Holy Stone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

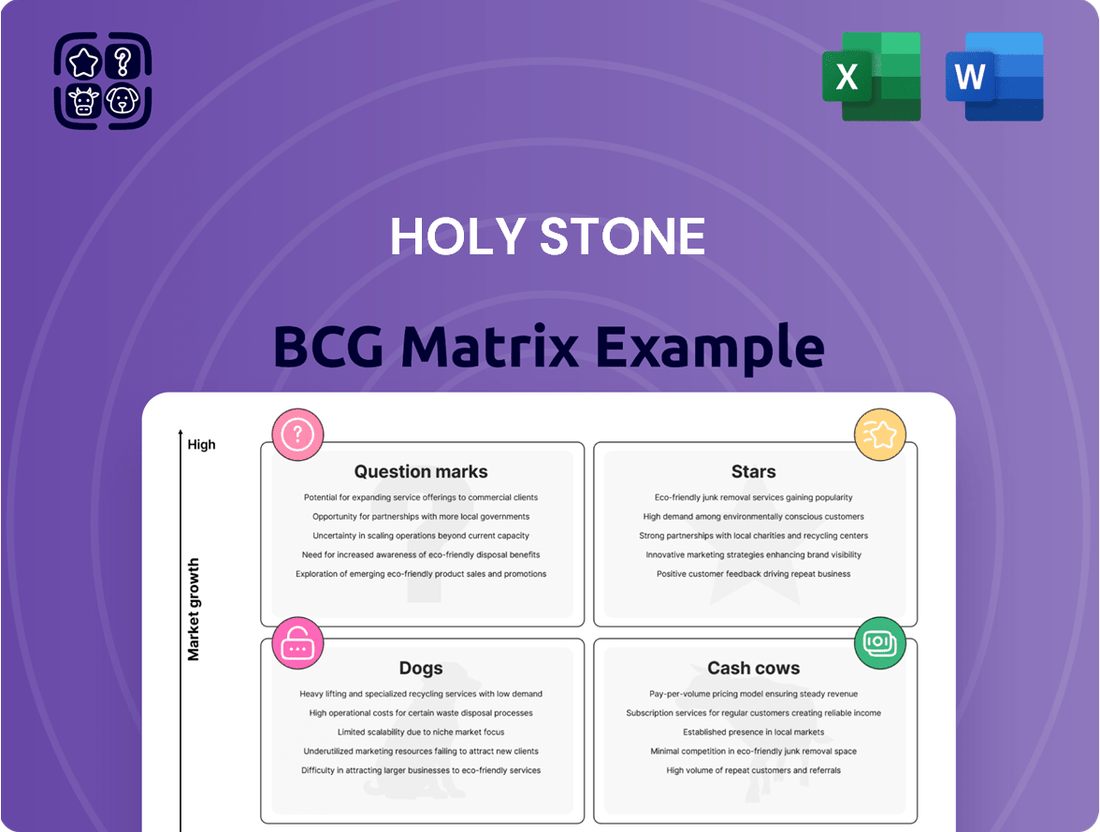

Understand the strategic positioning of Holy Stone's product portfolio with our BCG Matrix analysis. See which products are driving growth (Stars), generating consistent revenue (Cash Cows), need careful evaluation (Question Marks), or should be divested (Dogs).

Unlock the full potential of your business strategy by purchasing the complete Holy Stone BCG Matrix. Gain actionable insights and detailed quadrant breakdowns to make informed decisions about resource allocation and future product development.

Don't just guess where your products stand; know with certainty. The full BCG Matrix report for Holy Stone provides the clarity and data you need to navigate the competitive landscape and drive profitable growth.

Stars

Holy Stone's automotive-grade MLCCs are a prime example of a Star in the BCG matrix. The global market for these components is booming, fueled by the surge in electric vehicles and advanced driver-assistance systems. This market is expected to grow by USD 1.84 billion between 2024 and 2028, at an impressive compound annual growth rate of 10.5%.

