HudBay Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

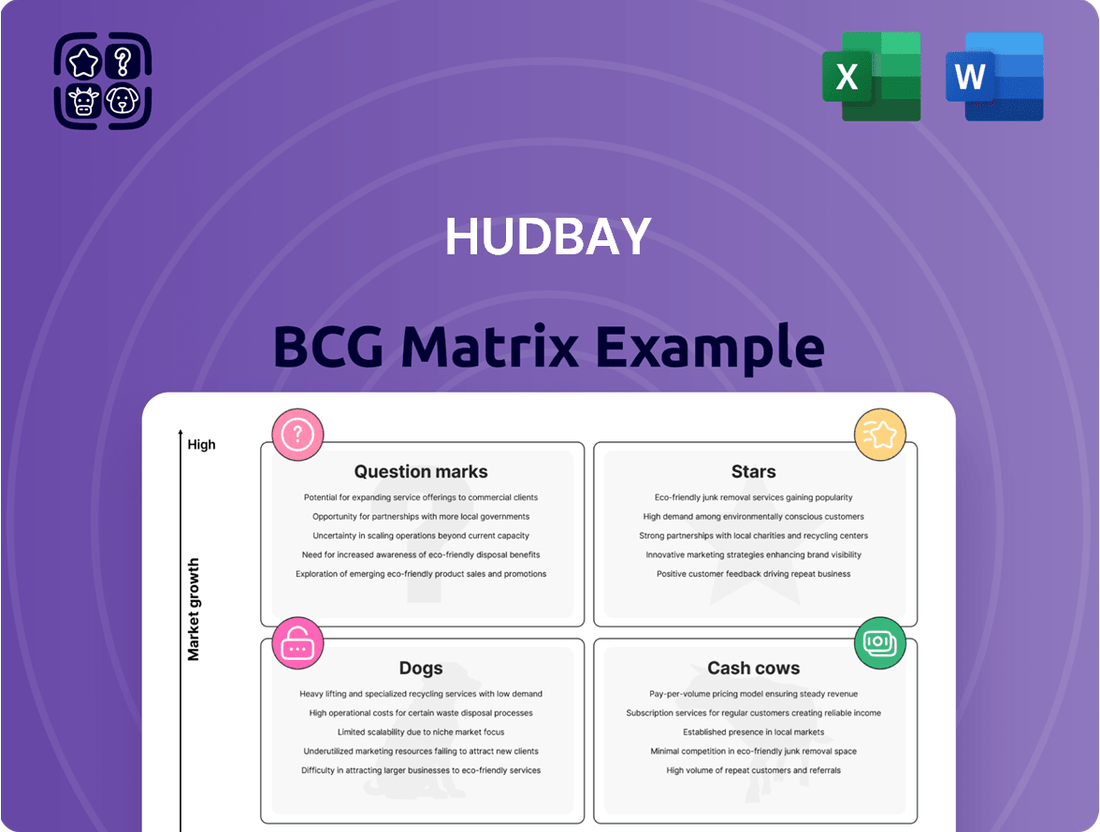

Unlock the strategic power of HudBay's business units with this insightful BCG Matrix preview. See how their mining operations are positioned as potential Stars, Cash Cows, Dogs, or Question Marks in the market.

Don't miss out on the full picture; purchase the complete BCG Matrix report for a detailed breakdown of each segment, revealing actionable strategies for resource allocation and future growth.

Stars

Hudbay's copper production is on a strong upward trend. By 2027, the company anticipates a 17% increase in consolidated copper output compared to its 2024 production figures. This growth is a direct result of ongoing operational improvements and strategic capital investments in its core copper mining assets.

The Copper Mountain mine in British Columbia is a significant asset for Hudbay, currently undergoing crucial optimization efforts. These upgrades are projected to boost its contribution to Hudbay's overall portfolio.

Over the next three years, Copper Mountain is anticipated to achieve an average annual copper production of 44,000 tonnes. This figure is set to see a dramatic increase, with production expected to reach 60,000 tonnes by 2027, representing a remarkable 127% jump from the 2024 output.

