The Home Depot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

Curious about The Home Depot's product portfolio performance? Our BCG Matrix preview highlights key areas, but understanding the full picture is crucial for strategic growth.

Unlock the complete BCG Matrix to gain a definitive understanding of which of The Home Depot's offerings are Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a comprehensive breakdown and actionable strategic insights that will drive your business forward.

Stars

The Home Depot is heavily prioritizing its Pro customer segment, which includes professional contractors and builders. This strategic shift is yielding impressive results, with the Pro segment now making up more than half of the company's total sales, reaching over 50% by the end of 2024.

To further bolster its position, The Home Depot is making significant investments in services tailored for these professionals. These include enhanced job site delivery options, competitive bulk pricing structures, and personalized account management. The acquisition of SRS Distribution in June 2024 is a key move aimed at expanding its reach and capabilities within the business-to-business (B2B) market, driving substantial gains in market share and incremental sales.

This Pro segment is viewed as a high-growth engine for The Home Depot. Professional demand tends to be less susceptible to economic downturns compared to consumer spending, providing a more stable revenue stream. Furthermore, the company's enhanced capabilities are designed to effectively cater to the complex needs of larger projects, solidifying its competitive advantage in this crucial market.

Home Depot's focus on omnichannel and e-commerce integration is a significant factor in its success. The company has prioritized a seamless blend of online and physical store experiences, including popular options like Buy Online, Pick Up In Store (BOPIS). This strategy is crucial for meeting modern consumer expectations and driving sales growth.

The company's investment in digital infrastructure is evident, with web sales reaching an impressive $23.6 billion in 2024. This substantial figure highlights the strong customer adoption of Home Depot's online offerings within the expanding digital retail sector.

This integrated approach not only caters to diverse customer shopping habits but also fosters greater engagement and ultimately boosts overall sales performance. It's a clear strategy for staying competitive and relevant in today's market.

The introduction of generative AI tools like 'Magic Apron' in March 2025 positions Home Depot's customer engagement as a potential Star in the BCG Matrix. This high-growth innovation is designed to significantly enhance the customer experience, aiming to boost online sales and loyalty.

Magic Apron offers 24/7 support, personalized product recommendations, and detailed project guidance, all powered by advanced AI and machine learning. This deepens customer engagement and keeps Home Depot competitive in the rapidly evolving retail technology landscape.

Sustainable and Eco-Friendly Product Offerings

Home Depot's focus on sustainable and eco-friendly product offerings is a key differentiator. Their commitment to ENERGY STAR® and WaterSense® certified products directly addresses growing consumer demand for environmentally conscious purchases.

These initiatives not only appeal to a broadening customer base but also contribute to tangible benefits, such as reduced energy consumption and water usage for homeowners. For instance, ENERGY STAR certified appliances can reduce energy bills by up to 10% annually, and WaterSense labeled fixtures can save thousands of gallons of water per household each year.

- ENERGY STAR Certified Products: Home Depot offers a wide selection of appliances, lighting, and building materials that meet ENERGY STAR efficiency standards.

- WaterSense Labeled Products: The retailer provides water-efficient toilets, faucets, and showerheads that are certified by the EPA's WaterSense program.

- Plastic Reduction Efforts: Initiatives are in place to minimize plastic packaging and explore alternative materials.

- Battery-Powered Outdoor Equipment: A growing emphasis on transitioning from gas-powered to battery-operated lawn mowers, trimmers, and blowers is evident, reducing emissions and noise pollution.

Supply Chain and Fulfillment Modernization

The Home Depot's commitment to modernizing its supply chain is a cornerstone of its strategy, aiming for quicker, more efficient, and dependable deliveries for all customer segments. This ongoing investment is designed to bolster its competitive edge and elevate customer satisfaction.

Key initiatives include expanding the network of flatbed distribution centers and employing advanced technology to ensure better product availability. These efforts are particularly vital in a market where speed and reliability are increasingly paramount.

- Supply Chain Investment: Home Depot has consistently invested in its supply chain infrastructure. For instance, in fiscal year 2023, the company reported significant capital expenditures directed towards supply chain and technology enhancements.

