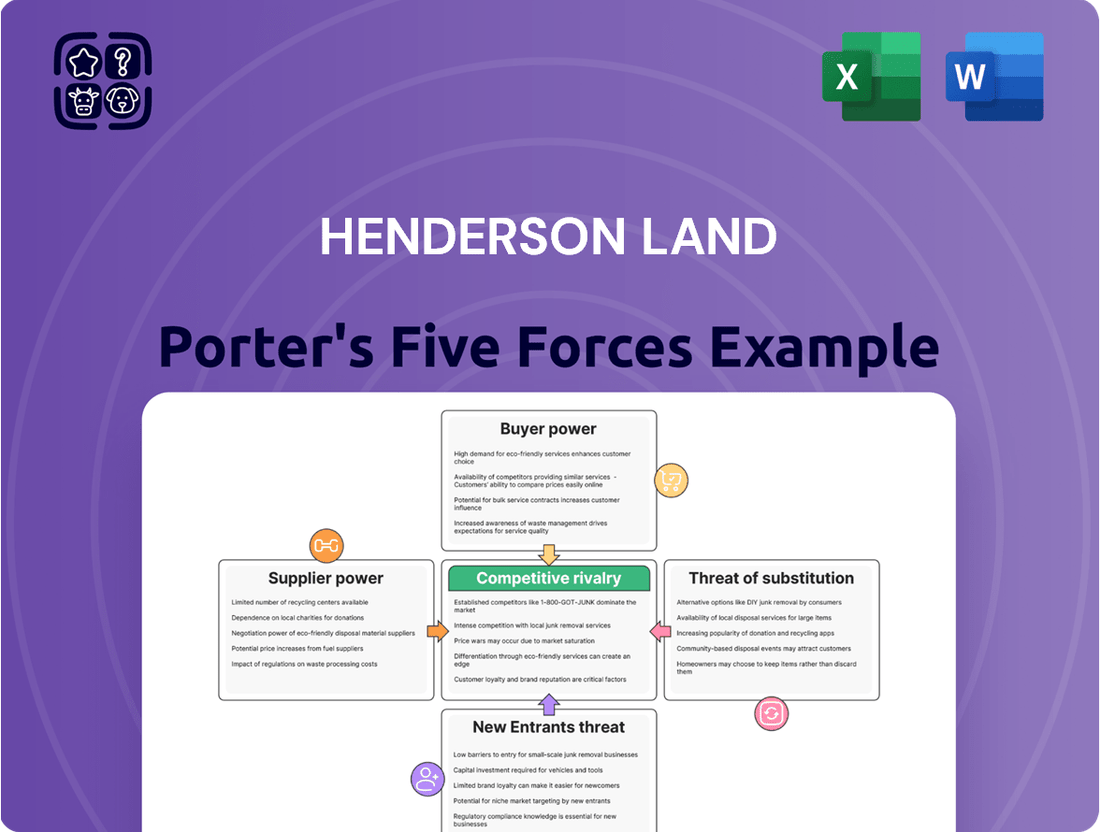

Henderson Land Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Henderson Land navigates a competitive landscape shaped by powerful buyer bargaining, the constant threat of new entrants, and the availability of substitutes. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Henderson Land’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For Henderson Land, the most crucial input is land, and Hong Kong's notoriously limited land supply significantly bolsters the bargaining power of its owners. This scarcity, primarily concentrated with the Hong Kong government and a handful of major private landowners, directly translates into higher land acquisition costs. In 2024, land premiums and government land sale prices remained a significant factor in development economics.

Suppliers of essential construction materials like steel and cement possess moderate bargaining power over Henderson Land. While a diverse supplier base exists, global commodity price volatility and localized supply chain disruptions in Hong Kong can significantly impact material costs, directly affecting Henderson Land's project expenses and profitability.

Hong Kong's construction industry, in general, has been grappling with elevated construction costs. For instance, in 2024, the cost of construction materials saw notable increases, with steel prices experiencing a significant upward trend due to global demand and production issues, putting pressure on developers like Henderson Land to manage their project budgets effectively.

