Hudson Pacific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

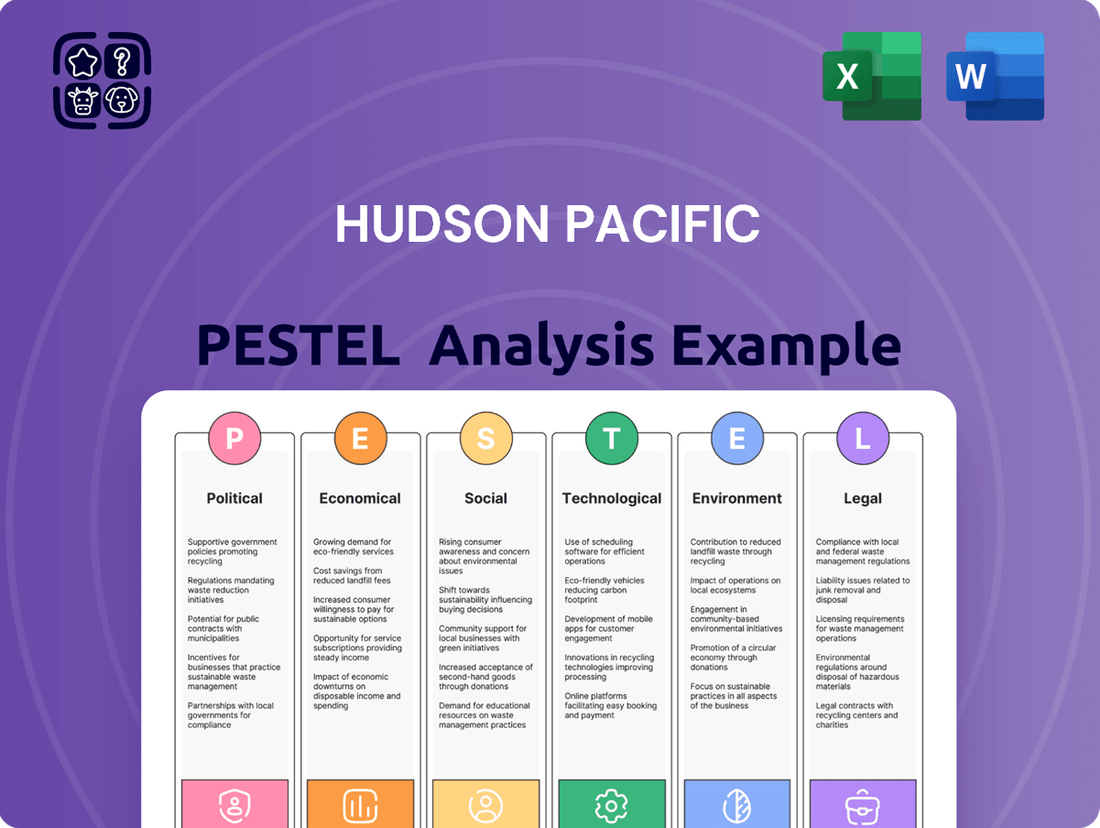

Navigate the complex external forces shaping Hudson Pacific's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Gain a critical edge by leveraging these expert insights to refine your own strategic planning and investment decisions. Download the full version now for immediate access to actionable intelligence.

Political factors

New California legislation, specifically Senate Bill 1103 and Assembly Bill 2347, effective January 1, 2025, will reshape commercial real estate operations. SB 1103 enhances protections for qualified commercial tenants by mandating longer notice periods for rent hikes and lease endings, alongside limitations on operating cost charges.

Furthermore, AB 2347 doubles the timeframe for tenants to respond in unlawful detainer proceedings. These legislative shifts require Hudson Pacific to adjust its leasing strategies and property management protocols to ensure compliance and maintain strong tenant relationships in the evolving regulatory landscape.

The potential introduction of a California film and television tax credit program in the latter half of 2025 is poised to be a significant catalyst for Hudson Pacific Properties. This initiative is designed to attract and retain production companies, directly boosting demand for their studio facilities.

