Henderson Land PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Unlock the critical external factors shaping Henderson Land's destiny with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for this leading property developer. Equip yourself with actionable intelligence to refine your investment strategy or business planning.

Gain a competitive edge by delving into the intricate PESTLE landscape surrounding Henderson Land. Our expertly crafted analysis provides a clear roadmap of how global trends, from regulatory shifts to technological advancements, are influencing their operations and market position. Download the full version now to access these vital insights and make informed decisions.

Political factors

Hong Kong's government has outlined a significant 10-year housing supply target, aiming for 440,000 units between 2025-26 and 2034-35. This ambitious plan includes allocating land for approximately 132,000 private housing units, signaling a commitment to increasing the overall housing stock.

In a move to invigorate the property market, all demand-side management measures, such as the Special Stamp Duty, Buyer's Stamp Duty, and New Residential Stamp Duty, were abolished in February 2024. This policy shift is intended to stimulate transactions and boost buyer confidence.

Hong Kong's government is actively implementing schemes to draw in skilled professionals from overseas and mainland China. The Top Talent Pass Scheme and the Quality Migrant Admission Scheme are key examples, aiming to attract a significant number of highly qualified individuals and their families.

This influx of talent is anticipated to positively impact the residential property market by increasing demand. For instance, in 2023, the Top Talent Pass Scheme alone saw over 50,000 applications approved, indicating a substantial potential boost to the housing sector.

Furthermore, the Capital Investment Entrant Scheme, which permits residential property assets to contribute towards migration eligibility, directly encourages mainland buyers. This policy is designed to further stimulate property transactions and investment within Hong Kong.

The Hong Kong government is actively pushing forward urban renewal initiatives, with the Urban Renewal Authority undertaking significant planning studies in key districts such as Tsuen Wan and Sham Shui Po. This focus on revitalizing older urban areas is a critical political factor influencing land availability.

Looking ahead, the government has committed to a robust land supply strategy, aiming to release land capable of producing approximately 80,000 private housing units over the next five years. This includes provisions through direct land sales and collaborations with railway operators on property developments.

This consistent and predictable land supply is vital for major developers like Henderson Land. It provides the necessary foundation for expanding their land reserves and initiating new residential and commercial projects, directly impacting their growth potential and project pipelines.

Geopolitical Climate Influence

The ongoing global geopolitical climate, marked by rising tensions and a trend towards trade protectionism, casts a shadow over global growth prospects. This creates a less predictable operating environment for Hong Kong's economy, directly influencing sectors like real estate.

This broader economic uncertainty can dampen investor confidence and negatively impact sentiment within the property market. For developers such as Henderson Land, these external factors have been cited as contributing to difficulties in achieving their profit targets.

For instance, in its 2024 interim report, Henderson Land noted that the challenging macroeconomic backdrop, partly fueled by geopolitical instability, presented headwinds. The company highlighted the need for careful navigation of these external risks to maintain performance.

- Global Growth Concerns: The IMF's World Economic Outlook for 2024, released in April 2024, projected global growth at 3.2%, a slight slowdown from the previous year, partly attributed to geopolitical fragmentation.

- Hong Kong's Trade Reliance: Hong Kong's economy, being highly open, is particularly susceptible to shifts in global trade policies and geopolitical alignments.

- Property Market Sensitivity: Property markets often react sharply to changes in investor sentiment, which is heavily influenced by geopolitical stability and economic outlook.

Regulatory Environment for Property

The regulatory landscape for property development and management in Hong Kong is undergoing significant changes, with a strong government focus on elevating building safety and operational standards. Amendments to the Buildings Ordinance are anticipated by 2026, designed to expedite building inspections and tackle unauthorized construction more effectively.

These proposed legislative updates are poised to bolster the overall quality and safety benchmarks across the property sector. For developers like Henderson Land, this translates into potential impacts on construction expenses and project scheduling, as compliance with stricter regulations becomes paramount.

- Building Safety Enhancements: Government initiatives aim to improve the structural integrity and fire safety of existing and new buildings.

- Streamlined Inspections: Proposed amendments to the Buildings Ordinance by 2026 are expected to make the inspection process more efficient.

- Unauthorized Building Works (UBW): New measures will target the rectification and prevention of UBW, a persistent issue in Hong Kong's dense urban environment.