Holy Stone is well-positioned to capitalize on this expansion. With expectations of steady growth in automotive orders for 2025, these high-demand, high-market-share products represent a significant opportunity for the company in a rapidly expanding sector.

The expansion of 5G networks is a significant catalyst for the MLCC market, demanding components that can handle high frequencies and possess low inductance. Holy Stone's offerings for this sector are positioned within a rapidly expanding market, with projections indicating the global MLCC market will reach USD 23.67 billion by 2025 and USD 54.15 billion by 2033, growing at a compound annual rate of 10.9%.

As a key player in MLCC manufacturing, Holy Stone is strategically investing in its 5G infrastructure products to capture a substantial share of this burgeoning demand. This focus on 5G components places Holy Stone's MLCCs in a prime position within the Stars quadrant of the BCG matrix, reflecting their high market growth and the company's strong competitive standing in this segment.

High Capacitance MLCCs, like those in Holy Stone's HCC series, are positioned as stars in the BCG Matrix due to strong market demand. The push for smaller, more powerful electronics in servers, data centers, and IT infrastructure fuels this growth. In 2024, the global MLCC market was projected to reach over $15 billion, with high-capacitance segments showing particularly robust expansion.

Low-ESL MLCCs for High-Frequency Applications

Low Equivalent Series Inductance (ESL) Multilayer Ceramic Capacitors (MLCCs) are indispensable for high-frequency operations, powering critical sectors like 5G infrastructure, automotive electronics, and advanced computing. These specialized components are designed to reduce signal loss, making them essential for maintaining signal integrity in high-speed data transmission.

The market for these high-performance MLCCs is expanding rapidly, driven by the increasing demand for faster and more efficient electronic devices. Holy Stone's strategic emphasis on application-specific ceramic capacitors suggests a strong presence in this lucrative and technically demanding market segment.

- Market Growth: The global MLCC market, valued at approximately $13.5 billion in 2023, is projected to reach over $20 billion by 2028, with high-frequency applications being a significant growth driver.

- Performance Advantage: Low ESL MLCCs can exhibit significantly lower impedance at high frequencies compared to standard MLCCs, leading to improved signal quality and reduced power consumption in sensitive circuits.

- Key Applications: Essential for RF filters, power amplifiers, and decoupling in base stations, smartphones, and advanced driver-assistance systems (ADAS).

- Holy Stone's Position: While specific data on Holy Stone's low-ESL MLCC market share isn't publicly detailed, their investment in advanced materials and manufacturing processes positions them to capitalize on this trend.

MLCCs for AI Chipset Decoupling

The burgeoning demand for AI chipset decoupling is creating a significant new growth avenue for Multilayer Ceramic Capacitors (MLCCs). This sector is showing strong positive market momentum.

- AI Chipset Decoupling: This represents a novel, high-growth segment for MLCCs, driven by the increasing complexity and power demands of AI hardware.

- Market Outlook: MLCC revenues are projected to see a substantial rise in FY 2025, buoyed by the recovery of various industries, including the technology sector.

- Holy Stone's Position: As a leading MLCC manufacturer, Holy Stone is strategically placed to invest in and secure a considerable market share within this rapidly expanding and technologically advanced application area.

Holy Stone's automotive-grade MLCCs are a prime example of a Star in the BCG matrix, benefiting from a booming global market driven by electric vehicles and advanced driver-assistance systems. This sector is projected to grow by USD 1.84 billion between 2024 and 2028, at a compound annual growth rate of 10.5%, positioning Holy Stone for significant expansion in 2025.

The company's MLCCs for 5G infrastructure are also Stars, capitalizing on a market expected to reach USD 23.67 billion by 2025 and USD 54.15 billion by 2033, with a CAGR of 10.9%. Holy Stone's strategic investments in these high-demand, high-growth products solidify their strong competitive standing.

High Capacitance MLCCs, like Holy Stone's HCC series, are Stars due to robust demand from servers, data centers, and IT infrastructure. The global MLCC market exceeded $15 billion in 2024, with high-capacitance segments showing particularly strong growth.