These governmental incentives are vital for ensuring the continued vibrancy of the film and television industry within California. For Hudson Pacific, this translates into increased occupancy rates and a more robust revenue outlook for their sound stages and production infrastructure.

In 2024, California's existing Film and Television Tax Credit Program allocated $1.6 billion, supporting over 100 projects and an estimated $10.9 billion in production spending. The proposed expansion aims to build on this success, further solidifying the state's competitive edge in attracting content creation.

Broader trade policies and potential restrictions, while difficult to predict precisely, could influence Hudson Pacific's technology and media tenants' global operations and expansion. For instance, if the United States were to implement new tariffs on goods from key Asian manufacturing hubs in late 2024 or early 2025, this could increase costs for tech companies reliant on those supply chains, potentially impacting their financial health and, consequently, their demand for office space.

Any adverse shifts in international trade could directly affect the financial well-being and space requirements of these crucial client segments. A slowdown in cross-border data flow or increased friction in international digital services, for example, might lead to a recalibration of expansion plans for media companies, impacting Hudson Pacific's leasing activity and overall revenue streams.

Local Building Performance Standards

Local governments, especially in key West Coast markets for Hudson Pacific, are increasingly implementing Building Performance Standards (BPS). These policies mandate emissions reductions for commercial properties, directly influencing operational strategies and capital investment for real estate owners.

These standards are designed to drive energy efficiency and sustainability upgrades. For Hudson Pacific, this means a continued focus on retrofitting existing buildings and ensuring new developments meet stringent environmental benchmarks. Compliance is not just a regulatory necessity but a factor in maintaining asset value and marketability.

For instance, cities like Seattle have established aggressive BPS, requiring large buildings to meet specific energy use intensity targets. By 2025, many buildings in such jurisdictions will need to demonstrate significant progress towards decarbonization, potentially impacting operating costs and necessitating proactive capital allocation for upgrades.

- Mandatory Emissions Reductions: Local BPS directly compel property owners to reduce their buildings' carbon footprint.

- Investment in Efficiency: These regulations necessitate capital outlays for energy-efficient technologies and sustainable retrofits.

- Market Competitiveness: Buildings that meet or exceed BPS are likely to be more attractive to tenants and investors, enhancing competitive positioning.

- Alignment with Net-Zero Goals: The push for BPS aligns with and can accelerate Hudson Pacific's existing net-zero carbon objectives.

Zoning and Land Use Regulations

Zoning and land use regulations on the West Coast significantly impact Hudson Pacific's development pipeline. For instance, California's housing crisis has led to some legislative efforts to streamline approvals, but local zoning often remains a hurdle. In 2024, cities like Los Angeles continue to grapple with balancing density goals against community concerns, directly affecting project timelines and costs for developers like Hudson Pacific.

These regulations dictate what can be built, where, and to what extent. Favorable zoning, such as upzoning initiatives in transit-oriented development areas, can unlock substantial value and demand for Hudson Pacific's properties. Conversely, restrictive zoning or lengthy entitlement processes, common in many West Coast municipalities, can delay or even halt projects, increasing capital costs and reducing potential returns.

- Impact of Zoning: Local zoning laws directly govern permissible building types, heights, and densities, influencing Hudson Pacific's project feasibility and potential profitability.

- Infrastructure Influence: Planned infrastructure improvements, often tied to zoning changes, can boost property values and tenant demand, benefiting Hudson Pacific's portfolio.

- Regulatory Hurdles: Navigating complex and evolving land use policies requires significant resources and can introduce project delays and cost overruns for the company.

- Growth Opportunities: Areas with supportive zoning and infrastructure development plans present greater opportunities for Hudson Pacific's expansion and value creation.

New California legislation, specifically Senate Bill 1103 and Assembly Bill 2347, effective January 1, 2025, will reshape commercial real estate operations by enhancing tenant protections and altering eviction proceedings.

The potential expansion of California's film and television tax credit program in late 2025 is a significant positive for Hudson Pacific, as it aims to boost demand for their studio facilities.

