The Home Depot PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

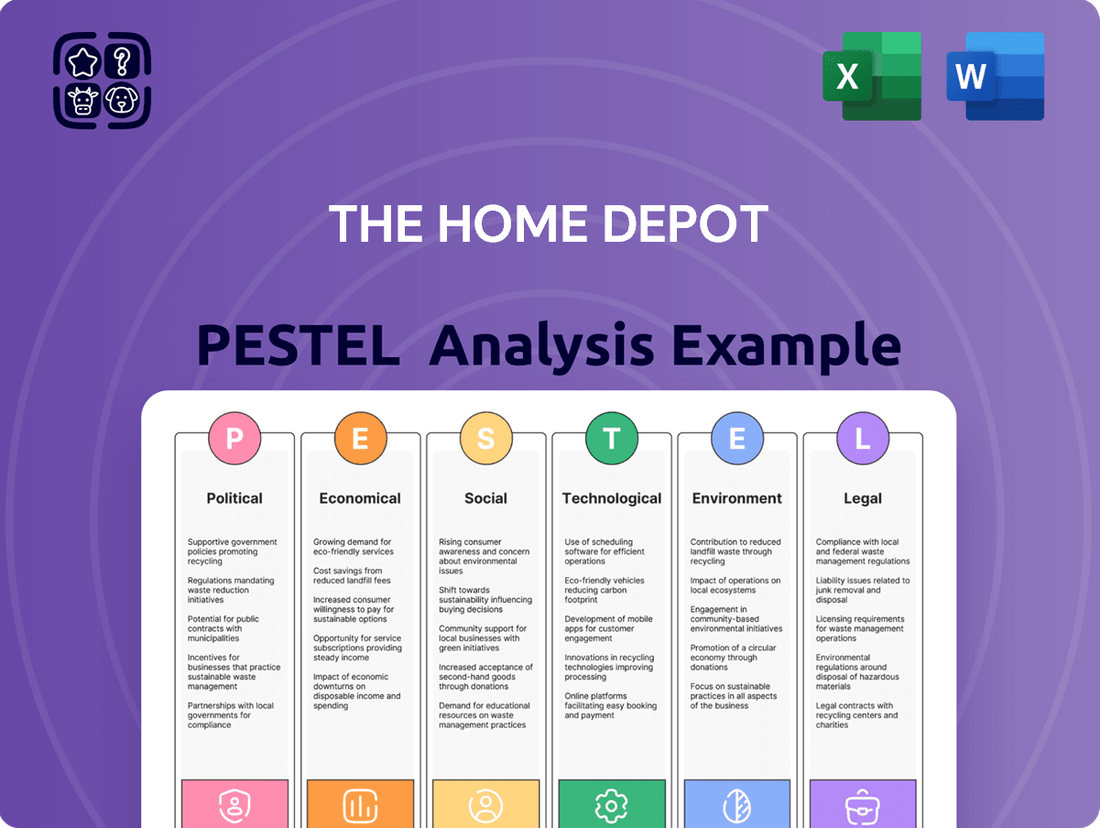

Navigate the dynamic landscape of the home improvement industry with our comprehensive PESTLE analysis of The Home Depot. Understand how political shifts, economic fluctuations, and technological advancements are shaping its future. Gain actionable insights to inform your own strategic decisions and secure a competitive advantage. Download the full version now for a complete breakdown.

Political factors

Government policies significantly shape The Home Depot's landscape. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continued to implement regulations impacting housing affordability and construction standards, indirectly influencing demand for home improvement products. Changes in building codes, often updated at state and local levels, can also alter the types of materials and services The Home Depot needs to stock and offer.

Retail trade regulations are equally critical. In 2024, discussions around minimum wage laws and labor practices continued across various U.S. states, affecting operational costs for large retailers like The Home Depot. Furthermore, evolving product safety standards, particularly for items like paints and power tools, necessitate ongoing compliance efforts and can impact supply chain management and inventory.

The Home Depot, like many global retailers, is sensitive to changes in international trade policies and tariffs. For instance, in 2024, ongoing trade discussions between the United States and China, as well as potential adjustments to agreements like the USMCA, could impact the cost of imported goods. Tariffs on key materials such as lumber or manufactured components could directly affect The Home Depot's cost of goods sold, potentially forcing price increases on consumer products or compressing margins if the company absorbs these costs.

Labor laws significantly influence The Home Depot's operational costs and strategies, given its large employee base. For instance, varying minimum wage laws across U.S. states, such as the recent increases in states like California and New York throughout 2024, directly impact payroll expenses. Compliance with regulations on working conditions and unionization efforts in different jurisdictions is crucial for maintaining smooth operations and avoiding costly disputes.

