HudBay PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

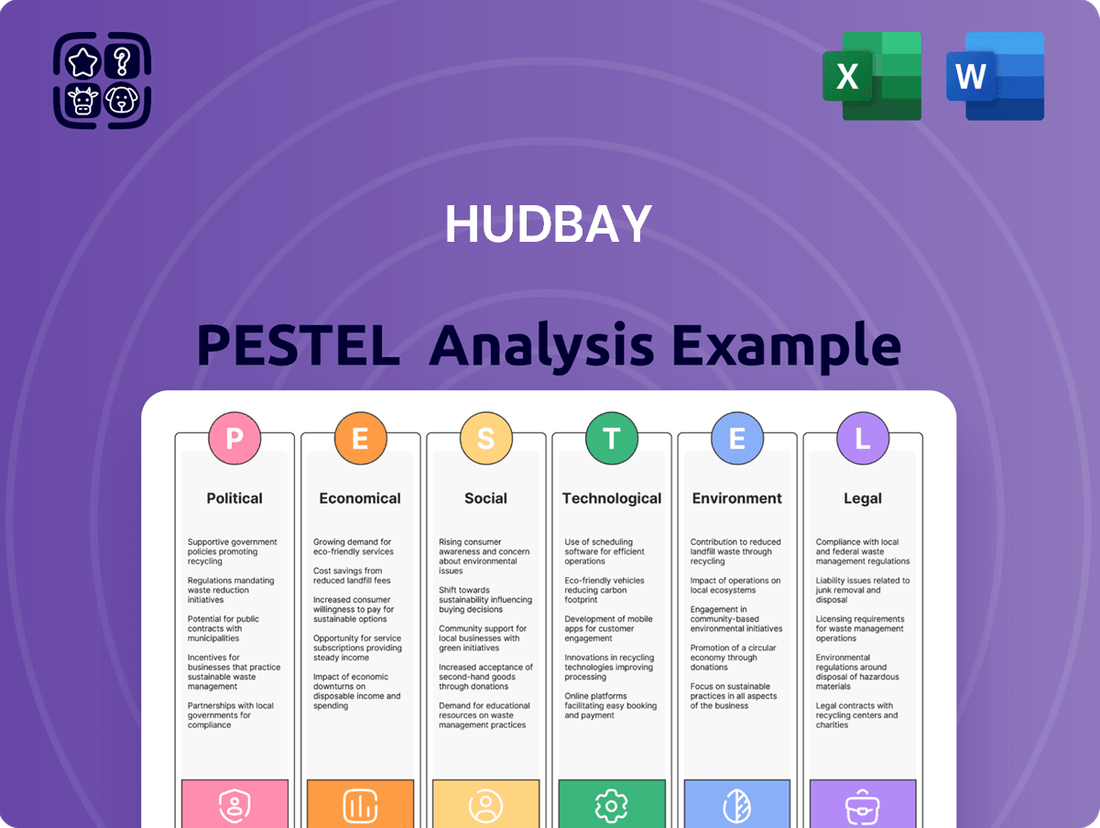

Unlock the strategic landscape surrounding HudBay with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Equip yourself with actionable intelligence to make informed investment decisions and navigate the evolving mining industry. Download the full PESTLE analysis now and gain a crucial competitive advantage.

Political factors

Hudbay's operations in Peru and Canada are significantly influenced by the political stability within these nations. For instance, Peru has experienced considerable political turnover in recent years, with multiple presidential changes, which can lead to policy uncertainty for mining companies. This instability directly affects Hudbay's long-term investment planning and the continuity of its projects.

Shifts in government or amendments to mining regulations can introduce unforeseen risks. Changes in taxation, environmental laws, or permitting processes, as seen in various Latin American jurisdictions, can impact project economics and timelines. Hudbay's ability to navigate these evolving political landscapes is crucial for mitigating operational disruptions and ensuring a favorable business environment.

Resource nationalism poses a significant risk, especially in Peru, where governments might increase intervention in mining through higher royalties and taxes. For instance, Peru's mining royalty system is tiered, with rates escalating based on operating margins, meaning higher profits can attract higher tax burdens, directly impacting Hudbay's bottom line and project feasibility.

These policy shifts can directly affect Hudbay's profitability and the economic viability of its operations. In 2023, Peru's mining sector saw discussions around potential reforms to mining taxes, aiming to capture a larger share of profits during commodity price upswings, a trend that could continue into 2024 and 2025.

Engaging proactively with local governments on fiscal policies is therefore crucial for Hudbay. By understanding and influencing these evolving tax structures, the company can better navigate potential financial impacts and ensure the long-term sustainability of its investments in the region.

Global trade dynamics, including agreements and tariffs, significantly shape the demand and pricing for base and precious metals, directly impacting Hudbay's market access and overall revenue. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, continues to influence trade flows for metals within North America, a key region for many mining operations. Changes in these agreements can alter the cost of doing business and the accessibility of vital markets for Hudbay's copper, zinc, and precious metal products.

