The Home Depot Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

Unlock the strategic blueprint behind The Home Depot's success with our comprehensive Business Model Canvas. Discover how they effectively serve diverse customer segments, from DIY enthusiasts to professional contractors, through tailored value propositions and robust distribution channels.

Dive deeper into the core activities, key resources, and strategic partnerships that fuel The Home Depot's operational efficiency and market dominance. This detailed canvas reveals their revenue streams and cost structure, offering invaluable insights for aspiring entrepreneurs and seasoned business strategists.

Ready to gain a competitive edge? Download the full Business Model Canvas for The Home Depot today and transform your understanding of retail strategy, enabling you to identify opportunities and refine your own business approach.

Partnerships

The Home Depot's success hinges on its extensive network of suppliers and manufacturers, providing everything from lumber to smart home devices. In 2024, the company continued to emphasize robust relationships with these partners to guarantee product availability and competitive pricing. These collaborations are vital for bringing new, innovative products to market and ensuring efficient supply chains.

Strong supplier relationships enable The Home Depot to manage inventory effectively and offer a diverse product selection. For instance, the company works closely with manufacturers on sustainable sourcing practices, aligning with its environmental goals. This strategic approach to supplier management is a cornerstone of its business model, ensuring a consistent flow of quality goods.

The Home Depot relies on a robust network of logistics and delivery partners to manage its extensive retail operations and expanding online sales. These collaborations are critical for ensuring timely inventory replenishment across its over 2,300 stores and for facilitating direct-to-job site deliveries, a key service for its professional contractor base.

These partnerships are also vital for the company's growing e-commerce segment, enabling efficient last-mile delivery of customer orders. In 2023, Home Depot continued its significant investments in its supply chain infrastructure, including the development of new distribution and fulfillment centers aimed at boosting delivery speed and overall reliability.

Home Depot partners with technology and software providers like Google Cloud to boost its digital offerings and operational smoothness. These collaborations focus on using advanced tech like AI and data analytics to refine inventory control, streamline logistics, and create new customer tools.

For instance, the use of AI, as seen in their 'Magic Apron' assistant, aims to provide customers with better in-store and online support. In 2023, Home Depot invested significantly in technology to improve its e-commerce platform and supply chain, reflecting a commitment to digital innovation.

Professional Contractor Service Providers

The Home Depot is actively cultivating its Pro ecosystem by forging strategic alliances with professional contractor service providers. This expansion is a direct response to the growing needs of its professional customer base, aiming to offer a more integrated and supportive experience for their projects.

These partnerships extend beyond simple supply agreements. By acquiring companies like SRS Distribution Inc. and Construction Resources, Home Depot is integrating specialized expertise and product lines. This allows them to cater to a wider range of contractor needs, from roofing and landscaping to more design-intensive projects.

The goal is to provide a holistic solution for contractors, especially those undertaking larger, more complex jobs. This strategic move aims to solidify Home Depot's position as a go-to partner for professionals, offering not just materials but also the services and specialized products required for success.

- Expansion of Pro Ecosystem: Home Depot is enhancing its offerings for professional contractors through strategic partnerships.

- Acquisitions Broaden Scope: Integrations of SRS Distribution Inc. and Construction Resources add specialized capabilities in roofing, landscaping, and design.

- Comprehensive Project Support: These alliances are designed to deliver end-to-end solutions for larger and more intricate contractor projects.

Community and Non-Profit Organizations

The Home Depot actively collaborates with community and non-profit organizations, primarily via The Home Depot Foundation. These partnerships are geared towards impactful initiatives, including aiding U.S. veterans, offering skilled trades education through its 'Path to Pro' program, and supporting communities affected by natural disasters.

This strategic engagement highlights a strong dedication to corporate social responsibility and community involvement. For instance, in 2023, The Home Depot Foundation committed over $100 million to veteran causes, further solidifying its role in community upliftment.

- Veteran Support: The Foundation has pledged significant financial support and volunteer hours to organizations that assist veterans with housing and employment.

- Skilled Trades Training: Programs like 'Path to Pro' aim to address the skilled labor shortage by training individuals for careers in trades, with over 30,000 participants enrolled by the end of 2023.

- Disaster Relief: Home Depot and its Foundation provide essential supplies and financial aid to communities devastated by natural disasters, demonstrating rapid response capabilities.

- Community Impact: These partnerships not only foster goodwill but also contribute to building stronger, more resilient communities where Home Depot operates.

The Home Depot's key partnerships extend to technology providers, crucial for enhancing its digital capabilities and operational efficiency. Collaborations with firms like Google Cloud are instrumental in leveraging AI and data analytics for inventory management and customer engagement. These tech alliances are vital for maintaining a competitive edge in an increasingly digital retail landscape.

The company also strategically partners with service providers to bolster its offerings to professional customers. By integrating specialized services, Home Depot aims to provide a comprehensive solution for contractors, moving beyond just material supply. These partnerships are designed to deepen relationships with its Pro segment and capture a larger share of their project spending.

| Partnership Type | Key Collaborators | Strategic Importance |

| Supplier & Manufacturer | Numerous national and international vendors | Ensures product availability, competitive pricing, and diverse selection. Drives innovation and efficient supply chains. |

| Logistics & Delivery | Third-party logistics providers | Facilitates timely inventory replenishment and efficient last-mile delivery for e-commerce and job sites. |

| Technology & Software | Google Cloud, various software vendors | Enhances digital offerings, AI capabilities, data analytics for operations, and customer experience improvements. |

| Pro Ecosystem & Services | SRS Distribution Inc., Construction Resources, specialized service providers | Expands offerings for professional contractors, integrating specialized expertise and services for comprehensive project support. |

| Community & Non-Profit | The Home Depot Foundation, veteran support organizations, skilled trades programs | Drives corporate social responsibility, supports veterans, addresses skilled labor shortages, and aids disaster relief efforts. |

What is included in the product

The Home Depot's Business Model Canvas outlines its strategy of serving both do-it-yourself (DIY) consumers and professional contractors through a vast retail network and online presence, offering a wide range of home improvement products and services.

