HudBay SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

HudBay's strengths lie in its diversified mineral portfolio and established operational expertise, but potential threats from commodity price volatility and regulatory changes demand careful navigation. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the mining sector.

Ready to uncover the full strategic picture? Purchase the complete HudBay SWOT analysis to gain access to detailed insights, actionable recommendations, and an editable report designed to empower your decision-making.

Strengths

Hudbay Minerals boasts a diversified asset portfolio, mining copper, gold, zinc, silver, and molybdenum across Canada, Peru, and the United States. This broad commodity and geographic spread significantly reduces risk, as the company isn't overly dependent on any single metal or region. Copper is their core product, but substantial gold output and valuable by-product metals further strengthen their market position.

Hudbay demonstrated exceptional financial strength in 2024, achieving record performance and a significantly strengthened balance sheet. The company met consolidated production guidance for all its metals and notably surpassed gold production targets.

This robust operational execution translated into record annual free cash flows. Furthermore, Hudbay successfully reduced its net debt by an impressive $512 million, establishing it as the peer with the lowest leverage in the industry.

Hudbay's operations are strategically located in Tier-One jurisdictions such as Canada, Peru, and the United States. This geographic diversification provides a stable foundation for both current operations and future growth initiatives, significantly mitigating political and operational risks often associated with less predictable regions.

Operating in these mining-friendly environments allows Hudbay to benefit from established regulatory frameworks and access to skilled labor. For instance, in 2023, Hudbay reported significant progress at its Constancia mine in Peru, a testament to its ability to manage operations effectively in a key Tier-One jurisdiction.

Significant Copper Growth Pipeline

Hudbay is strategically positioned with a robust copper growth pipeline, highlighted by the significant Copper World project in Arizona. This development is projected to boost consolidated annual copper production by more than 50% compared to current output, a substantial increase that will solidify its market position.

The full state-level permitting of Copper World represents a major de-risking milestone for this key growth initiative. This achievement underscores Hudbay's ability to navigate complex regulatory environments and advance its strategic objectives.

These growth projects are vital for Hudbay's long-term value creation strategy, aligning perfectly with the escalating global demand for copper. As the world transitions towards electrification and renewable energy, copper's importance is only set to grow.

- Copper World Project: Expected to increase consolidated annual copper production by over 50%.

- Permitting Status: Fully permitted at the state level, reducing project risk.

- Market Alignment: Capitalizes on increasing global demand for copper driven by electrification.

- Production Impact: Significant potential to elevate Hudbay's copper output and market share.

Commitment to Sustainability and ESG

Hudbay's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company's integrated annual and sustainability report highlights tangible progress on environmental and social fronts. For instance, Hudbay is targeting a 50% reduction in Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 2030, a crucial step in addressing climate change.

This focus on ESG is not just about environmental responsibility; it directly impacts Hudbay's social license to operate and its appeal to investors prioritizing sustainable practices. The company's high safety ratings further underscore this commitment, demonstrating a responsible approach to its workforce and operations.

- Commitment to Sustainability: Hudbay is actively pursuing a 50% reduction in Scope 1 and 2 GHG emissions by 2030.

- ESG Reporting: The company releases integrated annual and sustainability reports detailing progress on environmental and social initiatives.

- Safety Performance: Hudbay maintains high ratings in safety protocols, reflecting a strong operational focus.

- Investor Appeal: A robust ESG strategy enhances attractiveness to responsible investment funds and stakeholders.

Hudbay's diversified commodity and geographic base is a key strength, reducing reliance on any single metal or region. Their 2024 performance was exceptional, marked by record financial results and a strengthened balance sheet, including a $512 million reduction in net debt, making them the lowest-leveraged peer.

The company's strategic positioning in Tier-One jurisdictions like Canada, Peru, and the United States provides operational stability and access to skilled labor. Furthermore, Hudbay is advancing its robust copper growth pipeline, notably the Copper World project in Arizona, which is expected to increase annual copper production by over 50% and is now fully permitted at the state level.