The availability of skilled professionals like architects, engineers, and construction workers significantly impacts supplier power in the construction industry. Henderson Land, like many developers, must contend with the availability of this crucial talent.

Hong Kong's construction sector is experiencing notable skilled labor shortages. This scarcity, coupled with increasing wage demands, directly translates to higher project expenses for developers. For instance, in 2024, average construction wages saw an upward trend, putting pressure on project budgets and timelines.

These labor dynamics empower suppliers, including labor recruitment agencies and skilled individual contractors, as their expertise becomes more valuable. This increased bargaining power can lead to higher costs and potential project delays for Henderson Land if not managed proactively.

Financing and Lending Institutions

Financing and lending institutions act as vital suppliers, providing the capital necessary for property development. In 2024, Hong Kong's financial landscape saw a notable tightening of lending conditions. This environment, characterized by higher interest rates, directly increased the cost of capital for developers such as Henderson Land. Consequently, these financial institutions gained increased leverage, enhancing their bargaining power.

- Increased Financing Costs: Rising interest rates in 2024 directly translate to higher borrowing expenses for property developers.

- Lender Selectivity: Tighter credit markets mean lenders can be more selective, favoring projects with stronger fundamentals and developers with robust balance sheets.

- Impact on Project Viability: Higher financing costs can impact the profitability and feasibility of development projects, giving lenders more influence over project terms.

Specialized Contractors and Technology Providers

Specialized contractors and technology providers wield significant bargaining power when Henderson Land requires unique expertise or proprietary building solutions, such as advanced green building systems or integrated smart home technologies. This reliance on niche capabilities means these suppliers can command higher prices or more favorable terms. For instance, the increasing demand for high-performance facade systems or sophisticated Building Management Systems (BMS) in Hong Kong's premium developments can empower suppliers in these segments.

Henderson Land's commitment to innovation and sustainability, evident in projects like the LEED Platinum certified One Midtown, necessitates collaboration with specialized firms. The market for such advanced technologies is often concentrated, with fewer providers capable of meeting stringent performance and environmental standards. This limited supplier base, coupled with the specialized nature of their offerings, directly translates to enhanced bargaining leverage for these suppliers.

- Specialized Expertise: Suppliers of advanced green building materials or smart city integration technologies possess unique knowledge that is difficult for Henderson Land to replicate internally.

- Proprietary Technology: Companies holding patents or exclusive rights to innovative construction methods or building systems can leverage this exclusivity to negotiate better terms.

- Market Concentration: The limited number of providers for certain high-end construction technologies in the Hong Kong market can lead to a supplier-dominated pricing environment.

- Project Complexity: The intricate requirements of large-scale, high-spec developments undertaken by Henderson Land often mean fewer contractors can fulfill the scope, increasing the power of those who can.

The bargaining power of suppliers for Henderson Land is significantly influenced by the scarcity of land in Hong Kong, with the government and major private landowners holding considerable sway. This limited supply directly impacts land acquisition costs, a critical factor in development economics, as seen in 2024 land premium trends.

Suppliers of construction materials like steel and cement have moderate power, though global price volatility and local supply chain issues in 2024, such as rising steel prices, can increase project expenses. Skilled labor shortages in Hong Kong's construction sector in 2024 also empower specialized contractors and labor agencies, leading to higher wages and potential project delays.

Financial institutions, as capital suppliers, gained leverage in 2024 due to tighter lending conditions and higher interest rates, increasing financing costs for developers like Henderson Land. Specialized technology providers for green building or smart systems also hold strong bargaining power due to the niche nature of their offerings and market concentration.

| Supplier Type | Bargaining Power Factor | Impact on Henderson Land | 2024 Data Point/Trend |

|---|---|---|---|

| Landowners (Govt./Major Private) | Land Scarcity | Increased Land Acquisition Costs | Continued high land premium bids in government land sales. |

| Material Suppliers (Steel, Cement) | Commodity Price Volatility, Supply Chain Issues | Higher Material Costs, Impact on Profitability | Steel prices saw significant upward pressure in 2024. |

| Skilled Labor Providers | Labor Shortages, Wage Demands | Increased Labor Costs, Potential Project Delays | Average construction wages trended upwards in 2024. |

| Financial Institutions | Lending Conditions, Interest Rates | Increased Financing Costs, Lender Selectivity | Tightening credit markets and rising interest rates observed in 2024. |

| Specialized Tech/Contractors | Unique Expertise, Proprietary Technology, Market Concentration | Higher Prices for Niche Services, Favorable Terms | Growing demand for advanced green building systems and smart technologies. |