Low Equivalent Series Inductance (ESL) MLCCs, crucial for 5G, automotive, and computing, represent another Star category. The market for these high-performance components is rapidly expanding, and Holy Stone's focus on advanced materials positions them to capture significant share.

The burgeoning demand for AI chipset decoupling is creating a new, high-growth Star segment for MLCCs. Holy Stone is strategically placed to invest in and secure a considerable market share within this technologically advanced area, with MLCC revenues projected for a substantial rise in FY 2025.

| Product Category | Market Growth Driver | Projected Market Growth (2024-2028) | Holy Stone's Position |

|---|---|---|---|

| Automotive MLCCs | EVs, ADAS | USD 1.84 billion (CAGR 10.5%) | Star (High Growth, High Share) |

| 5G MLCCs | 5G Network Expansion | USD 23.67 billion by 2025 (CAGR 10.9%) | Star (High Growth, High Share) |

| High Capacitance MLCCs | Servers, Data Centers, IT | Robust Expansion in >$15B Market (2024) | Star (High Growth, High Share) |

| Low ESL MLCCs | 5G, Automotive, Computing | Rapid Expansion | Star (High Growth, High Share) |

| AI Chipset Decoupling MLCCs | AI Hardware Demand | New High-Growth Segment | Star (High Growth, High Share) |

What is included in the product

The Holy Stone BCG Matrix analyzes products based on market share and growth, guiding strategic decisions.

Visualizes Holy Stone's product portfolio, simplifying strategic decisions for resource allocation.

Cash Cows

General-purpose MLCCs for established consumer electronics, like standard smartphones and laptops, represent a significant cash cow for Holy Stone. This segment boasts a high market share for the company within the broader, growing MLCC market.

This is a stable, mature market where Holy Stone has cultivated a strong competitive advantage. Consequently, these products consistently generate substantial cash flow with comparatively lower investments needed for promotion and market placement.

These foundational passive components are crucial to Holy Stone's overall business. For instance, in 2024, the global MLCC market was projected to reach approximately $12 billion, with general-purpose MLCCs forming a substantial portion of this value, underscoring Holy Stone's strong position in this established segment.

Standard MLCCs for mature industrial automation represent a significant segment for Holy Stone. This sector, a key consumer of passive components, is experiencing shifts in demand.

While Holy Stone anticipates uncertain demand in the industrial control market for 2025, indicating potentially slower immediate growth, their strong market share in this established area is crucial.

These products are likely to generate consistent cash flow, allowing Holy Stone to benefit from these mature offerings without substantial reinvestment, characteristic of a cash cow.

Holy Stone's overall passive components business, contributing 42% to their Q1 2025 revenue, functions as a significant cash cow. This segment holds a substantial and well-established market share for the company, providing a reliable foundation.

While specific niches within passive components may see fluctuating growth, the collective portfolio delivers a consistent and considerable revenue stream. This stability allows Holy Stone to allocate resources towards developing and expanding other business areas.

MLCCs for Legacy Telecommunications Equipment

MLCCs for legacy telecommunications equipment represent a classic cash cow for Holy Stone. While the 5G market grabs headlines, these components are essential for maintaining existing, albeit slower-growing, network infrastructure and landline systems. Holy Stone likely commands a significant share in this mature market, where demand is stable and driven by ongoing upkeep rather than rapid expansion.

These products are dependable revenue generators, requiring little in terms of new capital expenditure. The consistent demand for replacement parts ensures a steady, predictable cash flow. For example, in 2024, the global telecommunications infrastructure maintenance market was estimated to be worth billions, with MLCCs forming a crucial, albeit niche, part of that value chain.

- Stable Revenue Stream: MLCCs for legacy systems provide consistent income due to ongoing maintenance and replacement needs in established telecommunications networks.

- High Market Share in Mature Market: Holy Stone likely holds a dominant position in this segment, characterized by low growth but high demand for reliable components.

- Low Investment Requirement: These products typically require minimal new investment, allowing for strong cash generation and profitability.