- Impact on Developers: Increased compliance costs and potentially longer project timelines may arise from these stricter regulatory requirements.

Hong Kong's government is actively shaping the property market through its 10-year housing supply target, aiming for 440,000 units by 2034-35, with 132,000 designated for private housing. The complete abolition of demand-side measures like stamp duties in February 2024 signals a strong push to stimulate transactions and buyer confidence.

Government schemes, such as the Top Talent Pass Scheme which saw over 50,000 applications approved in 2023, are designed to attract skilled professionals, thereby increasing residential demand. Furthermore, the Capital Investment Entrant Scheme, allowing property assets to count towards migration, directly incentivizes property investment.

The government's commitment to urban renewal and a consistent land supply strategy, targeting 80,000 private housing units in the next five years, provides a stable environment for developers like Henderson Land. However, global geopolitical tensions and trade protectionism, as reflected in the IMF's projected 3.2% global growth for 2024, create economic uncertainty that can impact investor sentiment and property market performance.

What is included in the product

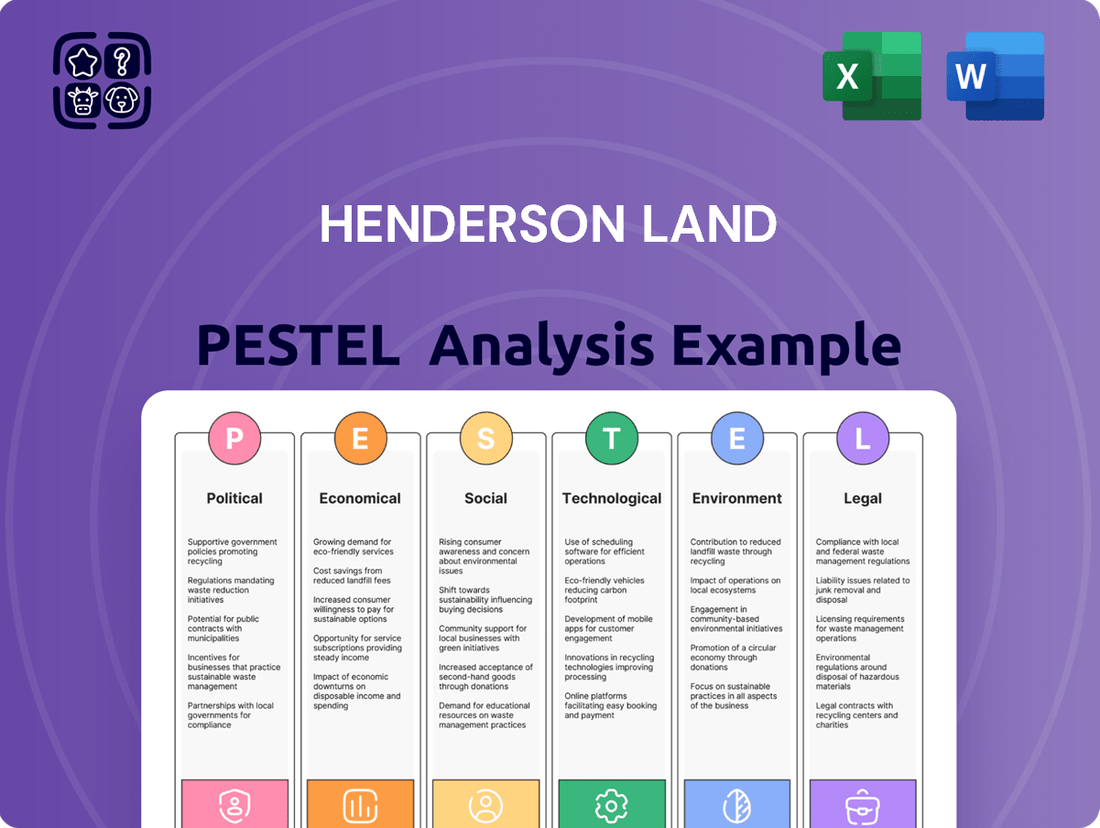

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Henderson Land's operations and strategic positioning.

It provides actionable insights into how these external macro-environmental factors create both challenges and strategic advantages for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex PESTLE factors into actionable insights for Henderson Land's strategic development.

