Holy Stone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

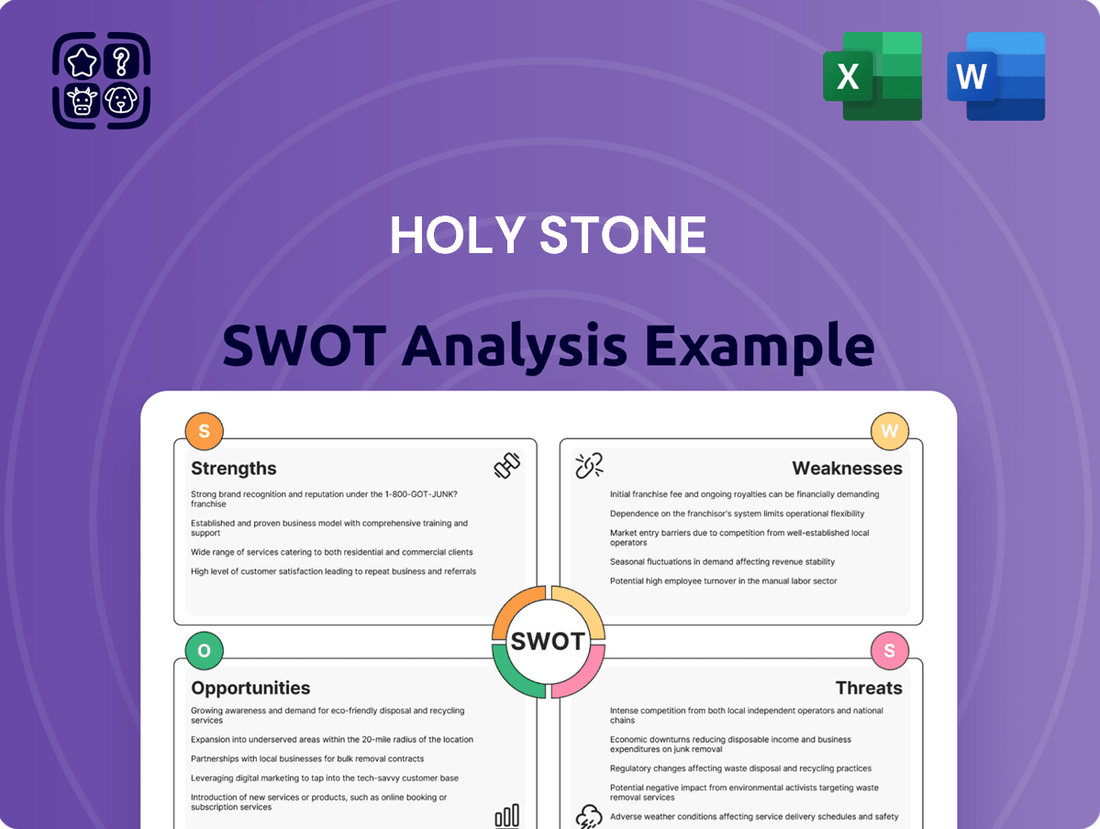

Holy Stone, a leader in the drone market, boasts strong brand recognition and a diverse product line, but faces intense competition and the need for continuous innovation to maintain its edge. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Holy Stone's competitive advantages, potential threats, and avenues for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Holy Stone holds a leading position in the passive electronic components market, especially in Multilayer Ceramic Capacitors (MLCCs). This specialization allows them to effectively serve high-demand sectors like automotive and consumer electronics.

Their strong market presence is built on a foundation of consistent quality and supply, making them a trusted partner in the global electronics ecosystem. As of Q1 2024, the global MLCC market was valued at approximately $12.5 billion, with Holy Stone being a significant contributor.

Holy Stone's diverse application portfolio is a significant strength, spanning critical industries like automotive, industrial, consumer electronics, and telecommunications. This broad market reach mitigates risk by reducing dependence on any single sector, offering stability even when some industries face headwinds. For example, the automotive sector is projected to see robust demand for advanced components through 2025, a trend Holy Stone is well-positioned to capitalize on.

