Hudson Pacific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

Discover the strategic genius behind Hudson Pacific's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a powerful framework for understanding their market dominance.

Unlock the complete strategic blueprint behind Hudson Pacific's innovative approach. This in-depth Business Model Canvas reveals how they cultivate valuable partnerships and drive operational efficiency to capture market share. Ideal for anyone seeking to learn from a leader.

Ready to dissect Hudson Pacific's winning strategy? Our full Business Model Canvas provides a clear, actionable view of their value proposition and cost structure. Download it now to gain critical insights for your own business endeavors.

Partnerships

Hudson Pacific Properties cultivates key partnerships with prominent technology and media firms, securing substantial long-term leases. These collaborations are vital for ensuring high occupancy and developing specialized spaces that cater to the unique and evolving needs of these innovative sectors, particularly within the vibrant West Coast markets.

Hudson Pacific Properties actively partners with real estate developers and contractors, a crucial element in their strategy for acquiring, developing, and redeveloping properties. These collaborations are vital for securing the specialized expertise needed in construction, design, and overall project management.

By teaming up with these industry professionals, Hudson Pacific ensures its projects, particularly its signature office and studio spaces, are built to the highest contemporary standards. This approach allows them to consistently meet and exceed tenant expectations for modern, high-quality facilities.

Hudson Pacific's relationships with banks, lenders, and institutional investors are critical for its financial stability and expansion. These partnerships are the backbone for securing the capital needed for new acquisitions, ongoing development projects, and the effective management of existing debt. For instance, in 2024, the company continued to leverage its strong ties with financial institutions to manage its capital structure efficiently, ensuring access to liquidity for strategic initiatives.

Local Governments and Agencies

Hudson Pacific's engagement with local governments and agencies is crucial for securing zoning approvals and necessary permits for their development projects. These relationships are vital for staying abreast of urban planning directives and ensuring compliance with local regulations. In 2023, Hudson Pacific reported significant progress in their development pipeline, with several projects advancing through municipal review processes.

Collaborations with these entities often extend to leveraging tax credit programs and economic incentives designed to stimulate real estate development and bolster local economies. For instance, partnerships can unlock incentives specifically aimed at supporting the film and television production industry, a key sector for Hudson Pacific’s studio properties. This strategic alignment helps to foster growth and create a favorable operating environment.

- Zoning and Permitting: Essential for project approval and execution.

- Urban Planning Alignment: Ensuring developments fit local strategic goals.

- Tax Credits and Incentives: Accessing financial benefits for development and industry support.

- Economic Development Collaboration: Partnering to boost local job creation and investment.

Sustainability and Climate Tech Partners

Hudson Pacific actively collaborates with entities dedicated to sustainability and climate technology to advance its environmental objectives. A prime example is its partnership with Fifth Wall's Climate Technology Fund, a venture capital firm that invests in pioneering technologies aimed at reducing carbon emissions and improving energy efficiency across real estate portfolios. This strategic alliance allows Hudson Pacific to access and deploy cutting-edge solutions within its own properties, aligning with its commitment to a greener future.

These partnerships are crucial for Hudson Pacific to meet its ambitious sustainability targets, such as achieving net-zero operational carbon emissions. By working with specialized climate tech investors and innovators, the company can identify and implement advancements that directly contribute to lowering its environmental impact. For instance, investments in technologies that enhance building envelope performance or optimize HVAC systems can lead to significant energy savings and a reduced carbon footprint.

- Fifth Wall's Climate Technology Fund: Invests in early-stage companies developing technologies for decarbonizing the built environment.

- Focus on Innovation: Collaborations aim to bring new solutions for energy efficiency and carbon reduction to Hudson Pacific's properties.

- Environmental Goals: Partnerships directly support Hudson Pacific's commitment to achieving net-zero operational carbon emissions.

- Strategic Alliances: These relationships provide access to capital and expertise for implementing sustainable building practices.

Hudson Pacific's key partnerships are foundational to its business model, enabling access to capital, specialized expertise, and prime development opportunities. These relationships ensure the company can effectively acquire, develop, and manage its portfolio of office and studio properties, particularly within its core West Coast markets.

The company actively collaborates with financial institutions, including banks and institutional investors, to secure the necessary capital for its strategic initiatives. This financial backing is crucial for acquisitions, development projects, and managing its debt effectively. For example, in 2024, Hudson Pacific continued to rely on these strong relationships to maintain liquidity and fund its growth pipeline.

Furthermore, partnerships with real estate developers and contractors provide essential construction and project management expertise, ensuring properties are built to the highest standards. Collaborations with technology and media firms secure long-term leases, guaranteeing high occupancy and the development of tailored spaces for these industries.

Hudson Pacific also engages with local governments and agencies for crucial zoning and permitting approvals, aligning its developments with urban planning goals and accessing economic incentives. Its commitment to sustainability is bolstered by partnerships with climate technology firms, such as Fifth Wall, to implement innovative solutions for reducing environmental impact and achieving net-zero emissions targets.

| Partnership Type | Key Function | Impact on Hudson Pacific | Example/Data Point |

|---|---|---|---|

| Financial Institutions | Capital Access & Debt Management | Enables acquisitions, development, and financial stability. | Continued reliance in 2024 for liquidity and growth funding. |

| Developers & Contractors | Construction & Project Management | Ensures high-quality, specialized property development. | Vital for building state-of-the-art office and studio spaces. |

| Technology & Media Tenants | Leasing & Occupancy | Secures long-term leases and drives demand for specialized spaces. | High occupancy rates in key West Coast markets. |

| Local Governments & Agencies | Zoning, Permitting & Incentives | Facilitates project approvals and leverages economic benefits. | Progress in municipal review processes reported in 2023. |

| Climate Technology Firms | Sustainability & Innovation | Drives environmental goal achievement and adoption of green tech. | Partnership with Fifth Wall's Climate Technology Fund. |

What is included in the product

A detailed breakdown of Hudson Pacific's strategy, focusing on its real estate development and management for technology and media tenants, outlining key customer segments, value propositions, and revenue streams.