Hudbay's commitment to ESG principles is a significant advantage, with a target to reduce Scope 1 and 2 GHG emissions by 50% by 2030 and a strong safety record. This focus enhances their appeal to investors prioritizing sustainability.

| Metric | 2023 (Actual) | 2024 (Guidance/Actual) | 2025 (Guidance) |

|---|---|---|---|

| Consolidated Copper Production (M lbs) | 202.1 | 202.1 (Actual) | 215-235 |

| Consolidated Gold Production (koz) | 209.5 | 225.6 (Actual) | 210-230 |

| Net Debt Reduction (Millions USD) | N/A | $512 | N/A |

| GHG Emission Reduction Target (Scope 1 & 2) | N/A | N/A | 50% by 2030 |

What is included in the product

Offers a full breakdown of HudBay’s strategic business environment, detailing its internal capabilities and external market dynamics.

HudBay's SWOT analysis offers a clear framework to identify and address operational challenges, transforming potential setbacks into strategic advantages.

Weaknesses

Hudbay saw a dip in consolidated copper and gold output in the second quarter of 2024 compared to the first, a trend that was anticipated due to lower planned grades and scheduled maintenance. While meeting overall guidance, these quarterly fluctuations can create short-term volatility in revenue and operational performance.

The company is actively managing these dips by advancing stripping programs at its operations, a strategy designed to unlock access to higher-grade ore in the immediate future, thereby smoothing out production levels.

Hudbay's accelerated mining of high-grade gold zones in 2024, which led to record gold production, presents a near-term challenge. This strategy is projected to result in lower gold production in 2025, potentially impacting the company's revenue mix. Investors will need to closely track how this shift affects overall profitability and the value of by-product credits.

As a mining company, Hudbay's financial health is closely tied to the fluctuating prices of key commodities like copper, gold, zinc, and silver. These price swings, which are largely outside of Hudbay's influence, can significantly affect its revenue and profit margins. For instance, the price of copper, a major driver for Hudbay, experienced considerable volatility in early 2024, impacting the company's stock performance.

Permitting Challenges and Delays

While Hudbay's Copper World project has secured crucial state permits, the broader landscape of large-scale mining permits remains intricate and prone to unforeseen delays or legal hurdles. Pima County's specific concerns about the Copper World Aquifer Protection Permit underscore the persistent scrutiny and the possibility of further conditions or setbacks emerging. These potential delays can significantly inflate project expenses and postpone the commencement of revenue streams, impacting financial projections.

The permitting process for major mining operations often involves navigating a complex web of federal, state, and local regulations. For Hudbay, this means ongoing engagement with various stakeholders and a readiness to address evolving environmental and community concerns. For example, the timeline for securing all necessary approvals for projects of this magnitude can extend over several years, as seen with other large mining developments in North America.

- Complex Regulatory Environment: Large mining projects like Copper World must comply with numerous environmental, water, and land use regulations, creating a challenging approval pathway.

- Potential for Legal Challenges: Opposition from local communities or environmental groups can lead to lawsuits, further delaying or potentially halting project progression.

- Cost Escalation: Extended permitting timelines directly translate to higher carrying costs for the project, including labor, equipment, and administrative expenses.

Increased Cash Costs in Some Operations

Hudbay's consolidated cash costs, after accounting for by-product credits, are anticipated to rise in 2024 compared to the previous year. This increase is largely attributed to diminished gold by-product credits and the full operational year of its British Columbia assets.

Despite ongoing initiatives to stabilize operations, the company faces the challenge of effectively managing and curbing these escalating cash costs. This cost control is vital for preserving robust profit margins across its various mining activities.

- Projected 2024 cash costs are higher than 2023.

- Lower gold by-product credits contribute to the increase.

- Full-year impact of British Columbia operations also a factor.

- Effective cost management is critical for profitability.

