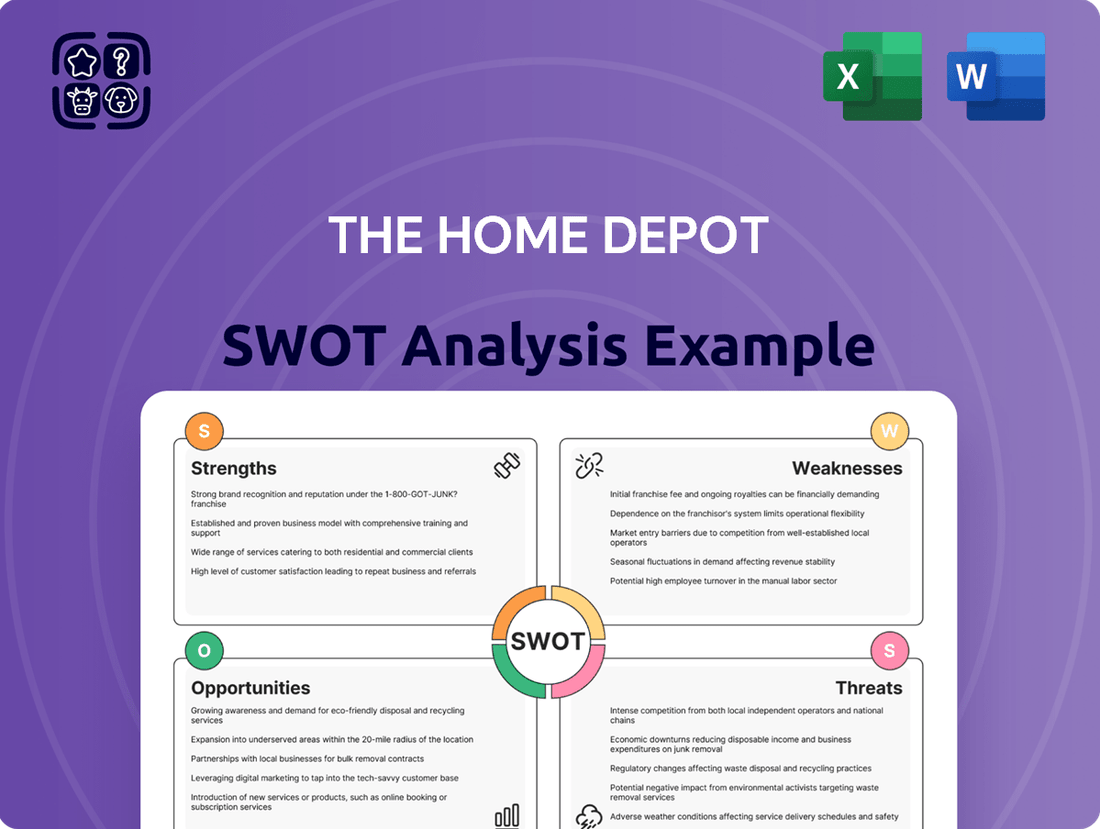

The Home Depot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

The Home Depot's robust brand recognition and extensive supply chain are significant strengths, while its reliance on the housing market presents a key vulnerability. Understanding these dynamics is crucial for anyone looking to navigate the home improvement retail landscape.

Want the full story behind The Home Depot’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Home Depot stands as the world's largest home improvement retailer, a position that grants it substantial market influence and significant competitive advantages derived from economies of scale. This leadership allows for greater negotiating power with suppliers and operational efficiencies that smaller competitors cannot match.

In 2024, The Home Depot's brand was valued at an impressive $52.8 billion, underscoring its strong global recognition and strategic market positioning. This high brand equity translates into customer loyalty and a premium perception, enabling the company to command market share and pricing power.

This combination of market dominance and robust brand value empowers The Home Depot to effectively drive down costs and maintain a competitive edge. It allows the company to invest in innovation, customer service, and store enhancements, further solidifying its leading position in the industry.

