Henderson Land Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

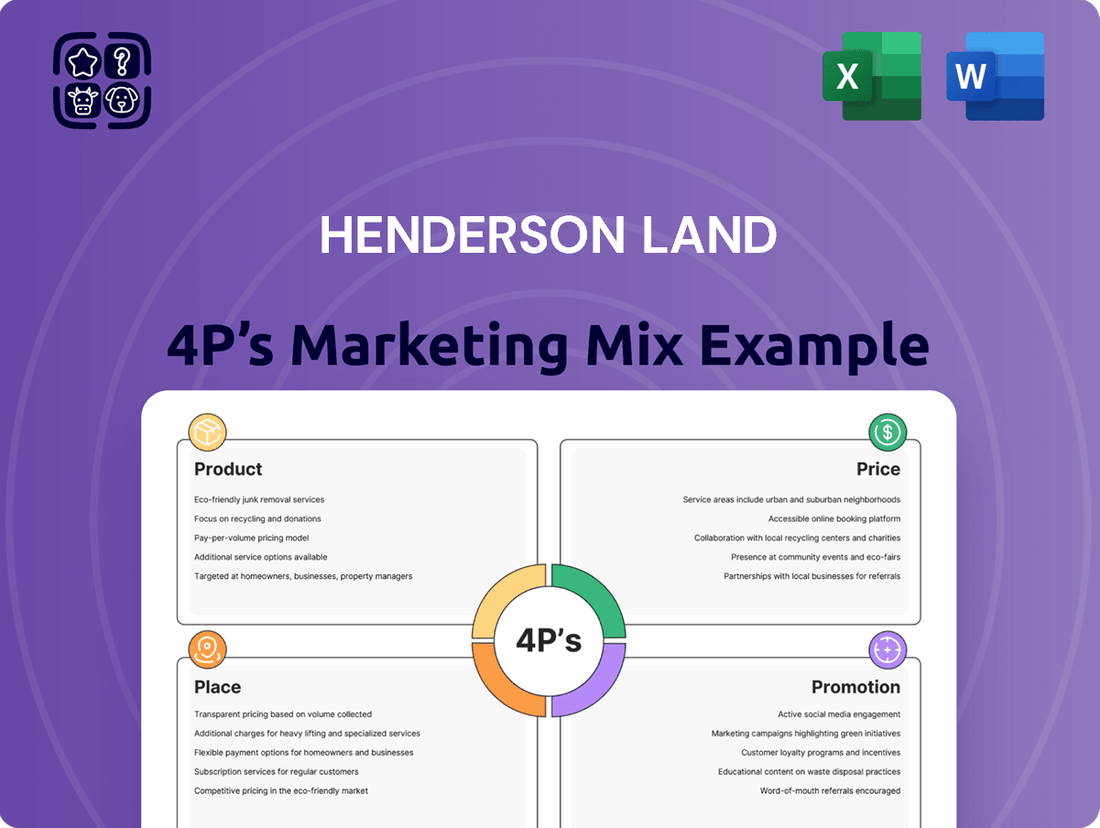

Discover how Henderson Land masterfully crafts its market presence through a strategic 4Ps approach, from its diverse property portfolio to its competitive pricing and targeted promotions.

Dive deeper into the specifics of Henderson Land's product innovation, pricing architecture, distribution channels, and promotional campaigns with our comprehensive analysis.

Unlock actionable insights and a ready-to-use framework by purchasing the full 4Ps Marketing Mix Analysis for Henderson Land, perfect for professionals and students alike.

Product

Henderson Land's product strategy is characterized by its diverse property portfolio, spanning residential, commercial, and mixed-use developments. This broad offering allows them to tap into various market segments and customer needs. For instance, as of the first half of 2024, the company reported a robust pipeline of residential projects, alongside a stable income stream from its commercial properties.