Hudson Pacific's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex strategic thinking.

It offers a digestible, one-page snapshot, streamlining the process of understanding and communicating their core business components.

Activities

Hudson Pacific's key activities center on the strategic acquisition and development of premium office and studio properties. This involves meticulously identifying and securing prime locations, particularly in high-growth West Coast markets like Los Angeles, San Francisco, and Seattle. They engage in both opportunistic purchases of existing assets and ambitious ground-up construction projects to expand their portfolio.

The company's development pipeline is a critical driver of growth, aiming to meet the evolving needs of their target tenants in the technology and media sectors. For instance, in 2024, Hudson Pacific continued to advance its development projects, focusing on creating modern, amenity-rich spaces designed to attract and retain these key industries. This proactive approach ensures their portfolio remains competitive and aligned with market demand.

Hudson Pacific actively manages and operates its diverse portfolio of office and studio properties. This hands-on approach is crucial for maintaining asset value and tenant satisfaction.

The company’s operations cover essential day-to-day tasks like property maintenance, security, and ensuring all building systems function optimally. For example, in 2023, Hudson Pacific reported total revenues of $1.1 billion, with a significant portion attributable to rental income derived from these well-managed properties.

Beyond basic upkeep, Hudson Pacific focuses on enhancing the appeal and functionality of its real estate assets through tenant services and strategic upgrades. This commitment to operational excellence supports their goal of attracting and retaining high-quality tenants, contributing to stable rental income streams.

Hudson Pacific's core operations revolve around the active leasing of its premium office spaces and specialized sound stages. This critical activity targets technology and media companies, ensuring a robust demand for their unique properties.

The company actively markets its portfolio, engages in skilled negotiation of lease agreements, and cultivates strong, lasting relationships with a diverse array of tenants. This focus on tenant satisfaction is paramount for maintaining high occupancy rates, which stood at 91.4% for their office portfolio as of the first quarter of 2024, and retaining key clients.

Capital Management and Financing

Hudson Pacific Properties actively manages its capital by securing various forms of financing to support its extensive real estate operations. This includes utilizing public offerings and credit facilities to maintain strong liquidity.

This strategic capital management is crucial for meeting operational expenses, servicing existing debt obligations, and funding new development projects within their portfolio.

- Securing diverse financing: Hudson Pacific leverages public equity offerings and various credit facilities to ensure access to capital.

- Maintaining liquidity: Effective capital management provides the necessary funds for day-to-day operations and strategic investments.

- Debt servicing and investment funding: Capital resources are allocated to meet debt repayment schedules and fuel the growth of their real estate assets.

As of the first quarter of 2024, Hudson Pacific reported total debt of approximately $6.2 billion, highlighting the significant scale of their financing activities. Their ability to access and manage this capital is fundamental to their business model.

Sustainability Initiatives and Innovation

Hudson Pacific Properties is deeply committed to sustainability, aiming for net-zero carbon operations. This commitment translates into tangible actions across their portfolio, including significant investments in climate technology and innovative energy solutions.

Their strategy involves rigorous implementation of energy efficiency measures and a strong focus on renewable energy sources. By prioritizing these aspects, Hudson Pacific aims to reduce its environmental footprint and lead in sustainable real estate practices.

The company actively pursues prestigious certifications like LEED and ENERGY STAR for its properties, underscoring its dedication to high environmental performance standards. As of 2024, a significant portion of their portfolio holds these certifications, reflecting ongoing progress in their sustainability journey.

- Net-Zero Carbon Operations: Hudson Pacific is actively working towards achieving net-zero carbon emissions across its operations.

- Climate Technology Investment: The company is investing in and deploying innovative climate technologies to enhance sustainability.

- Energy Efficiency & Renewables: Implementation of energy efficiency measures and the use of renewable energy are core to their strategy.

- LEED & ENERGY STAR Certifications: Properties are pursued for certifications like LEED and ENERGY STAR to validate environmental performance.

Hudson Pacific's key activities encompass acquiring, developing, and managing premier office and studio properties, primarily on the West Coast. They focus on creating spaces tailored for the tech and media industries, ensuring high occupancy rates. For example, their office portfolio occupancy stood at 91.4% in Q1 2024.

A significant part of their strategy involves active leasing, marketing their properties, and negotiating favorable lease terms. This proactive tenant engagement is crucial for maintaining strong rental income, which contributed significantly to their $1.1 billion in total revenues for 2023.

Capital management is another core activity, involving securing diverse financing like credit facilities and public offerings to fund operations and development. As of Q1 2024, their total debt was approximately $6.2 billion, underscoring the scale of their financial operations.