What is included in the product

Tailored exclusively for Henderson Land, analyzing its position within its competitive landscape by examining the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visually mapping Henderson Land's Porter's Five Forces, revealing key vulnerabilities and opportunities.

Customers Bargaining Power

Customers in Hong Kong's property market wield significant bargaining power, largely due to the city's notoriously high property prices. This affordability challenge is exacerbated by fluctuating mortgage rates, which directly impact a buyer's ability to purchase.

In 2024, for instance, mortgage rates remained elevated, reaching levels that made financing a property a substantial undertaking. This financial pressure makes potential buyers more sensitive to price adjustments, as even small increases can render a purchase unfeasible. Consequently, buyers are more inclined to negotiate harder, increasing their leverage with developers like Henderson Land.

In 2024, Hong Kong's residential property market is experiencing elevated levels of unsold inventory. This surplus of available homes, particularly in the new development sector, significantly enhances the bargaining power of potential buyers. With more choices readily available, customers face less pressure to commit to a purchase, allowing them to negotiate more effectively with developers like Henderson Land.

This oversupply directly translates into increased leverage for customers. Developers, keen to move their stock, are more inclined to offer price reductions, attractive financing options, or other incentives to secure sales. For instance, reports from early 2024 indicated that certain new residential projects saw developers offering discounts of up to 10% to stimulate demand, a clear manifestation of customer power driven by abundant supply.

Government policies, like stamp duties and loan-to-value ratios, directly affect how much customers can afford and how much they want to buy. For instance, in Hong Kong, the government has been adjusting property cooling measures. In February 2024, all special stamp duties were removed, a move that significantly aimed to boost property transactions. This policy shift can empower buyers by increasing their purchasing power and confidence.

While some of these measures have been eased, any future changes can dramatically shift market feelings and the number of deals happening. Customers, by deciding how to react to these regulations, can collectively influence demand. For example, if new taxes are introduced, buyers might hold back, thereby increasing their bargaining power against developers like Henderson Land.

Demand for Quality and Amenities

Customers, particularly those seeking luxury or contemporary living spaces, increasingly demand superior construction quality, innovative architectural designs, and a full suite of amenities. Henderson Land, recognized for its commitment to high standards, must cater to these evolving expectations. This focus on quality can empower customers, giving them greater leverage when specific features are paramount to their purchasing decision.

The rising demand for enhanced living experiences translates into significant bargaining power for buyers. For instance, in 2024, the Hong Kong property market saw continued interest in smart home technologies and sustainable building practices, features that developers must integrate to remain competitive. Henderson Land's ability to deliver these sought-after elements directly influences customer perception and willingness to negotiate on price or terms.

- Customer Expectations: Growing demand for high-quality construction and modern amenities in residential properties.

- Developer Response: Companies like Henderson Land must innovate and enhance project offerings to meet these evolving standards.

- Bargaining Power Shift: Customers gain leverage when specific, high-value features are prioritized in their property search.

- Market Trends: Integration of smart home technology and sustainable design is becoming a key differentiator in 2024.

Rental Market Dynamics

The bargaining power of customers, specifically tenants, significantly shapes Henderson Land's rental income. In periods of high vacancy, tenants gain considerable leverage to negotiate more favorable lease terms, potentially reducing Henderson Land's revenue from its investment properties.

For example, in the Hong Kong commercial property market, vacancy rates can fluctuate. Should these rates rise, as they did in certain segments of the office market in late 2023 and early 2024 due to economic headwinds, tenants are in a stronger position to demand concessions like reduced rents or shorter lease commitments. This directly impacts Henderson Land's ability to maintain consistent rental yields.

