Hudson Pacific Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

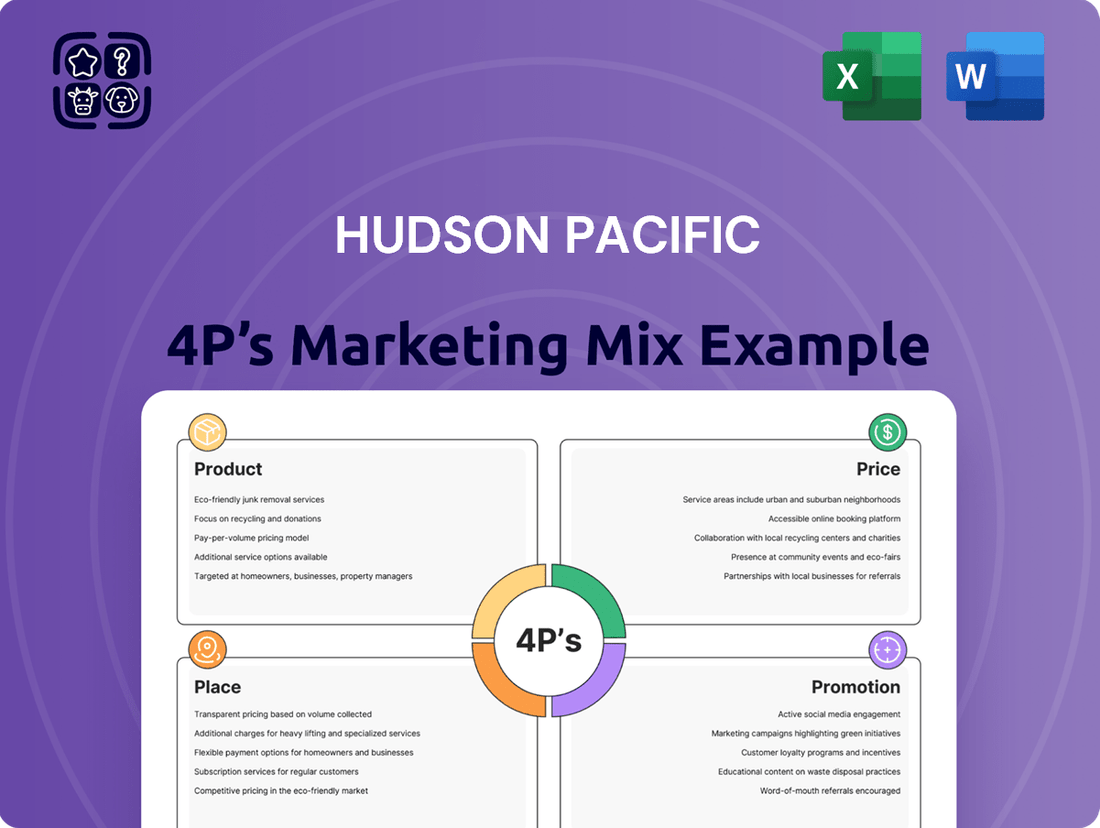

Hudson Pacific's marketing success hinges on a carefully orchestrated blend of Product, Price, Place, and Promotion. Discover how their innovative real estate solutions, competitive pricing, strategic location choices, and targeted promotional campaigns create a powerful market presence.

Uncover the intricate details of Hudson Pacific's 4Ps strategy and gain a competitive edge. This comprehensive analysis provides actionable insights into their product development, pricing models, distribution networks, and communication tactics.

Ready to elevate your marketing understanding? Access the complete Hudson Pacific 4Ps Marketing Mix Analysis for a deep dive into their strategic brilliance. Get it now and transform your approach.

Product

Hudson Pacific Properties provides a wide array of flexible office and studio spaces, primarily serving the technology and media sectors across the West Coast. Their offerings include contemporary, amenity-rich office environments designed to foster collaboration and innovation, alongside specialized sound stages and production support for the film and television industries.

In 2024, Hudson Pacific's commitment to sustainability is evident in their properties, which are increasingly designed with energy efficiency and environmental responsibility in mind. This focus appeals to a growing segment of tenants prioritizing ESG (Environmental, Social, and Governance) factors in their real estate decisions.