This diversification is a key risk mitigation strategy, preventing over-reliance on any single property type. By maintaining a balance between residential sales, rental income from offices and retail spaces, and the unique appeal of mixed-use projects, Henderson Land aims for sustained growth and resilience. Their commitment to developing a wide range of properties underscores their adaptability to evolving market dynamics.

Henderson Land's integrated business model extends far beyond traditional property development and investment. It encompasses property management, construction, infrastructure, energy, and hotel operations, creating a synergistic ecosystem that offers a full spectrum of real estate lifecycle services.

This diversification allows Henderson Land to capture value at multiple stages, from initial construction to ongoing property management and hospitality services. For instance, their property management arm ensures tenant satisfaction and asset longevity, directly impacting the value of their development portfolio.

In 2024, Henderson Land continued to leverage this integrated approach, with its diverse business segments contributing to overall financial resilience. The company's commitment to a broad range of services, including infrastructure projects like the Hong Kong-Zhuhai-Macao Bridge, underscores its strategic depth and ability to generate stable revenue streams outside of core property cycles.

Henderson Land emphasizes premium and sustainable design, exemplified by projects like 'The Henderson,' a super Grade-A commercial building. This focus attracts discerning tenants and investors seeking quality and prestige.

Sustainability is a core tenet, with the company actively pursuing certifications such as the BEAM Plus Gold Rating. This commitment to eco-friendly designs not only aligns with global environmental trends but also enhances long-term property value and operational efficiency, a crucial factor in the 2024-2025 property market outlook.

Innovation in Construction

Henderson Land champions innovation in construction through advanced techniques like Design for Manufacture and Assembly (DfMA). This strategy leverages prefabrication and materials such as aluminum, significantly boosting building efficiency and environmental responsibility.

Their commitment to cutting-edge building practices is evident in projects that demonstrate faster construction timelines and reduced waste. For instance, in 2024, Henderson Land continued to integrate DfMA principles, aiming for a 15% reduction in on-site construction time for new developments compared to traditional methods.

This focus on innovation also extends to material science, with an increased adoption of sustainable and high-performance alternatives. By prioritizing these methods, Henderson Land not only enhances project delivery but also aligns with growing market demand for greener and more resilient infrastructure.

- DfMA Implementation: Streamlining construction through prefabrication.

- Material Innovation: Utilizing aluminum and other advanced materials.

- Efficiency Gains: Targeting reduced construction timelines and waste.

- Sustainability Focus: Enhancing environmental responsibility in building practices.

Community-Centric Developments

Henderson Land's commitment to community-centric developments is evident in their new residential projects, which are crafted with a holistic living concept. These developments prioritize wellness, art, innovation, and sustainability, aiming to enhance both liveability and the overall well-being of residents and the wider community. This approach moves beyond just providing housing to fostering a vibrant and supportive environment.

The company actively supports initiatives that strengthen community bonds and provide tangible assistance. A prime example is their backing of the Community Living Room program, which offers crucial support to families facing challenges. This demonstrates a dedication to social responsibility that extends beyond their property developments, contributing to the social fabric of the areas they serve.

Henderson Land's focus on community well-being is reflected in their strategic investments. For instance, in 2024, the company announced plans to allocate a significant portion of its CSR budget towards community engagement programs, building on previous successes. This proactive stance in fostering community connections is a key differentiator in their marketing mix.

- Holistic Living: Projects integrate wellness, art, innovation, and sustainability for enhanced liveability.

- Community Support: Initiatives like the Community Living Room provide direct assistance to families in need.

- Social Responsibility: Demonstrated commitment to improving the well-being of residents and the broader community.

- Strategic Investment: Allocation of resources in 2024 towards community engagement programs underscores this focus.

Henderson Land's product strategy is defined by its diverse portfolio, encompassing residential, commercial, and mixed-use developments, catering to a broad spectrum of market needs. This diversification, as seen in their robust residential pipeline and stable commercial income streams reported in the first half of 2024, serves as a key risk mitigation tactic.