- Tenant Leverage: High vacancy rates in commercial properties empower tenants to negotiate rental terms, impacting Henderson Land's income.

- Market Conditions: Fluctuations in Hong Kong's commercial property vacancy rates, influenced by economic factors, directly affect tenant bargaining power.

- Negotiation Impact: Tenants may secure lower rents or more flexible lease agreements when market conditions favor them, pressuring Henderson Land's rental revenue.

The bargaining power of customers in Hong Kong's property market is substantial, driven by high prices, fluctuating mortgage rates, and increasing unsold inventory as of 2024. This environment allows buyers to negotiate more effectively with developers like Henderson Land, demanding price concessions and favorable terms.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Property Affordability & Mortgage Rates | Elevated prices and rates increase buyer sensitivity to cost, leading to stronger negotiation. | Mortgage rates remained a significant consideration for buyers throughout early 2024. |

| Unsold Inventory | Higher supply of properties gives buyers more choices and leverage. | Several new residential projects in 2024 reported higher-than-average unsold units, leading to developer discounts. |

| Government Policies | Changes in stamp duties and loan-to-value ratios directly affect purchasing power and buyer confidence. | The removal of all special stamp duties in February 2024 aimed to boost transactions, potentially shifting buyer leverage. |

| Customer Expectations (Quality & Amenities) | Demand for premium features empowers buyers who prioritize specific attributes. | Continued interest in smart home technology and sustainable design in 2024 means developers must meet these expectations to attract buyers. |

| Tenant Bargaining Power (Rental Market) | High vacancy rates in commercial properties grant tenants negotiation power for rent and lease terms. | Certain commercial property segments experienced increased vacancy in late 2023 and early 2024, pressuring rental income for landlords like Henderson Land. |

Preview Before You Purchase

Henderson Land Porter's Five Forces Analysis

This preview shows the exact Henderson Land Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted document is ready for your immediate use.

Rivalry Among Competitors

The Hong Kong property development sector is characterized by significant concentration, with a handful of dominant companies like Henderson Land, Sun Hung Kai Properties, Cheung Kong Holdings, and New World Development. This oligopolistic structure fuels fierce competition among these major developers for scarce land parcels and coveted market share.

This intense rivalry means that developers must constantly innovate and offer competitive pricing and product features to attract buyers. For instance, in 2023, Henderson Land reported revenue of HKD 22.8 billion, demonstrating the scale of operations and the financial muscle required to compete effectively in this demanding environment.

Developers are increasingly using aggressive pricing, including significant discounts, to move inventory in a tough market. This competitive pricing environment directly impacts Henderson Land's profitability by squeezing profit margins.

In 2024, the Hong Kong property market saw developers offering an average discount of 10-15% on new projects to stimulate sales amid high vacancy rates. This trend forces all market participants, including Henderson Land, to consider similar price adjustments to remain competitive.

Major Hong Kong developers like Henderson Land operate with highly diversified business models. These often include property development, investment, and management, alongside ventures into utilities and hospitality. This integration allows them to create synergistic advantages, potentially intensifying competition as they leverage different segments of their operations to outmaneuver rivals.

Land Acquisition Competition

The competition for prime land parcels is a significant driver of rivalry among property developers. Government land auctions frequently witness aggressive bidding wars, with the success rates of these sales serving as a barometer for market sentiment and the intensity of competition.

Henderson Land, like its peers, actively engages in these government land sales to expand its development pipeline. For instance, in the first half of 2024, Hong Kong's land sale revenue reached HK$29.7 billion, a notable increase from the previous year, highlighting the ongoing demand and competitive nature of land acquisition.

- Intense Bidding: Government land tenders often see multiple developers vying for the same plot, driving up prices.

- Market Sentiment Indicator: High participation and bidding levels in land sales reflect developer confidence and market outlook.

- Strategic Land Banking: Henderson Land's participation is crucial for securing future projects and maintaining its market position.

- 2024 Land Sale Performance: The robust performance of Hong Kong's land sales in early 2024 underscores the competitive landscape.