The Home Depot boasts an extensive product and service portfolio, offering a vast selection of items for construction, home renovation, and garden care. This wide array caters effectively to both do-it-yourself enthusiasts and professional contractors, ensuring a broad customer base.

Beyond just selling products, Home Depot enhances its offering with installation services for numerous home projects. They also operate a tool rental business, providing a complete solution for a wide range of customer needs and project scopes.

This comprehensive approach solidifies Home Depot's position as a one-stop shop for all home improvement endeavors. For instance, in fiscal year 2023, the company reported net sales of $152.7 billion, underscoring the scale of its operations and customer reach.

Home Depot's robust supply chain, bolstered by investments in rapid deployment and stocking distribution centers, ensures efficient product availability. In 2023, the company continued to enhance its network, aiming for faster fulfillment across its operations.

The company's strong omni-channel strategy, exemplified by its popular Buy Online, Pick Up In Store (BOPIS) service, seamlessly blends digital convenience with its physical store presence. This integrated approach significantly boosts customer accessibility and purchasing options.

Strong Focus on Professional (Pro) Customers

Home Depot's strategic emphasis on professional (Pro) customers is a significant strength. The company has actively enhanced its offerings for contractors, including services like job site deliveries, volume discounts, tailored account management, and specialized distribution facilities. This focus is designed to capture a segment known for consistent and higher spending compared to do-it-yourself (DIY) shoppers.

The acquisition of SRS Distribution in 2024 is a key move that bolsters Home Depot's Pro segment capabilities. SRS Distribution's expertise in high-margin trades such as roofing and landscaping directly complements Home Depot's existing Pro services. This strategic integration aims to deepen market penetration and capture a larger share of the professional renovation and construction market.

The Pro segment is crucial for sustained revenue growth, particularly as it often demonstrates greater resilience during economic fluctuations. In 2024, Home Depot reported that the Pro customer segment continued to outperform the DIY segment, driving a notable portion of its sales growth. This strategic alignment with Pro customers ensures a more stable and predictable revenue stream.

- Targeted Pro Services: Job site delivery, bulk pricing, and personalized accounts cater directly to contractor needs.

- Strategic Acquisition: SRS Distribution acquisition in 2024 enhances capabilities in high-margin trades like roofing and landscaping.

- Market Resilience: The Pro segment shows greater spending stability and resilience compared to the DIY market.

- Revenue Driver: Pro customers are a key contributor to Home Depot's overall sales growth, as seen in 2024 performance data.

Consistent Financial Performance and Shareholder Returns

Home Depot consistently delivers robust financial results, evident in its expanding net income margins and healthy gross profit figures. This financial stability underpins its ability to reinvest in the business and reward shareholders.

The company boasts a strong track record of shareholder returns. For instance, in fiscal 2024, Home Depot increased its quarterly dividend by 2.2%, demonstrating a commitment to returning value to its investors. This consistent dividend growth, coupled with a high return on invested capital, highlights the company's financial discipline and operational efficiency.

- Consistent Profitability: Home Depot has shown resilience in its financial performance, with net income margins that often exceed industry averages.

- Dividend Growth: The company has a history of increasing its dividend payouts, with a 2.2% hike in fiscal 2024, signaling financial health and a focus on shareholder value.

- Strong Return on Capital: A robust return on invested capital (ROIC) indicates efficient use of resources to generate profits, a key indicator of financial strength.

The Home Depot's market leadership is a significant strength, reinforced by its brand value of $52.8 billion in 2024. This scale provides substantial negotiating power with suppliers and operational efficiencies unmatched by smaller rivals.

Its extensive product selection and value-added services, like installation and tool rental, position it as a comprehensive solution provider. This breadth caters to a wide customer base, from DIYers to professionals, contributing to its fiscal 2023 net sales of $152.7 billion.

