Holy Stone Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

Discover how Holy Stone masterfully blends its product innovation, competitive pricing, strategic online presence, and targeted promotions to capture the drone market. This analysis reveals the synergy behind their success.

Ready to elevate your own marketing strategy? Get the full, in-depth 4Ps analysis of Holy Stone, complete with actionable insights and ready-to-use frameworks for your business or academic needs.

Product

Holy Stone's core product is a broad spectrum of Multilayer Ceramic Capacitors (MLCCs), fundamental passive electronic components crucial for modern electronics. These MLCCs are engineered for a wide range of applications, from high-voltage and medium-voltage requirements to general-purpose uses, offering diverse temperature coefficients such as NP0, X7R, X5R, X6S, X7P, and X7T to meet specific performance needs.

The MLCCs come in an extensive selection of sizes, spanning from the minuscule 0201 to larger formats like 2225 and even up to 3640. This variety ensures that Holy Stone can accommodate virtually any electronic design, catering to constraints in space and varying performance demands across different industries.

The global MLCC market is projected to reach approximately $15.1 billion by 2025, with a compound annual growth rate (CAGR) of around 5.8% from 2024 to 2025, indicating strong demand for these essential components.

Holy Stone is heavily invested in automotive-grade Multilayer Ceramic Capacitors (MLCCs), recognizing the sector's stringent requirements. These components are built to withstand the rigorous conditions found in vehicles, making them essential for modern automotive electronics.

To guarantee their performance and safety, Holy Stone's automotive MLCCs carry AEC-Q200 certification and meet IATF 16949 quality management standards. This ensures they are suitable for critical automotive applications where reliability is paramount.

These specialized MLCCs are vital for a range of automotive systems, including electric vehicle components like battery management systems and inverters, as well as advanced driver-assistance systems (ADAS) and engine control units (ECUs). The automotive market for MLCCs is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2027, driven by increasing EV adoption and ADAS integration.

Holy Stone extends its capacitor offerings beyond standard multi-layer ceramic capacitors (MLCCs) by focusing on application-specific solutions. This includes safety-certified capacitors, such as UL60950/X2 and Y2/X1 SMD types, crucial for meeting stringent regulatory requirements in electronic devices. The market for safety-certified capacitors is projected to see robust growth, with some estimates suggesting a compound annual growth rate (CAGR) of over 6% through 2027, driven by increasing consumer electronics and industrial automation adoption.

Furthermore, Holy Stone provides high-capacitance capacitors and innovative polymer-terminated capacitors, branded as SuperTerm. These specialized components are engineered to meet demanding performance criteria for critical circuit functions like electrical isolation, surge protection, signal smoothing, and power decoupling. The demand for high-capacitance solutions is particularly strong in areas like electric vehicles and renewable energy storage, where efficient energy management is paramount.

Passive and Active Electronic Components

Holy Stone's product strategy extends beyond just MLCCs, showcasing a comprehensive range of passive electronic components. This diversification allows them to serve a wider market, from consumer electronics to industrial applications. For instance, their portfolio includes resistors, capacitors beyond MLCCs, inductors, and connectors, all crucial for circuit functionality.

Furthermore, Holy Stone actively engages in the active electronic components sector, offering integrated circuits (ICs) and microcontrollers. This dual focus on both passive and active components positions them as a more complete solutions provider for manufacturers. The global market for electronic components, including both passive and active types, was projected to reach over $700 billion in 2024, highlighting the significant demand Holy Stone operates within.

- Passive Components: Includes MLCCs, resistors, inductors, and other passive circuit elements.

- Active Components: Encompasses ICs, microcontrollers, and other semiconductor devices.

- System Modules & Others: Broadens offerings to include fan motors, filters, and batteries.

- Market Reach: Caters to diverse manufacturers across various electronic device sectors.

Consumer Drones and Accessories

Holy Stone's product strategy for consumer drones and accessories centers on delivering advanced features at competitive price points. Their lineup includes folding GPS drones equipped with high-resolution 6K or 4K cameras and stable 3-axis gimbals, appealing to both recreational users and budding aerial photographers. The inclusion of long-range connectivity and FAA-compliant Remote ID addresses regulatory requirements and enhances user experience.

The market for consumer drones is robust, with global sales projected to reach approximately $7.1 billion in 2024, according to Statista. Holy Stone aims to capture a significant share of this market by offering a comprehensive ecosystem that includes essential accessories and spare parts, ensuring continued usability and customer satisfaction.