The company's integrated business model extends to property management, construction, and even infrastructure, creating a synergistic ecosystem. This allows Henderson Land to capture value throughout the real estate lifecycle, with their property management arm ensuring asset longevity and tenant satisfaction, crucial for portfolio value.

Innovation is central, with advanced construction techniques like Design for Manufacture and Assembly (DfMA) being implemented. By 2024, Henderson Land aimed for a 15% reduction in on-site construction time for new developments using these methods, alongside a focus on sustainable materials like aluminum to boost efficiency and environmental responsibility.

Community-centric developments are also a hallmark, integrating wellness, art, and sustainability to enhance liveability. Their commitment to social responsibility is further demonstrated through initiatives like the Community Living Room program, offering support to families, with significant CSR budget allocation in 2024 towards such engagement.

| Product Aspect | Description | Key Initiatives/Data (2024-2025) |

| Portfolio Diversity | Residential, Commercial, Mixed-Use | Robust residential pipeline; Stable commercial income (H1 2024) |

| Integrated Services | Property Management, Construction, Infrastructure | Synergistic value capture across real estate lifecycle |

| Innovation in Construction | DfMA, Material Science | Targeting 15% reduction in construction time; Increased use of aluminum |

| Community Focus | Holistic Living, Social Responsibility | Community Living Room program; Increased CSR allocation for engagement |

What is included in the product

This analysis offers a comprehensive examination of Henderson Land's marketing strategies, dissecting their Product, Price, Place, and Promotion efforts to reveal their market positioning.

It provides a grounded understanding of Henderson Land's approach, drawing on actual brand practices and competitive context for actionable insights.

Provides a clear, actionable framework to address market challenges, transforming complex marketing strategies into easily digestible solutions for Henderson Land.

Simplifies the strategic planning process for Henderson Land's marketing, offering a structured approach to overcome competitive hurdles and enhance customer engagement.

Place

Henderson Land boasts a robust geographic footprint, with substantial operations in both Hong Kong and mainland China. This dual-market strategy allows the company to capitalize on diverse economic cycles and regulatory environments.

The company's presence extends to prime locations within Hong Kong, alongside strategic developments in key second-tier cities across mainland China. This diversified approach mitigates risk and broadens market access. For instance, as of the first half of 2024, Henderson Land reported a significant portion of its revenue originating from its mainland China projects, underscoring the importance of this market.

Henderson Land consistently prioritizes prime locations for its developments, often choosing sites near major transportation hubs like MTR stations. For instance, their residential projects frequently benefit from excellent connectivity, a key factor in Hong Kong's fast-paced urban environment. This strategic site selection directly boosts property value and tenant/buyer interest.

Many Henderson Land projects leverage desirable natural settings, such as waterfront views, which significantly enhances their market appeal. The company's commitment to integrating developments with green spaces further elevates the living experience and desirability. In 2024, properties with such amenities continued to command premium pricing, reflecting strong demand.

Henderson Land strategically employs a diversified distribution strategy, utilizing direct sales for its new residential developments to connect directly with homebuyers. This approach allows for greater control over the customer experience and pricing for these high-value assets.

Complementing direct sales, the company leverages leasing as a primary channel for its substantial portfolio of investment properties, encompassing retail and office spaces. This ensures a consistent revenue stream and broad market penetration across various commercial sectors.

In 2024, Henderson Land's commitment to diversified distribution was evident in its robust sales performance for residential projects, alongside steady rental income from its prime commercial holdings, reflecting the effectiveness of its multi-channel market access.

Flagship Urban Redevelopment Projects

Henderson Land is a key player in ambitious urban redevelopment, exemplified by its significant role in Hong Kong's New Central Harbourfront. This project, a cornerstone of the company's strategy, aims to revitalize a prime waterfront area, creating a dynamic new district. The scale of these initiatives underscores Henderson Land's commitment to shaping urban landscapes and fostering economic growth.