- Predictable Demand: The ongoing operation of existing telecommunication infrastructure ensures a steady, predictable demand for these essential MLCCs.

MLCCs for LED Lighting Applications

Holy Stone's MLCCs for LED lighting applications represent a classic cash cow. This segment operates within a mature market, characterized by stable demand and established adoption rates for LED technology. While growth might not be explosive, the consistent need for reliable passive components in existing lighting infrastructure ensures steady revenue streams.

The market for LED lighting components, while mature, continues to be substantial. In 2024, the global LED lighting market was valued at approximately $60 billion, with passive components like MLCCs forming a critical, albeit less rapidly growing, part of this ecosystem. Holy Stone's established presence in supplying these essential parts allows for predictable and profitable operations, generating consistent cash flow for the company.

- Market Maturity: The LED lighting sector is well-established, leading to stable demand for MLCCs in ongoing replacements and new installations.

- Consistent Revenue: Holy Stone's strong position in this segment generates reliable and predictable cash flow, characteristic of a cash cow.

- Profitability: Despite potentially slower growth rates compared to newer technologies, the scale and stability of the LED lighting market ensure continued profitability for Holy Stone's MLCC offerings.

Holy Stone's general-purpose MLCCs for consumer electronics and MLCCs for legacy telecommunications equipment are prime examples of cash cows. These segments benefit from high market share in mature markets, ensuring stable and predictable revenue streams with minimal reinvestment required. For instance, the global MLCC market reached approximately $12 billion in 2024, with general-purpose components forming a significant portion.

| Product Segment | Market Characteristic | Cash Cow Attributes | 2024 Market Context |

| General-Purpose MLCCs (Consumer Electronics) | Established, High Share | Stable Revenue, Low Investment | Significant portion of $12B global MLCC market |

| MLCCs (Legacy Telecommunications) | Mature, Stable Demand | Predictable Cash Flow, Minimal Capex | Essential for billions in telecom infrastructure maintenance |

Delivered as Shown

Holy Stone BCG Matrix

The BCG Matrix report you are currently previewing is precisely the document you will receive upon purchase, containing no watermarks or sample data. This comprehensive analysis tool is fully formatted and ready for immediate strategic application within your business planning. You can confidently expect the exact same high-quality, professionally designed BCG Matrix to be delivered directly to you, enabling swift decision-making and clear visualization of your product portfolio.

Dogs

As a distributor since 1981, Holy Stone might still manage obsolete electronic components. These older parts typically reside in low-growth or shrinking markets, meaning they likely have a small market share and contribute little to overall revenue. This category often represents capital tied up with minimal prospects for substantial returns.

While the broader MLCC market is robust, certain standard or commodity MLCCs and other passive components showed signs of weakening demand and reduced lead times in late 2024 and early 2025, especially within the portable electronics sector. This trend suggests a potential shift for some product lines.

If Holy Stone has substantial inventory or production capacity focused on these specific, more commoditized components, they could be categorized as 'Dogs' within the BCG Matrix. This classification arises from a potentially low market share in these segments coupled with sluggish market growth, indicating a less favorable strategic position.

Holy Stone's 'Others' revenue category represented a notable 24% of its Q1 2025 earnings. This segment likely encompasses a variety of products, some of which may be underperforming or occupy niche markets with limited growth potential, suggesting they could be considered for divestment.

Niche Passive Components with Stagnant Demand

Within Holy Stone's broad portfolio, certain niche passive components likely fall into the Dogs quadrant of the BCG Matrix. These are highly specialized parts serving small, mature markets where demand isn't growing. Their market share is consequently low, and the environments they operate in offer little expansion potential.

These "Dogs" represent products that consume Holy Stone's resources—research and development, manufacturing, and marketing—without generating substantial returns. For instance, if a particular type of capacitor designed for an obsolete communication technology still exists in their catalog, it would fit this description. In 2024, the global market for passive components, while robust overall, shows varying growth rates across sub-segments. Niche areas with stagnant demand might see growth rates below 2%, contrasting sharply with high-growth areas like advanced ceramic capacitors for 5G infrastructure, which could see growth rates exceeding 8%.