Furthermore, Hudson Pacific is committed to sustainability, aiming for net-zero carbon operations by investing in climate technology and energy efficiency. Many of their properties hold certifications like LEED and ENERGY STAR, reflecting this dedication.

| Key Activity | Description | Relevant Data (as of Q1 2024 or 2023) |

|---|---|---|

| Property Acquisition & Development | Securing and building premium office and studio spaces. | Focus on West Coast markets; ongoing development projects. |

| Property Leasing & Tenant Relations | Marketing, leasing, and managing tenant relationships. | Office portfolio occupancy: 91.4%; targeting tech/media tenants. |

| Capital Management | Securing financing and managing liquidity. | Total debt: ~$6.2 billion; utilizes credit facilities and equity. |

| Sustainability Initiatives | Implementing energy efficiency and renewable energy solutions. | Aiming for net-zero carbon operations; pursuing LEED/ENERGY STAR certifications. |

Full Document Unlocks After Purchase

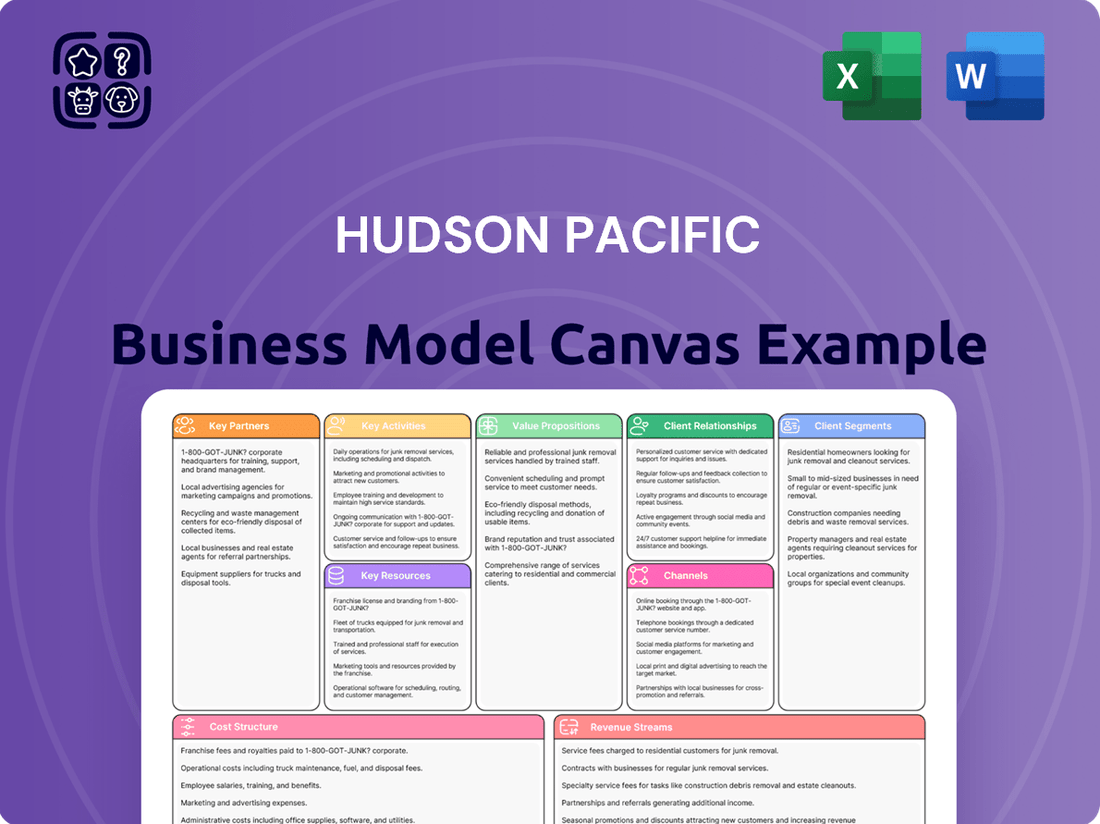

Business Model Canvas

The Business Model Canvas you see here is the actual document you will receive upon purchase. This preview offers a genuine glimpse into the complete, professionally structured framework. Once your order is processed, you'll gain full access to this exact file, ready for immediate use and customization.

Resources

Hudson Pacific's primary resource is its robust portfolio of premium office and studio properties. These high-quality assets are strategically situated in key West Coast markets, including California and the Pacific Northwest. This real estate forms the bedrock of their operations, enabling them to serve a diverse tenant base.

The company's extensive collection of sound stages is particularly crucial, catering to the booming media and entertainment industry. As of the first quarter of 2024, Hudson Pacific reported a significant portion of its revenue derived from its studio operations, highlighting the strategic importance of these specialized facilities.

Hudson Pacific's expertise in tech and media real estate is a cornerstone of their business model. They possess deep industry relationships and specialized knowledge, allowing them to pinpoint emerging trends and understand tenant requirements within these dynamic sectors.

This specialized insight enables Hudson Pacific to craft bespoke real estate solutions that cater specifically to the unique needs of tech and media companies. For instance, in 2024, their focus on these sectors has been critical in navigating the evolving demands for flexible office spaces and amenity-rich environments, which are highly valued by creative and technology-driven tenants.

Hudson Pacific's access to substantial financial capital, encompassing cash reserves, credit lines, and the capacity to issue new equity and debt, is a cornerstone of its business model. This financial muscle enables strategic property acquisitions and development projects.

In 2024, Hudson Pacific Properties reported total assets of approximately $10.1 billion, underscoring its significant financial base. This robust financial position is vital for funding its extensive portfolio of real estate assets and ongoing development initiatives.

Skilled Management and Operations Teams

Hudson Pacific's skilled management and operations teams are a cornerstone of its business model. This expertise spans critical areas like property management, leasing, development, and finance, directly impacting the company's ability to execute its strategy effectively.

The depth of experience within these teams is crucial for driving efficient day-to-day operations, securing successful leasing agreements, and making sound strategic decisions that align with market opportunities. For instance, in 2024, Hudson Pacific's leasing efforts continued to be a key driver of revenue growth.

- Property Management Excellence: Ensuring optimal performance and tenant satisfaction across its portfolio.

- Leasing Expertise: Securing and retaining high-quality tenants, contributing to strong occupancy rates.

