The Home Depot Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

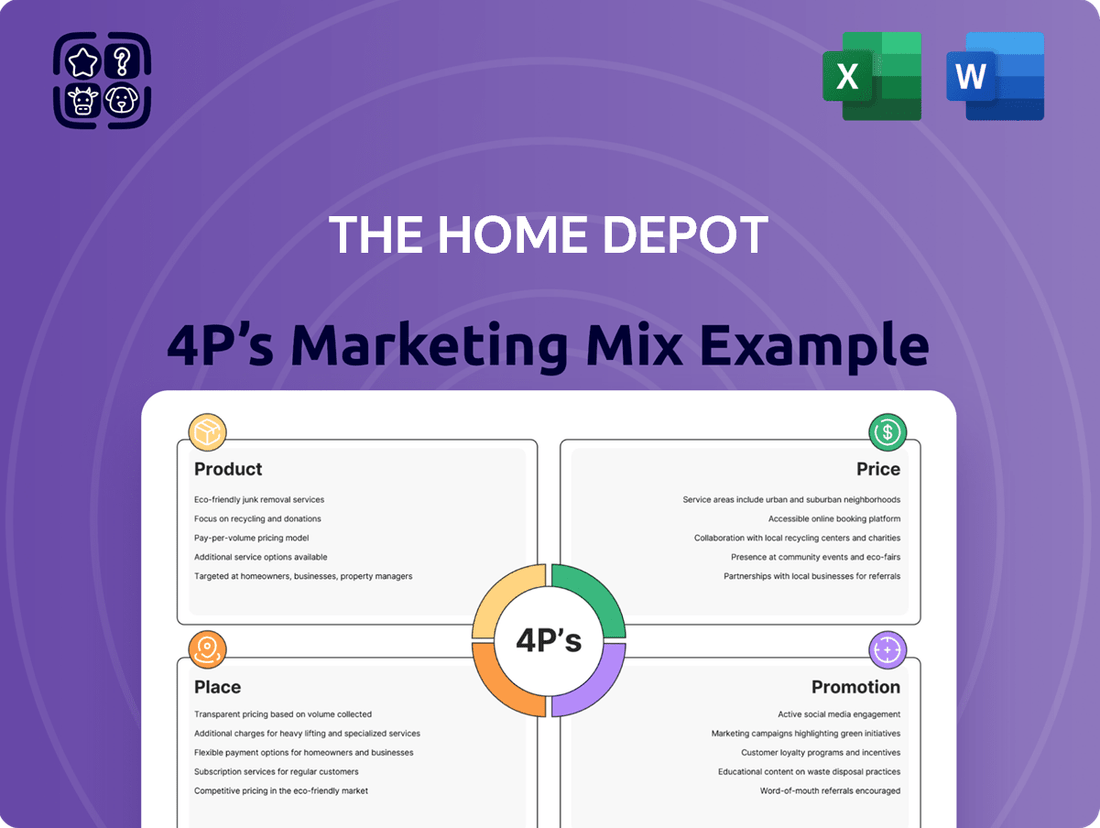

Discover how The Home Depot masterfully leverages its Product assortment, competitive Pricing, extensive Place (distribution), and impactful Promotion strategies to dominate the home improvement market. This analysis goes beyond the surface, offering actionable insights into their winning formula.

Unlock the full potential of understanding The Home Depot's marketing success by accessing our comprehensive 4Ps analysis. This ready-to-use, editable report provides the strategic depth you need to learn, benchmark, or plan your own business initiatives.

Product

The Home Depot's extensive assortment is a cornerstone of its marketing strategy, offering a staggering variety of products. This includes everything from lumber and plumbing supplies for major renovations to paint, flooring, and decorative items for smaller updates. For instance, in fiscal year 2023, Home Depot reported sales of approximately $152.7 billion, a testament to the breadth of their product offerings meeting diverse customer needs.

This vast product selection is meticulously curated to serve both the individual homeowner embarking on a DIY project and the professional contractor managing large-scale jobs. The sheer volume, often exceeding one million SKUs, positions Home Depot as a true one-stop shop. This wide availability ensures that customers can find virtually everything they need for any home improvement, repair, or maintenance task, fostering customer loyalty and repeat business.

