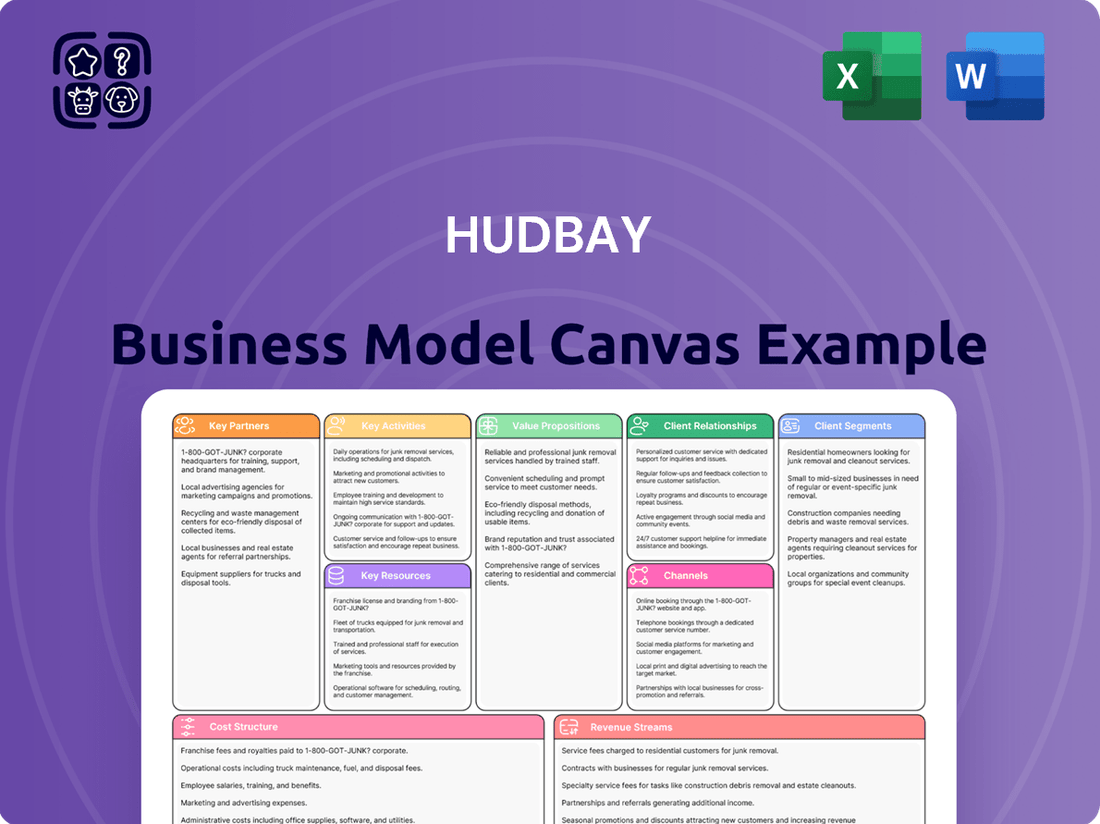

HudBay Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

Curious about the strategic engine driving HudBay's success? Our Business Model Canvas breaks down their key partners, value propositions, and revenue streams into a clear, actionable framework. Discover how they connect with customers and manage costs to maintain their competitive edge.

Partnerships

Hudbay's operations span Peru, Manitoba, and British Columbia, with significant future expansion planned for Arizona and Nevada. Navigating these diverse jurisdictions necessitates robust engagement with government and regulatory bodies. In 2023, Hudbay reported $1.9 billion in revenue, underscoring the critical need for smooth governmental relations to maintain operational licenses and permits.

Compliance with environmental regulations and mining laws in each operating region is paramount for Hudbay's continuity. This includes adhering to stringent standards set by agencies like Environment and Climate Change Canada and the Peruvian Ministry of Energy and Mines. Failure to comply could result in significant operational disruptions and financial penalties, directly impacting the company's ability to generate revenue and pursue growth initiatives.

Hudbay actively cultivates strong relationships with local communities and Indigenous groups, recognizing these partnerships as crucial for its social license to operate. This engagement focuses on fostering mutual benefit through local employment, providing business opportunities, and investing in community-driven initiatives.

For instance, Hudbay has established agreements with the Upper Similkameen Indian Band and Lower Similkameen Indian Band in British Columbia, demonstrating a commitment to collaborative development. These agreements often involve revenue sharing and commitments to local hiring, ensuring that the benefits of mining activities are shared.

Hudbay's strategic partnerships with suppliers and contractors are critical for smooth mining operations. These include vital relationships with equipment providers, energy suppliers, and various service companies that keep operations running efficiently.

A prime example of this is Hudbay's 10-year power purchase agreement with ENGIE, Energía Perú. This agreement, set to commence in 2026, will ensure Hudbay's Constancia mine is powered by 100% renewable energy, highlighting a commitment to sustainability and operational resilience through key supplier relationships.

Financial Institutions and Investors

Hudbay's relationships with financial institutions and investors are foundational to its operational and growth strategies. These partnerships are crucial for securing the necessary capital for significant undertakings like the development of the Copper World project. The company's ability to attract and retain investor confidence is directly linked to its financial health.

Hudbay demonstrated robust financial performance through 2024 and into Q1 2025. Key highlights include substantial debt reduction, which strengthens its balance sheet, and consistent free cash flow generation. This financial discipline is a major draw for both existing and potential investors.

- Banks: Provide credit facilities and working capital, essential for day-to-day operations and short-term funding needs.

- Investment Firms: Act as underwriters for equity and debt offerings, facilitating capital raises for major projects and acquisitions.

- Shareholders: Represent the ownership base, whose continued investment is vital for long-term growth and project financing.

- Financial Performance: In 2024, Hudbay reported significant progress in debt management and cash flow, enhancing its appeal to the investment community.