Political Stability and Geopolitical Events

The Home Depot's operations are significantly influenced by political stability in its primary markets, including the United States, Canada, and Mexico. For instance, the U.S. experienced a relatively stable political environment leading up to the 2024 elections, which generally supports consistent consumer spending on home improvement. However, potential shifts in policy following elections could impact regulatory landscapes and tax structures affecting the retail sector.

Geopolitical events pose a considerable risk. Trade disputes, such as those that have previously impacted tariffs on goods imported from China, can increase the cost of products for The Home Depot and its customers. In 2024, ongoing global tensions, including those in Eastern Europe and the Middle East, continue to pose a threat to supply chain reliability and can indirectly dampen consumer confidence due to broader economic uncertainty. For example, disruptions in shipping routes can lead to delays and increased freight costs, impacting inventory availability and profitability.

- Political Stability: The U.S. presidential election cycle in late 2024 could introduce policy uncertainty, potentially affecting consumer spending on discretionary home improvement projects.

- Trade Relations: Ongoing trade dialogues and potential new agreements or disputes with countries like China and Mexico can directly impact the cost of goods and supply chain efficiency for The Home Depot.

- International Sanctions: While The Home Depot primarily operates in North America, broader international sanctions can indirectly affect global economic conditions, influencing consumer sentiment and material costs.

Government Incentives for Green Building

Government incentives promoting energy efficiency and sustainable construction create significant opportunities for The Home Depot. For instance, the Inflation Reduction Act of 2022 offers substantial tax credits for homeowners installing solar panels and making energy-efficient upgrades, driving demand for related products. This policy shift encourages consumers to invest in greener building materials and technologies, aligning with The Home Depot's expanding eco-friendly product lines.

These initiatives, however, also present compliance challenges. As environmental regulations evolve, The Home Depot must ensure its product sourcing and operational practices meet increasingly stringent standards. This might necessitate investments in new product development, supply chain adjustments, and enhanced sustainability reporting to remain competitive and compliant in the green building sector.

- Increased demand for energy-efficient products: Driven by tax credits and rebates, consumers are actively seeking products like smart thermostats, high-efficiency windows, and insulation.

- Regulatory alignment: The company must adapt its offerings to meet evolving green building codes and certifications, potentially expanding its range of sustainable materials.

- Supply chain considerations: Sourcing and logistics for green products need to be optimized to meet growing consumer interest and potential regulatory requirements.

- Investment in sustainable solutions: The Home Depot can leverage government support to invest in and promote its own sustainable product lines and services, such as solar installation services.

Political stability is crucial, with the U.S. presidential election in late 2024 potentially introducing policy shifts that could influence consumer spending on home improvements. Trade relations, particularly ongoing dialogues with China and Mexico, directly affect The Home Depot's product costs and supply chain efficiency, as seen in 2024's trade discussions.

Government incentives, like those from the Inflation Reduction Act of 2022, are boosting demand for energy-efficient products, a trend continuing into 2024. However, evolving environmental regulations necessitate compliance adjustments in sourcing and operations.

Labor laws, including minimum wage adjustments in states like California and New York throughout 2024, significantly impact The Home Depot's operational costs and labor strategies.

| Political Factor | Impact on The Home Depot (2024-2025) | Example/Data |

|---|---|---|

| Government Regulations | Influences housing market, construction standards, and retail operations. | HUD regulations on housing affordability; state-level building code updates. |

| Trade Policies | Affects cost of goods and supply chain through tariffs and trade agreements. | Ongoing U.S.-China trade talks; potential adjustments to USMCA. |

| Labor Laws | Impacts payroll expenses and operational strategies. | Minimum wage increases in states like California and New York. |

| Political Stability | Shapes consumer confidence and spending on discretionary items. | U.S. political environment leading up to the 2024 elections. |

| Government Incentives | Drives demand for specific product categories, like energy-efficient items. | Inflation Reduction Act tax credits for home energy upgrades. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing The Home Depot, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats derived from current market trends and regulatory landscapes.

This PESTLE analysis offers a clear, summarized version of The Home Depot's external environment, providing actionable insights to alleviate pain points related to market volatility and operational challenges.

Economic factors

The housing market's vitality, measured by home sales and new construction, directly fuels The Home Depot's demand. As of early 2024, existing home sales in the U.S. showed some resilience, though inventory remained tight, impacting overall transaction volume. New housing starts, while seeing some growth, still lagged behind historical averages in many regions.

Interest rate movements are critical. The Federal Reserve's monetary policy decisions in 2024 continued to influence mortgage rates, which hovered in the mid-to-high 6% range for much of the year. Higher rates can dampen consumer confidence for major purchases like home renovations, as financing becomes more expensive, potentially slowing down discretionary spending on home improvement projects.