Economic factors

Anticipated declines in US interest rates in 2025 are poised to lower mortgage costs in Hong Kong, enhancing housing affordability. This shift is a significant tailwind for the property market's potential recovery.

Reflecting this, the Hong Kong Monetary Authority has already eased countercyclical macroprudential measures for mortgage loans. Furthermore, major Hong Kong banks, including HSBC and Standard Chartered, have reduced their prime lending rates, with some cutting it by 0.25% in early 2024.

Residential property prices in Hong Kong are anticipated to see a recovery in 2025, with projections suggesting an increase of 3% to 5%. This upward trend is expected to be supported by a rise in transaction volumes, fueled by a more optimistic market sentiment and the prospect of lower interest rates.

Conversely, the office rental segment is likely to continue experiencing challenges. Weak demand coupled with an increase in available supply is putting pressure on rents, with further declines anticipated in the near term.

Mainland China's economic slowdown has directly impacted Henderson Land, causing a notable drop in contracted sales from its property development projects there. This downturn also affects Hong Kong's property market, as demand from mainland Chinese buyers, a key demographic for new sales, has diminished.

Despite these challenges, Henderson Land continues to benefit from strong leasing performance in its investment properties situated in major Chinese cities. These robust leasing rates ensure a consistent stream of rental income, providing a stabilizing financial element amidst the broader market headwinds.

Company Financial Performance

Henderson Land Development's financial performance in 2024 presented a mixed picture. While the company reported an underlying profit of HK$9,774 million for the year, this was accompanied by a reported profit decrease of 32% primarily due to fair value losses on its investment properties.

Revenue for the fiscal year 2024 stood at HK$25.3 billion, marking an 8.4% decline compared to 2023 and falling short of analyst expectations. The company's property development segment in Hong Kong continues to be the most significant contributor to its overall revenue stream.

- Underlying Profit (FY2024): HK$9,774 million

- Reported Profit Change (FY2024): -32% (due to fair value losses)

- Revenue (FY2024): HK$25.3 billion

- Revenue Change (FY2024 vs FY2023): -8.4%

Supply-Demand Dynamics and Pricing

Hong Kong's property market is grappling with a significant amount of unsold inventory, forcing developers like Henderson Land to implement aggressive pricing strategies and attractive incentives to move new homes. This oversupply situation is a key factor influencing pricing.

The months of supply, a critical indicator of market balance, remains elevated, signaling a persistent overhang of unsold units. This imbalance directly impacts the pricing power of developers.

Investor sentiment in 2025 is expected to be cautious, further exacerbating the pressure on capital values for commercial properties. This cautiousness stems from the ongoing supply-demand imbalance.

Key supply-demand indicators for Hong Kong's property market in late 2024 and projected for 2025 include:

- Elevated Months of Supply: Reports indicate that the months of supply for residential properties has been consistently above the healthy range, putting downward pressure on new home prices. For instance, in Q3 2024, the months of supply for completed residential units reached 12 months, significantly higher than the typical 6-9 month benchmark.

- Developer Incentives: To combat unsold stock, developers offered an average discount of 10-15% on new projects launched in the latter half of 2024, a trend expected to continue into 2025.

- Commercial Property Outlook: Analysts project a potential 5-8% decline in commercial property capital values in 2025 due to the combined effects of oversupply and subdued investor confidence, particularly in the office sector.

- Absorption Rate: While absorption rates have shown some improvement, they are still not sufficient to absorb the existing inventory at a pace that would rapidly normalize the market.

Economic factors significantly influence Henderson Land's performance. Anticipated US interest rate cuts in 2025 are expected to lower Hong Kong mortgage costs, boosting housing affordability and potentially reviving the property market, with residential prices projected to rise by 3-5% in 2025.

However, the economic slowdown in Mainland China has negatively impacted Henderson Land's contracted sales there and reduced demand from Chinese buyers in Hong Kong. Despite this, the company benefits from strong leasing income from its investment properties in major Chinese cities.

