Hudson Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Pacific Bundle

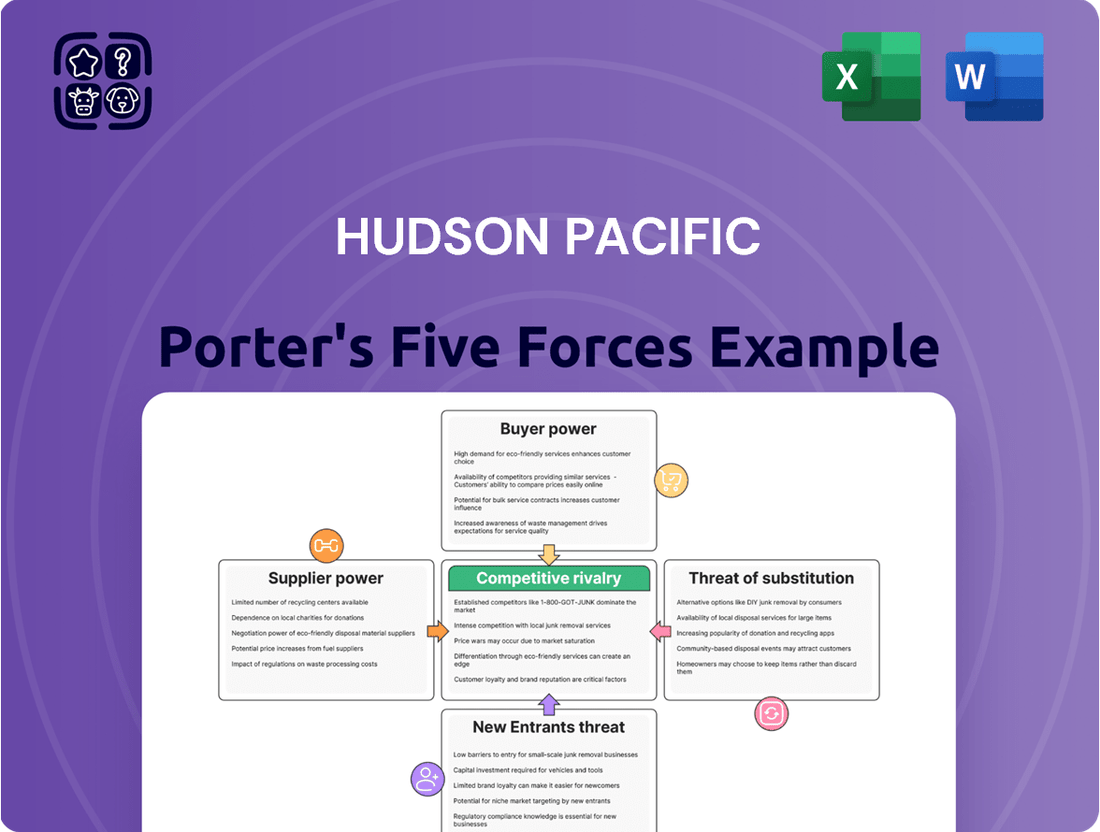

Hudson Pacific's competitive landscape is shaped by the interplay of buyer power, supplier leverage, and the threat of substitutes. Understanding these forces is crucial for grasping their market position.

The complete report reveals the real forces shaping Hudson Pacific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hudson Pacific Properties (HPP) faces significant supplier power due to the scarce availability of prime West Coast land. In 2024, the median price for developable land in key HPP markets like Los Angeles and San Francisco continued to reflect this scarcity, with some parcels exceeding $500 per square foot. This limited supply in high-demand urban centers grants landowners considerable leverage in negotiations.

Suppliers in construction, from general contractors to specialized trades, wield significant power through their pricing and the availability of their services. For Hudson Pacific Properties, this translates directly into project costs and timelines.

The broader commercial real estate market in 2024 has seen persistent increases in construction material costs, coupled with a highly competitive labor market. This dual pressure inflates developers' expenses, making project budgeting more challenging.

