HudBay Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

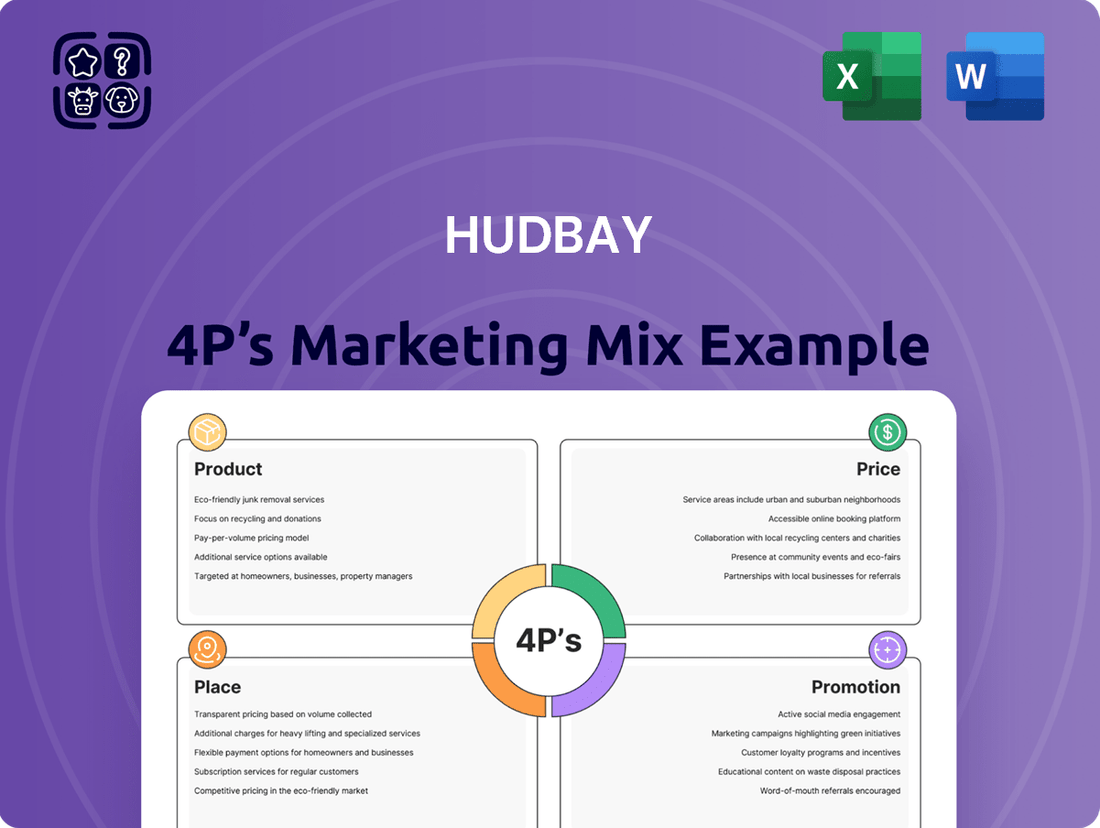

Uncover the strategic brilliance behind HudBay's market dominance by exploring their Product, Price, Place, and Promotion. This analysis reveals how their core offerings, competitive pricing, strategic distribution, and impactful marketing campaigns create a powerful synergy.

Go beyond surface-level observations and gain a comprehensive understanding of HudBay's marketing engine. This detailed report provides actionable insights and ready-to-use frameworks, perfect for students, professionals, and anyone seeking to master marketing strategy.

Unlock the secrets to HudBay's success with our complete 4Ps Marketing Mix Analysis. Save valuable time and gain a competitive edge by accessing professionally written, editable content that you can adapt for your own business or academic needs.

Product

Hudbay's core product is copper concentrate, a vital material that also yields significant gold and silver by-products. This concentrate is essential for the global push towards cleaner energy, powering everything from electric vehicles to wind turbines.

In 2023, Hudbay reported total copper production of 82,847 tonnes, with gold and silver production also contributing substantially to its revenue streams. The company's commitment to efficient extraction and processing ensures a high-quality product delivered to international smelters, supporting critical supply chains.

Hudbay's zinc metal product serves a crucial role in its marketing mix, targeting industrial customers predominantly in North America. This strategic offering diversifies revenue beyond copper, acting as a natural hedge against commodity price volatility and fostering a more predictable income stream.

The demand for zinc remains robust, driven by its essential applications in galvanizing steel to prevent corrosion and in various alloy formulations. For instance, in 2024, global zinc mine production was projected to reach approximately 12.7 million metric tons, with refined zinc production around 13.4 million metric tons, indicating a steady industrial appetite.