Brand Reputation and Project Innovation

Competitive rivalry in Hong Kong's property sector extends well beyond mere pricing. Henderson Land, like its peers, actively competes on the strength of its brand reputation, the perceived quality of its construction, and the allure of innovative project features. This differentiation is crucial for capturing market share and commanding premium pricing.

Developers are increasingly investing in unique architectural designs, incorporating sustainable building practices, and offering enhanced amenities to stand out. For instance, Henderson Land has notably emphasized its commitment to green and smart building technologies, aiming to attract environmentally conscious buyers and those seeking modern, technologically integrated living spaces. This strategic focus on innovation and sustainability is a key battleground.

- Brand Strength: Henderson Land's established reputation for quality and reliability is a significant competitive asset, influencing buyer perception and loyalty.

- Project Innovation: The company's investment in unique designs, green building certifications (e.g., LEED), and smart home features differentiates its offerings in a crowded market.

- Quality of Construction: Perceived superior construction quality and attention to detail contribute to brand equity and can justify higher price points.

- Customer Experience: Beyond the physical product, the overall customer experience, from sales to after-sales service, plays a vital role in competitive positioning.

Competitive rivalry among Hong Kong property developers, including Henderson Land, is intense, driven by a concentrated market structure and fierce competition for land and buyers. This rivalry necessitates aggressive pricing strategies, with developers offering discounts of 10-15% on new projects in 2024 to move inventory amidst high vacancy rates, directly impacting profit margins.

Beyond price, developers like Henderson Land compete on brand reputation, construction quality, and innovative features, such as green and smart building technologies. This differentiation is crucial for market share and premium pricing, as seen in Henderson Land's focus on sustainability to attract specific buyer segments.

The competition for prime land parcels is particularly acute, evidenced by aggressive bidding in government land auctions. Hong Kong's land sale revenue reaching HK$29.7 billion in the first half of 2024 highlights the ongoing demand and the high stakes involved in securing future development opportunities.

| Developer | 2023 Revenue (HKD Billion) | Key Competitive Focus | 2024 Land Sale Activity |

|---|---|---|---|

| Henderson Land | 22.8 | Brand, Green Tech, Smart Features | Active participant in land sales |

| Sun Hung Kai Properties | N/A* | Scale, Diversification | Major land acquisition |

| Cheung Kong Holdings | N/A* | Diversified Portfolio | Strategic land banking |

| New World Development | N/A* | Customer Experience, Design | Competitive bidding |

*Specific 2023 revenue figures for all competitors are not publicly detailed in this context.

SSubstitutes Threaten

The extensive existing property stock in Hong Kong's secondary market presents a potent substitute for Henderson Land's new developments. In 2024, with a substantial number of resale properties available, buyers and tenants can readily find alternatives, potentially at more attractive price points or with immediate availability, thereby dampening demand for newly launched projects.

For many individuals, particularly in high-cost urban environments like Hong Kong, rental housing presents a significant and accessible substitute for outright property ownership. This is especially true when considering the substantial down payments and ongoing mortgage commitments associated with buying.

As Hong Kong's rental market continues to evolve, with potential improvements in availability and quality, the attractiveness of renting as an alternative to purchasing is likely to increase. For instance, in 2024, the average rent for a standard apartment in Hong Kong remained a considerable expense, yet it often offered greater flexibility and lower upfront costs compared to buying, which could exceed HK$5 million for a modest unit.

Investors have a wide array of alternative investment opportunities beyond Henderson Land's core real estate offerings. For instance, in 2024, global equity markets saw significant inflows, with the MSCI World Index returning over 15% year-to-date by mid-year, presenting a compelling alternative for capital seeking growth.

The Hong Kong property market faced headwinds in 2024, with property transaction volumes declining by approximately 10% compared to the previous year, according to data from the Land Registry. This, coupled with interest rates remaining elevated, makes alternative assets like bonds or even emerging market equities potentially more attractive, thereby siphoning potential capital away from new Hong Kong property developments.

Co-living and Serviced Apartments

The rise of co-living spaces and serviced apartments presents a significant threat of substitutes for traditional residential property ownership and rentals. These alternatives cater to a growing demand for flexibility and community, particularly among younger demographics and transient workforces in urban centers.