Hudbay's financial performance is susceptible to commodity price volatility, with copper prices, a key revenue driver, experiencing significant fluctuations in early 2024. The company's projected increase in consolidated cash costs for 2024, driven by lower gold by-product credits and the full operational year of its British Columbia assets, presents a direct challenge to maintaining healthy profit margins.

The complex and lengthy permitting process for large-scale mining projects, such as Copper World, poses a significant risk of delays and cost escalations. Potential legal challenges from local communities or environmental groups could further impede project progression.

Hudbay's strategic decision to accelerate high-grade gold production in 2024, while boosting output, is expected to lead to lower gold production in 2025. This shift could negatively impact the company's revenue mix and overall profitability, requiring careful investor monitoring.

| Weakness | Description | Impact |

| Commodity Price Volatility | Reliance on fluctuating copper, gold, zinc, and silver prices. Copper prices saw notable swings in early 2024. | Directly affects revenue and profit margins, creating financial uncertainty. |

| Rising Cash Costs | Projected higher consolidated cash costs in 2024 due to lower gold by-product credits and BC operations. | Pressures profit margins and necessitates stringent cost management. |

| Permitting Delays & Legal Risks | Complex regulatory environment and potential opposition for projects like Copper World. | Can lead to significant cost overruns and postponed revenue generation. |

| Production Mix Shift | Accelerated gold production in 2024 leads to lower projected gold output in 2025. | May alter revenue composition and impact overall financial performance. |

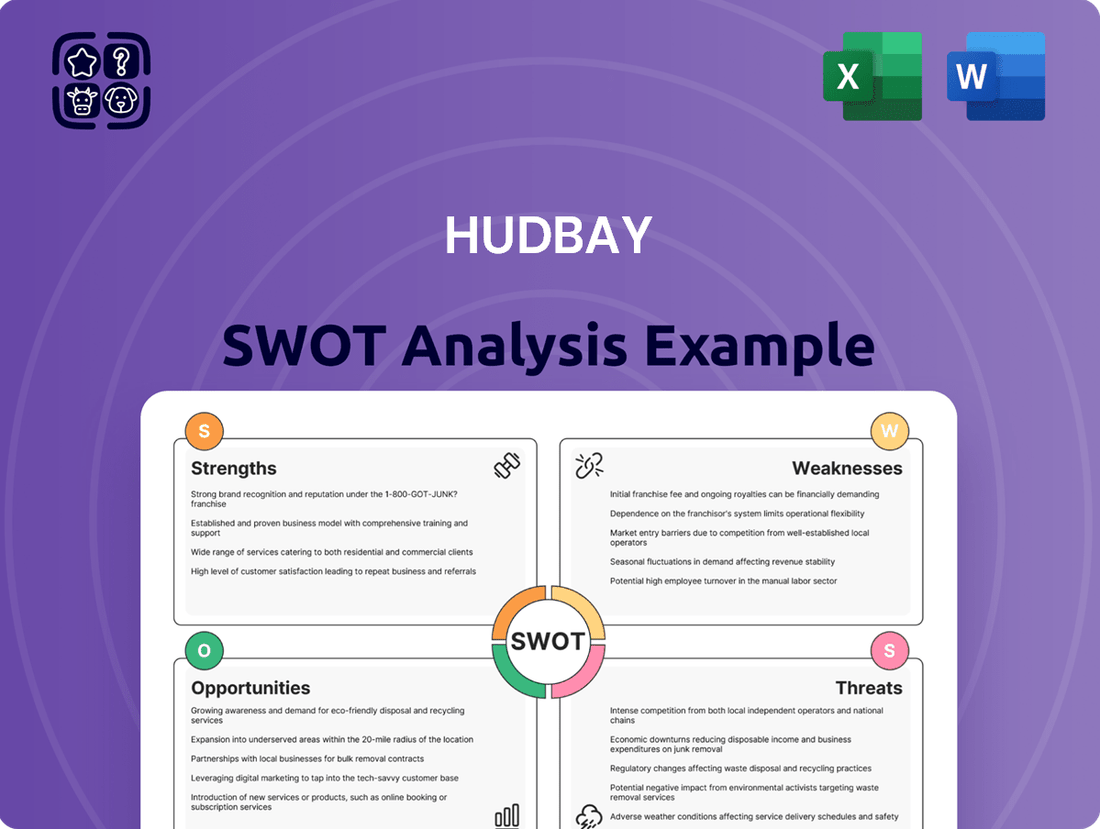

Preview the Actual Deliverable

HudBay SWOT Analysis

This is the actual HudBay SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into its comprehensive insights.