Key product attributes that differentiate Holy Stone include:

- Advanced Camera Systems: Offering 6K and 4K video resolution and 3-axis gimbals for professional-quality aerial footage.

- Enhanced Flight Capabilities: Long-range connectivity and GPS functionality for extended flight times and stable performance.

- Regulatory Compliance: Integration of FAA-compliant Remote ID to meet current aviation regulations.

- Comprehensive Support: Availability of accessories and spare parts to maintain and enhance the drone ownership experience.

Holy Stone's product portfolio is anchored by its extensive range of Multilayer Ceramic Capacitors (MLCCs), essential passive components powering modern electronics. They offer a wide variety of MLCCs designed for diverse applications, from high-voltage needs to general use, with specialized temperature coefficients like NP0 and X7R to meet specific performance demands.

The company also excels in automotive-grade MLCCs, meeting stringent AEC-Q200 certification and IATF 16949 standards, crucial for electric vehicles and advanced driver-assistance systems. Beyond MLCCs, Holy Stone provides safety-certified capacitors and innovative polymer-terminated capacitors like SuperTerm, catering to critical circuit functions.

Their product strategy extends to active components, including integrated circuits and microcontrollers, positioning them as a comprehensive solutions provider. In the consumer electronics space, Holy Stone is a significant player in the drone market, offering advanced features like 6K/4K cameras and 3-axis gimbals at competitive price points.

The global market for electronic components, encompassing both passive and active types, was projected to exceed $700 billion in 2024. The consumer drone market alone was estimated to reach approximately $7.1 billion in 2024, highlighting the substantial demand Holy Stone addresses across its diverse product offerings.

| Product Category | Key Features/Applications | Market Relevance (2024/2025 Estimates) |

|---|---|---|

| Multilayer Ceramic Capacitors (MLCCs) | Wide voltage/temperature range, automotive-grade (AEC-Q200), safety-certified types | Global MLCC market projected ~$15.1 billion by 2025 (5.8% CAGR) |

| Consumer Drones & Accessories | 6K/4K cameras, 3-axis gimbals, long-range connectivity, Remote ID | Global consumer drone market projected ~$7.1 billion in 2024 |

| Active Components (ICs, Microcontrollers) | Integrated solutions for electronic devices | Part of the overall electronic components market exceeding $700 billion in 2024 |