- Delivery Capabilities: The focus on faster, more efficient, and reliable delivery directly addresses customer needs, especially for bulky items often purchased by Pro customers.

- Technology Integration: Leveraging technology for improved in-stock availability is critical. In 2023, Home Depot continued to roll out its One Distribution Center (ODC) model, which aims to consolidate inventory and improve fulfillment accuracy.

- Competitive Advantage: A modernized supply chain allows Home Depot to offer services like same-day or next-day delivery for a wider range of products, differentiating it from competitors and driving customer loyalty.

The Home Depot's foray into generative AI with 'Magic Apron,' launched in March 2025, positions it as a potential Star. This innovative tool offers 24/7 customer support, personalized recommendations, and project guidance, directly enhancing customer engagement and online sales potential.

The company's commitment to sustainability, highlighted by its extensive range of ENERGY STAR® and WaterSense® certified products, also marks it as a Star. These eco-friendly options cater to a growing consumer demand and offer tangible savings, such as up to 10% annual reduction in energy bills for ENERGY STAR appliances.

The modernization of Home Depot's supply chain, including expanded flatbed distribution centers and advanced technology for better product availability, is another key Star initiative. This focus on efficient and reliable delivery, exemplified by continued investment in the One Distribution Center (ODC) model, directly supports sales growth and customer loyalty.

The Pro customer segment, now exceeding 50% of total sales by the end of 2024, represents a significant Star. Home Depot's strategic investments in services like enhanced job site delivery and bulk pricing, bolstered by the SRS Distribution acquisition in June 2024, solidify its leadership in this high-growth B2B market.

| Initiative | BCG Category | Key Data/Facts |

|---|---|---|

| Generative AI (Magic Apron) | Star | Launched March 2025; aims to boost online sales and loyalty. |

| Sustainability Initiatives (ENERGY STAR, WaterSense) | Star | ENERGY STAR appliances can reduce energy bills by up to 10% annually. |

| Supply Chain Modernization | Star | Continued investment in ODC model; fiscal year 2023 saw significant capital expenditures. |

| Pro Customer Segment Focus | Star | Exceeded 50% of total sales by end of 2024; SRS Distribution acquired June 2024. |