It details how Home Depot leverages its strong brand, efficient supply chain, and knowledgeable associates to deliver value and maintain market leadership.

The Home Depot Business Model Canvas offers a clear, actionable framework for understanding how the company addresses customer pain points like project complexity and product sourcing, simplifying the home improvement journey.

Activities

Merchandising and product sourcing are central to Home Depot's strategy, involving the procurement of a wide range of home improvement, construction, and garden items. This includes actively tracking market trends and securing favorable terms from a global supplier network to maintain competitive pricing. In 2023, Home Depot's inventory turnover rate was approximately 5.7 times, demonstrating efficient management of its vast product selection.

The Home Depot’s retail operations management is a core activity, focusing on the efficient running of its vast store network. This includes strategic store layout, compelling visual merchandising, and ensuring adequate staffing levels to provide excellent customer service. The company also hosts in-store events and workshops to enhance the customer experience.

Optimizing the in-store shopping journey for all customers, especially professionals, is paramount. This involves ensuring product availability, ease of navigation, and access to knowledgeable associates. For instance, in fiscal year 2023, The Home Depot operated over 2,300 retail stores across North America, highlighting the scale of these operations.

Home Depot's key activity involves the meticulous management and ongoing optimization of its extensive global supply chain and logistics operations. This encompasses the strategic oversight of distribution centers, transportation fleets, and inventory levels to guarantee the seamless and efficient movement of products from manufacturers all the way to their retail locations and directly to consumers' doorsteps.

In 2024, Home Depot continued its focus on enhancing its supply chain capabilities. The company has been making significant investments in expanding its network of direct fulfillment centers, which are crucial for supporting its growing e-commerce business and enabling faster delivery times. These centers are designed to streamline the process of getting online orders to customers quickly and efficiently.

Furthermore, Home Depot is actively working to improve its delivery speeds and reliability across its entire network. This includes leveraging technology to better track inventory, optimize delivery routes, and manage its transportation partners more effectively. For instance, the company has been investing in its own fleet and exploring new logistics solutions to reduce transit times and improve the customer experience, aiming to meet the increasing demand for same-day and next-day delivery options.

E-commerce and Digital Platform Development

The Home Depot's key activities heavily involve developing and maintaining its sophisticated e-commerce platforms and digital tools. This encompasses continuous enhancements to its website and mobile application, ensuring robust online search functionality, and integrating AI-powered assistants. These efforts aim to create a seamless, interconnected shopping experience for customers.

A significant strategic advantage is the company's ability to fulfill a substantial portion of online orders directly from its physical stores. This "ship-from-store" capability not only enhances delivery speed but also leverages existing inventory and store infrastructure, contributing to operational efficiency and customer satisfaction.

- E-commerce Platform Enhancement: Ongoing investment in website and mobile app features to improve user experience and functionality.

- Digital Tool Integration: Implementing AI and other technologies to personalize customer interactions and streamline the online journey.

- Omnichannel Fulfillment: Utilizing store network for efficient online order fulfillment, a critical component of their digital strategy.

- Online Search Optimization: Ensuring products are easily discoverable through advanced search algorithms and improved product categorization.

Pro Customer Engagement and Service Expansion

The Home Depot's key activity centers on enhancing engagement and expanding services specifically for its professional contractor base. This strategic focus involves creating specialized product selections, deploying dedicated sales teams, and implementing advanced digital platforms for efficient order management and tracking.

To further support these professionals, the company is investing in specialized distribution infrastructure. This includes facilities designed to handle job lot quantities and offer direct delivery to construction sites, streamlining the supply chain for large projects. In 2023, The Home Depot reported that its Pro segment sales grew by 7.4%, reaching $36.5 billion, indicating a strong response to these initiatives.

- Targeted Product Assortments: Offering specific product lines and brands favored by professional builders and remodelers.

- Dedicated Pro Sales Force: Employing sales associates with expertise in construction and renovation needs.

- Digital Tools: Providing online portals for account management, order placement, and project tracking.

- Specialized Distribution: Enhancing logistics for bulk orders and direct-to-jobsite deliveries.

Home Depot's key activities also encompass robust customer service and support, including in-store assistance, online chat, and a dedicated call center. This commitment extends to offering installation services and product protection plans, adding value beyond the initial purchase.

