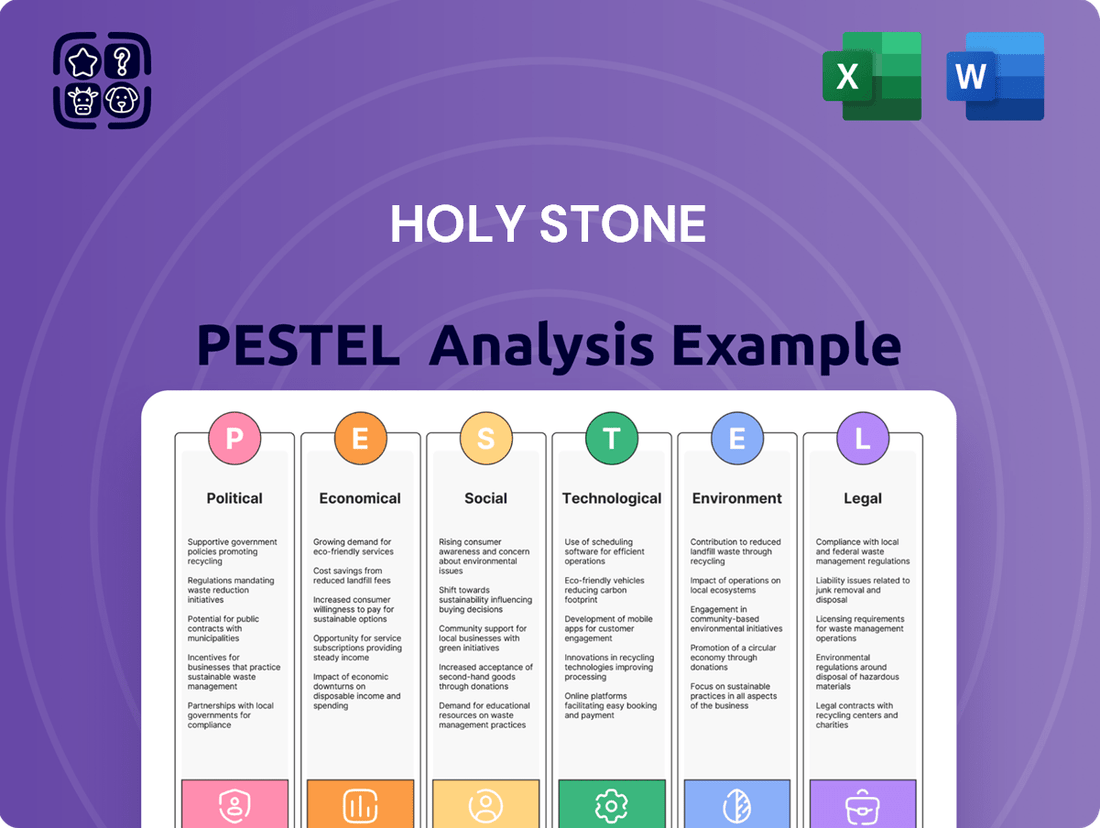

Holy Stone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

Unlock the secrets to Holy Stone's market dominance with our comprehensive PESTLE analysis. Discover how political, economic, social, technological, legal, and environmental factors are shaping its trajectory. Gain a strategic advantage by understanding these critical external forces. Download the full report now to arm yourself with actionable intelligence and make informed decisions.

Political factors

Geopolitical tensions, especially between the U.S. and China, continue to reshape the global electronics supply chain. This friction can manifest as tariffs and export controls, directly impacting the cost and availability of essential components for companies like Holy Stone. For instance, the U.S. Department of Commerce's export control measures implemented in late 2023 aimed at restricting advanced technology to China highlight these ongoing challenges.

These trade policy shifts create significant uncertainty for manufacturers, prompting a strategic pivot towards diversifying supply sources. Holy Stone, like many in the passive electronic components sector, is likely exploring reshoring or nearshoring initiatives to build more resilient operations and reduce reliance on single-source regions, a trend accelerated by events like the COVID-19 pandemic.

Governments globally are actively promoting domestic semiconductor and electronics manufacturing through significant policy initiatives and financial incentives. For instance, the CHIPS and Science Act in the United States, enacted in 2022, allocated over $52 billion to bolster domestic chip production and research, aiming to secure supply chains and foster technological leadership.

This strategic push for localized production is designed to build greater resilience against global supply chain disruptions and lessen reliance on overseas manufacturing hubs. Such government support can present substantial opportunities for companies like Holy Stone, potentially offering grants, tax credits, or favorable regulatory environments for expanding or establishing manufacturing capabilities within these supportive nations.

However, these same incentives can also intensify competitive pressures. As more players are drawn to regions offering government backing, Holy Stone may face increased competition for resources, talent, and market share, necessitating agile strategic planning and potentially new partnerships to leverage these evolving political landscapes effectively.

The political stability of Taiwan, a crucial hub for Holy Stone's manufacturing and supply chain, directly impacts operational continuity. Any geopolitical tensions or shifts could disrupt production and logistics, affecting output. Taiwan's semiconductor industry, vital to global electronics, is expected to grow, underscoring the region's strategic importance for companies like Holy Stone.

