Henderson Land Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

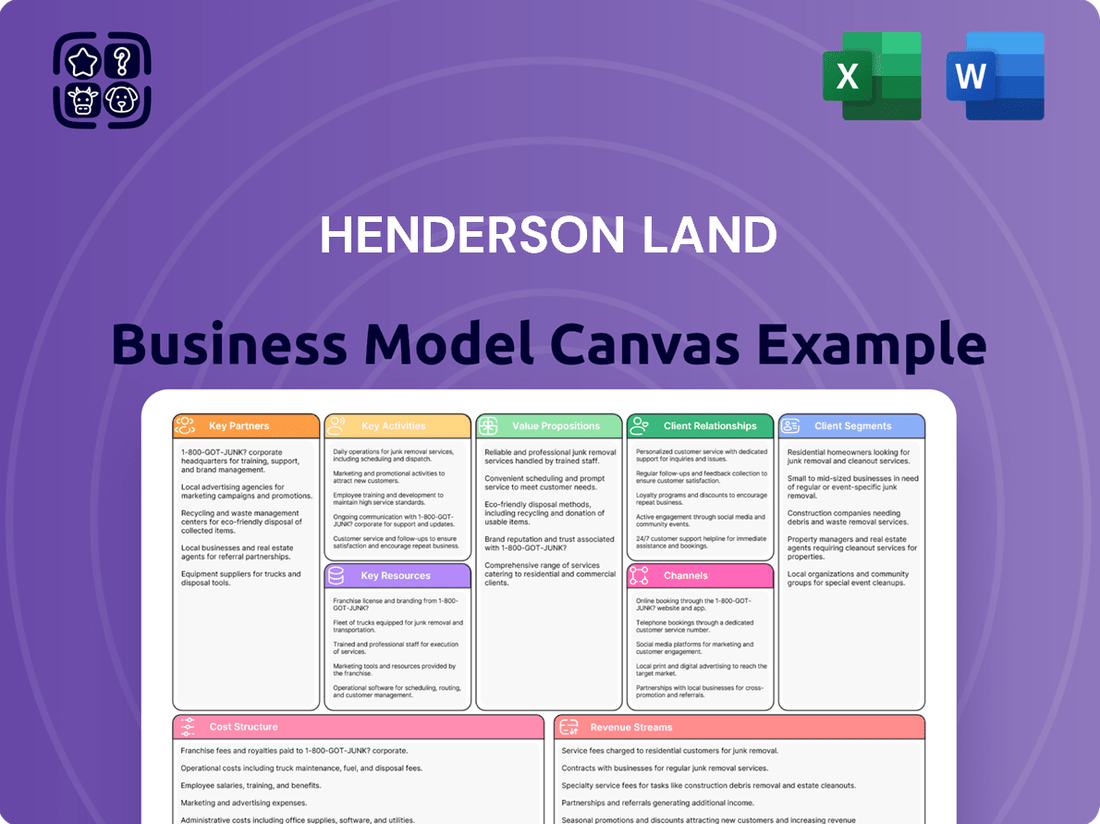

Discover the strategic core of Henderson Land's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in the competitive real estate market. Ready to unlock these insights for your own ventures?

Partnerships

Henderson Land frequently engages in joint ventures with other prominent property developers. This strategy allows them to pool resources and expertise, particularly for large-scale residential and commercial projects, thereby mitigating risks and sharing investment burdens. For instance, their collaboration with New World Development on projects like 8 Castle Road showcases this approach, enabling them to undertake more complex developments and expand their market reach.

Henderson Land cultivates robust partnerships with financial institutions, crucial for funding its vast development projects and investment portfolio. These relationships enable access to essential capital through various instruments.

The company actively utilizes loans and has recently demonstrated its diversified funding approach by raising HK$8 billion in convertible bonds in July 2025. This capital infusion is earmarked for general corporate purposes and refinancing existing debt, highlighting strategic financial management.

Henderson Land collaborates with a robust network of construction contractors and suppliers, essential for bringing its ambitious projects to life. This includes established building firms, specialized subcontractors, and providers of high-quality construction materials, all vetted for their reliability and expertise.

These key partnerships are fundamental to Henderson Land's ability to maintain rigorous construction standards and ensure projects are delivered on schedule. For instance, in 2024, the company continued to foster these relationships, leveraging their collective capabilities to manage complex urban developments and residential complexes, reflecting a commitment to quality that underpins its brand reputation.

Furthermore, these collaborations are vital for integrating innovative and sustainable building materials and practices. Henderson Land actively works with suppliers who can provide eco-friendly options, supporting the company's strategic focus on environmental responsibility and long-term value creation in its developments.

Government and Regulatory Bodies

Henderson Land's engagement with government and regulatory bodies is crucial for navigating the complex landscape of property development. These collaborations are vital for securing approvals, licenses, and permits, which are fundamental to initiating and completing projects. For instance, in 2024, the Hong Kong government continued its focus on urban renewal, a sector where Henderson Land actively participates. This involves adhering to stringent planning and environmental regulations, ensuring sustainable development practices.

