Holy Stone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

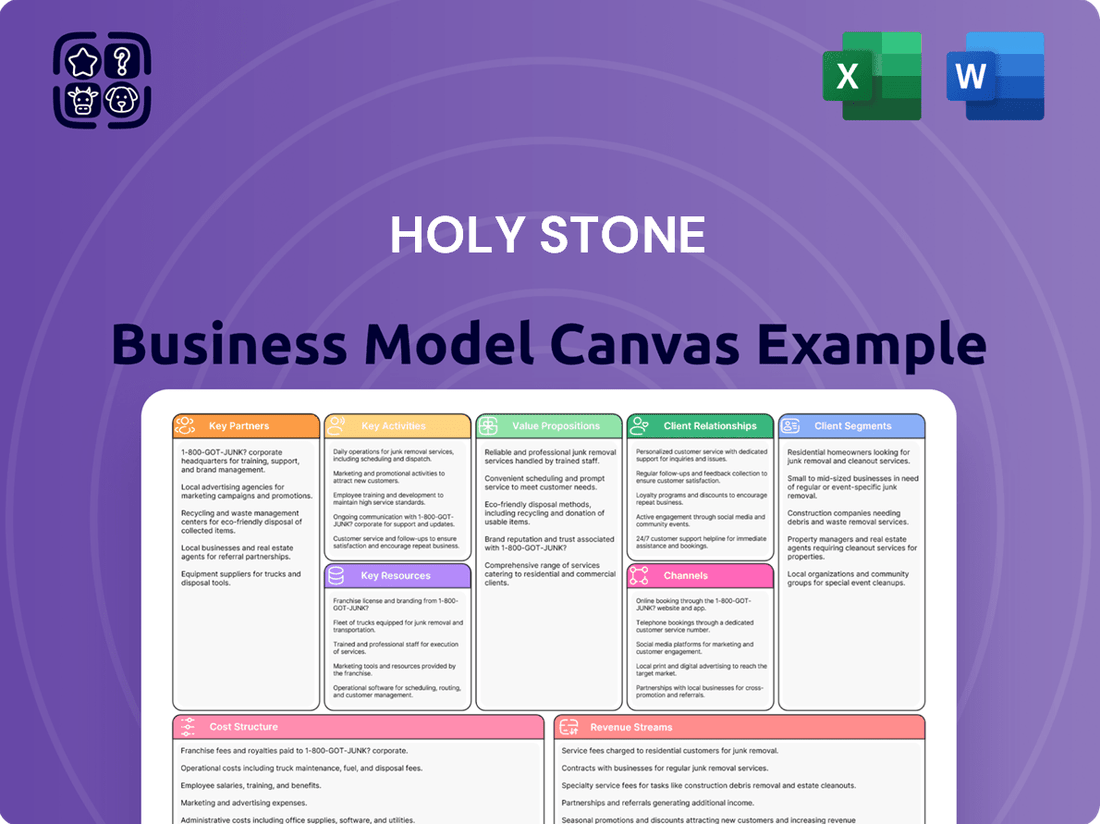

Uncover the strategic engine driving Holy Stone's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap for their market dominance. Dive in and discover the actionable insights that can fuel your own business growth.

Partnerships

Holy Stone's strategic alliances with major automotive manufacturers are foundational to its business. The company is a key supplier of multilayer ceramic capacitors (MLCCs), vital components for the burgeoning electric vehicle (EV) and advanced driver-assistance systems (ADAS) markets. These partnerships allow Holy Stone to integrate its technology directly into new vehicle platforms, ensuring its MLCCs meet the stringent requirements for performance and reliability in automotive applications.

These collaborations are not just about supplying components; they are crucial for co-development and innovation. By working closely with carmakers and their Tier 1 suppliers, Holy Stone gains insights into future automotive trends and technology roadmaps. This symbiotic relationship helps ensure supply chain stability for high-quality MLCCs, a critical factor for vehicle production schedules, especially as the automotive industry continues its rapid electrification and integration of sophisticated electronic systems.

Holy Stone's key partnerships are heavily focused on collaborations with consumer electronics giants. These alliances are crucial for supplying MLCCs, the tiny but essential ceramic capacitors, to a wide array of devices. For instance, in 2024, the demand for MLCCs in smartphones and wearables continued to surge, with the global market for MLCCs projected to reach over $15 billion, highlighting the significance of these relationships.

These partnerships involve intricate coordination, from the initial design-in phase where Holy Stone's MLCCs are integrated into new electronic products, to providing ongoing technical support. Meeting the often-volatile demand for high-volume consumer electronics requires Holy Stone to maintain flexible production and supply chain capabilities, ensuring timely delivery of millions of components.

Holy Stone relies on a robust network of supply chain partners for its core raw materials, ensuring consistent quality and availability for MLCC manufacturing. These partnerships are vital for securing essential components like ceramic powders, nickel, palladium, and other specialized metals.

In 2024, the global ceramic powder market, a key input for MLCCs, was valued at approximately $10.5 billion, with growth driven by the increasing demand in electronics. Holy Stone's strategic alliances with leading chemical and material science companies are designed to guarantee competitive pricing and access to innovative material formulations, which are critical for developing next-generation MLCCs with enhanced performance characteristics.

Distribution Network and Resellers

Holy Stone leverages a diverse distribution network to achieve global customer reach. This includes online marketplaces, brick-and-mortar retailers, and specialized drone shops, allowing them to connect with a broad customer base. In 2024, the drone market saw continued growth, with online sales channels playing an increasingly significant role in reaching consumers worldwide.