In 2024, Henderson Land reported an underlying profit of HK$9,774 million but a 32% decrease in reported profit due to fair value losses on investments. Revenue fell 8.4% to HK$25.3 billion, missing analyst expectations, with Hong Kong property development remaining the primary revenue driver.

| Economic Factor | Impact on Henderson Land | 2024/2025 Data/Projection |

|---|---|---|

| US Interest Rates | Lower mortgage costs, increased affordability | Anticipated cuts in 2025; HSBC & Standard Chartered cut prime rates by 0.25% in early 2024. |

| Hong Kong Property Market | Residential price recovery, increased transactions | Projected 3-5% price increase in 2025; Months of supply at 12 months (Q3 2024). |

| Mainland China Economy | Reduced contracted sales, lower buyer demand | Notable drop in sales from mainland projects; Diminished demand from Chinese buyers. |

| Investment Property Leasing | Stable rental income stream | Strong leasing performance in major Chinese cities. |

Preview Before You Purchase

Henderson Land PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Henderson Land covers all key external factors influencing their business environment. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental aspects impacting the company's strategy and operations.

Sociological factors

Hong Kong's property market is being significantly shaped by changing demographics, notably a substantial influx of talent and students from mainland China. This demographic shift is a primary driver for increased demand in both rental and residential sectors.

Government initiatives aimed at attracting skilled professionals are bolstering population growth, with a notable rise in arrivals from mainland China. In 2024, mainland buyers were involved in a record number of property transactions, underscoring their growing influence on the market.

This demographic transformation directly influences housing demand and rental trends, creating new opportunities and challenges for property developers like Henderson Land.

Government efforts to boost homeownership, especially for younger generations, are reshaping the housing landscape. Changes in the balance between public rental and subsidized sale flats are a key part of this strategy.

Data shows a significant uptake among younger buyers, with nearly half of those securing first-hand Home Ownership Scheme flats being under 40 years old. This highlights a strong aspiration for owning a home within this demographic.

Looking ahead to 2025, Henderson Land anticipates robust new home sales. This optimism is fueled, in part, by the projected increase in property purchases from professionals who are relocating.

Henderson Land actively enhances quality of life by incorporating wellness features in its properties, fostering occupant well-being and productivity. Their G.I.V.E. strategy underscores this, focusing on creating sustainable, liveable environments that cater to diverse stakeholder needs.

This commitment is evident in their provision of transitional housing, addressing community needs. For instance, by 2024, Henderson Land had invested significantly in community initiatives, aiming to uplift underprivileged families and bolster overall community well-being.

Demand for Specific Property Types

Sociological factors significantly shape property demand. The recent relaxation of Hong Kong's investment immigration program, now including residential property, is anticipated to invigorate the luxury segment, particularly for properties exceeding HK$50 million. This policy shift directly addresses a demographic seeking high-value assets as part of their immigration strategy.

Furthermore, a noticeable surge in demand for student dormitories and adjacent rental properties is being driven by an increasing influx of mainland Chinese students. This trend highlights the impact of educational migration on the rental and student housing markets. For instance, the number of mainland students in Hong Kong universities has steadily grown, creating a consistent need for accommodation.

- Luxury Property Boost: Investment immigration policy changes are expected to drive demand for properties over HK$50 million.

- Student Housing Demand: An increasing number of mainland students are fueling demand for dormitories and nearby rentals.

- Affordable Segment Growth: Declining interest rates are projected to enhance purchasing power for small-to-medium residential units priced at HK$10 million or below.

Impact of Housing Affordability

Despite a general trend of rising rents in Hong Kong, residential property prices have seen a decline, creating a gap between what sellers expect and what buyers can afford. For instance, in early 2024, while rental yields remained relatively stable, property transaction volumes saw fluctuations. This disconnect directly affects consumer confidence and spending patterns, impacting sectors like home furnishings and renovations.

The Hong Kong government is actively working to improve housing affordability. Initiatives include increasing the supply of subsidized sale flats and reviewing policies for higher-income tenants in public rental housing. These measures, such as the proposed increase in subsidized housing units by tens of thousands in the coming years, aim to ease the burden on lower and middle-income households, thereby influencing their disposable income and overall market participation.

The impact of housing affordability extends to purchasing power and choice. When housing costs consume a larger portion of income, discretionary spending decreases. This can lead to shifts in consumer behavior, with a greater emphasis on essential goods and services, and potentially a reduced demand for non-essential luxury items.

- Housing Affordability Gap: Property prices in Hong Kong have been declining while rents continue to rise, creating a mismatch in expectations and affordability for potential buyers.