A robust housing market generally translates to increased demand for The Home Depot's offerings. When more homes are bought and sold, and when homeowners feel financially secure, there's a greater propensity to invest in upgrades and maintenance. For instance, a strong resale market often encourages buyers to renovate to increase property value, directly benefiting retailers like Home Depot.

Consumer spending and disposable income are critical drivers for The Home Depot. In the US, personal consumption expenditures, a key indicator of consumer spending, saw robust growth through much of 2024, supported by a strong labor market and moderating inflation. For instance, retail sales, which include home improvement stores, demonstrated consistent upward trends, reflecting consumers' willingness to spend on their homes.

Higher disposable incomes directly translate to increased demand for discretionary home improvement projects. As of the latest available data for late 2024, real disposable income continued to show positive growth, allowing households to allocate more funds towards renovations and upgrades. This trend bodes well for The Home Depot's sales, particularly for higher-ticket items and services.

Conversely, any significant economic slowdown or persistent inflation that erodes purchasing power could dampen consumer appetite for non-essential home improvements. While essential repairs will likely continue, major renovation projects are often postponed when consumers feel financial pressure. The ability of consumers to maintain or increase their spending on home goods remains a key variable for the company's performance in 2025.

Inflationary pressures in 2024 have significantly impacted raw material costs for The Home Depot, with lumber prices experiencing volatility and metals like steel seeing upward trends. Fuel surcharges also remain a persistent concern, directly affecting transportation expenses.

These rising input costs directly increase The Home Depot's cost of goods sold. For instance, a 10% increase in lumber prices, a key component for many DIY projects, can substantially impact the company's inventory valuation and subsequent profit margins if not offset.

To maintain profitability, The Home Depot must implement strategic pricing adjustments and enhance supply chain efficiencies. Successfully navigating these cost fluctuations is crucial for offering competitive prices to consumers while preserving healthy profit margins in the face of economic headwinds.

Economic Growth and Recessionary Pressures

The Home Depot's performance is closely tied to the broader economic growth rate in its operating regions. A healthy economy, characterized by strong employment and consumer confidence, typically boosts spending on home improvement projects and new housing, directly benefiting The Home Depot's sales. For instance, in 2024, many developed economies are experiencing moderate growth, but concerns about inflation and interest rates are creating some headwinds.

Conversely, economic downturns or recessions present significant challenges. During such periods, consumers tend to cut back on discretionary spending, including home renovations, and may postpone larger purchases. This can lead to reduced foot traffic and lower sales volumes for retailers like The Home Depot. The potential for a mild recession in some markets in late 2024 or early 2025 remains a key consideration.

Key economic indicators to watch for The Home Depot include:

- GDP Growth: Higher GDP growth generally correlates with increased consumer spending on home improvement.

- Unemployment Rate: Lower unemployment boosts consumer confidence and disposable income, supporting sales.

- Consumer Confidence Index: A rising index suggests consumers are more optimistic about the economy and more likely to spend.

- Housing Market Activity: Trends in new home sales and existing home prices directly impact demand for renovation materials.

Unemployment Rates and Labor Market Trends

Unemployment rates directly influence The Home Depot's customer base and workforce. As of May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months, suggesting a cooling labor market. This can impact consumer confidence and discretionary spending on home improvement projects.

A lower unemployment rate, while signaling economic strength, can also present challenges for The Home Depot by increasing labor costs due to higher demand for workers. Conversely, a rising unemployment rate might lead to more available labor but could also dampen consumer spending.

Labor market trends also affect the demand for professional contractor services and the tools they use. For instance, shifts in the availability of skilled tradespeople, influenced by broader employment trends, can either boost or hinder sales of professional-grade equipment and materials.

- U.S. Unemployment Rate (May 2024): 4.0%

- Impact on Consumer Spending: Higher unemployment can reduce consumer confidence and discretionary spending on home improvement.

- Labor Costs: Lower unemployment generally leads to increased competition for workers, potentially driving up wages for The Home Depot.

- Skilled Trades: Labor market trends influence the availability of skilled tradespeople, impacting demand for contractor-focused products.

The economic landscape significantly shapes The Home Depot's performance. Consumer spending, driven by disposable income and confidence, is paramount. As of late 2024, robust U.S. retail sales, including home improvement, indicated consumers' willingness to spend, supported by a strong labor market and moderating inflation.

Interest rates, influenced by Federal Reserve policy, directly affect mortgage costs and consumer borrowing for renovations. In 2024, mortgage rates generally remained in the mid-to-high 6% range, making financing larger projects more expensive and potentially tempering demand for discretionary home improvements.