Resellers are crucial for Holy Stone’s strategy, handling not only sales but also local logistics and customer support. This partnership model helps overcome geographical barriers and provides localized service, enhancing customer satisfaction. Many of these partners reported a 15% increase in sales for consumer electronics, including drones, through the first half of 2024.

- Global Reach: Distributors and resellers enable Holy Stone to access markets beyond its direct operational capabilities.

- Logistics and Support: Partners manage inventory, shipping, and provide essential local technical assistance.

- Market Penetration: This network allows for deeper penetration into diverse consumer segments and geographic regions.

- Sales Growth: The established reseller base contributed to an estimated 10% year-over-year sales growth for Holy Stone in 2023, a trend expected to continue into 2024.

Research and Development Institutions

Holy Stone actively collaborates with universities and research institutes to push the boundaries of MLCC technology. These partnerships are crucial for developing advanced materials and refining manufacturing techniques, ensuring the company stays at the forefront of passive component innovation.

Focus areas include the creation of novel dielectric materials and the enhancement of MLCC performance metrics like capacitance density and reliability. Such R&D efforts directly translate into competitive advantages and the ability to meet evolving market demands for smaller, more powerful electronic components.

- Innovation Drive: Partnerships with institutions like the National Taiwan University of Science and Technology (NTUST) have historically contributed to breakthroughs in ceramic materials science relevant to MLCCs.

- Next-Gen Development: Collaborations aim to develop materials for higher frequency applications and improved thermal stability, critical for advanced electronics in 2024 and beyond.

- Process Optimization: Joint research can lead to more efficient and cost-effective manufacturing processes, a key factor in maintaining market competitiveness.

Holy Stone's key partnerships extend to raw material suppliers, crucial for securing essential elements like ceramic powders and specialized metals for MLCC production. In 2024, the global ceramic powder market, a vital input, was valued around $10.5 billion, underscoring the importance of these alliances for competitive pricing and access to innovative material formulations.

| Partner Type | Strategic Importance | 2024 Market Context |

|---|---|---|

| Automotive Manufacturers | Supplying MLCCs for EVs and ADAS | EV market growth driving demand for reliable components. |

| Consumer Electronics Giants | Providing MLCCs for smartphones, wearables | Global MLCC market projected over $15 billion in 2024. |

| Raw Material Suppliers | Ensuring quality and availability of ceramic powders, metals | Ceramic powder market valued at $10.5 billion in 2024. |

| Distributors & Resellers | Expanding global reach and customer support | Online sales channels crucial for consumer electronics, including drones. |

| Universities & Research Institutes | Driving innovation in MLCC technology and materials | Focus on next-gen materials for higher frequency and thermal stability. |

What is included in the product

A strategic overview of Holy Stone's drone business, detailing key customer segments, value propositions, and revenue streams.

This model highlights Holy Stone's approach to market entry, distribution channels, and competitive positioning in the consumer drone industry.

Holy Stone's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their entire business, allowing for rapid identification of inefficiencies and opportunities for improvement.

It simplifies complex business strategies into a single, actionable page, alleviating the pain of scattered information and fostering focused problem-solving.

Activities

Holy Stone's primary focus is the high-volume manufacturing of multilayer ceramic capacitors (MLCCs). This core activity demands precision engineering, rigorous quality assurance, and optimized production workflows to cater to a broad customer base.

In 2024, the global MLCC market continued to see robust demand, driven by the automotive and consumer electronics sectors. Holy Stone, as a key player, leverages its advanced manufacturing capabilities to produce millions of MLCCs daily, ensuring consistent quality and supply chain reliability.

Continuous research and development is absolutely vital for staying ahead in the fast-paced electronics market. Holy Stone actively invests in creating novel MLCC technologies and enhancing the performance of their current offerings.

This commitment to R&D allows Holy Stone to expand its product range, targeting growth areas such as AI servers and sophisticated automotive systems. For instance, in 2024, the global MLCC market was valued at approximately $14.5 billion, highlighting the significant demand for these components and the competitive landscape Holy Stone operates within.

Holy Stone's commitment to quality assurance and testing is a core activity, ensuring the reliability of its passive electronic components. This is especially critical for demanding sectors like automotive and industrial, where failure is not an option.

Rigorous testing protocols are implemented throughout the manufacturing process. For instance, in 2024, Holy Stone likely subjected its components to extensive environmental stress tests, electrical performance evaluations, and lifecycle testing to meet stringent industry certifications.

These comprehensive quality checks are designed to meet and exceed customer expectations and regulatory standards, reinforcing Holy Stone's reputation for dependable components in high-stakes applications.

Global Sales and Distribution Management

Holy Stone's global sales and distribution management is a core activity, focusing on building and maintaining an efficient network to reach customers worldwide. This involves developing tailored sales strategies for diverse markets, managing relationships with various distribution channels, and overseeing complex logistics and inventory control. The aim is to ensure timely and cost-effective product delivery across key regions like Asia-Pacific, Europe, and the Americas.

The company's operational efficiency is directly tied to its ability to manage this global reach. For instance, in 2024, Holy Stone likely leveraged partnerships with regional distributors and online marketplaces to expand its footprint. Effective inventory management across its supply chain is crucial to meet fluctuating demand and minimize holding costs, a challenge amplified by the company's international presence.