For instance, in 2024, the global co-living market was projected to reach over $11 billion, indicating strong consumer adoption. Serviced apartments also saw robust growth, with occupancy rates in major cities often exceeding 80% in the latter half of 2023 and continuing into 2024, demonstrating their appeal as a viable alternative to long-term leases or hotel stays.

- Flexibility: Co-living and serviced apartments offer shorter lease terms, appealing to individuals who may relocate frequently for work or prefer not to be tied down by long rental agreements.

- Affordability: Often, these options bundle utilities, Wi-Fi, and even cleaning services into a single monthly fee, which can be more predictable and sometimes more cost-effective than managing these separately in traditional rentals.

- Community and Amenities: Many co-living spaces emphasize shared amenities and a built-in community, attracting those seeking social interaction and convenience, which traditional single-family rentals or apartments may not offer.

- Targeted Demographics: These substitute offerings are particularly attractive to young professionals, digital nomads, and expatriates who prioritize convenience, networking opportunities, and a hassle-free living experience.

Virtual Offices and Remote Work for Commercial Property

The increasing adoption of virtual offices and remote work arrangements presents a significant threat of substitutes for traditional commercial property. Businesses are re-evaluating their physical space needs, with many finding that flexible workspaces or smaller, hub-and-spoke models can effectively replace the demand for large, long-term office leases.

This shift directly impacts the commercial real estate sector by reducing the necessity for extensive office footprints. For instance, a 2024 survey indicated that over 60% of companies are considering hybrid work models permanently, a trend that directly substitutes the need for traditional, fully occupied office buildings.

- Reduced Demand: The rise of remote work decreases the overall demand for physical office space.

- Flexible Workspaces: Virtual offices and co-working spaces offer a viable alternative to long-term leases.

- Smaller Footprints: Companies are opting for less square footage, substituting the need for expansive offices.

- Cost Savings: Businesses can achieve significant cost reductions by reducing their reliance on traditional office leases.

The availability of a vast secondary property market in Hong Kong, with numerous resale units in 2024, provides immediate and often more affordable alternatives to Henderson Land's new builds. This extensive existing stock can significantly dilute demand for new developments, especially when buyers prioritize quicker occupancy or lower entry costs.

Rental properties and flexible living arrangements like co-living and serviced apartments represent strong substitutes for property ownership. In 2024, while Hong Kong rents remained high, the flexibility and lower upfront capital required for renting, compared to the substantial down payments for purchasing, made it an attractive option for many, particularly young professionals.

Beyond real estate, a broad spectrum of alternative investments competes for investor capital. In 2024, with global equities showing robust returns, such as the MSCI World Index performance, and bonds offering stability, these asset classes present compelling alternatives that can divert funds away from property investments in Hong Kong.

| Substitute Type | 2024 Market Trend/Data | Impact on Henderson Land |

|---|---|---|

| Secondary Property Market | High volume of resale units available; transaction volumes down ~10% year-on-year. | Reduces demand for new developments; pressure on pricing. |

| Rental Market | Significant upfront costs for buying vs. lower entry for renting. | Increases attractiveness of renting, especially for those prioritizing flexibility. |

| Co-living & Serviced Apartments | Global market projected over $11 billion; high occupancy rates (80%+). | Appeals to younger demographics seeking flexibility and community, diverting demand from traditional rentals. |

| Alternative Investments | MSCI World Index returned >15% YTD by mid-2024; strong inflows into equities. | Siphons capital away from real estate as investors seek higher or more diversified returns. |

Entrants Threaten

The property development sector in Hong Kong presents a formidable barrier to entry due to its exceptionally high capital requirements. Aspiring developers need significant financial backing for land acquisition, the actual construction process, and extensive marketing campaigns. This financial hurdle is a major deterrent for newcomers, as evidenced by the reported decline in loans for property development, indicating a tightening credit environment for new projects.

The scarcity of developable land in Hong Kong, a prime market for Henderson Land, acts as a significant barrier to entry. The government's tight control over land supply further exacerbates this, making it exceedingly difficult for new developers to acquire prime sites at competitive prices. For instance, in 2023, Hong Kong's land sales revenue was HKD 74.3 billion, indicating the high cost and limited availability of land.