Industry Associations and Research Institutions

Hudbay actively engages with key industry associations, such as the Mining Association of Canada (MAC). This collaboration ensures adherence to evolving best practices and industry standards, exemplified by participation in initiatives like 'Towards Sustainable Mining' (TSM). In 2023, MAC members reported a 12% decrease in lost-time injury frequency rate compared to 2022, highlighting the impact of such collaborative efforts on safety.

Strategic alliances with research institutions are crucial for fostering innovation. These partnerships drive advancements in mining technologies and sustainability practices. For instance, collaborations can lead to the development of more efficient extraction methods or improved environmental monitoring systems, directly impacting operational efficiency and corporate responsibility.

- Industry Association Engagement: Collaboration with organizations like the Mining Association of Canada (MAC) reinforces commitment to industry best practices and standards.

- Sustainability Initiatives: Participation in programs such as 'Towards Sustainable Mining' (TSM) demonstrates a dedication to responsible mining operations.

- Research and Development Partnerships: Collaborating with universities and research bodies fuels innovation in mining technology and environmental stewardship.

- Knowledge Sharing and Best Practice Adoption: These partnerships facilitate the exchange of knowledge, leading to the adoption of cutting-edge techniques and a stronger focus on sustainability.

Hudbay's key partnerships are essential for its operational success and strategic growth. These include strong ties with financial institutions that provide crucial capital, as seen in the financing of major projects like Copper World. The company also relies on suppliers for equipment and energy, with a notable renewable energy agreement with ENGIE Perú highlighting a commitment to sustainability.

Furthermore, Hudbay fosters relationships with local communities and Indigenous groups, ensuring a social license to operate through shared benefits and employment opportunities. Collaboration with industry associations and research institutions drives innovation and adherence to best practices in mining. These diverse partnerships are fundamental to Hudbay's ability to navigate complex regulatory environments and achieve its business objectives.

| Partner Type | Examples | Strategic Importance | 2024/2025 Relevance |

|---|---|---|---|

| Financial Institutions | Banks, Investment Firms | Capital raising, debt financing, working capital | Securing funds for Copper World development, debt reduction |

| Suppliers & Contractors | Equipment providers, energy suppliers | Operational efficiency, resource provision | 10-year renewable energy PPA with ENGIE Perú starting 2026 |

| Communities & Indigenous Groups | Upper Similkameen Indian Band, Lower Similkameen Indian Band | Social license to operate, local benefits | Ongoing collaboration for mutual benefit |

| Industry Associations | Mining Association of Canada (MAC) | Best practices, safety standards, advocacy | Adherence to evolving industry standards |

| Research Institutions | Universities, R&D bodies | Innovation, technology advancement | Driving efficiency and sustainability in mining |

What is included in the product

A detailed exploration of HudBay's operational strategy, outlining its key customer segments, value propositions, and revenue streams within the mining industry.

This canvas provides a strategic overview of HudBay's business, detailing its core activities, resources, and partnerships to achieve sustainable growth.

The HudBay Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of the company's operations, allowing for quick identification of inefficiencies and areas for improvement.

It simplifies complex business strategies into a single, digestible page, easing the burden of understanding and refining the core elements of HudBay's value proposition.

Activities

Hudbay is actively focused on exploration to grow its mineral reserves, especially near its current mines and emerging projects such as Copper World in Arizona and Mason in Nevada. This strategic effort aims to secure future production and enhance long-term value.

These exploration endeavors involve detailed geological mapping, extensive drilling campaigns, and sophisticated resource modeling. The goal is to pinpoint and define new mineral deposits, ensuring a robust pipeline of future mining opportunities.

In 2023, Hudbay reported significant exploration success, with substantial increases in its measured and indicated resources, particularly at Copper World, which saw a 24% increase in contained copper. This highlights the effectiveness of their expansion strategy.

Hudbay's mining operations are the engine of its business, focusing on extracting valuable minerals from its sites in Peru and Canada. This includes the Constancia and Pampacancha mines in Peru, and the Snow Lake operations in Canada, which house mines like Lalor and Copper Mountain. These activities are fundamental to producing the raw materials that drive the company's revenue.

The process involves a series of critical steps: drilling into the rock, using explosives for blasting, and then loading and transporting the extracted ore and waste material. In 2023, Hudbay reported a total production of 81,573 tonnes of copper and 176,700 ounces of gold from these operations, demonstrating the scale and output of their mining activities.

Hudbay's core mineral processing and concentration activities involve transforming extracted ore into valuable metal concentrates. Their concentrators utilize crushing, grinding, and flotation techniques to isolate copper, zinc, gold, and silver. In 2023, the company processed approximately 10.5 million tonnes of ore across its operations, demonstrating significant throughput capacity.

These operations are crucial for separating valuable minerals from waste rock, a complex physical and chemical separation process. To enhance efficiency and output, Hudbay is actively pursuing mill improvement projects. For instance, at their Constancia operation, upgrades are underway to boost grinding capacity, aiming for a 10% increase in throughput by the end of 2024.

Marketing and Sales of Metals

Hudbay actively markets and sells its core metal products, which include copper, zinc, gold, and silver, to a global customer base. This critical function encompasses the negotiation and management of sales contracts, the intricate coordination of logistics, and ensuring timely delivery of these valuable commodities. The company's revenue streams are significantly bolstered by copper and gold, underscoring their importance in its overall financial performance.

In 2024, Hudbay's sales strategy focuses on leveraging its diverse metal portfolio to meet varied market demands. The company's commitment to reliable supply chains and strong customer relationships is paramount in maintaining its competitive edge in the international metals market. For instance, in the first quarter of 2024, Hudbay reported that copper sales represented a substantial portion of its revenue, reflecting the ongoing strong global demand for this essential metal.

- Copper and Zinc Sales: Hudbay manages contracts and deliveries for both copper and zinc, catering to industrial and manufacturing sectors worldwide.

- Precious Metals Marketing: The company also handles the marketing and sale of gold and silver, often benefiting from their status as safe-haven assets.