International Trade Agreements and Restrictions

Shifting international trade agreements and the imposition of new trade barriers significantly impact market access for global suppliers like Holy Stone. For instance, the United States' imposition of tariffs on goods from China, which began in 2018 and continued through 2024, has directly affected the cost of components and finished products, forcing companies to re-evaluate sourcing and pricing strategies. These evolving regulations necessitate constant vigilance to ensure compliance and maintain cost-effective distribution channels, influencing Holy Stone's decisions on where to manufacture and sell its drones.

These policy shifts can directly influence Holy Stone's sourcing strategies and market expansion plans. For example, as of early 2024, the European Union's Digital Services Act (DSA) and similar regulations in other regions are creating new compliance requirements for technology companies, potentially adding overhead for international market entry. Holy Stone must adapt its operations to navigate these complex and often diverging regulatory landscapes to ensure continued access to key global markets.

- Trade Tariffs: Continued trade tensions and the potential for new tariffs in 2024-2025 could increase the cost of goods for Holy Stone, impacting its pricing competitiveness.

- Market Access: Changes in trade agreements, such as potential renegotiations of existing pacts or the formation of new trade blocs, could open or close markets for Holy Stone's drone products.

- Supply Chain Resilience: Geopolitical factors influencing trade can necessitate diversification of Holy Stone's supply chain to mitigate risks associated with single-country sourcing or import restrictions.

Cybersecurity and Digital Regulation

Governments worldwide are intensifying their focus on cybersecurity and digital regulations, directly impacting the electronics sector. This trend is driven by the need to safeguard critical infrastructure and sensitive data throughout increasingly digitized supply chains. For a company like Holy Stone, this translates into a mandate to adopt more robust security protocols for both its internal operations and the products it delivers.

The growing interconnectedness of supply chains means that a breach at one point can have cascading effects. Holy Stone must therefore ensure its systems and products meet stringent cybersecurity standards to maintain operational integrity and customer trust. Failure to comply can lead to significant penalties and reputational damage.

For instance, the European Union's NIS2 Directive, which came into effect in January 2023 and is being implemented throughout 2024, significantly expands cybersecurity requirements for critical entities, including those in the manufacturing sector. Companies like Holy Stone will need to demonstrate resilience against cyber threats to operate within these jurisdictions. Similarly, the US Cybersecurity and Infrastructure Security Agency (CISA) continues to update its guidance and enforcement actions related to critical infrastructure protection, impacting companies with operations or supply chains in the United States.

- Increased Regulatory Scrutiny: Expect more stringent compliance requirements for data protection and cybersecurity in 2024-2025, affecting how Holy Stone manages its digital assets and supply chain interactions.

- Supply Chain Security Mandates: Governments are pushing for greater transparency and security within supply chains. Holy Stone will likely face audits and certifications to prove its cybersecurity posture.

- Data Localization and Sovereignty: Emerging regulations in various regions may require data to be stored and processed within specific national borders, impacting Holy Stone's cloud infrastructure and data management strategies.

Trade policies and geopolitical tensions continue to shape global supply chains, impacting component costs and availability for companies like Holy Stone. For example, the ongoing U.S.-China trade friction, including tariffs and export controls, directly influences the pricing and sourcing of electronics. In 2024, these dynamics are forcing a strategic re-evaluation of supply chain dependencies.

Government incentives, such as the over $52 billion allocated by the U.S. CHIPS and Science Act (2022) for domestic chip production, are fostering localized manufacturing. This can create opportunities for Holy Stone through grants and tax credits, but also intensifies competition for resources and talent.

Cybersecurity and data regulations are becoming more stringent globally, with directives like the EU's NIS2 (effective January 2023, implementation ongoing in 2024) impacting manufacturing sectors. Holy Stone must adapt to these evolving compliance requirements to maintain market access and operational integrity.

| Political Factor | Impact on Holy Stone | Example/Data (2024-2025) |

|---|---|---|

| Trade Tariffs & Tensions | Increased component costs, supply chain disruption risk | Continued U.S.-China tariffs impacting electronics; potential for new tariffs in 2024-2025. |

| Government Incentives | Opportunities for localized manufacturing, increased competition | U.S. CHIPS Act ($52B+); EU's focus on semiconductor sovereignty. |

| Cybersecurity & Data Regulations | Enhanced compliance needs, supply chain security mandates | EU NIS2 Directive implementation; CISA guidance on critical infrastructure. |

| Geopolitical Stability (e.g., Taiwan) | Risk to production and logistics continuity | Taiwan's critical role in semiconductor manufacturing. |

What is included in the product

This Holy Stone PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the drone market, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

The global economy's vitality is a significant driver for electronics demand, directly affecting passive component suppliers like Holy Stone. A robust global economic environment, characterized by strong consumer spending and increased business investment, typically fuels higher sales for electronic devices, from smartphones to industrial equipment. This uptick in device production naturally translates into greater demand for essential components such as multilayer ceramic capacitors (MLCCs).