Local governments, particularly in key West Coast markets, are implementing Building Performance Standards that mandate emissions reductions for commercial properties, requiring capital investment for sustainability upgrades.

What is included in the product

This Hudson Pacific PESTLE analysis thoroughly examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

The Hudson Pacific PESTLE analysis offers a clear, summarized version of complex external factors for easy referencing during strategic meetings, alleviating the pain of information overload.

Economic factors

The current interest rate environment directly impacts Hudson Pacific's borrowing costs and the overall health of the REIT market. While rates have seen a general decline, they may hover around the 3.5-4.0% mark, potentially limiting further Federal Reserve rate cuts and affecting the cost of capital for new projects and acquisitions.

Despite these potential constraints, debt markets are expected to remain accessible and dynamic throughout 2025, providing a degree of certainty for financing activities. This stability is crucial for companies like Hudson Pacific, which rely on debt for expansion and development in the competitive real estate sector.

The West Coast office market is still navigating a difficult period. Vacancy rates remain elevated, with San Francisco hitting a notable 28.6% in March 2025, indicating a challenging environment for landlords.

Hudson Pacific Properties' first quarter 2025 revenue reflected these headwinds, as lower office occupancy continued to exert pressure on their earnings. While there are some indications that the market might be stabilizing, a full recovery is not expected for several more years.

This persistent tenant-favorable market means that businesses leasing office space have significant leverage, and sustained growth for companies like Hudson Pacific will likely depend on broader economic improvements and a return to in-office work trends.

Overall economic growth is projected to be around 2.0-2.25% for 2025, a steady pace that typically supports demand for commercial real estate.

Strong venture capital flows, particularly to West Coast companies in the rapidly expanding AI sector, are a significant driver of demand for premium office spaces. For instance, venture funding into AI startups saw substantial increases throughout 2024, creating a fertile ground for new tenant acquisition.

This environment presents a prime opportunity for Hudson Pacific Properties to attract new tenants and expand existing leases within its portfolio, which is heavily concentrated in the tech and media industries.

Inflationary Pressures and Operating Costs

Persistent inflation, often termed 'sticky,' presents a significant challenge for Hudson Pacific by potentially driving up operating expenses. This includes increased costs for essential services such as property maintenance, utility consumption, and labor, all of which directly impact the company's bottom line.

These rising expenses can exert downward pressure on Hudson Pacific's net operating income (NOI) and overall profitability. To counteract this, the company will likely need to implement strategic expense management initiatives and consider adjustments to rental rates to ensure costs are offset and financial health is maintained.

- Consumer Price Index (CPI) in the U.S.: As of May 2024, the CPI rose 3.3% year-over-year, indicating continued inflationary pressures that could affect operating costs for real estate companies like Hudson Pacific.

- Wage Growth: Average hourly earnings for all employees in the U.S. increased by 4.1% in the year ending May 2024, suggesting higher labor costs for maintenance and property management staff.

- Commercial Real Estate Operating Expense Benchmarks: Industry reports for 2024 indicate that operating expenses for office buildings have seen an average increase of 5-7% compared to the previous year, driven by utilities and services.

REIT Sector Performance and Investor Confidence

The Real Estate Investment Trust (REIT) sector is projected to deliver total returns of 8-10% in 2025, with performance increasingly driven by the operational strength of their underlying assets. This general positive sentiment towards REITs can significantly bolster investor confidence and create a more receptive market for Hudson Pacific's stock and its ability to raise capital.

Interestingly, office REITs demonstrated robust performance in 2024, outperforming expectations despite prevailing negative narratives surrounding the sector. This resilience suggests that strong fundamentals can outweigh market sentiment, a factor that could benefit Hudson Pacific if its office portfolio exhibits similar operational strength.