What is included in the product

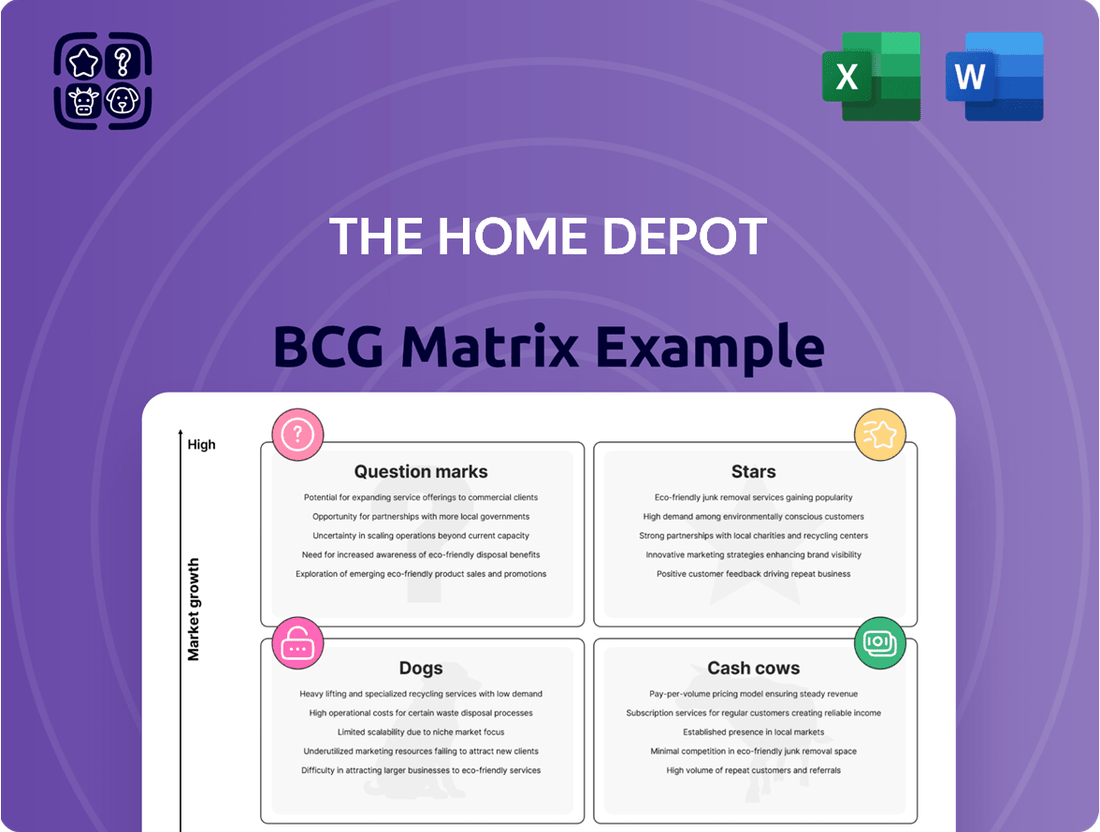

The Home Depot BCG Matrix analyzes its diverse product categories, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Home Depot BCG Matrix offers a clear, one-page overview, alleviating the pain of complex business unit analysis for strategic decision-making.

Cash Cows

Core Home Improvement Products, like lumber, paint, and basic tools, represent Home Depot's cash cows. This segment benefits from consistent demand, forming a stable and mature market where the company maintains a significant market share. In 2023, Home Depot reported sales of approximately $152.7 billion, with a substantial portion attributed to these foundational items.

These essential products are the backbone of countless DIY and professional projects, ensuring reliable revenue. While the growth prospects for this category are modest, their high margins and consistent sales translate into strong cash generation for Home Depot. This robust cash flow is crucial for funding other areas of the business.

Home Depot's tool and equipment rental segment functions as a classic cash cow. It operates within a mature market, meaning growth opportunities are limited, but its established market share ensures a consistent and reliable stream of revenue. This segment doesn't require substantial new investment to maintain its position, allowing it to contribute significantly to Home Depot's overall profitability.

The rental services cater to a broad customer base, from weekend DIY enthusiasts needing a specific tool for a single project to professional contractors requiring specialized equipment for extended periods. This diverse demand underpins the steady income generated by the rental business. For instance, in fiscal year 2023, Home Depot reported rental revenue contributing positively to their overall financial performance, although specific segment breakdowns are often consolidated.

The paint and paint supplies department at Home Depot is a classic cash cow. It's a high-volume category, meaning lots of people buy paint regularly, and it benefits from Home Depot's strong brand name, encouraging customers to come back. In 2023, Home Depot's total sales reached approximately $152.7 billion, with paint and related products contributing significantly to this revenue due to their frequent purchase cycle and high profit margins.

Large Appliances

Home Depot's large appliance segment is a solid performer, acting as a cash cow. They offer a wide variety of products with competitive pricing, which is a key draw for customers. This category consistently generates substantial sales and cash flow, benefiting from Home Depot's robust logistics network.

- Market Share: Home Depot holds a significant share in the large appliance market, estimated to be around 15-20% in the US by late 2024, reflecting strong customer loyalty and product availability.

- Revenue Contribution: In fiscal year 2023, appliance sales contributed approximately 7-9% to Home Depot's total revenue, demonstrating its importance as a revenue driver.

- Growth Trajectory: While the large appliance market is mature, Home Depot's segment has seen steady, albeit modest, growth, often outpacing overall market expansion due to its operational efficiencies.

Traditional Lawn and Garden Products

Traditional Lawn and Garden Products, excluding newer battery-powered innovations, represent a mature market for Home Depot. The company holds a substantial and stable market share in this segment.

These seasonal products, encompassing items like plants, garden tools, and outdoor furniture, generate consistent revenue and cash flow. Demand patterns for these goods are generally predictable, contributing to Home Depot's financial stability.