Home Depot's services extend far beyond just selling products, offering installation for items like flooring and water heaters, alongside tool rentals and DIY workshops. This dual approach caters to both those who prefer to hire professionals (the 'do-it-for-me' segment) and those who enjoy tackling projects themselves, providing essential support and knowledge.

In 2023, Home Depot's rental services saw continued demand, with revenue from tool and equipment rentals contributing to the company's overall performance. The company also continued to invest in its "HD Home" services, aiming to capture a larger share of the growing home improvement services market, which is projected to reach hundreds of billions globally by 2025.

Home Depot is heavily focused on its professional contractor segment, offering job lot quantities and specialized product assortments. This strategic push aims to cater directly to the needs of trade professionals.

The acquisition of SRS Distribution in 2024 was a significant move, bolstering Home Depot's offerings for specialty trades such as roofing, landscaping, and pool contractors. This expansion is designed to capture a greater share of the lucrative pro market.

By investing in exclusive brands and tailored services, Home Depot is solidifying its position as a go-to supplier for professionals. This segment is crucial for driving consistent sales and customer loyalty.

Private Brands and Exclusives

The Home Depot leverages its private brands, like Husky and Commercial Electric, to offer exclusive, high-quality products. These house brands are a key differentiator, providing unique value propositions that competitors cannot easily replicate.

These exclusive offerings foster customer loyalty by giving shoppers a reason to choose Home Depot over other retailers. In fiscal year 2023, Home Depot reported net sales of $152.7 billion, with private brands playing a significant role in driving customer engagement and purchase decisions.

- Exclusive Product Lines: Husky tools and Commercial Electric lighting are examples of proprietary brands available only at Home Depot.

- Competitive Advantage: Private brands allow for greater control over product quality and pricing, setting Home Depot apart from rivals.

- Customer Loyalty Driver: Unique product offerings encourage repeat business and build a stronger customer connection.

Sustainable and Eco-Friendly Options

Home Depot is actively expanding its range of sustainable and eco-friendly product options, responding to a significant shift in consumer preferences. This includes a growing emphasis on reducing the carbon footprint associated with the products they sell, as well as sourcing more sustainable materials. For instance, in 2023, Home Depot reported a 10% increase in sales of products designated as eco-friendly, demonstrating tangible market traction for these offerings.

The company's commitment extends to improving the environmental performance of its operations and supply chain. These initiatives are designed to meet the increasing demand from consumers who are prioritizing environmentally conscious purchasing decisions. By 2024, Home Depot aims to have 75% of its suppliers reporting on their environmental, social, and governance (ESG) performance, a key step in ensuring broader sustainability across its value chain.

Key aspects of Home Depot's sustainable and eco-friendly product strategy include:

- Expanded offerings of ENERGY STAR certified appliances and lighting.

- Increased availability of low-VOC (volatile organic compound) paints and finishes.

- Promoting water-saving fixtures and landscaping solutions.

- Focus on responsibly sourced lumber and building materials.

Home Depot's product strategy centers on an expansive and diverse assortment, catering to both DIY enthusiasts and professional contractors. This breadth, encompassing over a million SKUs, ensures customers find everything needed for home improvement projects.

The company strategically utilizes private brands like Husky and Commercial Electric to offer exclusive, high-quality items, fostering customer loyalty and providing a competitive edge. Furthermore, Home Depot is actively expanding its selection of sustainable and eco-friendly products, aligning with growing consumer demand for environmentally conscious options.

In fiscal year 2023, Home Depot reported net sales of $152.7 billion, with private brands playing a significant role in driving customer engagement. The company also noted a 10% increase in sales of eco-friendly products in the same year, highlighting market traction for these offerings.

| Product Category | Key Offerings | Fiscal Year 2023 Impact |

|---|---|---|

| Broad Assortment | Lumber, paint, tools, appliances, flooring, decor | $152.7 billion in net sales |

| Private Brands | Husky tools, Commercial Electric lighting | Drives customer engagement and loyalty |

| Sustainable Products | ENERGY STAR appliances, low-VOC paints, water-saving fixtures | 10% sales increase in eco-friendly products (FY23) |

What is included in the product

This analysis delves into The Home Depot's marketing mix, examining their comprehensive product assortment, competitive pricing strategies, extensive retail and online distribution channels, and impactful promotional activities.