Furthermore, ongoing supply chain disruptions continue to impact material delivery schedules. Delays for essential components can cascade, complicating project timelines and budget adherence for Hudson Pacific Properties.

Hudson Pacific Properties, as a Real Estate Investment Trust (REIT), is heavily dependent on capital markets for its operations and growth. The bargaining power of capital and financing providers, such as banks and institutional investors, is directly tied to the cost and accessibility of funds. For instance, in early 2024, the Federal Reserve's stance on interest rates significantly influenced borrowing costs for REITs, impacting their development and acquisition strategies.

The ability of lenders and investors to dictate terms is amplified when capital is scarce or interest rates are high. While REITs like Hudson Pacific have historically shown resilience in managing higher interest rate environments, a sustained increase in rates can elevate the bargaining power of financing providers, potentially increasing the cost of capital and affecting profitability. This dynamic was evident in market conditions throughout 2023 and into early 2024, where financing costs saw an upward trend.

Specialized Studio Equipment and Services

Hudson Pacific Properties' reliance on specialized studio equipment and services means that suppliers of niche production technology and ancillary services hold significant bargaining power. If there are few providers for essential, high-demand items or cutting-edge solutions, these suppliers can dictate higher prices or impose service limitations. This dependence can impact Hudson Pacific's operational costs and flexibility.

- Limited Niche Suppliers: The market for highly specialized studio equipment and advanced production services often features a concentrated number of providers, granting them leverage.

- Price Sensitivity: For critical production phases, Hudson Pacific may face pressure to accept higher costs from these specialized suppliers to avoid project delays.

- Technological Dependence: The rapid evolution of production technology can create situations where a few firms control access to essential, state-of-the-art equipment, increasing their bargaining strength.

Utility and Infrastructure Providers

Utility and infrastructure providers hold substantial bargaining power, especially in established urban markets where competition for essential services like electricity, water, and internet connectivity is often limited. These services are fundamental to both office and studio operations, making their availability and cost critical factors for Hudson Pacific Properties.

The reliance on these providers means Hudson Pacific must carefully consider the impact of their rates and service quality on overall operational expenses. For instance, in 2024, the average commercial electricity rate in California, a key market for Hudson Pacific, hovered around $0.16 per kilowatt-hour, a figure that can significantly influence tenant costs and, consequently, leasing strategies.

- Essential Services: Electricity, water, and internet are non-negotiable for Hudson Pacific's properties.

- Limited Competition: In many core urban areas, utility providers operate as regulated monopolies or oligopolies, granting them pricing leverage.

- Cost Impact: Fluctuations in utility costs directly affect operating expenses and must be incorporated into leasing agreements and profitability projections.

- 2024 Data: Commercial electricity rates in key markets like California can exceed $0.16/kWh, underscoring the financial significance of these providers.

Suppliers of specialized studio equipment and services possess considerable bargaining power due to the limited number of providers and the critical nature of their offerings for film and television production. This concentration allows them to command higher prices, as seen with the 2024 demand for advanced virtual production technology, where a few key vendors dictated terms. Hudson Pacific Properties must navigate these relationships carefully to manage project costs and maintain operational flexibility in its studio segment.

| Supplier Type | Bargaining Power Factors | Impact on HPP (2024 Context) |

|---|---|---|

| Landowners (Prime West Coast) | Scarcity of developable land, high demand in key markets | Elevated land acquisition costs, potentially exceeding $500/sq ft in LA/SF |

| Construction Services | Limited skilled labor, rising material costs, supply chain disruptions | Increased project expenses, potential timeline delays, impacting development budgets |

| Capital Providers (Banks, Investors) | Interest rate environment, availability of financing | Higher cost of capital, influencing development and acquisition strategies; borrowing costs sensitive to Fed policy |

| Specialized Studio Equipment/Services | Few niche providers, rapid technological evolution, dependence on cutting-edge tech | Higher prices for essential equipment, potential for service limitations, impacting production costs and flexibility |

| Utility & Infrastructure Providers | Limited competition (often regulated monopolies), essential service nature | Significant impact on operating expenses; e.g., commercial electricity rates around $0.16/kWh in California |

What is included in the product

Tailored exclusively for Hudson Pacific, analyzing its position within its competitive landscape and identifying key drivers of competition, customer influence, and market entry risks.