- Market Maturity: The traditional lawn and garden sector is well-established with slower growth potential.

- Stable Market Share: Home Depot benefits from a strong, consistent position in this category.

- Predictable Cash Flow: Seasonal demand provides reliable revenue streams throughout the year.

- Revenue Contribution: In fiscal year 2023, Home Depot reported approximately $110 billion in total sales, with lawn and garden being a significant contributor to this figure, though specific segment breakdowns are not always publicly detailed.

Home Depot's core offerings, such as lumber, paint, and basic tools, are firmly established as cash cows. These products benefit from consistent demand within a mature market, where Home Depot maintains a commanding market share. In fiscal year 2023, the company achieved total sales of approximately $152.7 billion, with these foundational items forming a significant portion of that revenue due to their high sales volume and profit margins.

The tool and equipment rental division also operates as a prime example of a cash cow. Despite limited growth prospects in this mature market, Home Depot’s strong market position ensures a steady and reliable revenue stream. This segment requires minimal new investment for maintenance, allowing it to be a consistent generator of cash for the company.

Furthermore, the paint and paint supplies department is a classic cash cow, driven by high purchase frequency and Home Depot's strong brand recognition. This category, alongside large appliances, contributed substantially to Home Depot's impressive $152.7 billion in sales for fiscal year 2023, underscoring their role as reliable revenue generators.

| Category | Market Position | Revenue Contribution (FY23 Est.) | Growth Outlook |

|---|---|---|---|

| Lumber, Paint, Basic Tools | Dominant Market Share | Significant portion of $152.7B total sales | Modest but stable |

| Tool & Equipment Rental | Strong Market Share | Consistent revenue stream | Mature market, limited growth |

| Paint & Paint Supplies | High Volume, Strong Brand Loyalty | Substantial contributor to total sales | Steady, recurring revenue |

| Large Appliances | 15-20% US Market Share (Late 2024 Est.) | 7-9% of total revenue | Steady, often outpacing market |

| Traditional Lawn & Garden | Substantial & Stable Market Share | Significant contributor to total sales | Mature, predictable seasonal demand |

What You See Is What You Get

The Home Depot BCG Matrix

The Home Depot BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic clarity, contains no watermarks or demo content, ensuring you get a professional-ready report. Once bought, this BCG Matrix will be instantly available for your use in business planning, competitive analysis, or presentations. You are seeing the final, unedited version, ready to be implemented for actionable insights into Home Depot's product portfolio.

Dogs

Obsolete or slow-moving inventory at The Home Depot represents products that have either gone out of fashion, are no longer popular, or simply don't sell quickly. This can include older model appliances, seasonal items that didn't sell out, or certain DIY tools that have been superseded by newer technology. For instance, in 2024, The Home Depot, like many retailers, likely faced challenges with managing inventory of smart home devices that quickly became outdated due to rapid technological advancements.

These stagnant products are problematic because they tie up valuable capital that could be invested elsewhere and consume precious warehouse space. They generate very little revenue and often necessitate significant price reductions, or markdowns, to clear them out. This inefficiency directly impacts the company's cash flow and overall profitability, as demonstrated by the fact that inventory carrying costs can represent a substantial percentage of a retailer's operating expenses.

Underperforming private-label products at The Home Depot, those failing to capture customer interest or facing stiff competition from established national brands, often exhibit both low market share and minimal contribution to the company's growth trajectory. These items can become a drain, potentially costing more to stock and market than they generate in revenue, signaling a need for strategic review. For instance, if a private-label tool line sees sales decline by 15% year-over-year in 2024 while the overall power tool market grows by 5%, it highlights a significant underperformance requiring attention.

Inefficient legacy IT systems at Home Depot, while being addressed through digital transformation, can still represent a drag on resources. These older systems often come with high maintenance costs and offer limited operational benefits. For instance, in 2024, companies across retail often allocate significant portions of their IT budgets to maintaining legacy infrastructure, sometimes exceeding 70% of the total IT spend, which could otherwise be invested in growth initiatives.