This analysis distills The Home Depot's 4Ps marketing mix into actionable insights, directly addressing the pain point of understanding how their strategies alleviate customer needs and drive loyalty.

It provides a concise overview of how Product, Price, Place, and Promotion work in tandem to solve customer problems, making it ideal for quick team alignment or leadership review.

Place

Home Depot's extensive physical store network is a cornerstone of its marketing strategy, boasting over 2,300 locations across North America as of early 2024. This vast footprint, spanning the United States, Canada, and Mexico, solidifies its position as the leading home improvement retailer globally. These strategically located stores ensure high accessibility for a broad customer base, from individual do-it-yourself enthusiasts to professional contractors, facilitating immediate product access and in-person customer support.

The Home Depot's commitment to omnichannel integration is a cornerstone of its marketing strategy, aiming to provide a fluid customer journey across all touchpoints. This approach saw significant investment in 2024, with the company continuing to refine its digital platforms and in-store services. Their robust website and mobile application are central to this, offering a wide array of fulfillment options.

Customers benefit from a variety of convenient choices, including buy online, pick up in-store (BOPIS), curbside pickup, and direct home delivery. These flexible options were particularly crucial in 2024, reflecting evolving consumer preferences for speed and ease. For instance, the company reported that a substantial percentage of online orders were fulfilled through these in-store pickup methods, underscoring their effectiveness in driving both online and offline traffic.

Home Depot is significantly investing in its supply chain and distribution network to better serve professional customers. In 2024, the company opened new pro-focused distribution centers in key markets including Detroit, Los Angeles, San Antonio, and Toronto. These strategic locations are crucial for improving delivery times and efficiency.

These new facilities are specifically equipped to handle large, bulky items and substantial job lot quantities. This capability allows Home Depot to offer direct job site deliveries, a critical service for their professional clientele. This also helps alleviate congestion within traditional retail stores, streamlining the shopping experience for all customers.

Digital Platforms and Mobile Accessibility

The Home Depot's digital presence is robust, anchored by its main website, homedepot.com, and complemented by specialized platforms like blinds.com for custom window treatments and hdsupply.com for maintenance, repair, and operations (MRO) supplies. This multi-platform approach caters to a wider range of customer needs.

Mobile accessibility is a key component, with dedicated apps enabling customers to easily find stores, verify product availability in real-time, and conveniently place orders. This seamless integration between online and physical retail enhances the overall customer journey, offering a personalized and efficient shopping experience. For instance, in Q1 2024, The Home Depot reported that digital sales represented approximately 9% of total sales, highlighting the significant role of these platforms.

- Digital Sales Growth: The Home Depot's digital sales have shown consistent growth, with online channels becoming increasingly vital for customer engagement and transactions.

- Mobile App Usage: The company's mobile applications are instrumental in driving in-store traffic and facilitating omnichannel shopping, allowing for features like "buy online, pick up in store."

- Website Traffic: homedepot.com consistently ranks among the top retail websites, attracting millions of visitors monthly, indicating strong brand recognition and online demand.

- Inventory Visibility: Real-time inventory tracking via the app and website empowers customers to make informed purchasing decisions, reducing friction in the buying process.

Pro-Focused Fulfillment and Services

The Home Depot has significantly bolstered its fulfillment and services for professional customers, recognizing their crucial role in the business. They've introduced specialized services such as direct job site delivery, ensuring materials arrive precisely when and where needed for construction projects. This focus is critical as the pro segment continues to be a major growth driver for the company.

To further cater to this segment, The Home Depot has deployed dedicated sales forces in key markets, providing personalized support and expertise. These teams work to understand the unique needs of contractors and builders, offering tailored solutions and account management. This hands-on approach aims to solidify customer loyalty and increase wallet share within the professional segment.

These pro-focused initiatives are complemented by localized product assortments and enhanced digital tools designed to streamline the shopping experience. For instance, in fiscal year 2023, The Home Depot reported that its pro sales represented approximately 45% of its total sales, highlighting the substantial impact of these targeted strategies.

- Job Site Delivery: Expedited and precise delivery of materials directly to active construction sites.

- Dedicated Sales Teams: In-market professionals offering personalized service and project support to pro customers.