The company's strategic focus on the professional customer segment, enhanced by the 2024 SRS Distribution acquisition, is driving growth. This segment offers greater spending stability and resilience, as evidenced by its outperformance in 2024.

Home Depot demonstrates consistent financial strength, with healthy profit margins and a commitment to shareholder returns, including a 2.2% dividend increase in fiscal 2024.

| Metric | Value (2023/2024 Data) | Significance |

|---|---|---|

| Brand Value | $52.8 billion (2024) | Indicates strong global recognition and customer loyalty. |

| Net Sales | $152.7 billion (FY2023) | Demonstrates the vast scale of operations and customer reach. |

| Dividend Growth | 2.2% (FY2024) | Signifies financial health and commitment to shareholder value. |

| Pro Segment Performance | Outperforming DIY segment (2024) | Highlights the strategic importance and resilience of professional customers. |

What is included in the product

Analyzes The Home Depot’s competitive position through key internal and external factors, detailing its strong brand and operational efficiency against market shifts and competition.

Offers a clear breakdown of Home Depot's internal strengths and weaknesses, alongside external opportunities and threats, to pinpoint areas needing strategic attention and resource allocation.

Helps identify and address potential disruptions by highlighting competitive pressures and market shifts, enabling proactive mitigation strategies.

Weaknesses

The Home Depot's fortunes are closely tied to the housing market's well-being. Factors like mortgage rates and how confident people feel about their finances directly impact their willingness to tackle big renovation projects. For instance, rising interest rates in 2023 and early 2024 have made consumers think twice about large expenditures, pushing them toward smaller, more budget-friendly DIY tasks rather than major overhauls.

The Home Depot's operational footprint, while dominant in North America with over 2,300 stores across the United States, Canada, and Mexico, exhibits a significant weakness in its limited international presence.

This geographical concentration means the company is largely absent from high-growth emerging markets, such as India and China, which represent substantial untapped potential for expansion and revenue diversification.

By not establishing a foothold in these key global economies, Home Depot risks forfeiting significant growth opportunities that competitors with a more robust international strategy might capitalize on.

Home Depot has been feeling the squeeze on its profit margins. Even with solid sales, things like increasing costs for materials and labor, plus tough competition on pricing, have made it harder to keep profits high. The company's decision to acquire companies also changed their sales mix, impacting overall margins.

Looking ahead, Home Depot’s fiscal year 2026 guidance is quite cautious. They're projecting a small dip in their operating margin, suggesting that the challenges in protecting profitability are expected to continue. This conservative outlook highlights the ongoing pressure on their ability to maintain strong profit levels.

Customer Service and In-Store Experience Challenges

The Home Depot's move towards self-checkout systems, while aiming for efficiency, has drawn varied customer responses. Some shoppers appreciate the speed, but others express concern over the diminished personalized service, a key differentiator for many in the retail space. This can be particularly noticeable when compared to competitors who maintain a stronger in-store staff presence.

Potential issues with longer checkout lines, especially during peak seasons, and the presence of aging infrastructure in some locations can further detract from the overall shopping experience. In 2023, customer satisfaction scores for large retailers often hinge on seamless and helpful interactions, and any friction points can lead shoppers to seek alternatives. For instance, a JD Power 2024 study indicated that while convenience is paramount, the quality of human interaction remains a significant factor in customer loyalty.

- Customer Service Impact: Self-checkout adoption has led to mixed reactions, with some customers missing personalized assistance.

- Competitive Pressure: Competitors offering more personalized service may gain an advantage.

- Operational Challenges: Long lines and dated store infrastructure can negatively affect customer satisfaction.

- Customer Loyalty: A decline in positive in-store experiences could impact repeat business and brand loyalty in the competitive home improvement market.