Preview Before You Purchase

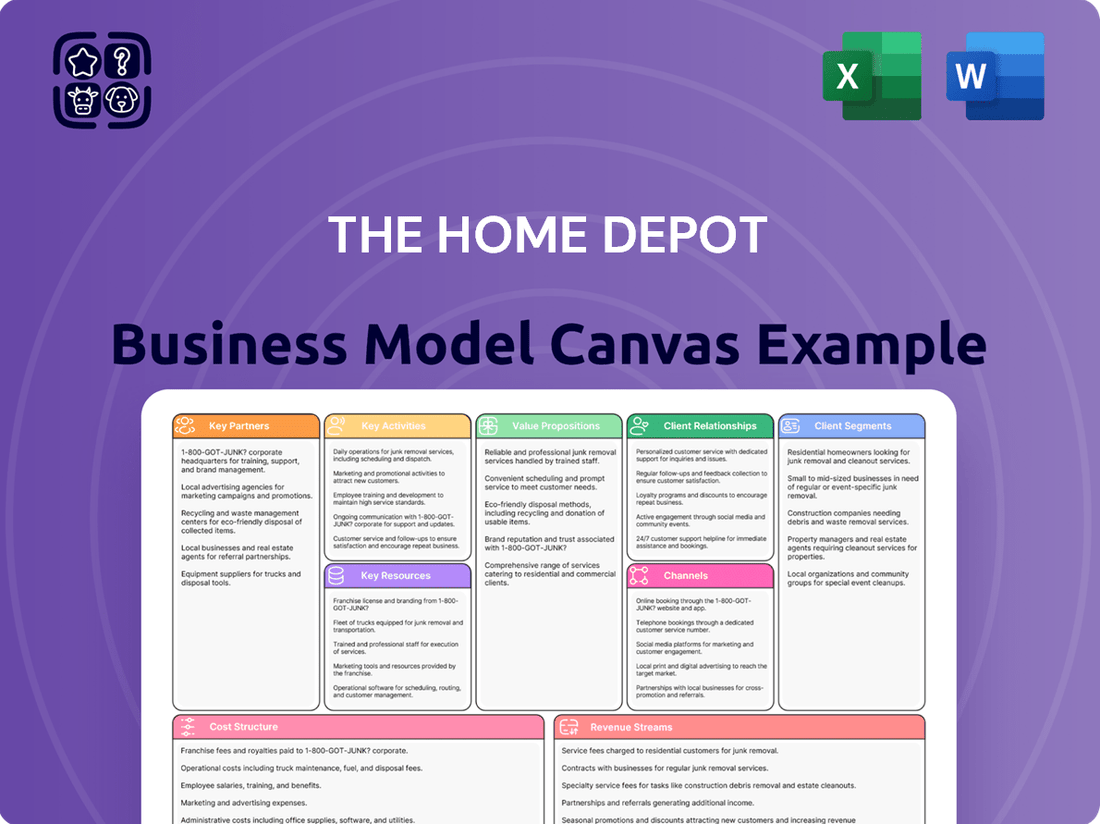

Business Model Canvas

The preview of The Home Depot Business Model Canvas you are viewing is the exact document you will receive upon purchase. This means you're seeing a genuine snapshot of the comprehensive analysis, not a generic example or mockup. When you complete your transaction, you'll gain full access to this identical, professionally structured file, ready for your immediate use.

Resources

The Home Depot's extensive store network and substantial real estate holdings are foundational to its business model. As of early 2024, the company operates over 2,300 retail stores across North America, a physical presence that facilitates direct customer interaction and sales.

These locations are not merely points of sale; they are strategically leveraged as fulfillment centers, supporting the growing e-commerce channel through services like Buy Online, Pick Up In Store. This omnichannel approach enhances customer convenience and drives store traffic.

The company’s significant real estate footprint also provides a platform for efficient inventory management and customer service, including handling returns. This robust physical infrastructure is a critical asset, differentiating Home Depot in a competitive retail landscape.

Home Depot's broad product assortment is a cornerstone resource, offering everything from basic lumber and paint to specialized plumbing and electrical supplies. This extensive inventory, covering over 30,000 SKUs in stores and an even larger online selection, caters to a vast array of customer needs, from DIY enthusiasts to professional contractors.

The company's commitment to maintaining a deep and diverse inventory positions it as a go-to destination for home improvement projects. In fiscal year 2023, Home Depot's sales reached $152.9 billion, underscoring the success of its strategy to provide a comprehensive product offering that meets the demands of a wide customer base.

The Home Depot's extensive workforce, numbering over 470,000 associates as of fiscal year 2023, is a cornerstone of its business model. This human capital includes associates with deep product knowledge, dedicated professional sales teams, and skilled tradespeople who understand the needs of both do-it-yourself (DIY) customers and professional contractors.

The expertise of these employees is crucial for delivering exceptional customer service. Their ability to provide project advice, recommend appropriate tools and materials, and troubleshoot challenges directly enhances customer satisfaction and loyalty. For instance, the company's investment in training programs ensures associates are up-to-date on new products and installation techniques, a key differentiator in the home improvement market.

Robust Supply Chain and Distribution Network

The Home Depot's sophisticated supply chain and distribution network is a cornerstone of its operations. This includes a growing number of direct fulfillment centers and specialized distribution centers catering to professional customers, ensuring products reach job sites efficiently.

This robust infrastructure allows for superior inventory management and rapid product movement. For instance, in fiscal year 2023, Home Depot reported approximately 90 distribution centers across North America, supporting its vast store network and online operations.

The network’s efficiency translates into reliable delivery services, a key differentiator in the home improvement market. This logistical prowess provides a significant competitive advantage by minimizing stockouts and speeding up order fulfillment.

- Direct Fulfillment Centers: Strategically located to expedite online order processing and delivery.

- Pro Distribution Centers: Tailored to meet the needs of professional contractors, offering bulk delivery and specialized services.

- Inventory Management: Advanced systems ensure optimal stock levels, reducing carrying costs and improving product availability.

- Delivery Speed: A critical component for customer satisfaction, particularly for time-sensitive professional projects.

Brand Value and Customer Loyalty Programs

The Home Depot's brand is a powerhouse, recognized worldwide for its quality and reliability. This strong brand equity is a key intangible resource, driving customer preference and trust. In 2024, this brand strength continues to be a cornerstone of their market position.

Customer loyalty programs, such as ProXtra, are vital for retaining their professional customer base. These programs provide tailored benefits and business-specific tools, encouraging repeat purchases and strengthening relationships. For instance, ProXtra members in 2024 have access to dedicated support and volume pricing, directly impacting their purchasing decisions.