Easily identify and mitigate competitive threats with a visual breakdown of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Customers Bargaining Power

The rise of remote and hybrid work has significantly boosted tenant bargaining power in the office real estate sector. Companies are reassessing their space requirements, often opting for smaller footprints or more adaptable lease agreements, contributing to increased vacancy rates. For instance, in Q1 2024, major U.S. markets saw office vacancy rates hover around 18-20%, a notable increase from pre-pandemic levels.

This shift compels landlords like Hudson Pacific Properties to be more accommodating. They are increasingly offering flexible lease terms, such as shorter durations and build-to-suit options, alongside enhanced amenities like collaborative spaces and advanced technology to remain competitive. These adjustments are crucial for retaining existing tenants and attracting new ones in a market where tenant needs have fundamentally changed.

Hudson Pacific Properties (HPP) primarily caters to technology and media tenants. While these industries are vibrant, a high concentration of business with a few large clients or within a single industry segment can amplify customer bargaining power. This means if a major tenant decides to reduce their space or not renew their lease, it could notably affect HPP's occupancy rates and overall revenue. For instance, the departure of a significant tenant from a property like Maxwell could create a substantial void.

However, HPP has recently demonstrated its ability to attract and retain large tenants, securing significant new leases. As of the first quarter of 2024, HPP reported a 96.5% occupancy rate for its stabilized portfolio, a testament to its leasing success despite potential concentration risks. This indicates a degree of stability and a healthy demand for its properties, mitigating some of the inherent bargaining power of its tenant base.

The availability of alternative office spaces significantly bolsters customer bargaining power. Tenants can choose from a wide array of options, including premium Class A and trophy buildings, flexible co-working solutions, or even repurposing existing structures. This broad selection empowers them to negotiate more favorable lease terms.

The prevailing flight to quality trend further amplifies this. As tenants increasingly prioritize higher-quality, amenity-rich environments, properties that don't meet these elevated standards face higher vacancy rates. For instance, in late 2023, major markets saw noticeable upticks in vacancy for lower-tier office spaces, while premium locations remained more resilient.

Hudson Pacific Properties strategically addresses this by concentrating on developing and managing world-class, amenity-rich, and sustainable office environments. This focus aims to attract and retain tenants by offering superior value, thereby mitigating the inherent bargaining power derived from abundant alternatives.

Studio Production Incentives and Alternative Locations

Customers, primarily film and television production companies, can wield significant bargaining power by seeking studio locations offering more attractive tax incentives or lower overall production costs. This is particularly evident as production increasingly looks beyond traditional hubs.

The shifting landscape of production days and California's diminishing share of US production, influenced by competitive tax credit programs in other states, directly empowers these tenants. For instance, in 2023, California’s Film and Television Tax Credit Program saw a significant demand, with over $400 million in tax credit reservations requested, highlighting the importance of these incentives in retaining productions.

- Tenant Leverage: Production companies can negotiate better terms or choose alternative locations if Hudson Pacific Properties' offerings are not competitive.

- Incentive Competition: States like Georgia and New Mexico offer robust tax credits, creating a competitive environment for California.

- California's Response: To counter this, California has enhanced its own incentive programs, aiming to secure a larger share of the estimated $100 billion global film and television production market.

Tenant Financial Performance and Industry Health

The financial health of Hudson Pacific's tenants, particularly those in the tech and media sectors, directly impacts their bargaining power. When these industries face economic headwinds or specific challenges, like the 2023 Hollywood strikes, their capacity to absorb rent increases or commit to new, long-term leases diminishes. This can pressure Hudson Pacific to offer more favorable terms to retain tenants.

