The Home Depot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

The Home Depot navigates a complex retail landscape, facing significant buyer power from its vast customer base and intense rivalry from competitors. Understanding these forces is crucial for any business operating in the home improvement sector.

The complete report reveals the real forces shaping The Home Depot’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Home Depot benefits from a vast network of suppliers for its diverse product range, which significantly weakens the bargaining power of any single supplier. This extensive pool allows the company to negotiate favorable terms and avoid over-reliance on a few vendors. For instance, in 2024, Home Depot sources products from thousands of suppliers globally, covering everything from lumber and paint to appliances and tools.

Home Depot's position as the world's largest home improvement retailer, with 2023 revenue exceeding $152 billion, grants it immense bargaining power with suppliers. This colossal purchasing volume allows them to negotiate favorable terms and secure significant bulk discounts, directly impacting their ability to maintain a low-cost provider strategy.

The sheer scale of Home Depot's operations enables them to drive down procurement costs, making it challenging for suppliers to unilaterally dictate pricing or terms. This leverage is a critical factor in their competitive advantage, as it allows them to pass savings onto consumers and maintain healthy profit margins.

The Home Depot's investment in and expansion of its private label brands, such as HDX and Husky, significantly bolsters its position against suppliers. By offering exclusive products, the company carves out a niche that reduces reliance on national brands for key categories.

This strategic move grants Home Depot greater leverage in negotiating terms and pricing with external manufacturers. It allows them to dictate product features and quality standards, directly impacting supplier dependency and strengthening their own bargaining power.

In 2023, private label brands represented a substantial portion of The Home Depot's sales, contributing to their ability to absorb potential price increases from suppliers or source comparable products more favorably.

Supplier Exclusivity is Low

Supplier exclusivity is generally low for Home Depot, meaning suppliers often sell to multiple retailers. This broad market access for suppliers reduces their individual leverage. For instance, in 2024, Home Depot worked with thousands of suppliers across various product categories, preventing any single supplier from holding significant sway.

The competitive landscape among suppliers further limits their bargaining power. With many companies vying to supply Home Depot, they are incentivized to offer competitive pricing and favorable terms. This dynamic ensures that Home Depot can source a wide array of products without being overly dependent on any one supplier.

- Broad Supplier Base: Home Depot's vast network of suppliers, numbering in the thousands, dilutes the power of any individual supplier.

- Competitive Market: The highly competitive nature of the home improvement supply market prevents suppliers from dictating terms.

- Lack of Exclusivity: Suppliers are typically not bound by exclusive contracts, allowing them to sell to other retailers, which limits their leverage over Home Depot.

Strategic Supply Chain Investments

Home Depot's strategic investments in its supply chain directly counter supplier bargaining power. By adding new distribution centers and adopting advanced logistics technology, the company boosts its operational efficiency and lessens its dependence on suppliers for critical distribution functions. For instance, in 2023, Home Depot continued its focus on supply chain modernization, aiming for faster delivery times and greater inventory visibility across its network.

These supply chain optimizations allow Home Depot to streamline the flow of goods, potentially enabling it to bypass certain traditional supplier-dependent channels. This enhanced control over logistics means Home Depot can negotiate more favorable terms with suppliers or even source directly from manufacturers, thereby diminishing the suppliers' ability to dictate prices or terms.

- Supply Chain Investment: Home Depot's ongoing investment in its supply chain infrastructure, including new distribution centers and technology, enhances its operational leverage.

- Reduced Supplier Reliance: By managing more logistics in-house, Home Depot decreases its reliance on suppliers for crucial supply chain functions.

- Efficiency Gains: Optimized logistics streamline product movement, potentially allowing for direct sourcing and bypassing intermediaries, which weakens supplier power.

- Negotiating Position: A more robust and controlled supply chain strengthens Home Depot's negotiating position with its suppliers.