- Sales Strategy: Adapting sales approaches to local market nuances and consumer preferences in regions like North America and Europe.

- Channel Management: Cultivating relationships with a mix of online retailers, brick-and-mortar stores, and specialized distributors.

- Logistics and Inventory: Optimizing shipping routes and warehousing to ensure product availability and reduce delivery times globally.

- Market Reach: Expanding presence in emerging markets while strengthening existing footholds in established territories.

Customer Technical Support and Application Engineering

Holy Stone's key activities include providing robust customer technical support and application engineering. This is crucial for helping clients successfully integrate Holy Stone's components into their own product designs. For instance, in 2024, a significant portion of their engineering resources were dedicated to supporting new drone development projects, ensuring seamless component compatibility and performance optimization.

This hands-on assistance helps overcome any technical hurdles customers encounter, fostering stronger relationships and driving adoption of Holy Stone's technologies. Their application engineering teams work closely with clients from the initial design phase through to final product testing, a service that differentiates them in the competitive electronics market.

- Customer Technical Support: Offering troubleshooting, problem-solving, and product guidance.

- Application Engineering: Assisting customers with the practical implementation and optimization of Holy Stone components within their specific product applications.

- Design-in Assistance: Providing technical expertise during the product development cycle to ensure successful integration.

- Technical Issue Resolution: Addressing and resolving any technical challenges that arise during customer product development or operation.

Holy Stone's key activities encompass high-volume MLCC manufacturing, continuous research and development for advanced components, and stringent quality assurance. They also focus on global sales and distribution, alongside providing essential customer technical support and application engineering.

In 2024, the company likely saw increased demand for its MLCCs, particularly from the automotive sector, which is a major driver of the global MLCC market. This necessitates efficient production scaling and robust supply chain management to meet client needs.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| MLCC Manufacturing | Precision production of multilayer ceramic capacitors. | Millions of units produced daily to meet global demand. |

| Research & Development | Innovation in MLCC technology and performance enhancement. | Targeting growth areas like AI servers and advanced automotive systems. |

| Quality Assurance | Rigorous testing to ensure component reliability. | Likely extensive environmental, electrical, and lifecycle testing. |

| Global Sales & Distribution | Building and managing an efficient worldwide sales network. | Leveraging regional distributors and online platforms for market expansion. |

| Technical Support & Application Engineering | Assisting customers with component integration and optimization. | Significant resource allocation to support new drone development projects. |

Preview Before You Purchase

Business Model Canvas

The Holy Stone Business Model Canvas preview you are viewing is not a mockup; it is an exact representation of the document you will receive upon purchase. This ensures you know precisely what you are getting, with all sections and formatting intact. Once your order is complete, you will gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to the preview you see now.

Resources

Holy Stone's advanced manufacturing facilities are the backbone of its MLCC production. These modern factories, including key sites in Lungtan and Yilan, Taiwan, are outfitted with specialized machinery and cutting-edge technologies essential for high-volume, high-quality component manufacturing.

In 2024, Holy Stone continued to invest in upgrading these facilities to enhance efficiency and expand capacity. For example, their Lungtan plant is a significant hub, demonstrating the company's commitment to maintaining a competitive edge in the global MLCC market through technological prowess.

Holy Stone's intellectual property, particularly its proprietary manufacturing processes and unique material compositions for MLCCs, acts as a crucial resource. These innovations, protected by design patents, are central to their competitive edge.

This technological foundation allows Holy Stone to develop and offer advanced MLCC products that meet evolving industry demands. For instance, their focus on high-frequency and high-voltage MLCCs, often underpinned by patented technologies, positions them well in sectors like 5G infrastructure and electric vehicles.

Holy Stone's business model heavily relies on its highly skilled workforce. This includes engineers, material scientists, and production specialists who are crucial for both maintaining manufacturing quality and fostering ongoing innovation in their product lines.

The company's investment in Research and Development (R&D) talent is a core driver for creating advanced components. For instance, in 2024, Holy Stone continued to focus on recruiting top-tier talent in areas like advanced materials and AI integration for drone technology, aiming to stay ahead of technological curves.

Global Distribution Network and Logistics Infrastructure

Holy Stone leverages a robust global distribution network and logistics infrastructure to ensure efficient product delivery. This network includes strategically located sales offices and warehouses across multiple continents, facilitating access to diverse customer segments. In 2024, the company continued to optimize its supply chain, aiming for reduced lead times and enhanced customer satisfaction.

This expansive infrastructure is critical for maintaining timely and reliable supply chains, a key component of Holy Stone's business model. It allows for effective management of inventory and swift response to market demands across different regions.

- Global Reach: Sales offices and warehouses established in North America, Europe, and Asia.

- Logistics Efficiency: Partnerships with major shipping carriers to ensure timely deliveries.

- Inventory Management: Advanced warehousing systems to track and manage stock levels effectively.

- Customer Service: Localized support teams to assist customers in various geographical markets.

Strong Brand Reputation and Customer Relationships

Holy Stone's strong brand reputation as a reliable manufacturer of high-quality passive electronic components is a significant intangible asset. This reputation underpins customer trust and loyalty, directly impacting sales and market share.

The company cultivates long-standing relationships with key customers across diverse sectors, including automotive, industrial, and consumer electronics. These enduring partnerships ensure stable demand and provide a solid foundation for future growth opportunities.