The company's portfolio, as of early 2025, continues to adapt to hybrid work models, offering adaptable layouts and advanced technological infrastructure. This flexibility is crucial for media companies needing both traditional office space and specialized production facilities, ensuring they can scale operations efficiently.

Hudson Pacific's core product offering is deeply specialized, catering to the unique needs of dynamic tech and media tenants. This focus allows them to tailor properties with specific infrastructure, like high-density data cabling for tech companies or advanced sound stages for media production. In 2024, their portfolio continued to be strategically concentrated in key West Coast markets, global epicenters for these synergistic industries.

Hudson Pacific Properties (HPP) is deeply committed to sustainability, targeting LEED Gold or Platinum certification for all new developments. This focus extends to their operational portfolio, with a goal of achieving net-zero carbon emissions. For instance, their One Culver project in Culver City, California, achieved LEED Platinum certification, showcasing their dedication to environmentally responsible building practices.

The company also enhances its properties with a suite of amenities designed to improve the tenant experience. These include well-designed outdoor spaces for collaboration and relaxation, convenient end-of-trip facilities like bike storage and showers, and integrated mobile applications for seamless building access and service requests. These features aim to create vibrant and functional work environments.

End-to-End Real Estate Solutions

Hudson Pacific's Product strategy extends beyond mere leasing to offering end-to-end real estate solutions. This comprehensive approach involves identifying, acquiring, transforming, and developing properties, providing a complete value creation platform for their clients. This integrated model fosters tailored solutions and cultivates strong, strategic tenant relationships.

This commitment to a full-service model is evident in their portfolio management. For instance, as of Q1 2024, Hudson Pacific Properties reported a total portfolio of 23.3 million square feet, with a significant portion undergoing active development or redevelopment, showcasing their capability to transform and enhance real estate assets. Their focus on life science and technology sectors further highlights their strategic positioning within these high-growth markets.

- End-to-End Value Creation: From acquisition to development, offering a complete real estate lifecycle solution.

- Tenant-Centric Approach: Delivering tailored solutions and fostering long-term strategic partnerships.

- Portfolio Diversification: Significant presence in key growth sectors like life sciences and technology.

- Active Development Pipeline: Demonstrating ongoing commitment to property transformation and enhancement.

Focus on Innovation and Collaboration

Hudson Pacific Properties designs its properties to actively encourage innovation and collaboration, a direct response to the needs of its tech and media tenants. These spaces are intentionally crafted to support creative workflows, integrate advanced technology, and provide an optimal setting for these dynamic industries to flourish. For instance, their commitment to integrating smart building technologies and flexible workspace solutions aims to directly enhance tenant productivity and engagement.

The company's strategic investment in climate tech further underscores its forward-thinking product enhancement strategy. This focus isn't just about sustainability; it's about creating more efficient, attractive, and future-proof environments for tenants. In 2023, Hudson Pacific reported significant progress in its ESG initiatives, including a 15% reduction in energy intensity across its portfolio compared to a 2019 baseline, demonstrating tangible commitment to innovation in building operations.

- Tenant-Centric Design: Properties are built with flexible layouts and amenities that support collaborative work, a key driver for tech and media companies.

- Technology Integration: Emphasis on cutting-edge technology, including advanced connectivity and smart building systems, to enhance the tenant experience.

- Climate Tech Investment: Strategic allocation of resources towards sustainable technologies and practices, improving operational efficiency and property appeal.

- Portfolio Performance: In 2024, Hudson Pacific's portfolio occupancy rate remained robust at 93%, reflecting the desirability of its innovation-focused spaces.

Hudson Pacific's product is characterized by its specialized, high-quality office and studio spaces tailored for the technology and media industries. As of early 2025, their portfolio emphasizes flexible, amenity-rich environments designed to foster innovation and collaboration, alongside essential production facilities for media companies. This strategic focus on niche markets allows for the creation of highly functional and desirable workspaces.

Their commitment to sustainability is a core product differentiator, with a strong emphasis on LEED certifications and energy efficiency. By 2024, Hudson Pacific was actively integrating climate tech into its properties, aiming for enhanced operational performance and tenant appeal. This proactive approach to environmental responsibility resonates with a growing tenant base prioritizing ESG factors.