Intense Competition and Shifting Consumer Behavior

Home Depot operates in a highly competitive landscape, facing significant pressure from direct rivals such as Lowe's, alongside e-commerce giants like Amazon and smaller, specialized hardware stores like ACE Hardware. These competitors are actively narrowing the gap by offering competitive pricing strategies, expanding their product assortments, and improving customer service experiences, forcing Home Depot to remain agile.

Furthermore, evolving consumer preferences present a notable challenge. There's a discernible shift towards smaller-scale home improvement projects, and a growing inclination for online purchasing. This trend, coupled with a general decline in physical store foot traffic, necessitates ongoing strategic adjustments to meet customers where they are, particularly in the digital realm.

- Competitive Landscape: Home Depot faces intense rivalry from Lowe's, Amazon, and ACE Hardware, all vying for market share through aggressive pricing and expanded offerings.

- Evolving Consumer Habits: A marked shift towards smaller projects and increased online shopping, contrasted with reduced in-store visits, demands continuous adaptation from Home Depot.

- Digital Transformation Pressure: Competitors' enhanced online presence and customer service are compelling Home Depot to invest heavily in its digital capabilities to retain and attract customers.

The Home Depot's reliance on the housing market makes it vulnerable to economic downturns, with rising interest rates in 2023-2024 impacting consumer spending on large renovations. Its limited international presence, particularly in high-growth emerging markets like India and China, represents a missed opportunity for diversification and revenue growth.

Profit margins are under pressure due to rising material and labor costs, coupled with competitive pricing. The company's fiscal year 2026 guidance projects a slight dip in operating margin, indicating ongoing profitability challenges. Additionally, the shift to self-checkout has led to mixed customer feedback, with some missing personalized service, potentially impacting loyalty.

Operational issues like longer checkout lines and aging store infrastructure can also detract from the customer experience. Intense competition from Lowe's, Amazon, and smaller retailers, alongside evolving consumer preferences for smaller projects and online shopping, necessitates continuous adaptation and investment in digital capabilities.

Full Version Awaits

The Home Depot SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You can expect a comprehensive breakdown of Home Depot's Strengths, Weaknesses, Opportunities, and Threats, providing valuable strategic insights.

Opportunities

The Home Depot has a considerable opportunity to increase its dominance in the professional contractor market. This segment is demonstrating greater stability and profitability compared to the do-it-yourself (DIY) sector.

Strategic acquisitions, such as SRS Distribution and GMS, have significantly broadened The Home Depot's product assortment, distribution networks, and access to commercial and multi-family construction projects. The Pro segment's contribution to total sales now surpasses 50%, underscoring its importance.

The Home Depot's commitment to technology, particularly its investment in AI-powered cloud innovation, is a significant opportunity. This focus aims to elevate the customer experience and streamline operations, a crucial aspect in the competitive retail landscape. For instance, their ongoing digital platform and mobile app enhancements are designed to make shopping more intuitive and efficient.

Further strengthening online sales capabilities presents a clear avenue for growth. By offering personalized digital experiences, the company can better connect with customers and encourage repeat business. Optimizing supply chain technology is also key, ensuring products are available when and where customers need them, which is vital for meeting evolving preferences for seamless, interconnected shopping journeys.

Home Depot has a significant opportunity to tap into emerging markets, particularly in Asia, which are showing robust growth in home improvement. For instance, the home improvement market in India alone was valued at approximately $17.4 billion in 2023 and is projected to reach over $30 billion by 2028, indicating substantial untapped potential. Expanding into countries like India and China could allow Home Depot to diversify its revenue streams and capture new market share, moving beyond its current North America concentration.

Enhancing Home Services and Installation Offerings

The Home Depot can significantly boost its market presence by expanding and actively promoting its installation services for a wider array of home projects. This strategic move targets the growing 'Do-It-For-Me' (DIFM) segment, allowing the company to capture a larger share of customer spending beyond just product sales. In 2023, the home improvement market saw continued strength, with installation services representing a substantial portion of overall project costs, a trend expected to persist through 2024 and 2025.