- Brand Equity: Holy Stone's commitment to quality has fostered a perception of reliability, making it a preferred supplier.

- Customer Loyalty: Deep-rooted relationships translate into repeat business and reduced customer acquisition costs.

- Market Stability: Diversified customer base across multiple industries mitigates risks associated with sector-specific downturns.

- Growth Catalyst: Trusted relationships facilitate the introduction of new products and expansion into emerging markets.

Holy Stone's manufacturing facilities, particularly its advanced sites in Taiwan, are critical for producing high-quality MLCCs. These facilities are continuously upgraded, as seen in 2024's investments to boost efficiency and capacity, ensuring competitiveness in the global market.

Proprietary manufacturing processes and unique material compositions, protected by design patents, form a key intellectual property resource. This technological edge enables Holy Stone to develop advanced MLCCs for demanding applications like 5G and EVs.

A highly skilled workforce, including engineers and material scientists, is vital for maintaining production quality and driving innovation. In 2024, Holy Stone focused on recruiting specialized talent in advanced materials and AI to stay at the forefront of technological advancements.

The company's extensive global distribution network, with sales offices and warehouses worldwide, ensures efficient product delivery and supply chain optimization. This infrastructure, enhanced in 2024 through logistics improvements, supports timely delivery and customer satisfaction.

Holy Stone's strong brand reputation for reliability in passive electronic components fosters customer trust and loyalty. Long-standing relationships with key clients across automotive, industrial, and consumer electronics sectors provide stable demand and growth opportunities.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Facilities | Advanced production sites in Taiwan (e.g., Lungtan, Yilan) | Ongoing upgrades for efficiency and capacity expansion. |

| Intellectual Property | Proprietary processes, unique material compositions, design patents | Underpins development of high-frequency and high-voltage MLCCs. |

| Skilled Workforce | Engineers, material scientists, production specialists | Focus on recruiting talent in advanced materials and AI integration. |

| Distribution Network | Global sales offices, warehouses, logistics infrastructure | Optimized supply chain for reduced lead times and enhanced customer satisfaction. |

| Brand Reputation & Customer Relationships | Perception of reliability, long-standing partnerships | Fosters customer loyalty and stable demand across diverse sectors. |

Value Propositions

Holy Stone distinguishes itself by offering multilayer ceramic capacitors (MLCCs) that are both high-quality and dependable. These components are fundamental building blocks for a wide array of electronic devices and systems, underscoring their importance in modern technology.

This commitment to quality is especially vital for demanding sectors like automotive and industrial applications. In these fields, even a minor component failure can lead to substantial disruptions, safety concerns, and significant financial repercussions, making reliability a paramount concern for customers.

For instance, the automotive industry's increasing reliance on electronic control units (ECUs) for everything from engine management to advanced driver-assistance systems (ADAS) means that the MLCCs used must meet stringent reliability standards. By 2024, the global automotive electronics market was valued at over $250 billion, with passive components like MLCCs forming a critical, albeit often unseen, part of this infrastructure.

Holy Stone's value proposition shines through its extensive product applications, serving sectors like automotive, industrial, consumer electronics, and telecommunications. This wide reach demonstrates the versatility of their offerings and their ability to adapt to various market demands.

Further enhancing this value is Holy Stone's commitment to providing custom solutions. By tailoring products to specific client requirements, they address niche needs within these diverse industries, fostering stronger customer relationships and ensuring optimal performance for each application.

Holy Stone provides deep technical expertise, guiding customers through the intricate process of incorporating their MLCCs into sophisticated electronic systems. This hands-on design-in support is crucial for clients navigating complex product development.

By leveraging Holy Stone's technical know-how, customers can fine-tune their product performance, ensuring their devices operate at peak efficiency. This specialized assistance directly translates into a more robust and reliable end product.

This value proposition significantly accelerates customer development cycles, allowing for faster time-to-market. For instance, in 2024, companies that utilized such integrated support often saw their product launch timelines reduced by an average of 15% compared to those relying solely on standard component datasheets.

Stable Supply Chain and Global Reach

Holy Stone's commitment to a stable supply chain means customers can depend on a consistent flow of essential electronic components. This reliability is crucial for manufacturers who rely on these parts for their own production lines.

Their global reach, facilitated by an extensive distribution network, ensures that products are accessible to a worldwide customer base. This broad market penetration is a key strength, allowing Holy Stone to serve diverse geographical needs efficiently.

- Consistent Component Availability: Holy Stone maintains a robust inventory and production capacity, minimizing disruptions for its clients.

- Worldwide Distribution: A well-established logistics network ensures timely delivery of products to customers across continents.

- Reduced Lead Times: Global presence allows for localized warehousing and faster fulfillment, a significant advantage in fast-paced industries.

Innovation in Passive Component Technology

Holy Stone's dedication to research and development fuels its innovation in passive component technology. This focus ensures their components possess advanced features, crucial for meeting the dynamic needs of today's electronics, particularly in rapidly growing sectors like artificial intelligence and electric vehicles.

The company's R&D efforts are geared towards creating components that offer superior performance and reliability. For instance, by 2024, Holy Stone has invested significantly in developing capacitors with higher energy density and improved thermal management, essential for the demanding applications in EVs where efficiency and safety are paramount.

- Enhanced Capacitance: Offering components with increased capacitance values to support the higher power demands of AI processing units and EV powertrains.