- Development Acumen: Navigating complex development projects from conception to completion.

- Financial Stewardship: Managing capital effectively and driving shareholder value.

Sustainable Infrastructure and Technology

Hudson Pacific's commitment to sustainable infrastructure is a crucial element of its business model. This includes significant investments in on-site renewable energy sources and advanced smart building technologies across its portfolio. For instance, by the end of 2023, the company had achieved notable progress in its sustainability initiatives, with a substantial portion of its portfolio featuring green building certifications.

These sustainable assets are not just about environmental responsibility; they directly contribute to enhanced property valuations and attract a growing segment of tenants prioritizing eco-friendly operations. This strategic focus positions Hudson Pacific favorably in a market increasingly valuing ESG (Environmental, Social, and Governance) performance.

- On-site Renewables: Investments in solar panels and other renewable energy generation reduce operational costs and carbon footprint.

- Smart Building Technologies: Implementation of systems for energy efficiency, occupant comfort, and operational optimization.

- Green Certifications: A growing number of properties hold certifications like LEED, attracting premium tenants and investors.

- Tenant Attraction: Sustainability features are a key differentiator, appealing to companies with strong ESG mandates.

Hudson Pacific's key resources are its prime real estate portfolio, particularly in tech and media hubs, its specialized studio facilities, and its financial strength. The company's deep industry relationships and expertise in these dynamic sectors are also vital, enabling tailored solutions for tenants. Their skilled management teams and commitment to sustainable infrastructure further bolster their operational capabilities and market appeal.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Real Estate Portfolio | Premium office and studio properties in West Coast markets. | Strategic locations catering to tech and media tenants. |

| Studio Facilities | Extensive sound stages and production infrastructure. | Crucial for the booming media and entertainment industry; significant revenue driver. |

| Industry Expertise | Deep knowledge of tech and media real estate trends and tenant needs. | Enables bespoke solutions and attracts specialized tenants. |

| Financial Capital | Cash reserves, credit lines, and access to capital markets. | Supported approximately $10.1 billion in total assets as of Q1 2024, enabling acquisitions and development. |

| Management & Operations | Skilled teams in property management, leasing, development, and finance. | Drives efficient operations, leasing success, and strategic decision-making. |

Value Propositions

Hudson Pacific Properties strategically places its premier office and studio assets within the most dynamic innovation hubs across the West Coast. This focus on prime locations in markets like the San Francisco Bay Area, Los Angeles, and Seattle ensures tenants are at the heart of technological advancement and creative industries.

By situating tenants in these vibrant ecosystems, Hudson Pacific fosters unparalleled opportunities for collaboration and access to a deep pool of specialized talent. For instance, their presence in Silicon Valley provides direct proximity to leading tech firms and venture capital, a critical advantage for growth-stage companies.

In 2024, Hudson Pacific continued to leverage these strategic locations, with a significant portion of its portfolio concentrated in these high-demand innovation centers. This commitment to premier locations directly translates into tenant value by facilitating easier recruitment and fostering industry connections.

Hudson Pacific Properties offers highly specialized real estate solutions, focusing on the unique needs of the tech and media sectors. This includes flexible office environments and advanced sound stages, directly addressing the operational and creative requirements of these fast-paced industries.

In 2024, Hudson Pacific continued to leverage its expertise in these niche markets. Their portfolio is strategically positioned to support the growth and evolving demands of technology and media companies, offering spaces that foster innovation and collaboration.

Hudson Pacific Properties is dedicated to developing and managing properties that foster sustainable and healthy environments. This commitment is underscored by their achievement of net-zero carbon operations, a significant milestone in environmental responsibility.

This focus on eco-friendly practices and tenant well-being directly appeals to businesses actively seeking to enhance their Environmental, Social, and Governance (ESG) performance. For instance, in 2023, Hudson Pacific reported that 95% of its portfolio achieved LEED certification, demonstrating a tangible commitment to green building standards.

Full-Service Value Creation Platform

Hudson Pacific's full-service value creation platform offers tenants a complete solution, managing everything from finding and acquiring properties to transforming, developing, and maintaining them. This integrated approach ensures tenants receive top-tier, well-kept spaces and prompt, reliable service.

This comprehensive management model translates into tangible benefits for tenants. For instance, Hudson Pacific's focus on strategic acquisitions and development, as seen in their significant investments in innovation hubs, directly contributes to the quality and desirability of their leased spaces. In 2023, the company reported a strong leasing pipeline, indicating sustained demand for their well-managed properties.

- End-to-End Property Solutions: Tenants experience a seamless process from initial property identification through ongoing management, reducing their operational burden.

- Quality Assurance: The vertically integrated model ensures high standards of construction, maintenance, and amenity provision across their portfolio.

- Responsive Service: Direct control over all aspects of property operations allows for quicker issue resolution and a more attentive tenant experience.

Strategic Flexibility and Future-Proofing

Hudson Pacific Properties' approach to real estate development emphasizes strategic flexibility, enabling adaptation to the dynamic needs of tenants and shifting market trends. This is particularly crucial given the rapid expansion of AI-driven companies, which often have unique and evolving space requirements.

This adaptability ensures that Hudson Pacific's portfolio remains relevant and valuable, even as the industry landscape transforms. For instance, in 2024, the company continued to focus on developing modern, tech-enabled spaces designed to accommodate the infrastructure and operational demands of innovative businesses.

- Adaptable Design: Properties are designed with modularity and technological integration in mind to easily accommodate changes in tenant needs.

- Market Responsiveness: Hudson Pacific actively monitors and responds to emerging market trends, such as the increasing demand for specialized data center and AI-ready facilities.