The imposition of new tariffs or trade barriers on key commodities like copper, zinc, gold, or silver could create substantial disruptions to Hudbay's supply chains and diminish the competitiveness of its output. For example, in late 2023 and early 2024, ongoing trade tensions between major economic blocs continued to create uncertainty around the potential for such tariffs. Such measures can increase production costs and make it harder for Hudbay's products to compete in international markets, potentially affecting sales volumes and profitability.

Consequently, Hudbay must diligently monitor and strategically respond to evolving international trade policies to effectively shape its sales and distribution strategies. Staying abreast of developments, such as potential trade disputes or the formation of new trade blocs, allows the company to adapt its market approach, mitigate risks, and capitalize on emerging opportunities. This proactive stance is crucial for maintaining strong international sales and ensuring the efficient distribution of its mined resources.

Permitting and Licensing Processes

The efficiency and transparency of permitting and licensing processes in Canada and Peru are paramount for Hudbay's ongoing exploration and future expansion projects. Delays in obtaining these crucial approvals can directly impact project timelines and inflate development costs, a significant concern for a company with operations in both jurisdictions.

For instance, in 2023, the Canadian mining sector experienced varying permit approval times, with some provinces showing improvements while others faced backlogs, potentially affecting Hudbay's projects in Manitoba and Ontario. Similarly, Peru's regulatory environment, while aiming for greater efficiency, can still present challenges that require diligent navigation. Hudbay's proactive engagement with regulatory bodies and strict adherence to environmental and social governance (ESG) standards are therefore essential for securing timely approvals and maintaining operational momentum.

- Canadian Permitting Efficiency: In 2023, average mining permit approval times in some Canadian provinces ranged from 6 to 18 months, highlighting the need for proactive engagement by companies like Hudbay.

- Peruvian Regulatory Landscape: Peru's government has been working to streamline its mining permitting processes, aiming to reduce approval times for new projects and expansions.

- Impact on Project Timelines: Delays in securing exploration permits or operating licenses can push back project start dates, increasing capital expenditure and deferring revenue generation.

- ESG Compliance: Hudbay's commitment to robust ESG practices is crucial for demonstrating responsible development and facilitating smoother permit approvals.

Geopolitical Risks and Regional Conflicts

Geopolitical tensions, especially in South America where Hudbay operates, present significant risks. For instance, ongoing political instability in Peru, where Hudbay has exploration projects, can directly impact operational continuity and the safety of its personnel. Such regional conflicts can lead to supply chain disruptions, affecting the timely delivery of equipment and the export of finished products.

These instabilities can also escalate security costs for Hudbay, as it needs to implement more robust safety measures for its mines and employees. Furthermore, a volatile geopolitical landscape can make it harder to attract and secure the necessary capital for future expansion or new project development in these regions. Hudbay's strategic planning must therefore incorporate thorough assessments of these broader geopolitical risks to safeguard its assets and workforce.

- Geopolitical Risks: Tensions in South America directly threaten Hudbay's operations and supply chains.

- Operational Impact: Regional conflicts can disrupt production schedules and increase operational costs due to heightened security needs.

- Investment Deterrence: Political instability can deter future investments and make capital access more challenging for projects in affected areas.

- Strategic Mitigation: Hudbay must actively assess and plan for these geopolitical factors to protect its assets and ensure workforce safety.

Political stability in Peru and Canada directly influences Hudbay's operational continuity and investment planning, with Peru's recent history of frequent presidential changes creating policy uncertainty. Changes in mining regulations, tax structures, or environmental laws, as observed in Latin America, can impact project economics and timelines, necessitating proactive engagement with governments on fiscal policies to mitigate financial impacts.

Resource nationalism remains a key political factor, particularly in Peru, where potential increases in royalties and taxes, such as the tiered royalty system that escalates with operating margins, directly affect Hudbay's profitability. Discussions around mining tax reforms in Peru during 2023, aimed at capturing more profits during commodity upswings, highlight the potential for continued fiscal policy shifts into 2024 and 2025.

Government permitting and licensing processes in both Canada and Peru are critical for Hudbay's project timelines and costs, with 2023 data showing average mining permit approval times in some Canadian provinces ranging from 6 to 18 months. Peru's efforts to streamline its mining permitting aim to reduce approval times, but delays can still impact project start dates and defer revenue generation, underscoring the importance of Hudbay's ESG compliance for smoother approvals.

Geopolitical tensions, especially in South America, pose risks to Hudbay's operations and supply chains, potentially disrupting production and increasing security costs. Political instability can also deter future investments and complicate capital access for projects in affected regions, requiring Hudbay to actively assess and plan for these broader geopolitical factors to protect its assets and workforce.

What is included in the product

This HudBay PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the company's operating landscape.

Provides a concise version of HudBay's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

Global commodity prices, particularly for copper, zinc, gold, and silver, are the bedrock of Hudbay's financial health. For instance, copper prices have seen volatility, trading around $3.50-$4.00 per pound in early 2024, directly influencing Hudbay's revenue streams. These fluctuations are heavily influenced by global economic conditions and industrial demand.