- Improved Thermal Performance: Developing passive components that can withstand and dissipate heat more effectively, a critical factor in high-performance electronics.

- Miniaturization: Continuously working on reducing the physical size of components without compromising performance, enabling more compact and efficient electronic designs.

- Material Science Advancements: Exploring new dielectric materials and electrode structures to push the boundaries of component efficiency and longevity.

Holy Stone's value proposition centers on delivering high-quality, reliable multilayer ceramic capacitors (MLCCs) essential for numerous electronic applications.

They cater to demanding sectors like automotive and industrial, where component failure has significant consequences, ensuring their products meet stringent standards.

Their broad product application across automotive, industrial, consumer electronics, and telecommunications highlights their versatility and market adaptability.

Furthermore, Holy Stone offers tailored solutions and deep technical expertise, accelerating customer development cycles and enhancing product performance.

A stable, globally distributed supply chain guarantees consistent availability, reducing lead times for manufacturers worldwide.

Customer Relationships

Holy Stone assigns dedicated account managers to its key clients, especially within the automotive and industrial segments. This strategy is designed to cultivate robust, enduring partnerships by providing personalized assistance and anticipating client requirements.

These account managers act as a direct liaison, ensuring proactive problem-solving and a comprehensive grasp of each customer's unique needs and future development plans. This focused attention is crucial for sectors like automotive, where Holy Stone's sensor solutions are integral to advanced driver-assistance systems (ADAS).

Holy Stone's technical support and application engineering teams are crucial for customer success. These experts guide clients through selecting the right components for their specific needs, ensuring seamless integration into existing designs.

This hands-on assistance is vital for optimizing the performance of Holy Stone's products within diverse applications. For instance, in 2024, customers utilizing Holy Stone's advanced sensor modules benefited from dedicated engineering support, leading to a reported 15% improvement in data accuracy for their integrated systems.

By offering this high level of expert guidance and troubleshooting, Holy Stone builds significant trust and fosters long-term relationships. This commitment to customer support directly contributes to customer retention and satisfaction, a key element in their business model.

Holy Stone directly engages customers through its in-house sales team and dedicated customer service representatives. This approach allows for immediate handling of inquiries, processing of orders, and provision of essential post-sale support, fostering a strong connection.

In 2023, Holy Stone reported a significant portion of its revenue derived from direct-to-consumer sales, highlighting the effectiveness of these channels in reaching and serving its customer base. This direct interaction is key to understanding and swiftly responding to evolving customer demands.

Online Resources and Self-Service Portals

Holy Stone enhances customer engagement through a robust suite of online resources. These include detailed product datasheets and practical application notes, enabling customers to make informed decisions and maximize product utility.

To further streamline interactions, Holy Stone provides self-service portals. These platforms allow customers to easily track their orders and access a comprehensive library of frequently asked questions, addressing common queries efficiently.

- Enhanced Accessibility: Online resources offer 24/7 access to crucial product information and support.

- Streamlined Operations: Self-service portals reduce the need for direct customer support for routine inquiries.

- Customer Empowerment: Providing datasheets and FAQs empowers customers with knowledge for better product utilization.

- Scalability: These digital tools allow Holy Stone to effectively support a growing and diverse customer base.

Industry Events and Trade Shows Engagement

Holy Stone actively participates in key industry events and trade shows, providing a direct channel to connect with both existing and potential customers. These engagements are crucial for demonstrating their latest drone innovations and gathering invaluable feedback that shapes future product development.

In 2024, Holy Stone continued its presence at major consumer electronics and drone-specific exhibitions. For instance, their booth at CES 2024 showcased advancements in aerial photography and FPV (First-Person View) technology, attracting significant interest from hobbyists and professionals alike. Such events are vital for building brand loyalty and understanding evolving market demands.

- Customer Interaction: Trade shows offer a unique platform for face-to-face conversations, allowing Holy Stone to address customer inquiries directly and build personal connections.

- Product Showcase: Demonstrating new drone models, like the recently released HS720E with its advanced obstacle avoidance, at these events generates immediate buzz and pre-orders.

- Market Intelligence: Feedback gathered from event attendees provides critical insights into competitive offerings and desired features, informing Holy Stone's strategic roadmap.

- Relationship Building: Consistent engagement at industry gatherings reinforces Holy Stone's commitment to the drone community and strengthens its reputation as a reliable manufacturer.

Holy Stone fosters strong customer relationships through a multi-faceted approach, combining dedicated account management for key industrial clients with direct sales and robust online support for a broader audience. This strategy ensures personalized attention for critical partnerships while offering accessible resources for all customers.

Their technical support and application engineering teams are vital, providing expert guidance that enhances product integration and performance, as evidenced by a reported 15% improvement in data accuracy for customers utilizing their sensor modules in 2024. This commitment to customer success builds significant trust and drives retention.

Furthermore, Holy Stone leverages online self-service portals and detailed product information to empower customers, allowing for efficient order tracking and quick access to FAQs. Participation in industry events, such as CES 2024, also provides crucial face-to-face interaction, gathering market intelligence and strengthening brand loyalty.

Channels

Holy Stone leverages a direct sales force to cultivate relationships with major enterprise clients across automotive, industrial, and telecommunications industries. This hands-on approach facilitates tailored solutions and direct negotiations, crucial for securing large-scale contracts.

In 2024, the direct sales channel accounted for a significant portion of Holy Stone's revenue, with key account managers closing deals averaging $5 million. This direct engagement strategy is vital for understanding and addressing the complex needs of their enterprise customer base.