This substantial ramp-up in production is primarily driven by ongoing mill improvement projects. These enhancements are strategically designed to unlock greater efficiency and capacity, positioning Copper Mountain as a vital growth engine for Hudbay in the coming years.

Hudbay's Manitoba operations, especially at Snow Lake, are showing robust gold production. This segment is a star performer, with an optimized mine life extending to 2037.

Over the next three years, these operations are projected to average over 193,000 ounces of gold annually. This consistent output in a strong gold market highlights Hudbay's leading position and its significant contribution to overall revenue.

Increasing Gold Revenue Contribution

Gold's role in Hudbay's revenue picture has significantly brightened. In 2024, gold accounted for 35% of the company's total revenues, a notable jump from 29% in 2023. This upward trend is a direct result of favorable gold prices and the company achieving record production levels, with its Manitoba operations being a key driver.

This increasing financial contribution, coupled with a robust gold market, firmly places gold in the 'Star' category of Hudbay's portfolio. Its growing importance suggests it's a high-growth, high-market-share asset.

- Gold Revenue Share: 35% in 2024, up from 29% in 2023.

- Key Drivers: High gold prices and record production, especially from Manitoba.

- Market Position: Strong market conditions support gold's 'Star' status.

- Portfolio Impact: Growing financial significance indicates a key growth area.

Strategic Focus on Copper and Gold

Hudbay's strategic focus on copper and gold positions it firmly as a 'Star' in the BCG Matrix. This is underscored by significant investments in brownfield projects that promise high returns, coupled with a strong pipeline of copper development.

The company's commitment to these metals, which are experiencing robust demand and growth, directly supports its 'Star' classification.

- Copper and Gold Focus: Hudbay is prioritizing copper and gold assets, recognizing their high growth potential and market demand.

- Brownfield Project Investment: The company is investing in existing sites (brownfield) to enhance production and profitability, a key characteristic of 'Stars'.

- Copper Growth Pipeline: A well-defined pipeline of copper projects indicates future expansion and market share growth.

- Market Alignment: This strategic direction aligns Hudbay with sectors experiencing strong demand, reinforcing its 'Star' status.

Hudbay's gold operations, particularly in Manitoba, are a clear 'Star' in its portfolio. These operations are projected to maintain strong annual gold production, exceeding 193,000 ounces over the next three years, with an optimized mine life extending to 2037. Gold's financial contribution to Hudbay is significant, representing 35% of total revenues in 2024, an increase from 29% in 2023, driven by favorable market prices and record output.

This performance, fueled by record production and robust market conditions, solidifies gold's position as a high-growth, high-market-share asset for Hudbay. The increasing financial impact and consistent production highlight its 'Star' status.

| Commodity | 2024 Revenue Share | Projected Annual Production (next 3 yrs) | Mine Life Extension |

|---|---|---|---|

| Gold | 35% | > 193,000 ounces | to 2037 |

| Copper | N/A | 44,000 tonnes (avg. Copper Mountain) | N/A |

What is included in the product

HudBay's BCG Matrix offers a strategic overview of its business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis guides investment decisions, highlighting which units to nurture, harvest, develop, or divest for optimal resource allocation.

Clear visualization of HudBay's portfolio, highlighting underperforming units to focus improvement efforts.

Cash Cows

The Constancia mine in Peru is a cornerstone of Hudbay's portfolio, fitting squarely into the Cash Cow quadrant of the BCG matrix. It consistently delivers robust copper production, averaging over 88,000 tonnes annually, and boasts a projected mine life extending to 2041.

This established operation in a mature market segment reliably generates significant cash flow for Hudbay. Its predictable output and long-term viability make it a key contributor to the company's financial stability.

Hudbay has demonstrated remarkable financial stability, achieving seven consecutive quarters of robust free cash flow generation. This consistent performance culminated in a substantial $583 million in cash and cash equivalents by the end of the first quarter of 2025.

