vulnerable, potentially becoming underperformers.

Office Properties with Negative Cash Rent Spreads

Hudson Pacific's office properties experiencing negative cash rent spreads present a challenge, potentially fitting into the BCG matrix's 'Dog' category. While GAAP rents saw a 4.8% increase in Q1 2025, a significant 13.6% drop in cash rents, particularly from new leases in the San Francisco Bay Area, highlights underlying market pressures.

These properties are likely consuming cash due to factors such as substantial tenant concessions or unfavorable leasing environments. This cash drain indicates a low market share and low growth potential, characteristic of a 'Dog' in the BCG framework.

- Negative Cash Rent Spreads: Properties where cash rents are falling, indicating a potential cash drain.

- Q1 2025 Performance: GAAP rents up 4.8%, but cash rents down 13.6%.

- Geographic Concentration: San Francisco Bay Area leasing activity is a key driver of the cash rent decline.

- BCG Matrix Classification: These properties likely represent 'Dogs' due to low growth and market share, consuming resources.

Non-Strategic or Outdated Assets

Properties within Hudson Pacific's portfolio that are considered non-strategic or are becoming outdated in terms of amenities, technology, or location attractiveness in a highly competitive market would fall into this quadrant. These assets tie up capital without providing sufficient returns.

For instance, older office buildings in less desirable submarkets, or those lacking modern features like advanced HVAC systems or smart building technology, might struggle to attract and retain tenants paying premium rents. This can lead to prolonged vacancy periods and reduced net operating income.

- Underperforming Assets: Properties with low occupancy rates or declining rental income.

- Obsolete Features: Buildings lacking modern amenities or technological infrastructure.

- Suboptimal Locations: Assets situated in areas with diminishing tenant demand or accessibility issues.

- Capital Drain: Properties requiring significant ongoing investment without commensurate returns.

Properties in Hudson Pacific's portfolio exhibiting negative cash rent spreads, particularly in areas like the San Francisco Bay Area, are classified as Dogs. This is evidenced by a 13.6% drop in cash rents in Q1 2025, despite a 4.8% increase in GAAP rents, signaling a cash drain and low market share with limited growth potential.

These underperforming assets, often older buildings lacking modern amenities or located in less desirable submarkets, tie up capital without generating sufficient returns. Their inability to attract tenants in the current flight-to-quality trend exacerbates their 'Dog' status.

Hudson Pacific's strategy to divest non-core assets, aiming to raise $125 million to $150 million, directly addresses these underperformers. This deleveraging effort focuses on shedding properties with uncertain future returns to improve the company's financial standing.

| Category | Characteristics | Hudson Pacific Example | Financial Impact | BCG Implication |

|---|---|---|---|---|

| Dogs | Low market share, low growth potential, cash consuming | Older office buildings in softer markets with high vacancy; properties with negative cash rent spreads | Negative cash flow, requires ongoing investment, potential capital loss | Divest or restructure to minimize losses |

| Q1 2025 Cash Rent Change | -13.6% (San Francisco Bay Area) | |||

| Q1 2025 GAAP Rent Change | +4.8% |

Question Marks

Hudson Pacific is keenly focused on the burgeoning office-first AI industry along the West Coast, a sector drawing substantial venture capital. This strategic alignment positions them to capitalize on emerging tech hubs where new or recently acquired office spaces, though currently lightly occupied, represent significant future growth potential.

Developments catering to this high-growth AI sector, characterized by low current occupancy but immense expansion prospects, would fall into the Stars category of the BCG Matrix for Hudson Pacific. Significant capital investment will be necessary to secure a strong market presence in these nascent, yet promising, technological frontiers.

Hudson Pacific's speculative studio projects in developing markets would likely be classified as Stars or Question Marks in a BCG Matrix. These ventures, targeting emerging production hubs, exhibit high growth potential driven by global industry expansion. However, Hudson Pacific's current market share in these nascent regions is minimal, necessitating substantial capital infusion to establish a significant presence and capitalize on these growth opportunities.

Redevelopment or repositioning projects for existing assets, especially those adapting to evolving tenant needs in dynamic markets, would likely fall into the Question Marks category of the Hudson Pacific BCG Matrix. These ventures demand significant capital outlay and carry considerable risk, much like new ventures. For instance, Hudson Pacific Properties itself has engaged in substantial repositioning efforts, such as the redevelopment of the historic Broadway Trade Center in Los Angeles, which involved a significant investment to transform it into a modern creative office and retail hub.