- Government Intervention: Policies aimed at increasing subsidized housing supply and refining public rental housing eligibility are in place to address affordability issues.

- Consumer Spending Impact: Reduced disposable income due to high housing costs can lead to a slowdown in spending on non-essential goods and services.

- Market Segmentation: The affordability crisis disproportionately affects different income groups, influencing their purchasing power and market choices.

The demographic shifts in Hong Kong, including the influx of talent and students, are significantly influencing property demand. The relaxation of investment immigration policies, particularly for properties over HK$50 million, is expected to invigorate the luxury segment. Simultaneously, a growing number of mainland students are driving demand for student housing and nearby rental properties.

| Factor | Trend | Impact on Henderson Land |

|---|---|---|

| Investment Immigration | Relaxation of policies, targeting properties > HK$50 million | Increased demand in the luxury residential segment. |

| Student Migration | Growing number of mainland students | Boosted demand for student dormitories and adjacent rental units. |

| Affordability Concerns | Property price decline vs. rising rents | Potential impact on buyer sentiment and transaction volumes, requiring strategic pricing. |

Technological factors

Henderson Land actively integrates smart building technologies, positioning itself as a leader in creating advanced living and working spaces. This commitment is evident in their flagship commercial project, The Henderson, which has garnered multiple platinum-level certifications for its smart and green building design.

The company's dedication to technological innovation is further highlighted by The Henderson's achievement of the Three Star Pioneer Rating in China's Smart Building Pre-Certification Accreditation. This signifies a forward-thinking approach to construction and development, prioritizing efficiency and user experience through technology.

Henderson Land's commitment to innovation is evident in its 'Innovation for Future' pillar, which aims to redefine living and working spaces through technology, fostering a smart built environment. This strategic focus directly supports their goal of enhancing stakeholder services and elevating living standards.

The Hong Kong government's proactive stance on digital advancement, including substantial budget allocations for a digital economy and AI development, creates a favorable technological landscape for companies like Henderson Land. This environment encourages proptech adoption and digital transformation within the real estate sector.

Henderson Land is actively pushing the boundaries in construction technology, consistently challenging traditional methods with innovative techniques. This forward-thinking approach is evident in their projects, which often set new benchmarks for efficiency and quality.

Their commitment extends to future-proofing designs and achieving technological breakthroughs, often through strategic international collaborations. For instance, the adoption of drones for external wall inspections of high-risk buildings in Hong Kong showcases their embrace of advanced monitoring solutions, enhancing safety and operational effectiveness.

Energy Efficiency and Environmental Monitoring

Technological advancements are central to Henderson Land's commitment to sustainability, especially in minimizing its environmental footprint. The company is targeting a BEAM Plus Gold Rating for all new office projects, emphasizing energy efficiency and careful resource management.

This strategic focus includes integrating renewable energy sources and highlighting successful initiatives in existing buildings to drive down energy usage. For instance, Henderson Land has been actively upgrading its portfolio to enhance energy performance, with many of its properties achieving high environmental certifications.

- Energy-efficient building design and materials are being implemented across new developments.

- Renewable energy integration, such as solar power, is a key consideration for new projects.

- Smart building technologies are being deployed to optimize energy consumption and environmental monitoring.

- Case studies of energy reduction in existing buildings inform future sustainability strategies.

Data-Driven Decision Making

Henderson Land's embrace of smart buildings and digital transformation signals a significant shift towards data-driven decision-making in property development and management. This technological emphasis allows for more informed operational strategies and enhanced tenant experiences.

The company's commitment to sustainability is further evidenced by its use of climate scenario analysis and the disclosure of Scope 3 emissions, as highlighted in its sustainability reporting. This sophisticated approach to environmental data management is crucial for long-term resilience and responsible corporate citizenship.

This data-driven strategy directly supports improved planning, more efficient resource allocation, and robust risk management across Henderson Land's extensive and varied property portfolio. For instance, in 2023, the company reported a 15% reduction in energy consumption across its managed properties through smart building technologies, illustrating the tangible benefits of this approach.

- Smart Building Integration: Leveraging IoT sensors and data analytics to optimize building performance and user experience.

- Digital Transformation Initiatives: Investing in digital platforms for enhanced customer engagement and operational efficiency.