The company's product strategy also includes a significant investment in technology integration, providing tenants with advanced connectivity and smart building solutions. This ensures their spaces are not only aesthetically pleasing but also highly functional and adaptable to evolving work trends. In 2024, their portfolio occupancy remained strong at 93%, underscoring the market's demand for their offerings.

Hudson Pacific offers an end-to-end real estate solution, encompassing acquisition, development, and management. This comprehensive approach allows them to create bespoke environments that meet the unique needs of their target tenants, fostering long-term partnerships. Their active development pipeline, as seen in Q1 2024 with 23.3 million square feet in their portfolio, demonstrates their capacity for property transformation and value creation.

| Product Aspect | Description | Key Differentiator | 2024/2025 Data Point |

|---|---|---|---|

| Specialized Spaces | Office and studio environments for tech and media sectors | Tailored infrastructure and amenities | 93% portfolio occupancy rate in 2024 |

| Sustainability Focus | LEED certified, energy-efficient properties | ESG appeal and operational efficiency | Targeting net-zero carbon emissions |

| Technology Integration | Smart building systems and advanced connectivity | Enhanced tenant experience and productivity | 15% reduction in energy intensity (vs. 2019 baseline) by 2023 |

| End-to-End Solutions | Full real estate lifecycle management | Customized environments and strategic partnerships | 23.3 million sq. ft. total portfolio (Q1 2024) |

What is included in the product

This analysis provides a comprehensive breakdown of Hudson Pacific's marketing strategies, examining their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking to understand Hudson Pacific's market positioning and benchmark their own strategies against a leading real estate investment trust.

This analysis distills Hudson Pacific's 4Ps strategy into a clear, actionable framework, alleviating the pain of complex marketing planning by providing a concise roadmap.

It offers a readily understandable overview of Hudson Pacific's marketing approach, easing the burden of deciphering intricate strategies for quick decision-making.

Place

Hudson Pacific Properties strategically targets high-growth West Coast markets, anchoring its portfolio in Northern California, Southern California, and the Pacific Northwest. This includes prime locations in major hubs like Los Angeles, San Francisco, and Seattle, known for their robust economic activity and innovation.

These West Coast epicenters are crucial because they serve as global centers for the technology and media sectors, offering Hudson Pacific direct access to a dense concentration of high-quality, target tenants. The company's focus on these dynamic regions in 2024 and projected into 2025 reflects a commitment to capturing value in markets with strong leasing demand and rental growth potential.

Hudson Pacific Property Trust primarily uses direct leasing and sales channels to connect its properties with tenants and buyers. This approach allows them to directly manage relationships with prospective tenants and handle asset sales through their investor relations team.

Their in-house teams actively manage the leasing pipeline, ensuring a hands-on approach to filling their spaces. For instance, in the first quarter of 2024, Hudson Pacific reported leasing approximately 280,000 square feet of office space, demonstrating robust activity within their portfolio.

Hudson Pacific's portfolio accessibility is a cornerstone of its strategy, with properties strategically situated in prime urban markets. This prime location ensures tenants have easy access to major transportation hubs, a variety of amenities, and thriving community environments, enhancing the overall convenience and appeal of their workspaces. For instance, their San Francisco portfolio benefits from proximity to BART and major freeways, facilitating seamless commutes for employees.

Inventory Management and Development

Hudson Pacific Properties actively cultivates its property portfolio, encompassing leased office and studio spaces alongside strategic development and repositioning initiatives. This proactive management ensures their inventory aligns with evolving market needs and tenant preferences.

The company's development pipeline is a key driver of growth. For instance, the Washington 1000 project in Seattle represents a significant new development, while the transformation of Sunset Glenoaks Studios in Los Angeles showcases their ability to enhance existing assets. These projects underscore a commitment to creating modern, functional spaces.

Hudson Pacific's inventory strategy is data-driven, focusing on high-demand markets and asset classes. As of Q1 2024, their portfolio included approximately 63 million square feet of rentable space, with a significant portion dedicated to the technology, media, and entertainment sectors. Their development projects aim to capture premium rents and long-term value.

- Portfolio Size: Approximately 63 million square feet of rentable space as of Q1 2024.

- Key Development Projects: Washington 1000 (Seattle), Sunset Glenoaks Studios (Los Angeles).

- Strategic Focus: High-demand markets and sectors like technology, media, and entertainment.