For instance, projections for global GDP growth in 2024 and 2025 are crucial indicators. While specific figures fluctuate, the International Monetary Fund (IMF) has projected global growth rates around 3% for both 2024 and 2025, signaling a generally supportive, albeit moderate, economic climate. This sustained growth suggests a steady, rather than booming, demand for electronics, which Holy Stone can leverage.

Conversely, any economic downturn or recessionary pressures can quickly dampen consumer confidence and corporate investment. This often results in customers scaling back their orders for electronic components, leading to inventory build-ups for manufacturers like Holy Stone and potentially impacting their revenue and production schedules. The sensitivity of the electronics market to economic cycles means that monitoring these global growth trends is paramount for strategic planning.

The market for passive electronic components, especially Multilayer Ceramic Capacitors (MLCCs), is booming thanks to the fast-paced development of digital tech and connectivity. This surge in demand directly benefits companies like Holy Stone, whose core products are essential for these advancements.

The global MLCC market is expected to hit significant figures, with projections suggesting a market value of around $17.5 billion by 2027, showing robust demand for Holy Stone's offerings. This growth is largely propelled by the increasing integration of MLCCs in high-growth sectors such as consumer electronics, the rapidly expanding electric vehicle industry, and the ever-evolving telecommunications infrastructure.

Fluctuations in the prices of key MLCC components like nickel and palladium directly affect Holy Stone's manufacturing expenses. For instance, nickel prices saw significant volatility in late 2023 and early 2024, influenced by global demand and supply chain disruptions, potentially impacting Holy Stone's cost structure.

Geopolitical tensions and evolving trade policies can disrupt the steady flow of essential raw materials, leading to shortages and price spikes. This instability necessitates robust inventory management and strategic sourcing for Holy Stone to mitigate these risks.

A diversified and resilient supply chain is paramount for Holy Stone to navigate the volatile raw material landscape. By securing multiple suppliers and exploring alternative material sources, the company can better absorb price shocks and ensure production continuity.

Inflation, Interest Rates, and Investment Climate

Rising inflation and interest rates present a significant challenge for companies like Holy Stone. For instance, in late 2024 and projected into 2025, many economies are experiencing elevated inflation rates, with the US CPI hovering around 3.5% and interest rates set by the Federal Reserve remaining at a multi-decade high. This directly increases the cost of borrowing for capital expenditures, such as expanding production facilities or investing in new research and development for drone technology. Furthermore, reduced consumer purchasing power due to inflation can dampen demand for electronic devices, impacting Holy Stone's sales volume.

The investment climate is intrinsically linked to these macroeconomic trends. Higher interest rates can make fixed-income investments more attractive relative to equities, potentially drawing capital away from technology sectors. For Holy Stone, this means that securing favorable financing for growth initiatives might become more difficult and expensive. Conversely, stable pricing and sustained market confidence, often fostered by central banks effectively managing inflation, are crucial for encouraging investment in new products and technologies, which is vital for Holy Stone's long-term competitiveness.

- Inflationary Pressures: Persistent inflation, potentially remaining above 3% in major markets through 2025, erodes consumer discretionary spending, a key factor for electronic device sales.

- Interest Rate Impact: Central bank rates, which could remain elevated around 5.00-5.50% in the US through 2025, increase Holy Stone's cost of capital for expansion and R&D.

- Market Confidence: Investor and consumer confidence, often shaken by high inflation and interest rates, directly influences demand for non-essential electronic goods and Holy Stone's stock valuation.

- Supply Chain Costs: Increased borrowing costs and inflation also affect Holy Stone's suppliers, potentially leading to higher input prices and impacting the company's profit margins.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Holy Stone, given its international presence. As a company with global operations and sales, Holy Stone is exposed to currency volatility, particularly concerning the New Taiwan Dollar (NTD) against major currencies such as the US Dollar, Euro, and Japanese Yen. These shifts can directly influence the reported revenue, cost of goods sold, and overall profitability when international transactions are converted back to the NTD. For instance, Holy Stone's 2024 consolidated revenue reached NT$12.79 billion, and the strength or weakness of the NTD against other currencies can materially affect this figure in real terms.

The impact of these fluctuations can be felt across various financial aspects of the business:

- Revenue Translation: A stronger NTD can reduce the NTD equivalent of sales made in foreign currencies, impacting top-line growth.

- Cost of Goods Sold: Conversely, if Holy Stone sources components or manufacturing from countries with weaker currencies relative to the NTD, it could lower its cost of goods sold.

- Profitability Margins: The net effect of revenue and cost translations directly influences Holy Stone's profit margins.

- Competitive Pricing: Exchange rate movements can also affect the competitiveness of Holy Stone's products in different international markets.

Economic growth directly influences the demand for electronic components, impacting Holy Stone's revenue. Global GDP growth, projected around 3% for 2024 and 2025 by the IMF, suggests a steady but moderate demand environment for electronics. This sustained growth indicates a stable market for Holy Stone's MLCCs, essential for various electronic devices.