- Low Market Share: These components likely hold a minimal percentage of their specific, small market.

- Stagnant Demand: The need for these niche parts is not increasing; it may even be declining due to technological shifts.

- Resource Drain: Continued investment in production or R&D for these products yields little profit.

- Strategic Consideration: Holy Stone may need to evaluate divesting or phasing out these low-performing products to reallocate resources to more promising segments.

Discontinued or Phased-Out Product Lines

In the fast-paced world of consumer electronics, products naturally have a limited lifespan. Holy Stone, like many companies in this sector, likely has product lines that are either no longer in production or are being gradually retired. These are typically older models or technologies that have fallen behind current market demands or have lost their competitive edge.

These phased-out or discontinued product lines would fit into the Dogs category of the BCG Matrix. They are characterized by a low market share within a market that is either stagnant or declining. For instance, if Holy Stone once produced a line of entry-level drones with basic features, and the market has since shifted towards advanced aerial photography drones with sophisticated AI capabilities, those older models would become Dogs.

Consider the drone market in 2024. While the overall market is growing, certain segments might be contracting. For example, reports from industry analysis firms indicate that the market for basic, toy-grade drones saw a decline in sales volume by approximately 5% year-over-year in late 2023 and early 2024, as consumers increasingly opt for more capable mid-range and professional models. This decline in demand for simpler drones would push older Holy Stone drone models into the Dog quadrant if they still exist in their portfolio.

- Low Market Share: Discontinued products typically hold a negligible share of their respective markets.

- Stagnant or Declining Market: The markets for these older technologies are usually not growing, or are actively shrinking.

- Example: Older drone models with limited flight time and basic camera functions would likely be considered Dogs in the current market.

- Strategic Implication: Holy Stone would likely seek to divest or phase out these products to reallocate resources to more promising areas.

Holy Stone's "Dogs" likely represent legacy electronic components or discontinued product lines with minimal market presence and little to no growth potential. These are products that consume resources without generating significant returns, often found in mature or declining market segments. For instance, certain standard passive components in portable electronics might face weakening demand, as observed in late 2024 and early 2025, pushing them into this category.

These "Dogs" are characterized by low market share within stagnant or shrinking markets, representing a drain on Holy Stone's R&D, manufacturing, and marketing efforts. The company may need to consider divesting or phasing out these underperforming assets to reallocate capital to more promising business areas. For example, older drone models with basic features would be considered Dogs in a market increasingly dominated by advanced AI-equipped drones.

The "Others" revenue category, which was 24% of Holy Stone's Q1 2025 earnings, could house several of these "Dog" products. These niche or commoditized items may serve small markets with limited growth prospects, potentially seeing growth rates below 2% in 2024, a stark contrast to high-growth areas. The strategic implication is to carefully evaluate these products for potential divestment to optimize resource allocation.

Question Marks

Holy Stone's branded drones represent a new venture into a dynamic, high-growth market. Their product line spans from entry-level mini drones to advanced 4K GPS camera drones, catering to a broad consumer base. This diversification into consumer electronics showcases their ambition beyond traditional toy markets.

The drone industry is experiencing rapid expansion, with projections indicating continued robust growth through 2024 and beyond. For instance, the global commercial drone market alone was valued at approximately $2.8 billion in 2023 and is expected to reach over $10 billion by 2028, demonstrating significant potential. However, Holy Stone faces intense competition from established giants like DJI, which holds a dominant market share, estimated to be over 70% in the consumer drone segment. Consequently, Holy Stone's current market share is likely modest, positioning their drones as potential Question Marks in the BCG matrix.

Significant investment in research and development, marketing, and distribution is crucial for Holy Stone to carve out a substantial presence in this competitive landscape. Success hinges on differentiating their offerings through innovation, quality, and price point. If they can achieve significant market penetration and growth, these drones could evolve into Stars. Conversely, without sufficient traction, they risk becoming Dogs, requiring divestment or repositioning.