Purchase unlocks the entire in-depth version, providing a complete strategic overview of HudBay's current position.

Opportunities

The advancement of HudBay's Copper World project in Arizona presents a substantial opportunity for growth, with projections indicating a more than 50% increase in consolidated annual copper production. This project is a key focus for the company, aiming to bolster its output significantly.

With the crucial Aquifer Protection Permit now secured, the Copper World project is on a clear path toward a construction sanctioning decision, anticipated in 2026. This regulatory milestone is essential for moving the project forward into its next critical phase.

Copper World is strategically positioned to become a vital contributor to the United States' domestic copper supply chain. The project is set to produce 'Made-in-America' copper cathode, directly addressing the need for secure and reliable domestic sourcing of this essential metal.

The global shift towards a low-carbon economy, particularly the surge in electric vehicles and renewable energy projects, is a significant tailwind for copper demand. This trend is projected to continue, with forecasts indicating a substantial increase in consumption through 2030 and beyond.

Hudbay, with its focus on copper production, is strategically positioned to benefit from these evolving market dynamics. The company's operations, including the Copper World project, are designed to align with and meet this escalating global need for copper, a critical component in green technologies.

Hudbay is making significant strides in expanding its resource base through aggressive exploration efforts. Their largest-ever exploration program is underway in the Snow Lake region, aiming to unlock new potential.

Furthermore, the company is advancing drill permitting for promising satellite properties adjacent to its Constancia operations. These strategic moves are designed to extend existing mine lives and convert inferred resources into proven reserves, fueling future growth.

The success of these exploration initiatives could lead to the discovery of new high-grade deposits, offering substantial long-term value and a stronger foundation for Hudbay's operational longevity.

Mill Optimization and Throughput Enhancement

Hudbay is actively investing in mill optimization projects at its operations in British Columbia and Peru. These initiatives are designed to boost mill throughput, with anticipated increases expected to commence in 2026. This focus on brownfield improvements aims to maximize output from existing infrastructure.

These strategic investments are projected to enhance operational efficiency and expand capacity, ultimately leading to higher production volumes. By improving existing facilities, Hudbay is pursuing a cost-effective strategy for growth.

- Targeted Mill Upgrades: Projects in British Columbia and Peru are underway.

- Projected Throughput Increase: Expected to begin impacting production from 2026 onwards.

- Brownfield Investment Strategy: Focuses on enhancing existing operational capacity and efficiency.

Strategic Partnerships and Deleveraging

Hudbay's robust financial health in 2024, marked by substantial debt reduction, creates a prime opportunity for strategic alliances. This deleveraging allows the company to allocate capital towards high-yield growth initiatives and explore joint ventures, particularly for projects such as Copper World.

The company plans to initiate a process to secure a minority joint venture partner for Copper World. This partnership could provide crucial funding for definitive feasibility studies and subsequent construction phases, accelerating project development.

- Debt Reduction: Hudbay's strategic focus on deleveraging in 2024 has significantly improved its balance sheet, providing financial flexibility.

- Reinvestment Capacity: Reduced debt allows for increased reinvestment in promising, high-return growth projects.

- Copper World JV: The planned minority joint venture for Copper World aims to share project development costs and risks.

- Funding Acceleration: A JV partner can expedite critical funding for feasibility studies and construction, potentially bringing Copper World online sooner.