- Projected REIT Sector Total Returns (2025): 8-10%

- Key Driver of Returns: Underlying operational performance

- Top Performing REIT Sub-sector (2024): Office REITs

- Impact on Hudson Pacific: Improved investor confidence and capital-raising environment

Economic factors present a mixed outlook for Hudson Pacific. While projected economic growth of 2.0-2.25% in 2025 generally supports commercial real estate, persistent inflation is increasing operating expenses, with U.S. CPI at 3.3% year-over-year in May 2024 and wage growth at 4.1% in the same period. Interest rates, potentially stabilizing around 3.5-4.0%, influence borrowing costs but debt markets are expected to remain accessible for financing in 2025.

| Economic Indicator | Value/Projection | Period | Impact on Hudson Pacific |

| Projected GDP Growth | 2.0-2.25% | 2025 | Supports general commercial real estate demand |

| U.S. CPI | 3.3% (YoY) | May 2024 | Increases operating expenses (utilities, services) |

| U.S. Average Hourly Earnings | 4.1% (YoY) | May 2024 | Increases labor costs for property management |

| Interest Rate Outlook | 3.5-4.0% | 2025 | Affects borrowing costs, but debt markets accessible |

What You See Is What You Get

Hudson Pacific PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hudson Pacific PESTLE analysis provides a detailed examination of the political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Hudson Pacific's strategic landscape.

Sociological factors

The shift towards hybrid and remote work models has significantly impacted office space demand. Many companies are now seeking to reduce their physical footprint, with some downsizing by as much as 20% to 30% as of late 2024. This evolving work dynamic compels Hudson Pacific to re-evaluate its portfolio and offerings to align with these changing tenant needs.

This trend has created a 'flight to quality' within the commercial real estate market. Companies that are downsizing are often prioritizing premium, well-located properties that offer enhanced amenities and better employee experiences to justify their reduced office space. Hudson Pacific must adapt by providing more flexible workspace solutions and focusing on the quality and desirability of its properties to attract and retain tenants in this new environment.

Tenant preferences are shifting, with modern renters, especially those in tech and media, actively seeking buildings that boast top-tier amenities. This includes a strong emphasis on health and wellness features, alongside flexible workspace designs that can adapt to evolving work styles. For instance, a 2024 survey indicated that 65% of tech companies consider amenity packages a key factor when choosing office locations.

Hudson Pacific's proactive approach to reinvesting in its properties directly addresses these evolving tenant demands. By upgrading facilities to offer desirable amenities and creating spaces that cater to health and well-being, the company positions itself to attract and retain high-caliber tenants. This strategy is particularly relevant as companies re-evaluate their office footprints in 2024 and 2025, often prioritizing quality and enhanced employee experience.

West Coast urban centers, particularly in California, continue to experience significant population growth. For instance, the Los Angeles metropolitan area saw its population increase by approximately 0.5% annually leading up to 2023, contributing to a larger pool of skilled workers. This demographic expansion directly fuels demand for commercial real estate, as businesses seek to locate near this growing talent base.

The influx of new residents, often younger professionals, also shapes the type of commercial spaces in demand. Hudson Pacific must consider this by offering properties that cater to modern workforce needs, including flexible office layouts and amenities that attract and retain employees. The company's focus on tech and media tenants aligns well with the demographic profile of many West Coast cities.

Influence of Media Consumption on Studio Demand

The ever-growing appetite for diverse entertainment, especially from streaming giants, directly translates into a robust demand for modern studio facilities. This cultural shift is a significant tailwind for Hudson Pacific, as production houses increasingly seek cutting-edge sound stages to bring their ambitious projects to life.

The streaming industry's expansion is a key driver. For instance, in 2024, major streaming services are projected to spend over $100 billion globally on content creation, a substantial portion of which requires physical production space. This sustained investment underpins the ongoing need for high-quality studio infrastructure.

- Streaming Growth: The global streaming market is expected to reach over $250 billion by 2025, fueling content production.

- Content Diversity: Demand for niche genres and international productions increases the need for flexible, well-equipped studio spaces.

- Production Investment: Major studios and streamers are increasing their annual content budgets, directly impacting studio rental demand.