- Brand Recognition: The Home Depot's brand is a globally recognized symbol of home improvement, contributing significantly to customer acquisition and retention.

- ProXtra Program: This loyalty initiative specifically targets professional contractors and businesses, offering them specialized perks and business management tools.

- Customer Retention: By providing value-added services through loyalty programs, The Home Depot cultivates repeat business and reduces customer churn, a critical factor in their ongoing success.

The Home Depot's extensive store network and sophisticated supply chain are critical resources. As of early 2024, the company operates over 2,300 stores across North America, functioning not only as sales points but also as fulfillment hubs for its growing e-commerce operations, enhancing customer convenience through services like Buy Online, Pick Up In Store.

The company's vast product assortment, featuring over 30,000 SKUs in stores and an even larger online selection, caters to both DIY customers and professional contractors, solidifying its position as a comprehensive home improvement destination. This broad offering is supported by a robust supply chain, including approximately 90 distribution centers as of fiscal year 2023, ensuring efficient inventory management and timely product delivery.

Furthermore, Home Depot's brand equity and its ProXtra loyalty program are significant intangible assets. The brand's strong recognition drives customer preference, while the ProXtra program fosters loyalty among professional clients by offering tailored benefits and business tools, contributing to customer retention and repeat business.

Value Propositions

The Home Depot's comprehensive product selection is a cornerstone of its value proposition, offering customers an unparalleled breadth of choices for all their home improvement needs. This vast inventory spans over 30,000 SKUs in stores and an even wider selection online, covering everything from lumber and paint to appliances and specialized tools.

This extensive range directly addresses the customer need for convenience and efficiency, allowing individuals to source all required materials for projects, whether big or small, from a single, trusted retailer. In fiscal year 2023, The Home Depot reported net sales of $152.7 billion, underscoring the significant customer reliance on its wide product assortment.

The Home Depot excels in convenience and accessibility through its robust omnichannel strategy. Customers can seamlessly transition between online browsing and in-store purchasing, utilizing services like Buy Online, Pick Up In Store (BOPIS). This integrated approach, a cornerstone of their business model, caters to diverse shopping preferences, ensuring ease of access to products and services.

Home Depot's value proposition includes expert advice and project support, crucial for customers tackling home improvement. Knowledgeable associates are available in-store to guide shoppers, and the company offers workshops to teach practical skills. In 2024, Home Depot continued to enhance its digital offerings, including the Magic Apron AI assistant, to provide on-demand project guidance, further solidifying its commitment to customer success.

Competitive Pricing and Value for Money

The Home Depot is committed to providing customers with competitive pricing and exceptional value. This is achieved through leveraging its immense scale and significant purchasing power, which translate into cost advantages. These savings are then passed directly to consumers, ensuring they receive high-quality products at attractive price points.

The company actively reinforces its value proposition through strategic initiatives. A key element is its price matching policy, which guarantees customers the best available price by matching competitor pricing. Furthermore, The Home Depot maintains a steadfast focus on everyday low prices, aiming to provide consistent affordability rather than relying on frequent, temporary sales.

- Everyday Low Price (EDLP) Strategy: Home Depot's EDLP model aims to offer consistently low prices on thousands of items, building customer trust and predictability.

- Purchasing Power: As the largest home improvement retailer, Home Depot's massive order volumes allow for significant negotiation leverage with suppliers, driving down costs.

- Price Guarantee: The company's price guarantee policy ensures customers receive competitive pricing by matching or beating competitor prices on identical items.

- Private Label Brands: Offering its own brands, such as HDX and Husky, allows Home Depot to control the supply chain and offer compelling value propositions compared to national brands.

Tailored Solutions for Professional Contractors

Home Depot provides professional contractors with a suite of tailored solutions designed to boost their productivity and project success. This includes specialized services, efficient job site deliveries, and competitive bulk pricing, all contributing to a streamlined operational experience.

The Pro ecosystem is built to support contractors at every stage of their work. In 2023, Home Depot's Pro segment revenue grew by 5.6%, reaching $31.6 billion, demonstrating the significant demand for these specialized offerings.

- Dedicated Services: Access to Pro Desks and dedicated associates for personalized support.

- Job Site Delivery: Timely delivery of materials directly to project locations, saving valuable time.

- Bulk Pricing and Pro Xtra: Opportunities for cost savings through volume purchases and loyalty rewards.

- Localized Assortments: Product selections tailored to regional needs and project types.

The Home Depot's value proposition centers on providing an extensive selection of home improvement products, coupled with convenient shopping experiences and expert advice. This broad offering, from basic supplies to specialized tools, caters to a wide range of customer needs, ensuring they can find everything required for their projects in one place. The company's commitment to making shopping easy through its omnichannel approach, including options like Buy Online, Pick Up In Store, further solidifies its customer-centric value.

Customer Relationships

Home Depot enhances customer relationships through strong self-service and digital tools. Its website and mobile app offer extensive product details, project tutorials, and account management, available around the clock. This digital ecosystem allows customers to find answers and manage their needs independently.

The company leverages AI, like its 'Magic Apron' assistant, to further personalize the self-service experience. These digital touchpoints are crucial for providing immediate support and information, fostering a sense of empowerment and convenience for shoppers. For instance, in fiscal year 2023, Home Depot's digital sales represented about 8% of total sales, demonstrating significant customer reliance on these platforms.