These partnerships also enable Henderson Land to contribute to urban redevelopment initiatives, shaping the future of Hong Kong's cityscape. By working closely with authorities, the company ensures compliance with all local planning ordinances and environmental protection standards. This proactive approach minimizes delays and fosters a stable operating environment, which is critical for long-term investment and growth. The company's ability to secure land parcels and obtain necessary building approvals is directly influenced by the strength of these governmental relationships.

- Securing Approvals: Essential for obtaining permits and licenses for construction and development projects.

- Urban Redevelopment: Facilitates participation in government-led urban renewal programs.

- Regulatory Compliance: Ensures adherence to planning, environmental, and building codes.

- Policy Influence: Opportunities to contribute to policy discussions affecting the property sector.

Technology and Innovation Partners

Henderson Land actively collaborates with technology and innovation partners to imbue its properties with cutting-edge smart building features and sustainable solutions. This strategic approach ensures properties are equipped with advanced building technologies and integrated smart systems designed for enhanced energy efficiency and an improved user experience.

A prime example of this partnership strategy is evident in projects like The Henderson, which has achieved multiple platinum-level certifications, underscoring a commitment to high standards in sustainability and technological integration. These collaborations are crucial for staying ahead in a rapidly evolving real estate market.

- Technology Integration: Partnering with tech firms to implement smart building management systems, IoT devices, and data analytics for operational efficiency.

- Sustainability Focus: Collaborating with research institutions and green technology providers to incorporate advanced energy-saving and eco-friendly solutions.

- User Experience Enhancement: Working with innovators to develop smart home features, digital concierge services, and personalized environmental controls for residents and tenants.

- Future-Proofing: Engaging with forward-thinking companies to adopt emerging technologies that anticipate future market demands and regulatory changes.

Henderson Land's key partnerships are multifaceted, encompassing joint ventures with fellow developers to share risk and expertise on large projects, and strong ties with financial institutions to secure vital funding. These collaborations are critical for accessing capital, as demonstrated by their HK$8 billion convertible bond issuance in July 2025. The company also relies on a network of construction contractors and material suppliers to ensure quality and timely project completion, a strategy that remained central in 2024.

What is included in the product

A comprehensive, pre-written business model tailored to Henderson Land's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Saves hours of formatting and structuring your own business model by providing a pre-defined framework for Henderson Land's operations.

Condenses Henderson Land's complex strategy into a digestible, one-page format for quick review and understanding of their value proposition.

Activities

Henderson Land's key activity of property development for sale encompasses the entire lifecycle from land acquisition and meticulous planning to sophisticated design and construction. This process culminates in the creation of diverse residential and commercial properties offered directly to the market.

The company's commitment to this segment is evident in its robust pipeline. For 2025, Henderson Land is set to unveil approximately 12 projects, collectively featuring around 5,400 residential units in Hong Kong. This strategic focus highlights their ongoing engagement in delivering new housing and commercial spaces.

Henderson Land actively develops and manages a broad range of investment properties, encompassing offices, retail centers, and industrial sites. This strategy is designed to create a consistent stream of rental income for the company.

In 2024, Henderson Land saw strong performance in its leasing activities. For instance, its investment properties in key urban areas such as Shanghai and Guangzhou maintained healthy leasing rates, which played a crucial role in boosting the company's overall revenue for the year.

Henderson Land offers extensive property management for its own developments and investments, focusing on top-tier maintenance, security, and tenant happiness. This integrated approach boosts the long-term worth and smooth operation of their property holdings.

In 2024, Henderson Land Development Company Limited reported a significant portion of its revenue derived from property rentals and management, underscoring the importance of this segment. The company's commitment to high operational standards in property management directly contributes to tenant retention and rental income stability, a key factor in their overall financial performance.

Construction and Infrastructure Projects

Henderson Land actively engages in construction services, undertaking projects that bolster its integrated business model. This segment is crucial for its property development pipeline, ensuring quality and timely delivery.

The company also strategically invests in infrastructure projects, a move that diversifies its revenue streams beyond residential and commercial property sales. This diversification contributes to a more resilient financial profile.

- Construction Services: Henderson Land directly manages construction for its developments, enhancing control over project execution and costs.

- Infrastructure Investment: The company participates in infrastructure ventures, such as transportation and utilities, generating stable, long-term returns.

- Revenue Diversification: These activities provide alternative income sources, reducing reliance on the cyclical property market.

- Synergistic Benefits: Construction and infrastructure involvement create synergies with its core property business, supporting overall growth and market presence.

Hotel and Energy Business Operations

Henderson Land actively manages hotel operations, contributing to diversified revenue. For instance, in 2023, the company's hotel segment generated HKD 1.06 billion in revenue. This diversification helps to offset the inherent volatility of the property market.

The company also holds significant interests in the utility and energy sectors, notably through its substantial stake in The Hong Kong and China Gas Company Limited (Towngas). Towngas reported a core net profit of HKD 4.05 billion for 2023. These utility operations offer stable, recurring income, providing a crucial buffer against property development cycles.

- Diversified Revenue Streams: Hotel and utility operations provide income beyond property development.

- Stability and Reduced Cyclicality: Utility businesses offer predictable earnings, smoothing out property market fluctuations.

- Strategic Investments: Holding interests in companies like Towngas leverages essential service demand for consistent returns.

- Operational Synergies: While distinct, these operations contribute to the overall resilience and financial strength of Henderson Land.