The bargaining power of suppliers for Home Depot is relatively low due to the company's immense scale and diversified supplier base. Home Depot's substantial purchasing volume, exceeding $152 billion in revenue in 2023, allows it to command favorable pricing and terms from its vendors. Furthermore, the company's strategic development of private label brands and its robust supply chain infrastructure further diminish supplier leverage.

| Factor | Impact on Home Depot | Evidence/Data (2023-2024) |

|---|---|---|

| Supplier Concentration | Low | Sources from thousands of global suppliers, preventing reliance on any single entity. |

| Purchasing Volume | High Leverage | 2023 Revenue: >$152 billion. Enables significant bulk discounts and favorable contract negotiations. |

| Private Label Brands | Increased Control | Private label sales contribute substantially, allowing negotiation of terms and quality standards with manufacturers. |

| Supplier Exclusivity | Low | Suppliers typically sell to multiple retailers, limiting their ability to dictate terms to Home Depot. |

| Supply Chain Efficiency | Reduced Dependence | Investments in logistics and distribution centers enhance operational control, lessening reliance on supplier-dependent channels. |

What is included in the product

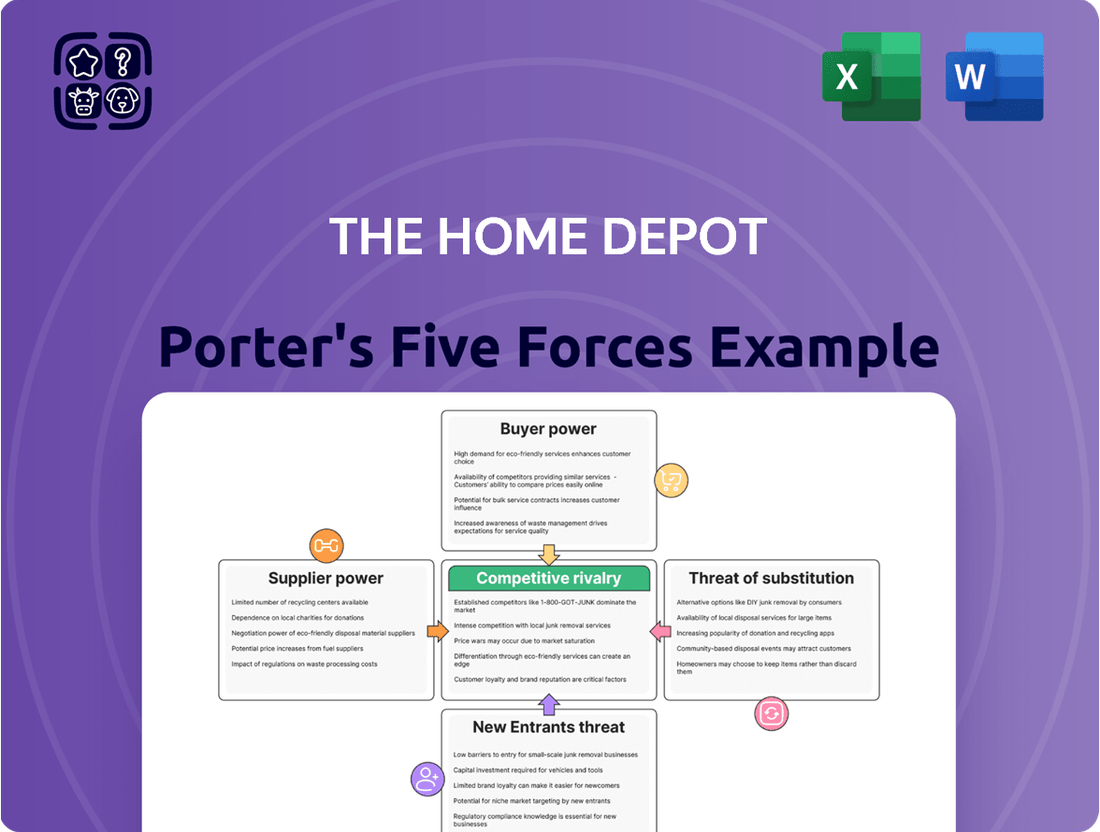

This Porter's Five Forces analysis for The Home Depot dissects the competitive intensity within the home improvement retail sector, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly grasp Home Depot's competitive landscape with a visual breakdown of each force, simplifying complex strategic analysis.