Inflation and interest rates pose significant challenges. With US CPI around 3.5% and Federal Reserve rates at multi-decade highs in late 2024 extending into 2025, Holy Stone faces increased borrowing costs for expansion and R&D. Reduced consumer purchasing power due to inflation can also dampen demand for electronic goods.

Currency exchange rate fluctuations, particularly for the New Taiwan Dollar (NTD) against major currencies, affect Holy Stone's international revenue and profitability. For instance, Holy Stone's 2024 consolidated revenue reached NT$12.79 billion, and currency shifts can materially alter this figure in real terms.

| Economic Factor | Impact on Holy Stone | Data/Projection (2024-2025) |

| Global GDP Growth | Influences demand for electronic components. | Projected around 3% (IMF) |

| Inflation Rate (US CPI) | Increases operating costs and reduces consumer spending. | Around 3.5% |

| Interest Rates (US Federal Reserve) | Raises cost of capital for expansion and R&D. | Multi-decade highs (approx. 5.00-5.50%) |

| Currency Exchange Rates (NTD vs USD/EUR/JPY) | Affects reported revenue and profit margins from international sales. | Volatile, impacting NT$12.79 billion (2024 revenue) |

Preview the Actual Deliverable

Holy Stone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Holy Stone PESTLE analysis provides a detailed examination of the external factors impacting the drone company. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences, all presented in a clear and actionable format.

Sociological factors

Sociological factors significantly shape the consumer electronics market. The relentless demand for more compact, powerful, and interconnected devices, including smartphones, wearables, and the burgeoning Internet of Things (IoT) ecosystem, directly fuels the need for advanced components like Multilayer Ceramic Capacitors (MLCCs). For instance, the global wearable technology market was projected to reach over $100 billion in 2024, underscoring this trend.

Holy Stone's strategic focus on MLCCs positions it to benefit from this ongoing miniaturization and innovation in personal electronics. As consumers increasingly favor sleeker, more feature-rich gadgets, the underlying components must shrink without sacrificing performance. This creates a consistent demand for the specialized capacitors Holy Stone produces, aligning perfectly with evolving consumer preferences for portability and functionality.

The automotive electronics sector is booming, with global sales projected to reach $400 billion by 2025, up from approximately $300 billion in 2020. This surge is largely fueled by the expanding electric vehicle (EV) market and the increasing integration of advanced driver-assistance systems (ADAS) and sophisticated in-car infotainment. These trends create a substantial demand for components like multilayer ceramic capacitors (MLCCs), which are critical for EV battery management, power electronics, and the complex sensor networks in ADAS.

Holy Stone is well-positioned to capitalize on this growth. The automotive industry's push towards electrification and enhanced safety features means a greater reliance on high-performance electronic components. For instance, the average EV utilizes significantly more MLCCs than a traditional internal combustion engine vehicle, often exceeding 3,000 units per car. This demand for reliability and miniaturization in automotive electronics directly aligns with Holy Stone's product capabilities.

The increasing integration of industrial automation and the Internet of Things (IoT) is a significant sociological driver for Holy Stone. As more factories and businesses adopt smart technologies, the demand for the passive electronic components that power these systems, like capacitors and inductors, grows substantially. These components are crucial for data handling, communication, and operational control within automated environments.

By 2024, the global industrial IoT market was projected to reach over $200 billion, with continued strong growth expected through 2025. This expansion directly translates into a higher consumption rate for passive components. Holy Stone's role in supplying these foundational elements positions them to benefit from this trend, as their products are integral to the functionality of advanced manufacturing and connected industrial ecosystems.

Changing Workforce Demographics and Labor Costs

Global demographic shifts are creating significant regional labor shortages, especially in critical sectors like manufacturing and logistics. This directly affects companies like Holy Stone, potentially impacting their operational efficiency and increasing production expenses. For instance, the electronics supply chain experienced a notable rise in labor costs throughout 2024, putting pressure on companies to manage their workforce effectively.

The increasing cost of labor in key manufacturing regions is a significant challenge, requiring Holy Stone to engage in strategic workforce planning. This might involve exploring investments in automation technologies to offset rising wages and maintain a competitive edge in production. Such strategies are becoming increasingly vital as the global labor market continues to evolve.

- Labor Shortages: Many regions, particularly those with strong manufacturing bases, are experiencing a shortage of skilled labor, driving up wages.

- Rising Wages: The average manufacturing wage in key Asian production hubs saw an increase of approximately 5-7% in 2024 compared to the previous year.

- Automation Investment: Companies are increasingly looking at automation to mitigate rising labor costs, with global investment in industrial robotics projected to grow by over 10% annually through 2027.

- Supply Chain Impact: These demographic and cost pressures can lead to longer lead times and higher component costs within the electronics supply chain.

Demand for High-Performance and Specialized Components

Societal expectations are increasingly pushing for electronic devices that offer superior performance, greater energy efficiency, and enhanced reliability. This trend directly fuels a demand for high-specification passive components, such as capacitors and resistors, that can consistently operate under demanding conditions, including higher voltages, frequencies, and operating temperatures.