The ability of tenants to negotiate better lease terms is amplified when their own financial performance is strained. For instance, a slowdown in advertising revenue for media companies or reduced venture capital funding for tech startups can lead them to seek concessions on rent or lease duration. This makes them more formidable negotiators.

- Tenant Financial Health: The profitability and cash flow of key tenants are paramount. Strong tenant financials mean less leverage to demand lower rents or more favorable lease terms.

- Industry Trends: The overall health and growth prospects of the tech and media industries influence tenant demand and their willingness to pay premium rents.

- Impact of Strikes: The 2023 Hollywood strikes significantly impacted the media sector, leading to reduced demand for studio space and potentially affecting tenant ability to meet lease obligations. Hudson Pacific reported a recovery in studio service revenue post-strikes, but the underlying economic sensitivity remains.

- Economic Climate: Broader economic conditions, including inflation and interest rates, can affect tenant profitability and their bargaining power with landlords like Hudson Pacific.

The bargaining power of customers, primarily tenants in the office and studio space sectors, is significantly influenced by market dynamics and industry-specific trends. In the office sector, the rise of remote work and a flight to quality have empowered tenants to demand more flexible lease terms and better amenities, leading to higher vacancy rates in less desirable properties. For instance, Q1 2024 saw office vacancy rates in major U.S. markets around 18-20%.

Hudson Pacific Properties (HPP) counters this by focusing on high-quality, amenity-rich properties. However, concentration within the tech and media industries, HPP's primary tenant base, can amplify individual tenant leverage. The financial health of these tenants, impacted by economic conditions like the 2023 Hollywood strikes, also affects their ability to negotiate favorable terms, as seen with the significant demand for California's tax credits in 2023, exceeding $400 million in reservations.

Despite these pressures, HPP demonstrated strong leasing performance, maintaining a 96.5% occupancy rate in its stabilized portfolio as of Q1 2024, indicating successful mitigation of tenant bargaining power through strategic property offerings and tenant retention efforts.

Full Version Awaits

Hudson Pacific Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hudson Pacific, detailing the competitive landscape and strategic implications for the company. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. You can trust that this professionally crafted analysis, covering all aspects of Hudson Pacific's competitive environment, is precisely what you will receive upon purchase.

Rivalry Among Competitors

The West Coast office market, particularly in major hubs like San Francisco and Los Angeles, is currently grappling with persistently high vacancy rates. This situation directly fuels intense competition among property owners, including Hudson Pacific Properties, as they vie for a limited pool of tenants.

In San Francisco, for example, office vacancy rates have remained exceptionally elevated, with reports indicating figures around 30% in late 2023 and early 2024. This means Hudson Pacific Properties faces a significant challenge in attracting and retaining tenants, often needing to offer more attractive lease terms and incentives.

While there are some indications that the market might be stabilizing, the pace of recovery on the West Coast lags behind many other regions. This prolonged period of high vacancy creates a decidedly tenant-favorable environment, putting further pressure on landlords to differentiate their offerings and secure occupancy.

The office market is seeing a pronounced 'flight to quality,' with tenants actively seeking out prime, Class A properties and leaving older, less desirable buildings behind. This trend directly benefits Hudson Pacific Properties, whose portfolio is heavily weighted towards high-quality, amenity-rich office spaces. For instance, as of Q1 2024, Class A office vacancy rates in major markets like San Francisco and Los Angeles were notably lower than for Class B and C properties, highlighting tenant preference.

While Hudson Pacific is well-positioned to capitalize on this shift, it also intensifies competition within the premium segment. Companies like Hudson Pacific must continually invest in superior amenities, advanced technology, and flexible lease terms to attract and retain tenants in this high-demand tier. This means the rivalry among developers and landlords offering top-tier office space is particularly fierce, with a constant need to differentiate and innovate.