- Localized Assortments: Product selections tailored to the specific needs and preferences of regional professional trades.

- Digital Enhancements: Improved online and mobile platforms for easier ordering, account management, and project planning for pros.

Home Depot's physical store network, exceeding 2,300 locations across North America by early 2024, ensures widespread accessibility for both DIY customers and professional contractors. This extensive reach facilitates immediate product availability and in-person customer service.

The company's commitment to an omnichannel approach is evident in its investment in digital platforms and in-store services, enhancing the customer journey. Features like buy online, pick up in-store (BOPIS) and curbside pickup were heavily utilized in 2024, reflecting a strong customer preference for convenient fulfillment.

New pro-focused distribution centers opened in 2024 in markets like Detroit and Toronto are crucial for improving delivery times for professional customers, enabling direct job site deliveries of bulk items.

Digital sales represented approximately 9% of total sales in Q1 2024, underscoring the growing importance of homedepot.com and its mobile applications, which offer real-time inventory visibility and streamlined ordering.

| Metric | Value (as of early 2024/Q1 2024) | Significance |

|---|---|---|

| Number of Stores | Over 2,300 | Ensures broad market reach and accessibility. |

| Digital Sales as % of Total Sales | Approx. 9% (Q1 2024) | Highlights the growing importance of online channels. |

| Pro Sales as % of Total Sales | Approx. 45% (FY 2023) | Indicates the significant contribution of the professional segment. |

Same Document Delivered

The Home Depot 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into The Home Depot's Product, Price, Place, and Promotion strategies, offering valuable insights into their successful market positioning. You can trust that the detailed breakdown of their 4Ps is exactly what you'll download immediately after checkout, ready for your own strategic planning.

Promotion

Home Depot's promotion strategy is a multi-faceted approach, leveraging national television commercials, print media, and a robust online advertising presence to reach a broad audience. This integrated campaign structure ensures consistent brand messaging across various platforms.

The company further refines its promotional efforts through a localized advertising strategy. By tailoring campaigns to specific markets and regional customer preferences, Home Depot fosters a more personal connection and addresses the unique needs of diverse communities.

For instance, in 2024, Home Depot's advertising spend is projected to be substantial, with a significant portion allocated to digital channels, reflecting the growing importance of online engagement. This investment underscores their commitment to an integrated advertising approach that balances national reach with localized resonance.

The Home Depot significantly boosts its reach through robust digital marketing, employing email campaigns to highlight products and enhance customer connection. This digital push is crucial for driving sales and brand awareness in a competitive retail landscape.

Social media engagement is a key component, with the company actively participating in platforms to foster community and share valuable content. This strategy extends to content marketing via blogs, podcasts, and YouTube, offering DIY tips and project inspiration.

Looking ahead, The Home Depot is exploring innovative technologies like augmented reality for in-home product visualization and voice-activated shopping to streamline the customer journey. These advancements aim to solidify its position as a digital leader in the home improvement sector.

Home Depot's in-store associates are crucial promoters, providing personalized help and expert advice. This focus on customer service drives satisfaction and fosters loyalty, a key differentiator in the retail space.

The company actively uses sales promotions, seasonal discounts, and special offers to encourage spending and retain customers. For instance, during the 2024 holiday season, Home Depot saw significant traffic driven by targeted deals, reflecting the effectiveness of these incentives.

Pro Xtra Loyalty Program and Targeted s

The Pro Xtra loyalty program is a cornerstone of Home Depot's strategy for its professional clientele. This program offers tangible benefits like volume pricing discounts, which are crucial for contractors managing large projects. It also provides purchase tracking, simplifying expense management and project budgeting for these busy customers. In 2023, Home Depot reported that its Pro segment continued to outperform, indicating the success of initiatives like Pro Xtra in capturing a significant share of the professional market.

Home Depot leverages targeted promotions and exclusive offers to further engage its professional customer base. These tailored campaigns are designed to address the specific needs of contractors, such as bulk material discounts or specialized tool offers. By focusing on this high-value segment, the company aims to foster repeat business and strengthen customer loyalty. For instance, during the 2024 spring selling season, Home Depot highlighted special financing options and bundled deals specifically for Pro customers undertaking major renovations.

The Pro Xtra program's benefits extend to:

- Volume Pricing: Allowing professionals to save money on bulk purchases.