Henderson Land's key activities include property development, where they acquire land, plan, design, and construct residential and commercial properties for sale. They also manage a portfolio of investment properties, generating rental income. Furthermore, the company engages in construction services and strategic infrastructure investments to diversify revenue and leverage synergies with their core business.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Property Development for Sale | Acquisition, planning, design, and construction of residential and commercial properties. | ~5,400 residential units across 12 projects planned for Hong Kong in 2025. |

| Investment Property Management | Developing and managing offices, retail centers, and industrial sites for rental income. | Healthy leasing rates observed in key urban areas like Shanghai and Guangzhou in 2024. |

| Construction Services | Direct management of construction for its developments to ensure quality and timely delivery. | Integral to supporting the property development pipeline. |

| Infrastructure Investment | Strategic participation in infrastructure projects for stable, long-term returns. | Contributes to revenue diversification beyond the property market. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as presented, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive analysis of Henderson Land's business strategy, ready for your review and application.

Resources

Henderson Land boasts a substantial land bank, particularly in Hong Kong and Mainland China. This extensive reserve is a bedrock for future development projects, ensuring a pipeline for sustained growth and revenue generation.

As of the first half of 2024, Henderson Land's property portfolio included a significant number of completed investment properties. These assets are vital for generating consistent recurring rental income, contributing stability to the company's financial performance.

Henderson Land possesses robust financial capital, enabling significant investments in ambitious, large-scale developments and supporting a conservative financial approach with careful debt oversight.

In 2024, the company demonstrated its strong funding capabilities by successfully issuing convertible bonds, a move that not only raised capital but also provided flexibility for future growth.

Furthermore, Henderson Land has actively secured sustainability-linked loans, tapping into cost-effective financing avenues that align with its environmental, social, and governance (ESG) commitments, showcasing a strategic approach to diverse funding access.

Henderson Land's experienced management team and skilled workforce are foundational intellectual resources. Their deep expertise spans property development, construction, and property management, directly fueling operational efficiency and strategic foresight.

In 2024, Henderson Land continued to leverage this human capital. For instance, their successful completion of the Henderson Central project, a significant urban regeneration initiative, directly reflects the project management acumen of their seasoned leaders and the technical proficiency of their construction teams.

Proprietary Construction and Property Management Expertise

Henderson Land leverages its proprietary construction and property management expertise, a cornerstone of its vertically integrated business model. This in-house capability allows for rigorous quality control from the ground up, ensuring that projects meet high standards and are completed efficiently. This integrated approach is a significant competitive differentiator in the property market.

This internal expertise translates into tangible benefits for Henderson Land. For instance, their commitment to quality construction management was evident in projects like the Henderson Centre, where meticulous oversight contributed to its successful development and ongoing tenant satisfaction. Their property management arm focuses on delivering premium services, enhancing the value and appeal of their portfolio.

- Vertically Integrated Operations: Henderson Land controls both construction and property management, fostering efficiency and quality assurance.

- Competitive Advantage: In-house expertise allows for superior project delivery and service, setting them apart in the market.

- Quality Control: Direct oversight throughout the project lifecycle ensures adherence to high standards.

- Enhanced Value: Premium property management services contribute to tenant retention and asset appreciation.

Reputable Brand and Market Intelligence

Henderson Land's enduring presence as a premier property developer in Hong Kong and Mainland China, dating back to 1976, forms a cornerstone of its brand equity. This long-established reputation is a significant intangible asset, fostering trust and recognition among customers and stakeholders.

The company leverages this reputable brand alongside robust market intelligence to guide its strategic decisions. This intelligence, gathered through continuous analysis of market trends, consumer behavior, and economic indicators, allows Henderson Land to identify lucrative investment opportunities and navigate the complexities of property development effectively.

- Established Reputation: Henderson Land has been a leading property conglomerate in Hong Kong and Mainland China since 1976, building a strong and trusted brand over decades.

- Market Intelligence: The company actively gathers and analyzes market data to make informed decisions about investments and development projects, ensuring alignment with current and future demand.

- Intangible Asset Value: The long-standing reputation and market insights are crucial intangible assets that contribute significantly to the company's competitive advantage and long-term success.

- Informed Decision-Making: By combining brand strength with sharp market intelligence, Henderson Land can confidently pursue strategic growth initiatives and mitigate potential risks in the dynamic property sector.

Henderson Land's key resources include its extensive land bank in Hong Kong and Mainland China, providing a solid foundation for future developments. The company also holds a significant portfolio of completed investment properties, generating stable recurring rental income, which was bolstered by a strong financial capital position in 2024, enabling substantial investments and prudent debt management.

The company's human capital, comprising an experienced management team and skilled workforce, is crucial for its operational efficiency and strategic direction, as demonstrated by successful projects like Henderson Central in 2024. This expertise is further amplified by proprietary construction and property management capabilities, ensuring quality control and premium services.