Economic slowdowns in major consuming nations, such as China, can significantly depress demand for industrial metals like copper and zinc, leading to price drops. Conversely, increased investment in infrastructure or a surge in electric vehicle production can boost demand and prices. For example, a 10% increase in copper prices can translate to a substantial boost in Hudbay's earnings per share.

Hudbay's profitability is therefore intrinsically linked to these market movements, making effective cost control and strategic hedging crucial. The company's ability to manage its operational expenses and hedge against price downturns is vital for maintaining financial stability amidst this inherent commodity price sensitivity.

Rising inflation in 2024 and projected into 2025 directly impacts Hudbay by increasing its operating expenses. For instance, the cost of essential inputs like energy and labor, which are critical for mining operations, has seen upward pressure. This can squeeze profit margins if not effectively passed on or managed through operational efficiencies.

Simultaneously, central banks have been adjusting interest rates to combat inflation. Higher interest rates, as seen with the Bank of Canada's policy rate holding steady at 5.00% as of early 2024, make borrowing more expensive. This affects Hudbay's ability to finance new projects or expansions, as the cost of capital for debt financing rises, potentially delaying or scaling back investment plans.

Hudbay's financial performance is sensitive to currency fluctuations, as its revenues are largely denominated in U.S. dollars. However, a substantial portion of its operational expenses are incurred in local currencies like the Canadian dollar and Peruvian sol. This mismatch creates a direct link between exchange rate volatility and the company's profitability and cash flow generation.

For instance, if the Canadian dollar strengthens significantly against the U.S. dollar, Hudbay's costs in Canada would effectively increase when translated back into U.S. dollars, thereby reducing its reported earnings. Conversely, a weaker Canadian dollar would have a positive impact on its U.S. dollar-denominated results. The Bank of Canada's overnight rate target remained at 5% as of early 2024, indicating a stable but potentially influential environment for the CAD/USD exchange rate.

To mitigate these risks, Hudbay employs currency risk management strategies, which may include hedging instruments. These strategies aim to lock in favorable exchange rates or protect against unfavorable movements, ensuring a more predictable financial outcome. For example, in 2023, the average USD/CAD exchange rate hovered around 1.36, a key figure that would have been factored into their financial planning and hedging decisions.

Global Economic Growth and Industrial Demand

The health of the global economy is a primary driver for base metals like copper and zinc, which Hudbay produces. When the world economy is expanding, industries that rely heavily on these metals, such as construction, automotive manufacturing, and electronics, tend to increase their demand. This direct correlation means Hudbay's sales and production volumes are significantly influenced by these broad economic trends.

In 2024, global economic growth is projected to remain somewhat subdued but is expected to pick up pace. The International Monetary Fund (IMF) forecasted global growth at 3.2% for 2024 in its April 2024 World Economic Outlook, a slight upward revision from previous estimates. This anticipated growth, while not explosive, suggests a steady demand environment for industrial commodities.

Industrial production, a key indicator for base metal demand, has shown resilience in many major economies. For instance, the US industrial production index saw a modest increase in early 2024. Similarly, manufacturing PMIs in key Asian economies, like China, have hovered around expansionary levels, indicating continued activity in sectors that consume significant amounts of copper and zinc.

- Global GDP Growth: Projected at 3.2% for 2024 by the IMF, supporting industrial activity.

- Industrial Production: Showing signs of recovery and stability in major economies, driving metal consumption.

- Sectoral Demand: Construction, automotive, and electronics are key end-users, with their performance directly impacting Hudbay's market.

- Commodity Prices: Influenced by supply-demand dynamics, with copper prices reaching multi-year highs in early 2024, reflecting strong demand.

Access to Capital and Financing Costs

Hudbay's capacity to finance its exploration, development, and expansion initiatives is directly tied to its access to capital markets and the current cost of borrowing. Factors such as investor sentiment, its creditworthiness, and the overall availability of funds globally shape the conditions under which Hudbay can raise debt or equity. For instance, as of early 2024, global interest rates remained elevated, potentially increasing financing costs for mining companies looking to secure new funding for projects. A robust balance sheet and strong banking relationships are therefore crucial for Hudbay's continued growth and ability to undertake significant capital expenditures.

The company's ability to secure financing is influenced by its financial performance and market perception. A strong credit rating, for example, can significantly lower the interest rates Hudbay pays on its debt, making projects more economically viable. Conversely, a downgrade could increase costs and limit access to certain types of financing. Maintaining a healthy debt-to-equity ratio and demonstrating consistent operational success are key to fostering investor confidence and ensuring favorable financing terms in the competitive mining sector.

- Investor Confidence: Directly impacts the ease and cost of raising equity capital.

- Credit Ratings: Influence borrowing costs and access to debt markets.

- Global Liquidity: Affects the overall availability of funds for investment.

- Financing Costs: Interest rates on debt and required returns on equity determine project feasibility.