- Revenue Contribution: In 2024, copper and gold sales continued to be the primary drivers of Hudbay's overall revenue, with copper sales alone contributing significantly to the company's financial results.

- Global Logistics: Ensuring efficient and cost-effective logistics is a key activity, enabling Hudbay to deliver its products to customers across different continents.

Environmental and Social Responsibility

Hudbay is committed to responsible mining, focusing on environmental stewardship, community well-being, and workplace safety. This commitment is demonstrated through adherence to international reporting standards and the implementation of strategies to reduce greenhouse gas emissions.

In 2023, Hudbay continued its efforts in environmental and social responsibility. The company aims to integrate sustainability into its core operations, reflecting a proactive approach to managing its impact.

- Environmental Management: Implementing programs to minimize environmental footprint and manage resources efficiently.

- Community Engagement: Actively participating in and supporting local development initiatives in the regions where it operates.

- Health and Safety: Prioritizing the well-being of employees and contractors through robust safety protocols and training.

- GHG Reduction: Working towards established targets for reducing greenhouse gas emissions across its operations.

Hudbay's key activities revolve around the entire mining lifecycle, from discovering new mineral deposits to selling refined metal products. This includes extensive exploration to expand reserves, efficient extraction through mining, and processing ore into saleable concentrates. The company also focuses on robust sales and marketing efforts, alongside a strong commitment to environmental and social responsibility.

These activities are underpinned by significant operational achievements and strategic investments. For example, Hudbay’s exploration success in 2023, particularly the 24% increase in contained copper at Copper World, directly feeds into its future production pipeline. Similarly, the company’s 2023 production figures of 81,573 tonnes of copper and 176,700 ounces of gold from its mining operations highlight the scale of its extraction capabilities.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Exploration | Growing mineral reserves through discovery and definition. | 24% increase in contained copper at Copper World (2023). |

| Mining | Extracting ore from underground and open-pit operations. | Produced 81,573 tonnes of copper and 176,700 ounces of gold (2023). |

| Processing | Transforming ore into metal concentrates. | Processed ~10.5 million tonnes of ore (2023); aiming for 10% grinding capacity increase at Constancia by end of 2024. |

| Sales & Marketing | Selling copper, zinc, gold, and silver globally. | Copper sales were a substantial portion of Q1 2024 revenue. |

| Sustainability | Focus on environmental, social, and governance practices. | Implementing programs for emissions reduction and community engagement. |

Preview Before You Purchase

Business Model Canvas

The HudBay Business Model Canvas preview you are viewing is the actual, complete document that you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring full transparency and no surprises. Once your order is confirmed, you'll gain immediate access to this professional, ready-to-use Business Model Canvas.

Resources

Hudbay's most critical resource is its extensive portfolio of mineral reserves and resources, encompassing copper, zinc, gold, silver, and molybdenum. These valuable assets are strategically located across Peru, Manitoba (Canada), British Columbia (Canada), Arizona (United States), and Nevada (United States), ensuring a robust and long-term production pipeline for the company.

As of December 31, 2023, Hudbay reported proven and probable mineral reserves of 5.7 million tonnes grading 1.3% copper and 1.5% zinc, alongside measured and indicated mineral resources of 25.1 million tonnes grading 1.0% copper and 1.2% zinc. These figures highlight the significant scale and potential of their mining operations, underpinning future revenue streams and operational stability.

Hudbay's mining and processing infrastructure forms the backbone of its operations, encompassing a network of mines, concentrators, and processing plants across Peru and Canada. These facilities are crucial for extracting and refining valuable minerals.

Key assets include the Constancia mine in Peru, a significant contributor to Hudbay's copper and molybdenum output. In Canada, the Snow Lake operations, featuring the Lalor mine and New Britannia mill, are vital for zinc, copper, and gold production. The Copper Mountain mine in British Columbia also plays a role in its copper supply chain.

In 2024, Hudbay's production figures highlight the importance of this infrastructure. For instance, the Constancia complex, including Pampacancha, produced approximately 81,000 tonnes of copper in the first nine months of 2024. The Snow Lake operations, particularly the Lalor mine, are expected to contribute significantly to the company's zinc and copper output for the full year.

Hudbay’s operations hinge on a highly skilled workforce, encompassing geologists, engineers, operators, and experienced management. This expertise is fundamental for efficient exploration, safe mining, and successful project development.

In 2023, Hudbay continued its commitment to talent development, investing in supervisory training and entry-level programs to build a robust talent pipeline. This focus ensures the company maintains its operational excellence and drives innovation in its mining practices.

Technology and Equipment

Hudbay's commitment to modern mining equipment, including electric vehicles and advanced processing technologies, is fundamental to enhancing operational efficiency and reducing costs. These investments directly impact their environmental performance, a growing consideration for stakeholders. For instance, in 2024, Hudbay continued to focus on mill improvement projects aimed at optimizing throughput and recovery rates, contributing to a more sustainable and cost-effective operation.

The exploration of cutting-edge technologies like autonomous haul trucks signifies Hudbay's forward-thinking approach. Such innovations have the potential to significantly improve safety and productivity within their mining operations. By integrating these advanced systems, Hudbay aims to stay competitive and lead in responsible resource extraction, with pilot programs and feasibility studies for automation being a key part of their 2024 strategy.

- Electric Vehicles: Reducing diesel emissions and operational fuel costs.

- Advanced Processing Technologies: Improving mineral recovery rates and product quality.

- Autonomous Haul Trucks: Enhancing safety, productivity, and operational uptime.

- Mill Improvement Projects: Increasing throughput and efficiency in mineral processing.

Financial Capital and Liquidity

Hudbay's access to substantial financial capital, encompassing cash on hand, available credit lines, and the capacity to issue new shares, is fundamental to financing its ongoing operations, capital-intensive growth initiatives, and managing its existing debt obligations. This financial flexibility is a cornerstone of its business model, enabling strategic execution and resilience.