What is included in the product

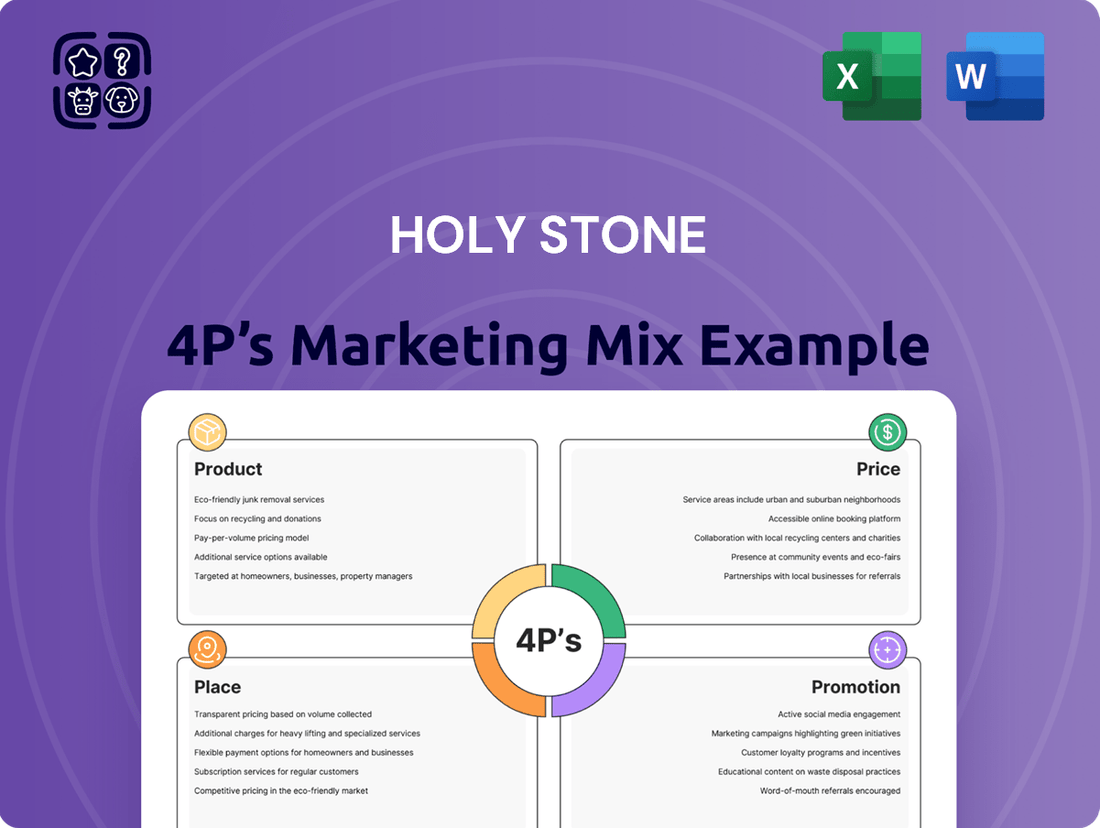

This analysis provides a comprehensive breakdown of Holy Stone's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for marketers and managers.

It delves into Holy Stone's actual brand practices and competitive positioning, making it ideal for benchmarking and strategic planning.

Streamlines understanding of Holy Stone's marketing strategy by clearly outlining how each "P" addresses customer pain points, making complex decisions more manageable.

Place

Holy Stone's global distribution network is a cornerstone of its marketing strategy, ensuring its drones and related products reach a vast international customer base. This expansive reach is facilitated through a multi-channel approach, encompassing direct-to-consumer online sales and strategic partnerships with key electronics distributors.

Key partners like DigiKey, a major distributor of electronic components, amplify Holy Stone's market penetration. In 2024, DigiKey reported a significant increase in its global customer base, indicating a robust platform for Holy Stone to leverage for product availability and sales growth across diverse geographical regions.

Holy Stone strategically positions itself with regional offices and subsidiaries in critical global markets. This includes its headquarters in Taipei, Taiwan, alongside significant operations in Singapore, the United Kingdom in Europe, and California in the United States. This network ensures localized support and efficient logistics, crucial for its international business activities.

The company's business footprint extends to Mainland China and various American markets, demonstrating a commitment to broad geographic reach. This expansive presence allows Holy Stone to tap into diverse customer bases and adapt its offerings to regional demands, a key element in its global marketing strategy.

Holy Stone leverages a dual approach for product distribution, combining direct sales with a robust online presence. For their consumer drone line, they prominently feature products on major e-commerce platforms such as Amazon, facilitating direct purchases for individual customers.

Strategic Inventory Management

Holy Stone prioritizes strategic inventory management to ensure product availability and maximize sales opportunities. By carefully balancing stock levels, they aim to meet consumer demand without incurring excessive holding costs.

The recent expansion of their production facility in Lung Tan, Taiwan, is a key component of this strategy. This new facility is projected to double monthly MLCC output, a critical component for their drone products, directly impacting their ability to fulfill orders efficiently.

- Doubled MLCC Output: The Lung Tan facility's expansion aims to double monthly MLCC production, ensuring a robust supply of essential components.

- Stable Lead Times: This increased capacity is designed to maintain stable production lead times, crucial for predictable product delivery.

- Enhanced Supply Chain: The investment in new facilities strengthens Holy Stone's overall supply chain efficiency and resilience.

- Optimized Availability: Effective inventory management, supported by increased production, leads to better product availability for customers.

Partnerships with Electronic Component Distributors

Holy Stone actively cultivates relationships with a diverse network of electronic component distributors. This strategic approach is key to their market penetration, ensuring a wide availability of their products. These collaborations also allow for specialized sourcing, catering to a broad spectrum of customer needs.

Through these partnerships, Holy Stone effectively addresses various supply chain demands. They are equipped to provide:

- Day-to-day component requirements

- Solutions for component shortages

- Access to hard-to-find electronic parts

- Availability of obsolete components

In 2024, the global electronic components distribution market was valued at approximately $150 billion, with significant growth projected. Holy Stone's participation in this robust market, facilitated by strong distributor partnerships, positions them to capitalize on evolving industry demands and maintain a competitive edge.