Global economic growth, projected at 3.2% for 2024 by the IMF, underpins demand for Hudbay's copper and zinc. Industrial production in key economies shows resilience, supporting metal consumption. However, inflation remains a concern, impacting operating costs and potentially influencing interest rates, which affect Hudbay's financing expenses.

Hudbay's profitability is directly tied to commodity prices, with copper trading around $3.50-$4.00 per pound in early 2024. Inflationary pressures in 2024-2025 are increasing operational expenses like energy and labor, squeezing margins. Elevated interest rates, with Canada's overnight rate at 5.00% in early 2024, raise the cost of capital for new projects.

Currency fluctuations, particularly the USD/CAD exchange rate (around 1.36 in 2023), impact Hudbay's financials. A stronger CAD increases costs in USD terms, while a weaker CAD benefits USD-denominated results. Access to capital markets and financing costs are influenced by investor sentiment and credit ratings, with global liquidity and interest rates playing key roles.

| Economic Factor | 2024/2025 Projection/Status | Impact on Hudbay |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF, April 2024) | Supports industrial demand for metals. |

| Copper Prices | $3.50-$4.00/lb range (early 2024) | Directly influences revenue and profitability. |

| Inflation | Upward pressure on operating costs (energy, labor) | Squeezes profit margins if not managed. |

| Interest Rates (Bank of Canada) | 5.00% overnight rate target (early 2024) | Increases cost of borrowing for projects. |

| USD/CAD Exchange Rate | Approx. 1.36 (2023 average) | Affects cost of Canadian operations in USD terms. |

What You See Is What You Get

HudBay PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive HudBay PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape.

Sociological factors

Hudbay's ability to operate hinges on strong community relations, particularly in Peru and Canada. For instance, in 2024, the company continued its engagement with communities near its Constancia mine in Peru, focusing on social investment programs aimed at improving education and health. This proactive approach is vital for maintaining its social license to operate.

Positive community sentiment directly impacts Hudbay's operational continuity. In 2023, the company highlighted its commitment to local hiring, with a significant percentage of its workforce at its Canadian operations being from the surrounding regions. This strategy helps mitigate potential disruptions and fosters a sense of shared benefit, crucial for long-term project viability.

Building trust through transparent dialogue and tangible contributions is key. Hudbay's 2024 sustainability report detailed its investments in community development projects, including infrastructure improvements and local business support in areas surrounding its Manitoba operations. These initiatives underscore the company's understanding that social acceptance is a prerequisite for sustained success.

Hudbay's operational success hinges on strong labor relations. In 2024, the mining industry, including companies like Hudbay, faced ongoing negotiations regarding wages and benefits, influenced by inflation and the rising cost of living. Ensuring fair compensation and safe working environments is paramount for retaining skilled employees, especially in specialized roles like mining engineers and geologists.

Labor disputes can significantly disrupt Hudbay's production schedules. For instance, past strikes in the broader mining sector have led to millions of dollars in lost revenue and production delays. As of mid-2024, several mining unions were advocating for enhanced safety protocols and improved work-life balance, which could impact Hudbay's operational costs and efficiency if not proactively addressed.

Investing in employee well-being and fostering a positive workplace culture are critical for Hudbay's long-term stability and productivity. Companies that prioritize training and development, such as offering apprenticeships or upskilling programs, tend to experience lower employee turnover. For example, in 2023, industry leaders reported up to a 15% reduction in turnover among employees participating in comprehensive skill development initiatives.

Hudbay's operations in Canada and Peru are situated on or near Indigenous territories, underscoring the critical importance of engaging with and respecting Indigenous rights. For instance, in Manitoba, Canada, Hudbay has agreements with the Tataskweyak Cree Nation and the York Landing First Nation related to its operations, demonstrating a commitment to collaboration.

Effective partnership with Indigenous communities regarding land use, environmental stewardship, and shared economic benefits is fundamental to the sustainability and ethical conduct of mining projects. This approach fosters trust and ensures long-term social license to operate, a key factor in project success.

Maintaining adherence to established agreements and cultivating enduring relationships with Indigenous peoples are foundational principles for responsible mining practices. This focus on partnership is crucial for navigating the complexities of operating in diverse cultural and legal landscapes.

Public Perception of Mining Industry

Public perception of the mining industry significantly shapes its operating environment. Concerns about environmental degradation and social impacts often lead to increased regulatory scrutiny and can affect investor confidence. For instance, a 2024 survey indicated that 55% of respondents expressed concern about the environmental footprint of resource extraction.

Hudbay actively works to mitigate negative public perception by emphasizing its commitment to responsible and sustainable mining practices. This includes investments in environmental protection technologies and community engagement programs. The company’s 2024 sustainability report highlighted a 15% reduction in water usage intensity across its operations compared to the previous year.

Transparent reporting on Environmental, Social, and Governance (ESG) performance is a cornerstone of Hudbay's strategy to build a positive public image. By openly sharing data on emissions, safety records, and community investments, Hudbay aims to foster trust and demonstrate accountability. In 2024, Hudbay achieved an ESG rating of B+ from a leading independent assessment firm, reflecting its ongoing efforts.