Hudson Pacific Properties operates in a highly competitive arena, facing off against numerous other Real Estate Investment Trusts (REITs), private equity firms, and established real estate developers. This intense rivalry is particularly evident when vying for prime office and studio properties, as well as securing sought-after tenants.

The competition for attractive assets and high-profile tenants is fierce, driving up acquisition costs and potentially impacting rental rates. For instance, the broader REIT sector is bracing for a wave of mergers and acquisitions projected for 2025, indicating a market where consolidation and aggressive competition are likely to intensify.

Studio Market Supply and Demand Dynamics

The studio real estate market is seeing a significant uptick in competition. This is largely driven by a wave of new, purpose-built studio facilities coming online across various regions. For instance, by the end of 2023, the Los Angeles area alone had over 2 million square feet of new studio space either recently completed or under construction, adding to existing inventory.

Simultaneously, the growth in global film and TV production spending has shown signs of deceleration. In 2023, global production spending was estimated to be around $250 billion, a modest increase from the previous year, but analysts project slower growth rates moving forward into 2024 and 2025.

This imbalance of increasing supply and moderating demand intensifies rivalry. Major production houses are increasingly favoring long-term leases or ownership of dedicated facilities over short-term rentals, further pressuring occupancy rates for existing, multi-tenant studio spaces. Hudson Pacific Properties is actively seeking to secure high-quality production clients to bolster its occupancy levels amidst this competitive landscape.

- Increased Studio Supply: New purpose-built studio developments are expanding capacity in key production hubs.

- Slowing Production Spending Growth: Global film and TV production expenditure growth is moderating, impacting demand.

- Shift to Dedicated Facilities: Major producers are increasingly opting for owned or long-term leased spaces, reducing reliance on traditional studio leases.

- Hudson Pacific Strategy: The company is focusing on attracting premium production clients to maintain strong occupancy rates.

Pricing Pressures and Lease Concessions

In a market characterized by elevated vacancy rates and evolving tenant preferences, landlords like Hudson Pacific Properties (HPP) often encounter significant pricing pressures. This can manifest as a need to provide rent concessions, offer substantial tenant improvement allowances, or agree to more flexible lease terms to secure and retain tenants.

Hudson Pacific Properties has acknowledged experiencing some cash rent decreases across its portfolio, a clear indicator of these competitive pressures. However, the situation is not uniformly negative; the company has also reported increases in net effective rents on new lease agreements. This suggests a more complex market dynamic where HPP's specific portfolio and strategic leasing efforts are yielding varied outcomes.

- Vacancy Rates: As of Q1 2024, HPP reported a portfolio occupancy rate of 90.4%, with office vacancy at 13.1% and media/tech specific properties at 10.1%.

- Lease Concessions: While specific concession figures are not detailed, reported cash rent decreases point to landlords absorbing costs to maintain occupancy.

- Net Effective Rents: HPP noted positive net effective rent growth on new leases in the first quarter of 2024, contrasting with cash rent trends.

- Tenant Demands: Shifting tenant needs, particularly in the office sector, contribute to the pressure on landlords to offer more attractive lease structures.

Hudson Pacific Properties operates in a highly competitive landscape, particularly in the West Coast office and studio real estate markets. Intense rivalry stems from high vacancy rates, especially in San Francisco, where office vacancy reached around 30% in early 2024, forcing landlords to offer incentives. This competitive pressure is further amplified by a clear tenant preference for prime, Class A properties, intensifying the battle for quality tenants among developers and landlords.