These flagship projects are designed to be more than just buildings; they are envisioned as integrated commercial, residential, and cultural centers. The New Central Harbourfront, for instance, is expected to become a major destination, attracting both local residents and international visitors. Such developments are crucial for enhancing a city's global competitiveness and appeal.

- New Central Harbourfront: A transformative project redefining Hong Kong's skyline and economic activity.

- Economic Impact: Expected to generate substantial economic benefits through job creation and increased commercial opportunities.

- Investment Focus: Demonstrates Henderson Land's strategic focus on high-value, long-term urban regeneration.

Operational Reach Through Subsidiaries

Henderson Land's operational reach is significantly amplified through its strategic use of listed subsidiaries and associates. This structure allows the company to tap into diverse market segments and leverage specialized expertise across various industries.

These subsidiaries are instrumental in extending the company's presence into key service sectors. For instance, their involvement in hotel operations provides direct access to the hospitality market, while department store ventures cater to retail consumers. Furthermore, utility services, such as gas supply, ensure a consistent and essential service offering to a broad customer base, solidifying Henderson Land's integrated approach to market penetration.

As of the first half of 2024, Henderson Land's property development segment reported a revenue of HK$10.7 billion. The company's subsidiaries contribute to this by managing a portfolio that includes:

- Hotel Operations: Providing a range of hospitality services and accommodations.

- Department Stores: Engaging directly with consumers through retail outlets.

- Utility Services: Ensuring access to essential services like gas supply, enhancing property value and customer convenience.

Place, as a core component of Henderson Land's marketing mix, is defined by its strategic selection of prime locations and its commitment to creating desirable environments. The company's substantial presence in both Hong Kong and mainland China, with a focus on areas near transportation hubs and natural amenities, directly influences property value and market appeal. This geographic diversification, as highlighted by its significant revenue contribution from mainland projects in early 2024, mitigates risk while broadening market access.

| Location Focus | Key Attributes | Market Significance (H1 2024 Data) |

|---|---|---|

| Hong Kong | Prime districts, MTR connectivity | Core market for residential sales |

| Mainland China | Key second-tier cities | Significant revenue contributor |

| Development Sites | Waterfront views, green spaces | Enhances property value and demand |

What You Preview Is What You Download

Henderson Land 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Henderson Land 4P's Marketing Mix Analysis is ready for immediate use upon purchase, ensuring you receive exactly what you see.

Promotion

Henderson Land prioritizes transparency with timely releases of its annual and interim financial reports, alongside investor presentations. These publications are crucial for stakeholders, offering a clear view of the company's financial health and strategic direction. For instance, their 2024 interim report, released in August 2024, detailed a revenue of HK$12.5 billion, reflecting ongoing operational performance.

These investor relations efforts empower stakeholders with vital insights into Henderson Land's performance, strategic initiatives, and future outlook. The company's commitment to open communication is evident in its consistent delivery of detailed financial data, enabling informed decision-making by investors and analysts alike.

Henderson Land actively engages in corporate communications, regularly releasing announcements and circulars to keep the market and its shareholders informed. These updates cover crucial events like annual general meetings, dividend declarations, and bond issuances, ensuring transparency and timely information flow. For instance, in their 2024 interim report, the company detailed its financial performance and strategic outlook, reinforcing its commitment to shareholder value.

Henderson Land actively promotes its commitment to sustainability, evidenced by their comprehensive sustainability reports and the articulation of their G.I.V.E. strategies: Green for Planet, Innovation for Future, Value for People, and Endeavour for Community. This framework clearly outlines their dedication to environmental, social, and governance (ESG) principles.

In 2023, Henderson Land's sustainability efforts were highlighted by their continued focus on green building certifications, with a significant portion of their portfolio achieving LEED or equivalent accreditations, demonstrating tangible progress in their environmental commitments.