As of the first quarter of 2024, Hudbay reported cash and cash equivalents of $282 million. Furthermore, the company had $415 million available under its revolving credit facility, demonstrating a robust liquidity position. This strong financial footing, coupled with a significantly reduced net debt, positions Hudbay favorably for pursuing its strategic objectives and capitalizing on future investment opportunities.

- Financial Capital Access: Cash reserves, credit facilities, and equity raising capabilities are crucial for funding operations and growth.

- Liquidity Position: Hudbay's strong liquidity, evidenced by $282 million in cash as of Q1 2024, supports immediate financial needs.

- Credit Availability: An undrawn revolving credit facility of $415 million in Q1 2024 provides significant financial flexibility.

- Debt Management: A reduced net debt position enhances financial stability and capacity for future investments.

Hudbay's key resources are its substantial mineral reserves and resources, which are the foundation of its mining operations. These reserves are complemented by its operational infrastructure, including mines and processing facilities. A skilled workforce and advanced mining technology are also critical for efficient and safe extraction. Finally, strong access to financial capital ensures the company can fund its operations and growth initiatives.

Value Propositions

Hudbay's diversified metal production strategy centers on a robust portfolio of copper, zinc, gold, and silver. This mix offers significant resilience against the inherent volatility of individual commodity prices, providing a more stable revenue stream. In 2023, Hudbay reported that copper represented approximately 60% of its revenue, with gold contributing a notable 30%, showcasing a strong and growing diversification.

Hudbay is deeply committed to responsible and sustainable mining, integrating environmental stewardship and community well-being into its core operations. This commitment is demonstrated through tangible actions aimed at minimizing environmental impact and fostering positive relationships with local stakeholders.

In 2023, Hudbay achieved a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to its 2022 baseline, reflecting its dedication to climate action. The company also advanced its water management initiatives, with 98% of water used at its operations being recycled or reused, significantly reducing its freshwater footprint.

Furthermore, Hudbay actively invests in community development programs, contributing to local economies through job creation and supporting social infrastructure. In 2023, the company reported over $40 million in direct economic contributions to the communities where it operates, underscoring its role as a responsible corporate citizen.

Hudbay's strategic focus on long-life assets within Tier-1 jurisdictions, such as its operations in Canada and Peru, offers a significant value proposition. These locations are characterized by political stability and established mining frameworks, which directly translate to reduced geopolitical risk for investors and a more predictable operational environment.

The company's commitment to developing projects in the United States further reinforces this value. By concentrating on jurisdictions with robust legal systems and a history of supporting resource development, Hudbay aims to secure a stable, long-term operating base. This geographical diversification within stable regions mitigates the impact of localized disruptions and enhances overall investment security.

Growth Potential from Project Pipeline

Hudbay's value proposition hinges significantly on its robust project pipeline, particularly its growth potential. The company holds a world-class portfolio of copper development projects, poised to drive substantial future production and value.

A prime example is the fully permitted Copper World project located in Arizona. This project is anticipated to be a major contributor to Hudbay's copper output, offering a clear path for increased production volumes and, consequently, enhanced stakeholder returns.

In 2024, Hudbay's strategic focus on advancing its growth projects, including Copper World, underscores its commitment to long-term value creation. The company's ability to successfully execute these projects is a key driver for its future financial performance and market position.

The growth potential from this project pipeline translates into tangible benefits:

- Significant increase in copper production: Copper World alone is projected to add substantial copper ounces to Hudbay's portfolio.

- Future value creation: The development and eventual operation of these projects are expected to generate considerable economic value for shareholders and other stakeholders.

- Enhanced market position: A strong pipeline of growth projects solidifies Hudbay's standing as a key player in the copper market.

Operational Efficiency and Cost Control

Hudbay is deeply committed to enhancing operational efficiency and rigorously controlling costs. This dedication translates into industry-leading profit margins and robust free cash flow. For instance, in the first quarter of 2024, Hudbay reported adjusted EBITDA of $115 million, showcasing their ability to manage expenses effectively while driving profitability.

Key initiatives driving these improvements include optimizing mill throughput and the strategic adoption of battery electric vehicles. These advancements directly contribute to lowering operating expenses, as seen in the company's ongoing efforts to streamline production processes and reduce reliance on traditional fuel sources.

- Mill Throughput Optimization: Continuous improvements in processing capacity and efficiency.

- Battery Electric Vehicle Integration: Reducing fuel and maintenance costs in underground operations.

- Cost Management Focus: Maintaining stringent oversight on all operational expenditures.

- Margin Enhancement: Directly linking operational efficiencies to improved profitability.

Hudbay's value proposition is built on a diversified metal portfolio, responsible mining practices, and a strategic focus on long-life assets in stable jurisdictions. This approach ensures resilience against market volatility and reduces geopolitical risk.

The company's commitment to sustainability is evident in its emissions reduction targets and water management initiatives. Furthermore, significant investments in community development highlight its role as a responsible corporate citizen.

Hudbay's robust project pipeline, notably the Copper World project in Arizona, promises substantial future copper production and value creation for stakeholders, solidifying its market position.

Operational efficiency and cost control are paramount, leading to industry-leading margins and strong free cash flow, as demonstrated by their Q1 2024 adjusted EBITDA of $115 million.

Customer Relationships

Hudbay's customer relationships are anchored by long-term commercial contracts for its metal concentrates and doré. These agreements are crucial for ensuring revenue stability and predictability, providing a solid foundation for financial planning and operational consistency.

These contracts often include provisions for pricing and volume, offering Hudbay a degree of certainty in its sales pipeline. For instance, in 2024, Hudbay continued to focus on securing these types of agreements to support its production forecasts and manage market volatility.

Hudbay's commitment to its industrial customers is evident in its dedicated sales and technical support teams. These teams are crucial for navigating complex product specifications and logistical challenges, ensuring a seamless experience for clients.