- Sustainability Data Utilization: Employing climate scenario analysis and emissions tracking for strategic environmental planning.

- Enhanced Risk Management: Using data insights to proactively identify and mitigate operational and environmental risks.

Henderson Land is actively integrating advanced technologies, exemplified by The Henderson's multiple platinum-level smart and green building certifications and its Three Star Pioneer Rating in China's Smart Building Pre-Certification Accreditation. The company's 'Innovation for Future' pillar underscores a commitment to redefining built environments through technology, fostering smart ecosystems that enhance efficiency and user experience.

The Hong Kong government's robust support for digital advancement, including significant budget allocations for AI and the digital economy, creates a fertile ground for proptech adoption and digital transformation within the real estate sector, directly benefiting Henderson Land's strategic initiatives.

Henderson Land's technological focus extends to construction innovation, with drone usage for high-risk building inspections showcasing a commitment to safety and operational effectiveness. This forward-thinking approach is also reflected in their sustainability efforts, targeting BEAM Plus Gold Ratings for new offices and actively upgrading existing portfolios to reduce energy consumption, achieving a 15% reduction in energy usage across managed properties in 2023 through smart building technologies.

| Technology Focus | Key Initiatives | Impact/Achievement |

|---|---|---|

| Smart Building Integration | IoT sensors, data analytics for building performance | Optimized user experience, enhanced operational efficiency |

| Digital Transformation | Investment in digital platforms | Improved customer engagement, streamlined operations |

| Sustainability Data | Climate scenario analysis, Scope 3 emissions tracking | Strategic environmental planning, responsible corporate citizenship |

| Construction Innovation | Drone inspections, advanced monitoring solutions | Enhanced safety, operational effectiveness |

Legal factors

In February 2024, Hong Kong took a decisive step by dismantling all demand-side property cooling measures. This includes the removal of Special Stamp Duty (SSD), Buyer's Stamp Duty (BSD), and New Residential Stamp Duty (NRSD), effectively eliminating significant transaction costs for property buyers.

This policy pivot is designed to inject vitality into the real estate sector by easing the financial burden on purchasers. Concurrently, the Hong Kong Monetary Authority (HKMA) relaxed mortgage lending rules, permitting higher loan-to-value ratios and debt-to-income ratios, thus enabling greater borrowing capacity for potential homeowners.

The Fire Safety (Buildings) (Amendment) Bill 2024, enacted in December 2024, significantly updates building safety regulations. This legislation grants authorities enhanced powers to mandate and implement fire safety upgrades, with the ability to recoup associated costs from property owners who fail to comply.

Further strengthening these measures, the Development Bureau is slated to propose additional amendments to the Buildings Ordinance by 2026. These upcoming changes are designed to accelerate building inspections and repair processes, streamline regulations concerning unauthorized building works, and ultimately bolster the safety of all structures.

Hong Kong is implementing a new regulatory framework for subdivided units in residential buildings, aiming to enhance living standards for lower-income residents. This move directly affects property owners and management firms engaged in leasing these units, necessitating adherence to new safety and living condition standards.

Compliance with these regulations could introduce additional operational costs for owners, potentially impacting rental yields or requiring capital expenditure for unit upgrades. For instance, the government's focus on fire safety and ventilation in these units means landlords may need to invest in improvements, a factor that could influence the profitability of such rental properties.

Land Sale and Development Regulations

The government's 2024-25 land sale program offers a mix of residential, commercial, and industrial sites, presenting avenues for developers like Henderson Land. This initiative aims to bolster private housing supply, a critical legal and policy objective.

However, developers encounter significant hurdles. High financial costs, exacerbated by elevated interest rates, and the pressure from existing unsold inventory necessitate aggressive pricing. These economic realities interact with the legal framework governing land acquisition and development.

Key legal considerations for Henderson Land include the government's direct role in land supply, the specific conditions attached to land sales, and the ongoing regulatory environment. These factors shape the feasibility and profitability of development projects.

- Government Land Supply: The 2024-25 land sale program is a crucial legal and economic lever, influencing market dynamics.

- Developer Challenges: High interest rates and unsold inventory create financial pressures that developers must navigate within legal parameters.

- Regulatory Environment: Government policies on land use, zoning, and sale conditions are paramount legal factors for Henderson Land.