Hudbay's strategic focus on advancing its Copper World project in Arizona is a significant opportunity, with projected annual copper production to increase by over 50% once operational. The securing of the Aquifer Protection Permit in 2024 paves the way for a construction sanctioning decision in 2026, positioning the project to contribute vital 'Made-in-America' copper cathode to the domestic supply chain.

The global demand for copper is experiencing a robust upswing, driven by the accelerating transition to a low-carbon economy, particularly the growth in electric vehicles and renewable energy infrastructure. This trend is expected to sustain through 2030 and beyond, creating a favorable market environment for copper producers like Hudbay.

Hudbay is actively expanding its resource base through an ambitious exploration program, notably in the Snow Lake region, and by advancing drill permitting for satellite properties near its Constancia operations. These efforts aim to extend mine lives and convert resources into reserves, bolstering long-term operational capacity.

Investments in mill optimization at its British Columbia and Peru operations are projected to increase mill throughput starting in 2026, enhancing efficiency and output from existing infrastructure. Furthermore, Hudbay's strong financial position in 2024, following substantial debt reduction, enables strategic alliances and the pursuit of a minority joint venture partner for Copper World to accelerate its development.

| Project | Status/Milestone | Projected Impact | Key Driver |

|---|---|---|---|

| Copper World (Arizona) | Aquifer Protection Permit secured (2024); Construction sanctioning decision anticipated 2026 | >50% increase in consolidated annual copper production | Domestic supply chain for 'Made-in-America' copper cathode; Green energy transition |

| Exploration Programs | Largest-ever program in Snow Lake; Advancing drill permitting for Constancia satellite properties | Resource base expansion; Extension of mine lives; Conversion of inferred resources to proven reserves | Unlocking new high-grade deposits; Long-term value creation |

| Mill Optimization (BC & Peru) | Projects underway; Projected throughput increase commencing 2026 | Enhanced operational efficiency and capacity; Higher production volumes | Brownfield improvements; Maximizing output from existing infrastructure |

| Financial Strategy | Substantial debt reduction (2024); Planning for minority JV partner for Copper World | Improved balance sheet; Financial flexibility for growth initiatives; Accelerated project development funding | Strategic alliances; Capital allocation to high-yield growth |

Threats

Hudbay faces significant threats from regulatory and environmental scrutiny. Stringent environmental regulations are a constant challenge for mining operations, and public watchfulness adds another layer of complexity. For instance, the Copper World project, while making headway with permits, has encountered local authority concerns about protecting groundwater quality and managing tailings facilities.

Any shifts in environmental policies or continued regulatory hurdles could indeed mean project delays, escalating operational costs, or even restrictions on how Hudbay can conduct its business. As of early 2024, the company is actively navigating these environmental permitting processes, which are crucial for the future development of its key projects.

Hudbay's operations in Peru, despite being in a tier-one jurisdiction, face the threat of social unrest and protests, particularly from informal miners. These disruptions, as highlighted by MMG and Hudbay themselves, can directly impact production schedules and raise safety concerns, jeopardizing operational continuity.

The potential for such events underscores the critical importance of robust community engagement strategies. Maintaining strong relationships with local communities is paramount for Hudbay to effectively mitigate these geopolitical and social risks and ensure stable operations.

Hudbay's operational costs are closely tied to by-product credits from metals like gold, zinc, and silver. For 2024, the company anticipates lower gold by-product credits, which directly increases the net cash costs associated with copper production. This sensitivity means that any shifts in the market prices or output volumes of these by-products can significantly alter Hudbay's overall cost structure and profitability.

Capital Expenditure Requirements for Growth Projects

Advancing major growth projects, such as the Copper World development, necessitates significant capital expenditures. Hudbay has made strides in strengthening its balance sheet, but substantial investments remain on the horizon, with 2024 growth capital spending in Arizona projected to rise.

The challenge lies in funding these crucial projects while simultaneously preserving financial health and managing existing debt. This delicate balancing act becomes even more precarious if commodity prices experience unfavorable shifts.