In 2024, Hudbay's focus on customer relationships, bolstered by robust support, contributed to maintaining strong demand for its zinc and copper products in key markets like North America and Europe.

Hudbay cultivates robust connections with international metal traders and smelters, ensuring efficient sales channels and favorable pricing for its zinc, copper, and precious metal outputs. These partnerships are vital for managing the logistics of its concentrate, streamlining the journey from its Canadian and U.S. mines to global markets.

In 2024, Hudbay's focus on these relationships is paramount as it navigates market dynamics. For instance, its 2024 guidance anticipates significant production, requiring dependable off-take agreements. Strong smelter relationships ensure that Hudbay's concentrate, like that from its Snow Lake operations, finds competitive processing partners, directly impacting its revenue streams and overall profitability.

Market Intelligence and Responsiveness

Hudbay actively monitors global metal markets, including supply and demand for copper, zinc, and precious metals, to inform its operational and sales strategies. This continuous market intelligence allows for agile adjustments to production and sales volumes, aiming to optimize pricing and revenue. For instance, in the first quarter of 2024, Hudbay reported an average realized price of $3.77 per pound for copper, reflecting market conditions.

The company's responsiveness to evolving customer needs and market shifts is crucial. By understanding these dynamics, Hudbay can better align its product offerings and sales channels. This proactive approach helps ensure that the company remains competitive and can capitalize on favorable market conditions, contributing to its overall financial performance.

- Market Trend Analysis: Hudbay's intelligence gathering focuses on price fluctuations, geopolitical impacts on supply chains, and emerging industrial demand for its commodities.

- Customer Needs Assessment: Understanding specific customer requirements for metal grades, delivery schedules, and contractual terms is vital for tailored sales approaches.

- Production Optimization: Market insights directly influence production planning, allowing Hudbay to adjust output to meet anticipated demand and favorable pricing environments.

- Sales Strategy Adaptation: Real-time market data enables Hudbay to refine its sales strategies, including hedging activities and contract negotiations, to maximize value.

Sustainability Reporting and Transparency

HudBay’s commitment to transparency in sustainability reporting is a cornerstone of its customer relationships. By openly sharing data on ethical sourcing and environmental performance, the company fosters trust with a growing segment of consumers and business partners who prioritize responsible supply chains.

This dedication to Environmental, Social, and Governance (ESG) principles is not just a policy but a tangible aspect of their customer engagement. For instance, in 2023, HudBay reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating concrete progress in their environmental stewardship.

- Transparent Sustainability Reporting: Customers value clear communication about HudBay's environmental impact and ethical practices.

- Ethical Sourcing Verification: Demonstrating adherence to ethical sourcing standards builds confidence in product origins.

- ESG Alignment: Meeting customer expectations for ESG performance strengthens brand loyalty and market position.

- Performance Metrics: Sharing quantifiable achievements, like the 2023 emissions reduction, provides concrete evidence of commitment.

Hudbay's customer relationships are built on a foundation of long-term contracts for its metal concentrates and doré, ensuring revenue stability. These agreements often include specific pricing and volume terms, providing Hudbay with sales pipeline certainty. The company's sales and technical support teams are key in managing complex product specifications and logistics for its industrial clients.

In 2024, Hudbay continued to foster strong ties with international metal traders and smelters, vital for efficient sales channels and competitive pricing of its zinc, copper, and precious metals. This focus is critical for managing concentrate logistics from its Canadian and U.S. mines to global markets. For instance, Hudbay's 2024 guidance anticipates substantial production, underscoring the need for dependable off-take agreements to ensure its concentrate, like that from Snow Lake, finds processing partners.

The company actively monitors global metal markets, including supply and demand for copper, zinc, and precious metals, to refine its operational and sales strategies. This market intelligence allows for agile adjustments in production and sales volumes to optimize pricing and revenue. In Q1 2024, Hudbay reported an average realized copper price of $3.77 per pound, reflecting prevailing market conditions.

Hudbay's commitment to transparency in sustainability reporting builds trust with customers prioritizing responsible supply chains. Sharing data on ethical sourcing and environmental performance is a key aspect of their customer engagement. For example, in 2023, Hudbay achieved a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline.

| Key Customer Relationship Aspects | Description | 2024 Relevance/Data |

| Long-Term Contracts | Ensures revenue stability and predictability through secured sales of metal concentrates and doré. | Crucial for supporting production forecasts and managing market volatility in 2024. |

| Sales & Technical Support | Dedicated teams assist industrial customers with product specifications and logistical challenges. | Maintains strong demand for zinc and copper products in North America and Europe. |

| Smelter & Trader Partnerships | Vital for efficient sales channels, competitive pricing, and managing concentrate logistics globally. | Ensures competitive processing partners for concentrate, impacting revenue and profitability. |

| Market Intelligence | Continuous monitoring of global metal markets informs operational and sales strategies. | Allows agile adjustments to optimize pricing, with Q1 2024 copper price at $3.77/lb. |

| Sustainability Transparency | Builds trust through open sharing of ethical sourcing and environmental performance data. | Demonstrated by a 15% reduction in Scope 1 & 2 GHG emissions intensity in 2023 (vs. 2019 baseline). |

Channels

Hudbay primarily engages in direct sales of its copper, zinc, gold, and silver concentrates and doré to major industrial customers, including smelters and refiners worldwide. This direct approach facilitates robust relationship building and allows for tailored negotiations.

In 2024, Hudbay's sales strategy continued to leverage these direct channels, ensuring competitive pricing and consistent demand for its diverse metal output. For instance, the company's 2024 production figures, such as the expected 75,000 to 85,000 tonnes of zinc and 100,000 to 110,000 tonnes of copper, are primarily channeled through these direct industrial relationships.

HudBay leverages global metal trading houses and brokers to expand its market reach, connecting its copper, zinc, and precious metal products with international buyers. These partnerships are crucial for navigating complex global supply chains and accessing diverse customer bases.

