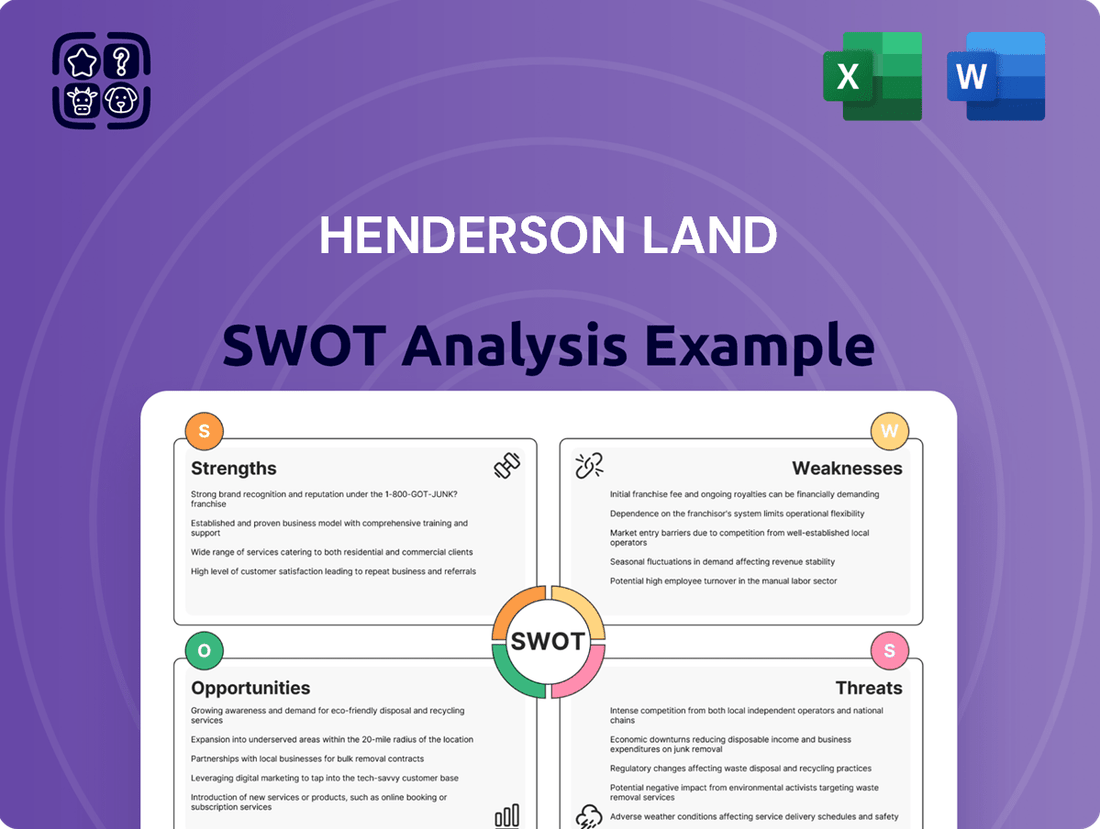

Henderson Land SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Henderson Land's strategic positioning is clear, but what are the hidden opportunities and potential threats lurking beneath the surface? Our comprehensive SWOT analysis dives deep into their strengths, weaknesses, market opportunities, and competitive threats, offering a nuanced view of their landscape.

Want to truly understand Henderson Land's competitive edge and potential vulnerabilities? Purchase the full SWOT analysis to gain access to a professionally crafted, editable report packed with actionable insights and strategic recommendations, perfect for investors and industry analysts.

Strengths

Henderson Land boasts a remarkably diversified business model, spanning property development, investment, management, construction, infrastructure, energy, and hotel operations. This wide array of ventures creates multiple, independent revenue streams, significantly reducing the company's vulnerability to downturns in any single market segment. For instance, as of the first half of 2024, the company reported a substantial contribution from its property sales segment, alongside steady income from its extensive property portfolio and utility operations.