Henderson Land benefits from significant intangible assets, including its strong brand equity built since 1976 and robust market intelligence. This combination allows for informed strategic decisions, identifying lucrative opportunities and navigating the property market effectively.

| Key Resource | Description | 2024 Relevance/Data |

| Land Bank | Extensive holdings in Hong Kong & Mainland China | Crucial for pipeline development. Specific land acquisition details for 2024 were part of ongoing strategy. |

| Investment Properties | Completed assets generating rental income | Significant portion of portfolio contributing to recurring revenue. |

| Financial Capital | Robust funding capacity | Enabled large-scale investments; evidenced by successful convertible bond issuance in 2024. |

| Human Capital | Experienced management & skilled workforce | Drove successful project completion, e.g., Henderson Central. |

| Proprietary Expertise | In-house construction & property management | Ensures quality control and operational efficiency. |

| Brand Equity & Market Intelligence | Long-standing reputation & data analysis | Guides strategic decisions and competitive advantage. |

Value Propositions

Henderson Land distinguishes itself by providing a broad spectrum of residential and commercial properties. This includes everything from upscale homes to prime Grade-A office spaces and comprehensive, mixed-use developments, ensuring they meet a wide array of customer demands.

The company's dedication to maintaining high standards in both its products and customer service forms a core part of its value proposition. For instance, in 2024, Henderson Land continued its focus on premium residential projects, with several key developments contributing significantly to its sales performance, reflecting customer confidence in their quality.

Henderson Land champions sustainability, crafting buildings that are not only green and healthy but also intelligent, adhering to stringent environmental and social benchmarks.

The company’s commitment is evident in projects like The Henderson, which has garnered numerous platinum-level certifications, attracting tenants and investors prioritizing environmental responsibility.

This focus on eco-friendly and technologically advanced spaces positions Henderson Land favorably in a market increasingly valuing sustainable development, as demonstrated by the growing demand for green building certifications in 2024.

For investors, Henderson Land offers a compelling avenue for stable rental income, bolstered by its extensive and varied portfolio of investment properties. This diversification across different property types and locations helps to mitigate risk and ensure consistent returns.

The company's strategic land bank, a key asset, combined with consistently robust leasing rates, presents attractive long-term investment prospects. For instance, in 2024, Henderson Land continued to demonstrate strong leasing performance across its commercial and retail segments, contributing to predictable revenue streams.

Integrated Property and Related Services

Henderson Land offers customers a unified experience through its integrated property and related services. This encompasses everything from the initial purchase of a property to its ongoing upkeep and support, creating a comprehensive and convenient journey for clients.

This integrated approach streamlines the customer lifecycle, ensuring a high level of satisfaction and loyalty. For instance, in 2024, Henderson Land continued to emphasize its commitment to service excellence across its portfolio.

- Seamless Property Acquisition: Customers benefit from a streamlined process when buying properties developed by Henderson Land.

- Comprehensive Property Management: Ongoing maintenance, security, and operational services are provided to ensure properties remain in excellent condition.

- Value-Added Services: Beyond core property functions, Henderson Land may offer related services that enhance the living or working experience for its customers.

- Customer-Centric Approach: The integration aims to provide a holistic and supportive environment for all stakeholders, fostering long-term relationships.

Contribution to Urban Development and Community

Henderson Land actively shapes urban landscapes through significant infrastructure investments and large-scale urban redevelopment initiatives. These projects are designed to revitalize city districts, enhancing their functionality and aesthetic appeal.

The company's G.I.V.E. (Growth, Innovation, Value, Engagement) strategies underscore a deep commitment to fostering sustainable community development. This approach aims to create enduring benefits that extend beyond immediate project completion.

- Urban Regeneration: Henderson Land’s involvement in projects like the revitalisation of the former Kai Tak airport area in Hong Kong demonstrates its role in transforming underutilized spaces into vibrant urban hubs.

- Community Infrastructure: The company often incorporates public amenities, green spaces, and improved transportation links within its developments, directly benefiting local residents and enhancing community well-being.

- Economic Impact: These developments contribute to local economies through job creation during construction and ongoing economic activity once completed, as seen in mixed-use projects that attract businesses and residents.

Henderson Land's value proposition is built on delivering a diverse portfolio of high-quality residential and commercial properties, from luxury homes to prime office spaces. Their commitment to excellence extends to customer service, as evidenced by their continued focus on premium residential projects in 2024, which resonated well with buyers. Furthermore, the company champions sustainability and intelligent building design, adhering to strict environmental standards, a strategy that aligns with the growing market demand for green certifications observed throughout 2024.

Henderson Land provides investors with a stable income stream through its diversified property portfolio, mitigating risk and ensuring consistent returns. Their strategic land bank and strong leasing performance across commercial and retail segments in 2024 highlight attractive long-term investment potential. The company also offers a seamless, integrated customer experience, covering property acquisition through to ongoing management and support, fostering client loyalty and satisfaction.