Workforce Migration and Urbanization Trends

Workforce migration, particularly the continued draw of West Coast innovation hubs, directly impacts commercial property demand for companies like Hudson Pacific. Despite post-pandemic shifts, a notable trend is the flight to quality within urban centers, suggesting that prime, well-located office spaces remain highly sought after by businesses prioritizing talent attraction and retention.

Recent data highlights these dynamics. For instance, in Q4 2024, major West Coast tech markets experienced a slight uptick in office leasing activity, though overall vacancy rates remained elevated compared to pre-pandemic levels. Asking rents in prime downtown San Francisco, while down from their peak, showed resilience in Class A buildings, indicating a bifurcated market where top-tier properties outperform.

Key considerations for Hudson Pacific include:

- Shifting Demographics: Younger workforces increasingly favor urban living, bolstering demand for mixed-use developments in accessible city centers.

- Remote Work Impact: While remote work persists, companies are re-evaluating office footprints, often consolidating into higher-quality, collaborative spaces.

- Talent Competition: The intense competition for skilled labor means companies are willing to invest in premium office environments to attract and keep employees.

- Regional Growth Pockets: Beyond traditional hubs, secondary markets with strong tech or life science sectors are also seeing increased migration and property demand.

Societal shifts, particularly the enduring preference for hybrid work models, continue to reshape office space needs. By late 2024, many firms were reducing their physical footprints, with some downsizing by 20% to 30%, compelling Hudson Pacific to adapt its portfolio to meet these evolving tenant requirements.

This trend fuels a 'flight to quality,' where companies prioritize premium, amenity-rich locations to attract and retain talent. Hudson Pacific's strategy of reinvesting in its properties, enhancing facilities, and focusing on well-being features directly addresses this demand. For instance, a 2024 survey revealed that 65% of tech companies view amenities as crucial when selecting office spaces.

West Coast urban centers, especially in California, are experiencing sustained population growth, with areas like Los Angeles seeing around 0.5% annual growth leading up to 2023. This demographic expansion, often comprising younger professionals, increases demand for commercial real estate and influences the types of spaces sought, favoring flexible designs and attractive amenities.

The burgeoning entertainment industry, driven by streaming services, is a significant factor, creating robust demand for modern studio facilities. Global content creation spending by major streamers was projected to exceed $100 billion in 2024, directly boosting the need for high-quality production infrastructure, a segment where Hudson Pacific is strategically positioned.

| Sociological Factor | Impact on Hudson Pacific | Supporting Data (2024-2025) |

|---|---|---|

| Hybrid/Remote Work | Reduced office footprint demand, increased need for flexible spaces | Companies downsizing office space by 20-30% (late 2024) |

| Flight to Quality | Demand for premium locations and enhanced amenities | 65% of tech companies prioritize amenities (2024 survey) |

| Demographic Shifts | Increased demand in West Coast urban centers, preference for walkable, amenity-rich areas | LA metro area population growth ~0.5% annually (pre-2023) |

| Entertainment Industry Growth | High demand for studio facilities due to increased content production | Global streaming content creation spend >$100 billion (2024 projection) |

Technological factors

PropTech, including AI and IoT, is revolutionizing commercial real estate. Hudson Pacific can boost efficiency and tenant satisfaction by adopting these advancements, tapping into the smart building market expected to reach $78.3 billion by 2025, according to Statista.

The rapid advancement of Artificial Intelligence (AI) is reshaping the office space landscape, creating a dual effect on demand. Companies heavily invested in AI development and those implementing broader in-office work policies are actively seeking premium, well-situated office environments. This surge in demand from a key sector presents a notable opportunity for real estate firms like Hudson Pacific, which strategically targets technology tenants.

Hudson Pacific's portfolio, with its emphasis on high-quality, tech-centric properties, is well-positioned to capitalize on this trend. For instance, the company reported that tech tenants accounted for a significant portion of its leasing activity in recent periods, a trend expected to continue as AI innovation drives further office space requirements. This focus aligns directly with the evolving needs of a crucial tenant base.