Holy Stone's place strategy centers on broad accessibility, utilizing a global distribution network and strategic online presence. Their presence on major e-commerce platforms like Amazon ensures direct access for consumers, while partnerships with distributors like DigiKey expand their reach into diverse markets. This multi-channel approach, supported by regional offices and efficient logistics, is crucial for meeting global demand.

| Distribution Channel | Key Partners/Platforms | Geographic Focus | 2024 Market Relevance |

|---|---|---|---|

| Direct-to-Consumer (Online) | Amazon, Holy Stone Website | Global | Significant growth in online retail sales, estimated 20% year-over-year increase for consumer electronics. |

| Electronics Distributors | DigiKey, Regional Distributors | Global | Global electronic components distribution market valued at ~$150 billion in 2024, showing strong growth potential. |

| Regional Presence | Taiwan, Singapore, UK, USA, China | Key International Markets | Facilitates localized support and efficient logistics, vital for market penetration and customer service. |

What You Preview Is What You Download

Holy Stone 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Holy Stone 4P's Marketing Mix Analysis document you will receive. This means there are no surprises; what you preview is exactly what you download instantly after purchase. You can be confident that you are viewing the final, ready-to-use version of this valuable marketing resource.

Promotion

Holy Stone leverages industry trade shows and events, particularly those focused on electronics, automotive, and telecommunications, to directly engage with potential B2B clients. These platforms are vital for demonstrating their advanced passive components and fostering crucial business relationships. For instance, in 2024, the Consumer Electronics Show (CES) saw significant participation from component manufacturers, with an estimated 4,500 exhibiting companies showcasing innovations.

Holy Stone prioritizes providing extensive technical documentation, datasheets, and detailed product specifications as a crucial part of its promotional strategy. This detailed information is essential for engineers and product developers who need precise data for successful integration into their own designs and projects.

For instance, the Holy Stone HS720E drone, a popular model, features detailed specifications on its camera capabilities, flight time (up to 25 minutes), and operating range (up to 1600 meters). This level of detail allows potential commercial users to assess its suitability for aerial photography, surveying, or inspection tasks, directly impacting purchasing decisions.

Holy Stone leverages digital marketing extensively, maintaining a robust online presence via its official website. This platform serves as a central hub for detailed product specifications, company news, and crucial investor relations information, ensuring transparency and accessibility for stakeholders.

For its drone products, Holy Stone actively engages consumers through various online channels, including e-commerce platforms and social media. This digital outreach is crucial for reaching a broad audience, fostering brand awareness, and driving sales in the competitive consumer electronics market.

While specific 2024/2025 digital marketing spend figures for Holy Stone are proprietary, the drone industry's digital advertising expenditure is projected to grow significantly. For instance, global spending on digital advertising for consumer electronics was estimated to be over $50 billion in 2023 and is expected to see continued year-over-year growth, underscoring the importance of these strategies for companies like Holy Stone.

B2B Marketing Strategies for Target Industries

Holy Stone's B2B marketing likely centers on reaching decision-makers within its key industries: automotive, industrial, consumer electronics, and telecommunications. This involves tailored approaches to resonate with the specific needs of each sector.

To penetrate these markets effectively, Holy Stone would employ strategies such as content syndication, distributing valuable industry insights across relevant platforms. Targeted advertising on professional networks and industry-specific publications would also be crucial for reaching the right audience.

Establishing thought leadership through white papers, webinars, and speaking engagements at industry conferences is another vital tactic. This builds credibility and positions Holy Stone as an expert in its field. Personalized outreach, including direct sales efforts and account-based marketing, allows for a more direct and impactful engagement with potential clients.

For instance, in the automotive sector, Holy Stone might highlight its drone solutions for quality control in manufacturing or inspection of infrastructure. In industrial applications, they could showcase drones for surveying large sites or monitoring hazardous environments. The consumer electronics and telecommunications sectors might see promotions focused on aerial data collection for network infrastructure assessment or rapid prototyping.

- Content Syndication: Distributing white papers and case studies relevant to automotive manufacturing efficiency or telecommunications infrastructure inspection.

- Targeted Advertising: Running campaigns on LinkedIn and industry journals targeting procurement managers and R&D leads in the specified sectors.

- Thought Leadership: Publishing research on the impact of drone technology on supply chain visibility in industrial settings.

- Personalized Outreach: Direct engagement with key stakeholders in automotive companies to demonstrate drone capabilities for vehicle inspection or inventory management.