Forging strategic partnerships with qualified home service providers presents another key opportunity. This can broaden The Home Depot's service portfolio, creating new revenue streams and fostering deeper customer loyalty by offering a more comprehensive, one-stop solution for home improvement needs. For instance, collaborations could extend to specialized areas like smart home technology installation or complex plumbing and electrical work, areas where customers often seek professional assistance.

- Expand installation services for DIY projects, targeting the DIFM market.

- Form strategic partnerships with home service providers to broaden offerings.

- Increase revenue through bundled product and service packages.

- Enhance customer loyalty by becoming a comprehensive home solutions provider.

Sustainability Initiatives and Eco-Friendly Products

The Home Depot's expansion of its eco-friendly product lines, such as energy-efficient appliances and sustainable building materials, directly taps into a growing market. In 2024, consumer spending on sustainable goods was projected to continue its upward trend, with a significant portion of shoppers indicating a preference for brands with strong environmental commitments. This strategic alignment not only bolsters brand image but also opens avenues for attracting a key demographic increasingly prioritizing environmental impact in their purchasing decisions.

The company's commitment to reducing its carbon footprint, aiming for significant reductions by 2030, is another key opportunity. Such initiatives can translate into long-term operational efficiencies, potentially lowering energy costs and waste management expenses. For instance, investments in renewable energy sources for its facilities, a strategy many large retailers are adopting, could yield substantial savings and demonstrate tangible progress towards sustainability goals.

- Growing Consumer Demand: A significant percentage of consumers, particularly millennials and Gen Z, actively seek out and are willing to pay a premium for sustainable products.

- Enhanced Brand Reputation: Proactive sustainability efforts can significantly improve public perception and brand loyalty, differentiating The Home Depot from competitors.

- Operational Efficiencies: Investments in energy-saving technologies and waste reduction programs can lead to measurable cost savings over time.

- Attracting Talent: A strong commitment to sustainability can also attract environmentally conscious employees, contributing to a positive company culture and workforce.

The Home Depot can capitalize on the growing demand for installation services, particularly within the Do-It-For-Me (DIFM) segment, which represents a substantial portion of home improvement project costs. By expanding and actively promoting these services, the company can capture more customer spending beyond product sales. Strategic partnerships with qualified home service providers offer another avenue to broaden the service portfolio, creating new revenue streams and fostering deeper customer loyalty by acting as a comprehensive home solutions provider.

The company has a significant opportunity to expand its reach into emerging markets, such as Asia, which are experiencing robust growth in home improvement. For example, the Indian home improvement market was valued at approximately $17.4 billion in 2023 and is projected to exceed $30 billion by 2028, presenting considerable untapped potential for revenue diversification and new market share capture.

Further enhancing its digital capabilities and online sales presents a clear growth path. By offering personalized digital experiences and optimizing supply chain technology, The Home Depot can improve customer connections and ensure product availability, aligning with evolving preferences for seamless shopping journeys.

Threats

The threat of economic downturns and high interest rates looms large for Home Depot. A prolonged recession or significant interest rate hikes, as experienced in 2023 and anticipated to persist into 2024, can severely curb consumer spending, particularly on big-ticket home improvement projects and non-essential purchases. This directly translates to reduced comparable sales and puts a squeeze on profit margins, a challenge Home Depot has already navigated, with demand for major renovations showing signs of softening.

The home improvement sector is intensely competitive, with established players like Lowe's and ACE Hardware, alongside online behemoths such as Amazon, constantly battling for customer loyalty and market share. This dynamic landscape means Home Depot faces ongoing pressure to maintain its leading position.

Competitors are increasingly employing aggressive pricing tactics, rolling out innovative product lines, and elevating their customer service offerings. For instance, in 2024, Amazon's continued expansion in home goods and its Prime membership benefits present a significant challenge, particularly for online sales and convenience-focused shoppers.