The company actively contributes to urban development through significant infrastructure investments and large-scale redevelopment projects, revitalizing city districts. These initiatives, guided by their G.I.V.E. strategies, focus on sustainable community growth, creating lasting benefits. Their involvement in projects like the Kai Tak area revitalization showcases their ability to transform spaces, while the inclusion of public amenities and green spaces enhances community well-being and stimulates local economies.

| Key Value Proposition Aspect | Description | 2024 Relevance/Data Point |

|---|---|---|

| Diverse Property Offerings | Residential (luxury homes), Commercial (Grade-A offices), Mixed-Use Developments | Continued focus on premium residential projects contributing to sales performance. |

| Commitment to Quality & Service | High standards in property and customer service. | Customer confidence reflected in sales of quality-focused projects. |

| Sustainability & Intelligent Design | Green, healthy, and technologically advanced buildings. | Growing market demand for green building certifications in 2024. |

| Investment Stability | Stable rental income from diverse property portfolio. | Strong leasing performance across commercial and retail segments in 2024. |

| Integrated Customer Experience | Seamless property acquisition to ongoing support. | Emphasis on service excellence across the portfolio in 2024. |

| Urban Development & Community Impact | Infrastructure investments, urban redevelopment, community amenities. | Revitalisation of Kai Tak area as an example of urban transformation. |

Customer Relationships

Henderson Land leverages dedicated sales and leasing teams to foster direct engagement with prospective buyers and tenants. This approach ensures personalized service, crucial for understanding specific needs and efficiently closing transactions.

These specialized teams are instrumental in driving Henderson Land's success, contributing to strong sales performance. For instance, in 2024, the company reported robust sales figures for its residential developments, underscoring the effectiveness of this direct customer relationship strategy.

Henderson Land cultivates enduring customer relationships by providing top-tier property management. This includes meticulous maintenance, robust security, and responsive resident support, aiming to exceed expectations and foster loyalty.

In 2024, Henderson Land's commitment to service excellence was evident, contributing to a high tenant retention rate across its diverse portfolio, which includes residential, commercial, and retail spaces. This focus on resident satisfaction is a cornerstone of their business model.

Henderson Land prioritizes clear communication with its investors. This includes providing regular financial reports, holding annual general meetings, and conducting investor presentations to keep shareholders updated on the company's performance and strategic direction.

In 2024, Henderson Land's commitment to transparency was evident in its detailed interim and final results announcements, which offered insights into its property development pipeline and rental income streams. The company's dividend policy, a key focus for many investors, was consistently communicated through these channels.

Customer Feedback and Service Improvement

Henderson Land actively gathers customer feedback through various channels to refine its property developments and service standards. This commitment to listening ensures their offerings remain aligned with evolving buyer preferences and market trends.

By incorporating this feedback, Henderson Land fosters stronger customer relationships and builds loyalty, a critical factor in the competitive Hong Kong property market. For instance, in 2024, the company continued to emphasize customer engagement initiatives across its residential projects.

- Customer Feedback Mechanisms: Henderson Land likely utilizes surveys, online platforms, and direct communication channels to solicit input on property features, amenities, and after-sales service.

- Service Improvement Cycle: Feedback collected is systematically analyzed to identify areas for enhancement, leading to iterative improvements in property management and customer support.

- Market Adaptability: This continuous feedback loop allows Henderson Land to adapt its strategies, ensuring its projects meet the dynamic demands of the real estate market.

- Customer Loyalty: By demonstrating responsiveness to customer needs, the company aims to cultivate long-term relationships and repeat business.

Community Engagement and CSR Initiatives

Henderson Land actively cultivates community ties through its corporate social responsibility (CSR) programs, embodying its commitment to the community. These efforts foster positive public perception and deepen relationships beyond mere business transactions.

In 2024, Henderson Land continued its focus on community engagement, notably through initiatives like the "Henderson Land Art for All" program, which aims to make art accessible and enjoyable for the public. This aligns with their broader strategy of contributing positively to society.

- Community Pillar: Henderson Land's 'Endeavour for Community' pillar guides its CSR activities, demonstrating a commitment to social well-being.

- Public Perception: These initiatives are designed to build goodwill and enhance the company's reputation among the general public.

- Beyond Transactions: The company strives to create meaningful connections that extend beyond the typical customer-business relationship.

Henderson Land's customer relationships are built on direct engagement via specialized sales and leasing teams, ensuring personalized service that drives successful transactions. For instance, in 2024, the company reported strong residential sales, highlighting the effectiveness of this direct approach.

Exceptional property management, including maintenance, security, and responsive support, fosters enduring relationships and customer loyalty. This commitment to service excellence in 2024 contributed to high tenant retention across their diverse property portfolio.

Transparent communication with investors, through regular financial reports and meetings, is a cornerstone of Henderson Land's strategy. In 2024, their detailed interim and final results announcements kept shareholders informed about performance and strategic direction.

Actively gathering and acting on customer feedback through various channels allows Henderson Land to refine its offerings and adapt to market demands. This continuous feedback loop, evident in their 2024 customer engagement initiatives, strengthens relationships and builds loyalty.

| Customer Relationship Aspect | Strategy | 2024 Impact/Focus |

|---|---|---|

| Direct Engagement | Dedicated Sales & Leasing Teams | Robust residential sales performance |

| Property Management | Top-tier maintenance, security, support | High tenant retention across portfolio |

| Investor Communication | Regular financial reports, AGMs | Transparent dividend policy communication |

| Feedback Integration | Surveys, online platforms, direct communication | Enhanced customer engagement initiatives |

Channels

Henderson Land operates its own dedicated sales galleries and leasing offices. These physical spaces are crucial for directly engaging with potential buyers and tenants, offering a controlled environment to present properties and brand messaging. This direct approach fosters a premium customer experience, allowing for personalized interactions and immediate feedback.