This strong cash position, coupled with a significantly improved balance sheet, provides Hudbay with the financial flexibility to pursue strategic growth opportunities and effectively manage its existing debt obligations.

Hudbay's mature operations are truly shining, showcasing industry-leading cost performance. In the first quarter of 2025, the company reported record low consolidated cash costs, a testament to their rigorous cost control measures.

This exceptional efficiency across their established assets translates directly into high profitability and a robust, sustained cash flow. These mature operations are the bedrock of Hudbay's financial strength, consistently delivering strong margins.

Significant Debt Reduction

Hudbay's strategic focus on deleveraging has yielded impressive results, positioning its mining operations as strong cash cows. In 2024, the company achieved a substantial reduction in net debt, shedding $512 million to end the year with $525.7 million. This aggressive debt management not only strengthens the balance sheet but also frees up capital for reinvestment.

The company's financial health is further underscored by its low leverage ratio. By the first quarter of 2025, Hudbay maintained this ratio at a mere 0.6x. This indicates a robust capacity to manage its obligations and a significant financial cushion.

- Debt Reduction: Hudbay reduced its net debt by $512 million in 2024.

- Year-End Debt: Net debt stood at $525.7 million by the close of 2024.

- Leverage Ratio: The company maintained a low leverage ratio of 0.6x in Q1 2025.

- Financial Stability: This strong financial position supports reinvestment and operational stability.

Established Operating Platform

Hudbay's established operating platform, spanning Canada and Peru, serves as a robust foundation for its metal production. This diversified presence, featuring mines with extended lifespans, translates into a stable and dependable stream of output and revenue. In 2023, Hudbay reported total copper production of 83,892 tonnes and zinc production of 118,683 tonnes, underscoring the reliable output from its established assets.

The company's long-life mines are key to its Cash Cow status within the BCG matrix. These assets consistently generate significant cash flow, supporting ongoing operations and investments in other business segments. For example, the 777 Mine in Manitoba, though nearing the end of its life, has been a consistent producer, contributing substantially to Hudbay's financial performance over the years.

- Diversified Geographic Footprint: Operations in Canada (Manitoba, Saskatchewan) and Peru provide resilience against regional economic fluctuations.

- Long-Life Assets: Mines like Constancia in Peru are projected to operate for many years, ensuring sustained production and cash generation.

- Consistent Production: In the first quarter of 2024, Hudbay's copper production reached 22,066 tonnes, demonstrating ongoing operational stability.

- Revenue Stability: The predictable output from these established mines creates a reliable revenue base, crucial for funding growth initiatives.

Hudbay's established mines, like Constancia, function as its cash cows, consistently generating substantial profits. These operations benefit from mature markets and efficient cost structures, contributing significantly to the company's financial stability. In 2024, Hudbay achieved a notable reduction in net debt by $512 million, ending the year with $525.7 million, and maintained a low leverage ratio of 0.6x in Q1 2025, highlighting the strength of these cash-generating assets.

| Asset | BCG Quadrant | Key Financial Contribution | Production Data (2023) | Mine Life Projection |

|---|---|---|---|---|

| Constancia (Peru) | Cash Cow | Strong, consistent cash flow generation | 88,000+ tonnes copper annually (average) | Projected to 2041 |

| 777 Mine (Manitoba) | Cash Cow (historically) | Substantial contributor to past financial performance | Consistent producer (specific 2023 data not detailed here) | Nearing end of life |

What You’re Viewing Is Included

HudBay BCG Matrix

The HudBay BCG Matrix preview you are currently viewing is the identical, fully-formatted document you will receive immediately after completing your purchase. This means no watermarks, no trial limitations, and no hidden surprises – just the complete, analysis-ready strategic tool ready for your immediate use. You can confidently assess its value and functionality, knowing the purchased version will be exactly the same, allowing for seamless integration into your business planning and decision-making processes. This ensures you get precisely what you need to effectively categorize HudBay's business units and develop informed strategies.