Economic growth and employment levels are also critical. While many economies showed moderate growth in 2024, concerns about inflation and interest rates created headwinds. The U.S. unemployment rate at 4.0% in May 2024 suggested a cooling labor market, which could impact consumer confidence and discretionary spending.

| Economic Indicator | Value/Trend (Late 2024/Early 2025 Outlook) | Impact on The Home Depot |

|---|---|---|

| U.S. GDP Growth | Projected moderate growth, but with inflation/rate concerns | Supports discretionary spending, but headwinds exist |

| U.S. Unemployment Rate | Around 4.0% (May 2024), potential slight increase | Slightly reduces consumer confidence, potential labor cost moderation |

| Consumer Confidence Index | Fluctuating, sensitive to inflation and economic outlook | Higher confidence drives renovation spending; lower confidence leads to postponement |

| Mortgage Rates | Mid-to-high 6% range | Increases cost of financing home purchases and renovations |

| Inflation | Moderating but still a concern for input costs | Impacts raw material costs and profit margins if not passed on |

What You See Is What You Get

The Home Depot PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Home Depot covers all critical external factors impacting the company's operations and strategy. You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Demographic shifts are significantly reshaping consumer demand for home improvement products. The aging population, for instance, increasingly requires products that enhance home accessibility and safety, such as grab bars and walk-in tubs. Conversely, a growing cohort of millennial homeowners, often concentrated in urban areas, is driving demand for space-saving solutions and smart home technology, reflecting a preference for efficient and modern living.

The shift in consumer behavior between tackling projects themselves (DIY) and hiring professionals significantly influences The Home Depot's sales. For instance, a 2024 survey indicated that while 65% of homeowners still engage in some DIY, there's a growing segment, particularly among younger demographics, seeking professional installation due to time constraints.

Economic conditions play a crucial role in this dynamic; during periods of inflation or economic uncertainty, like the ongoing cost-of-living adjustments seen in 2024, consumers often lean towards DIY to save money, boosting sales of basic tools and materials.

Conversely, as lifestyles become more demanding, and with a greater emphasis on convenience, The Home Depot is seeing increased demand for its "Pro" services and specialized product lines designed for professional use, reflecting a need for efficiency and expertise.

Modern lifestyles are significantly reshaping how people use and improve their homes. The ongoing rise of remote and hybrid work models, for example, has spurred a demand for dedicated home office spaces, with many homeowners investing in renovations to create more functional and comfortable work environments. This trend saw continued momentum through 2024, with many companies maintaining flexible work policies.

Beyond interiors, there's a growing emphasis on enhancing outdoor living areas, driven by a desire for more versatile and enjoyable home spaces. This includes everything from patio upgrades and deck building to creating outdoor kitchens and entertainment zones. Furthermore, the integration of smart home technology continues to be a major lifestyle trend, influencing purchasing decisions for everything from smart thermostats to automated lighting systems, aiming to improve convenience and energy efficiency.

Social Attitudes Towards Homeownership and Renovation

Societal values deeply influence the home improvement market. A persistent cultural emphasis on homeownership, seen as a cornerstone of financial security and personal achievement, directly fuels demand for renovation and maintenance. This is particularly evident in the United States, where, as of Q1 2024, the homeownership rate stood at approximately 65.9%, indicating a substantial base of homeowners actively investing in their properties.

The desire to personalize living spaces and enhance property value appreciation also remains a strong motivator for consumers. This trend is supported by data showing continued consumer spending on home improvement projects. For instance, the U.S. home improvement market was valued at over $500 billion in 2023, demonstrating a robust commitment to enhancing residential properties.

- Homeownership as a cultural ideal: Many societies view owning a home as a significant life goal, driving investment in property upkeep and upgrades.

- Value placed on property enhancement: Consumers often see home renovations as investments that increase resale value and personal satisfaction.

- Impact of economic shifts: While homeownership remains popular, a significant downturn in the housing market or a rise in rental preferences could temper long-term growth in the sector.

Sustainability and Ethical Consumption

Consumers are increasingly prioritizing sustainability and ethical sourcing, directly impacting retail giants like The Home Depot. This growing awareness means shoppers are actively seeking out products that are environmentally friendly and produced responsibly. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's sustainability practices when making purchasing decisions.

The Home Depot is therefore under pressure to expand its offerings of green products, from low-VOC paints to sustainably harvested lumber. Demonstrating robust corporate social responsibility and transparent sourcing practices are no longer optional but essential for maintaining customer loyalty. In 2023, The Home Depot reported a 15% increase in sales for its eco-friendly product lines.

- Growing Demand: Over 60% of consumers consider sustainability in purchasing decisions (2024 data).

- Product Expansion: The Home Depot saw a 15% sales increase in eco-friendly products (2023).

- Brand Reputation: Aligning with ethical values enhances brand image and attracts environmentally conscious demographics.

Societal values significantly influence The Home Depot's market. The strong cultural emphasis on homeownership, seen as a key life achievement, continues to drive demand for renovations and maintenance. As of Q1 2024, the U.S. homeownership rate was around 65.9%, indicating a large base of homeowners invested in their properties.