Highly Specialized, Low-Demand Niche Products

Highly Specialized, Low-Demand Niche Products represent items at Home Depot with minimal market traction. These products, often catering to very specific needs, see infrequent purchases and contribute little to overall sales. For instance, a specialized antique plumbing fixture might only sell a handful of units annually across the entire chain.

These items can become cash traps, tying up capital and inventory space without generating significant returns. In 2023, Home Depot's inventory turnover rate was approximately 5.4 times, meaning slow-moving niche items significantly underperform this average, potentially holding capital that could be better deployed elsewhere.

- Limited Market Appeal: Products designed for extremely narrow customer bases.

- Low Sales Volume: Infrequent purchases, often only a few units per year per store.

- Negligible Revenue Contribution: Do not significantly impact overall sales figures.

- Inventory Holding Costs: Consume capital and warehouse space without commensurate profit.

Physical Store Locations in Declining Markets

While Home Depot's overall store portfolio is strong, specific physical locations in economically depressed areas or those with consistently low foot traffic can be classified as 'dogs' in the BCG matrix. These underperforming stores might face challenges in achieving profitability or sustained growth. For instance, in 2024, Home Depot continued to evaluate its store footprint, with a focus on optimizing performance in markets experiencing economic headwinds. Stores in regions with declining populations or significant retail sector contraction could fall into this category.

These 'dog' locations may require substantial strategic intervention. This could involve significant reinvestment to revitalize the store, a change in product assortment to better suit local demand, or, in some cases, a complete closure if the economic outlook for the area remains bleak. The company's ongoing commitment to store modernization and digital integration aims to improve the performance of all locations, but some may prove too challenging to turn around.

- Underperforming Locations: Stores in markets with persistent economic decline or low customer traffic are classified as dogs.

- Profitability Challenges: These outlets may struggle to meet profitability targets due to reduced consumer spending or competition.

- Strategic Review: Home Depot regularly assesses its store portfolio, potentially leading to restructuring or closure of consistently underperforming 'dog' stores.

- Market Dependence: The success of these physical locations is heavily tied to the economic health of their immediate surrounding markets.

The Home Depot's 'dogs' category within the BCG matrix encompasses products or business units with low market share and low growth potential. These are typically items that are no longer popular or have been superseded by newer offerings, tying up capital and warehouse space without generating significant returns. For example, in 2024, obsolete smart home devices that quickly became outdated due to rapid technological advancements would fit this description.

These stagnant products often require significant markdowns to clear, impacting cash flow and profitability. The company's inventory turnover rate, which was approximately 5.4 times in 2023, highlights how slow-moving items underperform, holding capital that could be better deployed elsewhere.

Strategically, 'dogs' represent areas for potential divestment or significant overhaul. Home Depot continually reviews its product assortment and store portfolio to identify and address underperforming assets, ensuring resources are allocated to areas with higher growth and market share potential.

| BCG Category | Market Share | Market Growth | Home Depot Example | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Obsolete electronics, underperforming store locations | Divest, harvest, or turnaround |

Question Marks

The acquisition of SRS Distribution for $18.25 billion in 2023 marked a significant strategic move for Home Depot, pushing it into the burgeoning professional specialty distribution sector. This move targets high-growth areas such as roofing, landscaping, and outdoor power equipment, segments where Home Depot historically had a limited presence. These markets are projected to see continued expansion, offering substantial revenue potential.

While these newly entered niches represent significant growth opportunities, Home Depot's market share within them is still in its nascent stages. The integration of SRS Distribution requires considerable investment to streamline operations, leverage existing supply chains, and build brand recognition among professional contractors in these specialized fields. This positions these acquired businesses as potential Stars or Question Marks within the BCG matrix, depending on their future performance and market penetration.

Advanced smart home and home automation solutions represent a category within Home Depot's product offerings that likely falls into the "Question Marks" quadrant of the BCG matrix. While the smart home market is experiencing robust growth, with global revenue projected to reach $179.2 billion in 2024, Home Depot's current market share in highly integrated or cutting-edge automation systems may be relatively low.