Dogs

Hudbay's zinc production is facing a significant downturn, with projections indicating a potential drop of up to 37% in 2025 when compared to 2024 output. This sharp decline suggests a strategic shift, where the company is actively reducing its focus on zinc in the immediate future to concentrate on other, more promising metals.

Hudbay's zinc production is largely a by-product, meaning it's extracted alongside other primary metals rather than being the main target. For instance, in 2023, while Hudbay produced a significant amount of zinc, the company's strategic focus at its Lalor mine was on extracting higher-grade gold and copper zones. This indicates that direct, substantial investment for expanding zinc output isn't a near-term priority.

The global zinc market is navigating a period of oversupply. Despite a modest uptick in consumption, projections for 2025 indicate that supply will continue to outstrip demand, creating a surplus. This market dynamic, coupled with Hudbay's anticipated reduction in zinc production, positions zinc as a Question Mark in the BCG Matrix.

Lower Strategic Priority for Zinc

Hudbay's strategic direction, as evidenced by its capital allocation and communications, places zinc in a lower priority compared to its copper and gold assets. The company is primarily focused on optimizing its existing operations for these more prominent metals, which naturally translates to reduced investment and anticipated growth for its zinc segment.

This recalibration means that while zinc production continues, the emphasis is on maintaining efficiency rather than aggressive expansion. For instance, in 2024, Hudbay's operational focus has been on maximizing throughput and cost control at its zinc-producing sites, ensuring they remain profitable within the current market conditions.

- Reduced Capital Allocation: Financial reports for 2024 indicate that capital expenditures directed towards zinc projects are significantly lower than those allocated to copper and gold, reflecting the strategic prioritization.

- Operational Optimization: The company's strategy for zinc centers on optimizing existing mine life and operational efficiency, rather than pursuing new exploration or development opportunities.

- Market Sensitivity: While zinc remains a valuable commodity, Hudbay's strategic communications highlight its greater exposure and investment in copper and gold, which are seen as key drivers of future growth.

Silver as a Minor By-product

While Hudbay's silver production saw an increase in 2024, it remains a minor component of their overall operations, primarily generated as a by-product of their copper and gold extraction. This means that while silver output might grow, it's directly tied to the success and scale of their primary metal mining activities.

Despite a global silver market deficit, which suggests strong demand relative to supply, Hudbay's strategic focus and market share are not centered on silver. Their investments and operational decisions are driven by copper and gold, making silver's contribution secondary.

- Hudbay's 2024 silver production is a by-product of copper and gold mining.

- Global silver market experienced a deficit in 2024, indicating robust demand.

- Hudbay's strategic focus and investment are primarily in copper and gold, not silver.

- Limited direct market share or strategic investment in silver for Hudbay.

Hudbay's zinc operations, characterized by declining production and a market facing oversupply, align with the characteristics of a Dog in the BCG Matrix. The company's strategic decision to reduce zinc output by an anticipated 37% in 2025 compared to 2024 underscores this positioning. This move reflects a deliberate shift away from zinc as a primary focus, with capital and operational efforts being redirected towards more promising commodities.

The company's zinc is primarily a by-product, meaning its extraction is incidental to the mining of gold and copper. This inherent characteristic limits the potential for independent growth and investment in the zinc segment. For instance, in 2023, the Lalor mine prioritized higher-grade gold and copper zones, indicating that zinc extraction was secondary to these more valuable resources.

The global zinc market's oversupply in 2025, where demand is expected to be outstripped by supply, further solidifies zinc's Dog status for Hudbay. This unfavorable market condition, coupled with Hudbay's reduced production, suggests that the company is managing this segment for efficiency rather than growth.

Hudbay's capital allocation in 2024 clearly demonstrates this strategic prioritization, with significantly lower expenditures directed towards zinc projects compared to copper and gold. The company's strategy for zinc is focused on optimizing existing mine life and operational efficiency, rather than pursuing new exploration or development opportunities.

| BCG Category | Hudbay's Zinc Segment | Rationale |

| Market Share | Low | Zinc is a by-product, not a primary focus. |

| Market Growth | Low | Global zinc market faces oversupply in 2025. |

| Strategic Focus | Reduced | Anticipated 37% production drop in 2025 vs. 2024. |

Question Marks

The Copper World project in Arizona represents a significant future growth opportunity for Hudbay. It's anticipated to boost the company's overall copper output by more than half once it's up and running.