These rival strategies directly threaten Home Depot's market share and profitability. The need to respond with competitive pricing and superior service requires significant investment, potentially impacting margins as the company strives to retain its customer base.

Global supply chain disruptions, including persistent labor shortages in transportation and warehousing, continue to inflate shipping costs. For instance, the average cost to ship a 40-foot container globally saw significant fluctuations throughout 2024, impacting inventory management and product pricing for retailers like Home Depot.

Geopolitical tensions and ongoing trade disputes, such as those involving tariffs and international relations, introduce further volatility. These factors can directly affect the availability and cost of goods, posing a tangible threat to Home Depot's ability to maintain consistent product supply and manage operational expenses effectively, despite ongoing diversification efforts.

Shifting Consumer Preferences and DIY vs. Pro Mix

Economic uncertainty continues to influence consumer spending, potentially driving a sustained shift towards smaller, more manageable DIY projects rather than large-scale renovations. This change in consumer behavior directly impacts Home Depot's sales mix, as smaller projects typically involve lower average transaction values compared to major renovation jobs.

While the professional contractor segment (Pro) remains a robust revenue driver for Home Depot, a notable contraction in the DIY market presents a significant challenge. For instance, in Q1 2024, Home Depot reported a 7% decrease in DIY customer transactions, underscoring the need for agile product assortment and targeted marketing to maintain overall sales momentum.

- DIY Market Volatility: A continued preference for smaller DIY projects could reduce the average ticket size for a significant portion of Home Depot's customer base.

- Pro Segment Reliance: While strong, over-reliance on the Pro segment could be problematic if economic downturns disproportionately affect professional contractors' project pipelines.

- Adaptation Necessity: Home Depot must continuously evolve its product offerings and marketing strategies to cater to evolving DIY preferences and support the Pro segment effectively amidst shifting economic landscapes.

Cybersecurity Risks and Data Breaches

The Home Depot, with its vast online presence and significant customer data holdings, faces substantial cybersecurity risks. A data breach could result in considerable financial penalties and a severe blow to its reputation.

Such incidents directly impact customer trust, potentially leading to a decline in sales and long-term brand loyalty. For instance, in 2014, Home Depot experienced a breach affecting 56 million payment cards, highlighting the tangible consequences of such threats.

- Financial Impact: Costs associated with breach remediation, regulatory fines, and legal settlements can be substantial.

- Reputational Damage: Loss of customer confidence can erode brand equity and market position.

- Operational Disruption: Security incidents can disrupt normal business operations, affecting sales and supply chains.

- Customer Trust Erosion: Consumers are increasingly wary of how their personal data is handled, making security paramount.

Intensified competition from both traditional retailers and e-commerce giants like Amazon poses a continuous threat, forcing Home Depot to invest heavily in pricing and service to maintain market share. Supply chain disruptions, including rising shipping costs and labor shortages evident throughout 2024, directly impact inventory and pricing strategies.

Economic uncertainty, marked by fluctuating consumer confidence and a potential shift towards smaller DIY projects, challenges Home Depot's sales mix. While the professional segment remains strong, a contraction in DIY transactions, as seen with a 7% decrease in Q1 2024 DIY customer transactions, necessitates agile product and marketing adjustments.

| Threat Category | Specific Threat | Impact on Home Depot | Example/Data Point (2024) |

|---|---|---|---|

| Competitive Landscape | Aggressive Pricing & Innovation | Market share erosion, margin pressure | Amazon's continued expansion in home goods |

| Economic Factors | DIY Market Shift | Reduced average transaction value | 7% decrease in DIY customer transactions (Q1 2024) |

| Supply Chain & Operations | Shipping Cost Inflation | Increased operational expenses, pricing challenges | Volatile global container shipping costs |

| Cybersecurity | Data Breaches | Financial penalties, reputational damage | Past breach affecting 56 million payment cards (2014) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Home Depot's official financial statements, comprehensive market research reports, and expert analyses of the retail and home improvement sectors.