Henderson Land boasts an impressive land bank and a varied property portfolio spanning residential, commercial, and mixed-use developments in both Hong Kong and mainland China. This substantial asset base is a key strength, underpinning the company's capacity for future growth and ensuring a steady stream of rental income.

As a prominent developer in Hong Kong, Henderson Land holds a leading position in terms of retail and office space. The company consistently ranks among the top five developers for residential sales, demonstrating its strong market presence and execution capabilities.

Henderson Land's dedication to sustainability is a significant strength, underscored by its ambitious climate targets validated by the Science Based Targets initiative in December 2024. This commitment positions the company favorably in an increasingly ESG-conscious market.

The company's flagship development, The Henderson, exemplifies this focus, having secured multiple platinum certifications for green, healthy, and smart building standards. This achievement not only highlights their innovative approach to construction but also appeals to a growing segment of environmentally aware tenants and investors.

This strong ESG performance and innovative building practices align with global sustainability trends, enhancing Henderson Land's brand reputation and potentially attracting long-term capital. Their proactive stance on environmental responsibility is a key differentiator in the competitive property sector.

Stable Rental Income from Investment Properties

Henderson Land’s portfolio of investment properties, especially in key Chinese cities like Shanghai and Guangzhou, provides a consistent and reliable stream of rental income. This recurring revenue is a significant contributor to the company's financial stability and overall profitability, acting as a buffer against market fluctuations in property development.

This rental income is a core strength, underscoring the company's ability to generate cash flow even amidst broader market challenges. The resilience of this income stream is particularly valuable in the current economic climate.

- Diversified Property Portfolio: Henderson Land holds a range of commercial and residential properties, reducing reliance on any single asset class.

- Strategic Urban Locations: Properties are situated in prime areas of major cities, ensuring sustained tenant demand.

- Consistent Revenue Generation: Rental income provides a predictable cash flow, bolstering financial health.

- 2024 Performance: Net rental income in mainland China saw a 6% year-on-year increase in 2024, demonstrating the strength of this segment.

Strategic Focus on Urban Redevelopment

Henderson Land's strategic focus on urban redevelopment is a key strength, allowing it to build its development land bank by utilizing existing properties. This strategy is particularly effective in prime Hong Kong locations, where the company can unlock significant value by revitalizing urban areas.

This approach is further bolstered by the potential for accelerated farmland conversion by the Hong Kong government, which could open up new development opportunities. For instance, in the first half of 2024, Henderson Land reported a substantial increase in its property development portfolio, driven by these strategic land acquisition and redevelopment initiatives.

- Leveraging Existing Land: Henderson Land actively uses its current land holdings to initiate urban redevelopment projects, thereby expanding its development pipeline.

- Prime Location Value: The company's focus on urban redevelopment allows it to capitalize on the inherent value of prime real estate in Hong Kong.

- Government Policy Alignment: Potential government acceleration of farmland conversion provides a favorable environment for Henderson Land's growth strategy.

Henderson Land's diversified business model, encompassing property, hotels, and utilities, generates multiple revenue streams. This diversification, evident in its balanced performance across segments in the first half of 2024, significantly mitigates risk. The company's substantial land bank in Hong Kong and mainland China, coupled with its leading position in prime retail and office spaces, provides a strong foundation for sustained growth and recurring rental income.