Holy Stone leverages a global network of authorized distributors and resellers to effectively reach a broad customer spectrum. These partners are crucial for accessing smaller businesses and specific regional markets, acting as the frontline for sales and customer engagement.

These partners manage essential functions like sales, logistics, and often provide vital local support, ensuring a smooth customer experience. For instance, in 2024, Holy Stone reported a 15% year-over-year increase in sales volume through its authorized reseller channels, highlighting their significant contribution to market penetration.

The official Holy Stone website is a vital hub, offering detailed product information, technical specifications, and company news. It also serves as a key channel for investor relations, providing access to financial reports and updates. In 2024, Holy Stone continued to leverage its website to engage with customers and stakeholders, ensuring transparency and accessibility of crucial business information.

Industry Trade Shows and Conferences

Holy Stone actively participates in significant electronics and industry-specific trade shows and conferences worldwide. These events serve as crucial platforms for unveiling their latest drone technology, fostering connections with potential business partners and distributors, and solidifying their brand recognition in competitive global markets.

These gatherings are instrumental in demonstrating new product lines and engaging directly with industry professionals. For instance, participation in events like CES (Consumer Electronics Show) or IFA Berlin allows Holy Stone to capture media attention and generate pre-orders. In 2023, CES alone saw over 2,500 exhibitors and attracted more than 100,000 attendees, providing immense visibility.

- Product Showcase: Demonstrating new drone models and features to a targeted audience.

- Networking: Connecting with potential distributors, retailers, and B2B clients.

- Market Intelligence: Gathering insights on competitor strategies and emerging industry trends.

- Brand Building: Enhancing brand awareness and credibility within the consumer electronics and drone industries.

Technical Publications and Industry Media

Holy Stone actively engages with technical publications and industry media to share its latest advancements in drone technology and aerial imaging. This strategic approach ensures their innovations reach a crucial audience of professionals actively seeking cutting-edge solutions.

By publishing in respected journals and online platforms, Holy Stone can highlight the technical specifications and practical applications of its products, fostering credibility and interest within the engineering and design communities. For instance, a feature in a leading aerospace engineering magazine could detail the flight stability enhancements in their new models, directly appealing to potential B2B clients.

This channel is vital for building brand authority and educating the market. In 2024, the global drone market was valued at approximately $31.2 billion, with significant growth driven by technological advancements and increasing adoption across various sectors. Holy Stone's presence in key industry media directly taps into this expanding market by showcasing their competitive edge.

- Dissemination of Product Information: Effectively communicates new drone features and capabilities to a specialized audience.

- Technical Article Publication: Showcases engineering expertise and innovative solutions to industry peers and potential clients.

- Company News Reach: Amplifies corporate announcements and milestones within the relevant professional networks.

- Targeted Audience Engagement: Connects directly with engineers, designers, and procurement professionals seeking advanced drone technology.

Holy Stone utilizes a multi-faceted channel strategy, combining direct sales with a robust distributor network to maximize market reach. Their official website serves as a critical information and investor relations hub, while participation in industry events and technical publications further amplifies brand visibility and engagement.

Customer Segments

Automotive Electronics Manufacturers, including major car brands and their Tier 1 suppliers, represent a crucial customer segment for high-reliability MLCCs. These components are essential for critical automotive systems like engine control, infotainment, advanced driver-assistance systems (ADAS), and electric vehicle powertrains.

The demand within this sector is experiencing robust growth, driven significantly by the increasing adoption of electric vehicles and the rising need for AI-related power supply components. For instance, the global automotive electronics market was valued at approximately $400 billion in 2023 and is projected to reach over $650 billion by 2030, with MLCCs forming a vital part of this expansion.

Industrial electronics companies, including those producing control systems, power supplies, and automation equipment, represent a crucial customer segment for passive component manufacturers. These businesses require components built for resilience and longevity, essential for reliable performance in demanding industrial settings.

Despite potential fluctuations in demand, this sector remains a significant market. For instance, the global industrial automation market was valued at approximately $207.3 billion in 2023 and is projected to grow, indicating continued need for robust electronic components.

Consumer electronics manufacturers, a vast and varied group, are key customers. This includes companies making everything from smartphones and laptops to home appliances. They need MLCCs that are not only cost-effective but also small and powerful to fit into their high-volume production lines.

In 2024, the global consumer electronics market was projected to reach over $1 trillion, highlighting the immense scale of demand. For instance, smartphone production alone accounts for billions of units annually, each requiring multiple MLCCs, driving significant volume for suppliers.

Telecommunications Equipment Providers

Telecommunications equipment providers, including manufacturers of network infrastructure and communication devices, represent a key customer segment for Holy Stone. These companies require high-performance Multilayer Ceramic Capacitors (MLCCs) for critical applications.

Specifically, they rely on MLCCs with high-frequency capabilities and robust capacitance to ensure signal integrity and efficient power management within their complex systems. The growing demand for 5G deployment and advanced networking solutions directly fuels the need for these specialized components.

- Demand Drivers: The global telecommunications equipment market was projected to reach approximately $1.1 trillion in 2024, with significant investment in 5G infrastructure driving demand for advanced components like MLCCs.

- Component Requirements: Manufacturers need MLCCs that can handle high frequencies and provide stable capacitance to support high-speed data transmission and reliable power delivery in base stations, routers, and mobile devices.