The Home Depot emphasizes in-store assistance, with knowledgeable associates offering expert consultation. This personalized approach aids customers in product selection and project planning, fostering trust and loyalty. In fiscal year 2023, The Home Depot reported that approximately 70% of its sales were generated in its physical stores, highlighting the continued importance of this customer relationship channel.

Home Depot's Pro-Specific Account Management is a cornerstone for building lasting relationships with professional contractors. This involves dedicated sales forces who understand the unique needs of these customers, offering personalized service and expert advice.

These specialized accounts provide tools for efficient management of complex orders and access to trade credit, streamlining operations for busy professionals. In 2023, Home Depot’s Pro segment represented a significant portion of its total sales, underscoring the importance of these tailored customer relationships.

Community Engagement and Workshops

Home Depot actively cultivates customer loyalty through robust community engagement, notably its DIY workshops. These sessions, which often feature expert advice and practical demonstrations, empower customers to tackle home improvement projects, thereby deepening their connection with the brand. In 2023, Home Depot hosted thousands of these workshops across its stores, attracting millions of participants.

Beyond workshops, Home Depot's commitment extends to community partnerships, supporting local initiatives and events. This approach not only enhances brand perception but also builds trust and goodwill within the communities it serves. These collaborations often align with Home Depot's core business, reinforcing its role as a helpful neighbor.

- Community Workshops: Home Depot's "DIY workshops" are a cornerstone of their customer relationship strategy, offering practical skills and inspiration.

- Community Partnerships: Supporting local causes and organizations strengthens brand ties and demonstrates corporate social responsibility.

- Value Beyond Products: These engagement efforts provide educational and community-building value, fostering a sense of belonging and shared learning among customers.

- Customer Empowerment: By equipping customers with knowledge and confidence, Home Depot builds lasting relationships that transcend transactional sales.

Loyalty Programs and Personalized Offers

The Home Depot actively cultivates customer loyalty through its ProXtra program, designed specifically for trade professionals and DIY enthusiasts. This initiative offers tiered rewards, exclusive discounts, and dedicated support, fostering a sense of appreciation and encouraging sustained engagement.

Personalization is key to their approach. By analyzing purchase history and browsing behavior, The Home Depot delivers tailored product recommendations and special offers directly to customers. This data-driven strategy aims to increase conversion rates and deepen customer relationships, making their shopping experience more relevant and efficient.

- ProXtra Program: Rewards professionals with benefits like volume pricing and dedicated support.

- Personalized Offers: Leverages customer data to provide relevant product suggestions and discounts.

- Customer Retention: Aims to increase repeat purchases by recognizing and rewarding loyal shoppers.

- Data-Driven Engagement: Utilizes purchase history to tailor the shopping experience and build stronger connections.

Home Depot cultivates relationships through a blend of digital self-service, expert in-store assistance, and loyalty programs. Their digital platforms and AI tools empower customers, while knowledgeable associates provide personalized guidance. The ProXtra program and community workshops further deepen engagement.

| Customer Relationship Strategy | Key Features | Fiscal Year 2023 Impact |

|---|---|---|

| Digital Self-Service & AI | Website, mobile app, 'Magic Apron' AI assistant | Digital sales ~8% of total sales |

| In-Store Expertise | Knowledgeable associates, project consultation | ~70% of sales generated in physical stores |

| Pro Customer Focus | ProXtra program, dedicated sales forces, trade credit | Significant portion of total sales from Pro segment |

| Community Engagement | DIY workshops, local partnerships | Thousands of workshops hosted, millions of participants |

Channels

The Home Depot's primary channel remains its vast network of over 2,300 large-format physical retail stores across North America. These stores are not just points of sale but also crucial hubs for customer engagement, product visualization, and personalized service.

These physical locations are fundamental to Home Depot's strategy, acting as key points for product display and expert advice. They also play a vital role in the company's omnichannel approach, facilitating services like Buy Online, Pick Up In Store (BOPIS), which saw significant growth and customer adoption.

In fiscal year 2023, Home Depot reported net sales of $152.9 billion, with a substantial portion still driven by in-store purchases. The physical store footprint is essential for fulfilling same-day pickup orders, a service that significantly boosts customer convenience and sales conversion.

Home Depot's e-commerce website and mobile app are vital for customers to browse products, make purchases, and find project ideas, seamlessly blending with their in-store experience. In fiscal year 2023, online sales represented approximately 8% of total sales, demonstrating the growing importance of these digital touchpoints.

The Home Depot's direct-to-jobsite delivery is a crucial channel for professional contractors, offering unparalleled convenience. This service leverages specialized distribution centers and an expanding fleet of delivery trucks to bring bulk materials directly to project locations. In 2024, Home Depot continued to invest in this infrastructure, aiming to streamline logistics for its pro customers and reduce their on-site time.

Installation Services

Home Depot's Installation Services act as a crucial channel, transforming product purchases into comprehensive project solutions. This offering allows customers to buy appliances, flooring, or roofing and have them expertly installed, simplifying the home improvement process.

This service extends Home Depot's value proposition from a mere product retailer to a full-service provider. In 2023, Home Depot reported that its installation services contributed significantly to its overall revenue, with a substantial portion of major appliance sales and renovation projects including installation.

- Project Completion: Facilitates end-to-end project management for customers.

- Revenue Diversification: Adds a service-based revenue stream beyond product sales.

- Customer Loyalty: Enhances customer satisfaction and encourages repeat business.

- Market Reach: Attracts customers seeking convenience and professional expertise.

Call Centers and Customer Service

The Home Depot utilizes call centers and online chat support as crucial channels for customer engagement. These platforms are designed to handle a wide range of customer needs, from answering product questions to resolving post-purchase issues. In 2023, The Home Depot reported handling millions of customer interactions across its various service channels, demonstrating their significant role in customer support.