Consumers also prioritize personalizing their homes and increasing property value, fueling spending on improvement projects. The U.S. home improvement market exceeded $500 billion in 2023, reflecting this ongoing commitment. Furthermore, a growing awareness of sustainability is shaping purchasing habits, with over 60% of consumers considering environmental practices in 2024.

| Societal Factor | Description | Impact on Home Depot | Supporting Data |

|---|---|---|---|

| Homeownership Ideal | Owning a home is a significant cultural goal. | Drives consistent demand for upkeep and upgrades. | U.S. homeownership rate: ~65.9% (Q1 2024) |

| Property Enhancement | Desire to increase home value and personal satisfaction. | Boosts spending on renovation materials and services. | U.S. home improvement market: >$500 billion (2023) |

| Sustainability Focus | Increasing consumer preference for eco-friendly and ethical products. | Requires expansion of green product lines and responsible sourcing. | >60% of consumers consider sustainability (2024) |

Technological factors

The Home Depot's technological strategy is heavily influenced by the booming e-commerce sector and the growing demand for integrated shopping experiences. By 2024, online sales represented a significant portion of retail revenue, and this trend is projected to continue growing, making a strong digital presence non-negotiable.

To stay competitive, The Home Depot must continue investing in its online infrastructure and mobile capabilities. This includes enhancing features like buy online, pick up in-store (BOPIS) and optimizing last-mile delivery to ensure a smooth customer journey across all touchpoints.

Technological advancements are revolutionizing The Home Depot's supply chain. Automation, including robotics in distribution centers and sophisticated logistics software, is key to boosting efficiency. For instance, by the end of fiscal year 2023, The Home Depot had invested significantly in supply chain technology, aiming to improve delivery times and inventory accuracy.

Optimizing inventory management and demand forecasting through advanced analytics directly impacts cost reduction and product availability. In 2024, the company continued to enhance its network of fulfillment centers, leveraging technology to ensure products are where customers need them, when they need them, thereby streamlining delivery processes and improving overall operational reliability.

The Home Depot heavily relies on data analytics and AI to understand its vast customer base. In 2024, the company continued to invest in these technologies to personalize marketing campaigns, aiming to increase conversion rates by offering tailored product recommendations and promotions. This data-driven approach helps optimize inventory management, reducing stockouts and overstock situations.

AI plays a key role in enhancing operational efficiency at The Home Depot. Predictive analytics are employed for demand forecasting, ensuring the right products are available at the right time, which is critical for a retailer with a wide product range. Furthermore, AI-powered chatbots and recommendation engines are improving customer service by providing instant support and guiding shoppers to relevant items, thereby boosting customer satisfaction and sales.

In-Store Technology and Customer Experience

The Home Depot is actively integrating advanced technologies into its physical stores to elevate the customer experience. Innovations like self-checkout kiosks are streamlining transactions, while augmented reality (AR) tools allow customers to visualize paint colors or furniture placement in their homes before purchasing. Digital signage provides dynamic product information and project inspiration, creating a more engaging and informative shopping environment. This technological infusion aims to boost efficiency and reduce customer wait times.

These in-store technological advancements are crucial for bridging the gap between online convenience and the tangible benefits of physical retail. For instance, The Home Depot's "Project Color" app utilizes AR to let users virtually try out different paint colors on their walls, a feature that directly addresses a common customer pain point. By offering interactive tools that assist in project planning and execution, the company enhances customer confidence and satisfaction, ultimately driving sales and loyalty.

- Self-Checkout Expansion: The Home Depot continues to roll out self-checkout options, aiming for a significant percentage of transactions to be handled this way by 2025, improving speed for customers.

- AR Integration: Augmented reality features in the mobile app, like visualizing flooring or appliances in a customer's space, are being expanded to more product categories, enhancing pre-purchase decision-making.

- Digital Signage Network: The company is investing in updated digital displays across its store network, providing real-time promotions, product details, and DIY project tutorials.

Emerging Building Materials and Smart Home Technology

Innovation in building materials, like sustainable composites and advanced insulation, is rapidly changing construction. The Home Depot needs to integrate these cutting-edge products to meet growing consumer interest in eco-friendly and high-performance homes. This proactive approach ensures they remain a relevant supplier in a shifting market.

The widespread adoption of smart home technology, from connected thermostats to automated lighting, presents a significant opportunity. By stocking a comprehensive range of smart home devices, The Home Depot can cater to the increasing demand for convenience, energy efficiency, and home automation, thereby broadening its appeal to a tech-savvy customer base.

- Smart Home Market Growth: The global smart home market was projected to reach over $135 billion in 2024, with continued strong growth expected.

- Sustainable Building Materials Adoption: Consumer surveys in 2024 indicated a growing preference for sustainable building materials, with over 60% of homeowners willing to pay a premium for them.