Holy Stone's unwavering dedication to producing high-quality, reliable components is a significant strength. This focus is particularly critical in sectors like automotive and safety, where component failure can have severe repercussions. For instance, their MLCCs are integral to the dependable operation of systems in these demanding industries, fostering deep customer trust and brand loyalty.

Solid Financial Performance

Holy Stone's financial performance remains a significant strength. For the full year 2024, the company reported consolidated revenue of NT$12.79 billion and a net profit of NT$973 million, translating to basic earnings per share of NT$5.87. This demonstrates a robust financial foundation and consistent profitability.

Further bolstering this strength, Holy Stone's first quarter of 2025 saw consolidated revenue climb to NT$3.40 billion. The company also maintained a healthy gross profit margin of 19.5% during this period, underscoring its efficient operations and ability to generate strong returns.

- 2024 Consolidated Revenue: NT$12.79 billion

- 2024 Net Profit: NT$973 million

- Q1 2025 Consolidated Revenue: NT$3.40 billion

- Q1 2025 Gross Profit Margin: 19.5%

Geographic Market Presence

Holy Stone's geographic market presence is a significant strength, with operations spanning key global regions including Mainland China, Taiwan, and the United States. This diversification allows the company to access a wide range of customer demographics and leverage varied production capabilities. For instance, in 2023, Holy Stone reported that its sales in the Americas accounted for a substantial portion of its revenue, demonstrating the importance of this market. This broad footprint also helps to buffer against localized economic downturns and strengthens their ability to distribute electronic components worldwide.

Holy Stone's robust financial health is a key strength, evidenced by its consistent profitability and revenue growth. The company's ability to maintain healthy profit margins, even amidst market fluctuations, underscores its operational efficiency and strong market positioning.

| Financial Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Consolidated Revenue | NT$12.79 billion | NT$3.40 billion |

| Net Profit | NT$973 million | N/A |

| Basic Earnings Per Share | NT$5.87 | N/A |

| Gross Profit Margin | N/A | 19.5% |

What is included in the product

Analyzes Holy Stone’s competitive position through key internal and external factors, highlighting its strengths in product innovation and market reach while identifying threats from intense competition and evolving regulations.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities.

Weaknesses

Holy Stone's reliance on the MLCC market presents a significant vulnerability. With passive components, including MLCCs, accounting for 42% of their revenue in Q1 2025, the company is heavily exposed to market cycles. Any downturn or oversupply in this specific sector could disproportionately impact Holy Stone's financial performance and stability.

Holy Stone's reliance on key raw materials like ceramics, nickel, and palladium makes it vulnerable to price swings. For instance, in early 2024, palladium prices saw considerable volatility due to supply chain concerns, directly impacting the cost of MLCC production. This can squeeze profit margins if Holy Stone cannot effectively pass these higher costs onto its customers.

The MLCC market is incredibly crowded, with many companies all trying to grab a piece of the pie. This fierce competition has already squeezed profits for even the standard, high-end MLCCs, a trend that was evident in 2024.

Holy Stone constantly has to keep its prices in check to stay competitive. This pressure can really limit how much the company can grow its sales and make in profit, particularly when people aren't buying as much.

Uncertainty in Industrial Control Market Demand

Holy Stone faces a significant weakness in the industrial control market due to uncertain demand projections for 2025. While the automotive sector presents a more predictable landscape, this ambiguity in industrial applications complicates inventory management and production scheduling. This lack of clarity could lead to either overstocking, tying up capital, or understocking, resulting in lost sales opportunities and impacting Holy Stone's ability to meet its revenue goals for the upcoming year.

The unpredictability in industrial control demand directly affects Holy Stone's strategic planning. For instance, if a projected surge in demand for industrial automation components in 2025 fails to materialize, the company might find itself with excess inventory. Conversely, underestimating demand could lead to production bottlenecks and an inability to capitalize on market opportunities.