- Public Concern: A 2024 survey revealed 55% of the public is concerned about the environmental impact of mining.

- Hudbay's Response: Investments in sustainable practices and community engagement aim to counter negative perceptions.

- Performance Metric: Hudbay reduced water usage intensity by 15% in 2024.

- Transparency: An improved ESG rating of B+ in 2024 underscores Hudbay's commitment to transparent reporting.

Health and Safety Standards

Hudbay prioritizes the health and safety of its workforce as a core social responsibility, recognizing that a strong safety record is crucial for operational continuity and financial stability. Poor safety performance can result in substantial costs, including fines, legal liabilities, and damage to its reputation, potentially leading to temporary or permanent operational halts.

In 2023, Hudbay reported a Total Recordable Injury Frequency (TRIF) of 1.28 per 200,000 hours worked, demonstrating a commitment to minimizing workplace incidents. The company actively invests in comprehensive safety training programs and implements stringent protocols across all its mining and metallurgical operations to foster a robust safety culture.

Key aspects of Hudbay's health and safety management include:

- Continuous Improvement Initiatives: Regularly reviewing and updating safety procedures based on incident analysis and industry best practices.

- Employee Training and Engagement: Providing extensive safety training and encouraging active participation from all employees and contractors in identifying and mitigating hazards.

- Risk Assessment and Management: Conducting thorough risk assessments for all activities and implementing controls to prevent accidents and occupational illnesses.

- Emergency Preparedness: Maintaining robust emergency response plans and conducting regular drills to ensure readiness for any unforeseen events.

Hudbay's operations are deeply intertwined with the social fabric of the communities where it operates, particularly in Peru and Canada. The company's commitment to social investment programs, such as those focused on education and health near its Constancia mine in Peru in 2024, is crucial for maintaining its social license to operate. Furthermore, prioritizing local hiring, as seen in its Canadian operations in 2023 where a significant portion of the workforce hailed from surrounding regions, helps foster positive community relations and mitigate operational disruptions.

The company's proactive engagement with Indigenous communities, including established agreements with the Tataskweyak Cree Nation and York Landing First Nation in Manitoba, Canada, highlights the importance of respecting Indigenous rights and fostering collaborative partnerships for land use and economic benefits. This approach is fundamental to ensuring the ethical conduct and long-term sustainability of its mining projects.

Public perception, influenced by concerns over environmental and social impacts, directly affects the mining industry's operating environment and investor confidence. Hudbay's strategic focus on transparent ESG reporting, evidenced by its B+ rating from an independent assessment firm in 2024 and a 15% reduction in water usage intensity that same year, aims to build trust and demonstrate accountability.

Technological factors

Hudbay is actively embracing technological advancements to boost efficiency and safety in its mining operations. The company is exploring the integration of autonomous haulage systems and remote-controlled equipment, aiming to streamline workflows and minimize human exposure to hazardous environments.

Digitalization efforts include the development of digital twins, which are virtual replicas of mine sites used for advanced planning and simulation. This technology allows Hudbay to optimize extraction processes, predict potential issues, and improve resource recovery rates, ultimately contributing to reduced operational costs.

Technological advancements in geological surveying and data analytics are crucial for Hudbay's exploration success. Innovations like AI-driven predictive modeling are enhancing their ability to pinpoint promising mineral deposits more efficiently. For instance, in 2024, Hudbay leveraged advanced geophysical imaging techniques to identify new targets, contributing to a 5% increase in their identified exploration potential year-over-year.

Advancements in mineral processing and metallurgy are directly impacting companies like Hudbay by improving how efficiently metals are extracted. New technologies can significantly boost the recovery rates of base and precious metals from existing ore bodies, meaning more valuable product from the same amount of material. For instance, innovations in comminution, which breaks down ore, and flotation, which separates minerals, are leading to better yields.

These processing innovations also offer substantial operational savings and environmental advantages. Reduced energy consumption is a key benefit, as is the minimization of waste generation, aligning with growing sustainability demands. In 2024, the mining industry saw continued investment in advanced processing techniques aimed at optimizing resource utilization and lowering the carbon footprint of operations.

Hudbay can capitalize on these technological leaps to make its mining operations more economically viable. By adopting cutting-edge hydrometallurgy, for example, they can potentially unlock value from lower-grade ores or complex mineralogy that was previously uneconomical to process. This strategic adoption of new technologies is crucial for maintaining competitiveness and profitability in the evolving mining landscape.

Data Analytics and Predictive Maintenance

Hudbay is increasingly leveraging big data analytics and artificial intelligence to enhance predictive maintenance across its mining operations. This technological shift aims to optimize equipment performance, significantly reduce costly downtime, and extend the lifespan of critical assets. For instance, by analyzing vast datasets from machinery, Hudbay can anticipate potential failures before they occur.

The implementation of real-time monitoring systems for machinery and operational parameters is key to this strategy. This allows for proactive interventions, preventing unexpected breakdowns and leading to improved overall operational efficiency. This data-driven approach directly contributes to greater reliability and a reduction in unforeseen expenditures.