Customers Bargaining Power

Home Depot's customers generally face low switching costs. This means it's relatively easy for shoppers to take their business to a competitor if they find better prices or a wider selection of home improvement goods. For instance, a customer can easily compare prices for a specific tool or paint brand across Home Depot, Lowe's, or online retailers without significant effort or expense.

This low barrier to switching directly enhances the bargaining power of these customers. They can readily shop around, leveraging competitive pricing and promotions offered by various home improvement stores. The widespread availability of information online further empowers buyers to make informed decisions based on price and product features.

The home improvement market itself is quite competitive, featuring numerous players. This includes large national chains like Lowe's, as well as regional hardware stores and a growing number of online retailers. This saturation of options means customers have a wide array of choices, further tipping the scales in their favor when it comes to negotiating or seeking the best value.

The home improvement market is flooded with alternatives, meaning customers have plenty of choices beyond The Home Depot. Think about general retailers like Walmart or Target that also carry basic home goods, or specialized shops focusing on specific areas like flooring or lighting. Plus, the rise of online giants like Amazon means consumers can easily compare prices and products from anywhere.

This abundance of substitutes significantly boosts customer bargaining power. When customers can readily find similar products or services elsewhere, they are less tied to a single retailer. For instance, in 2023, online sales for home improvement goods continued to grow, indicating a strong customer preference for convenient, often price-competitive options available through digital channels.

Consequently, The Home Depot must constantly strive to offer competitive pricing and superior service to retain its customer base. The ability for customers to easily switch to a competitor, whether online or offline, puts pressure on The Home Depot to maintain attractive value propositions. This competitive landscape is a key factor influencing their operational strategies and pricing decisions.

Consumers are quite sensitive to the prices of home improvement products, viewing many of them as optional buys rather than necessities. This means they're more likely to shop around for the best price. For example, during 2024, Home Depot faced increased competition from online retailers and discount chains, which intensified price comparisons among shoppers.

The ease with which customers can check prices, whether by visiting multiple stores or browsing online, directly impacts Home Depot. They can readily find lower prices elsewhere, forcing Home Depot to maintain competitive pricing to retain its customer base. This dynamic puts significant pressure on the company's profit margins.

Large Population of Buyers

While Home Depot serves a vast number of individual customers, the sheer volume of these buyers generally limits the bargaining power of any single customer. This broad customer base means that no one buyer can dictate terms or significantly influence pricing. However, collective consumer trends and purchasing preferences can still exert considerable influence on Home Depot's product offerings and strategic decisions.

The company must effectively cater to a wide array of customer needs, from weekend DIYers to professional contractors who rely on Home Depot for their businesses. For instance, in 2023, Home Depot reported that professional customers accounted for a significant portion of its sales, highlighting the importance of this segment.

- Large Customer Base: Home Depot's extensive customer reach dilutes individual buyer power.

- Collective Influence: Broad consumer trends and preferences can still shape company strategy.

- Diverse Needs: The company serves both DIY enthusiasts and professional contractors.

- Professional Segment Importance: In 2023, professional customer sales represented a substantial part of Home Depot's revenue.

Access to Information and Digital Tools

Customers today possess unparalleled access to product details, reviews, and price comparisons via online channels. This readily available information significantly boosts their ability to make informed purchasing decisions, thereby increasing their bargaining power against retailers like Home Depot.

Home Depot recognizes this shift and is actively investing in its digital and omnichannel capabilities. For instance, in fiscal year 2023, the company reported a 4.4% increase in online sales, reaching $16.5 billion, demonstrating their commitment to meeting digitally empowered customer expectations and mitigating this rising bargaining power.

- Informed Purchasing: Customers can easily research product specifications, read user reviews, and compare prices across different retailers.

- Price Sensitivity: Increased transparency fuels price sensitivity, pressuring retailers to offer competitive pricing.

- Omnichannel Expectations: Buyers expect seamless integration between online and in-store experiences, demanding convenience and consistent information.