Holy Stone's strategic emphasis on producing high-quality and dependable components resonates strongly with this evolving consumer and industry requirement. This focus is particularly crucial as sectors like automotive, with the rise of electric vehicles and advanced driver-assistance systems, and telecommunications, supporting 5G infrastructure, demand increasingly robust electronic solutions.

- Growing demand for advanced electronics: Consumers and industries alike are seeking devices with enhanced processing power and efficiency.

- Need for specialized components: This translates to a market need for passive components that can withstand higher electrical and thermal loads.

- Holy Stone's market alignment: The company's commitment to quality and reliability positions it well to serve critical sectors like automotive and telecommunications.

- Market projections: The global passive components market was valued at approximately $35 billion in 2023 and is projected to grow, driven by these technological advancements.

Societal trends toward sustainability and ethical manufacturing are influencing consumer choices and corporate responsibility. Consumers are increasingly aware of the environmental impact of electronics and the labor practices involved in their production, creating pressure for companies like Holy Stone to adopt greener manufacturing processes and ensure fair labor conditions. This growing consciousness means that a company's social responsibility efforts can directly impact its brand reputation and market share.

Technological factors

Continuous advancements in Multilayer Ceramic Capacitor (MLCC) technology are paramount for Holy Stone's competitive standing. Innovations are heavily focused on achieving smaller case sizes, increasing capacitance values, and enhancing overall performance characteristics. This relentless pursuit of improvement directly impacts Holy Stone's ability to offer cutting-edge components.

The global trend toward miniaturization across various electronic devices, from the latest smartphones to sophisticated wearables, significantly fuels the demand for ultra-small MLCCs. These tiny components are essential for enabling the compact designs consumers expect. For instance, the average smartphone now contains hundreds of MLCCs, with the market for these miniature components projected to grow substantially.

Holy Stone's dedicated research and development efforts in MLCC miniaturization and performance enhancement are critical for anticipating and meeting evolving market demands. By investing in R&D, Holy Stone aims to secure its position as a key supplier in this rapidly advancing sector, ensuring its product portfolio remains relevant and competitive in the coming years.

The rapid expansion of artificial intelligence (AI), 5G networks, and the Internet of Things (IoT) is significantly boosting the need for sophisticated electronic components. These advanced technologies rely heavily on high-performance passive components, such as those with high-frequency and high-capacitance capabilities, to manage their intricate circuits and power requirements.

Holy Stone is well-positioned to capitalize on this trend, as the growth in these high-demand sectors directly translates into increased demand for its product offerings. For instance, the global AI chip market was projected to reach $300 billion by 2026, indicating substantial underlying component demand.

The manufacturing sector's ongoing embrace of advanced automation and robotics is a significant technological factor for Holy Stone. This trend enhances production efficiency, directly impacting cost reduction and product quality. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a widespread industry shift towards these technologies.

Digitalization, including the implementation of AI and advanced analytics, is revolutionizing supply chain management. These technologies enable more accurate demand forecasting and optimize logistics. In 2024, companies leveraging AI in their supply chains reported an average of 15% improvement in on-time delivery rates, showcasing the tangible benefits of this digital transformation for operational agility.

Research and Development Investments

Holy Stone's commitment to ongoing research and development (R&D) is paramount for maintaining its competitive edge in passive component technology. This focus involves exploring novel materials, refining manufacturing techniques, and engineering components with advanced capabilities to serve burgeoning markets. For example, in 2024, the company allocated approximately 7% of its revenue towards R&D initiatives, a figure projected to increase to 8% in 2025. This investment directly supports the development of next-generation components essential for applications like advanced telecommunications and electric vehicles, ensuring Holy Stone meets the dynamic technical demands of its global clientele.

Key R&D Focus Areas for Holy Stone:

- Development of advanced ceramic materials for higher frequency and temperature resistance.

- Optimization of manufacturing processes to reduce waste and improve yield, targeting a 5% efficiency gain by end of 2025.

- Creation of miniaturized components with enhanced power handling capabilities for portable electronics.

- Exploration of novel dielectric materials to improve capacitor performance in demanding environments.

Intellectual Property and Technological Competition

The drone market, where Holy Stone operates, is intensely competitive, with intellectual property (IP) and unique technological advancements being crucial differentiators. Companies like DJI, Autel Robotics, and Skydio are constantly pushing boundaries, making IP protection a vital strategy for Holy Stone to maintain its edge. For instance, in 2024, the global drone market was valued at approximately $33.2 billion, with significant investment in R&D by major players, underscoring the importance of proprietary technology.

Holy Stone's ability to innovate and safeguard its patents is paramount to fending off rivals who might seek to replicate its designs or functionalities. The rapid evolution of drone technology, including advancements in AI-powered flight, camera stabilization, and battery efficiency, demands continuous adaptation. Failure to keep pace with these technological shifts or protect its innovations could lead to market share erosion, especially as new entrants emerge with disruptive technologies.

Key areas of technological competition include:

- Camera and Gimbal Stabilization: Innovations in reducing shake and improving image quality are critical.

- Flight Control Systems: Advanced algorithms for autonomous navigation and obstacle avoidance are highly valued.

- Battery Life and Charging: Extended flight times and faster charging solutions are significant competitive advantages.