Technological advancements are reshaping media production, with virtual production and sophisticated equipment becoming standard. This necessitates modern, flexible studio spaces that can accommodate these evolving needs.

Hudson Pacific's focus on robust production services, including investments in green production trailers like solar all-electric units, directly addresses these client demands. This strategy aligns with the industry's push towards decarbonization, positioning them as a forward-thinking partner.

Digital Platforms for Property Management

Digital platforms are revolutionizing how properties are managed. Think about digital lease management systems and virtual property tours; these are no longer niche offerings but becoming expected in commercial real estate. They really help make transactions smoother and more transparent for everyone involved.

For Hudson Pacific, embracing and improving these digital tools is key. It means tenants and investors get a much better, more seamless experience. This directly translates to better operational efficiency and keeps Hudson Pacific competitive in a fast-evolving market.

- Increased Adoption: Reports indicate that by the end of 2024, over 85% of commercial real estate transactions are expected to involve some form of digital platform for leasing or tours.

- Tenant Demand: A 2025 survey found that 70% of commercial tenants prioritize properties offering advanced digital management tools and virtual viewing options.

- Operational Savings: Companies utilizing integrated digital property management systems have reported an average reduction of 15-20% in administrative costs by 2024.

Cybersecurity and Data Privacy for Tech Tenants

Hudson Pacific's technology and media tenants operate in environments where data security is paramount. As of early 2024, the global cost of a data breach averaged $4.45 million, a figure that underscores the financial and reputational risks associated with inadequate cybersecurity. For Hudson Pacific, this translates into a necessity to invest in and maintain state-of-the-art security infrastructure within its properties to protect tenant data and ensure business continuity.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is also a critical technological factor. These regulations impose strict requirements on how data is collected, stored, and processed, with significant penalties for non-compliance. Hudson Pacific must ensure its building management systems and any shared digital infrastructure meet these stringent standards to avoid legal repercussions and maintain tenant confidence.

- Cybersecurity Investment: Continued investment in advanced network security, access controls, and threat detection systems is essential.

- Data Privacy Compliance: Adherence to global data privacy laws is non-negotiable, requiring robust data handling policies and transparent practices.

- Secure Digital Infrastructure: Providing secure, reliable, and high-speed digital connectivity is a core expectation for tech tenants.

- Tenant Awareness: Educating tenants on best practices for cybersecurity within their leased spaces can foster a shared responsibility for data protection.

The integration of PropTech, especially AI and IoT, is transforming commercial real estate, enhancing efficiency and tenant experience. Hudson Pacific's strategic alignment with smart building technologies positions it to benefit from a market projected to reach $78.3 billion by 2025.

Legal factors

California's Commercial Tenant Protection Act, SB 1103, taking effect January 1, 2025, introduces substantial new legal duties for commercial property owners like Hudson Pacific. This legislation mandates specific timelines for rent increase notifications and lease termination notices, adding complexity to landlord-tenant relationships.

Hudson Pacific will need to adapt to new rules concerning the pass-through of operating costs, potentially impacting their revenue models. Furthermore, the act requires lease translations for designated 'qualified commercial tenants,' necessitating investments in multilingual documentation and compliance processes to avoid penalties.

Assembly Bill 2347, effective January 1, 2025, will alter commercial eviction procedures by extending a tenant's response period to an unlawful detainer complaint from five to ten days. This change could potentially slow down property recovery and re-leasing for Hudson Pacific, necessitating a review of their legal approaches to tenant disputes.

Hudson Pacific faces a significant legal landscape on the West Coast, with a surge of new sustainability regulations set to impact its operations over the next decade. These include stringent building performance standards and ambitious emissions reduction targets, demanding continuous capital allocation to ensure portfolio compliance.

To maintain its leadership in corporate responsibility and avoid potential penalties, Hudson Pacific must invest in upgrading its properties to meet these evolving environmental mandates. For instance, California's Climate Accountability Package, enacted in 2023, sets aggressive greenhouse gas reduction goals that will trickle down to real estate development and operations.