These channels are vital for providing comprehensive assistance, aiming to enhance the overall customer experience. By offering readily available support, The Home Depot can address concerns promptly, fostering customer loyalty and satisfaction. The company invests in training its customer service representatives to ensure they are knowledgeable about products and company policies.

- Customer Inquiry Resolution: Call centers and online chat are primary points for resolving customer questions and issues efficiently.

- Product Information Access: Customers can easily obtain detailed product specifications and usage guidance through these support channels.

- Enhanced Customer Experience: Providing accessible and effective support contributes significantly to overall customer satisfaction and retention.

- Operational Efficiency: In 2023, The Home Depot continued to refine its digital support tools to manage high volumes of customer interactions effectively.

The Home Depot's channels are a blend of physical and digital, with over 2,300 stores serving as the bedrock for sales and customer interaction. These stores are crucial for BOPIS services, a key component of their omnichannel strategy. In fiscal year 2023, Home Depot's net sales reached $152.9 billion, with in-store purchases remaining a significant driver, supported by the convenience of same-day pickups.

Online channels, including their website and mobile app, are essential for product browsing and purchasing, complementing the in-store experience. These digital touchpoints represented about 8% of total sales in fiscal year 2023. The company also focuses on direct-to-jobsite delivery for professionals and offers installation services, transforming product sales into project solutions and enhancing customer loyalty.

| Channel | Description | Fiscal Year 2023 Relevance |

| Physical Stores | Over 2,300 large-format retail locations | Core for sales, BOPIS, and customer engagement |

| E-commerce & Mobile App | Online browsing, purchasing, and project ideas | ~8% of total sales, growing importance |

| Direct-to-Jobsite Delivery | Bulk material delivery for professionals | Streamlining logistics for pro customers |

| Installation Services | Expert installation for appliances, flooring, etc. | Adds service revenue and enhances customer value |

| Customer Support (Call Centers/Chat) | Product inquiries and issue resolution | Millions of interactions handled, fostering loyalty |

Customer Segments

Do-It-Yourself (DIY) homeowners are a core customer segment for The Home Depot. These individuals are actively involved in their home maintenance and improvement projects, from minor repairs to significant renovations. They value access to a broad product selection and reliable advice to complete their tasks successfully.

This segment is driven by a desire for cost savings and personal satisfaction derived from completing projects themselves. In 2024, the DIY home improvement market continued to show robust activity, with homeowners increasingly investing in upgrades and repairs. The Home Depot's ability to cater to this segment with a wide array of tools, materials, and project guidance is crucial for its business model.

Professional contractors represent a crucial customer segment for Home Depot, encompassing a wide range of tradespeople like builders, remodelers, and specialized craftspeople who rely on the company for their business operations. This group actively purchases materials in bulk, often needing job lot quantities to complete projects efficiently.

These pro customers have distinct needs, including access to specialized products not always found in standard retail offerings, and demand reliable, timely delivery directly to their active job sites. Home Depot's ability to meet these logistical requirements is paramount for retaining this valuable customer base.

In 2024, Home Depot continued to focus on enhancing services tailored to these professionals, recognizing that their purchasing power significantly contributes to overall sales. For instance, their Pro Xtra loyalty program offers benefits designed to streamline procurement and provide cost savings, acknowledging the business-driven purchasing habits of this segment.

The Home Depot's Garden and Outdoor Enthusiasts segment comprises individuals passionate about transforming their yards and outdoor spaces. These customers actively seek out plants, soil, fertilizers, and a variety of gardening tools to cultivate vibrant gardens and maintain healthy lawns. In 2023, The Home Depot reported strong performance in its gardening categories, reflecting sustained customer interest in outdoor living and home improvement projects.

This segment also includes those focused on outdoor living, purchasing items like patio furniture, grills, and decor to enhance their al fresco experiences. The company's extensive selection caters to diverse tastes and needs, from basic lawn care essentials to sophisticated outdoor entertainment solutions. The Home Depot's commitment to offering a comprehensive range of products ensures it remains a go-to destination for these customers.

Commercial and Institutional Clients (HD Supply)

Through its HD Supply segment, Home Depot caters to a significant commercial and institutional client base. This includes property managers, hospitality businesses, and healthcare facilities that rely on a steady supply of maintenance, repair, and operations (MRO) products. These clients often require bulk purchasing and specialized services to keep their operations running smoothly.

The MRO segment is crucial for these customers, encompassing everything from plumbing and electrical supplies to cleaning products and safety equipment. Home Depot's HD Supply division is positioned to meet these diverse needs, often through dedicated sales channels and logistics designed for business-to-business transactions.

- HD Supply's focus on MRO products serves sectors like property management, hospitality, and healthcare.

- These clients typically require bulk quantities and specialized services for their operational needs.

- In 2023, Home Depot's total revenue reached approximately $152.7 billion, with a significant portion likely attributable to its commercial and institutional channels.

Eco-Conscious Consumers

Eco-conscious consumers represent a significant and growing customer segment for The Home Depot. This group actively seeks out products and brands that demonstrate a commitment to environmental responsibility and sustainability. In 2024, the demand for such offerings continued to rise, influencing purchasing decisions across various home improvement categories.

The Home Depot is responding to this trend by expanding its selection of eco-friendly products. This includes energy-efficient appliances that help reduce household energy consumption, as well as building materials with lower environmental impact, such as recycled content or sustainably sourced wood. The company's initiatives also extend to promoting sustainable practices within its own operations and encouraging customers to adopt them.