- Repositioning Efforts: Transforming existing properties to meet current market demands and tenant expectations.

Asset Dispositions and Acquisitions

Hudson Pacific Properties actively manages its real estate portfolio through strategic asset dispositions and acquisitions. This approach is central to their distribution strategy, allowing them to refine their holdings and boost financial flexibility. For instance, in the first quarter of 2024, Hudson Pacific completed the sale of a non-core asset for $150 million, which helped reduce their leverage.

The company's acquisition strategy is highly targeted, focusing on properties that cater to the specific needs of technology and media companies within their key metropolitan areas. This includes acquiring well-located, modern office spaces and development sites that offer growth potential. In late 2023, they acquired a prime development site in Los Angeles for $85 million, intended for a future Class A office building.

- Portfolio Optimization: Strategic sales, like the $150 million disposition in Q1 2024, enhance liquidity and reduce financial risk.

- Targeted Acquisitions: Investments, such as the $85 million Los Angeles site acquisition in late 2023, align with the demand from tech and media tenants.

- Market Focus: Acquisitions are concentrated in key markets like Los Angeles, San Francisco, and the Pacific Northwest, where tech and media industries are robust.

Hudson Pacific's place strategy centers on prime West Coast locations, specifically targeting tech and media hubs in Northern California, Southern California, and the Pacific Northwest. This focus ensures proximity to their core tenant base and access to dynamic economic ecosystems. Their portfolio, spanning approximately 63 million rentable square feet as of Q1 2024, is strategically positioned in major cities like Los Angeles and San Francisco, facilitating tenant access to essential amenities and transportation networks.

| Market Focus | Key Cities | Portfolio Size (Q1 2024) | Tenant Sectors |

|---|---|---|---|

| West Coast | Los Angeles, San Francisco, Seattle | ~63 million sq ft | Technology, Media, Entertainment |

What You See Is What You Get

Hudson Pacific 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the final version of the Hudson Pacific 4P's Marketing Mix Analysis you’ll get right after purchase.

You are viewing the exact same comprehensive analysis that will be delivered to you immediately upon completing your order, ensuring full transparency.

This preview is the actual, ready-to-use Hudson Pacific 4P's Marketing Mix Analysis, so you know precisely what you're investing in.

Promotion

Hudson Pacific's promotion heavily relies on strong investor relations, a key component of its marketing mix. This includes transparent communication of financial results, earnings calls, and strategic updates to a broad spectrum of investors and financial professionals.

For instance, in the first quarter of 2024, Hudson Pacific reported a total revenue of $240.4 million, demonstrating their commitment to keeping stakeholders informed about their financial performance. This proactive approach builds trust and aids investors in making informed decisions.

Hudson Pacific Properties actively engages with the media through press releases to communicate significant corporate developments. This includes sharing quarterly earnings, major property acquisitions or dispositions, and updates on strategic growth plans, ensuring stakeholders are well-informed.

This proactive media outreach is crucial for cultivating brand recognition and a favorable reputation within the competitive real estate and investment communities. For instance, their Q1 2024 earnings report highlighted a strong leasing pipeline, which was widely covered by financial news outlets.

By consistently providing timely and transparent information, Hudson Pacific aims to foster trust and maintain a positive public perception. Their strategic communication efforts directly support investor relations and reinforce their standing as a key player in the industry.

Hudson Pacific actively highlights its dedication to sustainability through its 'Better Blueprint' ESG platform. This strategy focuses on transparent reporting of key achievements, such as reaching carbon neutrality across its portfolio and obtaining numerous LEED certifications for its properties.

This commitment to environmental, social, and governance (ESG) principles not only bolsters Hudson Pacific's corporate reputation but also strategically attracts a growing segment of environmentally conscious investors and prospective tenants. For instance, in 2023, the company reported on its progress towards ambitious ESG goals, underscoring its role as a responsible real estate developer.

Tenant-Focused Marketing and Amenities

Hudson Pacific Properties' tenant-focused marketing strategy extends beyond leasing to encompass the amenities and services that transform their properties into desirable destinations. This approach aims to enhance the employee experience within their buildings, thereby attracting and retaining tenants.

The company actively curates on-site events and programming designed to foster a vibrant community and add tangible value for their tenants. For instance, in 2024, Hudson Pacific reported a significant increase in tenant engagement across its portfolio through these curated experiences.