- Future-Proofing Investments: By anticipating future industry shifts, the company aims to maintain the long-term value and competitiveness of its real estate assets.

- Tenant Collaboration: Engaging closely with tenants, including those in the AI sector, allows for the co-creation of spaces that directly support their growth and operational efficiency.

Hudson Pacific Properties provides premier office and studio spaces in prime West Coast innovation hubs, fostering tenant access to talent and collaboration opportunities. Their 2024 portfolio concentration in these high-demand areas directly enhances tenant recruitment and industry networking.

The company specializes in tailored real estate solutions for the tech and media sectors, offering flexible environments and advanced facilities that meet specific operational needs. This focus ensures their properties support the dynamic growth of these industries.

Hudson Pacific is committed to sustainability, achieving net-zero carbon operations and maintaining high ESG standards, with 95% of its portfolio LEED certified as of 2023. This dedication appeals to environmentally conscious businesses.

Their integrated, full-service platform manages the entire property lifecycle, ensuring high-quality, well-maintained spaces and responsive tenant service. This comprehensive approach, evidenced by a strong 2023 leasing pipeline, delivers significant tenant value.

Customer Relationships

Hudson Pacific cultivates robust customer relationships by assigning dedicated leasing and property management teams. These specialized groups offer tailored support, ensuring tenant needs are met swiftly and maintaining a seamless leasing and occupancy journey.

Hudson Pacific Properties actively cultivates long-term partnerships with its tenants, fostering enduring relationships that often translate into extended lease agreements and a strong foundation for repeat business. This focus on tenant longevity is a cornerstone of their strategy.

By deeply understanding tenant growth trajectories and proactively adapting their real estate solutions, Hudson Pacific ensures their spaces remain supportive of evolving business needs. This collaborative approach is key to their success.

In 2024, a significant portion of Hudson Pacific's portfolio is anchored by these long-term relationships, reflecting a commitment to tenant satisfaction and a stable revenue stream. Their tenant retention rate remains a key performance indicator.

Hudson Pacific cultivates strong customer relationships by delivering exceptional amenities and building vibrant communities within its properties. This strategy focuses on creating environments that are not just functional but also engaging, transforming spaces into sought-after destinations.

Key to this approach are features like well-designed outdoor areas, comprehensive end-of-trip facilities, and curated events. For instance, in 2024, Hudson Pacific continued to invest in enhancing these shared spaces, recognizing their importance in tenant satisfaction and retention. These elements encourage interaction and a sense of belonging among occupants.

Proactive Communication and Investor Relations

Hudson Pacific maintains transparent and proactive communication with its investors and stakeholders. This commitment ensures they are consistently informed about the company's performance and strategic trajectory.

- Regular Financial Reporting: Providing timely and accurate financial statements is a cornerstone of their investor relations strategy.

- Earnings Calls and Investor Presentations: These platforms offer direct engagement, allowing for in-depth discussions on financial results and future outlook.

- Strategic Direction Updates: Keeping stakeholders abreast of key initiatives and market positioning is vital for building confidence and alignment.

For instance, during their Q1 2024 earnings call, Hudson Pacific highlighted a strong leasing pipeline and provided an updated outlook for the remainder of the year, demonstrating their proactive approach to investor engagement.

Technology-Enabled Tenant Services

Hudson Pacific leverages technology to significantly improve tenant interactions and property management. Mobile applications are central to this strategy, offering a seamless platform for communication and service requests, which directly enhances the tenant experience.

This digital focus not only boosts tenant satisfaction but also drives operational efficiency. By streamlining how tenants report issues or make inquiries, the company ensures quicker response times and more effective resolution of needs.

- Mobile Apps: Facilitate direct communication, rent payments, and maintenance requests.

- Digital Portals: Provide tenants with 24/7 access to building information and services.

- Data Analytics: Inform service improvements and personalize tenant offerings.

Hudson Pacific's customer relationships are built on dedicated support and long-term partnerships, aiming for tenant retention and satisfaction. They foster community through enhanced amenities and proactive communication, leveraging technology for seamless interactions.

Channels

Hudson Pacific Property Trust leverages its dedicated in-house leasing teams to directly engage potential tenants, fostering strong relationships within the technology and media sectors. This direct approach is complemented by strategic partnerships with experienced commercial real estate brokers, expanding their market reach and access to a diverse client base.

In 2024, Hudson Pacific's leasing efforts continued to drive occupancy across its prime portfolio. For instance, the company reported a strong leasing environment, with significant square footage secured by key tenants in its innovation centers, underscoring the effectiveness of its dual leasing strategy.

Hudson Pacific's corporate website and investor portals are crucial communication hubs. These platforms offer detailed property listings, financial statements, and timely company updates, directly reaching potential tenants, existing clients, and the investment community.

In 2024, Hudson Pacific reported total revenue of $1.02 billion, with a significant portion likely driven by information disseminated through these digital channels to attract and retain business.

Hudson Pacific Properties actively participates in key industry conferences and networking events, such as the National Association of Real Estate Investment Trusts (NAREIT) convention and local real estate expos. These gatherings are crucial for showcasing their modern office and media-focused properties, like their recent developments in Silicon Valley and Vancouver. In 2024, events like these provided direct access to potential anchor tenants and strategic joint venture partners, fostering relationships that are vital for leasing up new developments and securing future growth opportunities.

Strategic Partnerships and Industry Relationships

Hudson Pacific's strategic partnerships and industry relationships serve as a crucial channel for driving new business. These deep-rooted connections within the tech and media sectors are instrumental in identifying and securing new tenants.

Leveraging these established networks, the company benefits from a consistent stream of referrals and direct introductions to potential clients. This approach significantly enhances their tenant acquisition efforts, reducing the time and cost associated with traditional marketing.