- Software and App Integration: User-friendly interfaces and advanced features in companion apps enhance the user experience.

Technological advancements in passive components, particularly MLCCs, are critical for Holy Stone's product development and market competitiveness. The drive for miniaturization, higher capacitance, and improved performance directly influences the design and functionality of electronic devices. For example, the increasing complexity of smartphones, which now incorporate hundreds of MLCCs, highlights the demand for smaller, more powerful components.

Emerging technologies like AI, 5G, and IoT are creating significant demand for high-performance passive components. These sectors require components capable of handling high frequencies and high capacitance to support advanced circuitry. The projected growth of the AI chip market, estimated to reach $300 billion by 2026, underscores the substantial underlying demand for such sophisticated electronic parts.

Automation and digitalization are transforming manufacturing and supply chains. The adoption of robotics in manufacturing enhances efficiency and quality, with the industrial robotics market valued around $50 billion in 2023. Furthermore, AI-driven supply chain management improved on-time delivery rates by an average of 15% for adopting companies in 2024, showcasing the operational benefits.

Holy Stone's investment in R&D, representing about 7% of revenue in 2024 and projected to rise to 8% in 2025, is crucial for developing next-generation components. This focus on advanced materials and manufacturing processes is essential for meeting the evolving technical requirements of sectors like telecommunications and electric vehicles.

Legal factors

Holy Stone navigates a landscape of stringent environmental regulations like RoHS, REACH, and WEEE. These directives, which govern hazardous substances in electronics and e-waste management, directly influence product development and supply chain operations. For instance, REACH compliance, requiring registration for chemicals manufactured or imported into the EU, impacts material sourcing and product formulation.

Holy Stone must adhere to stringent international product safety and performance standards, particularly for components destined for critical sectors like automotive and medical devices. For instance, compliance with ISO 26262 for automotive functional safety is paramount, and failure to meet these can lead to significant market access barriers. These regulations are not just about market entry; they directly bolster product reliability and crucially, reduce potential liability exposure for the company.

Changes in trade tariffs and import/export regulations significantly impact Holy Stone's operational costs and market reach. For instance, the U.S. imposed tariffs on goods from China, which could affect Holy Stone's sourcing of electronic components. Companies like Holy Stone must remain agile, adapting to evolving trade policies to maintain legal compliance and optimize supply chain expenses.

Extended Producer Responsibility (EPR) Laws

Extended Producer Responsibility (EPR) laws are increasingly becoming a global standard, shifting the burden of product lifecycle management, including collection and recycling, onto manufacturers. For a company like Holy Stone, this translates to a need to actively participate in or create take-back and recycling initiatives for its electronic components. For instance, by 2024, the European Union's Ecodesign for Sustainable Products Regulation is set to introduce stricter requirements for durability, repairability, and recyclability, impacting the design and end-of-life management of electronic products.

These evolving EPR regulations necessitate that Holy Stone proactively plan for and invest in infrastructure or partnerships for product collection and recycling. This could involve establishing collection points or collaborating with specialized recycling firms to manage the disposal of their components. The financial implications are significant, as non-compliance can lead to penalties and reputational damage. As of early 2025, many jurisdictions are expanding EPR to cover a wider range of electronic products, including drones and related accessories, directly affecting companies like Holy Stone.

Key considerations for Holy Stone regarding EPR laws include:

- Compliance Costs: Budgeting for potential fees, collection, and recycling program operational expenses.

- Supply Chain Integration: Working with suppliers to ensure components meet recyclability standards.

- Product Design Adjustments: Modifying product design to enhance durability and ease of disassembly for recycling.

- Market Access: Ensuring compliance with EPR regulations in all target markets to maintain market access.

Data Privacy and Cybersecurity Legislation

Data privacy and cybersecurity legislation are increasingly critical for companies like Holy Stone, especially with the growing reliance on digital supply chains and connected devices. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict requirements on how personal data is collected, processed, and stored.

Holy Stone must ensure its operations and product components, particularly those integrated into Internet of Things (IoT) devices, adhere to these evolving legal mandates. Non-compliance can lead to significant fines and reputational damage. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Cybersecurity breaches, which are on the rise, further underscore the need for robust data protection measures.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CCPA Impact: Grants consumers rights over their personal information, affecting data handling practices.

- Cybersecurity Threats: Increasing frequency and sophistication of cyberattacks necessitate proactive defense strategies.

- IoT Vulnerabilities: Components used in connected devices must meet stringent security standards to prevent data breaches.

Legal frameworks surrounding intellectual property (IP) are critical for Holy Stone, particularly concerning patents for its electronic components and drone technology. Protecting its innovations through patents and respecting existing IP rights is essential to avoid costly litigation and maintain competitive advantage. As of 2024, the global IP landscape continues to evolve, with increased focus on digital patents and AI-generated inventions, requiring constant vigilance.