The bargaining power of Home Depot's customers is generally high due to low switching costs and the availability of numerous substitutes. Consumers can easily compare prices and products across various retailers, both online and in physical stores, forcing Home Depot to maintain competitive pricing. This ease of comparison is amplified by the widespread availability of product information and reviews, making customers highly price-sensitive.

| Factor | Impact on Home Depot | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Switching Costs | Low, increasing customer power | Minimal costs to switch between home improvement retailers. |

| Availability of Substitutes | High, empowering customers | Growth in online sales (e.g., Home Depot's $16.5 billion in FY2023) indicates strong competition from digital channels. |

| Price Sensitivity | Significant, pressuring margins | Increased competition from discount chains and online retailers in 2024 intensified price comparisons. |

| Customer Information Access | High, leading to informed decisions | Customers readily access product details, reviews, and price comparisons online. |

Preview Before You Purchase

The Home Depot Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of The Home Depot details the competitive landscape, including buyer and supplier power, threat of new entrants, substitutes, and industry rivalry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The home improvement retail landscape is crowded, with numerous players vying for market share. Beyond giants like Lowe's, a vast network of smaller, local hardware stores and emerging online platforms, including Amazon, contribute to this intense rivalry. This competitive density pressures Home Depot to constantly refine its offerings and customer experience to stand out.

The ease with which customers can switch between home improvement retailers significantly fuels competitive rivalry. With low switching costs, buyers can readily move to competitors offering better prices or a more convenient experience, putting pressure on The Home Depot to constantly innovate and maintain customer satisfaction.

This dynamic necessitates a strong focus on customer loyalty for Home Depot. The company must excel in areas like exceptional customer service, a comprehensive and well-curated product assortment, and consistently competitive pricing to prevent customer attrition and secure its market position.

In 2024, the home improvement retail sector continued to see intense competition. For instance, Home Depot's net sales for the first quarter of fiscal 2024 were $37.7 billion, a slight decrease from the previous year, underscoring the challenges of retaining customers in a low-switching-cost environment.

The home improvement retail sector, including Home Depot, faces moderate exit barriers. This means companies are not easily incentivized to leave the market, even when facing difficulties. For instance, the significant investment in physical store locations and established supply chains makes a complete withdrawal costly and complex.

Consequently, existing competitors are likely to persist and continue vying for market share. This sustained presence fuels ongoing competitive rivalry, as companies like Lowe's and Ace Hardware remain active participants. In 2024, the home improvement sector continued to see robust activity, with major players investing in store remodels and digital capabilities, underscoring their commitment to remaining in the market.

Strategic Investments and Acquisitions

Home Depot's competitive rivalry is intensified by its proactive approach to strategic investments and acquisitions. A prime example is the acquisition of SRS Distribution, a move designed to significantly bolster its presence in the professional contractor market. This expansion aims to capture a larger share and erect hurdles for competitors by providing a more complete suite of products and services.

These strategic maneuvers are not isolated events; they represent a consistent effort to solidify Home Depot's market standing. By integrating businesses like SRS Distribution, Home Depot seeks to offer a more compelling value proposition to a broader customer base, thereby increasing the switching costs for its rivals.

- Market Share Expansion: Home Depot's acquisition of SRS Distribution, valued at approximately $18.25 billion, significantly enhances its competitive edge, particularly within the professional contractor segment.

- Enhanced Product Offerings: This strategic investment allows Home Depot to broaden its product and service portfolio, catering more effectively to the specialized needs of trade professionals.

- Competitive Barrier Creation: By consolidating its position and offering integrated solutions, Home Depot aims to make it more challenging for smaller or less diversified competitors to match its value proposition.

Focus on Pro Customers and Omnichannel

Home Depot's strategic pivot towards its professional contractor (Pro) customer base, a segment known for higher average ticket sizes, significantly intensifies competitive rivalry. This focus is amplified by their robust omnichannel strategy, blending online convenience with in-store accessibility, a move that directly challenges competitors relying on less integrated models.

In 2024, Home Depot reported that its Pro segment represented approximately 50% of its total sales, a testament to the success of this customer-centric approach. This strategic emphasis allows them to capture a larger share of the lucrative contractor market, putting pressure on rivals to enhance their own service offerings and digital capabilities to compete effectively.