- Strategic Alliances: Hudson Pacific cultivates alliances with major tech and media companies, facilitating access to their expanding real estate needs.

- Referral Networks: A robust referral system with existing tenants and industry influencers directly contributes to filling vacant spaces.

- Industry Expertise: Deep understanding of tenant requirements, fostered through relationships, allows for tailored property solutions.

Media and Public Relations

Hudson Pacific's Media and Public Relations strategy focuses on building brand recognition and clearly communicating its value to stakeholders. By actively engaging with key financial news outlets, specialized real estate publications, and broader media channels, the company aims to enhance its public profile.

These efforts are crucial for disseminating information about significant company milestones, such as new property developments, advancements in sustainability initiatives, and strong financial performance. For instance, in 2024, Hudson Pacific continued to emphasize its commitment to ESG principles, a narrative amplified through targeted media outreach.

- Brand Awareness: Consistent media engagement increases visibility within the investment community and the general public.

- Value Proposition Communication: Highlighting development projects and financial stability reinforces the company's core strengths.

- Key Development Updates: Announcing new leases or building completions through press releases and media features provides timely information.

- ESG Storytelling: Showcasing sustainability achievements, such as energy efficiency upgrades in their 2024 portfolio, resonates with environmentally conscious investors and tenants.

Hudson Pacific's channels for reaching customers are multifaceted, combining direct engagement with strategic outreach. Their in-house leasing teams actively connect with potential tenants, particularly within the tech and media industries, while partnerships with commercial real estate brokers broaden their market penetration.

Digital platforms, including their corporate website and investor portals, serve as vital information hubs, detailing property listings and company performance. Industry events and conferences offer direct interaction opportunities, fostering relationships with both tenants and partners.

Media and public relations efforts are key to building brand recognition and communicating their value proposition, especially regarding sustainability initiatives, a narrative amplified in 2024.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| In-house Leasing Teams | Direct tenant engagement, relationship building | Secured significant square footage in innovation centers |

| Broker Partnerships | Expanded market reach, diverse client access | Complemented direct leasing efforts |

| Digital Platforms (Website, Portals) | Property listings, financial data, company updates | Supported $1.02 billion total revenue |

| Industry Events & Conferences | Showcasing properties, networking for tenants/partners | Facilitated access to potential anchor tenants |

| Media & Public Relations | Brand awareness, value communication, ESG narrative | Amplified commitment to ESG principles |

Customer Segments

Large technology corporations are a key customer segment for Hudson Pacific Properties, with these giants actively seeking substantial office footprints in sought-after West Coast markets. Companies like Netflix and Google, for instance, have historically leased significant square footage, driving demand for premium locations and modern facilities. These tenants typically require adaptable floor plans and cutting-edge amenities to support their expansive teams and dynamic operational requirements.

Media and entertainment production companies, including major film and television studios, are key customers for Hudson Pacific. These businesses need specialized facilities like sound stages and production offices to create content. Hudson Pacific's portfolio is designed to meet these specific, often demanding, requirements.

In 2024, the film and television production sector continued to be a significant driver of demand for studio space. For example, major studios are investing heavily in new productions, with total production spending in the US alone projected to reach over $100 billion in 2024, highlighting the ongoing need for high-quality, well-equipped facilities.

Hudson Pacific actively courts emerging growth companies, especially those at the forefront of artificial intelligence. These businesses typically require flexible, state-of-the-art environments designed to foster collaboration and accommodate swift scaling. In 2024, the AI sector continued its robust expansion, with venture capital funding in AI startups reaching significant milestones, underscoring the demand for specialized real estate solutions.

Creative and Digital Content Firms

Creative and digital content firms, encompassing everything from advertising agencies to video production studios, represent a key customer segment for Hudson Pacific. These businesses thrive on innovation and collaboration, actively seeking environments that not only house their operations but also stimulate their creative processes. They are drawn to locations that offer a palpable sense of industry energy and connection.

These firms require flexible and modern office spaces that can adapt to evolving team sizes and project needs. Access to a network of complementary businesses and talent within the same building or district is also a significant draw, creating opportunities for partnerships and organic growth. For instance, many tech-forward creative companies are prioritizing locations with robust digital infrastructure and amenities that support a dynamic work culture.

- Demand for Inspiring Workspaces: Creative firms prioritize environments that foster innovation and collaboration, often seeking spaces with natural light, open layouts, and access to communal areas.

- Industry Ecosystem Benefits: Proximity to other creative and technology companies provides opportunities for networking, talent acquisition, and synergistic partnerships.

- Flexibility and Scalability: These businesses often require adaptable lease terms and office configurations to accommodate project-based work and fluctuating team sizes.

- Digital Infrastructure Needs: Reliable high-speed internet and advanced technological capabilities are crucial for digital content creation and distribution, making well-equipped buildings a priority.

Institutional and Individual Investors

Hudson Pacific Properties, as a Real Estate Investment Trust (REIT), caters to a broad spectrum of investors. This includes large institutional funds, such as pension funds and endowments, as well as financial professionals managing wealth, and individual investors seeking exposure to real estate.

These customers are primarily motivated by the potential for stable income generation through dividends and capital appreciation from real estate assets. They are particularly drawn to Hudson Pacific's strategic focus on high-growth sectors, especially the technology and media industries, which often exhibit strong leasing demand and rental growth prospects.

For instance, in 2023, REITs as a sector saw varied performance, but those with strong tenant bases in resilient industries like technology often outperformed. Hudson Pacific's portfolio, heavily weighted towards these sectors, positions it attractively for investors looking for growth-oriented real estate exposure.