- Purchase Tracking: Offering detailed records for easier job costing and tax preparation.

- Exclusive Perks: Including early access to sales, dedicated support, and special events.

- Targeted Promotions: Delivering offers relevant to specific trades and project types.

Community Engagement and Brand Reputation

Home Depot's promotional strategy significantly leverages community engagement and a robust brand reputation. The Home Depot Foundation, for instance, actively supports veterans through housing initiatives and disaster relief efforts. In 2023, the foundation committed $50 million to support veteran causes, demonstrating a tangible investment in social responsibility. This focus on giving back not only strengthens community ties but also bolsters Home Depot's image as a reliable and caring brand.

This commitment translates directly into customer loyalty and a positive brand perception, critical elements in their marketing mix. Consumers increasingly favor companies that align with their values, and Home Depot's consistent support for skilled trades training and community development resonates with this trend. This builds a strong brand reputation for quality and trustworthiness, attracting and retaining a broad customer base.

Key aspects of their community engagement and brand reputation include:

- Veteran Support: The Home Depot Foundation has invested over $400 million since 2011 to improve the homes and lives of veterans.

- Disaster Relief: The company actively participates in disaster recovery efforts, providing essential supplies and support to affected communities.

- Skilled Trades Training: Initiatives like "Path to Pro" aim to address the skilled labor shortage by providing training and career pathways in construction trades.

- Brand Perception: Home Depot consistently ranks high in customer satisfaction surveys, reinforcing its reputation for quality products and dependable service.

Home Depot's promotional strategy is comprehensive, blending national advertising with localized efforts and a strong digital presence. Their commitment to customer engagement is evident through social media, content marketing, and in-store associate expertise. Sales promotions, seasonal discounts, and the Pro Xtra loyalty program are key drivers for both consumer and professional segments.

The Pro Xtra program, a significant aspect of their professional customer outreach, offers benefits like volume pricing and purchase tracking, contributing to the segment's outperformance. In 2023, the Pro segment continued its strong growth trajectory, underscoring the program's effectiveness. Targeted promotions for Pros, such as special financing during the 2024 spring season, further solidify this customer relationship.

Community engagement, particularly through The Home Depot Foundation's support for veterans and skilled trades training, enhances brand reputation. By investing $50 million in veteran causes in 2023 and over $400 million since 2011, the company fosters loyalty and positive brand perception. This commitment to social responsibility aligns with consumer values and reinforces their image as a dependable brand.

| Promotion Element | Key Initiatives | 2023/2024 Data/Impact |

|---|---|---|

| Digital Marketing | Online ads, email campaigns, social media, content marketing | Significant portion of 2024 advertising spend allocated to digital; drives sales and brand awareness. |

| In-Store Promotion | Associate expertise, personalized assistance | Drives customer satisfaction and loyalty; key differentiator. |

| Sales Promotions | Seasonal discounts, special offers | Effective in driving traffic and spending, as seen during the 2024 holiday season. |

| Pro Xtra Program | Volume pricing, purchase tracking, exclusive perks | Pro segment outperformed, indicating program success in capturing professional market share. |

| Community Engagement | The Home Depot Foundation, veteran support, skilled trades training | $50 million committed to veteran causes in 2023; over $400 million invested since 2011. |

Price

Home Depot's pricing strategy is centered on an Everyday Low Price (EDLP) model. This means they focus on offering consistently competitive prices across their vast product selection rather than relying on frequent sales or promotions. This approach is designed to build customer loyalty by assuring them they can find good value whenever they shop.

This EDLP strategy is a cornerstone of Home Depot's market positioning, directly supporting their objective to be the go-to destination for home improvement needs. By maintaining stable, attractive pricing, they effectively compete against rivals and attract a broad customer base looking for reliability in their spending.

In 2023, Home Depot reported net sales of $152.7 billion, underscoring the scale at which their EDLP strategy operates. This consistent revenue stream is a testament to the effectiveness of their pricing in drawing and retaining customers in the competitive retail landscape.

The Home Depot actively maintains competitive pricing, regularly benchmarking against rivals like Lowe's and online giants such as Amazon. This strategy is crucial for attracting and retaining customers in the home improvement sector.