The studio market faces a similar competitive dynamic, with new, purpose-built facilities increasing supply while production spending growth moderates. This creates a challenging environment where Hudson Pacific actively seeks premium production clients to maintain occupancy. The company is also up against numerous other REITs and private equity firms, driving up acquisition costs and influencing rental rates, with market consolidation expected to intensify competition in 2025.

| Metric | Q1 2024 Data | Implication for Rivalry |

|---|---|---|

| HPP Portfolio Occupancy | 90.4% | Indicates a need to compete for the remaining 9.6% of tenants. |

| HPP Office Vacancy | 13.1% | Higher than desired, intensifying competition for office tenants. |

| San Francisco Office Vacancy (est.) | ~30% (late 2023/early 2024) | Drives aggressive competition and tenant concessions in a key market. |

| New Studio Space (LA area) | Over 2 million sq ft (by end of 2023) | Increases supply, intensifying competition for studio tenants. |

SSubstitutes Threaten

The widespread adoption of remote and hybrid work represents a significant substitute for traditional office spaces, directly challenging Hudson Pacific Properties' (HPP) core business. As more companies embrace flexible work arrangements, their need for large, centralized office leases diminishes, potentially reducing demand for HPP's properties. Indeed, a 2024 survey indicated that 70% of companies plan to offer hybrid work options, a substantial increase from pre-pandemic levels, underscoring this threat.

The increasing prevalence of co-working and flexible office spaces serves as a significant substitute for traditional, long-term office leases. Companies, especially those prioritizing adaptability and cost control, are increasingly drawn to these flexible arrangements that often include shorter commitment periods and shared resources. For instance, WeWork, a prominent player in this market, reported a global portfolio of over 700 locations by late 2023, illustrating the scale of this substitution threat.

Major tech and media companies, the core of Hudson Pacific Properties' (HPP) tenant base, increasingly consider building or expanding their own dedicated corporate campuses or specialized production facilities. This trend is particularly evident among large film producers who are investing in purpose-built spaces to control their environments and long-term operational needs.

This strategic shift by key tenants to internalize their real estate solutions acts as a significant substitute for HPP's leasing model. By developing their own campuses, these companies bypass the need for third-party landlords, directly impacting the demand for HPP's properties and narrowing the pool of potential lessees.

Virtual Production Technologies and AI in Media

The rise of virtual production and AI presents a significant threat of substitutes for traditional media production facilities. These technologies can replicate complex environments and streamline content creation, potentially lessening the reliance on extensive physical sound stages and studio lots. For example, advancements in AI-powered generative design are allowing filmmakers to create realistic virtual sets, reducing the need for costly physical builds and location shoots.

This shift could directly impact the demand for traditional studio space. By simulating environments and automating aspects of production, virtual production can enable smaller, more agile teams to create high-quality content with a reduced physical footprint. This is particularly relevant as the cost of physical production continues to be a major factor for many creators.

While AI might also spur demand for specialized office spaces for AI development and data centers, its disruptive potential for physical production infrastructure is undeniable. Consider that the global virtual production market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a clear trend towards these alternative methods.

- Virtual Production Market Growth: The global virtual production market is expected to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of over 20% in the coming years, underscoring its increasing adoption.

- AI in Content Creation: AI tools are increasingly being used for tasks like scriptwriting, storyboarding, and even generating visual effects, reducing the need for extensive human labor and physical resources in certain production phases.

- Cost Efficiency: Virtual production and AI can offer significant cost savings compared to traditional methods, making them attractive substitutes for productions operating under tight budgets.

- Reduced Physical Footprint: The ability to create content with less reliance on physical sets and locations directly challenges the value proposition of traditional studio facilities.

Shifting Geographic Preferences for Production

The availability of attractive film and TV production incentives in other states or countries presents a significant threat of substitutes for West Coast studio production. These incentives act as a direct alternative, drawing productions away from traditional hubs like Los Angeles. For instance, states like Georgia and Louisiana have historically offered substantial tax credits, and as of 2024, many continue to enhance these programs to attract a larger share of the production market. This geographic shift can directly impact demand for studio space, potentially reducing occupancy and rental revenue for companies like Hudson Pacific Properties.