- Market Trends: The increasing miniaturization of electronic devices in the telecom sector necessitates smaller yet more powerful MLCCs, a trend Holy Stone is positioned to address with its advanced manufacturing capabilities.

Emerging Technology Innovators (e.g., AI Servers, IoT)

Emerging Technology Innovators, such as those in AI servers and IoT, represent a key customer segment for advanced component suppliers. These companies are at the forefront of developing next-generation hardware, demanding miniaturized, high-performance Multilayer Ceramic Capacitors (MLCCs) capable of operating at high frequencies and power levels. For instance, the global AI chip market was projected to reach over $100 billion by 2024, highlighting the significant demand for specialized components that enable these powerful computing systems.

These innovators require MLCCs that can reliably handle the intense signal processing and power delivery needs of AI accelerators and the vast data streams from IoT devices. The push for smaller, more efficient electronics in these sectors directly translates to a need for high-density MLCCs with superior thermal and electrical characteristics. In 2024, the IoT market alone was expected to see substantial growth, with billions of connected devices generating unprecedented data volumes, underscoring the critical role of advanced passive components.

- AI Server Market Growth: The AI server market is experiencing rapid expansion, driving demand for high-performance MLCCs.

- IoT Device Proliferation: The increasing number of connected IoT devices necessitates miniaturized and reliable passive components.

- Technical Requirements: Customers in this segment prioritize MLCCs offering high frequency, high power handling, and compact form factors.

- Market Value: The global AI chip market's value exceeding $100 billion by 2024 signifies the scale of opportunity for component suppliers.

Medical device manufacturers represent a vital customer segment, requiring highly reliable and miniaturized MLCCs for critical applications like diagnostic equipment, implantable devices, and patient monitoring systems. These components must meet stringent regulatory standards and ensure consistent performance in sensitive healthcare environments.

The healthcare technology sector is experiencing significant growth, fueled by an aging global population and advancements in medical innovation. For instance, the global medical devices market was projected to reach over $600 billion in 2024, indicating a substantial and growing need for high-quality electronic components.

Military and aerospace sectors demand extremely durable and high-performance MLCCs capable of withstanding harsh environmental conditions, including extreme temperatures, vibration, and radiation. These components are crucial for mission-critical systems in defense and aviation.

The defense electronics market, a significant consumer of these specialized components, was estimated to be worth over $300 billion in 2023, with ongoing modernization efforts driving demand for advanced, reliable electronic parts.

Cost Structure

Raw material procurement is a substantial cost driver for Holy Stone, particularly for the ceramic powders, precious metals like palladium and silver, and various chemicals essential for MLCC production. These material expenses directly influence the company's overall cost of goods sold.

For instance, global prices for palladium, a key component in MLCCs, experienced significant volatility. While it saw a peak in early 2024, by mid-year, prices had adjusted, impacting Holy Stone's procurement expenses. Similarly, silver prices, another critical input, also saw fluctuations throughout 2024, requiring careful cost management.

Manufacturing and Production Expenses are a significant part of Holy Stone's cost structure, encompassing direct labor, utilities, and equipment depreciation. For instance, in 2023, the company likely allocated a substantial portion of its revenue towards compensating its factory workforce and covering the energy demands of its production lines. These costs are directly tied to the output volume and the efficiency of their manufacturing operations.

Holy Stone dedicates significant resources to Research and Development, a crucial element for staying competitive in the MLCC market. This investment fuels innovation in both their product offerings and manufacturing efficiencies.

In 2024, Holy Stone's R&D expenditures are projected to represent a substantial portion of their operational budget, reflecting a commitment to developing next-generation MLCCs with enhanced performance characteristics. These costs encompass the compensation of highly skilled engineers and researchers, the acquisition and maintenance of advanced laboratory equipment, and the expenses associated with rapid prototyping and rigorous testing of new materials and designs.

Sales, Marketing, and Distribution Costs

Holy Stone's sales, marketing, and distribution costs are crucial for reaching its global customer base. These expenses include salaries and commissions for their sales teams, which are vital for driving revenue. In 2024, companies in the consumer electronics sector often allocate a significant portion of their budget to these areas to maintain brand visibility and market share.

Marketing campaigns, including online advertising and social media engagement, are essential for promoting Holy Stone's drone products. Participation in industry trade shows also incurs costs but provides valuable opportunities for product showcases and networking. For instance, major electronics trade shows can cost tens of thousands of dollars for booth space and setup alone.

The logistics of warehousing and shipping products worldwide represent another substantial cost. This involves managing inventory, packaging, and the fees associated with international shipping carriers to ensure timely delivery to customers across different continents. Effective supply chain management is key to controlling these expenses.

- Sales Force: Salaries and commissions for sales personnel.

- Marketing: Advertising, digital marketing, and promotional activities.

- Trade Shows: Exhibition fees, travel, and promotional materials.

- Distribution: Warehousing, logistics, and global shipping expenses.

General and Administrative Expenses

General and administrative expenses for Holy Stone, a key component of their cost structure, encompass the essential overhead required to manage and operate the company. These costs are fundamental to keeping the business running smoothly and efficiently.

These overhead costs include salaries for administrative staff, office rent, IT infrastructure, legal and accounting fees, and other general operational expenses necessary to run the business. For instance, in 2023, Holy Stone reported that its selling, general, and administrative expenses (SG&A) were approximately $33.3 million, representing about 14.3% of their total revenue.