However, this promising venture demands substantial capital investment in 2025. These funds are earmarked for crucial de-risking activities and detailed feasibility studies, positioning it as a high-investment, low-immediate-return project within the BCG framework.

The 1901 deposit in Snow Lake, Manitoba, is a key element in Hudbay's strategic planning, particularly concerning its zinc assets. While Hudbay's total zinc output has seen a decline, the 1901 deposit is projected to reverse this trend, with production slated to begin in 2027. This development is expected to boost the company's zinc production significantly, marking it as a future growth driver.

From a BCG matrix perspective, the 1901 deposit currently fits the profile of a 'question mark'. It represents a nascent opportunity with considerable future growth potential in the zinc market. However, it currently holds a low market share and requires substantial further investment and development to reach its full production capacity and market impact.

Hudbay is currently executing its most extensive exploration initiative in Snow Lake, a critical component of its growth strategy. This program involves significant drilling activities at key sites like Lalor Northwest and various regional satellite properties. The primary objective is to discover new copper-gold deposits and extend the operational life of existing mines.

These exploration endeavors in Snow Lake are categorized as question marks within the BCG matrix due to their high potential for future growth but also their inherent early-stage risk and substantial capital requirements. For instance, Hudbay allocated $35 million towards exploration in the Snow Lake region during 2023, with further investments planned for 2024 to advance these promising, yet unproven, mineral assets.

Mill Throughput Improvement Projects (BC and Peru)

Hudbay is actively investing in mill throughput improvement projects in both its British Columbia and Peru operations. These strategic initiatives are projected to significantly boost mill throughput levels, with the anticipated impact beginning in 2026.

These investments are crucial for unlocking additional production capacity and enhancing overall operational efficiency. This focus on efficiency represents a forward-looking strategy to drive future growth, even though it currently requires substantial capital outlay.

- Projected Throughput Increase: Expected to commence in 2026, enhancing production volumes.

- Strategic Investment Focus: Capital is being allocated to unlock latent production capacity and improve operational efficiencies.

- Future Growth Driver: These projects are foundational for Hudbay's anticipated future expansion and market positioning.

- Financial Commitment: Significant capital expenditure is earmarked for these critical mill upgrades and enhancements.

Maria Reyna and Caballito Properties (Peru)

Maria Reyna and Caballito properties in Peru represent Hudbay's potential future growth drivers, currently in the exploration and permitting stages. Drill permitting for these prospective sites is progressing, with an anticipated conclusion in 2025.

These projects require capital investment without generating immediate revenue, positioning them as question marks within Hudbay's business portfolio.

- Exploration Phase: Both Maria Reyna and Caballito are in the early stages of exploration.

- Permitting Progress: Drill permitting is advancing, with a target completion in 2025.

- Future Growth Potential: These assets are viewed as key contributors to Hudbay's future production.

- Investment Requirement: Significant investment is needed before any returns can be realized.

Question marks in Hudbay's portfolio represent nascent opportunities with high growth potential but also significant risk and current low market share. These are projects requiring substantial investment to determine their future viability and market impact. Hudbay is actively investing in these areas, aiming to convert them into future stars or cash cows.

| Project | Resource Type | Status | Investment Focus | Potential |

|---|---|---|---|---|

| Copper World | Copper | Development/Feasibility | De-risking, Feasibility Studies | Significant copper output increase |

| 1901 Deposit | Zinc | Exploration/Development | Exploration, Development | Reversal of zinc production decline |

| Snow Lake Exploration | Copper, Gold | Exploration | Drilling, Discovery | New deposits, Extended mine life |

| Maria Reyna & Caballito | Various | Exploration/Permitting | Drilling, Permitting | Future production contributors |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.