If productions increasingly migrate to lower-cost markets with more generous tax credits, it could diminish the demand for Hudson Pacific Properties' Los Angeles-based studio facilities. While California has made efforts to bolster its own incentive programs, such as the California Film and Television Tax Credit Program, the competitive landscape remains intense. For example, in 2023, California allocated an additional $150 million to its incentive program, bringing the total to $330 million annually, but this may not always outweigh the benefits offered elsewhere. The continued attractiveness of these external markets poses a persistent challenge to maintaining strong demand for West Coast studio infrastructure.

The threat of substitutes is amplified by the ease with which productions can relocate. Advances in technology and logistics mean that setting up production in a new location is more feasible than ever. This flexibility allows content creators to chase the most advantageous financial packages. As of early 2024, several international locations, including Canada and the United Kingdom, also offer compelling incentive structures that compete directly with U.S. states and, by extension, California's offerings. This global competition for production dollars means Hudson Pacific Properties must continually adapt to a dynamic market where geographic preferences can shift rapidly based on financial incentives.

The increasing adoption of remote and hybrid work models directly substitutes for traditional office spaces, impacting Hudson Pacific Properties (HPP). Companies seeking flexibility are reducing their need for large, centralized leases. A 2024 survey revealed that 70% of companies intend to offer hybrid work, a significant increase, highlighting this substitution threat.

Flexible office spaces and co-working solutions also serve as substitutes for long-term leases. Businesses are drawn to adaptable arrangements with shorter commitments. WeWork's extensive global portfolio, exceeding 700 locations by late 2023, demonstrates the scale of this competitive alternative.

Major tenants, particularly in tech and media, are opting to build their own campuses or specialized facilities. This trend, especially among film producers seeking controlled environments, directly substitutes for HPP's leasing model by bypassing third-party landlords.

Entrants Threaten

Entering the commercial real estate sector, particularly for major office and studio spaces in desirable West Coast markets, demands substantial capital. For instance, acquiring prime development sites in areas like Los Angeles or the San Francisco Bay Area can easily run into tens or hundreds of millions of dollars. This initial outlay for land, construction, and ongoing portfolio management creates a formidable financial barrier.

The sheer scale of investment needed to develop modern, amenity-rich office buildings or specialized studio facilities presents a significant hurdle. Consider the cost of a new, Class A office building, which can easily exceed $500 per square foot to construct. This high capital requirement effectively limits the pool of potential new competitors capable of challenging established players like Hudson Pacific Properties.

The threat of new entrants in the real estate development sector, particularly in established West Coast markets like those Hudson Pacific Properties (HPP) operates in, is significantly mitigated by substantial regulatory barriers. These include intricate zoning ordinances, stringent environmental impact assessments, and protracted permitting procedures that can add years and considerable expense to any new construction project.

For instance, the average time to obtain a building permit in California can extend well over a year, significantly delaying project timelines and increasing upfront capital requirements. This complexity acts as a formidable deterrent, making it challenging for new, less experienced players to enter the market and compete effectively against established firms like HPP, which possess the expertise and resources to navigate these challenges.

Hudson Pacific Properties (HPP) benefits from deeply entrenched relationships with major tech and media companies, a significant barrier for potential new entrants. These aren't just casual connections; they represent years of trust and tailored service delivery.

Newcomers would find it incredibly difficult to replicate HPP's specialized knowledge in catering to the unique needs of these demanding sectors. This niche expertise translates directly into attracting and retaining the most valuable tenants.

For instance, HPP's focus on the media and entertainment sector, which saw significant growth in demand for specialized production space throughout 2024, highlights this advantage. New entrants would face a steep learning curve and a lack of established credibility.

Brand Reputation and Portfolio Scale

Hudson Pacific Properties (HPP) benefits from a significant barrier to entry due to its established brand reputation and the sheer scale of its diversified, high-quality real estate portfolio. This strong market presence makes it challenging for newcomers to compete effectively. For instance, as of the first quarter of 2024, HPP’s portfolio comprised approximately 23 million square feet of primarily office and media-focused properties, a scale that requires substantial capital and time for any new entrant to replicate.