In 2024, the global metals trading market continued to be a vital conduit for producers like HudBay. For instance, the London Metal Exchange (LME), a key venue for metal trading, saw significant activity, reflecting the ongoing demand for base metals essential for industrial and technological advancements.

These intermediaries often manage intricate logistics, including shipping, warehousing, and customs, thereby reducing HudBay's operational burden and allowing the company to focus on its core mining and production activities. This strategic outsourcing enhances efficiency and market responsiveness.

HudBay leverages sophisticated logistics and shipping networks to move its metal concentrates from mines in Peru and Canada. This intricate process involves transporting materials to various ports before final delivery to international customers, highlighting the management of complex global supply chains.

In 2024, HudBay's operational efficiency in logistics was a key factor. For instance, the company's Chumbivilcas mine in Peru, a significant contributor, relies on these established networks to ensure timely and cost-effective transport of its copper and zinc concentrates to global markets.

Investor Relations and Public Communications

HudBay actively engages investors through its annual reports, quarterly financial results, investor presentations, and timely news releases. These channels are vital for transparently communicating company performance, strategic direction, and future outlook. For instance, in 2024, HudBay continued its practice of hosting conference calls and webcasts following each quarterly earnings release, providing direct access to management for analysts and shareholders.

These communications are designed to foster trust and provide a clear understanding of the company's operations and financial health. Key data points shared often include production volumes, cost metrics, and progress on major projects. In the first quarter of 2024, HudBay reported adjusted EBITDA of $29 million, demonstrating ongoing operational performance and strategic execution.

The company's investor relations efforts also extend to participation in industry conferences and one-on-one meetings. This proactive approach ensures that stakeholders are well-informed and have opportunities to ask questions. Such interactions are crucial for building long-term investor confidence and support.

- Annual Reports: Comprehensive overview of financial performance and strategic initiatives.

- Quarterly Results: Regular updates on operational and financial metrics.

- Investor Presentations: Detailed insights into strategy, projects, and market outlook.

- Conference Calls & Webcasts: Direct engagement with management for Q&A.

Industry Conferences and Trade Fairs

Industry conferences and trade fairs are crucial for Hudbay to connect with key stakeholders. These events provide a platform to showcase its latest mining technologies and sustainability initiatives. For instance, in 2023, Hudbay actively participated in events like the Prospectors & Developers Association of Canada (PDAC) convention, a premier global mining event, allowing direct engagement with potential off-takers and financial institutions.

These gatherings enable Hudbay to foster relationships with potential customers, collaborators, and investors. By presenting its operational strengths and future projects, the company can attract new business opportunities and secure vital funding. In 2024, Hudbay is expected to continue its presence at major mining expos, aiming to highlight its growth strategies and commitment to responsible resource development.

Furthermore, attending these events keeps Hudbay informed about emerging market trends, technological advancements, and competitive landscapes. This market intelligence is vital for strategic planning and maintaining a competitive edge. For example, insights gained from industry discussions in 2023 helped Hudbay refine its exploration strategies for its Snow Lake operations.

- Networking Opportunities: Direct engagement with potential customers, partners, and investors at events like PDAC.

- Showcasing Capabilities: Demonstrating innovative mining techniques and commitment to ESG principles.

- Market Intelligence: Staying updated on industry trends, competitor activities, and technological advancements.

- Brand Visibility: Enhancing Hudbay's profile as a leading and responsible mining company.

Hudbay utilizes direct sales to industrial customers for its metal concentrates and doré, building strong relationships and enabling tailored negotiations. In 2024, this strategy remained central, with production targets like 75,000-85,000 tonnes of zinc and 100,000-110,000 tonnes of copper being primarily channeled through these direct industrial relationships.

Global metal trading houses and brokers are key for expanding market reach, connecting Hudbay’s products with international buyers and navigating complex supply chains. The London Metal Exchange (LME) in 2024 continued to be a vital venue for base metal trading, underscoring the importance of these intermediary channels for producers like Hudbay.

Hudbay's investor relations channels, including annual reports, quarterly results, and conference calls, ensure transparent communication of performance and strategy. In Q1 2024, Hudbay reported adjusted EBITDA of $29 million, a key metric shared with investors to demonstrate operational performance.

Industry conferences and trade fairs, such as the PDAC convention, are vital for Hudbay to connect with stakeholders, showcase capabilities, and gather market intelligence. Participation in these events in 2023 and planned attendance in 2024 are crucial for fostering relationships and attracting opportunities.

| Channel | Description | 2024 Relevance/Example |

| Direct Sales to Industrial Customers | Selling concentrates and doré directly to smelters and refiners. | Key for pricing and demand for zinc and copper output. |

| Metal Trading Houses & Brokers | Utilizing intermediaries to access global markets and diverse buyers. | Essential for navigating international supply chains and leveraging venues like the LME. |

| Investor Relations (Reports, Calls) | Communicating performance, strategy, and outlook to stakeholders. | Q1 2024 adjusted EBITDA of $29 million shared via these channels. |

| Industry Conferences & Trade Fairs | Networking, showcasing capabilities, and gaining market intelligence. | Participation in events like PDAC for stakeholder engagement. |

Customer Segments

Global smelters and refiners represent a core customer segment for Hudbay, primarily purchasing its copper concentrates. These industrial partners are crucial in transforming Hudbay's raw materials into refined metals essential for manufacturing.

In 2024, Hudbay's production of copper concentrate is expected to be a significant driver of revenue from this segment. For instance, their Constancia operations in Peru are a key source of this material, with production levels closely watched by these industrial buyers.

Precious metal buyers, such as bullion dealers and jewelers, represent a key customer segment for HudBay's gold and silver doré. These buyers are primarily interested in the high purity and verifiable origin of the metals, which are crucial for their own product manufacturing and resale. In 2024, the global demand for gold jewelry remained robust, with significant consumption in Asia, indicating a consistent market for refined precious metals.