Awards and Industry Recognition

Henderson Land actively uses its accolades to bolster its standing. For instance, being named Asia's Top Green Companies at the ACES Awards and Developer of the Year at the Real Estate Asia Awards significantly amplifies its market presence and underscores its commitment to eco-friendly practices and forward-thinking development.

These awards serve as tangible proof of Henderson Land's excellence, directly impacting customer perception and investor confidence. In 2024, such recognitions are particularly crucial in a competitive market where sustainability and innovation are increasingly valued by stakeholders.

The company's strategy leverages these achievements to:

- Enhance Brand Reputation: Prestigious awards validate Henderson Land's commitment to quality and responsible development.

- Highlight Sustainable Development: Recognition like Asia's Top Green Companies directly communicates its environmental stewardship.

- Showcase Innovation: Awards such as Developer of the Year at Real Estate Asia Awards signal its leadership in industry advancements.

- Attract Talent and Investment: A strong reputation built on awards makes the company more appealing to top talent and potential investors.

Project-Specific Marketing and Sales Launches

Henderson Land implements focused marketing and sales strategies for each new development. This includes setting up dedicated sales offices and meticulously designed show flats to give potential buyers a tangible experience of the property. For instance, the second phase of Belgravia Place saw such targeted efforts to build buzz and encourage early uptake.

These project-specific launches are crucial for generating immediate interest and driving sales velocity. By creating physical touchpoints like sales galleries and interactive displays, Henderson Land aims to connect with buyers on a deeper level. This approach was evident in the successful launch activities for projects throughout 2024 and early 2025, contributing to their overall sales performance.

- Targeted Awareness: Sales offices and show flats create direct engagement points for new projects.

- Sales Generation: These initiatives are designed to convert interest into actual sales.

- Project Momentum: Specific campaigns help build and sustain excitement for individual developments.

- Customer Experience: Show flats offer a tangible preview, aiding buyer decision-making.

Henderson Land employs targeted promotional activities for its residential projects, utilizing dedicated sales offices and well-designed show flats to offer prospective buyers an immersive experience. These efforts are crucial for generating immediate interest and driving sales, as seen in the successful launch of projects throughout 2024 and early 2025.

The company also leverages its strong corporate reputation and sustainability achievements to enhance brand value and attract investment. Awards like Asia's Top Green Companies underscore their commitment to ESG principles, which is increasingly important for stakeholders. This focus on recognition bolsters their market presence and appeals to a broad audience.

Henderson Land's investor relations strategy emphasizes transparency through timely financial reports and investor presentations. For example, their 2024 interim report, released in August 2024, provided detailed financial performance data, ensuring stakeholders are well-informed about the company's direction and health.

| Promotional Tactic | Objective | Example/Impact |

|---|---|---|

| Project-Specific Sales Offices & Show Flats | Generate immediate interest, drive sales velocity, provide tangible buyer experience | Successful launch activities for 2024/2025 projects, e.g., Belgravia Place Phase 2 |

| Awards & Accolades | Enhance brand reputation, highlight sustainability and innovation, attract talent and investment | Asia's Top Green Companies, Developer of the Year (Real Estate Asia Awards) |

| Financial Reporting & Investor Presentations | Ensure transparency, inform stakeholders of financial health and strategic direction | 2024 Interim Report (August 2024) showing HK$12.5 billion revenue |

Price

Henderson Land strategically prices its properties, from luxury residences to commercial spaces, by closely monitoring market trends and demand. For instance, in early 2024, Hong Kong's property market saw fluctuating mortgage rates, influencing buyer affordability and Henderson Land's pricing adjustments to remain competitive.

The company tailors pricing to the specific value of each project, factoring in location, amenities, and unique selling points. Anticipating an increase in skilled worker migration to Hong Kong in 2024-2025, Henderson Land may adjust pricing for developments in key business districts to capture demand from this demographic.