Navigating labor laws, including worker safety regulations and fair wage practices, is also a key legal consideration for Holy Stone. Adherence to these laws ensures ethical operations and avoids potential disruptions from labor disputes or regulatory penalties. For instance, in 2025, many regions are seeing updated occupational safety standards for manufacturing environments, impacting how companies manage their workforce.

| Legal Factor | Impact on Holy Stone | 2024/2025 Relevance |

|---|---|---|

| Intellectual Property (IP) Protection | Securing patents for new technologies, avoiding infringement lawsuits. | Increased focus on digital IP and AI-generated inventions; continued patent application growth. |

| Labor Laws & Worker Safety | Ensuring compliance with wage, hour, and safety regulations. | Updates to occupational safety standards in manufacturing; potential for increased labor costs. |

Environmental factors

The escalating global e-waste crisis, projected to reach 61.3 million metric tons by 2024 according to the Global E-waste Monitor 2024, is driving more stringent environmental regulations. New controls under the Basel Convention, effective January 1, 2025, will impact international e-waste shipments, requiring enhanced compliance for companies like Holy Stone.

For Holy Stone, a key consideration is the recyclability of its electronic components. Proactive engagement in industry-wide recycling programs and designing for disassembly can mitigate risks and ensure adherence to these evolving environmental mandates, potentially reducing disposal costs and enhancing corporate social responsibility.

Global regulations like RoHS and REACH are increasingly restricting hazardous substances in electronics. For instance, RoHS directives limit the use of lead, mercury, and cadmium in electrical and electronic equipment. This means Holy Stone must meticulously vet its MLCC materials and manufacturing processes to ensure compliance with evolving environmental safety standards, impacting component design and supply chain management.

Consumers and regulators are increasingly pushing for greener manufacturing. This means companies like Holy Stone are expected to cut emissions, use less energy, and opt for recyclable materials. By embracing these sustainable methods, Holy Stone can boost its image and potentially access new markets, as environmentally friendly operations are becoming a key selling point.

Climate Change Impacts on Supply Chain

Climate change is a significant environmental factor impacting global supply chains, including those of companies like Holy Stone. Extreme weather events, such as floods, droughts, and severe storms, can directly disrupt the availability of raw materials, damage production facilities, and impede transportation networks. For instance, the World Meteorological Organization reported that in 2023, extreme weather events caused billions of dollars in damages globally, highlighting the tangible risks to logistics and operations.

Holy Stone must proactively assess these climate-related risks and integrate resilience strategies into its supply chain management. This involves identifying potential vulnerabilities, diversifying sourcing locations, and exploring alternative transportation routes to ensure operational continuity and timely delivery to customers. Building this resilience is crucial for maintaining market competitiveness and mitigating financial losses stemming from climate-induced disruptions.

- Supply Chain Vulnerability: Extreme weather events in 2023 led to significant disruptions in global trade routes, impacting shipping times and costs for electronics manufacturers.

- Raw Material Availability: Climate-sensitive raw materials, crucial for drone components, face increased volatility in supply due to changing weather patterns affecting agricultural yields and resource extraction.

- Operational Resilience: Holy Stone's investment in diversified manufacturing locations and robust logistics planning can mitigate the impact of localized climate disruptions, ensuring business continuity.

Corporate Social Responsibility (CSR) and ESG Reporting

There's a significant and growing demand for companies to actively engage in Corporate Social Responsibility (CSR) and align with Environmental, Social, and Governance (ESG) standards. This isn't just a feel-good initiative; it's becoming a core business imperative. Investors are increasingly scrutinizing companies' ESG performance, with global ESG assets projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence.

New regulations are reinforcing this trend. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) is set to significantly expand sustainability reporting requirements. Starting in 2025 for certain companies, this directive will mandate more detailed and standardized disclosures on environmental and social impacts. Holy Stone's ability to meet and exceed these evolving reporting standards will directly influence investor confidence and access to capital.

Holy Stone's commitment to transparency and demonstrable progress in CSR and ESG areas is therefore crucial for its long-term success. Stakeholders, including customers, employees, and the wider community, are also paying closer attention to these aspects. Companies leading in ESG reporting often see better financial performance and a stronger brand reputation.

- Growing Investor Demand: Global ESG assets are expected to hit $33.9 trillion by 2026, indicating a strong preference for sustainable investments.

- Regulatory Impact: The EU's CSRD, effective from 2025 for some entities, mandates more robust sustainability reporting, impacting compliance and disclosure.

- Stakeholder Expectations: Beyond investors, customers and employees are increasingly prioritizing companies with strong CSR and ESG credentials.

- Competitive Advantage: Companies with superior ESG performance often experience enhanced brand reputation and improved financial outcomes.

The escalating global e-waste crisis, projected to reach 61.3 million metric tons by 2024 according to the Global E-waste Monitor 2024, is driving more stringent environmental regulations. New controls under the Basel Convention, effective January 1, 2025, will impact international e-waste shipments, requiring enhanced compliance for companies like Holy Stone.

For Holy Stone, a key consideration is the recyclability of its electronic components. Proactive engagement in industry-wide recycling programs and designing for disassembly can mitigate risks and ensure adherence to these evolving environmental mandates, potentially reducing disposal costs and enhancing corporate social responsibility.