- Energy Efficiency Demand: In 2025, energy efficiency remains a top priority for new home construction, driving demand for advanced insulation and smart energy management systems.

The Home Depot's technological investments are central to its 2024-2025 strategy, focusing on enhancing customer experience and operational efficiency. The company is prioritizing its digital infrastructure, including mobile capabilities and last-mile delivery, to meet the growing demand for seamless online and in-store interactions. By the end of fiscal year 2023, significant investments were made in supply chain technology to improve delivery times and inventory accuracy, a trend that continued into 2024 with further enhancements to fulfillment centers.

Data analytics and AI are being leveraged to personalize customer engagement, with tailored marketing campaigns and product recommendations aiming to boost conversion rates. AI also drives operational efficiency through predictive analytics for demand forecasting and enhanced customer service via chatbots. In-store technology, such as self-checkout kiosks and augmented reality (AR) features for visualizing products, is expanding to streamline transactions and improve the shopping experience.

The company is actively integrating smart home technology, recognizing the market's projected growth to over $135 billion in 2024. Furthermore, The Home Depot is incorporating innovative and sustainable building materials, driven by a 2024 consumer preference for eco-friendly options, with over 60% of homeowners willing to pay a premium.

| Technology Area | 2024/2025 Focus | Impact | Key Data Point |

|---|---|---|---|

| E-commerce & Digital Presence | Enhancing online infrastructure, mobile capabilities, BOPIS, last-mile delivery | Improved customer journey, increased online sales | Online sales a significant portion of retail revenue in 2024 |

| Supply Chain & Logistics | Automation (robotics), advanced logistics software, fulfillment center enhancements | Boosted efficiency, improved delivery times, inventory accuracy | Continued investment in supply chain technology through FY2023 |

| Data Analytics & AI | Personalized marketing, demand forecasting, AI-powered customer service | Increased conversion rates, optimized inventory, enhanced customer satisfaction | AI employed for demand forecasting and customer support |

| In-Store Technology | Self-checkout expansion, AR integration, digital signage | Streamlined transactions, improved visualization, engaging shopping environment | AR features expanding to more product categories |

| Smart Home & Sustainable Materials | Stocking smart home devices, integrating advanced building materials | Catering to growing demand for convenience, energy efficiency, and eco-friendly options | Smart home market projected over $135 billion in 2024; 60%+ homeowners willing to pay premium for sustainable materials |

Legal factors

The Home Depot navigates a complex web of consumer protection laws, encompassing product safety standards, warranty provisions, advertising integrity, and fair trade principles. These regulations are critical for maintaining customer trust and ensuring ethical business operations.

Product liability laws are particularly impactful, making The Home Depot accountable for any defects in the merchandise it offers. This necessitates robust quality assurance processes and transparent dealings with its extensive network of suppliers to mitigate risks associated with faulty products.

Failure to adhere to these legal frameworks can result in substantial financial penalties, costly litigation, and significant damage to The Home Depot's brand reputation. For instance, in 2023, the Consumer Product Safety Commission (CPSC) reported over $100 million in civil penalties collected from companies for violations related to consumer product safety.

The Home Depot must navigate a complex web of national, state, and local building codes and safety regulations. These standards directly impact the products sold, especially for contractors, and the installation services offered. For instance, in 2024, the International Code Council (ICC) continues to update its building codes, influencing material requirements and construction methods across the US.

Adherence to these evolving mandates is crucial for maintaining product compliance and ensuring the quality of Home Depot's professional services. Failure to comply can lead to significant penalties and reputational damage, affecting its substantial contractor customer base, which represents a significant portion of its revenue.

The Home Depot, as a major employer with over 471,000 associates globally as of early 2024, must navigate a complex web of employment and labor laws. These regulations cover everything from minimum wage and overtime under the Fair Labor Standards Act (FLSA) to workplace safety mandated by the Occupational Safety and Health Administration (OSHA). Failure to comply can lead to significant penalties and reputational damage.

In 2023, the U.S. Department of Labor continued to emphasize enforcement of wage and hour laws, with investigations often uncovering violations affecting numerous employees. For instance, back wages recovered due to FLSA violations reached billions of dollars annually, highlighting the critical need for robust compliance programs. Additionally, anti-discrimination laws and regulations concerning employee benefits, such as healthcare and retirement plans, add further layers of legal complexity.

Data Privacy and Cybersecurity Regulations

The Home Depot navigates a complex landscape of data privacy and cybersecurity regulations. Laws such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), where applicable, dictate how customer data is collected, stored, and utilized. As of 2024, the regulatory environment continues to evolve with new state-level privacy laws emerging, requiring constant adaptation and compliance efforts. Failure to adhere can result in significant fines, with CCPA penalties reaching up to $7,500 per intentional violation.