Henderson Land benefits significantly from its diverse investment property portfolio, which provides a steady stream of rental income. For instance, as of the first half of 2024, rental income from investment properties remained a crucial contributor to the company's overall revenue, underscoring the stability of this income source.

The company's ability to maintain high leasing rates across its prime locations, especially in major urban centers, ensures consistent financial performance. This strategic leasing approach, evident in their occupancy rates in key Hong Kong districts throughout 2024, directly bolsters Henderson Land's revenue predictability.

Henderson Land demonstrates a commitment to shareholder returns through a consistent dividend policy, aiming for attractive yields even when earnings fluctuate. For instance, the company maintained its annual dividend payout, signaling a stable approach to rewarding investors.

Capital Structure Management through Bond Issuances

Henderson Land strategically manages its capital structure, leveraging bond issuances as a key financial tool. This approach helps diversify funding, refinance debt, and fuel business growth, thereby influencing its cost of capital.

In 2024, Henderson Land continued to optimize its financial footing. For instance, the company's financial statements as of December 31, 2023, showed total debt of approximately HKD 66.4 billion, with a significant portion likely to be managed through such issuances in the upcoming period.

- Diversified Funding: Bond issuances offer an alternative to traditional bank loans, broadening the company's financial avenues.

- Refinancing Strategy: These issuances can be used to replace existing, potentially higher-cost debt with more favorable terms.

- Cost of Capital Impact: Successful bond management can lower the overall weighted average cost of capital (WACC), enhancing profitability.

- Supporting Growth: Funds raised through bonds are often earmarked for new projects and business expansion, crucial for long-term development.

Financial Performance and Market Valuation

Henderson Land's pricing strategy is intrinsically linked to its financial performance, with revenue and net income directly impacting its market valuation. For instance, as of the first half of 2024, the company reported a revenue of HK$12.3 billion, a figure that underpins investor confidence and influences its market capitalization, which stood at approximately HK$70 billion in mid-2024.

Factors such as earnings per share (EPS) and the overall economic climate, including interest rate adjustments by the Hong Kong Monetary Authority, significantly shape the perceived value of Henderson Land's extensive property portfolio. These elements collectively influence how the market prices the company's shares and, by extension, its assets.

- Revenue Growth: Henderson Land's ability to generate consistent revenue, exemplified by its H1 2024 performance, is crucial for maintaining a strong market valuation.

- Net Income and EPS: Profitability, reflected in net income and earnings per share, directly impacts investor sentiment and share price.

- Market Capitalization: The total market value of the company's outstanding shares, influenced by financial results and investor confidence, is a key indicator of its perceived worth.

- Interest Rate Sensitivity: Fluctuations in interest rates can affect property values and borrowing costs, thereby influencing Henderson Land's financial health and market valuation.

Henderson Land's pricing strategy is dynamic, adapting to market conditions and project specifics. For instance, in early 2024, fluctuating mortgage rates in Hong Kong prompted adjustments to ensure competitiveness. The company also tailors pricing based on location and unique selling points, with potential adjustments for developments in business districts anticipating increased demand from skilled workers in 2024-2025.

The company's financial health directly influences its pricing power. Henderson Land reported revenue of HK$12.3 billion in the first half of 2024, supporting a market capitalization of approximately HK$70 billion mid-year. This financial performance, alongside factors like earnings per share and interest rate movements, shapes investor perception and the valuation of its property portfolio.

| Metric | Value (as of H1 2024) | Significance |

|---|---|---|

| Revenue | HK$12.3 billion | Underpins investor confidence and market valuation. |

| Market Capitalization | Approx. HK$70 billion | Reflects overall market perception of company worth. |

| Interest Rate Impact | Variable | Affects property values and borrowing costs, influencing financial health. |

4P's Marketing Mix Analysis Data Sources

Our Henderson Land 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive market research and competitive intelligence. We also incorporate data from property listings, sales performance reports, and industry publications to provide a holistic view of their strategies.