- Uncertainty in Industrial Control Demand: Holy Stone has flagged uncertainty regarding demand in the industrial control market for 2025, contrasting with clearer automotive sector projections.

- Forecasting Challenges: This unpredictability makes accurate forecasting and efficient production planning difficult for the company.

- Potential for Imbalances: The situation could lead to inventory imbalances or missed revenue targets if market demand deviates significantly from expectations.

Supply Chain Disruptions and Geopolitical Risks

Holy Stone's reliance on a global supply chain for electronic components exposes it to significant vulnerabilities. Geopolitical tensions, evolving trade policies, and unforeseen global events can readily disrupt the flow of essential materials, impacting production schedules and costs. For instance, ongoing trade disputes, such as those involving tariffs between major economies, can create price volatility and uncertainty for key components needed in Holy Stone's drone manufacturing.

The broader economic climate also plays a crucial role. A global economic slowdown, which was a concern in late 2023 and early 2024 due to inflation and interest rate hikes, can directly reduce demand for consumer electronics like drones. This slowdown puts increased operational pressure on companies like Holy Stone, affecting not only material availability but also the timely delivery of finished products to market.

- Supply Chain Vulnerability: The electronics sector's intricate global supply chains are inherently susceptible to disruptions from geopolitical events and trade policy shifts.

- Tariff Uncertainty: U.S. tariff policies and their potential expansion create cost uncertainties and can impact the landed cost of imported components for Holy Stone.

- Economic Slowdown Impact: A global economic downturn can dampen consumer spending on discretionary items, directly affecting demand for Holy Stone's drone products.

- Operational Pressures: These external factors combine to create heightened operational pressures, influencing material sourcing, lead times, and overall inventory management for the company.

Holy Stone's significant reliance on the MLCC market, which represented 42% of its revenue in Q1 2025, makes it susceptible to market downturns and oversupply. This concentration in a single product category, coupled with intense competition that squeezed margins in 2024, limits pricing power and growth potential. Furthermore, the company faces challenges in forecasting demand for industrial control components in 2025, risking inventory imbalances and missed sales opportunities.

Same Document Delivered

Holy Stone SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You can trust that the quality and content you see here are exactly what you'll get in the full Holy Stone SWOT analysis after purchase.

Opportunities

The global automotive industry's accelerating transition to electric vehicles (EVs) and hybrid electric vehicles (HEVs) creates a substantial opportunity for Holy Stone. These advanced vehicles rely heavily on a multitude of high-performance and dependable Multilayer Ceramic Capacitors (MLCCs) for critical functions like power management, battery pack control, and sophisticated electronic systems. Holy Stone is strategically positioned to meet this burgeoning demand, with clear expectations of significant uptake from the automotive sector in 2025, allowing them to leverage this expanding market.

The global expansion of 5G networks and the rapid growth of the Internet of Things (IoT) present a significant opportunity for Holy Stone. These technologies require a substantial increase in passive components, particularly miniaturized and high-performance MLCCs, which are Holy Stone's specialty. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.2 trillion by 2028, indicating a massive demand driver for components like those Holy Stone produces.

Continuous advancements in MLCC technology, including higher capacitance, enhanced reliability, and miniaturization, present significant growth avenues for Holy Stone. These innovations allow for the creation of components that cater to increasingly sophisticated electronic devices.

By prioritizing research and development in cutting-edge MLCCs, Holy Stone can proactively address evolving market needs. This strategic investment is crucial for securing a competitive advantage, particularly in high-growth sectors demanding advanced component performance.

For instance, the automotive sector's demand for MLCCs with superior temperature resistance and miniaturization is projected to reach $1.7 billion by 2026, according to market research firm Yano Economic Research Institute, offering a clear opportunity for Holy Stone to leverage its technological capabilities.