Building Codes and Safety Standards

Hudson Pacific Properties must navigate a complex web of building codes and safety standards, a constant legal obligation impacting its development and redevelopment efforts. These regulations are not static; they evolve, requiring ongoing adaptation to ensure compliance. For instance, in 2024, many jurisdictions are focusing on updated seismic retrofitting requirements and enhanced fire safety protocols, directly affecting the cost and timeline of new construction and renovations.

Adherence to these codes is paramount for maintaining the structural integrity and ensuring the safety of occupants within their diverse portfolio of office and studio properties. Failure to comply can result in significant fines, project delays, and reputational damage.

- Evolving Regulations: Building codes are regularly updated, requiring continuous legal monitoring and adaptation by Hudson Pacific.

- Safety Mandates: Standards dictate construction materials, methods, and safety features crucial for occupant well-being.

- Compliance Costs: Meeting these standards can add substantial costs to development and redevelopment projects, impacting financial projections.

- Risk Mitigation: Strict adherence mitigates legal risks, potential fines, and operational disruptions.

Data Protection and Privacy Laws

Hudson Pacific, with its significant concentration of technology and media tenants, must meticulously adhere to evolving data protection and privacy legislation. Navigating regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), is paramount. These laws, which came into full effect in 2023, impose stringent requirements on how companies collect, use, and protect personal information, directly impacting building management systems and tenant data.

Compliance is not merely a legal obligation but a critical factor in maintaining tenant trust and mitigating substantial legal and financial risks. For instance, data breaches can lead to significant fines; under the CCPA, statutory damages for data breaches can range from $100 to $750 per consumer per incident, or actual damages, whichever is greater. This underscores the importance of robust data security protocols, particularly as smart building technologies become more integrated, generating and processing vast amounts of data.

- CCPA/CPRA Compliance: Adherence to California's comprehensive privacy laws is essential for operations within the state, impacting data handling practices in smart buildings.

- Data Security Mandates: Regulations often stipulate specific security measures for data storage and transmission, requiring continuous investment in cybersecurity infrastructure.

- Tenant Data Handling: Ensuring transparency and obtaining consent for data collection and usage from tenants is crucial to avoid legal challenges and reputational damage.

- Global Regulatory Landscape: Awareness of international data privacy frameworks, such as the EU's GDPR, may also be relevant for tenants with global operations, influencing data management strategies.

Hudson Pacific must navigate a complex legal environment, particularly concerning new tenant protections and eviction procedures. California's SB 1103, effective January 1, 2025, mandates specific notice periods for rent increases and lease terminations, while AB 2347 extends the tenant response time for unlawful detainer actions to ten days, potentially impacting lease-up velocity.

Sustainability regulations are a growing legal concern, with California's Climate Accountability Package setting aggressive greenhouse gas reduction goals that will influence real estate development and operations through 2025 and beyond. Hudson Pacific needs to invest in property upgrades to comply with evolving building performance standards and emissions targets.

Data privacy laws, such as the CCPA and CPRA, which are fully in effect, impose stringent requirements on handling tenant data. Non-compliance, especially with smart building technologies generating more data, can lead to significant fines, with CCPA statutory damages ranging from $100 to $750 per consumer per incident.

Environmental factors

Hudson Pacific Properties has made significant strides in environmental sustainability, notably achieving 100% net zero carbon operations in 2020, well ahead of their initial target. This early success underscores their proactive approach to environmental stewardship.

Looking ahead, the company has set an ambitious science-based target to slash absolute operational greenhouse gas emissions by 50% by 2030, using 2018 as their baseline year. This commitment highlights their dedication to decarbonizing their extensive portfolio and production assets.

The market is seeing a significant upswing in demand for buildings that are not only energy-efficient but also actively reduce their environmental footprint. This trend is being driven by both investors and tenants who are increasingly prioritizing sustainability in their real estate choices.

Hudson Pacific Properties is well-positioned to capitalize on this by aiming for LEED Gold or Platinum certification on its new projects. This commitment to green building standards, evident in their portfolio expansion, is projected to boost property values. Furthermore, it attracts premium tenants who recognize the long-term benefits and are willing to pay a higher rent for these sustainable, high-quality spaces.