Maintaining robust cybersecurity is paramount, not just for legal compliance but for safeguarding customer trust. Data breaches can lead to substantial financial repercussions, including remediation costs, legal fees, and reputational damage. For instance, in 2023, the average cost of a data breach in the retail sector exceeded $4.5 million, underscoring the financial imperative for strong data protection measures.

- CCPA Penalties: Up to $7,500 per intentional violation for non-compliance with data privacy requirements.

- GDPR Fines: Potential fines of up to €20 million or 4% of annual global turnover, whichever is higher.

- Retail Data Breach Costs: Average cost exceeding $4.5 million in 2023, impacting customer confidence and operational stability.

- Evolving State Laws: Continuous need to monitor and adapt to new privacy legislation across various US states.

Environmental Regulations and Compliance

The Home Depot navigates a complex web of environmental regulations, impacting everything from product sales to operational waste. These laws cover crucial areas such as hazardous materials handling, air and water quality standards, and chemical management, requiring constant vigilance and adherence. For instance, in 2023, the company reported managing millions of pounds of waste, underscoring the scale of its compliance efforts.

Compliance with specific product lifecycle regulations, including the disposal of items like paints, batteries, and chemicals, is paramount. Failure to comply can lead to significant penalties and reputational damage. The company’s sustainability reports highlight ongoing initiatives to reduce its environmental footprint, such as decreasing landfill waste by 10% year-over-year as of their latest disclosures.

Adherence to these environmental mandates is not just about avoiding legal repercussions; it’s integral to mitigating operational risks and advancing The Home Depot’s stated sustainability objectives. Their 2024 environmental strategy includes targets for reducing greenhouse gas emissions by 30% from their 2017 baseline.

- Waste Management: Adherence to regulations on waste disposal, including hazardous waste, is a continuous operational requirement.

- Product Stewardship: Compliance with laws governing the sale and end-of-life management of products like paints and batteries.

- Emissions Control: Meeting air and water quality standards and managing chemical usage across its vast retail and distribution network.

- Sustainability Goals: Environmental compliance directly supports The Home Depot's commitment to reducing its ecological impact, with a stated goal of achieving carbon neutrality by 2050.

The Home Depot must navigate stringent consumer protection laws, covering product safety, warranties, and advertising, to maintain customer trust and ethical operations. Product liability laws hold the company accountable for merchandise defects, necessitating robust quality control and transparent supplier dealings to mitigate risks.

In 2024, the company continued to face evolving building codes and safety regulations, impacting product sales and installation services, particularly for its contractor base. Adherence to these standards is critical for product compliance and service quality, with non-compliance risking penalties and reputational harm.

As a major employer with over 471,000 associates globally in early 2024, The Home Depot is subject to comprehensive employment and labor laws, including wage, hour, and workplace safety regulations. Billions in back wages were recovered annually due to FLSA violations in 2023, highlighting the importance of compliance.

Data privacy and cybersecurity regulations, such as CCPA and GDPR, dictate customer data handling, with CCPA penalties reaching up to $7,500 per intentional violation. The average cost of a data breach in retail exceeded $4.5 million in 2023, emphasizing the financial imperative for strong data protection.

| Legal Area | Key Regulations/Concerns | Potential Impact of Non-Compliance | Relevant Data/Trends (2023-2024) |

| Consumer Protection | Product safety, warranties, advertising integrity | Financial penalties, litigation, reputational damage | CPSC civil penalties over $100M in 2023 for safety violations |

| Building & Safety Codes | National, state, local building codes | Product non-compliance, service quality issues, penalties | ICC continuously updates codes impacting materials and methods |

| Employment & Labor | FLSA, OSHA, anti-discrimination laws | Wage/hour violations, workplace safety fines, reputational damage | Billions in back wages recovered annually due to FLSA violations |

| Data Privacy & Cybersecurity | CCPA, GDPR, evolving state laws | Significant fines (e.g., $7,500/violation for CCPA), data breach costs | Retail data breach costs averaged over $4.5M in 2023 |

Environmental factors

The Home Depot's dedication to sustainability is a growing factor, with a focus on responsibly sourcing materials like lumber and championing energy-efficient products. This commitment resonates with environmentally conscious consumers and can drive operational improvements.

By managing resources prudently, minimizing waste, and adopting green practices throughout its operations and supply chain, The Home Depot can achieve cost efficiencies. For instance, their efforts to reduce their carbon footprint and enhance recycling programs are key components of this strategy.

Climate change poses significant operational challenges for The Home Depot. Extreme weather events, such as hurricanes and severe storms, can disrupt store operations, damage inventory, and impact foot traffic. For instance, the increasing frequency of severe weather events in regions like the Gulf Coast and Florida directly affects sales and supply chain reliability.