- Growing Demand: Surveys in 2024 indicated that a substantial percentage of consumers consider environmental impact when making purchasing decisions, with a notable portion willing to pay a premium for sustainable products.

- Product Expansion: Home Depot has increased its inventory of ENERGY STAR certified appliances and low-VOC (volatile organic compound) paints, directly addressing the eco-conscious consumer's preferences.

- Sustainability Initiatives: The company is investing in renewable energy for its stores and promoting recycling programs, further aligning its brand with sustainability values.

- Market Opportunity: This segment represents a key growth area, with companies that effectively cater to eco-conscious consumers often seeing increased brand loyalty and market share.

The Home Depot serves a diverse customer base, primarily divided into DIY homeowners undertaking personal projects and professional contractors requiring bulk materials for their businesses. Additionally, the company caters to garden enthusiasts and commercial clients needing maintenance, repair, and operations (MRO) supplies through its HD Supply division. A growing segment includes eco-conscious consumers actively seeking sustainable products.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| DIY Homeowners | Undertake home maintenance and improvement projects; value selection and advice. | Continued strong engagement in home upgrades and repairs. |

| Professional Contractors | Purchase materials in bulk for job sites; require specialized products and timely delivery. | Pro Xtra loyalty program enhances procurement and savings for this vital segment. |

| Garden & Outdoor Enthusiasts | Focus on landscaping, gardening, and outdoor living spaces. | Strong performance in gardening categories reflects sustained interest in outdoor projects. |

| Commercial & Institutional (HD Supply) | Require MRO products for property management, hospitality, healthcare; need bulk purchasing. | HD Supply caters to B2B transactions, supporting operational needs across various sectors. |

| Eco-Conscious Consumers | Seek sustainable and environmentally responsible products. | Growing demand for energy-efficient appliances and low-impact building materials. |

Cost Structure

The cost of goods sold (COGS) represents a significant portion of Home Depot's expenses, encompassing the direct costs of acquiring the vast array of products sold in its stores and online. This includes everything from lumber and paint to appliances and tools, sourced from numerous suppliers.

Home Depot leverages its immense scale and strong supplier relationships to negotiate favorable pricing, a critical factor in managing COGS. For the fiscal year 2023, Home Depot reported a Cost of Goods Sold of $92.3 billion, underscoring the substantial investment in inventory required to meet customer demand.

The Home Depot incurs substantial costs to run and maintain its vast network of over 2,300 retail stores. These expenses encompass rent for prime retail locations, utilities to power lighting and climate control, property taxes, and the wages for a large store labor force. For fiscal year 2023, the company reported selling, general, and administrative (SG&A) expenses of $22.7 billion, a significant portion of which is directly tied to these store operations.

The Home Depot's intricate supply chain and distribution network are significant cost drivers. These include substantial expenses for transportation, managing its numerous warehouses, and last-mile delivery operations. For fiscal year 2023, the company reported selling, general, and administrative expenses of $20.5 billion, a portion of which directly relates to these logistical outlays.

Ongoing investments in enhancing its distribution capabilities, such as building new, more efficient distribution centers and expanding its in-house delivery fleet, also add to these operational costs. These strategic investments are crucial for maintaining competitive delivery times and managing inventory across its vast store network and online operations.

Marketing and Advertising Expenses

Home Depot allocates substantial resources to marketing and advertising, a critical component for engaging its broad customer base, which includes DIY enthusiasts and professional contractors. In fiscal year 2023, the company reported spending $1.6 billion on advertising, a slight increase from the previous year, reflecting its commitment to brand visibility and customer acquisition across multiple platforms.

These expenditures cover a wide array of channels designed to reach different segments effectively. This includes robust digital marketing efforts, such as search engine optimization, social media campaigns, and targeted online advertisements, alongside traditional media like television commercials and print flyers. In-store promotions and events also play a key role in driving traffic and sales.

- Digital Marketing: Investments in online advertising, SEO, and social media engagement.

- Traditional Advertising: Spending on television, radio, and print media to build brand awareness.

- In-Store Promotions: Costs associated with sales events, product demonstrations, and loyalty programs.

- Customer Reach: Efforts to connect with both do-it-yourself homeowners and professional contractors.

Employee Wages, Benefits, and Training

The Home Depot's cost structure is significantly influenced by its substantial investment in its workforce. Labor costs, encompassing wages, comprehensive benefits packages, and ongoing training initiatives for its vast employee base, represent a major expense. For instance, in fiscal year 2023, The Home Depot reported total operating expenses of $94.2 billion, with a significant portion allocated to personnel.

The company views its investment in employee development as a strategic imperative to enhance productivity and elevate the customer service experience. This commitment to training is crucial for equipping associates with the product knowledge and skills necessary to assist customers effectively in a complex retail environment.

- Labor Costs: Wages, salaries, and associated payroll taxes are a primary component of operating expenses.

- Employee Benefits: The cost of health insurance, retirement plans, and other employee benefits contributes significantly to the overall labor expenditure.

- Training and Development: The Home Depot invests in extensive training programs to ensure its workforce is knowledgeable and customer-centric.

- Workforce Size: The sheer scale of The Home Depot's workforce, which numbered approximately 465,000 associates as of fiscal year 2023, directly impacts the magnitude of these labor-related costs.

The Home Depot's cost structure is dominated by its Cost of Goods Sold (COGS), which for fiscal year 2023 stood at $92.3 billion. This reflects the immense volume of products, from lumber to appliances, that the company purchases from a vast supplier network. Beyond inventory, significant operational expenses are tied to its extensive retail footprint, with selling, general, and administrative (SG&A) expenses totaling $22.7 billion in fiscal year 2023, covering store maintenance, utilities, and property taxes.