The ability to attract top-tier tenants and secure favorable financing is directly linked to this established scale and reputation. New entrants would face considerable hurdles in building a comparable brand recognition and demonstrating the financial stability and tenant relationships that HPP already possesses. This advantage translates into lower costs of capital and greater negotiating power, further deterring potential new competitors.

- Established Brand: HPP’s long-standing reputation in the real estate market, particularly within the media and technology sectors, acts as a significant deterrent to new entrants.

- Portfolio Scale: With a substantial portfolio of approximately 23 million square feet as of Q1 2024, HPP possesses economies of scale that new competitors would struggle to match.

- Tenant Attraction: The company's strong brand and portfolio quality enable it to attract and retain high-quality tenants, a feat that requires considerable time and investment for new players.

- Capital Access: HPP’s established financial track record and scale facilitate easier and more cost-effective access to capital, a critical advantage over nascent competitors.

Market Saturation and Existing Supply

The West Coast office market is experiencing significant saturation, with high vacancy rates impacting profitability for new entrants. Despite population increases, the sheer volume of existing office space makes it difficult for newcomers to secure a foothold without aggressive pricing, potentially leading to unsustainable business models.

For instance, as of early 2024, many major West Coast office markets, such as San Francisco and Los Angeles, have reported vacancy rates exceeding 20%, a substantial increase from pre-pandemic levels. This oversupply acts as a strong deterrent to new office development.

The industrial sector, while generally more robust, also faces increasing vacancy rates, albeit from a lower starting point. This trend suggests that even sectors previously considered less susceptible to oversupply are beginning to show signs of market saturation, further complicating the threat of new entrants.

- West Coast Office Vacancy: Exceeding 20% in key markets like San Francisco and Los Angeles in early 2024.

- Impact on New Entrants: High vacancy necessitates aggressive pricing, challenging profitability.

- Industrial Sector Trend: Rising vacancy rates, though from a lower base, indicate broader market saturation.

- Deterrent to New Development: Market saturation significantly discourages new office construction.

The threat of new entrants for Hudson Pacific Properties (HPP) is considerably low due to immense capital requirements, stringent regulatory hurdles, and established tenant relationships, especially in the competitive West Coast real estate market. The sheer scale of investment for prime locations and the lengthy, complex approval processes act as significant deterrents.

New players would struggle to replicate HPP's specialized expertise and its strong, long-standing connections with major media and tech firms, which are crucial for attracting and retaining high-value tenants. This niche advantage, coupled with a substantial portfolio of approximately 23 million square feet as of Q1 2024, creates formidable barriers.

Market saturation, particularly in the office sector with vacancy rates exceeding 20% in key West Coast markets like Los Angeles and San Francisco in early 2024, further discourages new development. This oversupply makes it difficult for newcomers to gain traction without compromising profitability.

| Barrier Type | Description | Impact on New Entrants | HPP Advantage |

|---|---|---|---|

| Capital Requirements | Acquiring prime land and construction costs for large-scale projects. | Very High | Established financial capacity and access to capital. |

| Regulatory Hurdles | Complex zoning, environmental reviews, and permitting processes. | High | Expertise in navigating regulatory landscapes. |

| Tenant Relationships | Deeply entrenched relationships with key media and tech tenants. | Very High | Specialized knowledge and established credibility. |

| Market Saturation | High vacancy rates in West Coast office markets (e.g., >20% in LA/SF as of early 2024). | High | Strong tenant retention and diversified portfolio. |

| Brand Reputation & Scale | Extensive portfolio (approx. 23 million sq ft as of Q1 2024) and strong market presence. | Very High | Economies of scale and superior negotiating power. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hudson Pacific Properties leverages data from their SEC filings, investor relations materials, and industry-specific real estate market reports. We also incorporate insights from commercial real estate data providers and economic forecasting agencies to assess competitive dynamics.