- Institutional Investors: Seeking diversification and stable, income-generating assets within their portfolios.

- Financial Professionals: Advising clients and allocating capital towards real estate investments with growth potential.

- Individual Investors: Looking for direct or indirect investment in real estate, often attracted by REIT dividends and market appreciation.

- Focus on Tech & Media: Customers are specifically interested in real estate markets benefiting from the expansion of these dynamic industries.

Hudson Pacific's customer base extends to a diverse group of investors, including large institutional funds, financial professionals, and individual investors. These stakeholders are attracted by the potential for consistent returns through dividends and property value appreciation, particularly within the company's strategically chosen tech and media-focused markets.

The company's REIT structure appeals to those seeking real estate exposure with the liquidity and income potential characteristic of publicly traded securities. For example, in 2023, the real estate sector experienced fluctuations, but REITs with strong tenant portfolios in resilient sectors like technology demonstrated notable resilience and growth potential.

Investors are drawn to Hudson Pacific's specific portfolio concentration, which aligns with the growth trajectories of the technology and media industries. This focus is crucial for investors aiming to capitalize on the expansion and leasing demand within these vibrant economic sectors.

| Investor Type | Primary Motivation | Key Interest Area |

|---|---|---|

| Institutional Funds | Diversification, stable income, capital appreciation | Real estate assets in growth sectors |

| Financial Professionals | Client portfolio growth, risk management | REITs with strong leasing demand |

| Individual Investors | Dividend income, real estate market exposure | Companies with high-growth industry tenants |

Cost Structure

Hudson Pacific's property operating expenses are a significant component of its cost structure, reflecting the substantial investment required to maintain its extensive real estate portfolio. These costs encompass essential services like utilities, which are crucial for tenant comfort and operational efficiency, and property taxes, a direct reflection of the value and location of their assets.

Beyond these, insurance premiums protect against unforeseen events, while ongoing repairs and maintenance ensure the long-term viability and appeal of their properties. General administrative expenses, including property management salaries and overhead, are also factored in, ensuring smooth day-to-day operations across their diverse holdings.

For context, in 2023, Hudson Pacific reported total operating expenses of approximately $800 million, with a notable portion attributed to these property operating costs, underscoring their essential nature in preserving asset value and generating rental income.

Acquisition and development costs represent a significant portion of Hudson Pacific's expenses. These costs encompass the purchase of new land, the transformation of raw land into usable sites, and the renovation of existing properties to enhance their value and functionality.

Key components within this cost structure include the initial outlay for land acquisition, the extensive expenses associated with construction and building, and fees related to managing these complex development projects. For instance, in 2023, Hudson Pacific reported significant capital expenditures related to its development pipeline, reflecting these substantial upfront investments.

As a Real Estate Investment Trust (REIT), Hudson Pacific Properties' cost structure is significantly impacted by financing and interest expenses. These costs are primarily driven by interest payments on the company's various debt instruments, including secured and unsecured loans, as well as credit facilities used to fund its substantial real estate portfolio. For the first quarter of 2024, Hudson Pacific reported total interest expense of $50.8 million, reflecting the ongoing cost of servicing its debt.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Hudson Pacific represent the essential overhead needed to operate the business. These include costs like executive compensation, corporate office rent and utilities, legal and accounting services, and other central administrative functions. These are not directly linked to the revenue generation of a specific property but are crucial for the company's overall management and compliance.

Hudson Pacific has been actively pursuing cost efficiencies within its G&A structure. For instance, in the first quarter of 2024, the company reported G&A expenses of $21.4 million. This focus on streamlining operations aims to improve profitability by reducing non-property-specific expenditures.

- Executive Salaries and Benefits: Compensation for the leadership team overseeing strategic decisions and corporate operations.

- Corporate Office Operations: Costs associated with maintaining the company's headquarters, including rent, utilities, and staff.

- Legal and Professional Fees: Expenses for legal counsel, auditing, and other specialized advisory services.

- Information Technology and Systems: Investment in and maintenance of the technological infrastructure supporting the entire organization.

Leasing and Marketing Expenses

Hudson Pacific's cost structure includes significant leasing and marketing expenses essential for tenant acquisition and retention. These costs are directly tied to the company's ability to maintain high occupancy rates in its portfolio.

These expenses encompass a range of activities aimed at attracting and securing new tenants. This includes broad marketing campaigns to showcase available properties, leasing commissions paid to brokers who facilitate deals, and tenant improvement allowances, which are funds provided to customize leased spaces according to the specific needs of new occupants.

- Marketing Campaigns: Costs for advertising, digital marketing, and promotional materials to reach potential tenants.

- Leasing Commissions: Payments to brokers for successfully signing new leases or renewals, typically a percentage of the lease value.

- Tenant Improvement Allowances: Capital provided to tenants for customizing their leased spaces, impacting upfront costs per lease.

For instance, in 2024, real estate investment trusts (REITs) like Hudson Pacific often manage these costs carefully to balance tenant acquisition with profitability. The average leasing commission can range from 4% to 6% of the total lease value, and tenant improvement allowances can vary widely based on market conditions and tenant demands, often ranging from $50 to $150 per square foot.

Hudson Pacific's cost structure is heavily weighted towards property operating expenses, which are essential for maintaining its extensive real estate portfolio. These include utilities, property taxes, insurance, and ongoing repairs, all vital for asset value and rental income generation. For 2023, total operating expenses neared $800 million, highlighting the scale of these property-specific costs.

Financing and interest expenses form another critical component, reflecting the debt used to fund its substantial real estate holdings. In the first quarter of 2024, interest expense alone was $50.8 million, underscoring the significant cost of servicing its debt obligations.