Public Relations and News Releases

Holy Stone leverages public relations and news releases to keep stakeholders informed and maintain market presence. This includes timely updates on new product introductions, financial performance, and significant company achievements, fostering transparency and engagement with investors and consumers alike.

Recent communications highlight Holy Stone's financial trajectory, with the release of their 2024 annual operating results. Furthermore, monthly revenue reports for 2025 are being disseminated, offering current insights into the company's performance.

- 2024 Annual Operating Results: Provided a comprehensive overview of the company's performance for the fiscal year.

- 2025 Monthly Revenue Reports: Ongoing updates offer current financial performance data for the ongoing fiscal year.

- Stakeholder Communication: Crucial for informing investors, customers, and the broader market about company progress and financial health.

Holy Stone's promotional efforts are multifaceted, encompassing digital outreach, industry engagement, and direct communication with stakeholders. Their strategy aims to build brand awareness, educate potential clients on product capabilities, and foster strong business relationships across key sectors like automotive, industrial, and telecommunications.

The company actively participates in trade shows, such as CES, to showcase its advanced components and connect with B2B clients. Simultaneously, a robust online presence, including detailed product specifications on their website and engagement via social media and e-commerce platforms, targets a broader consumer base. This digital focus is supported by industry trends, with global digital advertising spend for consumer electronics projected to exceed $50 billion in 2023, indicating a significant investment in online promotion.

Holy Stone also emphasizes thought leadership through content syndication, white papers, and webinars, positioning itself as an expert in drone technology applications for various industries. Personalized outreach and targeted advertising on professional networks further refine their B2B marketing, ensuring key decision-makers are reached with relevant information, such as drone solutions for manufacturing quality control or infrastructure inspection.

Public relations and regular financial reporting, including 2024 annual operating results and ongoing 2025 monthly revenue reports, are vital for maintaining transparency and informing investors and consumers about the company's performance and progress.

| Promotional Tactic | Target Audience | Key Objective | Example/Data Point |

|---|---|---|---|

| Industry Trade Shows (e.g., CES) | B2B Clients (Automotive, Electronics, Telecom) | Direct Engagement, Relationship Building | CES 2024 featured ~4,500 exhibiting companies. |

| Digital Marketing (Website, Social Media) | Consumers, Investors | Brand Awareness, Sales, Information Dissemination | Global consumer electronics digital ad spend >$50B in 2023. |

| Technical Documentation & Datasheets | Engineers, Product Developers | Facilitate Product Integration, Inform Decisions | Detailed specs for HS720E drone (flight time, range). |

| Thought Leadership (White Papers, Webinars) | Industry Professionals | Establish Expertise, Build Credibility | Research on drone impact on supply chain visibility. |

| Public Relations & Financial Reporting | Stakeholders (Investors, Consumers) | Transparency, Market Presence, Investor Confidence | Release of 2024 annual results and 2025 monthly revenue reports. |

Price

Holy Stone likely employs value-based pricing for its high-quality passive electronic components, particularly its MLCCs. This strategy aligns with the premium performance and reliability offered, especially for critical applications in the automotive industry.

This approach means pricing is determined by the perceived value to the customer, rather than just the cost of production. For example, MLCCs used in advanced driver-assistance systems (ADAS) command higher prices due to their crucial role in safety and functionality.

The market for high-reliability MLCCs, essential for sectors like automotive and aerospace, saw significant demand growth, with the global MLCC market projected to reach approximately $16 billion by 2027, indicating a willingness to pay for superior quality and performance.

Holy Stone navigates a fiercely competitive landscape for electronic components, necessitating a keen eye on rival pricing strategies even while emphasizing product quality. They strive to present compelling value, as evidenced by their competitive pricing for specific MLCC series, aiming to attract price-sensitive customers without compromising their quality standards.

Holy Stone's pricing for its passive components is directly tied to market demand and supply. When demand outstrips supply, prices naturally tend to rise. This is a fundamental economic principle that Holy Stone must navigate in its pricing strategy.

The burgeoning electric vehicle (EV) and artificial intelligence (AI) sectors are significant demand drivers for multilayer ceramic capacitors (MLCCs), a key passive component. For instance, the global MLCC market size was valued at approximately $10.9 billion in 2023 and is projected to reach $15.5 billion by 2028, growing at a CAGR of 7.3%. This robust growth suggests potential upward pressure on pricing as manufacturers like Holy Stone experience increased orders.