Henderson Land actively partners with external real estate agencies and brokers to broaden its property sales and leasing reach. These collaborations are crucial for tapping into established client networks and specialized market knowledge, effectively extending the company's market presence beyond its internal capabilities.

In 2024, the Hong Kong property market saw significant activity, with agencies playing a vital role in facilitating transactions. For instance, the Centaline Property Index, a key indicator, reflects the volume and price trends that these agencies navigate. Henderson Land's engagement with such channels allows them to access a diverse pool of potential buyers and tenants, thereby optimizing sales velocity and rental occupancy rates for their developments.

Henderson Land leverages its official website and prominent online property portals as key channels. These digital platforms are essential for showcasing properties, offering detailed information, and capturing potential buyer interest, ensuring wide reach and efficient communication.

In 2024, the digital real estate market continued its strong growth. Major property portals reported significant year-over-year increases in user engagement, with many transactions initiated or influenced by online searches. Henderson Land's presence on these platforms ensures it connects with a vast audience actively seeking property solutions.

Investor Relations Platforms

Henderson Land disseminates crucial investor information through multiple channels, ensuring transparency and accessibility. These include official stock exchange filings, which are legally mandated and provide comprehensive financial data. The company’s dedicated investor relations website serves as a central hub for news, reports, and presentations. Furthermore, engagement with financial news outlets helps reach a broader audience within the financial community.

These platforms are vital for maintaining compliance with regulatory requirements and for effectively communicating the company's performance and strategic direction. For instance, during 2024, Henderson Land, like other major listed companies, would have provided updates on its financial results, property development progress, and any significant corporate actions through these channels. The accessibility of this information empowers investors to make informed decisions.

- Official Stock Exchange Filings: Adherence to listing rules for timely disclosure of financial results and material events.

- Investor Relations Website: A dedicated portal offering annual reports, interim results, press releases, and corporate governance information.

- Financial News Outlets: Leveraging media to disseminate key announcements and company performance highlights to a wider financial audience.

Targeted Marketing and Public Relations

Henderson Land employs extensive marketing campaigns, advertising, and public relations to build excitement for new property launches and solidify its brand image. These efforts are crucial for reaching target demographics and influencing how the public perceives their projects.

In 2024, Henderson Land continued to invest heavily in both traditional and digital channels. For instance, their campaigns often feature high-profile collaborations and digital content designed to resonate with specific buyer profiles, such as young professionals or affluent families.

- Extensive Marketing Campaigns: In 2024, Henderson Land's marketing spend across various channels aimed to maximize reach for key developments like the Henderson Hub and One Canton Road.

- Advertising and Public Relations: The company actively engaged in media relations and advertising placements, including significant digital advertising spend on platforms like Google and social media to target potential buyers.

- Brand Visibility: Through consistent messaging and strategic PR, Henderson Land aims to maintain its reputation as a leading developer in Hong Kong's competitive real estate market.

Henderson Land utilizes a multi-faceted channel strategy encompassing direct sales, partnerships, and digital platforms. Their own sales galleries and leasing offices provide a controlled environment for customer engagement, while collaborations with external real estate agencies expand market reach and tap into established networks. This blend ensures comprehensive coverage and optimized property transactions.

In 2024, the Hong Kong property market saw continued reliance on these channels. Agencies like Centaline played a significant role, with their indices reflecting market dynamics. Henderson Land's presence on online portals also remained crucial, connecting them with a broad audience actively seeking properties, highlighting the dual importance of physical and digital touchpoints.

Henderson Land also maintains robust investor communication through official stock exchange filings, its dedicated investor relations website, and engagement with financial news outlets. These channels ensure transparency and accessibility of crucial corporate information, enabling informed decision-making by stakeholders.

Marketing and PR efforts are integral to Henderson Land's channel strategy, building brand awareness and driving interest in new developments. In 2024, significant investment in both traditional and digital advertising campaigns, including collaborations and targeted online content, underscored their commitment to reaching diverse buyer segments and reinforcing their market position.

Customer Segments

Residential Property Buyers are the core focus for Henderson Land, encompassing individuals and families looking for their next home. This segment spans from first-time buyers to those seeking to upgrade or invest in luxury residences. Henderson Land offers a wide array of residential properties, thoughtfully developed to meet diverse needs and budgets across Hong Kong and Mainland China.

In 2024, the Hong Kong property market saw continued demand, with Henderson Land actively participating. For instance, their projects like the Murray House in Central, a luxury residential development, attracted significant interest, reflecting the enduring appeal of prime locations. The company's strategy involves catering to various income levels, ensuring accessibility for a broad range of buyers.

Commercial tenants are the backbone of Henderson Land's property portfolio, encompassing a broad spectrum from global giants to neighborhood businesses. These entities require diverse commercial spaces, including prime office locations and sought-after retail storefronts, to conduct their operations and engage with customers.

In 2024, Henderson Land continues to attract a wide array of businesses. For instance, the company's developments cater to multinational corporations seeking prestigious office addresses, as well as local retail and food & beverage operators looking for high-traffic locations. This diversity ensures a robust and resilient tenant base.