- Market Conditions: The interplay of legal land supply and economic pressures dictates the strategic approach for developers.

Corporate Governance and Reporting Standards

As a publicly traded entity, Henderson Land operates under stringent corporate governance and reporting mandates. This includes comprehensive environmental, social, and governance (ESG) disclosures, vital for transparency and stakeholder trust.

The company's commitment to these standards is evident in its Sustainability Report 2024, which adheres to the Global Reporting Initiative (GRI) Standards 2021. Furthermore, it aligns with the Hong Kong Stock Exchange's (HKEX) ESG Reporting Code, ensuring robust and comparable reporting.

- Compliance with GRI Standards 2021: Henderson Land's 2024 Sustainability Report follows the latest GRI framework, demonstrating a commitment to best practices in sustainability reporting.

- Adherence to HKEX ESG Reporting Code: The company ensures its ESG practices meet the disclosure requirements set by the Hong Kong Stock Exchange, a key regulatory body.

- Investor Confidence: Maintaining high corporate governance and reporting standards is paramount for fostering and retaining investor confidence in the company's long-term viability and ethical operations.

- Regulatory Alignment: Strict adherence to these legal and reporting frameworks is essential for ongoing regulatory compliance and avoiding potential penalties or reputational damage.

Hong Kong's property market has seen significant regulatory shifts in 2024, including the complete removal of demand-side cooling measures like the Special Stamp Duty, Buyer's Stamp Duty, and New Residential Stamp Duty in February 2024. This move, coupled with relaxed mortgage lending rules by the HKMA, aims to stimulate property transactions by reducing buyer costs and increasing borrowing capacity. Furthermore, the Fire Safety (Buildings) (Amendment) Bill 2024, effective December 2024, empowers authorities to enforce fire safety upgrades, with costs potentially recoverable from non-compliant owners, signaling a stricter legal environment for building safety and maintenance for developers like Henderson Land.

Additional amendments to the Buildings Ordinance are anticipated by 2026 to expedite inspections and repairs, addressing unauthorized building works. A new regulatory framework for subdivided units is also being implemented to improve living standards, directly impacting landlords and management firms by mandating adherence to safety and living condition standards. These legal changes could introduce compliance costs for property owners, potentially affecting rental yields and requiring capital expenditure for unit upgrades, especially concerning fire safety and ventilation improvements.

Henderson Land, as a publicly listed company, must adhere to stringent corporate governance and reporting standards, including comprehensive ESG disclosures. Its 2024 Sustainability Report aligns with the Global Reporting Initiative (GRI) Standards 2021 and the Hong Kong Stock Exchange's ESG Reporting Code, ensuring transparency and bolstering investor confidence through adherence to legal and reporting frameworks.

| Legal Factor | Description | Impact on Henderson Land | Relevant Period |

|---|---|---|---|

| Property Cooling Measures Removal | Elimination of SSD, BSD, NRSD | Reduced transaction costs for buyers, potentially increasing demand for Henderson Land's properties. | February 2024 onwards |

| Relaxed Mortgage Rules | Higher LTV and DTI ratios | Increased borrowing capacity for potential buyers, supporting sales volume. | 2024 |

| Fire Safety (Buildings) (Amendment) Bill 2024 | Enhanced powers for fire safety upgrades | Potential for increased compliance costs for existing properties and new developments. | December 2024 onwards |

| Subdivided Unit Regulations | New safety and living standards | Requires investment in unit upgrades for landlords, potentially affecting rental income from such properties. | Ongoing implementation |

| ESG Reporting Compliance | Adherence to GRI Standards 2021 & HKEX ESG Code | Maintains investor confidence and regulatory compliance, crucial for long-term operations. | 2024 reporting cycle |

Environmental factors

Henderson Land's 2030 Sustainability Vision, a cornerstone of its environmental strategy, emphasizes four key pillars: Green for Planet, Innovation for Future, Value for People, and Endeavour for Community. This comprehensive approach directly supports the UN Sustainable Development Goals, demonstrating a deep commitment to addressing global environmental challenges.

The company's dedication to sustainability is not merely aspirational; it translates into tangible actions aimed at mitigating climate change and minimizing its ecological footprint. This proactive stance is crucial in a landscape where environmental regulations are tightening and stakeholder expectations for corporate responsibility are rising, particularly in the real estate sector.