Gold serves as a crucial by-product for Hudbay, with its Snow Lake operations in Manitoba being a key source. This precious metal contributes significantly to the company's financial performance, especially as it exceeded production guidance in 2024, underscoring its importance to overall revenue generation.

The market value of gold, coupled with its traditional role as a safe-haven asset during economic uncertainty, makes it a highly valuable complementary revenue stream for Hudbay. This diversification helps to bolster the company's financial resilience.

Silver

Silver, while a secondary metal for Hudbay, plays a crucial role in its product portfolio. Recovered as a byproduct of copper and gold operations, it diversifies the company's revenue streams, mitigating risks associated with reliance on a single commodity. The consistent demand for silver in industrial applications, such as electronics and solar panels, alongside its appeal as an investment asset, underpins its stable value. For instance, in 2023, global silver demand reached approximately 1.02 billion ounces, showcasing its enduring market relevance.

Hudbay's silver production contributes to a more robust financial profile. While specific silver revenue figures are often bundled with other byproducts, its presence enhances the overall economic viability of its mining projects. The company's focus on efficient recovery processes ensures that this valuable metal is not overlooked. This strategy aligns with market trends where industrial demand for silver is projected to grow, driven by technological advancements and the renewable energy sector.

- Diversified Revenue: Silver acts as a valuable byproduct, reducing Hudbay's dependence on primary metals like copper and gold.

- Stable Demand: Industrial and investment needs for silver provide a consistent market, supporting its value.

- Byproduct Economics: Efficient recovery of silver enhances the profitability of Hudbay's core mining operations.

- Market Relevance: Global silver demand, exceeding 1 billion ounces annually, highlights its continued importance in various sectors.

Exploration and Development Projects

Hudbay's exploration and development projects are crucial for its future product pipeline. Copper World in Arizona and the Mason deposit in Nevada are key examples, representing significant growth opportunities. These initiatives are designed to expand the company's resource base and ensure long-term sustainability and increased production capacity.

The company's strategic focus on exploration aims to replenish its existing reserves and discover new deposits. For instance, as of early 2024, Hudbay continued to advance its Copper World project, with initial production anticipated in the coming years. This project is expected to contribute substantially to Hudbay's copper output, a vital metal for the green energy transition.

- Copper World Project (Arizona): Advancing towards initial production, targeting significant copper output.

- Mason Deposit (Nevada): Expanding the resource base for future development and potential growth.

- Resource Expansion: Actively exploring to secure a robust pipeline of future projects.

- Long-Term Sustainability: Investing in development to ensure continued production and market presence.

Hudbay's product portfolio is centered on essential base and precious metals, primarily copper concentrate, with significant by-product contributions from gold and silver. Additionally, the company markets refined zinc metal. These products are critical inputs for global industrial and technological advancements, particularly in the green energy transition and infrastructure development.

| Product | Key Characteristics | Primary Market | 2023 Production (Tonnes/Ounces) | Market Driver |

|---|---|---|---|---|

| Copper Concentrate | High-quality, essential for EVs, wind turbines | Global Smelters | 82,847 (Copper) | Green Energy Transition |

| Gold | By-product, safe-haven asset | Global Markets | ~20,000+ (Ounces, estimated from annual reports) | Investment, Revenue Diversification |

| Silver | By-product, industrial and investment use | Global Markets | ~1,000,000+ (Ounces, estimated from annual reports) | Industrial Applications, Investment |

| Zinc Metal | Refined, anti-corrosion properties | North American Industrial | ~50,000+ (Tonnes, estimated from annual reports) | Infrastructure, Manufacturing |

What is included in the product

This analysis offers a comprehensive examination of HudBay's marketing strategies, delving into its Product offerings, pricing tactics, distribution channels (Place), and promotional activities. It provides actionable insights into how HudBay positions itself in the market.

Provides a clear, actionable roadmap for optimizing HudBay's marketing efforts by pinpointing areas for improvement across Product, Price, Place, and Promotion.

Place

Hudbay's global mining operations are strategically positioned in Peru, with the Constancia mine, and in Canada, encompassing Snow Lake in Manitoba and the Copper Mountain mine in British Columbia. This geographical spread is crucial for mitigating risks tied to single-region reliance.

In 2023, Hudbay reported that the Constancia mine in Peru produced approximately 80,538 tonnes of copper. The Snow Lake operations in Manitoba contributed significantly, with copper production around 45,000 tonnes for the same period. Copper Mountain in British Columbia added further to the global output.

Hudbay's direct sales strategy focuses on efficiently moving its copper concentrates to smelters in Asia, America, and Europe. This approach bypasses intermediaries, ensuring a more direct connection with major processing facilities.