The company's ability to secure anchor tenants, such as the financial services firm Jane Street at The New Central Harbourfront, underscores its appeal to major corporations. Such anchor tenants not only provide significant rental income but also enhance the prestige and desirability of the properties for other businesses.

Property investors, both institutional and individual, are a crucial customer segment for Henderson Land. They are primarily driven by the prospect of long-term capital appreciation and consistent rental income from their property acquisitions. This segment actively seeks opportunities within Henderson Land's portfolio, whether through direct investment in properties or by investing in the company's listed shares.

Hotel Guests and Patrons

Henderson Land's hotel operations cater to a broad spectrum of guests. This primary segment comprises both leisure travelers looking for a relaxing stay and business travelers requiring convenient and efficient accommodation for their work trips. These individuals are seeking not just a room, but a comprehensive hospitality experience, including dining and other amenities.

Beyond overnight stays, the customer base extends to patrons who utilize Henderson Land's catering services and other hospitality-related offerings. This includes individuals attending events, dining at hotel restaurants, or availing themselves of any ancillary services provided. In 2024, the hospitality sector continued to see a strong rebound, with many hotels reporting increased occupancy rates and revenue per available room (RevPAR) compared to pre-pandemic levels, reflecting sustained demand.

- Leisure Travelers: Individuals and families on vacation or short breaks.

- Business Travelers: Professionals on work assignments, conferences, or corporate events.

- Event Attendees: Guests participating in banquets, meetings, or social functions held at hotel venues.

- Diners and Patrons: Customers utilizing hotel restaurants, bars, and other F&B outlets.

Utility and Energy Consumers

Henderson Land's utility and energy segment caters to a vast array of customers, encompassing residential, commercial, and industrial users who depend on essential services. Through its significant stake in The Hong Kong and China Gas Company Limited (Towngas), the company ensures the reliable supply of town gas, a critical resource for countless households and businesses in Hong Kong and mainland China.

The customer base extends beyond just gas provision. Henderson Land, via its utility interests, also plays a role in water supply and is increasingly involved in developing and offering emerging energy solutions. This diversified approach means they serve everyone from individual homeowners needing heating and cooking fuel to large-scale industrial operations requiring consistent energy inputs.

In 2023, Towngas reported a net profit attributable to shareholders of HKD 3,549 million, underscoring the scale of its operations and the substantial customer base it serves. This financial performance highlights the consistent demand for the utility services provided to millions of consumers.

- Residential Customers: Millions of households rely on Towngas for cooking, water heating, and space heating.

- Commercial Clients: Restaurants, hotels, and retail businesses utilize town gas for their diverse operational needs.

- Industrial Users: Factories and manufacturing plants depend on a stable gas supply for production processes.

- Emerging Energy Consumers: A growing segment seeking cleaner and more sustainable energy alternatives provided by the group.

Henderson Land's customer segments are diverse, ranging from individuals seeking residential properties to institutional investors. The company also serves a broad base of commercial tenants and hospitality guests. Furthermore, its utility arm caters to millions of residential, commercial, and industrial users.

In 2024, the company's focus remains on meeting the varied needs of these groups. For residential buyers, Henderson Land offers a spectrum of properties, from affordable housing to luxury residences, reflecting the dynamic Hong Kong and mainland China markets. Commercial tenants, including multinational corporations and local businesses, are drawn to prime office and retail spaces.

The hospitality segment attracts both leisure and business travelers, with a growing emphasis on enhanced guest experiences. The utility segment, primarily through Towngas, ensures reliable energy supply to a vast customer network, with a growing interest in sustainable energy solutions.

Cost Structure

Henderson Land's cost structure heavily features land acquisition and development expenses. In 2024, the company continued its strategic expansion of its development land bank, which requires significant upfront capital for purchasing prime locations. These costs are fundamental to their long-term growth strategy, as securing future project sites is paramount.

Construction and material expenses are a significant part of Henderson Land's cost structure. These include the actual costs incurred in building residential, commercial, and infrastructure projects, encompassing labor, a wide array of building materials, and the necessary equipment.

For fiscal year 2024, Henderson Land reported that its cost of sales represented 65% of its total revenue, underscoring the substantial investment in project development and execution.

Henderson Land incurs significant ongoing expenses to manage and maintain its vast property portfolio. These costs cover essential services like security, cleaning, and utilities across its investment properties and completed developments.

In 2024, such operational expenditures are crucial for preserving asset value and ensuring tenant satisfaction. For instance, a substantial portion of Henderson Land's operating expenses are allocated to property upkeep, reflecting the sheer scale of its holdings.

Financing Costs and Debt Servicing

Henderson Land, being a capital-intensive developer, faces substantial financing costs. These primarily stem from interest payments on various forms of debt, including bank loans and outstanding convertible bonds. Effectively managing these expenses is paramount to maintaining profitability and financial stability.

The company's need to raise significant capital, such as the HK$8 billion in convertible bonds issued in 2020, directly contributes to these financing costs. For instance, the interest expense on these bonds, along with other borrowings, forms a core component of their cost structure.

- Interest Expense: In the fiscal year ending June 30, 2024, Henderson Land's finance costs, largely driven by interest on borrowings, were a significant factor in its profitability.