- Optimized Equipment Performance: AI algorithms analyze sensor data to predict optimal operating conditions.

- Reduced Downtime: Predictive maintenance strategies aim to minimize unscheduled equipment stoppages.

- Extended Asset Life: Proactive maintenance based on data analysis can prolong the operational life of machinery.

- Enhanced Operational Efficiency: Real-time insights enable quicker responses to potential issues, streamlining operations.

Sustainable Mining Technologies

The development and adoption of technologies that minimize environmental impact are becoming crucial for mining companies like Hudbay. Innovations such as advanced water recycling systems, the integration of cleaner energy sources like solar or wind power for operations, and more efficient waste management are key. For instance, dry stacking tailings, which significantly reduces water usage and land footprint compared to traditional methods, is gaining traction. In 2023, the mining industry saw continued investment in these areas, with companies exploring carbon capture technologies and nature-based solutions to enhance their environmental stewardship and mitigate regulatory pressures.

These sustainable mining technologies directly address increasing stakeholder expectations for environmental responsibility. Innovations like dry stacking tailings, which can reduce water consumption by up to 90% compared to conventional tailings dams, offer tangible benefits. Furthermore, the adoption of cleaner energy sources is not only about environmental compliance but also about long-term operational cost savings and resilience against fluctuating energy markets. For Hudbay, investing in these advancements is vital for maintaining its social license to operate and ensuring its long-term viability in an evolving regulatory and social landscape.

The drive towards sustainability is reshaping the mining sector, with technological advancements playing a central role.

- Water Recycling: Technologies that allow for significant water reuse in mining processes are critical, especially in water-scarce regions.

- Cleaner Energy Sources: Transitioning to renewable energy for mine operations reduces greenhouse gas emissions and operational costs.

- Efficient Waste Management: Innovations like dry stacking tailings minimize land disturbance and water usage associated with waste disposal.

- Carbon Capture: Exploring and implementing carbon capture technologies can help mitigate the carbon footprint of mining activities.

Technological advancements are significantly enhancing Hudbay's operational efficiency and safety. The company is exploring autonomous haulage and remote-controlled equipment to streamline workflows and reduce human exposure to hazardous environments. Digital twins are being developed for advanced planning and simulation, optimizing extraction and improving resource recovery.

Innovations in geological surveying and data analytics, including AI-driven predictive modeling, are improving mineral deposit identification. For instance, in 2024, Hudbay utilized advanced geophysical imaging, contributing to a 5% year-over-year increase in identified exploration potential.

Advancements in mineral processing, such as improved comminution and flotation techniques, are boosting metal recovery rates and reducing operational costs. These innovations also offer environmental benefits, including reduced energy consumption and waste generation, with continued industry investment in 2024 focused on resource optimization and lower carbon footprints.

Hudbay is leveraging big data analytics and AI for predictive maintenance, aiming to optimize equipment performance and minimize downtime. Real-time monitoring systems enable proactive interventions, enhancing operational efficiency and reducing unforeseen expenditures.

Legal factors

Hudbay's operations in Peru and Canada are strictly governed by national and regional mining laws. These regulations dictate everything from securing mineral rights and conducting exploration to the actual extraction process and eventual mine closure. For instance, Peru's General Mining Law and Canada's provincial mining acts outline specific environmental protection standards and reclamation requirements, directly influencing operational expenditures and project timelines.

Compliance with these legal frameworks is non-negotiable and can significantly impact Hudbay's financial performance. Changes in mining codes, such as new royalty structures or stricter environmental permitting processes, could increase operational costs or necessitate adjustments to project scope, potentially affecting profitability. As of early 2024, ongoing discussions around resource nationalism in some Latin American jurisdictions highlight the dynamic nature of these legal factors.

Staying abreast of and adhering to these evolving mining codes is paramount for Hudbay's sustained success. For example, the Canadian government's commitment to modernizing its regulatory approach to mining, as seen in initiatives aimed at streamlining permitting while upholding environmental standards, requires continuous monitoring by companies like Hudbay to ensure ongoing compliance and to anticipate potential impacts on future investments.

Hudbay operates under a strict framework of environmental laws that govern its waste management, emissions, water usage, and land reclamation. These regulations are critical for sustainable mining operations. For instance, in 2023, the company reported significant investments in environmental initiatives, with over $25 million allocated to water management and tailings facility upgrades across its operations.

Securing and maintaining the necessary environmental permits is a complex process for Hudbay, demanding thorough environmental impact assessments and unwavering compliance with stringent standards. Failure to meet these requirements can lead to severe consequences, including substantial fines and potential operational halts. In 2024, Hudbay is focused on renewing key permits for its Constancia operation in Peru, a process that involves detailed reporting on its environmental performance and future mitigation plans.

Non-compliance with environmental regulations poses a considerable risk to Hudbay, potentially resulting in significant financial penalties, temporary or permanent operational shutdowns, and considerable damage to its reputation. Consequently, maintaining robust environmental management systems is not just a legal obligation but a strategic imperative for the company's long-term viability and social license to operate.