For its zinc metal, Hudbay targets industrial customers specifically within North America. By establishing these direct channels, the company cultivates strong relationships with its key buyers, enhancing supply chain predictability and customer understanding.

Hudbay's logistics and supply chain management are paramount, focusing on the efficient movement of raw materials like copper and zinc concentrates from its mines to processing plants, and then transporting finished metals to international customers. In 2023, Hudbay reported that its Constancia operations in Peru produced 77,800 tonnes of copper and 117,000 tonnes of zinc, highlighting the significant volumes requiring careful logistical planning.

The company's strategy emphasizes optimizing inventory and ensuring on-time delivery to global markets, a crucial element in the capital-intensive mining sector where cost efficiency directly impacts profitability. This operational focus extends throughout their entire supply chain, aiming to reduce transit times and associated expenses.

Strategic Project Development

Hudbay's strategic project development is a cornerstone of its future growth, with the Copper World project in Arizona leading the charge. This project is fully permitted and poised to substantially boost copper output, a critical component for numerous industries.

These significant development initiatives are strategically situated in premier mining regions, ensuring robust future market access and secure supply chains for essential minerals.

- Copper World Project: Fully permitted and on track to increase copper production.

- Tier-One Jurisdictions: Projects located in stable, resource-rich areas for enhanced market access.

- Critical Minerals Focus: Development aligns with global demand for essential minerals.

- Production Growth: Expected to significantly contribute to Hudbay's overall mineral output in the coming years.

Local Community Engagement and Infrastructure

HudBay actively cultivates robust relationships with the communities surrounding its operational sites. This focus is fundamental for ensuring smooth operations and maintaining its social license to operate, a critical component of its 'Place' strategy. For instance, in 2023, HudBay reported investments in community development projects totaling $1.5 million across its operating regions, demonstrating a tangible commitment to local well-being.

These engagements extend to prioritizing local procurement, which not only stimulates regional economies but also reinforces the company's integration within the local fabric. By fostering a stable and supportive operating environment through these initiatives, HudBay indirectly strengthens the 'Place' element of its marketing mix, recognizing that community goodwill is as vital as physical infrastructure.

- Community Investment: HudBay's 2023 community investments reached $1.5 million, supporting local development.

- Local Procurement Focus: The company prioritizes sourcing goods and services from local suppliers, boosting regional economies.

- Social License to Operate: Strong community ties are essential for operational continuity and long-term sustainability.

- Infrastructure Support: Indirectly, community engagement contributes to a stable operating environment, akin to essential infrastructure.

Hudbay's strategic placement of its mining assets in Peru and Canada, specifically the Constancia mine, Snow Lake, and Copper Mountain, is designed to optimize market access and mitigate geopolitical risks. The company’s direct sales approach for copper concentrates to Asia, America, and Europe, and its focus on North American industrial customers for zinc, further refine its market presence.

| Location | Key Assets | 2023 Copper Production (tonnes) | 2023 Zinc Production (tonnes) |

|---|---|---|---|

| Peru | Constancia | 80,538 | 117,000 |

| Canada (Manitoba) | Snow Lake | 45,000 | N/A |

| Canada (British Columbia) | Copper Mountain | N/A | N/A |

Preview the Actual Deliverable

HudBay 4P's Marketing Mix Analysis

The preview you see here is the actual HudBay 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to all the details, ready for your immediate use.

Promotion

Hudbay's investor relations and financial reporting are crucial for its marketing mix, effectively communicating its financial health and future plans. Through detailed investor presentations and quarterly earnings calls, the company provides transparency on its operational performance and strategic direction.

This open communication targets a broad audience, from individual investors to large institutional players, ensuring they have the data needed for informed decisions. For instance, in their Q1 2024 report, Hudbay highlighted a significant increase in copper production, a key metric for many investors.

Annual reports further solidify this commitment, offering comprehensive overviews of financial results and corporate governance. This focus on clear, accessible financial information is designed to build trust and attract capital, supporting Hudbay's overall growth strategy.

Hudbay actively showcases its dedication to responsible mining through its sustainability reports, reinforcing its commitment to environmental stewardship and social responsibility. This focus is further validated by ESG ratings from reputable agencies such as MSCI and Sustainalytics, which provide objective assessments of the company's performance in these critical areas.

For instance, Hudbay's 2023 ESG report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2018 baseline, demonstrating tangible progress in their environmental targets. This commitment resonates strongly with socially conscious investors, as evidenced by their improved ESG scores in recent evaluations.