The medical device sector is a burgeoning area for MLCCs, fueled by the growing use of electronic health equipment that demands exceptional reliability and accuracy. This trend positions the medical application segment as a high-growth opportunity for MLCC manufacturers.

Holy Stone's presence in this specialized medical market is likely nascent, meaning its current market share is relatively small. This makes it a prime candidate for the Question Mark category in the BCG matrix, signifying a need for significant investment to cultivate a stronger market position.

For instance, the global medical device market was valued at approximately $520 billion in 2023 and is projected to reach over $800 billion by 2030, growing at a CAGR of around 7.5%. This expansion directly translates to increased demand for critical components like MLCCs.

The Internet of Things (IoT) market is experiencing explosive growth, with smart devices and connected systems becoming commonplace. These devices critically depend on Multilayer Ceramic Capacitors (MLCCs) for their small size and reliable performance. Holy Stone, a key player in MLCC manufacturing, is strategically positioned to capitalize on this burgeoning sector.

The demand for MLCCs in IoT applications is a significant growth driver, with the global IoT market projected to reach over $1.1 trillion by 2026. Holy Stone's focus on this area aligns with a high-growth trajectory, but their specific market share within the diverse and fragmented IoT landscape is still evolving. This necessitates continued strategic investment to solidify their position.

New Product Innovations in Advanced Materials/Designs

Holy Stone's commitment to advanced materials research, particularly in MLCC technologies, positions its innovations as potential Stars in the BCG matrix. The company is actively developing MLCCs with higher capacitance values and enhanced reliability, targeting emerging, high-growth sectors.

These new product innovations, while promising, represent significant investment opportunities. They are designed for nascent markets where Holy Stone aims to establish a strong foothold, necessitating substantial capital for scaling production and market penetration.

- Focus on MLCC Advancements: Holy Stone is investing in higher capacitance MLCCs and improved reliability, critical for next-generation electronics.

- Targeting High-Growth, Nascent Markets: Innovations are geared towards emerging applications where Holy Stone seeks to build market leadership.

- Significant Investment Required: Scaling these specialized MLCCs for new markets demands substantial capital outlay for R&D and production capacity.

- Potential for Market Dominance: Successful innovation and market entry could lead to dominant positions in future high-demand sectors for advanced capacitors.

MLCCs for Renewable Energy Systems

The renewable energy sector, particularly solar and wind power, is seeing increased demand for Multilayer Ceramic Capacitors (MLCCs). These components are crucial for power inverters and energy storage systems, essential for managing and distributing clean energy. This market is expanding rapidly due to global commitments to sustainability and decarbonization.

Holy Stone's involvement in supplying MLCCs for these renewable energy applications positions them within a high-growth segment. While this aligns with their core competency in MLCC manufacturing, their market share in this specific niche may still be developing. This suggests that while the opportunity is significant, the company's current position might be considered a 'Question Mark' within the BCG matrix, indicating potential for substantial growth but requiring further investment and strategic focus to capture market leadership.

- Market Growth: The global renewable energy market is projected to reach over $1.9 trillion by 2030, with MLCCs playing a vital role in enabling this expansion.

- Application Demand: MLCCs are critical for the efficiency and reliability of power electronics in solar inverters and battery storage, areas experiencing exponential growth.

- Holy Stone's Position: While Holy Stone is a significant player in the broader MLCC market, its specific share and competitive standing within the rapidly evolving renewable energy segment are still being established, characteristic of a Question Mark.

Question Marks represent business units or products in low-market share, high-growth markets. These ventures require significant investment to increase market share and could potentially become Stars or revert to Dogs if unsuccessful. Identifying and strategically managing Question Marks is key to future growth.

BCG Matrix Data Sources

Our Holy Stone BCG Matrix is constructed using a blend of internal sales figures, market share data from industry reports, and competitor analysis to provide a comprehensive view of product performance and market position.