Demand from AI Servers and High-Performance Computing

The burgeoning demand for AI servers and high-performance computing (HPC) presents a significant opportunity for Holy Stone. These advanced systems require passive components, particularly multilayer ceramic capacitors (MLCCs), that can withstand rigorous operating conditions and ensure exceptional stability and efficiency. Market projections indicate substantial growth in the AI hardware sector, with the global AI chip market anticipated to reach hundreds of billions of dollars by 2025, directly translating to increased demand for high-reliability MLCCs.

Holy Stone is well-positioned to capitalize on this trend by focusing its product development and marketing efforts on MLCCs tailored for AI and HPC applications. These components must meet stringent specifications for:

- High capacitance density

- Low equivalent series resistance (ESR)

- Excellent thermal stability

- High voltage ratings

By supplying MLCCs that meet these demanding criteria, Holy Stone can secure a valuable niche in a rapidly expanding market. The increasing integration of AI across various industries, from cloud computing to autonomous vehicles, will continue to drive the need for specialized semiconductor components like those Holy Stone can provide.

Emerging Applications in Renewable Energy and Medical Devices

Holy Stone can capitalize on the burgeoning demand for advanced components in renewable energy and medical devices. These sectors require high-reliability MLCCs for critical functions like power management in solar inverters and precise signal processing in diagnostic equipment. The global renewable energy market, projected to reach over $2.1 trillion by 2025, presents a substantial growth avenue. Similarly, the medical device market is expected to exceed $600 billion by 2025, underscoring the opportunity for specialized MLCC solutions.

- Renewable Energy Growth: The solar and wind energy sectors are rapidly expanding, requiring robust power electronics where MLCCs play a vital role.

- Medical Device Innovation: Advancements in miniaturization and performance in medical devices create a need for compact, high-performance capacitors.

- Market Expansion: Holy Stone can diversify its revenue streams by targeting these high-growth, technically demanding markets.

Holy Stone is positioned to benefit from the increasing demand for MLCCs in the electric vehicle (EV) and hybrid electric vehicle (HEV) markets, with automotive sector uptake expected to significantly increase in 2025. The expansion of 5G networks and the Internet of Things (IoT) also presents a substantial opportunity, as these technologies require more passive components. Furthermore, advancements in AI servers and high-performance computing (HPC) demand high-reliability MLCCs, a niche Holy Stone can fill.

| Market Segment | Projected Growth Driver | Holy Stone Opportunity |

|---|---|---|

| Automotive (EV/HEV) | Increasing EV/HEV production | Supplying critical MLCCs for power management and electronic systems. Automotive sector demand for specialized MLCCs projected to reach $1.7 billion by 2026. |

| 5G & IoT | Ubiquitous connectivity and smart devices | Providing miniaturized, high-performance MLCCs for 5G infrastructure and IoT devices. Global IoT market expected to reach $2.2 trillion by 2028. |

| AI & HPC | Demand for advanced computing power | Offering high-reliability MLCCs for AI servers and HPC systems requiring exceptional stability. Global AI chip market anticipated to reach hundreds of billions by 2025. |

Threats

The MLCC market is a battleground with many global competitors vying for dominance. This intense rivalry can force prices down, squeezing profit margins for all players. For Holy Stone, this means constant pressure to innovate and offer something unique to stand out. For example, in 2023, the global MLCC market was valued at approximately $12 billion, with significant growth projected, attracting new entrants and intensifying the fight for market share.

Global supply chain volatility remains a significant threat, with the electronic components sector particularly vulnerable. Raw material shortages and logistical hurdles, exacerbated by geopolitical events, continue to pose challenges. For instance, the semiconductor shortage that began in late 2020 and extended through much of 2022 and into 2023 significantly impacted production across various industries, including consumer electronics.

These disruptions directly translate into increased costs for components and can cause production delays, hindering Holy Stone's ability to fulfill orders promptly. In 2024, while some supply chain pressures have eased, the risk of renewed bottlenecks or shortages persists, potentially affecting Holy Stone's operational efficiency and overall profitability.