Additionally, acquisition and development costs, including land purchase, construction, and project management fees, represent substantial upfront investments. Leasing and marketing expenses, such as commissions and tenant improvement allowances, are also key to securing and retaining tenants, with commissions often ranging from 4% to 6% of lease value.

| Cost Category | Key Components | 2023/Q1 2024 Relevance |

|---|---|---|

| Property Operating Expenses | Utilities, Property Taxes, Insurance, Maintenance | Significant portion of ~$800M total operating expenses in 2023 |

| Financing & Interest Expenses | Interest on debt, credit facilities | $50.8M in Q1 2024 |

| Acquisition & Development Costs | Land purchase, construction, project management | Substantial upfront investments reflected in capital expenditures |

| Leasing & Marketing Expenses | Commissions, tenant improvements, advertising | Commissions typically 4-6% of lease value; crucial for occupancy |

| General & Administrative (G&A) | Executive compensation, office operations, legal fees | $21.4M in Q1 2024; focus on efficiency |

Revenue Streams

Hudson Pacific Properties' core revenue generation stems from its substantial portfolio of office properties, primarily leased to the dynamic technology and media sectors. These agreements are typically structured as long-term leases, ensuring a predictable and consistent income stream for the company.

As of the first quarter of 2024, Hudson Pacific’s rental revenue from its office and media properties was $194.7 million. This highlights the significant contribution of these leases to the company's overall financial performance.

Hudson Pacific generates revenue by leasing its sound stages and production facilities to various media and entertainment companies. This core offering forms a significant portion of their income, catering to the high demand for specialized filming spaces.

Beyond just leasing space, the company enhances its revenue by offering a suite of related services. These can include equipment rentals and other production support, which adds value for clients and diversifies income streams for Hudson Pacific.

In 2023, Hudson Pacific Properties reported that its media and entertainment segment, which heavily relies on studio property leases and services, represented a substantial part of its overall business, demonstrating the critical nature of this revenue stream.

Beyond its primary leasing activities, Hudson Pacific Properties diversifies its income through ancillary services and amenities. These offerings, designed to enhance the tenant experience, contribute to overall property revenue.

Examples include revenue generated from parking facilities, the rental of flexible event spaces for tenant functions, and other value-added services tailored to occupants' needs. For instance, in the first quarter of 2024, Hudson Pacific reported rental and other property income of $231.1 million, a figure that implicitly includes contributions from these supplementary revenue streams.

Development and Redevelopment Profits

Hudson Pacific Properties generates significant revenue from development and redevelopment projects. This involves creating new, modern properties or revitalizing existing ones to enhance their market value. Profits are realized through increased rental income from upgraded spaces or by selling these improved assets.

For instance, in 2024, the company continued to focus on its development pipeline, aiming to capture value appreciation. This strategy is crucial for long-term growth.

- Capturing Value: Profits are derived from the difference between development costs and the increased market value of properties post-completion or redevelopment.

- Rental Income Growth: Upgraded or new properties command higher rents, directly boosting recurring revenue streams.

- Asset Sales: Strategic sales of stabilized or redeveloped assets can provide lump-sum profits and capital for reinvestment.

Asset Sales and Dispositions

Hudson Pacific Properties periodically divests assets, both non-core and stabilized properties, to strategically refine its portfolio and enhance financial flexibility. These sales are crucial for generating capital to fuel new development projects or reduce existing debt.

In 2024, Hudson Pacific continued this practice, with asset sales contributing to its overall financial performance. For instance, the company completed the sale of several office properties, demonstrating its active management approach.

- Portfolio Optimization: Asset sales allow Hudson Pacific to shed underperforming or non-strategic assets, focusing resources on higher-growth opportunities.

- Capital Generation: Dispositions provide immediate liquidity, which can be reinvested in development projects or used to strengthen the balance sheet.

- Leverage Reduction: Selling assets helps lower the company's debt-to-equity ratio, improving its financial stability and creditworthiness.

- Market Responsiveness: The ability to sell assets allows Hudson Pacific to capitalize on favorable market conditions and adapt to evolving real estate demand.

Hudson Pacific’s revenue streams are anchored by its extensive portfolio of office and media properties, primarily serving the technology and media industries through long-term leases. The company also generates income from leasing specialized sound stages and production facilities, a crucial segment for the entertainment sector.

Ancillary services, such as parking and event space rentals, further diversify income, enhancing the tenant experience. Development and redevelopment projects contribute significantly, with profits realized through increased rental income or asset sales upon completion.

Strategic asset sales also play a role, providing capital for new projects and optimizing the company’s portfolio. This multifaceted approach ensures a robust and adaptable revenue generation model.

| Revenue Stream | Description | 2024 Q1 Contribution (Approx.) |

|---|---|---|

| Office & Media Property Leases | Core business of leasing space to tech and media companies. | $194.7 million (Rental Revenue) |

| Studio & Production Facilities | Leasing specialized facilities for media and entertainment. | Integral part of 2023 Media & Entertainment segment revenue. |

| Ancillary Services | Parking, event spaces, and other value-added tenant services. | Implicitly included in $231.1 million (Rental and Other Property Income) |

| Development & Redevelopment | Profits from increased rents or asset sales of improved properties. | Ongoing focus in 2024 for value appreciation. |

| Asset Sales | Strategic divestment of properties to generate capital. | Contributed to overall financial performance in 2024. |

Business Model Canvas Data Sources

The Hudson Pacific Business Model Canvas is informed by a blend of financial disclosures, industry-specific market research, and internal operational data. This robust data foundation ensures each component, from key resources to revenue streams, is strategically aligned and factually supported.