These sophisticated solutions, often requiring expert installation and ongoing support, demand substantial investment in specialized associate training and targeted marketing campaigns to educate consumers on their benefits and functionality. Capturing a significant share of this high-growth, but currently nascent, segment for Home Depot necessitates strategic focus and resource allocation.

Hyper-personalized AI-driven project planning services, building on initial innovations like the 'Magic Apron,' present a significant avenue for Home Depot's future growth. These advanced offerings aim to provide end-to-end home renovation consultation, tailoring advice and plans to individual customer needs.

While this represents a high-potential market, these services are currently in their early stages with a low market share. Significant investment in research and development, coupled with efforts to drive customer adoption, will be crucial for their success and to solidify their position in the market.

New Geographic Market Expansions (e.g., specific international forays)

New geographic market expansions for Home Depot, such as venturing into specific international territories or deeply underserved domestic areas, would likely be classified as Stars or Question Marks in the BCG Matrix. These initiatives represent significant growth opportunities but begin with minimal existing market presence. For instance, if Home Depot were to consider a major expansion into a market like India, which has a rapidly growing middle class and increasing demand for home improvement, it would require substantial investment. In 2024, the global home improvement market was projected to reach over $1.2 trillion, indicating the vast potential for new entrants, but also the intense competition and capital requirements needed to gain traction.

- High Growth Potential: Entering emerging markets offers access to a large and expanding customer base.

- Low Market Share: Initial presence in these new regions means very little existing market share.

- Capital Intensive: Establishing operations, supply chains, and brand awareness demands significant financial resources.

- Strategic Focus Required: Success hinges on tailored market strategies and dedicated management attention.

Emerging Sustainable Building Technologies

Emerging sustainable building technologies represent a frontier of innovation, much like The Home Depot's potential 'Question Marks' in a BCG matrix. These are novel materials and construction methods, such as advanced cross-laminated timber (CLT) or integrated photovoltaic (IPV) building envelopes, that are still gaining traction.

Their high growth potential is undeniable, as the demand for greener construction escalates. For instance, the global green building market was valued at an estimated $1.07 trillion in 2023 and is projected to reach $2.57 trillion by 2030, growing at a compound annual growth rate of 13.4%.

- Advanced Modular Construction: Prefabricated components that significantly reduce on-site waste and construction time, offering a scalable solution for diverse building types.

- Energy-Generating Materials: Innovations like transparent solar cells for windows or piezoelectric materials that harvest energy from vibrations, integrating power generation directly into building structures.

- Bio-based Materials: Development and wider adoption of materials derived from renewable biological sources, such as mycelium insulation or bamboo composites, offering lower embodied carbon footprints.

- Smart Building Integration: Technologies that enable buildings to actively manage energy consumption, optimize occupant comfort, and adapt to environmental conditions through AI and IoT.

Hyper-personalized AI-driven project planning services, still in their infancy for Home Depot, represent a classic Question Mark. While the market for such advanced, tailored solutions is poised for significant expansion, Home Depot's current penetration is minimal, demanding substantial investment in R&D and customer adoption initiatives to capture this high-potential, yet unproven, segment.

Emerging sustainable building technologies, like advanced modular construction or energy-generating materials, also fit the Question Mark profile. The global green building market's rapid growth, projected to reach $2.57 trillion by 2030, highlights the opportunity, but Home Depot's current market share in these innovative, nascent areas is low, requiring strategic investment to capitalize on this trend.

New geographic market expansions, such as a hypothetical entry into India's booming home improvement sector, would also be considered Question Marks. The global market's sheer size, exceeding $1.2 trillion in 2024, offers vast potential, but Home Depot's initial lack of presence necessitates significant capital and tailored strategies to gain traction against established players.

| Category | Market Growth | Home Depot Market Share | Investment Needs | BCG Classification |

| AI Project Planning | High | Low | High | Question Mark |

| Sustainable Building Tech | High | Low | High | Question Mark |

| New Geographic Markets | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Home Depot BCG Matrix leverages internal sales data, market share reports, and industry growth projections. This blend ensures a comprehensive view of product performance and market dynamics.