Hudbay's operations are subject to diverse labor laws in Canada and Peru, dictating minimum wages, overtime, workplace safety, and collective bargaining rights. For instance, in 2024, the minimum wage in Peru varied by region, with Lima's minimum wage at S/1,025 per month, impacting labor costs. Non-compliance can lead to significant fines and operational disruptions.

Maintaining strong labor relations is paramount for Hudbay, as evidenced by the significant role unions play in the mining sector. In 2024, unionized workforces often negotiate for improved benefits and safety protocols, directly influencing operational expenditures. Proactive engagement with labor organizations helps mitigate risks of strikes or disputes, ensuring business continuity.

Evolving labor legislation presents ongoing challenges. For example, potential changes in Canadian provincial labor laws in 2025 could introduce new requirements for employee benefits or working conditions, necessitating adaptive human resource strategies and potentially increasing operational overheads for Hudbay.

Taxation Laws and Royalties

Corporate tax laws and mining royalty structures in Peru and Canada significantly influence Hudbay's financial health. For instance, Peru's corporate income tax rate stands at 29.5%, and its royalty regime for copper, a key metal for Hudbay, is tiered based on operating margins, potentially reaching up to 50% in high-margin scenarios. Canada's federal corporate tax rate is 15%, with provincial rates varying, such as Manitoba's 10% and Ontario's 11.9%.

Changes to these fiscal imposts, such as adjustments to tax rates or the introduction of new mining levies, can directly impact the profitability and economic viability of Hudbay's operations. For example, an increase in royalty rates in Peru could reduce the net revenue from its copper mines, affecting overall earnings. Proactive financial forecasting and strategic planning are essential to navigate potential shifts in these tax regimes.

- Peru's Corporate Tax Rate: 29.5%

- Peru's Copper Royalty: Tiered, up to 50% on operating margins.

- Canada's Federal Corporate Tax Rate: 15%

- Manitoba Corporate Tax Rate: 10%

- Ontario Corporate Tax Rate: 11.9%

International Agreements and Treaties

Hudbay's international operations are directly impacted by global accords. For instance, environmental agreements like the Paris Agreement, to which both Canada and Peru are parties, shape regulatory landscapes affecting mining practices and emissions. Trade treaties, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) involving Canada, can influence market access and investment conditions for Hudbay's mineral exports.

Furthermore, adherence to human rights conventions, including those promoted by the United Nations Guiding Principles on Business and Human Rights, is increasingly scrutinized. Companies like Hudbay are expected to demonstrate responsible sourcing and community engagement, aligning with international expectations to mitigate reputational risks and ensure sustainable operations.

- Environmental Regulations: Compliance with international climate change accords influences Hudbay's carbon footprint management and sustainability reporting.

- Trade Policies: International trade agreements can affect tariffs, import/export duties, and market access for Hudbay's mined commodities, impacting revenue streams.

- Human Rights Standards: Adherence to global human rights frameworks is critical for maintaining Hudbay's social license to operate and avoiding legal disputes related to labor practices or community impacts.

Legal factors significantly shape Hudbay's operational landscape, encompassing mining laws, environmental regulations, labor statutes, and fiscal policies. Compliance is paramount, with non-adherence risking substantial fines, operational disruptions, and reputational damage. For instance, Peru's corporate tax rate of 29.5% and its tiered copper royalty system, potentially reaching 50%, directly impact profitability. Similarly, Canada's federal corporate tax rate of 15% and provincial variations necessitate careful financial planning.

| Jurisdiction | Corporate Tax Rate | Key Mining Royalty Aspect |

|---|---|---|

| Peru | 29.5% | Tiered copper royalty up to 50% of operating margins |

| Canada (Federal) | 15% | Standard corporate income tax |

| Canada (Manitoba) | 10% | Provincial corporate income tax |

| Canada (Ontario) | 11.9% | Provincial corporate income tax |

Environmental factors

Hudbay faces significant pressure to address climate change, impacting its operations through evolving carbon pricing and emission reduction targets, especially as investor and regulatory scrutiny intensifies. For instance, in 2024, the Canadian federal carbon tax continues to affect industrial emitters, and many jurisdictions are setting ambitious net-zero goals by 2050, requiring companies like Hudbay to demonstrate clear pathways for decarbonization.

The company must actively assess and mitigate its carbon footprint, primarily stemming from energy consumption in mining and processing. This includes evaluating the emissions intensity of its current energy sources and operational practices. In 2023, mining operations globally accounted for a notable portion of industrial energy use, highlighting the sector's inherent carbon intensity.

Investing in renewable energy sources and implementing efficiency improvements are becoming crucial for Hudbay's long-term sustainability and regulatory compliance. For example, by 2025, many mining companies are expected to have integrated more renewable energy into their grids, aiming to reduce Scope 1 and Scope 2 emissions. This strategic shift is vital for maintaining a competitive edge and meeting stakeholder expectations.