- Pro Customer Focus: Home Depot's dedicated efforts to serve professional contractors, including specialized services and bulk purchasing options, create a strong loyalty base.

- Omnichannel Integration: The seamless connection between online ordering, in-store pickup, and delivery options provides a significant convenience advantage over less sophisticated competitors.

- Competitive Differentiation: By excelling in these areas, Home Depot establishes a clear competitive edge, forcing other home improvement retailers to invest heavily in similar capabilities to remain relevant.

The home improvement retail sector is characterized by intense competition, with Home Depot facing rivals like Lowe's, Ace Hardware, and a growing number of online players. This crowded market means constant pressure to innovate and offer superior value to customers, as switching between retailers is generally easy and inexpensive.

Home Depot's strategic focus on the professional contractor segment, which accounted for roughly 50% of its sales in 2024, further intensifies rivalry. By enhancing its Pro offerings and omnichannel capabilities, the company aims to capture a larger market share and create higher switching costs for its competitors.

The acquisition of SRS Distribution for approximately $18.25 billion in 2024 exemplifies Home Depot's aggressive strategy to bolster its position in the Pro market. This move not only expands its product and service portfolio but also aims to build a more formidable competitive barrier against rivals seeking to serve trade professionals.

| Competitor | Market Focus | Key Strategies |

|---|---|---|

| Lowe's | Homeowners and DIY, growing Pro segment | Store remodels, digital investment, Pro services |

| Ace Hardware | Local, community-focused, independent dealers | Cooperative model, localized inventory, customer service |

| Amazon | Online retail, broad product selection | Convenience, competitive pricing, fast delivery |

SSubstitutes Threaten

The threat of substitutes is amplified by the widespread availability of general merchandise stores like Walmart and Costco. These retailers offer a broad selection of home improvement items, directly competing with Home Depot for certain product categories. For instance, in 2023, Walmart reported over $648 billion in revenue, showcasing its immense reach and ability to stock diverse product lines, including many found in home improvement centers.

While these general merchandise stores may not match Home Depot's specialized inventory depth, their convenience and often aggressive pricing strategies can sway price-sensitive consumers. This broad accessibility means customers can often fulfill immediate, less specialized needs without visiting a dedicated home improvement retailer, thus fragmenting potential sales.

The threat of substitutes is amplified by low switching costs for Home Depot's customers. It’s incredibly easy for consumers to shift their spending to alternative retailers or even entirely different solutions for their home improvement projects. For instance, a customer needing lumber might easily choose a local lumber yard or even a big-box general merchandise store if the price or convenience is better, rather than exclusively relying on Home Depot.

This lack of buyer loyalty means Home Depot must constantly compete on price and service to retain its customer base. In 2023, Home Depot reported net sales of $152.7 billion, indicating the sheer volume of transactions where switching is a constant possibility. The ease with which customers can access comparable products elsewhere significantly pressures Home Depot's market share and profitability.

Customers often consider doing projects themselves (DIY) as a substitute for buying directly from Home Depot, sourcing materials from various places. Alternatively, they can hire professional contractors who may procure their own supplies, bypassing Home Depot's retail model entirely for those specific projects. This dual threat means Home Depot must cater to both individual consumers and professional tradespeople to maintain market share.

Online-Only Retailers and Specialized Stores

The proliferation of online-only retailers and highly specialized brick-and-mortar stores poses a significant substitute threat to Home Depot. These competitors often focus on specific product categories, like flooring or lighting, allowing them to offer a curated selection and potentially deeper expertise. For instance, in 2024, e-commerce continued its strong growth trajectory, capturing an increasing share of retail sales, which directly impacts traditional home improvement giants.

These specialized outlets can leverage lower overheads compared to large-format stores, enabling them to offer competitive pricing online. This price advantage, coupled with a focused product assortment, can attract customers seeking specific items or better deals, thereby diverting sales from Home Depot’s broader inventory. The ability of these substitutes to offer niche products or specialized services can also appeal to a segment of Home Depot's customer base.