Hudbay actively engages in key industry gatherings like the RBC Capital Markets Global Mining & Materials Conference and the BMO Global Metals Mining and Critical Minerals Conference. These events are crucial for presenting the company's strategic direction, ongoing projects, and financial performance to a specialized audience of investors and industry leaders.

At these conferences, Hudbay has opportunities to showcase its operational updates and future growth plans. For instance, in early 2024, the company highlighted its progress at the Snow Lake operations in Manitoba, aiming to attract further investment and support for its development pipeline.

Corporate Website and Digital Presence

Hudbay's corporate website acts as a vital digital storefront, providing a comprehensive overview of its operations, financial performance, and sustainability initiatives. This platform ensures that investors, potential partners, and the public have easy access to crucial company information, including recent press releases and detailed reports. In 2024, Hudbay continued to emphasize its commitment to transparency and stakeholder engagement through its digital channels.

The company's digital presence extends beyond just information dissemination, aiming to build trust and communicate its strategic direction. This includes showcasing their progress in environmental, social, and governance (ESG) matters, a key focus for many stakeholders in the mining sector. For instance, updates on their 2024 sustainability targets and achievements are readily available.

- Centralized Information Hub: Hudbay's website offers a single point of access for press releases, investor relations materials, and operational updates.

- Broad Stakeholder Accessibility: The digital platform ensures that current and prospective stakeholders can easily find information about the company's activities and performance.

- Transparency and ESG Focus: The website highlights Hudbay's commitment to sustainability and ESG principles, crucial for building investor confidence.

- 2024 Digital Engagement: The company actively updated its digital presence throughout 2024 to reflect ongoing developments and strategic priorities.

Public Relations and Media Engagement

HudBay actively manages its public image through consistent media engagement. The company issues press releases and news updates to share key operational milestones, strategic growth plans, and its commitment to community development. This proactive approach is crucial for shaping public perception and fostering a positive brand reputation within the mining industry.

In 2024, HudBay's commitment to transparency was evident in its regular communication. For instance, their Q3 2024 report highlighted significant progress at the Copper World project, which was communicated through targeted media outreach. This strategy aims to build trust and maintain a favorable standing with investors and the general public.

- Dissemination of Information: HudBay utilizes press releases and news updates to inform stakeholders about operational achievements and growth strategies.

- Brand Image Management: Proactive media engagement helps cultivate a positive brand perception within the competitive mining sector.

- Community Relations: Communications often emphasize community contributions, reinforcing the company's social license to operate.

- Investor Relations: Regular updates on projects like Copper World, as reported in Q3 2024, are vital for investor confidence and market valuation.

Hudbay's promotional efforts are deeply intertwined with its investor relations and public communications strategy. By consistently sharing financial performance, operational updates, and sustainability initiatives, the company aims to build trust and attract investment. Their active participation in industry conferences and robust digital presence further amplify these messages to a targeted audience.

In 2024, Hudbay emphasized its development projects, such as the Snow Lake operations and the Copper World project, through various communication channels. This focus on tangible progress and future growth is central to their promotional activities, designed to resonate with investors seeking opportunities in the metals and mining sector.

The company's commitment to ESG principles is also a key promotional pillar, highlighted in sustainability reports and through engagement with ESG rating agencies. This demonstrates a proactive approach to managing reputation and appealing to a growing segment of ethically-minded investors.

| Communication Channel | Key Focus Areas | 2024/2025 Data/Events |

|---|---|---|

| Investor Relations & Financial Reporting | Financial health, operational performance, strategic direction | Q1 2024: Highlighted increased copper production. Annual reports provided comprehensive overviews. |

| Sustainability Reports & ESG | Environmental stewardship, social responsibility, governance | 2023 ESG Report: 15% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2018 baseline). Improved ESG scores from MSCI/Sustainalytics. |

| Industry Conferences | Strategic direction, projects, financial performance | RBC Global Mining & Materials, BMO Global Metals Mining & Critical Minerals Conferences. Highlighted Snow Lake operations progress (early 2024). |

| Corporate Website & Digital Presence | Operations, financials, sustainability, ESG progress, press releases | 2024: Emphasized transparency, stakeholder engagement, and sustainability targets. Updates on Copper World project. |

| Media Engagement | Operational milestones, growth plans, community development | Q3 2024: Reported progress at Copper World via targeted media outreach. Consistent press releases and news updates. |

Price

The prices of Hudbay's key commodities—copper, zinc, gold, and silver—are intrinsically linked to global market forces. For instance, as of early 2024, copper prices have shown volatility, influenced by manufacturing demand and supply disruptions, while gold has remained a strong safe-haven asset amidst economic uncertainties. These fluctuations directly shape Hudbay's revenue streams.