- Copper World Project Capital: While specific 2024 Copper World capital figures are still being refined, the overall growth capital expenditure for Arizona in 2024 is expected to increase compared to previous periods, reflecting the project's progression.

- Balance Sheet Strength: Hudbay reported a net debt to adjusted EBITDA ratio of 1.6x as of the first quarter of 2024, indicating an improved financial position, yet large-scale project funding still demands careful financial management.

- Commodity Price Sensitivity: The company's ability to fund growth is inherently linked to market conditions; a downturn in copper or zinc prices could strain financial resources available for capital allocation.

Global Economic Downturn and Metal Demand

A significant global economic downturn presents a substantial threat to Hudbay Minerals. Reduced industrial activity and consumer spending during such periods typically lead to lower demand for base metals, including copper, which is a key product for Hudbay. This decreased demand can directly translate into lower metal prices and reduced sales volumes, impacting the company's top-line revenue and overall profitability.

While the long-term forecast for copper demand remains robust, driven by the global push towards electrification and renewable energy infrastructure, the short-to-medium term economic outlook is a concern. Economic instability and potential recessions in major economies could create significant headwinds for Hudbay. For instance, if major markets like China or the United States experience a sharp economic contraction, it could severely dampen copper consumption.

The mining sector, by its very nature, is cyclical and highly sensitive to the ebb and flow of the global economy. Factors such as inflation, interest rate hikes, and geopolitical tensions can all contribute to economic instability. For example, the International Monetary Fund (IMF) has projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, indicating a cautious economic environment that could affect commodity demand.

- Economic Slowdown Impact: A global recession could decrease demand for copper by as much as 5-10% in affected regions, directly impacting Hudbay's sales.

- Price Volatility: Copper prices, which averaged around $8,500 per tonne in early 2024, could see significant declines if demand falters due to economic weakness.

- Profitability Squeeze: Reduced sales volumes and lower commodity prices would put pressure on Hudbay's profit margins, potentially impacting its ability to fund ongoing operations and development projects.

Hudbay faces ongoing threats from stringent environmental regulations and public scrutiny, particularly concerning water quality and tailings management at projects like Copper World, which could lead to delays and increased costs. Social unrest and protests, especially from informal miners in Peru, pose risks to operational continuity and safety, highlighting the need for strong community relations.

The company's profitability is sensitive to by-product credits, with anticipated lower gold credits in 2024 directly increasing net cash costs for copper production. Furthermore, significant capital is required for growth projects like Copper World, and while Hudbay has improved its balance sheet, funding these investments while managing debt remains a challenge, especially with potential commodity price downturns.

A global economic downturn poses a substantial threat, potentially reducing demand and prices for copper and other base metals, thereby impacting Hudbay's revenue and profitability. The mining sector's cyclical nature makes it vulnerable to economic instability, inflation, and geopolitical tensions, with projected global growth slowdowns in 2024 indicating a cautious economic environment.

| Threat Category | Specific Risk | Potential Impact | Key Data/Context (2024/2025) |

|---|---|---|---|

| Regulatory & Environmental | Stricter environmental policies, permitting delays (Copper World) | Increased costs, project delays, operational restrictions | Copper World permitting ongoing; environmental compliance costs a factor. |

| Social & Geopolitical | Social unrest, protests (Peru operations) | Production disruptions, safety concerns, operational continuity | Past incidents highlight vulnerability; community engagement crucial. |

| Financial & Operational Costs | Lower by-product credits (e.g., gold), commodity price volatility | Higher net cash costs, reduced profitability, funding challenges | Anticipated lower gold by-product credits in 2024; copper prices volatile. |

| Economic Conditions | Global economic slowdown, reduced demand for base metals | Lower sales volumes, decreased metal prices, profit margin pressure | Global growth forecasts suggest cautious economic environment; copper prices sensitive to demand shifts. |

SWOT Analysis Data Sources

This HudBay SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary, ensuring a robust and insightful strategic assessment.