Exploration of New Geographic Sub-markets

Exploring new geographic sub-markets, especially those with perceived high growth potential driven by sectors like tech or media, would position Hudson Pacific Properties as a Question Mark in the BCG matrix. These nascent ventures, likely characterized by a low current market share, would necessitate substantial capital infusion for marketing and tenant acquisition to build brand recognition and secure a foothold. For instance, if Hudson Pacific were to target emerging tech hubs in the Pacific Northwest or even explore opportunities in the burgeoning Austin, Texas market, these would represent initial, high-risk, high-reward plays.

- Initial Investment: Significant capital would be required to establish a presence in new, high-growth sub-markets.

- Market Share Growth: The primary objective would be to rapidly increase market share in these nascent areas.

- Risk Assessment: These ventures carry higher risk due to unproven market penetration and competitive landscapes.

- Potential for High Returns: Successful expansion into these areas could yield substantial long-term returns if growth potential is realized.

Properties with High Vacancy but Strong Future Demand Outlook

Certain Hudson Pacific properties may currently exhibit elevated vacancy rates but are strategically positioned in locations anticipating robust future demand from tech and media tenants. For instance, specific sub-markets within Seattle and Silicon Valley, despite current occupancy challenges, are projected for significant economic recovery and increased tenant interest. These assets represent a cash drain in the present due to underutilization.

These holdings, while requiring ongoing capital investment and operating expense coverage, possess the inherent potential to transition into Star performers. This transformation hinges on favorable shifts in market conditions and Hudson Pacific's efficacy in securing new leases. As of late 2024, the office vacancy rate in San Francisco, a key market for Hudson Pacific, hovered around 20%, underscoring the challenges but also the potential upside for well-located assets.

- High Vacancy Assets: Properties with current occupancy below 85% in markets with anticipated tenant demand growth.

- Future Demand Drivers: Areas with strong projected job growth in tech and media sectors, indicating a future tenant pool.

- Cash Consumption: These properties require capital for maintenance and operating expenses without commensurate rental income.

- Potential for Growth: Successful leasing efforts in recovering markets can elevate these assets to Star status within the portfolio.

Question Marks in Hudson Pacific's portfolio represent ventures with high growth potential but low current market share. These require substantial investment to capture market opportunities, carrying significant risk but offering the possibility of high future returns. Repositioning existing assets or entering new geographic sub-markets, such as exploring opportunities in Austin, Texas, exemplifies these Question Mark strategies.

These ventures demand significant capital outlay and carry considerable risk, much like new ventures. For instance, Hudson Pacific Properties itself has engaged in substantial repositioning efforts, such as the redevelopment of the historic Broadway Trade Center in Los Angeles, which involved a significant investment to transform it into a modern creative office and retail hub.

Exploring new geographic sub-markets, especially those with perceived high growth potential driven by sectors like tech or media, would position Hudson Pacific Properties as a Question Mark in the BCG matrix. These nascent ventures, likely characterized by a low current market share, would necessitate substantial capital infusion for marketing and tenant acquisition to build brand recognition and secure a foothold.

Certain Hudson Pacific properties may currently exhibit elevated vacancy rates but are strategically positioned in locations anticipating robust future demand from tech and media tenants. For instance, specific sub-markets within Seattle and Silicon Valley, despite current occupancy challenges, are projected for significant economic recovery and increased tenant interest. These assets represent a cash drain in the present due to underutilization.

| BCG Category | Hudson Pacific Example | Market Growth | Market Share | Capital Needs | Risk/Reward |

|---|---|---|---|---|---|

| Question Mark | Repositioning Broadway Trade Center | High (Creative Office/Retail) | Low to Moderate | High | High Risk, High Potential Reward |

| Question Mark | Entering Austin, Texas Market | High (Tech Sector) | Low | High | High Risk, High Potential Reward |

| Question Mark | High Vacancy Assets in Seattle | Moderate to High (Anticipated Tech Recovery) | Low | Moderate (for repositioning/leasing) | Moderate Risk, Moderate Potential Reward |

BCG Matrix Data Sources

Our Hudson Pacific BCG Matrix is informed by a robust blend of financial disclosures, real estate market analytics, and industry trend reports to ensure accurate strategic positioning.