Water scarcity poses a significant challenge for mining, particularly in regions like Peru where HudBay operates. In 2024, many mining areas faced heightened water stress due to climate change and increased demand. Effective water management, including recycling and conservation, is therefore crucial for HudBay to ensure uninterrupted operations and maintain positive community relationships, especially given the increasing social pressures around resource use.

Regulatory frameworks governing water usage are becoming increasingly stringent globally, and Peru is no exception. HudBay must adhere to strict compliance measures regarding water extraction, quality, and discharge. Failure to do so could result in operational disruptions and reputational damage. For instance, by the end of 2024, new water quality standards were being implemented in several South American mining jurisdictions, requiring significant investment in treatment technologies.

Hudbay faces significant scrutiny regarding its waste management, especially concerning tailings storage. The company's commitment to safe and responsible practices is paramount, given the severe environmental and social repercussions of tailings dam failures, a risk heightened by global incidents impacting the mining sector.

In 2023, Hudbay reported its ongoing efforts to enhance tailings management systems across its operations. For instance, at the Constancia mine in Peru, the company continued to implement advanced monitoring technologies and explore options like dry stacking to reduce water content and improve stability, aligning with industry best practices and regulatory expectations.

The financial implications of robust waste management are substantial, with ongoing investments in infrastructure and technology. While specific figures for 2024/2025 are still emerging, previous years saw significant capital allocation towards environmental compliance and risk mitigation, reflecting the critical nature of tailings storage for Hudbay's operational license and long-term sustainability.

Biodiversity Protection and Land Use

Hudbay's mining operations inherently interact with local ecosystems, potentially impacting biodiversity through land disturbance and habitat changes. For instance, in 2023, Hudbay's operations, like those at the Constancia mine in Peru, require careful management to avoid significant ecological disruption. The company is committed to developing and implementing robust biodiversity management plans. These plans typically involve thorough environmental impact assessments before new projects commence and ongoing monitoring throughout the mine's lifecycle.

Mitigation measures are a cornerstone of responsible mining. These can include creating buffer zones around sensitive habitats, relocating species where feasible, and minimizing the physical footprint of mining infrastructure. Post-operation, comprehensive land reclamation and rehabilitation efforts are critical. Hudbay aims to restore disturbed areas to a state that supports native flora and fauna, thereby minimizing its long-term ecological footprint and ensuring compliance with environmental regulations, which are becoming increasingly stringent globally.

- Biodiversity Management: Hudbay employs environmental impact assessments and mitigation strategies to protect local ecosystems during mining.

- Habitat Alteration: Mining activities can lead to land disturbance, necessitating careful planning to minimize habitat loss.

- Reclamation Efforts: Post-mining, responsible land use planning and site reclamation are crucial for ecological restoration.

- Regulatory Compliance: Adherence to evolving environmental regulations is paramount for Hudbay's operational sustainability.

Environmental Impact Assessments and Permitting

Hudbay's operations are subject to stringent Environmental Impact Assessments (EIAs) for any new projects or significant expansions. These legally mandated evaluations are crucial for identifying and planning mitigation strategies for potential environmental consequences. For instance, in 2023, Hudbay reported investing approximately $10 million in environmental management and rehabilitation efforts across its operations, a figure that underscores the significant financial commitment required for compliance and responsible stewardship.

The findings from these EIAs directly shape permitting decisions made by regulatory bodies and significantly influence public perception and acceptance of Hudbay's activities. A strong track record of conducting thorough EIAs and demonstrating a tangible commitment to reducing its environmental footprint, such as through initiatives aimed at water management and emissions reduction, is therefore essential for Hudbay to secure and maintain necessary operational approvals. In 2024, the company is expected to finalize EIAs for its proposed projects in Arizona, with regulatory review timelines being a key factor in project advancement.

- EIA Requirements: Legal mandates for new projects and expansions to identify and mitigate environmental effects.

- Permitting Influence: EIA outcomes are critical for securing operational permits and gaining public trust.

- Environmental Investment: Hudbay's 2023 environmental management and rehabilitation spending reached $10 million.

- Future Focus: 2024 sees a focus on finalizing EIAs for Arizona projects, impacting future approvals.

Hudbay's environmental performance is increasingly scrutinized, with a focus on reducing its carbon footprint and managing water resources effectively. Investor and regulatory pressures are driving investments in cleaner energy and water conservation, especially as climate change impacts regions where Hudbay operates.

The company must navigate evolving regulations concerning water usage and waste management, particularly tailings storage, to ensure operational continuity and maintain social license. For example, by 2025, stricter water quality standards are anticipated in key South American mining jurisdictions, requiring proactive compliance measures.

Hudbay's commitment to biodiversity protection and land reclamation is crucial for mitigating the ecological impact of its mining activities. This includes rigorous environmental impact assessments and the implementation of robust management plans to restore disturbed areas post-operation, aligning with global trends towards sustainable resource extraction.

PESTLE Analysis Data Sources

Our HudBay PESTLE Analysis draws from a robust blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting HudBay.