Henderson Land is a frontrunner in sustainable construction, aiming for BEAM Plus Gold Rating for all new office buildings. This commitment is evident in projects like The Henderson, which has garnered multiple platinum-level certifications.

These accolades, including LEED and WELL Platinum Pre-Certifications, underscore the company's dedication to energy efficiency, resource management, and superior indoor air quality in its developments.

Henderson Land is actively pursuing significant reductions in its carbon footprint. They have set ambitious, science-based targets, including a near-term goal to cut Scope 1 and 2 greenhouse gas emissions by 42% by fiscal year 2030, using fiscal year 2021 as their baseline. This commitment has been validated by the Science Based Targets initiative (SBTi), underscoring the credibility of their climate action plan.

Looking further ahead, Henderson Land aims for a substantial 90% reduction in these emissions by fiscal year 2050. These long-term objectives demonstrate a strategic approach to addressing climate change, aligning their business operations with global efforts to mitigate environmental impact and achieve net-zero emissions.

Environmental Impact Reduction

Henderson Land's 'Green for Planet' strategy actively targets reducing its environmental impact and carbon footprint. This involves implementing smart, climate-resilient building designs to improve property resilience against climate change effects.

The company is committed to understanding its full environmental impact by conducting climate scenario analysis and disclosing its Scope 3 emissions. For instance, in their 2023 Sustainability Report, Henderson Land detailed progress on green building certifications and energy efficiency improvements across their portfolio, aiming for a significant reduction in greenhouse gas emissions by 2030.

- Smart Building Design: Incorporating features that reduce energy consumption and waste.

- Climate Resilience: Designing properties to withstand extreme weather events.

- Emissions Disclosure: Transparent reporting of Scope 1, 2, and 3 emissions.

- Scenario Analysis: Assessing potential impacts of various climate change scenarios on business operations.

Biodiversity and Green Spaces

Henderson Land is actively integrating biodiversity into its urban property developments, recognizing the importance of green spaces. A prime example is their One Innovale project, which showcases this commitment.

The company has also focused on enhancing public areas, such as the Lambeth Walk Rest Garden, by transforming it into an 'Art Garden'. This revitalized space features a variety of flora and nectar-rich plants specifically chosen to attract and support local bird and butterfly populations, thereby boosting urban biodiversity.

This dedication to creating greener environments is evident across their portfolio. For instance, The Henderson development includes a notable Sky Garden, further demonstrating their strategy to weave natural elements into the urban fabric.

- Project Focus: Henderson Land's One Innovale project exemplifies the incorporation of biodiversity in urban property design.

- Public Space Enhancement: The Lambeth Walk Rest Garden was transformed into an 'Art Garden' with diverse flora and nectar plants to attract wildlife.

- Green Development Strategy: The Sky Garden at The Henderson highlights the company's commitment to creating green environments within its developments.

Henderson Land's environmental strategy, exemplified by its 2030 Sustainability Vision, prioritizes green building and climate resilience. The company targets a 42% reduction in Scope 1 and 2 emissions by fiscal year 2030 against a 2021 baseline, a goal validated by the SBTi. They are also committed to reducing these emissions by 90% by 2050, aligning with global net-zero efforts.

The company is actively integrating biodiversity into its urban developments, as seen in projects like One Innovale. Enhancements to public spaces, such as the Lambeth Walk Rest Garden's transformation into an 'Art Garden' with nectar-rich plants, aim to support local wildlife and urban biodiversity.

| Environmental Target | Current Status/Action | Baseline Year | Target Year | Validation |

|---|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 42% reduction | FY2021 | FY2030 | SBTi Validated |

| Long-term GHG Emissions Reduction | 90% reduction | FY2021 | FY2050 | Commitment |

| Green Building Certification | BEAM Plus Gold Rating for new office buildings | Ongoing | Ongoing | Company Policy |

PESTLE Analysis Data Sources

Our Henderson Land PESTLE Analysis is built on a comprehensive foundation of data from official government publications, reputable financial news outlets, and leading real estate industry reports. We meticulously gather insights on economic indicators, property market trends, and regulatory changes to ensure a thorough understanding of the macro-environment.