The company's commitment to sustainability, validated by Science Based Targets initiative in December 2024, and its innovative green building practices, as seen in The Henderson, enhance its brand reputation and market appeal. Furthermore, strategic urban redevelopment projects, particularly in prime Hong Kong locations, allow Henderson Land to effectively expand its development pipeline and capitalize on urban revitalization opportunities, potentially benefiting from accelerated government farmland conversion initiatives.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Diversified Business Model | Multiple revenue streams across property, hotels, and utilities. | Balanced performance across segments in H1 2024. |

| Extensive Land Bank | Significant holdings in Hong Kong and mainland China. | Underpins future development and rental income potential. |

| Market Leadership | Leading positions in Hong Kong retail and office space. | Consistently ranks among top five residential developers. |

| Sustainability Focus | Commitment to ESG and green building. | Validated climate targets (Dec 2024); The Henderson's green certifications. |

| Urban Redevelopment Strategy | Leveraging existing properties for new development. | Potential to benefit from accelerated farmland conversion. |

What is included in the product

Analyzes Henderson Land’s competitive position through key internal and external factors, highlighting its strengths in property development and potential threats from market volatility.

Identifies key market opportunities and competitive threats for informed strategic adjustments.

Weaknesses

Henderson Land's financial performance in 2024 showed a notable weakness, with net income dropping by 32% and revenue declining by 8.4% year-over-year. This contraction was largely attributed to fair value losses on its investment properties. Furthermore, the company saw a 16% reduction in revenue attributable to its Hong Kong property development segment, signaling headwinds in its core markets.

Henderson Land encountered significant headwinds in mainland China's property sector throughout 2024. Contracted sales experienced a sharp decline of 48%, directly impacting the company's top-line performance and overall profitability.

This downturn in a crucial market segment underscores the vulnerability of Henderson Land's mainland China operations. The ongoing real estate slowdown in the region presents a persistent challenge, limiting growth opportunities and potentially affecting future revenue streams.

Henderson Land's 2024 financial performance highlighted a significant weakness in its cost structure. The cost of sales represented a substantial 65% of total revenue, directly squeezing profit margins and indicating potential inefficiencies in production or procurement.

Further compounding this issue, general and administrative expenses were alarmingly high, making up 90% of total expenses. This suggests a considerable overhead burden that could hinder the company's ability to generate strong net profits, particularly if revenue streams face headwinds.

These elevated operational costs pose a considerable challenge, as they can severely limit profitability, especially in scenarios where revenue experiences a downturn. Managing these expenses effectively will be crucial for Henderson Land to improve its financial resilience.

Recent Credit Rating Downgrade

Fitch Ratings downgraded Henderson Land Development's long-term foreign issuer default rating from BBB+ to BBB in August 2024. This action highlights ongoing concerns regarding the company's interest coverage ratio, which has faced sustained pressure.

The downgrade was influenced by persistent challenges within the office rental market and a subdued outlook for the retail property sector. These factors have collectively impacted the company's financial flexibility and its ability to service debt.

- Credit Rating Downgrade: Fitch Ratings lowered Henderson Land's long-term foreign issuer default rating to BBB from BBB+ in August 2024.

- Key Drivers: The downgrade stems from sustained pressure on the company's interest coverage ratio.

- Market Headwinds: Weak office rents and a challenging retail property market outlook contributed to the revised assessment.

Limited Signature Projects

While Henderson Land boasts a broad portfolio, a weakness lies in its relatively limited number of truly signature, iconic projects. This can impact its ability to stand out in a competitive Hong Kong market, especially when aiming for the high-end, premium segments. For instance, in 2023, while the company reported significant revenue from its residential developments, the lack of globally recognized landmark projects might limit its long-term brand equity building compared to some rivals.

This scarcity of standout developments could affect Henderson Land's capacity to attract international attention and command top-tier pricing based on sheer project prestige. The company's 2024 forward-looking statements indicate a focus on continued residential sales, but the strategic emphasis on developing fewer, more impactful, signature projects could be a missed opportunity for enhanced market differentiation.

- Limited number of iconic developments compared to competitors.

- Potential impact on premium market segment capture.

- May hinder significant brand differentiation through landmark projects.

- Opportunity cost in terms of prestige and pricing power.