Industrial manufacturers are crucial indirect customers for Hudbay, forming the backbone of demand for its base and precious metals. These sectors, including automotive, electronics, construction, and renewable energy, rely heavily on metals like copper and zinc for their production processes.

For instance, the automotive sector, particularly the burgeoning electric vehicle (EV) market, is a significant consumer of copper, with EVs requiring substantially more copper than traditional internal combustion engine vehicles. In 2024, the global EV market is projected to continue its robust growth, driving increased demand for copper, a key component in EV powertrains and charging infrastructure.

Commodity Traders and Brokers

Commodity traders and brokers are key players who facilitate the buying and selling of Hudbay's metal concentrates and refined products. These entities, often large financial institutions and specialized trading firms, manage significant volumes of metals, ensuring liquidity and efficient movement within the global market. Their operations are vital for connecting producers like Hudbay with end-users, thereby playing a crucial role in the overall supply chain.

In 2024, the global metals trading market continued to be dynamic, influenced by macroeconomic trends and industrial demand. For instance, copper, a key metal for Hudbay, saw significant price volatility throughout the year, driven by factors such as supply disruptions and the accelerating pace of electrification. Trading firms actively managed these price fluctuations, providing essential hedging and price discovery mechanisms for producers.

These intermediaries provide Hudbay with several benefits:

- Market Access: They offer broad access to international markets and diverse customer bases, expanding Hudbay's reach beyond direct sales.

- Price Risk Management: Traders help mitigate price volatility by offering forward contracts and other hedging instruments, providing revenue certainty.

- Logistical Support: Many trading houses also manage the complex logistics of transporting and storing metals, reducing operational burdens for Hudbay.

Strategic Partners for Specific Metal Applications

Hudbay is actively cultivating strategic partnerships with companies at the forefront of critical mineral applications, particularly those driving the electric vehicle and renewable energy sectors. These collaborations are designed to align production with the specific needs of emerging technologies, ensuring a reliable supply chain for essential metals. For instance, in 2024, the global demand for copper, a key component in EVs and grid infrastructure, was projected to reach over 26 million metric tons, highlighting the significant market opportunity.

These partnerships are crucial for Hudbay to capitalize on the increasing demand for materials like copper and zinc, which are vital for the green transition. By working closely with end-users, Hudbay can tailor its output and explore innovative uses for its metals. The company's 2023 financial reports indicated a strong performance in its copper segment, with production volumes supporting its strategic goals.

- Targeted Supply Agreements: Securing long-term contracts with manufacturers of batteries, electric motors, and wind turbines.

- Joint Development Projects: Collaborating on research and development to optimize metal purity and form for specific technological requirements.

- Market Intelligence Sharing: Exchanging insights on future demand trends and technological advancements in critical mineral applications.

- Investment in Downstream Processing: Exploring opportunities to invest in or partner with companies involved in the refining and processing of metals for specialized uses.

Hudbay's customer base extends to specialized industrial consumers who require specific metal grades and forms for advanced manufacturing. These clients, often in sectors like aerospace or advanced electronics, value consistent quality and reliable delivery.

In 2024, the demand for high-purity zinc, a key product for Hudbay, remained strong, particularly from the galvanizing industry which uses it for corrosion protection in construction and automotive applications. The company's 777 mine in Manitoba is a significant source of zinc concentrate, feeding these specialized industrial needs.

Furthermore, Hudbay engages with metal fabricators and component manufacturers who integrate its products into larger assemblies. These customers depend on Hudbay for the foundational materials that enable their own production lines, making supply chain reliability paramount.

Cost Structure

Mining and processing costs are Hudbay's most significant expense category, covering everything from extracting ore through drilling and hauling to milling processes like crushing and grinding. These costs also include essential elements such as labor, energy consumption, and the various consumables needed for operations.

In 2023, Hudbay reported total cash costs of $1.06 per pound of zinc produced, and $2.36 per pound of copper. The company is actively pursuing strategies to maintain rigorous cost control and boost operational efficiency across these critical areas.

Hudbay's cost structure heavily features significant investments in exploration and development. These are crucial for identifying new mineral reserves and advancing projects like Copper World. This includes substantial outlays for geological surveys, extensive drilling programs, and rigorous feasibility studies to assess project viability.

In 2023, Hudbay reported exploration and development expenses totaling $64.2 million. This figure underscores the company's commitment to future growth through the discovery and advancement of its mineral assets.

Capital expenditures are crucial for HudBay, encompassing both maintaining current operations and investing in future growth. Sustaining capital ensures existing mines and facilities run efficiently, while growth capital fuels expansion and new project development.

For 2025, HudBay anticipates a significant investment in its future. Total sustaining capital is projected at $365 million, covering essential upkeep. Additionally, growth capital is slated for $205 million, earmarked for expanding production capacity and advancing new mine development projects.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent Hudbay's corporate overhead, encompassing costs like executive salaries, accounting, legal services, and other essential administrative functions not directly tied to production. For 2024, Hudbay has been focused on optimizing these costs to ensure efficient operations. These expenses are crucial for the smooth functioning of the entire organization, supporting strategic decision-making and compliance.

Hudbay's commitment to controlling G&A expenses is evident in its ongoing efforts to streamline processes and leverage technology. In the first quarter of 2024, the company reported G&A expenses of $33.1 million, a slight increase from the prior year, reflecting investments in talent and systems to support growth initiatives. This figure is carefully monitored to maintain competitiveness.

- Corporate Overhead: Includes costs for corporate offices, IT infrastructure, and general operational support.

- Administrative Salaries: Compensation for management, finance, HR, and legal personnel.

- Legal and Professional Fees: Expenses related to legal counsel, auditing, and other professional services.

- Efficiency Initiatives: Ongoing efforts to reduce G&A as a percentage of revenue.