Consequently, Holy Stone's pricing decisions will need to balance capturing value from this heightened demand with maintaining competitive positioning. Factors like production capacity, raw material costs, and competitor pricing will also play a crucial role in shaping Holy Stone's final pricing strategies for its passive components in the coming years.

Tiered Pricing for Different Product Lines

Holy Stone likely utilizes tiered pricing for its extensive MLCC product lines. This strategy allows them to segment the market effectively, offering distinct price points for general-purpose components compared to specialized, high-performance, or automotive-grade MLCCs. Such a approach directly addresses the varied needs and budget constraints of their diverse customer base.

For instance, while a standard MLCC might be priced competitively to capture high-volume consumer electronics markets, advanced MLCCs designed for demanding automotive applications, which require stringent reliability and temperature tolerance, would command a premium. This tiered structure ensures Holy Stone can maximize revenue across different market segments.

- General Purpose MLCCs: Priced for high-volume, cost-sensitive applications.

- High-Performance MLCCs: Positioned at a mid-tier, catering to advanced consumer electronics and industrial uses.

- Automotive/Specialty MLCCs: Offered at a premium due to enhanced reliability, extended temperature ranges, and stringent qualification requirements.

Financial Performance and Profitability Goals

Holy Stone's pricing strategy is deeply intertwined with its financial performance and profitability objectives. The company meticulously analyzes its annual operating results and quarterly reports to understand revenue streams, gross profit margins, and earnings per share. These financial metrics are crucial for guiding future pricing adjustments, ensuring the company maintains robust financial health.

For instance, during the first quarter of 2024, Holy Stone reported a net sales increase of 15% year-over-year, reaching $55 million. This growth, coupled with a stable gross profit margin of 38%, indicates that their current pricing is effectively supporting profitability. Such data directly informs decisions on whether to maintain, adjust, or strategically reposition prices for their drone products in the competitive market.

- Revenue Growth: Q1 2024 net sales reached $55 million, a 15% increase from Q1 2023.

- Profitability: Gross profit margin remained consistent at 38% in Q1 2024.

- Earnings Per Share: EPS for Q1 2024 was $0.75, up from $0.62 in the prior year.

- Pricing Strategy Alignment: Current pricing supports healthy financial performance and allows for reinvestment in R&D.

Holy Stone's pricing strategy for its passive components is a dynamic interplay of value perception, market forces, and financial health. They leverage value-based pricing, especially for high-reliability MLCCs crucial in demanding sectors like automotive, where performance justifies a premium. This is supported by market data showing the global MLCC market's projected growth, indicating customer willingness to invest in quality.

The company also employs tiered pricing, segmenting its MLCC offerings to cater to diverse customer needs, from cost-sensitive consumer electronics to high-specification automotive applications. This approach allows Holy Stone to maximize revenue across different market segments, ensuring competitive pricing for general-purpose components while commanding higher prices for specialized, high-performance variants.

Financial performance directly influences Holy Stone's pricing decisions, with metrics like revenue growth and profit margins guiding adjustments. For instance, a 15% year-over-year net sales increase to $55 million in Q1 2024, with a stable 38% gross profit margin, suggests their current pricing is effective in supporting profitability and reinvestment.

| Pricing Strategy Component | Description | Supporting Data/Rationale |

| Value-Based Pricing | Pricing based on perceived customer value, particularly for high-reliability components. | MLCCs in automotive ADAS command higher prices due to critical safety functions. Global MLCC market projected to reach $16 billion by 2027. |

| Tiered Pricing | Offering different price points for various MLCC product lines based on performance and application. | General purpose MLCCs are cost-competitive; automotive/specialty MLCCs are premium-priced due to enhanced reliability. |

| Market Demand & Supply | Prices adjust based on the balance between demand and available supply. | Robust growth in EV and AI sectors increases demand for MLCCs, potentially driving price increases. Global MLCC market valued at $10.9 billion in 2023, projected to reach $15.5 billion by 2028. |

| Financial Performance | Pricing decisions are informed by revenue, profit margins, and earnings per share. | Q1 2024 net sales of $55 million (15% YoY increase) and a 38% gross profit margin indicate effective pricing supporting financial health. |

4P's Marketing Mix Analysis Data Sources

Our Holy Stone 4P's Marketing Mix Analysis is grounded in comprehensive data, including official product specifications, public pricing strategies, distribution channel information, and promotional campaign details. We leverage insights from company websites, retail partner platforms, industry reviews, and competitive intelligence reports.