Consider the following points regarding this threat:

- Niche Market Focus: Specialized retailers concentrate on specific home improvement segments, offering deeper product assortments and expertise that can be more appealing to certain customer needs than a generalist approach.

- Online Convenience and Pricing: Online-only retailers provide the ease of shopping from home and often compete aggressively on price, a factor that remains highly influential in consumer purchasing decisions in 2024.

- Agility and Innovation: Smaller, specialized competitors can sometimes be more agile in adopting new technologies or sourcing unique products, allowing them to quickly respond to evolving consumer trends and preferences.

Performance-to-Price Ratio of Substitutes

The performance-to-price ratio of substitutes significantly impacts Home Depot. When alternative products offer comparable quality at a lower cost, consumers are naturally drawn to them. For instance, while Home Depot offers a wide range of branded power tools, smaller, independent hardware stores or online retailers might provide comparable tools from lesser-known brands at a noticeably lower price point. This competitive dynamic compels Home Depot to consistently demonstrate and reinforce its value proposition to retain customer loyalty.

This pressure is evident when considering the DIY market. A homeowner looking for basic tools for a weekend project might find that a big-box retailer's private label tool set offers sufficient functionality for their needs at a fraction of the cost of a professional-grade tool from Home Depot. In 2023, the average price increase for consumer goods across various sectors ranged from 3% to 7%, meaning that even small price differences in substitutes can become a significant factor for budget-conscious consumers.

- Value Proposition Defense: Home Depot must continually highlight its product quality, brand reputation, and customer service to justify its pricing against lower-cost alternatives.

- Price Sensitivity: A significant portion of Home Depot's customer base, particularly DIYers, is price-sensitive, making them susceptible to attractive substitute offers.

- Market Share Risk: A strong performance-to-price ratio among substitutes can lead to market share erosion if Home Depot fails to remain competitive on value.

The threat of substitutes for Home Depot is substantial, driven by a variety of alternatives ranging from general merchandise retailers to specialized online stores and even the DIY approach itself. These substitutes often compete on price, convenience, or niche product offerings, forcing Home Depot to constantly re-evaluate its value proposition. For example, in 2023, the continued growth of e-commerce presented a significant challenge, with online retail sales capturing an increasing share of the market.

Customers can easily switch to alternatives like Walmart or Amazon for many home improvement essentials, especially when price is the primary consideration. The low switching costs associated with purchasing home improvement goods mean that Home Depot must remain competitive in both its pricing and the breadth of its product selection. The ease with which consumers can source materials elsewhere, or even opt for professional installation which includes material procurement, further amplifies this threat.

| Substitute Type | Key Competitive Factors | Impact on Home Depot |

|---|---|---|

| General Merchandise Retailers (e.g., Walmart, Costco) | Price, Convenience, Broad Product Assortment | Market share erosion for non-specialized items, price pressure. |

| Online-Only Retailers | Price, Convenience, Niche Product Focus | Direct competition on price and product availability, potential for lower overheads. |

| Specialized Brick-and-Mortar Stores | Deep Product Assortment, Expertise, Niche Offerings | Attracts specific customer segments seeking specialized solutions or advice. |

| DIY (Do-It-Yourself) & Professional Contractors | Cost Savings (DIY), Material Sourcing Flexibility (Contractors) | Reduces direct retail sales volume, shifts procurement power. |

Entrants Threaten

Establishing a retail operation comparable to Home Depot's vast network of over 2,300 stores and its sophisticated supply chain demands immense capital. This significant financial hurdle makes it exceedingly difficult for new players to enter the market and achieve the necessary economies of scale to compete effectively.

Home Depot benefits from decades of cultivating strong brand recognition and deep customer loyalty. This established trust makes it difficult for newcomers to gain a foothold.

New entrants would need to invest heavily in marketing and customer acquisition to even begin to rival Home Depot's brand equity. For instance, in fiscal year 2023, Home Depot's net sales reached $152.7 billion, underscoring its massive market presence and the challenge for any new competitor to capture even a small fraction of this revenue.