Established major developers like Henderson Land boast a significant advantage due to their long-standing brand reputations, cultivated over decades of successful projects and customer satisfaction. This deep-seated trust makes it difficult for newcomers to gain traction.

Henderson Land's extensive land banks, a crucial asset in the property development sector, provide a substantial barrier to entry. For instance, as of the first half of 2024, Henderson Land reported a substantial portfolio of development properties, ensuring a pipeline of future projects that new entrants would struggle to match in terms of scale and immediate opportunity.

Furthermore, established players benefit from robust relationships with suppliers, contractors, and financial institutions. These strong networks translate into better pricing, reliable service, and easier access to capital, all of which are harder for new entrants to replicate quickly, hindering their ability to compete effectively.

Complex Regulatory Environment

Navigating Hong Kong's intricate regulatory landscape for property development presents a significant hurdle for potential new entrants. This includes a labyrinth of zoning laws, stringent environmental regulations, and detailed building codes that demand substantial expertise and financial commitment to comply with.

The sheer complexity and the ongoing evolution of these regulations, such as the recent updates to the Buildings Ordinance in 2023 aimed at enhancing building safety, require deep local knowledge and continuous adaptation. For example, obtaining the necessary approvals for a new development can be a lengthy process, often taking years, which acts as a substantial barrier to entry.

- Regulatory Expertise: New entrants must invest heavily in legal and compliance teams familiar with Hong Kong's specific property laws.

- Compliance Costs: Adhering to environmental standards and building codes incurs significant upfront and ongoing expenses.

- Time Delays: The approval process for new projects can extend for several years, impacting cash flow and project viability.

Economic and Market Volatility

The property market's inherent volatility and cyclical nature, intensified by broader economic uncertainties and elevated interest rates in Hong Kong, present a significant deterrent to new entrants. These challenging market conditions, particularly evident in 2024 and projected into 2025, amplify the risks associated with entering this sector.

For instance, Hong Kong's property market experienced a notable downturn in 2023, with overall property sales volume falling by approximately 10% compared to 2022. This trend, coupled with interest rate hikes by the Hong Kong Monetary Authority throughout 2023 and into early 2024, creates a less hospitable environment for newcomers needing substantial capital and facing uncertain returns.

- High Capital Requirements: Entry into the property development and sales market demands significant upfront capital for land acquisition and construction, a substantial barrier when financing costs are high.

- Economic Sensitivity: The sector is highly sensitive to economic downturns, which can lead to decreased demand and falling property values, impacting profitability for any new player.

- Regulatory Hurdles: Navigating Hong Kong's stringent property regulations and licensing requirements can be complex and time-consuming for new businesses.

- Established Competition: Existing developers like Henderson Land possess strong brand recognition, established supply chains, and deep market knowledge, making it difficult for new entrants to gain market share.

The threat of new entrants for Henderson Land in Hong Kong's property sector is considerably low. High capital requirements, scarcity of land, and established brand loyalty present significant hurdles for newcomers. Furthermore, navigating complex regulations and the market's inherent volatility, especially with rising interest rates as seen in 2023 and early 2024, deter potential entrants.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Extremely high costs for land acquisition, construction, and marketing. | Major deterrent due to significant financial outlay needed. |

| Land Scarcity & Control | Limited developable land and government control over supply. | Difficult to acquire prime sites at competitive prices. |

| Brand Reputation & Loyalty | Established developers have decades of trust and successful projects. | Challenging for newcomers to build credibility and attract buyers. |

| Regulatory Complexity | Intricate zoning, environmental, and building codes requiring expertise. | Demands substantial investment in legal and compliance teams, and lengthy approval processes. |

| Market Volatility & Interest Rates | Sensitivity to economic downturns and rising financing costs. | Increases risk and reduces profitability for new, capital-intensive ventures. |

Porter's Five Forces Analysis Data Sources

Our Henderson Land Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's annual reports, investor presentations, and publicly available financial statements. We supplement this with insights from reputable real estate industry publications and market research reports to provide a comprehensive view of the competitive landscape.