Logistics and marketing also represent substantial cost centers. The company's complex supply chain, including transportation and warehouse management, contributes to SG&A, alongside a $1.6 billion advertising budget in fiscal year 2023 aimed at reaching both DIYers and professionals. Finally, labor costs, encompassing wages and benefits for its approximately 465,000 associates as of fiscal year 2023, are a major expense, contributing significantly to the overall operating expenses of $94.2 billion reported for the same period.

| Cost Category | Fiscal Year 2023 (in billions) | Key Components |

|---|---|---|

| Cost of Goods Sold (COGS) | $92.3 | Product acquisition costs, supplier negotiations |

| Selling, General & Administrative (SG&A) - Store Operations | $22.7 | Rent, utilities, property taxes, store labor |

| Selling, General & Administrative (SG&A) - Logistics & Other | $20.5 | Transportation, warehousing, last-mile delivery |

| Advertising & Marketing | $1.6 | Digital marketing, traditional media, in-store promotions |

| Total Operating Expenses (Approximate) | $94.2 | Includes COGS, SG&A, and other operational costs |

Revenue Streams

The Home Depot's primary revenue comes from selling a wide array of home improvement, construction, and garden products. This happens both in their physical stores and through their online channels, serving everyone from do-it-yourself homeowners to professional contractors.

For the fiscal year 2023, The Home Depot reported net sales of $108.5 billion. This demonstrates the significant volume of product sales that form the backbone of their business model, with a substantial portion driven by these direct customer transactions.

The Home Depot generates revenue by offering installation services, providing customers with a comprehensive solution for their home improvement needs. This includes projects like flooring, kitchen renovations, and window replacements, extending value beyond product sales.

In fiscal year 2023, The Home Depot reported that installation services contributed significantly to its overall revenue, with the company completing millions of installations. This segment highlights their strategy to capture a larger share of the home improvement market by offering end-to-end project support.

The Home Depot's tool and equipment rental segment is a significant revenue driver, serving both do-it-yourself enthusiasts and professional contractors. This business line allows customers to access specialized machinery for short-term needs, avoiding the upfront cost of ownership.

In fiscal year 2023, The Home Depot reported rental revenue of $1.3 billion. This segment offers a diverse range of tools, from basic hand tools to heavy-duty construction equipment, meeting the varied demands of its customer base.

Pro-Specific Services and Subscriptions

Home Depot is increasingly generating revenue from specialized services and subscriptions designed for professional contractors. These offerings often include advantageous bulk purchasing programs and flexible trade credit solutions, making it easier for businesses to manage their project costs and cash flow.

The company is also exploring future subscription-based models. These could provide ongoing access to premium support, analytics, or curated product bundles tailored to the specific operational demands of professional trades, further solidifying customer loyalty and recurring revenue.

- Pro Xtra Loyalty Program: This program offers tiered benefits, including volume pricing and dedicated support, directly impacting contractor purchasing power.

- Trade Credit: Extended payment terms and credit lines are crucial for contractors, smoothing out cash flow between project payments.

- Specialized Services: Offerings like tool rental, delivery services, and project management support cater directly to the needs of professional clients.

Extended Warranty and Protection Plans

The Home Depot generates revenue through the sale of extended warranty and protection plans, a common practice for retailers of durable goods. These plans offer customers extended service coverage beyond the manufacturer's warranty, particularly for high-value items like appliances and power tools. This segment provides a recurring revenue stream and enhances customer loyalty by offering peace of mind.

In fiscal year 2023, The Home Depot reported that its protection plans, which include extended warranties, represented a significant portion of its service revenue. While specific figures for this segment alone are not always broken out, the company's overall service and other revenue, which encompasses these plans, has shown consistent growth. For instance, in 2023, the company's total revenue was approximately $110 billion, with a notable contribution from these value-added services.

- Protection Plans: Offer extended service and repair coverage for purchased products, primarily appliances and power tools.

- Customer Value: Provide peace of mind and financial protection against unexpected repair costs for customers.

- Revenue Contribution: These plans represent a recurring revenue stream for The Home Depot, contributing to overall profitability.

- Market Presence: The Home Depot's extensive product range, especially in home improvement and appliances, creates a large customer base for these protection offerings.

The Home Depot's revenue streams are multifaceted, anchored by the sale of a vast array of home improvement products, from lumber and paint to appliances and decor. This core business is supported by a growing segment of installation services and tool rentals, catering to both DIY enthusiasts and professional contractors.

The company also leverages its customer relationships through programs like Pro Xtra, offering loyalty benefits and trade credit to professionals, and by selling extended warranty and protection plans on high-value purchases.

In fiscal year 2023, The Home Depot achieved net sales of $108.5 billion, with its tool rental segment alone generating $1.3 billion. These figures underscore the significant contribution of both product sales and ancillary services to its overall financial performance.

| Revenue Stream | Description | FY 2023 Contribution (Approx.) |

|---|---|---|

| Product Sales | Sale of home improvement, construction, and garden products | $108.5 billion (Net Sales) |

| Installation Services | Providing professional installation for various home projects | Significant contributor to overall revenue |

| Tool & Equipment Rental | Rental of tools and machinery for short-term use | $1.3 billion |

| Protection Plans | Extended warranties and service contracts for products | Notable portion of service revenue |

| Professional Services & Subscriptions | Loyalty programs, trade credit, and specialized contractor offerings | Growing segment focused on recurring revenue |

Business Model Canvas Data Sources

The Home Depot's Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer behavior and industry trends, and competitive analysis of retail and home improvement sectors. These data sources ensure a comprehensive and accurate representation of the company's strategic framework.