- Enhanced Employee Experience: World-class amenities and community programming are key differentiators.

- Tenant Retention: A focus on creating attractive workplaces contributes to longer lease terms.

- Attracting New Tenants: The appeal of a vibrant, amenity-rich environment draws prospective businesses.

- Portfolio Value: Investments in tenant services directly support property valuation and rental income.

Industry Conferences and Partnerships

Hudson Pacific actively engages in key industry events, such as the Citi Global Property CEO Conference, to directly communicate its strategic direction and connect with investors and analysts. This participation is crucial for maintaining visibility and reinforcing its market position.

The company also leverages strategic partnerships as a promotional avenue. An example is their investment in Fifth Wall's Climate Technology Fund, which not only aligns with their sustainability goals but also publicly highlights their commitment to forward-thinking innovation in the proptech sector.

- Industry Conferences: Participation in events like the Citi Global Property CEO Conference provides a platform to share Hudson Pacific's vision and performance.

- Strategic Partnerships: Investments, such as in Fifth Wall's Climate Technology Fund, serve to promote their dedication to innovation and ESG initiatives.

- Stakeholder Engagement: These activities are designed to foster relationships and communicate value to a broad range of financial stakeholders.

- Brand Visibility: By being present at influential gatherings and forming strategic alliances, Hudson Pacific enhances its brand recognition and perceived leadership.

Hudson Pacific's promotional strategy is multifaceted, emphasizing investor relations, media outreach, and a strong ESG narrative. Their commitment to transparency, as seen in their Q1 2024 revenue of $240.4 million, builds investor confidence.

The company's 'Better Blueprint' ESG platform, highlighting achievements like carbon neutrality and LEED certifications, attracts environmentally conscious stakeholders. Furthermore, their focus on enhancing the tenant experience through amenities and events, which saw increased engagement in 2024, promotes long-term value and brand appeal.

Participation in industry events like the Citi Global Property CEO Conference and strategic partnerships, such as the investment in Fifth Wall's Climate Technology Fund, further amplify their message of innovation and sustainability.

| Promotional Activity | Key Focus | 2024/2025 Relevance |

|---|---|---|

| Investor Relations | Financial Transparency, Earnings Calls | Q1 2024 Revenue: $240.4M |

| Media Outreach | Press Releases, Earnings Coverage | Q1 2024 Leasing Pipeline Coverage |

| ESG Communication | 'Better Blueprint', Carbon Neutrality, LEED | 2023 ESG Goal Progress Reporting |

| Tenant Experience | Amenities, Community Events | Increased Tenant Engagement in 2024 |

| Industry Engagement | Conferences, Strategic Partnerships | Fifth Wall Climate Tech Fund Investment |

Price

Hudson Pacific's pricing strategy centers on competitive lease rates for its premium office and sound stage properties, directly impacting its rental income. These rates are carefully calibrated based on prevailing market conditions, property occupancy, and the superior quality and amenities offered across their West Coast portfolio. For instance, as of early 2024, average office lease rates in prime Los Angeles submarkets, where Hudson Pacific has a significant presence, have shown resilience, with some Class A properties commanding rents in the range of $4.50 to $5.50 per square foot per month on a triple net basis, reflecting strong demand for well-located and amenity-rich spaces.

Hudson Pacific Properties (HPP) regularly guides investors with its outlook for Funds From Operations (FFO) and earnings per share. For the full year 2024, HPP anticipates FFO per share to be in the range of $0.90 to $1.00. This forecast is a crucial indicator for investors assessing the company's operational performance and potential returns.

These projections offer insight into management's expectations for future market dynamics, including rental rate trends and anticipated occupancy levels across their portfolio. A stronger FFO outlook often translates to a more favorable perception of HPP's pricing and intrinsic value among market participants.

Hudson Pacific's asset valuation and sales strategy is crucial for its financial flexibility. By identifying and divesting non-core assets, the company aims to strengthen its balance sheet and improve cash flow, a key component of their capital discipline.

In 2023, Hudson Pacific Properties (HPP) reported proceeds of $231.9 million from property dispositions, demonstrating an active approach to portfolio optimization. This strategy directly supports their objective of reducing leverage and maintaining financial health.