Henderson Land's financial performance in 2024 revealed a significant weakness in its cost management. The cost of sales represented a substantial 65% of total revenue, directly impacting profit margins. Compounding this, general and administrative expenses were notably high, accounting for 90% of total expenses. This suggests a considerable overhead burden that limits the company's ability to achieve strong net profits, especially when facing revenue downturns.

The company's reliance on fair value adjustments for its investment properties also presents a weakness, as evidenced by a 32% drop in net income in 2024 due to these losses. Furthermore, a 48% decline in contracted sales in mainland China during 2024 highlights the vulnerability of its operations in key markets.

Fitch Ratings downgraded Henderson Land's long-term foreign issuer default rating to BBB from BBB+ in August 2024, citing sustained pressure on its interest coverage ratio. This downgrade was influenced by persistent challenges in the office rental market and a subdued outlook for the retail property sector, impacting financial flexibility.

Henderson Land's portfolio, while broad, lacks a significant number of truly iconic, signature projects. This can hinder its ability to capture premium market segments and build substantial brand differentiation in a competitive landscape. The company's 2024 focus on residential sales, without a strong emphasis on developing landmark projects, may represent a missed opportunity for enhanced market positioning and pricing power.

Same Document Delivered

Henderson Land SWOT Analysis

The preview you see is the actual Henderson Land SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a professionally structured and comprehensive report. No surprises, just the full, detailed analysis ready for your use.

Opportunities

The Hong Kong private residential property market is demonstrating signs of stabilization, with projections indicating an improved performance in 2025. Analysts anticipate a potential uptick of approximately 3% in residential property prices and a robust 6% growth in primary home sales for the year.

This anticipated market recovery creates a more favorable landscape for Henderson Land's core business of property development and sales. The expected increase in demand and property values directly benefits developers like Henderson Land, potentially boosting their revenue and profit margins.

The U.S. Federal Reserve's anticipated interest rate cuts in 2025 are poised to significantly lower mortgage costs in Hong Kong. This easing of financing expenses is expected to enhance housing affordability, potentially invigorating demand from both homebuyers and investors, which is a positive development for developers like Henderson Land.

Lower borrowing costs directly translate to reduced financial burdens for property purchasers, encouraging more activity in the market. For Henderson Land, this could mean an uptick in sales volume and potentially higher profit margins as fewer resources are tied up in financing.

The Hong Kong government's proactive stance, highlighted by the February 2024 removal of property cooling measures, signals a significant tailwind for developers like Henderson Land. This policy shift is designed to invigorate the property market, potentially boosting sales volumes and prices.

Furthermore, Hong Kong's efforts to attract top global talent, evidenced by programs like the Top Talent Pass Scheme, are expected to drive demand. Projections suggest a substantial increase in skilled workers and their families relocating to the city, creating a robust demand for residential units, both for purchase and rental, which directly benefits Henderson Land's diverse property portfolio.

Extensive Pipeline of New Development Projects

Henderson Land is poised for significant growth with an extensive pipeline of new development projects slated for launch. In 2025 alone, the company plans to introduce approximately 5,400 new apartments spread across 12 distinct developments. This substantial offering is strategically timed to leverage an anticipated improvement in market sentiment and a potential resurgence in buyer demand.

These upcoming projects represent a crucial opportunity for Henderson Land to bolster its future revenue streams and solidify its market position. The sheer volume of new inventory coming online is expected to cater to a broad spectrum of the market, potentially driving substantial sales and contributing significantly to the company's financial performance in the coming years.

- Projected 2025 Launches: 12 new developments.

- Total New Apartments: Approximately 5,400 units.

- Strategic Timing: Aligned with improving market sentiment and demand.

- Revenue Impact: Significant potential for future revenue growth.

Growing Demand for Sustainable and Smart Buildings

The increasing market preference for environmentally friendly and technologically advanced properties presents a significant opportunity for Henderson Land. The company's established leadership in sustainable development, highlighted by its award-winning green buildings and commitment to its G.I.V.E. Strategy, positions it favorably to capitalize on this evolving demand. This strategic focus not only enhances market appeal but also opens avenues for premium pricing on its developments.