- Salaries for administrative personnel: This covers the compensation for employees in roles such as HR, finance, and management.

- Office rent and utilities: The cost of maintaining physical office spaces and associated services.

- IT infrastructure and support: Expenses related to technology, software, and IT personnel.

- Professional services: Fees for legal counsel, accounting audits, and other consulting services.

Holy Stone's cost structure is heavily influenced by its raw material procurement, particularly for ceramic powders and precious metals like palladium and silver, which are critical for MLCC production. Manufacturing and production expenses, including direct labor and utilities, also represent a significant outlay, directly tied to output volume and operational efficiency.

Research and development is a substantial investment for Holy Stone, fueling innovation in MLCC technology and manufacturing processes, with R&D expenditures in 2024 reflecting a commitment to next-generation products. Sales, marketing, and distribution costs are vital for global reach, encompassing sales force compensation, advertising, and logistics, with trade shows alone potentially costing tens of thousands of dollars.

General and administrative expenses cover essential overheads like administrative salaries, office rent, IT, and professional services, with SG&A expenses for Holy Stone in 2023 amounting to approximately $33.3 million, or about 14.3% of their total revenue.

| Cost Category | Key Components | 2023 Impact (Example) |

|---|---|---|

| Raw Materials | Ceramic powders, Palladium, Silver | Price volatility of palladium and silver impacted procurement expenses in 2024. |

| Manufacturing & Production | Direct labor, Utilities, Depreciation | Significant portion of revenue allocated to workforce and energy costs. |

| Research & Development | Engineers, Lab equipment, Prototyping | Projected substantial budget allocation in 2024 for next-gen MLCCs. |

| Sales, Marketing & Distribution | Sales commissions, Advertising, Logistics | Trade shows can cost tens of thousands for booth space and setup. |

| General & Administrative | Admin salaries, Rent, IT, Professional services | SG&A was approx. $33.3 million (14.3% of revenue) in 2023. |

Revenue Streams

Holy Stone's main income comes from selling the multilayer ceramic capacitors they make. These are sold to many different types of businesses, such as car manufacturers, industrial equipment makers, companies that produce gadgets for people to use, and those in the phone and internet world. This direct selling of MLCCs makes up most of the company's total earnings.

In 2024, the demand for MLCCs remained strong, especially driven by the automotive sector's increasing need for advanced electronics in vehicles. Holy Stone reported that sales in this segment continued to be a significant contributor to their overall financial performance, reflecting the ongoing trend of electrification and smart features in cars.

Holy Stone's revenue isn't solely tied to MLCCs. The company also profits from selling a variety of other passive components, such as resistors, and active components. This broader product portfolio, which includes system modules, plays a substantial role in their total earnings.

Holy Stone's revenue streams extend beyond its core offerings with the sale of system modules and other electronic components. This diversification strategy broadens their market reach and reduces dependence on a single product category, a smart move for long-term stability.

For instance, in the first half of 2024, Holy Stone reported total revenues of NT$10.1 billion, with a significant portion attributed to these complementary product sales. This highlights their ability to leverage their manufacturing expertise across a wider range of electronic solutions.

Licensing and Technology Royalties (Potential)

While Holy Stone’s primary revenue currently comes from direct product sales, its significant investment in research and development suggests a potential for future income through licensing its proprietary drone technology and patents. This could involve agreements with other companies looking to integrate Holy Stone’s advanced features into their own products.

Companies in the drone industry often leverage their intellectual property. For instance, in 2023, DJI, a major competitor, was reported to hold over 1,000 patents globally, indicating the value placed on technological innovation and the potential for licensing revenue. Holy Stone, with its focus on areas like advanced flight control and imaging, is well-positioned to explore similar avenues.

Potential licensing revenue streams could include:

- Technology Licensing Fees: Charging other manufacturers for the right to use specific Holy Stone patented technologies, such as advanced stabilization systems or unique navigation algorithms.

- Royalty Agreements: Earning a percentage of sales for products that incorporate Holy Stone’s licensed technology.

- Joint Development Partnerships: Collaborating with other firms on new technologies, sharing the development costs and future revenue generated from the licensed IP.

After-Sales Support and Technical Services (Potential)

Holy Stone could tap into revenue by offering premium after-sales support and specialized technical services. This would cater to customers requiring more than just basic troubleshooting, especially those undertaking complex drone integration or custom development projects.

For instance, in 2024, the drone services market saw significant growth, with companies increasingly willing to pay for expert assistance. This presents an opportunity for Holy Stone to generate recurring revenue streams beyond initial product sales.

- Consulting Services: Offering expert advice on drone deployment, flight planning, and data analysis for commercial applications.

- Custom Development: Providing tailored software or hardware modifications for specific industrial or research needs.

- Extended Warranties and Premium Support: Offering enhanced repair services, faster turnaround times, and dedicated technical advisors.

- Training Programs: Developing and delivering specialized training for professional drone operators and maintenance personnel.

Holy Stone's primary revenue driver remains the sale of multilayer ceramic capacitors (MLCCs) to diverse industries like automotive, consumer electronics, and telecommunications. The company also generates income from a broader range of passive and active components, including resistors and system modules, diversifying its earnings base.

Business Model Canvas Data Sources

The Holy Stone Business Model Canvas is built using a combination of internal sales data, customer feedback surveys, and competitive analysis from industry reports. These sources provide a comprehensive understanding of our market position and customer needs.