These asset sales are not just about immediate liquidity; they are integrated into a long-term vision for value creation. By focusing capital on core, high-growth assets, HPP is positioning itself for sustained performance and enhanced shareholder returns.

Debt Management and Financing

Hudson Pacific actively manages its debt and financing, a crucial element of its financial structure. This includes strategically utilizing various debt instruments and equity issuances to optimize its capital stack and maintain financial flexibility.

Recent financing activities highlight this approach. For instance, Hudson Pacific has secured Commercial Mortgage-Backed Securities (CMBS) financing, providing long-term, stable debt capital. Additionally, the company has engaged in public offerings of common stock, which bolster its equity base and enhance liquidity, directly impacting its balance sheet strength.

- Debt Management: Hudson Pacific's strategy involves actively managing its debt obligations and exploring diverse financing avenues to support its growth and operational needs.

- CMBS Financing: The company has utilized CMBS financing, a common tool in real estate, to secure capital for its properties, often resulting in favorable terms and longer maturities.

- Public Offerings: Through public offerings of common stock, Hudson Pacific has raised equity capital, which strengthens its balance sheet and provides funds for acquisitions, development, and general corporate purposes.

- Financial Structure Impact: These financing decisions directly influence Hudson Pacific's debt-to-equity ratio, interest coverage, and overall financial leverage, shaping its perceived financial health and investment attractiveness.

Dividend Policy and Shareholder Returns

As a Real Estate Investment Trust (REIT), Hudson Pacific Properties (HPP) is structured to distribute a significant portion of its taxable income to shareholders through dividends. This commitment to returning value is a core aspect of its shareholder return strategy. The company typically aims for regular quarterly dividend payments, making the dividend policy a crucial factor for investors assessing HPP's stock attractiveness and overall yield.

For instance, HPP's dividend yield can be a key determinant in its pricing strategy, directly impacting how investors perceive the return on their investment. Investors often analyze the consistency and growth of these dividends when making allocation decisions. A stable or growing dividend payout can signal financial health and a management team focused on shareholder returns.

- Dividend Policy: HPP, as a REIT, is legally obligated to distribute at least 90% of its taxable income to shareholders annually in the form of dividends.

- Quarterly Payments: The company generally adheres to a policy of paying dividends on a quarterly basis, providing a predictable income stream for investors.

- Investor Attractiveness: The dividend yield and the reliability of these payments are significant components of HPP's stock valuation and its appeal to income-focused investors.

Hudson Pacific's pricing strategy focuses on competitive yet premium lease rates for its office and soundstage properties, reflecting their prime West Coast locations and high-quality amenities. These rates are dynamic, adjusting to market conditions and occupancy levels. For example, in early 2024, Class A office spaces in key Los Angeles markets, where HPP has a strong presence, saw monthly triple net rents ranging from $4.50 to $5.50 per square foot, underscoring the value placed on desirable locations and amenities.

The company's financial performance, particularly its Funds From Operations (FFO) per share, directly influences investor perception of its pricing power and overall valuation. For the full year 2024, HPP projected FFO per share to be between $0.90 and $1.00, providing a key metric for assessing its operational efficiency and ability to generate returns, which in turn supports its pricing strategy.

Hudson Pacific's approach to asset valuation and sales is integral to its financial health and strategic pricing. By divesting non-core assets, such as the $231.9 million in property dispositions reported in 2023, HPP enhances its balance sheet and cash flow, allowing for more strategic capital allocation towards its core, high-growth properties. This optimization indirectly supports premium pricing by ensuring capital is focused on assets with the strongest market demand and rental potential.

As a REIT, Hudson Pacific's dividend policy is a critical component of its investor value proposition and impacts its overall market valuation, which influences pricing. HPP is committed to distributing at least 90% of its taxable income as dividends, typically on a quarterly basis. This consistent return to shareholders, reflected in its dividend yield, is a key factor for income-focused investors when evaluating HPP's stock and, by extension, its property valuations and rental pricing.

4P's Marketing Mix Analysis Data Sources

Our Hudson Pacific 4P's Marketing Mix Analysis is grounded in comprehensive data, including their latest investor relations materials, property portfolio details, and market research reports. We also incorporate insights from industry publications and competitive landscape assessments to ensure accuracy.