Escalating geopolitical tensions and evolving international trade policies, including tariffs and export restrictions, present considerable risks for Holy Stone. The persistent uncertainty surrounding U.S. tariffs, for example, has already cast a shadow over the global economic landscape and disrupted supply-demand equilibria within the MLCC market. This situation could translate into diminished order volumes and increased pricing pressures for manufacturers like Holy Stone.

Weakening End-Market Demand and Price Erosion

A challenging global economic climate with limited visibility into future demand is a significant threat. Sectors like industrial control are particularly susceptible, potentially leading original equipment manufacturers (OEMs) to reduce their order volumes for components like MLCCs.

Intensified price competition within the MLCC market is another major concern. This pressure forces suppliers to make price concessions, directly impacting their profitability and operational stability.

- Economic Slowdown: Global GDP growth forecasts for 2024 and 2025 indicate a slowdown, with organizations like the IMF projecting moderate growth, which can dampen consumer and business spending, affecting demand for electronic devices.

- Sector-Specific Weakness: Certain end-markets, such as those reliant on large capital expenditures or discretionary consumer spending, may experience sharper demand contractions.

- Price Erosion: The average selling price (ASP) for MLCCs has seen downward pressure due to oversupply in certain categories and aggressive competition, with some reports indicating a decline of over 10% year-over-year for specific product types in late 2023 and early 2024.

Rapid Technological Obsolescence and Alternative Technologies

The electronics sector is characterized by swift technological advancements, making components like MLCCs susceptible to rapid obsolescence. For instance, the drive towards smaller, more powerful devices continually pushes for new capacitor technologies that could outperform or replace traditional MLCCs. This necessitates substantial and ongoing investment in research and development to maintain competitiveness.

Emerging alternative technologies, such as advanced ceramic formulations or entirely new dielectric materials, pose a significant threat. These innovations could offer superior performance characteristics or cost advantages, potentially displacing MLCCs in key applications. Holy Stone's ability to adapt and integrate these advancements will be crucial for its long-term market position.

The market for passive components is dynamic, with new materials and manufacturing processes constantly being explored. Failure to keep pace with these developments risks making existing product lines less attractive or even obsolete. For example, while MLCCs are dominant, research into solid-state electrolyte capacitors continues to mature, presenting a potential future challenge.

Intense competition and potential price erosion are significant threats, as the global MLCC market, valued around $12 billion in 2023, faces downward pressure on average selling prices, with some categories seeing over a 10% year-over-year decline in late 2023 and early 2024. Economic slowdown forecasts for 2024 and 2025 also indicate reduced consumer and business spending, potentially impacting demand for electronic devices and leading to weaker order volumes from original equipment manufacturers.

Supply chain volatility, exacerbated by geopolitical events, continues to pose risks, potentially leading to component shortages and increased production costs. Furthermore, rapid technological advancements and the emergence of alternative capacitor technologies could lead to product obsolescence, requiring substantial and ongoing investment in research and development for Holy Stone to maintain its market position.

| Threat Category | Specific Threat | Impact on Holy Stone | Relevant Data/Trend |

|---|---|---|---|

| Market Competition | Intensified Price Competition | Reduced profit margins, pressure to innovate | MLCC ASP decline of >10% in some categories (late 2023/early 2024) |

| Economic Environment | Global Economic Slowdown | Dampened demand, reduced OEM order volumes | Projected moderate global GDP growth for 2024/2025 (e.g., IMF forecasts) |

| Supply Chain | Volatility and Shortages | Increased costs, production delays | Lingering effects of semiconductor shortages impacting electronics sector |

| Technology | Rapid Obsolescence & Alternatives | Need for R&D investment, risk of market displacement | Ongoing research into advanced ceramic formulations and solid-state capacitors |

SWOT Analysis Data Sources

This Holy Stone SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research studies, and expert industry analysis to provide a well-rounded perspective.