Environmental and Social Compliance Costs

Hudbay incurs significant costs to meet environmental regulations and implement sustainability. For 2024, these include expenses for emissions monitoring, waste management, and water treatment, crucial for responsible mining operations.

Implementing community development programs and robust health and safety measures are also key cost drivers. These investments are vital for maintaining Hudbay's social license to operate and fostering positive stakeholder relationships.

- Environmental Compliance: Costs for air quality monitoring, water discharge permits, and reclamation bonds.

- Sustainability Initiatives: Investments in renewable energy, biodiversity protection, and carbon footprint reduction programs.

- Community Development: Funding for local infrastructure, education, and social programs in operating regions.

- Health and Safety: Expenses for safety training, personal protective equipment, and occupational health services.

Hudbay's cost structure is dominated by mining and processing, with significant investments in exploration and development to secure future resources. Capital expenditures are also a major component, split between maintaining current operations and fueling growth.

General and Administrative expenses, while smaller, are crucial for corporate oversight and strategic direction, with ongoing efforts to optimize these costs. Furthermore, the company incurs substantial expenses related to environmental compliance, sustainability initiatives, and community engagement, reflecting a commitment to responsible operations.

| Cost Category | 2023 Actuals (approx.) | 2024 Focus | 2025 Projections |

|---|---|---|---|

| Mining & Processing | Cash Costs: $1.06/lb Zn, $2.36/lb Cu | Rigorous cost control & efficiency | Ongoing optimization |

| Exploration & Development | $64.2 million | Advancing projects like Copper World | Continued investment in new reserves |

| Capital Expenditures (Sustaining) | N/A | Maintaining operational efficiency | $365 million |

| Capital Expenditures (Growth) | N/A | Expansion and new project development | $205 million |

| General & Administrative | Q1 2024: $33.1 million | Streamlining processes, leveraging technology | Continued optimization |

| Environmental & Social | Ongoing compliance & program funding | Emissions monitoring, community programs | Sustainability investments |

Revenue Streams

Copper sales are the bedrock of Hudbay's income, making up the largest portion of its earnings. The company mines copper concentrates in Peru and Canada, then sells these to smelters and refiners worldwide.

In 2024, copper prices have shown volatility, but Hudbay's production remains a key driver. For instance, the company reported significant copper production figures from its operations, contributing substantially to its financial performance.

Gold sales are a vital and growing revenue stream for Hudbay, complementing its copper production. In 2023, gold contributed approximately 30% of Hudbay's total revenue, a notable increase from previous years.

This precious metal is primarily generated as a valuable by-product from its base metal operations, but Hudbay also operates dedicated gold-producing assets, enhancing its overall gold output and market presence.

Zinc sales represent a significant revenue stream for Hudbay, primarily generated as a by-product from its polymetallic mining operations. This diversification means that even when primary metal prices fluctuate, the company still benefits from the value of its zinc output. For instance, in 2023, Hudbay reported that its zinc production contributed substantially to its overall financial performance, underscoring the importance of this revenue segment.

Silver Sales

Silver sales represent a significant, albeit secondary, revenue stream for Hudbay, often generated as a by-product of its primary base metal operations. This diversification strengthens the company's overall financial resilience, as fluctuations in silver prices can be partially offset by performance in other commodities. For instance, in 2023, Hudbay's silver production contributed meaningfully to its revenue mix.

Hudbay's business model benefits from this by-product status, as the costs associated with silver extraction are largely absorbed by the primary metal production. This leads to a higher profit margin on silver sales compared to operations solely focused on silver mining.

- By-product Status: Silver is produced alongside copper and zinc, enhancing revenue without significant incremental mining costs.

- Revenue Diversification: Reduces reliance on any single commodity, creating a more stable income base.

- 2023 Performance: Hudbay reported significant silver production and sales, underscoring its importance to the company's financial results.

Molybdenum Sales

Molybdenum, a valuable by-product of Hudbay's copper and zinc operations, significantly contributes to its revenue diversification. This metal is crucial in steel alloys, catalysts, and lubricants, creating a stable demand. In 2023, Hudbay reported that molybdenum accounted for a notable portion of its overall sales, underscoring its importance as a revenue stream beyond its primary commodities.

The company's integrated mining and processing facilities are optimized to recover molybdenum efficiently. This strategic advantage allows Hudbay to capitalize on market opportunities for this metal. For instance, during the first nine months of 2024, the average realized price for molybdenum saw an uptick, directly benefiting Hudbay's financial performance.

- Molybdenum's Role: A key by-product metal enhancing revenue diversity.

- Market Demand: Essential in steel alloys, catalysts, and lubricants.

- 2024 Performance: Benefited from an increase in realized molybdenum prices.

Hudbay's revenue streams are primarily driven by the sale of base and precious metals, with copper being the dominant contributor. The company also generates substantial income from zinc and gold, often as by-products of its main operations, further diversifying its earnings. Molybdenum and silver sales, while smaller, add to this revenue mix, particularly as by-products that enhance profitability without significant additional extraction costs.

| Commodity | Primary Source | By-product Status | 2023 Revenue Contribution (Approx.) | 2024 Outlook Notes |

|---|---|---|---|---|

| Copper | Concentrates from Peru and Canada | Primary | Largest Portion | Price volatility, production remains key driver |

| Gold | By-product and dedicated assets | Significant By-product | ~30% | Growing revenue stream |

| Zinc | Polymetallic operations | Significant By-product | Substantial | Diversifies income |

| Silver | By-product of base metal operations | Secondary By-product | Meaningful | Enhances financial resilience |

| Molybdenum | By-product of copper and zinc operations | Valuable By-product | Notable Portion | Benefited from increased realized prices in early 2024 |

Business Model Canvas Data Sources

The HudBay Business Model Canvas is informed by a blend of internal financial reports, operational data, and external market intelligence. This comprehensive approach ensures that each component, from value propositions to cost structures, is grounded in accurate and actionable insights.