- Debt Servicing: The regular payments required to service its debt obligations, including principal and interest, represent a fixed outflow that must be managed diligently.

- Capital Raising Impact: The issuance of new debt or equity to fund projects directly influences future financing costs, necessitating careful consideration of the cost of capital.

Staff Salaries and Administrative Overheads

Henderson Land's cost structure is significantly influenced by staff salaries and administrative overheads across its diverse operations. This includes compensation for employees in management, sales, construction, and property management, ensuring smooth functioning of all business segments.

General administrative expenses are also a crucial component, encompassing costs like office rent, marketing initiatives, and essential legal services. These overheads are vital for maintaining the company's operational infrastructure and brand presence in the competitive property market.

For the fiscal year 2024, General & Administrative costs represented a substantial operating expense for Henderson Land, reflecting the scale of its extensive business activities and ongoing development projects.

- Employee Compensation: Salaries for management, sales teams, construction crews, and property managers.

- Administrative Expenses: Costs associated with office rent, marketing campaigns, and legal counsel.

- FY2024 Impact: General & Administrative costs were a significant operating expense in the fiscal year 2024.

Henderson Land's cost structure is dominated by land acquisition and development, followed by construction expenses. In fiscal year 2024, cost of sales was 65% of revenue, highlighting these project-related expenditures. Ongoing property maintenance and financing costs, including interest on debt, are also substantial components. Finally, administrative overheads and staff compensation are essential for operational execution.

| Cost Category | Description | FY2024 Relevance |

| Land Acquisition & Development | Costs to secure future project sites. | Significant upfront capital expenditure. |

| Construction & Materials | Labor, materials, and equipment for building projects. | Core component of cost of sales. |

| Property Maintenance | Security, cleaning, utilities for existing portfolio. | Preserves asset value and tenant satisfaction. |

| Financing Costs | Interest on loans and convertible bonds. | Impacted by debt levels, e.g., HK$8 billion in 2020 bonds. |

| Staff & Administration | Salaries, office rent, marketing, legal services. | Essential for operational infrastructure and brand presence. |

Revenue Streams

Henderson Land's primary income source is the sale of properties it builds, both for people to live in and for businesses.

In the fiscal year 2024, the company saw significant income from its Hong Kong property development projects, which brought in HK$11.7 billion. This figure alone accounted for 46% of its overall revenue, highlighting the importance of this segment.

Henderson Land secures a significant and dependable income through the leasing of its varied investment properties. This portfolio encompasses office buildings, retail spaces, and industrial facilities, providing a consistent revenue flow.

In the fiscal year 2024, the company reported HK$6.5 billion in pre-tax net rental income. This figure underscores the substantial contribution of property leasing to Henderson Land's overall financial performance.

Henderson Land generates revenue through property management fees, a crucial component of its integrated business model. These fees are collected for providing comprehensive management services, not just for its own extensive portfolio but also potentially for third-party properties.

Hotel Operations Revenue

Henderson Land's hotel operations are a significant contributor to its revenue, encompassing income from guest room rentals, dining and beverage services, and various other hospitality amenities. This segment diversifies the company's income streams beyond its core property development and investment activities.

In 2024, Henderson Land's hotel portfolio, which includes properties like The Murray, Hong Kong, and the Grand Hyatt Hong Kong, continued to demonstrate resilience. For instance, the company reported that its hotels generally saw an uplift in occupancy rates and average daily rates compared to prior periods, reflecting a recovery in the tourism and business travel sectors.

- Room Bookings: This is the primary revenue driver, generated from overnight stays in the company's hotel properties.

- Food & Beverage Sales: Income from restaurants, bars, banqueting, and in-room dining services.

- Other Hospitality Services: Revenue from amenities such as spas, fitness centers, event spaces, and retail outlets within the hotels.

Utility and Energy Sales

Henderson Land benefits from a consistent revenue flow through its involvement in utility and energy sectors. This includes the production, transmission, and sale of essential services like gas and water supply, which are inherently stable and recurring income generators.

The company's financial performance in fiscal year 2024 highlights the significance of these operations. Specifically, Henderson Land reported a share of after-tax net profit amounting to HK$3.0 billion from its stake in Hong Kong and China Gas.

- Stable Income: Revenue from utility and energy sales provides a predictable and recurring income stream.

- Key Contributor: The gas and water supply businesses are vital to Henderson Land's overall financial health.

- FY2024 Performance: A profit share of HK$3.0 billion from Hong Kong and China Gas underscores the segment's profitability.

Henderson Land's revenue streams are diverse, spanning property development and sales, property leasing, hotel operations, and utility businesses. The company's strong performance in fiscal year 2024 demonstrates the robust contribution of each segment to its overall financial health.

| Revenue Stream | FY2024 Contribution (HK$ billion) | Percentage of Total Revenue |

|---|---|---|

| Property Development & Sales | 11.7 | 46% |

| Property Leasing (Net Rental Income) | 6.5 | N/A* |

| Utility & Energy (Profit Share from HK & China Gas) | 3.0 | N/A* |

*Note: Percentage of total revenue for leasing and utility segments is not directly provided but their financial impact is significant.

Business Model Canvas Data Sources

The Henderson Land Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and extensive market research reports. These diverse data sources provide a comprehensive view of our operations and market positioning.