To further solidify its value proposition, Home Depot offers a robust price-match guarantee. This policy ensures customers receive the best available price, even if a competitor offers a lower one, fostering trust and encouraging purchases.

For instance, in fiscal year 2023, Home Depot reported net sales of $152.9 billion, underscoring the effectiveness of its pricing and promotional strategies in a highly competitive retail landscape.

Home Depot's Pro Xtra program is a cornerstone of its segmented pricing strategy, directly addressing the needs of professional contractors. This program offers tiered discounts and special pricing for bulk purchases, recognizing the significant volume these customers represent. For instance, in 2023, Pro Xtra members accounted for a substantial portion of Home Depot's sales, with the company reporting that nearly half of its revenue came from professional customers.

Promotional Deals and Discounts

Home Depot actively uses promotional deals and discounts to draw in customers. This includes seasonal sales, like their Spring Black Friday event, and special offers on big-ticket items such as appliances. For instance, during their 2024 Spring Black Friday sale, customers could find discounts of up to 40% on select outdoor power equipment and significant savings on appliances.

These strategies are vital for capturing the attention of shoppers who are particularly focused on price. By offering compelling price reductions, such as 20-25% off specific product categories, Home Depot aims to boost immediate sales volume and attract new customers.

- Seasonal Promotions: Events like the Spring Black Friday sale drive significant traffic and sales.

- Appliance Specials: Targeted discounts on appliances are a key tactic to move inventory and attract large purchases.

- Percentage-Based Discounts: Offers like 20-25% off specific items directly appeal to price-conscious consumers.

- Special Buys: These limited-time offers create urgency and encourage impulse purchases.

Financing Options and Credit Terms

Home Depot enhances product accessibility through robust financing options and credit terms, making larger purchases more manageable for customers. For instance, their promotional offers often include interest-free financing periods on qualifying purchases, encouraging higher transaction values.

These flexible payment solutions are a key part of their marketing mix, directly impacting sales by reducing upfront cost barriers. The availability of credit, like the Home Depot Consumer Credit Card, allows customers to spread payments over time, increasing the perceived affordability of items like appliances and building materials.

- Interest-Free Financing: Offers extended periods of 0% APR on qualifying purchases, especially for larger ticket items.

- Consumer Credit Card: Provides a revolving line of credit for ongoing purchases, often with special financing promotions.

- Project Loans: For significant home improvement projects, alternative financing solutions may be available.

- Accessibility: These options directly address customer concerns about affordability, driving sales volume.

Home Depot's pricing strategy is a dynamic blend of Everyday Low Price (EDLP) and strategic promotions. This dual approach ensures consistent value while also driving traffic and sales through targeted discounts. The company’s ability to maintain competitive pricing is evident in its substantial revenue, with net sales reaching $152.7 billion in 2023.

The Pro Xtra program exemplifies their segmented pricing, offering tiered discounts that significantly benefit professional contractors, who accounted for nearly half of Home Depot's revenue in 2023. This focus on key customer segments, combined with broad promotional events like the Spring Black Friday sale, reinforces their market leadership.

Home Depot's commitment to value is further bolstered by a price-match guarantee, assuring customers they will always get the best deal. This, alongside flexible financing options like interest-free periods on qualifying purchases, removes cost barriers and encourages larger transactions, contributing to their overall sales success.

| Pricing Tactic | Description | Impact/Example |

|---|---|---|

| Everyday Low Price (EDLP) | Consistent, competitive pricing across a wide product range. | Builds customer loyalty and trust in value. |

| Price-Match Guarantee | Matching competitor prices to ensure customers get the lowest cost. | Enhances customer confidence and reduces price-related purchase barriers. |

| Pro Xtra Program | Tiered discounts and special pricing for professional contractors. | Drives significant revenue from professional customers, nearly half of total sales in 2023. |

| Promotional Sales (e.g., Spring Black Friday) | Seasonal events with significant discounts on select items. | Drives traffic and immediate sales volume; e.g., up to 40% off outdoor power equipment in 2024. |

| Financing Options (e.g., 0% APR) | Interest-free periods on qualifying purchases. | Makes larger purchases more accessible, encouraging higher transaction values. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for The Home Depot is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also leverage insights from their e-commerce platform, marketing campaign data, and reputable industry analysis to provide a holistic view of their strategy.