Global regulations like RoHS and REACH are increasingly restricting hazardous substances in electronics. For instance, RoHS directives limit the use of lead, mercury, and cadmium in electrical and electronic equipment. This means Holy Stone must meticulously vet its MLCC materials and manufacturing processes to ensure compliance with evolving environmental safety standards, impacting component design and supply chain management.

Consumers and regulators are increasingly pushing for greener manufacturing. This means companies like Holy Stone are expected to cut emissions, use less energy, and opt for recyclable materials. By embracing these sustainable methods, Holy Stone can boost its image and potentially access new markets, as environmentally friendly operations are becoming a key selling point.

Climate change is a significant environmental factor impacting global supply chains, including those of companies like Holy Stone. Extreme weather events, such as floods, droughts, and severe storms, can directly disrupt the availability of raw materials, damage production facilities, and impede transportation networks. For instance, the World Meteorological Organization reported that in 2023, extreme weather events caused billions of dollars in damages globally, highlighting the tangible risks to logistics and operations.

Holy Stone must proactively assess these climate-related risks and integrate resilience strategies into its supply chain management. This involves identifying potential vulnerabilities, diversifying sourcing locations, and exploring alternative transportation routes to ensure operational continuity and timely delivery to customers. Building this resilience is crucial for maintaining market competitiveness and mitigating financial losses stemming from climate-induced disruptions.

- Supply Chain Vulnerability: Extreme weather events in 2023 led to significant disruptions in global trade routes, impacting shipping times and costs for electronics manufacturers.

- Raw Material Availability: Climate-sensitive raw materials, crucial for drone components, face increased volatility in supply due to changing weather patterns affecting agricultural yields and resource extraction.

- Operational Resilience: Holy Stone's investment in diversified manufacturing locations and robust logistics planning can mitigate the impact of localized climate disruptions, ensuring business continuity.

There's a significant and growing demand for companies to actively engage in Corporate Social Responsibility (CSR) and align with Environmental, Social, and Governance (ESG) standards. This isn't just a feel-good initiative; it's becoming a core business imperative. Investors are increasingly scrutinizing companies' ESG performance, with global ESG assets projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence.

New regulations are reinforcing this trend. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) is set to significantly expand sustainability reporting requirements. Starting in 2025 for certain companies, this directive will mandate more detailed and standardized disclosures on environmental and social impacts. Holy Stone's ability to meet and exceed these evolving reporting standards will directly influence investor confidence and access to capital.

Holy Stone's commitment to transparency and demonstrable progress in CSR and ESG areas is therefore crucial for its long-term success. Stakeholders, including customers, employees, and the wider community, are also paying closer attention to these aspects. Companies leading in ESG reporting often see better financial performance and a stronger brand reputation.

- Growing Investor Demand: Global ESG assets are expected to hit $33.9 trillion by 2026, indicating a strong preference for sustainable investments.

- Regulatory Impact: The EU's CSRD, effective from 2025 for some entities, mandates more robust sustainability reporting, impacting compliance and disclosure.

- Stakeholder Expectations: Beyond investors, customers and employees are increasingly prioritizing companies with strong CSR and ESG credentials.

- Competitive Advantage: Companies with superior ESG performance often experience enhanced brand reputation and improved financial outcomes.

Environmental factors significantly influence Holy Stone's operations and strategic planning. The increasing volume of e-waste globally, expected to reach 61.3 million metric tons by 2024, drives stricter regulations like the Basel Convention, impacting international shipments from January 2025. Holy Stone must prioritize component recyclability and sustainable design to comply with these mandates and manage disposal costs effectively.

Adherence to regulations like RoHS and REACH, which limit hazardous substances such as lead and cadmium, necessitates careful material sourcing and process management for components like MLCCs. Furthermore, growing consumer and regulatory demand for greener manufacturing practices, including emission reduction and recyclable materials, presents an opportunity for Holy Stone to enhance its brand image and market access.

Climate change poses tangible risks to Holy Stone's supply chain, with extreme weather events in 2023 causing billions in global damages, disrupting raw material availability and logistics. Implementing resilience strategies, such as diversifying sourcing and transportation, is vital for operational continuity and mitigating financial losses.

| Environmental Factor | Impact on Holy Stone | Key Regulations/Trends | Data Point (2024/2025 Focus) |

|---|---|---|---|

| E-Waste Management | Increased compliance costs, need for sustainable design | Basel Convention (effective Jan 2025), Global E-waste Monitor | 61.3 million metric tons e-waste by 2024 |

| Hazardous Substance Restrictions | Supply chain vetting, process adjustments | RoHS, REACH directives | Restriction of lead, mercury, cadmium |

| Climate Change & Supply Chain | Risk of disruption, need for resilience | WMO reports on extreme weather impacts | Billions USD in damages from extreme weather (2023) |

| Corporate Social Responsibility (CSR) / ESG | Investor scrutiny, reporting requirements | EU CSRD (from 2025 for some), ESG investment growth | Global ESG assets projected to reach $33.9 trillion by 2026 |

PESTLE Analysis Data Sources

Our Holy Stone PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable market research firms, and leading technology trend reports. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is current and fact-based.