Supply chains are particularly vulnerable. Disruptions due to climate-related events can lead to product shortages, increased transportation costs, and delays in receiving merchandise. This necessitates a robust and adaptable logistics network that can reroute shipments and mitigate the impact of unforeseen weather phenomena.

Consumer demand also shifts with climate change. There's a growing need for products that aid in climate adaptation, such as storm shutters, water management solutions, and energy-efficient home improvements. The Home Depot's strategy must evolve to meet these changing customer needs, potentially expanding its product lines and services to support resilient living.

The Home Depot's commitment to waste management and recycling is crucial, especially considering the vast amount of materials it handles. In 2023, the company reported diverting over 1.2 million tons of waste from landfills through its recycling programs, a significant step towards reducing its environmental footprint.

These initiatives focus on recycling cardboard, plastics, and other packaging materials. Furthermore, The Home Depot actively promotes take-back programs for items like batteries and fluorescent bulbs, encouraging responsible disposal and contributing to a circular economy.

Regulatory Pressure for Greener Products

Growing governmental and consumer demand for eco-friendly products is directly impacting The Home Depot's inventory. This translates into stricter regulations concerning chemical composition in goods, enhanced energy efficiency mandates for appliances, and a greater emphasis on sustainable sourcing certifications for wood and lumber.

The Home Depot must actively seek out and feature products that align with these developing environmental benchmarks to maintain its competitive edge and ensure regulatory adherence. For instance, the company's commitment to sustainability includes expanding its range of ENERGY STAR certified appliances, with sales of these products showing consistent year-over-year growth, reflecting consumer preference for energy-saving options.

- Regulatory Scrutiny: Increased government oversight on product environmental impact, from manufacturing to disposal.

- Consumer Demand: A significant portion of consumers, especially younger demographics, prioritize purchasing from brands with strong environmental credentials. In 2024, surveys indicated over 60% of consumers were willing to pay more for sustainable products.

- Supply Chain Impact: Pressure on suppliers to adopt greener practices, affecting sourcing and product availability.

- Product Innovation: Driving the need for The Home Depot to invest in or partner with manufacturers developing innovative, sustainable materials and technologies.

Water Scarcity and Water Quality Concerns

Water scarcity and quality are significant environmental considerations for The Home Depot, impacting both its supply chain and retail operations. The manufacturing of many home improvement products, from plumbing fixtures to garden supplies, can be water-intensive. Moreover, maintaining store facilities, particularly landscaping and cleaning, also contributes to water consumption.

The company is actively addressing these concerns by promoting water-efficient products, such as low-flow toilets and drought-tolerant plants, to its customers. Internally, The Home Depot is implementing water conservation measures across its stores and distribution centers. For instance, by 2023, the company had achieved a 15% reduction in water usage intensity compared to its 2017 baseline across its facilities.

- Water-Intensive Products: Many items sold, like irrigation systems and building materials, require significant water during their production.

- Operational Water Use: Retail locations use water for landscaping, cleaning, and restrooms, contributing to overall consumption.

- Supply Chain Impact: Sourcing decisions are increasingly influenced by regional water stress, affecting product availability and cost.

- Conservation Efforts: The Home Depot aims to reduce its water footprint through product innovation and facility management.

The Home Depot faces increasing pressure from consumers and regulators to offer sustainable products. In 2024, over 60% of consumers indicated a willingness to pay more for eco-friendly items, influencing inventory choices and supplier demands. This trend drives product innovation, pushing the company to invest in greener materials and technologies to meet evolving environmental standards.

Water scarcity is a growing concern, impacting both product manufacturing and retail operations. The Home Depot's efforts to conserve water included a 15% reduction in water usage intensity by 2023 compared to its 2017 baseline across its facilities.

| Environmental Factor | Impact on The Home Depot | Key Initiatives/Data |

|---|---|---|

| Climate Change | Disruptions to operations, inventory damage, and supply chain delays due to extreme weather. | Increasing frequency of severe weather events impacts sales and logistics reliability. |

| Waste Management | Pressure to reduce landfill waste and promote circular economy principles. | Diverted over 1.2 million tons of waste in 2023 through recycling programs; promotes take-back programs for batteries and bulbs. |

| Consumer Demand for Eco-Friendly Products | Shift in purchasing habits favoring sustainable brands, influencing product selection. | Over 60% of consumers willing to pay more for sustainable products (2024 data); expansion of ENERGY STAR certified appliances. |

| Water Scarcity | Impacts water-intensive product manufacturing and operational water use. | Promoting water-efficient products; achieved a 15% reduction in water usage intensity by 2023 (vs. 2017 baseline). |

PESTLE Analysis Data Sources

Our Home Depot PESTLE analysis is grounded in a comprehensive review of official government publications, reputable economic indicators, and leading industry research reports. This approach ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and factually sound.