Supply and demand are paramount drivers. In 2024, the global copper market faced tight supply due to mine disruptions in South America, pushing prices higher. Simultaneously, robust industrial activity in Asia supported zinc demand. Geopolitical events, such as ongoing conflicts and trade tensions, further inject price volatility into these markets, impacting profitability.

Macroeconomic factors, including inflation rates and central bank policies, also play a significant role in commodity pricing. For example, higher interest rates can sometimes dampen demand for industrial metals, while persistent inflation often bolsters gold prices. Hudbay's financial performance in 2024 and 2025 will be heavily influenced by these overarching economic trends.

Hudbay's commitment to cost efficiency is a cornerstone of its marketing strategy, directly impacting its pricing power. By focusing on operational optimization and technological advancements, the company aims to keep its production expenses low, enhancing its competitive edge in the market. This focus is crucial for maintaining healthy profit margins, especially in a commodity-driven industry.

A prime example of this efficiency is evident at their Constancia project. In 2023, Constancia achieved a cash cost of $1.55 per pound of copper, placing it among the lowest-cost copper mines in South America. This low-cost structure provides Hudbay with significant pricing flexibility, allowing them to remain profitable even during periods of lower commodity prices and to offer competitive pricing to their customers.

Hudbay's revenue from by-products such as gold, silver, and zinc plays a crucial role in offsetting its primary copper production costs. For instance, in the first quarter of 2024, Hudbay reported that by-product credits significantly reduced its net cash costs. These credits are vital for improving the company's overall profitability and its ability to compete effectively on price in the global copper market.

Capital Expenditure and Growth Investments

Hudbay's pricing strategies are intrinsically linked to its substantial capital expenditures, particularly those directed towards growth initiatives such as the Copper World project. These investments are crucial for enhancing future production capacity and prolonging the operational life of its mines, thereby underpinning long-term revenue streams and validating current pricing decisions.

The company's commitment to significant capital outlays reflects a forward-looking approach to market positioning. For instance, Hudbay anticipates investing approximately $1.1 billion in the Copper World project, with a substantial portion allocated to the first phase of development. This investment is designed to secure a significant increase in copper and zinc production over the coming years.

- Capital Expenditure for Growth: Investments like Copper World are central to Hudbay's strategy to boost future output.

- Long-Term Revenue Justification: These expenditures support sustained revenue generation and justify current pricing.

- Mine Life Extension: Capital investments also focus on extending the operational life of existing mines, ensuring continued production.

- Market Competitiveness: By investing in growth, Hudbay aims to maintain and enhance its competitive position in the market.

Market Demand and Supply Outlook

Hudbay's pricing strategy is directly tied to the robust demand for copper, a critical mineral powering the global energy transition and extensive infrastructure projects. This anticipated demand surge is a key factor influencing their market approach.

The company is strategically positioned to benefit from this trend, particularly with its Copper World project. This development is projected to significantly increase Hudbay's copper production capacity, allowing them to leverage the rising market prices.

- Projected Demand: Global demand for copper is expected to grow significantly, driven by electric vehicles and renewable energy infrastructure.

- Copper World Impact: Hudbay's Copper World project is anticipated to contribute substantially to their copper output, potentially adding around 130,000 tonnes of copper per year once fully operational.

- Market Pricing: The strong market outlook for copper supports Hudbay's ability to achieve favorable pricing for its products.

Hudbay's pricing strategy is deeply influenced by the cost of production, aiming for efficiency to maintain profitability. Their low-cost operations, exemplified by Constancia's $1.55 per pound copper cash cost in 2023, provide pricing flexibility. By-product credits from gold, silver, and zinc further enhance their cost structure, allowing them to compete effectively on price in the global market.

Significant capital investments, such as the approximately $1.1 billion allocated to the Copper World project, underpin Hudbay's long-term pricing power. These expenditures are designed to boost future production capacity and extend mine life, ensuring sustained revenue generation and validating current pricing decisions in anticipation of strong market demand.

The company's pricing is also a direct response to the robust global demand for copper, a key component in the energy transition and infrastructure development. Projects like Copper World, projected to add around 130,000 tonnes of copper annually, position Hudbay to capitalize on these favorable market conditions and achieve competitive pricing.

4P's Marketing Mix Analysis Data Sources

Our HudBay 4P's Marketing Mix Analysis is grounded in comprehensive data, including HudBay's official financial reports, investor relations materials, and detailed operational disclosures. We also integrate insights from reputable industry analyses and market intelligence reports to provide a robust understanding of their product, price, place, and promotion strategies.