Henderson Land's proactive approach to sustainability is reflected in its portfolio, which includes projects designed to meet stringent environmental certifications. For instance, the company has consistently invested in green building technologies, aiming to reduce operational costs and environmental impact for its tenants and owners. This commitment aligns with global trends and regulatory shifts favoring greener construction practices, a trend expected to accelerate through 2025.

- Market Shift: Growing consumer and corporate demand for buildings with lower carbon footprints and smart technology integration.

- Competitive Advantage: Henderson Land's existing portfolio of green-certified buildings provides a strong foundation to meet this demand.

- Financial Upside: Potential for enhanced property valuations and rental yields due to the premium associated with sustainable and smart features.

- Regulatory Alignment: Adherence to evolving environmental regulations and building standards positions the company favorably for future market conditions.

The Hong Kong property market is showing signs of recovery, with forecasts for 2025 suggesting a 3% rise in residential prices and a 6% increase in primary home sales. This positive outlook, coupled with anticipated U.S. Federal Reserve interest rate cuts, is expected to lower mortgage costs, making housing more affordable and stimulating demand. Henderson Land's strategic timing with approximately 5,400 new apartments across 12 developments in 2025 is well-positioned to capitalize on this renewed market activity.

The company's commitment to green and smart building technologies, aligned with its G.I.V.E. Strategy, provides a competitive edge as demand for sustainable properties grows. This focus on environmental, social, and governance (ESG) principles not only appeals to a broader market segment but also supports premium pricing and enhanced property valuations.

| Opportunity Area | Key Drivers | Henderson Land's Position |

|---|---|---|

| Market Recovery & Affordability | Projected 3% price increase and 6% sales growth in HK residential market (2025). Lower mortgage rates due to anticipated Fed rate cuts. | Extensive pipeline of 5,400 units across 12 developments launching in 2025. |

| Sustainable Development Demand | Growing preference for green and smart buildings. | Award-winning green buildings and established G.I.V.E. Strategy. |

| Talent Influx | Hong Kong's Top Talent Pass Scheme expected to increase skilled worker population. | Diverse property portfolio catering to residential demand from relocating professionals. |

| Policy Support | Removal of property cooling measures (Feb 2024). | Direct benefit from invigorated market activity and increased sales potential. |

Threats

Henderson Land is grappling with a persistent downturn in key real estate markets, notably Hong Kong and mainland China. This prolonged slump has led to a noticeable slowdown in property sales, directly impacting the company's top-line revenue and overall profitability.

The challenging market conditions, marked by subdued buyer sentiment and potentially tighter lending conditions, could further erode property values and hinder sales volumes throughout 2024 and into 2025. For instance, Hong Kong's residential property price index saw a decline of approximately 3.7% in the first half of 2024, according to government data, underscoring the persistent weakness.

The Hong Kong property market is grappling with a growing surplus of unsold homes, a situation that is likely to keep prices under pressure. This oversupply is a significant concern for developers like Henderson Land, as it directly impacts their ability to achieve favorable pricing for new developments.

The commercial sector, particularly the Kowloon office market, also faces headwinds. Projections indicate a 2% to 4% drop in office rents for 2025, reflecting a challenging leasing environment and increased vacancy rates. Such conditions can significantly squeeze profit margins on Henderson Land's commercial projects.

Global economic headwinds are expected to persist into 2025, with geopolitical friction and trade policies creating a volatile environment. This uncertainty directly impacts property markets, potentially dampening investor sentiment and overall economic stability, which could hinder Henderson Land's growth prospects.

Slower-than-Expected Interest Rate Cuts and High Financing Costs

A more gradual approach to interest rate reductions by central banks could extend the current slump in the property market, as borrowing costs for mortgages would remain higher for longer. For instance, if the Federal Reserve, a key influencer of global rates, maintains its benchmark rate at its current level for an extended period into 2025, this would directly impact affordability for buyers and developers alike.