The sheer scale of Home Depot's operations and its established supply chain further erects barriers. Replicating their extensive product selection, competitive pricing, and efficient distribution network would require substantial capital and time, making the threat of new entrants relatively low.

Home Depot's extensive supply chain and distribution network is a formidable barrier to entry. This complex infrastructure, which includes over 130 distribution centers and robust last-mile delivery, makes it incredibly difficult for newcomers to match their operational efficiency and reach. In 2023, Home Depot reported over $152 billion in sales, a testament to the effectiveness of this established system.

Moderate Cost of Doing Business

While the immense capital needed to replicate Home Depot's vast network of over 2,300 stores presents a significant barrier, the moderate cost of establishing a smaller, localized presence or an e-commerce operation within the home improvement sector still allows for the emergence of new competitors. This means that while challenging, outright replication is not the only threat; smaller, specialized players can carve out niches.

This dynamic is evident in the continued growth of online retailers and specialized brick-and-mortar stores focusing on specific product categories. For instance, the rise of direct-to-consumer brands in areas like smart home technology or specialized tools demonstrates that a lower initial investment can still yield market share. However, achieving Home Depot's scale, with its extensive supply chain and brand recognition, remains exceptionally difficult for these smaller entrants.

- Moderate initial investment for niche players: Opening a single home improvement store or an online platform requires less capital than building a national chain.

- Scalability challenges for new entrants: Reaching Home Depot's market penetration and operational efficiency is a significant hurdle for smaller competitors.

- E-commerce and specialized retail threats: Online-only retailers and niche physical stores can attract customers with focused product offerings and potentially lower overhead.

Low Switching Costs for Buyers

Low switching costs for buyers in the home improvement sector mean customers can easily move between retailers like Home Depot without significant financial or operational hurdles. This ease of switching can intensify competition as new entrants can attract customers more readily. For instance, a new online-only retailer might offer competitive pricing or unique product bundles to draw customers away from established brick-and-mortar stores.

While this dynamic slightly lowers the barrier for new entrants, they still face the challenge of convincing customers to switch from trusted brands like Home Depot, which benefits from brand loyalty and extensive store networks. In 2024, the home improvement retail market continued to see robust competition, with online sales growth outpacing physical store growth, indicating a willingness among consumers to explore new channels.

- Low Switching Costs: Customers can switch between home improvement retailers with minimal effort or expense.

- Increased Rivalry: This ease of switching fuels competition, putting pressure on existing players to maintain customer loyalty.

- New Entrant Advantage: It slightly reduces the barrier for new companies to enter the market by making customer acquisition less costly.

- Value Proposition is Key: New entrants must offer superior value, price, or convenience to persuade customers to switch from established retailers like Home Depot.

The threat of new entrants for Home Depot is generally considered moderate. While replicating Home Depot's vast physical footprint and sophisticated supply chain requires immense capital, the rise of e-commerce and specialized retailers presents a more accessible entry point for smaller players. For example, in 2024, online sales in the home improvement sector continued to grow, offering a less capital-intensive avenue for new businesses to reach consumers. Home Depot's fiscal year 2023 net sales of $152.7 billion highlight the scale of the market, but also the potential for niche players to capture segments with focused offerings.

| Barrier to Entry | Impact on New Entrants | Home Depot's Advantage |

|---|---|---|

| Capital Requirements (Stores & Supply Chain) | Very High | Extensive network of over 2,300 stores; robust distribution centers. |

| Brand Recognition & Customer Loyalty | High | Decades of established trust and widespread brand awareness. |

| Economies of Scale | High | Ability to negotiate better prices with suppliers due to high volume. |

| E-commerce & Niche Specialization | Moderate | Lower initial investment allows for specialized online or smaller physical stores. |

| Switching Costs for Customers | Low | Customers can easily switch, creating opportunities for new entrants with compelling offers. |

Porter's Five Forces Analysis Data Sources

Our Home Depot Porter's Five Forces analysis is built upon a foundation of robust data, including Home Depot's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista. We also incorporate macroeconomic data and competitor analysis to provide a comprehensive view of the competitive landscape.