The increasing frequency of extreme weather events, such as heatwaves and floods, is a growing concern for commercial real estate. This trend is directly impacting insurance costs, with premiums for properties in vulnerable areas seeing significant upward pressure. For instance, in 2024, certain regions experienced double-digit percentage increases in property insurance rates due to heightened climate risks.

Hudson Pacific Properties is actively addressing these challenges through its 'Better Blueprint' ESG platform. A key component involves investing in climate tech innovation and deploying technologies that boost energy efficiency and on-site renewable energy generation. This proactive approach aims to build more resilient infrastructure, reducing long-term operational risks and costs for their portfolio.

Energy Efficiency and Conservation Initiatives

Hudson Pacific is making significant strides in energy efficiency and conservation. As of their latest reporting, a substantial 71% of their in-service office portfolio proudly holds ENERGY STAR certification, with an even higher 80% achieving LEED certification. These certifications underscore a deep commitment to sustainable building practices.

Their proactive approach involves integrating cutting-edge technologies such as advanced HVAC systems, energy-saving LED lighting, and sophisticated automation. These efforts are not just about compliance; they are driven by ambitious targets. Hudson Pacific aims to reduce its like-for-like energy consumption by 10% by 2025, using 2019 as their baseline year.

- ENERGY STAR Certification: Approximately 71% of Hudson Pacific's in-service office portfolio is ENERGY STAR certified.

- LEED Certification: An impressive 80% of their office portfolio has achieved LEED certification.

- Energy Consumption Reduction Goal: Targeting a 10% reduction in like-for-like energy consumption by 2025 from a 2019 baseline.

- Technology Implementation: Adoption of advanced HVAC systems, LED lighting, and automation technologies.

Waste Management and Circular Economy Principles

Hudson Pacific is actively working towards its 2025 sustainability targets, notably aiming for net zero waste across all its operations. This commitment is driving the adoption of circular economy principles within its real estate development and management practices.

The company's strategy emphasizes responsible material sourcing and utilization, a key component of minimizing waste generated during construction phases. Furthermore, Hudson Pacific is prioritizing design for adaptability in its properties, which extends the lifespan of buildings and reduces the need for premature demolition and reconstruction, thereby lowering its overall environmental footprint.

- Net Zero Waste Goal: Hudson Pacific aims to achieve net zero waste by 2025.

- Circular Economy Integration: Embracing principles like responsible material use and waste minimization in construction.

- Design for Adaptability: Enhancing building longevity to reduce future waste and environmental impact.

- Environmental Impact Reduction: These initiatives collectively contribute to a more sustainable approach in real estate.

Hudson Pacific Properties is a leader in environmental sustainability, achieving 100% net zero carbon operations in 2020 and setting a 2030 goal to cut greenhouse gas emissions by 50%. The demand for green buildings is rising, with 71% of their office portfolio holding ENERGY STAR certification and 80% LEED certified, reflecting a market shift towards eco-conscious real estate. The company is also targeting net zero waste by 2025, integrating circular economy principles and design for adaptability to minimize its environmental impact.

| Environmental Factor | Hudson Pacific's Action/Goal | Key Data/Metric |

|---|---|---|

| Carbon Emissions | Achieved 100% Net Zero Carbon Operations | 2020 |

| Greenhouse Gas Reduction | Target 50% absolute reduction | By 2030 (from 2018 baseline) |

| Building Certification | Focus on LEED Gold/Platinum | 71% ENERGY STAR, 80% LEED certified (office portfolio) |

| Waste Management | Target Net Zero Waste | By 2025 |

| Energy Efficiency | Target 10% reduction in energy consumption | By 2025 (from 2019 baseline) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hudson Pacific is built on a comprehensive review of public company filings, industry-specific market research reports, and economic data from reputable institutions. We integrate insights from government policy announcements, technological innovation trackers, and demographic trend analyses to provide a well-rounded view.