Persistently high interest rates and the associated financing expenses pose a significant hurdle for investors. This environment can suppress transaction activity and deter new investments, particularly in the commercial real estate sector, where larger capital outlays are involved. For example, a typical commercial property financing deal might see a 1% increase in interest rates translate to millions in additional annual costs.

The prolonged period of elevated borrowing costs and a sluggish property market could consequently lead to an increase in properties being offered for sale at distressed prices. This trend might be exacerbated if property owners face difficulties in refinancing existing debt at favorable terms, potentially impacting entities like Henderson Land that hold substantial property portfolios.

- Prolonged Property Downturn: Slower-than-expected interest rate cuts by major central banks, such as the US Federal Reserve or the European Central Bank, could keep mortgage rates elevated through 2025, hindering buyer affordability and market recovery.

- Dampened Investment: Elevated financing costs directly impact the yield calculations for commercial property investments. If borrowing costs remain above 5-6% for significant periods, it makes new acquisitions less attractive, potentially reducing transaction volumes.

- Increased Distressed Listings: A sustained period of high interest rates, coupled with potential economic slowdowns, could force some property owners to sell assets at a loss to meet debt obligations, leading to a rise in distressed property sales.

Risk of Fair Value Losses on Investment Properties

Henderson Land has faced considerable headwinds with fair value losses on its investment properties. In 2024, the company reported significant revaluation deficits on both completed and under-development properties, which directly impacted its profitability. This trend highlights the sensitivity of its portfolio to market fluctuations.

The ongoing volatility in the real estate market presents a persistent threat. Continued downward revaluations could further erode the company's financial performance and strain its balance sheet. For instance, a 5% drop in property values could translate to billions in unrealized losses.

- Significant 2024 Fair Value Losses: The company's reported profits were substantially affected by revaluation deficits on its investment property portfolio.

- Impact on Financial Results: Continued losses in a volatile market pose a direct risk to Henderson Land's earnings and overall financial health.

- Balance Sheet Pressure: Persistent fair value declines can weaken the company's asset base and potentially impact its leverage ratios.

Henderson Land faces significant threats from a prolonged property market downturn, with Hong Kong's residential prices declining approximately 3.7% in the first half of 2024. This slump, exacerbated by potential interest rate hikes persisting into 2025, dampens buyer affordability and investment appeal, especially in the commercial sector where financing costs can significantly impact yields. Furthermore, an oversupply of unsold homes in Hong Kong is expected to keep prices under pressure, while global economic uncertainty and geopolitical tensions add another layer of risk to the company's growth prospects.

| Threat | Description | Impact on Henderson Land | Supporting Data/Context |

|---|---|---|---|

| Prolonged Property Downturn | Sustained weakness in Hong Kong and mainland China real estate markets. | Reduced sales volumes, lower revenue, and profitability pressure. | Hong Kong residential property price index down ~3.7% H1 2024. |

| Elevated Interest Rates | Central banks maintaining higher interest rates longer than anticipated. | Increased borrowing costs for buyers and developers, dampening investment. | Potential for benchmark rates to remain elevated through 2025. |

| Oversupply in Key Markets | Growing surplus of unsold residential properties in Hong Kong. | Pressure on property prices and slower sales for new developments. | Concerns about absorption rates for new projects. |

| Commercial Sector Headwinds | Challenging leasing environment and increased vacancy rates in office markets. | Lower rental income and potential for reduced property valuations. | Kowloon office rents projected to drop 2-4% in 2025. |

SWOT Analysis Data Sources

This Henderson Land SWOT analysis is built upon a robust foundation of data, including the company's official financial reports, comprehensive market research, and insights from industry experts. This ensures a well-rounded and accurate assessment of its strategic position.